Market

Metaplanet Appoints Eric Trump to Strategic Advisory Board

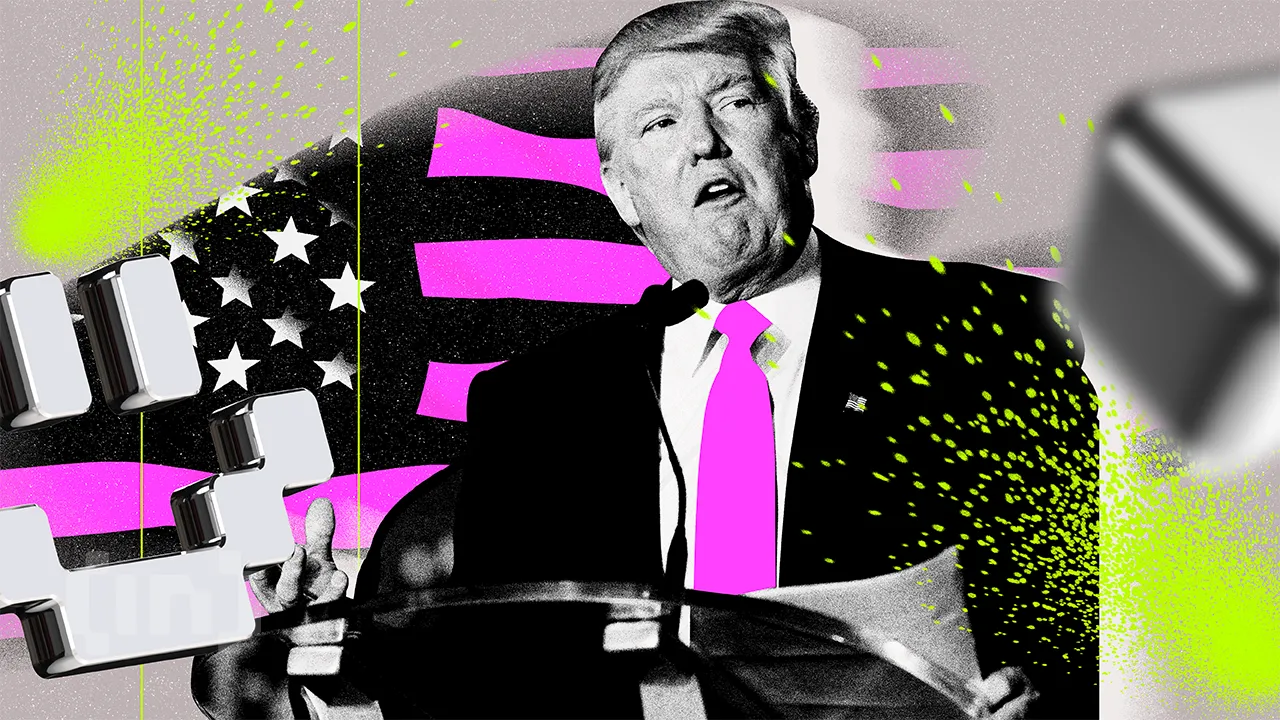

Japanese Corporation Metaplanet has announced the appointment of Eric Trump, son of US President Donald Trump, as the inaugural member of its newly established Strategic Board of Advisors.

The announcement made on March 21 highlights Metaplanet’s strategic intent to strengthen its influence within the global Bitcoin economy.

According to the official statement, Eric Trump’s appointment aims to leverage his vast experience in real estate, finance, brand development, and strategic business growth. Beyond his business credentials, Eric Trump has positioned himself as a key advocate for digital assets and blockchain innovation.

He also serves as a Web3 ambassador for World Liberty Financial (WLFI), a Trump-backed decentralized finance (DeFi) project focused on advancing financial freedom through decentralized technologies.

“His business acumen, love of the Bitcoin community and global hospitality perspective will be invaluable in accelerating Metaplanet’s vision of becoming one of the world’s leading Bitcoin Treasury Companies,” said Metaplanet CEO Simon Gerovich.

