Market

Onyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

Onyxcoin has surged by nearly 30% in the past 24 hours, riding the wave of a broader crypto market rally.

But beyond the market-wide momentum, on-chain data suggests that XCN’s spike, its strongest in over a month, is driven by genuine demand for the altcoin.

Onyxcoin Rallies, But There Is a Catch

XCN’s double-digit rally has been accompanied by a surge in its daily trading volume. This totals $128 million at press time, rocketing 480% over the past day.

When an asset’s price and trading volume spike simultaneously, it signals strong market interest and momentum. This means more participants are actively trading XCN and validating its price movement.

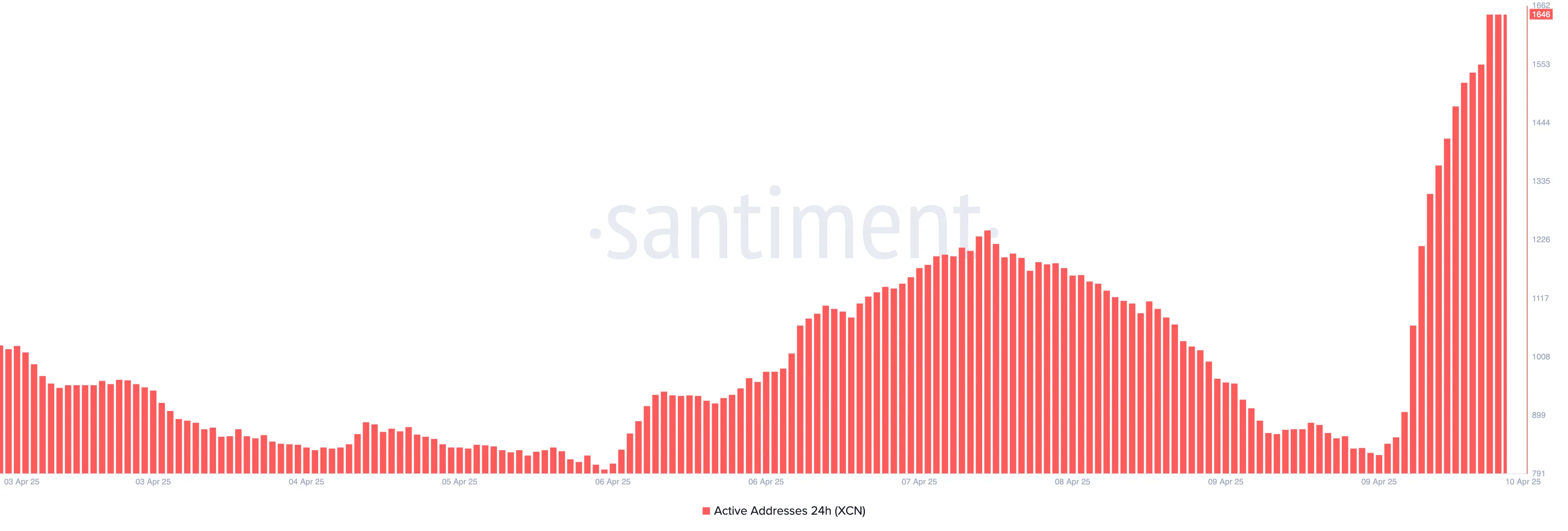

Moreover, the daily count of active addresses that have traded XCN today has climbed to a 60-day high of 1,646.

This spike in active addresses reflects growing retail and possibly institutional interest in XCN. More wallets transacting the token typically suggests broader network participation and confidence, which can serve as a strong bullish signal for the asset.

