Market

ONDO TVL Has Reached $506M After RWA Tokenization Hearing

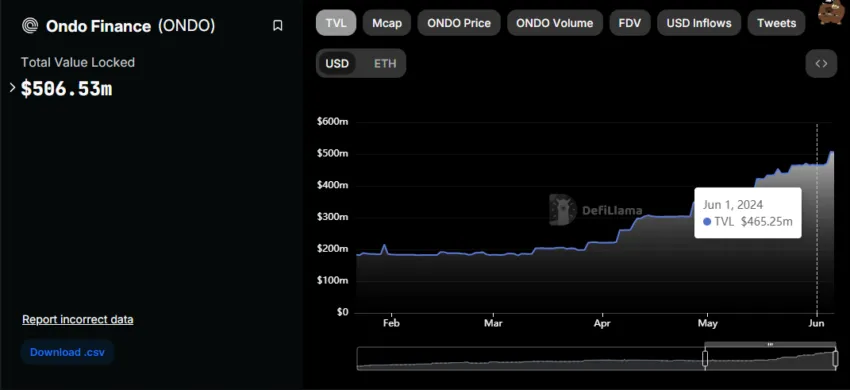

Ondo Finance continues solidifying its name in the RWA space, with the network’s TVL soaring past the $500 million threshold.

It comes as real-world assets tokenization gains mainstream attention, with crypto-focused companies, global bankers, and asset managers front-running this interest.

ONDO Thrives on Real World Assets Tokenization Buzz

Ondo Finance’s Total Value Locked (TVL) has exploded 43% since May, moving from $352.67 million on May 1 to $506 million on June 6.

TVL is an important metric used to measure the adoption and success of decentralized finance platforms. The surge in Ondo Finance TVL indicates a significant increase in assets deposited into the protocol. It highlights growing interest, market confidence, increased activity, and the potential for ONDO price increase.

According to CoinGecko, ONDO stands out as the leader in RWA coins, boasting a market capitalization of $2 billion, which represents 21% of the $9.3 billion sector. Other prominent tokens include Pendle (PENDLE), MANTRA (OM), XDC Network (XDC), and Polymesh (POLYX).

Read More: What Are Tokenized Real-World Assets (RWA)? Everything You Need to Know

The recent surge in TVL can be attributed to the growing interest among crypto-focused companies, global bankers, and asset managers in bringing traditional financial instruments such as bonds, funds, or credit to blockchains. Among them, BlackRock launched its tokenized treasury bond, BUIDL, on the Ethereum network.

Recognizing the fundamental potential of tokenizing securities to transform capital markets, the US Congress is acknowledging TradFi’s integration into the blockchain. In a Wednesday hearing, the US House Financial Services Digital Assets Subcommittee discussed the tokenization of RWAs, highlighting divergent views on the topic.

Read More: What is The Impact of Real World Asset (RWA) Tokenization?

ONDO Price Outlook

Ondo’s native token is trading with a bullish bias, with immediate support at $1.36, defending the 23% gains made in the last seven days. In the previous 24 hours, the RWA token price is up almost 3% amid ongoing bullish efforts toward further upside. Notably, the next directional bias is contingent on how ONDO bulls play their hand as they contend against the $1.44 roadblock that has held as resistance for six consecutive days.

The Relative Strength Index (RSI) positions at 69, sustaining the higher low points to strong bullish momentum. If the RSI holds above the ascending trendline, the Ondo Finance price could extend a neck higher.

A stable candlestick close above $1.44, where the ONDO price effectively closes above the centerline of the ascending parallel channel, would increase the chances for further upside. This could potentially lead the token to reach a new all-time high of $1.60.

Read more: Real World Asset (RWA) Backed Tokens Explained

The Moving Average Convergence Divergence (MACD) is notable above the signal line (orange band). This indicates that the short-term moving average is above the long-term moving average, which usually suggests a bullish momentum in ONDO’s price.

However, a closer look reveals a dropping RSI and a weak MACD, indicating seller momentum. Therefore, a price correction could happen. If the $1.36 support level breaks, ONDO Finance could drop to test the $1.16 support level, but only a daily candlestick close below $0.98 would invalidate the bullish outlook.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.