Alongside Eric Trump, Metaplanet’s Strategic Board of Advisors will include other renowned industry leaders and financial experts. These individuals will remain committed to advancing the company’s Bitcoin mission and fostering financial innovation in the digital asset sector.

The appointment comes as Metaplanet intensifies its Bitcoin investment strategy. On March 18, the company announced the issuance of 2 billion yen ($13.4 million) in zero-coupon ordinary bonds. The proceeds will be dedicated to acquiring more Bitcoin.

This aligns with Metaplanet’s ambitious roadmap. The company aims to amass 10,000 Bitcoins by the end of this year and 21,000 BTC by the close of 2026.

According to the latest data from Bitcoin Treasuries, Metaplanet currently holds 3,200 BTC, acquired at an average cost of $83,107 per coin. While this has resulted in a modest 1.8% profit, the firm remains vulnerable to Bitcoin price fluctuations.

The company faced potential losses multiple times in March 2025, when Bitcoin’s price fell below its acquisition cost. In fact, last week, Bitcoin dipped as low as $76,555—its lowest price since November 2024—putting downward pressure on Metaplanet’s portfolio. Nonetheless, the market has seen a slight recovery since.

At the time of writing, Bitcoin was trading at $84,414. According to BeInCrypto data, this reflected a 1.54% decline over the past 24 hours. This offers a narrow margin of safety for Metaplanet’s holdings but underlines the ongoing volatility of the cryptocurrency market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PumpSwap’s Total Trading Volume Surpasses $1 Billion

PumpSwap, a newly launched decentralized exchange (DEX) on the Solana blockchain, has quickly reached significant milestones.

Developed by the Pump.fun team, this platform offers a seamless trading experience with low fees. It aims to reshape the DEX space on Solana.

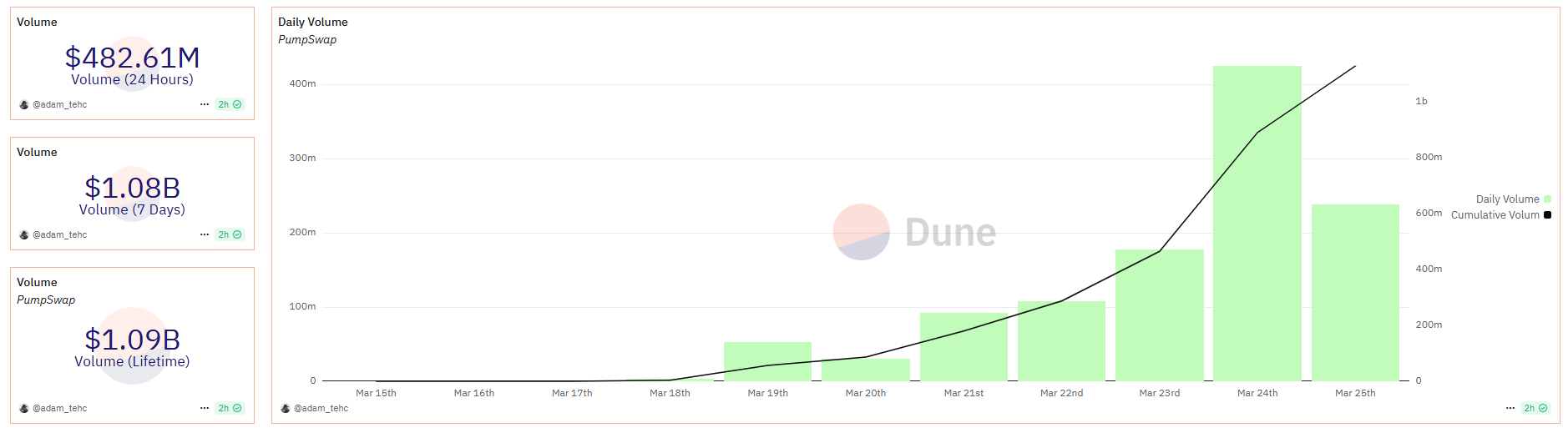

PumpSwap’s Cumulative Trading Volume Exceeds $1 Billion

Since its launch on March 20, 2025, PumpSwap has achieved impressive milestones, solidifying its position within the Solana ecosystem.