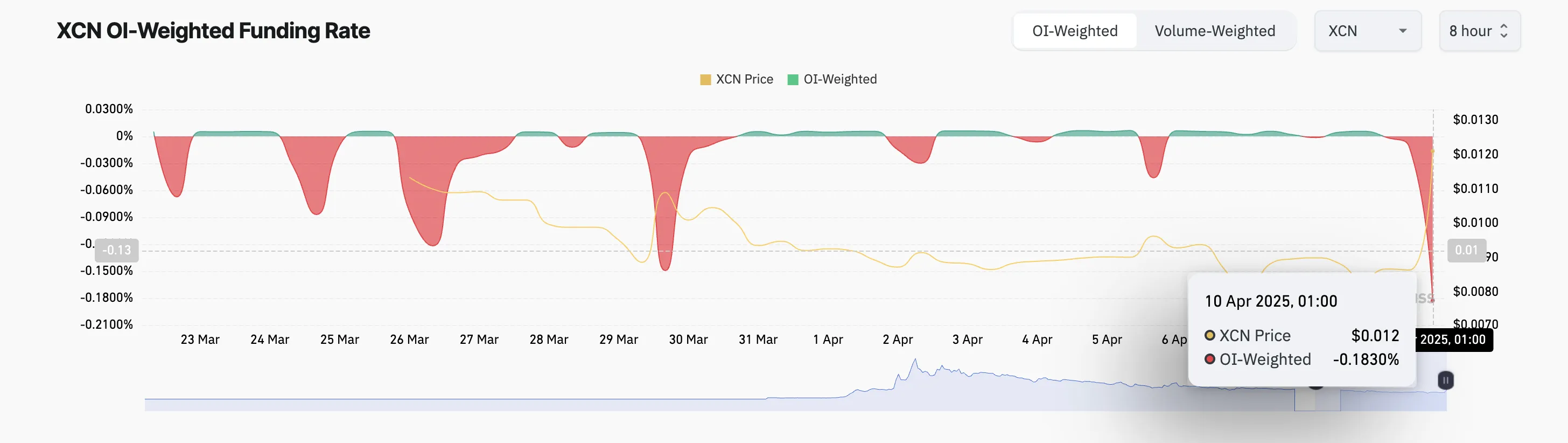

However, not all traders share this bullish sentiment. In the XCN futures market, the outlook is persistently bearish, as reflected by the token’s negative funding rate. This is at a two-month low of -0.18% at press time.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures to keep the contract price in line with the spot price.

When an asset’s funding rate is negative like this, short traders pay long traders. This indicates bearish sentiment and that more XCN traders are betting on the price to fall.

XCN Clears Key Barrier as Accumulation Grows — Is $0.015 Next?

Apart from the broader market recovery, the price rally is also supported by a visible uptick in on-chain user engagement, signaling that XCN traders are not just following hype but are actively accumulating.

On the daily chart, XCN has broken above the crucial $0.01 resistance level—a price point it struggled to break for two weeks. If the rally persists, XCN’s price could climb to $0.015, a high it last reached on March 5.

However, if market participants begin profit-taking, XCN could shed its recent gains and fall below the $0.011 support toward $0.0075.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CoinGecko Conduct Survey on AI and Proof of Personhood

CoinGecko conducted a recent survey on AI user opinions, particularly centered around Proof of Personhood (PoP). The overwhelming majority of users want to distinguish humans from AI and are open to adopting PoP.

Proof of Personhood (PoP) is a mechanism designed to verify that a user is a unique human being—not a bot, not an AI, and not a duplicate identity. Many users feel it’s increasingly critical as generative AI and autonomous agents proliferate across digital platforms.

Is Personhood the Next Big Trend in AI?

AI projects have seen declining popularity over the past months, largely due to macroeconomic factors and other narratives dominating the Web3 space. Yet, AI agent development remains strong.

AI agents are now highly integrated into crypto Twitter and social media. They are driving conversations, changing narratives, and even creating dialog. So, the concept of personhood has become a critical discussion among the crypto community.

Most recently, CoinGecko conducted a survey on AI-related opinions and identifying personhood.

