Market

MEXC’s Insurance Fund Account Provides $414M+ to Mitigate Traders’ Bankruptcy Losses

MEXC, a leading global cryptocurrency exchange, has provided over $414 million through its Insurance Fund Account to cover deficits that occur when users’ losses during liquidation exceed their available margin as of January 23, 2025. This impressive figure underscores MEXC’s commitment to asset security and risk mitigation. Combined with Proof of Reserve, MEXC offers traders robust protection against extreme market fluctuations.

How MEXC’s Insurance Fund Account Mitigates Risk for Traders

The MEXC Insurance Fund Account, launched in November 2024, is specifically designed to protect traders from extreme market fluctuations, such as those experienced during a bull run, where rapid price swings can lead to a user’s account value to dip below the required margin level, triggering a liquidation. Should the liquidation price be worse than expected, resulting in losses that exceed than the available margin (a scenario known as bankruptcy), the Insurance Fund steps in to cover these excess losses, thus facilitating a smoother liquidation process.

The fund is continually replenished by surpluses generated from liquidation orders executed at better-than-expected prices, ensuring its stability and ongoing protection during periods of high volatility.

In line with its commitment to transparency, MEXC provides users with direct access to both current and historical insurance fund amounts for various cryptocurrencies on the platform.

In addition, MEXC provides Proof of Reserve to ensure asset safety and maintain transparency for its users. This allows users to trade with confidence, free from concerns about withdrawal runs. The reserve rates are updated every two months. As of Dec 1, 2024, the latest reserve rates for various cryptocurrencies are as follows:

- USDT: 104.52%

- USDC: 116.52%

- BTC: 105.88%

- ETH: 105.65%

By offering high leverage alongside an Insurance Fund Account and Reserve Rate exceeding 100%, MEXC ensures multiple layers of protection to safeguard traders’ positions and ensure asset security.

The Go-To Platform for Seamless Crypto Trading

In addition to implementing robust safety measures to ensure a secure trading environment, the platform offers a variety of features and services designed to enhance the user experience. These features help traders minimize costs and maximize returns. MEXC is committed to empowering traders by enabling investments across the widest range of assets, ensuring safe and seamless transactions regardless of market conditions.

- M – Most Trending Tokens: MEXC is known for its rapid token listings and diverse selection of popular tokens, helping users capitalize on emerging opportunities. To date, over 3,000 tokens have been listed on the platform.

- E – Everyday Airdrops: MEXC makes it easy for users to engage in daily airdrop events and receive substantial rewards without complex procedures. In 2024, the platform completed 2,293 airdrop events, distributing over $136 million in rewards.

- X – Xtremely Low Fees: MEXC offers highly competitive trading fees, helping users reduce costs and maximize their growth potential.

- C – Comprehensive Liquidity: Backed by strong liquidity and market depth, MEXC ensures the efficient and seamless execution of every transaction, minimizing slippage even during volatile conditions.

These features have helped MEXC attract over 30 million users across over 170 countries, establishing it as the platform of choice for an increasing number of traders around the world.

Learn more about the MEXC Insurance Fund Account.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto”. Serving over 30 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, frequent airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

Risk Disclaimer:

The information provided in this article about cryptocurrencies does not represent MEXC’s official stance or investment advice. Given the highly volatile nature of the cryptocurrency market, investors are encouraged to carefully evaluate market fluctuations, project fundamentals, and potential financial risks before making any trading decisions.

Market

Circle, BitGo, and Others Eye Bank Charters in US

With support from Trump’s White House and easing regulations, firms like Circle and BitGo are pursuing becoming full-fledged financial institutions.

Reports indicate a new wave of crypto companies knocking on the once-closed doors of the American banking system. This time, someone is listening.

Crypto Firms Seek Bank Charters as Wall Street’s Doors Reopen

After years of being sidelined, crypto companies are coming back, this time through the front door of the US banking system.

Citing sources familiar with the matter, the Wall Street Journal revealed that several major players, including Circle and BitGo, are preparing to apply for bank charters or financial licenses.

Traditional banks are also responding to the shift. US Bancorp is re-launching its crypto custody program via NYDIG, while Bank of America (BofA) said it would issue its stablecoin once the legal framework is in place.

Even global giants are watching closely. A consortium including Deutsche Bank and Standard Chartered is evaluating how to expand crypto operations into the US.

While details remain scarce, the interest signals that crypto is no longer just a niche but a competitive frontier.

These firms reportedly aim to operate with the same legitimacy and access as traditional lenders. This includes holding deposits, issuing loans, and launching stablecoins under regulatory supervision.

The timing is not random. A sharp pivot in federal policy, driven by President Trump’s pledge to make the US a Bitcoin superpower, has reopened regulatory pathways once shut after the FTX collapse.

In parallel, Congress is advancing stablecoin legislation requiring issuers to secure federal or state licenses.