Data from Dune reveals that on March 24, PumpSwap recorded a 24-hour trading volume of $454 million. The platform attracted 243,000 users and generated $1.06 million in trading fees. PumpSwap accounted for 14% of Solana’s total DEX trading volume, a remarkable figure for a platform that has been live for less than a week.

PumpSwap’s total trading volume reached $1.04 billion in just seven days, showcasing rapid growth.

The launch of PumpSwap marks a crucial step in Pump.fun’s strategy. Pump.fun is a leading token launchpad on Solana. Previously, tokens completed the bonding curve on Pump.fun had to pay a 6 SOL fee to migrate to Raydium, which often took hours. PumpSwap was designed to eliminate this issue. It allows tokens to transition automatically without fees while providing higher liquidity and faster transactions.

The platform also plans to introduce a revenue-sharing model for token creators shortly. This initiative will incentivize new projects to join. PumpSwap’s emergence benefits users and intensifies competition with other DEXs like Raydium, which currently holds a 46.1% market share on Solana.

“Anyone still saying the team at Pump are greedy and don’t care about the community needs to get their facts straight. One of the reasons PumpSwap was created was so they have full control over the fee structure to benefit the users. Coin creators will soon be getting a percentage of the revenue earned. That alone is a game changer. Why would you launch a coin anywhere else?” a crypto expert commented.

Since the launch of PumpSwap, the number of new tokens created on Pump.fun has slightly increased. According to data from Dune, 34,000 meme tokens were created on March 24. This represents a 40% increase compared to the daily average of 24,000 tokens in March.

Additionally, the platform’s daily revenue reached $7.4 million, the highest level in the past month.

However, BeInCrypto has warned that the meme coin boom on DEXs like PumpSwap comes with high risks. Many of these tokens lack intrinsic value and may collapse after a period of rapid growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network’s Lack of Transparency Behind Listing Delay

A crypto analyst has proposed a theory explaining why Pi Network (PI) remains unlisted on major exchanges such as Binance and Coinbase.

Pi listing on these exchanges, especially Binance, has remained elusive despite significant community demand.

Analyst Alleges Transparency Gaps Behind Pi Network’s Binance Listing Delay

Dr. Altcoin, an analyst on X, ascribes the delayed listing of Pi coin to a lack of transparency from the Pi Core Team. Specifically, the opaque nature of Pi Network’s locking and burning mechanisms of billions of Pi coins may be the primary reason for the continued absence of a listing.

“I now better understand why Pi is not listed on major exchanges such as Binance and Coinbase. Likely, the Pi Core Team has not been transparent enough about the locking and burning mechanism involving the billions of Pi coins currently owned by the PCT,” Dr Altcoin opined.

The analyst previously noted that the circulating supply of Pi coins decreased by another 10 million to 6.77 billion. In their opinion, this suggested that the Pi Network core team could adjust the supply to stabilize prices.

“The last time a large number of Pi coins were unlocked, it sent the wrong signal and caused panic selling. However, the PCT [Pi Core Team] still needs to be transparent about the Pi burning mechanism and its plans for locking the majority of Pi coins owned by the PCT,” he added.

According to Dr. Altcoin, the absence of transparency makes it easy to misconstrue this as potential plans for market manipulation. He further suggested that Pi Network may eventually gain listings once the Pi Core team improves transparency and most community-held coins are traded for under $1.

This speculation aligns with recent concerns about Pi Network’s centralization issues, particularly concerning SuperNodes. BeInCrypt reported concerns about network control and governance transparency. These factors could further delay Pi’s acceptance by top-tier exchanges like Binance and Coinbase.

Pi Network’s Community Demand Faces Roadblock

Despite these concerns, Pi Network continues to enjoy significant community support. The project recently surpassed 4 million followers on social media, reflecting its strong user base. Moreover, a Binance survey revealed that 86% of participants wanted Pi listed on the exchange.

However, Binance has yet to take action, leading to controversy. Despite significant voter support in a community poll, Pi’s listing remains uncertain, fueling frustration among its supporters.

Of note, the vote to list Pi Network on Binance came amid the exchange’s resolve to involve the community in its listing and delisting actions.

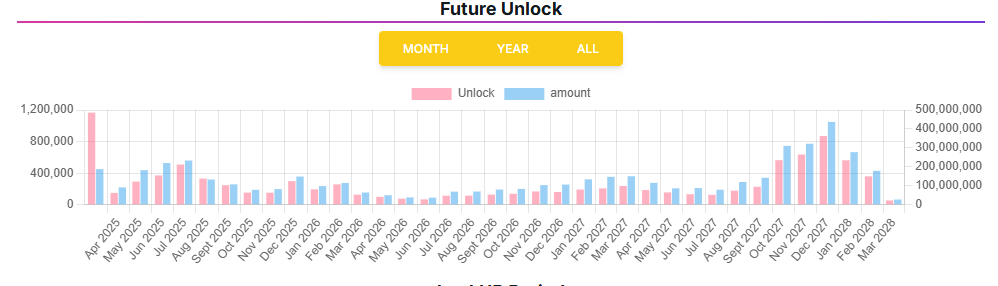

Adding to the uncertainty, Pi Network is preparing for another token unlock in April, following the release of 188 million tokens in March. These unlocks have raised fears of price manipulation, especially given the lack of clarity on how PCT handles locked and burned coins.

According to data on ExplorerPi, Pi Network will unlock over 91.9 million Pi tokens in April. Based on market rates as of this writing, $0.906 on CoinGecko, this volume of Pi coins is worth approximately $83 million.

Citing Keyrock research, BeInCrypto recently reported that 90% of token unlocks drive prices down. For Pi Network, therefore, a token unlock of this magnitude could impact the price of the Pi coin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin Price Awaits Reversal To End 8-Week Long Downtrend

Onyxcoin (XCN) price has struggled to break out of its multi-week downtrend, failing to recover after several attempts. Despite these setbacks, the altcoin still holds the support of a critical group of investors.

However, broader market backing will be essential for Onyxcoin to regain upward momentum and move toward higher price levels.

Onyxcoin Is Noting Mixed Signals

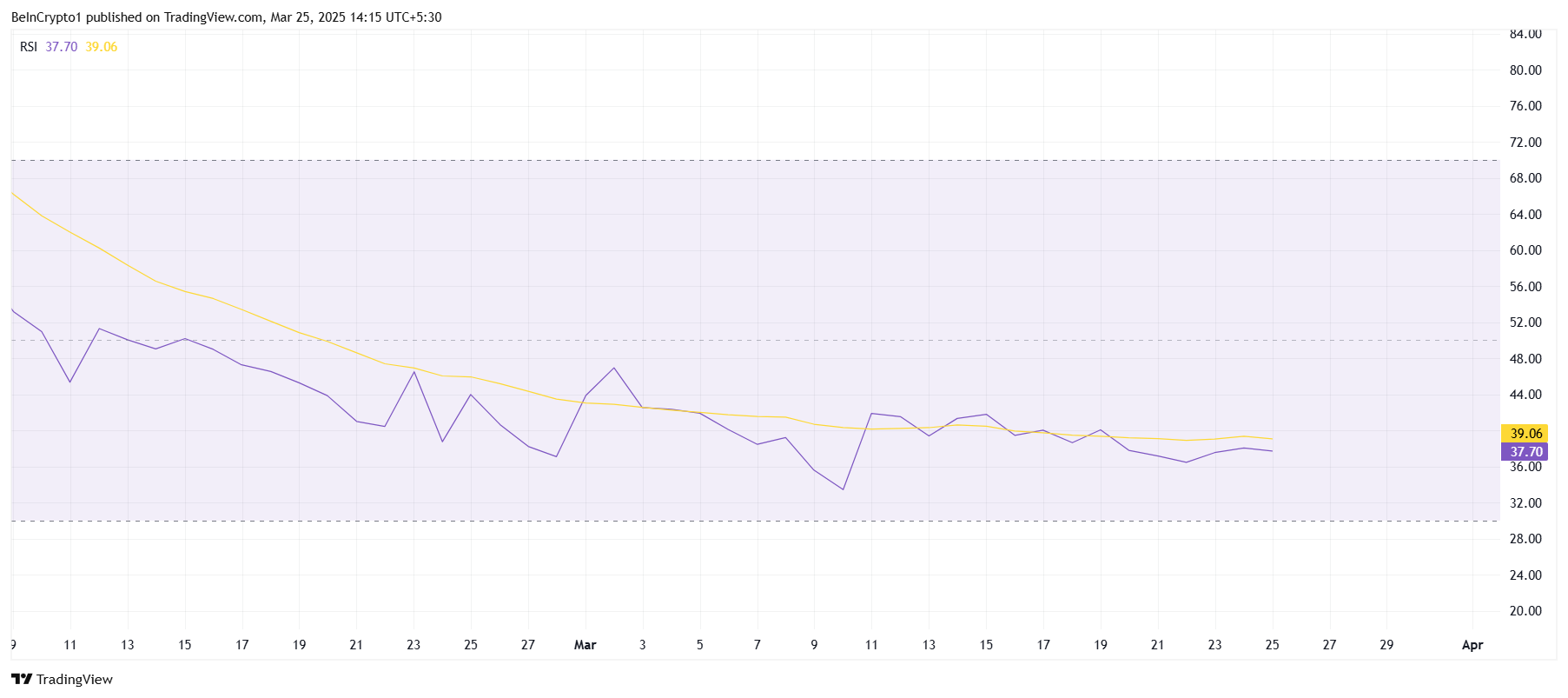

The Relative Strength Index (RSI) for Onyxcoin remains below the neutral 50.0 level, indicating that market momentum is still bearish. The failure of the altcoin to break through this neutral zone signals a lack of support from the broader market. Until the RSI shows an upward trend, it’s unlikely that Onyxcoin will experience any significant price recovery.

A shift in the market sentiment is necessary for Onyxcoin to break out of this slump. The lack of positive momentum from the broader crypto market has kept the altcoin under pressure. A reversal in market trends could trigger a potential price movement upward, but this will depend on external factors.