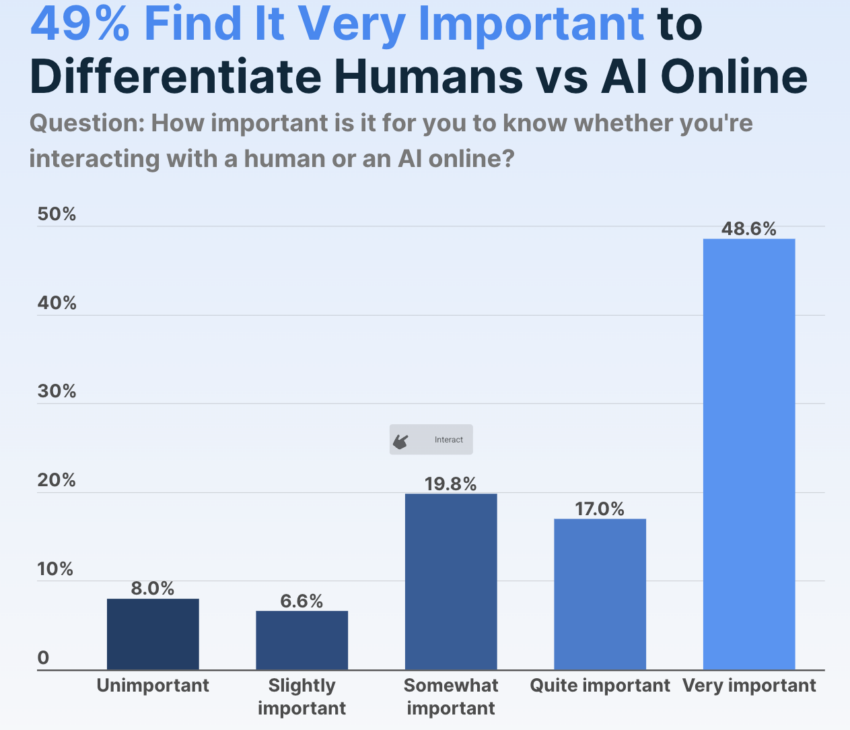

CoinGecko’s data shows that most AI users firmly believe that it’s important to know if they’re interacting with a human. Nearly half of respondents think this task is “very important,” and 92% think it’s at least somewhat important.

This can help explain why Proof of Personhood (PoP), a concept pioneered by Sam Altman’s Worldcoin, has remained an enduring idea in the AI space.

What’s the problem, then? Although this survey shows that AI users want to identify personhood, that doesn’t mean that everyone is willing to adopt PoP methods as currently devised or understood.