The push for bank status comes amid a broader effort to legitimize crypto within US finance. Earlier this year, regulators rolled back key restrictions. Among them, the SEC’s controversial SAB 121, which had blocked banks from holding crypto on behalf of clients.

Meanwhile, Federal Reserve (Fed) Chair Jerome Powell affirmed that banks could serve crypto customers provided proper risk management strategies exist.

In another regulatory green light, the Office of the Comptroller of the Currency (OCC) clarified that banks can offer stablecoin and custody services. However, this is provided they comply with established banking rules.

These signals have emboldened crypto firms previously kept at arm’s length. Anchorage Digital, the only US crypto-native firm with a federal bank charter, says the regulatory lift is massive but worth it.

“It hasn’t been easy… the whole gamut of regulatory and compliance obligations that banks have can be intertwined with the crypto industry,” Anchorage CEO Nathan McCauley reportedly admitted.

McCauley cited tens of millions in compliance costs. Nevertheless, Anchorage has since collaborated with BlackRock, Cantor Fitzgerald, and Copper for high-profile custody and lending programs.

BitGo, which will reportedly custody reserves for Trump-linked stablecoin USD1, is nearing a bank charter application.

Circle, the issuer of USDC, is also pursuing licenses while fending off competition, just like Tether. This is a traditional finance (TradFi) venture into stablecoins.

The firm delayed its IPO this month, citing market turmoil and financial uncertainty. However, insiders say regulatory clarity remains a top priority.

Firms like Coinbase and Paxos are exploring similar routes, considering industrial banks or trust charters to expand their financial offerings legally.

At the policy level, venture firm a16z has called on the SEC to modernize crypto custody rules for investment firms, reflecting the industry’s hunger for clarity and parity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Springs Back From $531 With Unshaken Bullish Conviction

My name is Godspower Owie, and I was born and brought up in Edo State, Nigeria. I grew up with my three siblings who have always been my idols and mentors, helping me to grow and understand the way of life.

My parents are literally the backbone of my story. They’ve always supported me in good and bad times and never for once left my side whenever I feel lost in this world. Honestly, having such amazing parents makes you feel safe and secure, and I won’t trade them for anything else in this world.

I was exposed to the cryptocurrency world 3 years ago and got so interested in knowing so much about it. It all started when a friend of mine invested in a crypto asset, which he yielded massive gains from his investments.

When I confronted him about cryptocurrency he explained his journey so far in the field. It was impressive getting to know about his consistency and dedication in the space despite the risks involved, and these are the major reasons why I got so interested in cryptocurrency.

Trust me, I’ve had my share of experience with the ups and downs in the market but I never for once lost the passion to grow in the field. This is because I believe growth leads to excellence and that’s my goal in the field. And today, I am an employee of Bitcoinnist and NewsBTC news outlets.

My Bosses and co-workers are the best kinds of people I have ever worked with, in and outside the crypto landscape. I intend to give my all working alongside my amazing colleagues for the growth of these companies.

Sometimes I like to picture myself as an explorer, this is because I like visiting new places, I like learning new things (useful things to be precise), I like meeting new people – people who make an impact in my life no matter how little it is.

One of the things I love and enjoy doing the most is football. It will remain my favorite outdoor activity, probably because I’m so good at it. I am also very good at singing, dancing, acting, fashion and others.

I cherish my time, work, family, and loved ones. I mean, those are probably the most important things in anyone’s life. I don’t chase illusions, I chase dreams.

I know there is still a lot about myself that I need to figure out as I strive to become successful in life. I’m certain I will get there because I know I am not a quitter, and I will give my all till the very end to see myself at the top.

I aspire to be a boss someday, having people work under me just as I’ve worked under great people. This is one of my biggest dreams professionally, and one I do not take lightly. Everyone knows the road ahead is not as easy as it looks, but with God Almighty, my family, and shared passion friends, there is no stopping me.

Market

XRP Futures Traders Increase Bets on Upside

Over the past week, XRP’s price has remained range-bound amid the broader market’s recovery attempt.

However, with a growing bullish bias toward the altcoin, XRP may be on the brink of breaking free from this range and trending upward. This analysis explains why.

XRP Futures Traders Bet on Upside as Long Positions

The momentum shift towards the bulls has become evident, particularly within the futures market, where long bets on XRP are now surpassing short positions. This is reflected by the token’s XRP’s long/short ratio, which is currently at 1.07.

The long/short ratio measures the proportion of long positions (bets on price increases) to short positions (bets on price declines) in the market.

When its value is below one, it indicates that the number of short positions outweighs long positions in the market, suggesting bearish sentiment or a lack of confidence in the token’s future price performance.

As with XRP, when an asset’s long/short ratio is above one, it means there are more long positions than short ones. It indicates that traders are predominantly bullish on XRP and hints at a higher likelihood of an upward breach of its narrow range.

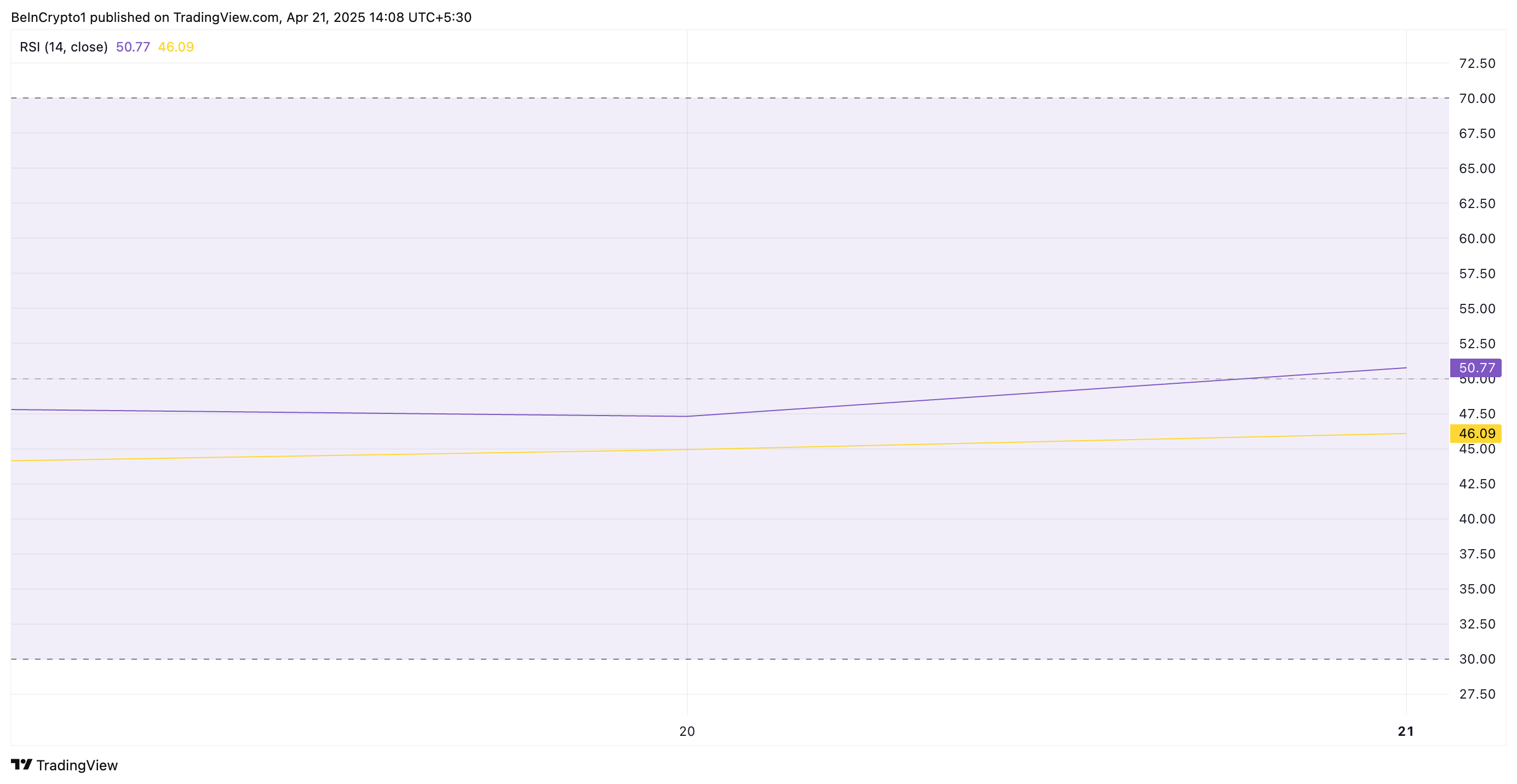

In addition, XRP’s relative strength index (RSI) has climbed steadily, indicating a gradual rise in demand for the token. The key momentum indicator, at 50.77, currently rests above the neutral line and is in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 50.77, XRP’s RSI signals a shift toward bullish momentum. It indicates that buying pressure is starting to outweigh selling pressure, and the asset may be poised for further price increases.

XRP Eyes $2.18 Resistance as Bulls Look to Push for $2.29

XRP currently trades at $2.13, just 3% away from its next significant resistance level, $2.18. If buying pressure intensifies and the altcoin successfully flips this price point into a support floor, it could trigger further price growth. In this scenario, XRP could potentially climb to $2.29.

However, if demand weakens and the bears regain control, XRP may remain range-bound. It could even break below the $2.03 support and fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market21 hours ago

Market21 hours agoTokens Big Players Are Buying

-

Market23 hours ago

Market23 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market20 hours ago

Market20 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Market18 hours ago

Market18 hours agoWill XRP Break Support and Drop Below $2?

-

Market11 hours ago

Market11 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Bitcoin9 hours ago

Bitcoin9 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market8 hours ago

Market8 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V