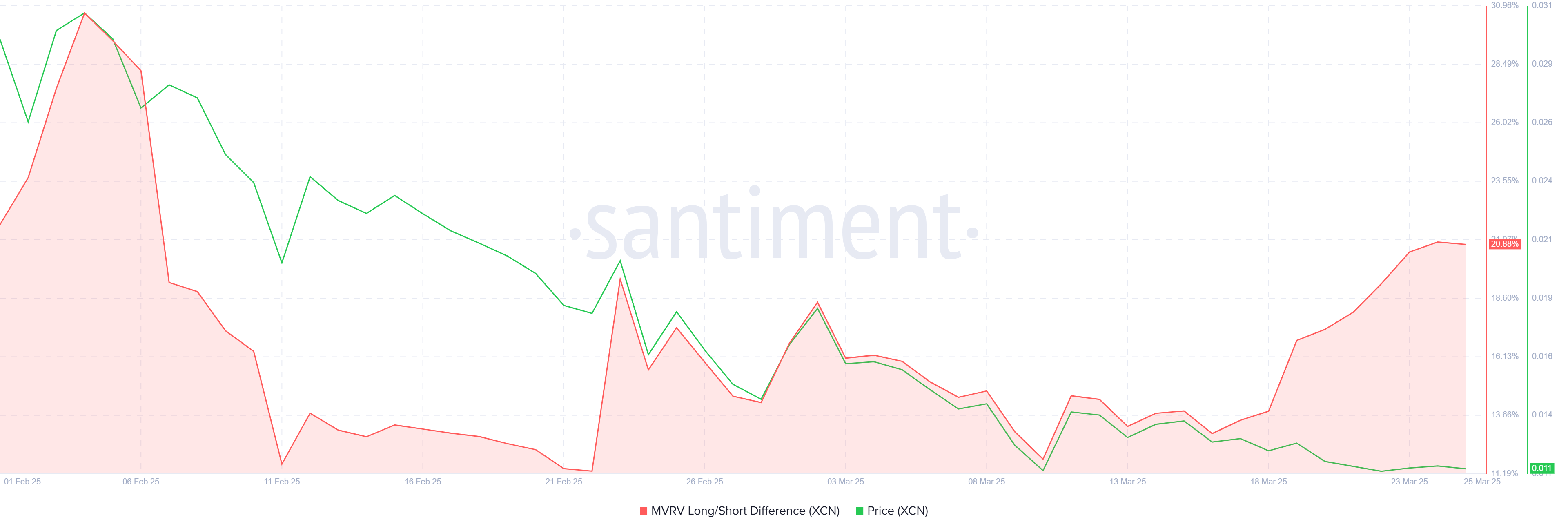

Looking at the overall macro momentum, Onyxcoin has shown some positive signs when considering the MVRV Long/Short Difference. Long-term holders (LTHs) are currently seeing increased profits, while short-term holders (STHs) are losing out due to the recent price decline. This dynamic provides a strong foundation for Onyxcoin, as LTHs are less likely to sell during bearish conditions, helping to stabilize the price.

This behavior from LTHs indicates that despite the short-term volatility, the coin has room for a potential recovery. As the STHs suffer from losses, LTHs accumulate more, which could drive the price back in a more favorable direction. The stability provided by LTHs allows Onyxcoin to weather market fluctuations while positioning for a recovery.

XCN Price Fails Breakout Again

Onyxcoin’s price is currently trading at $0.0112, within a descending wedge. This downtrend has persisted for eight weeks, with the altcoin repeatedly failing to break through the $0.0120 resistance. This price range has been a persistent barrier, and until Onyxcoin manages to break through, it is likely to remain stuck under $0.0120.

Considering the current factors, Onyxcoin’s price could stay below the $0.0120 resistance. The next critical support level lies at $0.0100. If the price falls below this level, it could continue its decline, potentially reaching $0.0083.

For the bearish-neutral outlook to be invalidated, Onyxcoin must flip the $0.0120 resistance level into support. If this happens, the price could bounce toward $0.0150, breaking free from the descending wedge pattern. This move would mark a significant shift in market sentiment and may help Onyxcoin establish an upward trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoWorldcoin Jumps 13% As World Network Eyes VISA Partnership

-

Market23 hours ago

Market23 hours agoXRP Demand Dips as Bearish Trends Set In Post-SEC Lawsuit

-

Market22 hours ago

Market22 hours agoXRP Price Could Suffer April Flash Crash, Analyst Shows How Low It Could Go

-

Bitcoin21 hours ago

Bitcoin21 hours agoMicroStrategy’s Bitcoin Holdings Exceed 500,000 BTC

-

Market16 hours ago

Market16 hours agoDid World Liberty Financial Launch a Stablecoin on BNB Chain?

-

Regulation20 hours ago

Regulation20 hours agoChainlink Teams Up With Abu Dhabi’s ADGM To Promote Tokenization In The UAE

-

Regulation18 hours ago

Regulation18 hours agoUS SEC To Shift Attention From Crypto Enforcement To Traditional Cases: Details

-

Bitcoin17 hours ago

Bitcoin17 hours agoWhat Does Trump’s Liberation Day Tariff Mean for Crypto Prices?