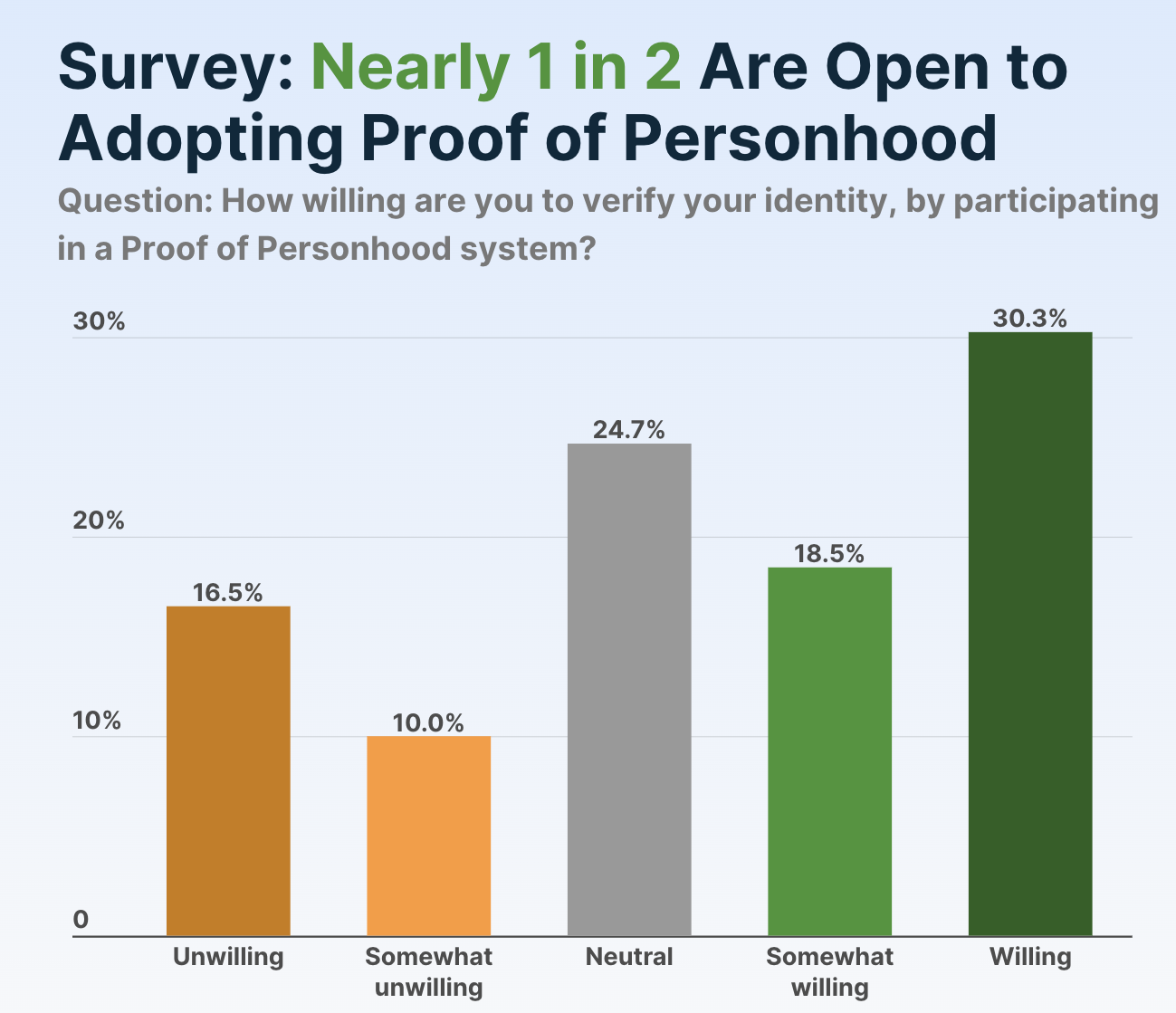

Nearly half of users were willing or somewhat willing to try them, but it was a far smaller margin than the other question.

Furthermore, the survey determined that only 30.3% of respondents believe that it’s very important to distinguish humans from AI and are also willing to adopt Proof of Personhood methods.

On the other hand, 18.3% thought identifying humans was important but were neutral or actively opposed to PoP.

The survey did not apparently describe specific PoP protocols from any one project. PoP generally involves using non-traditional forms of verification, such as biometric data, social media profiles, or other methods that are difficult to fake or replicate, but there isn’t a single industry standard yet.

Considering that another CoinGecko survey identified declining interest in AI investment, this polling discrepancy could present a problem. AI users are mostly unified as to what the issue is, but the proposed solutions are much more controversial.

A heavy-handed approach to the personhood question could turn users away from AI. This is far from ideal in the current market.

Still, it’s important not to overstate the level of controversy. Although less than half of AI users want to adopt Proof of Personhood, the pool of hostile respondents was comparatively small.

There’s a substantial number of ambivalent people, and they may respond well to new protocols, marketing campaigns, or other incentives.

Overall, it’s evident that PoP is becoming a key discussion point in the Web3 community. As autonomous agents gain influence, PoP might serve as a firewall between digital manipulation and genuine participation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

Market

$7 Million Hack Hits Binance-Backed Project

KiloEx, a newly launched perpetual trading platform backed by YZi Labs (formerly Binance Labs), has suffered a cross-chain exploit resulting in the theft of approximately $7 million.

The attack, which began on April 14, is ongoing and has impacted operations across BNB Smart Chain, Base, and Taiko networks.

Hackers Drain $7 Million from KiloEx Using Tornado Cash

Cyvers analysts report that the attacker used a Tornado Cash-funded address to execute a series of coordinated transactions. It exploited potential access control flaws in KiloEx’s price oracle system.

On-chain evidence shows rapid fund movements between multiple chains. This raises concerns over systemic vulnerabilities in multi-chain DeFi architecture.

KiloEx launched its Token Generation Event (TGE) on March 27 in partnership with Binance Wallet and PancakeSwap. It’s currently listed on Binance Alpha.

“Root cause was a potential price oracle access control vulnerability. The attacker is still actively exploiting the system, and USDC may be subject to blacklisting,” wrote Cyvers.

The project was incubated by YZi Labs, an investment and innovation division previously branded as Binance Labs.

The launch attracted significant attention due to its backing and integration with BNB Smart Chain.

Following the attack, KiloEx has suspended its platform and is collaborating with security partners to investigate the breach and track stolen funds.

The team has announced plans to launch a bounty program to encourage white hat assistance and recover user assets.

The incident has triggered sharp market reactions. The KILO token plummeted by 30%, with its market capitalization dropping from $11 million to $7.5 million within hours of the attack.

Security teams are actively monitoring the attacker’s wallet addresses. The situation remains fluid as remediation efforts continue and the vulnerability is further assessed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin17 hours ago

Altcoin17 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market22 hours ago

Market22 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market18 hours ago

Market18 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Bitcoin17 hours ago

Bitcoin17 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market17 hours ago

Market17 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry