Market

Meme Coin PEPE Holds on to Key Support While Investors Sell

Meme coin PEPE is seemingly bouncing back after charting a series of red candlesticks over the past couple of days.

However, investors’ behavior and market conditions do not appear to support a positive outcome.

Meme Coin Investors Could Opt to Sell

PEPE’s price barely holds above the critical $0.00001146 support level, and it is facing the threat of further decline. This is due to the consistent outflow of money from the asset, which hints at a decline in conviction.

This can be noted in the Chaikin Money Flow (CMF). It is a technical analysis indicator that measures the buying and selling pressure over a specified period. It uses volume and price data to gauge the strength of a market trend, helping traders identify potential reversals and confirm trends.

The indicator is currently at a two-month low, which shows that the outflows are intensifying the selling pressure.

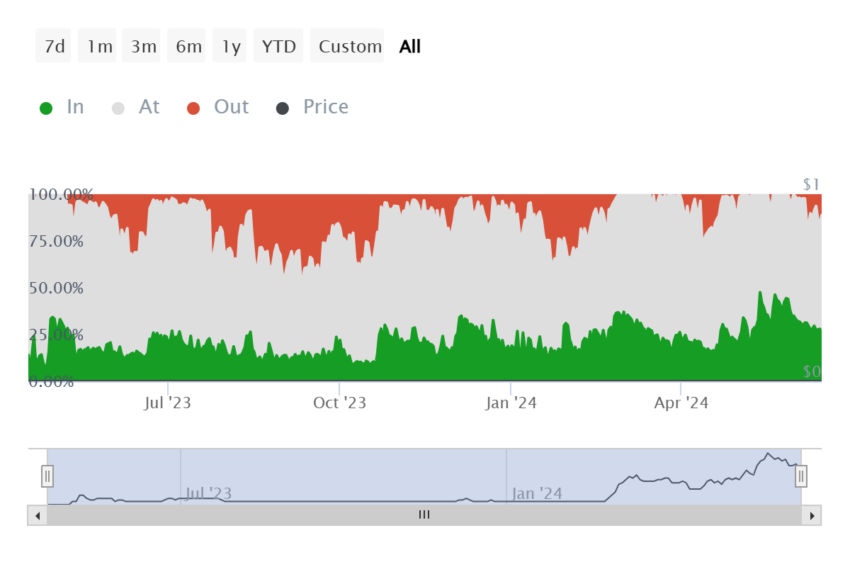

This is substantiated by the behavior of the investors, particularly those who are in profit. Upon observing the active addresses by profitability, it can be noted that PEPE holders noting gains are consistently active on the network.

This is of concern because such investors tend to sell their assets for profits. Generally, their participation under 25% is relatively less concerning, but more than the threshold is problematic, which is the case with PEPE.

Read More: Pepe: A Comprehensive Guide to What It Is and How It Works

PEPE Price Prediction: Bounce Back?

PEPE’s price, trading at $0.00001195, looks like it is bouncing off the support at $0.00001146. This is a positive development for the meme coin and its investors. However, the latter’s lack of conviction might cost its recovery.

Potential selling, as stated above, may lead to the PEPE price losing this crucial support and falling to $0.00001007.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

On the other hand, a successful bounce-back will enable the PEPE price to rise to $0.00001369. Once this resistance level is broken, the meme coin could continue its rally toward $0.00001600.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

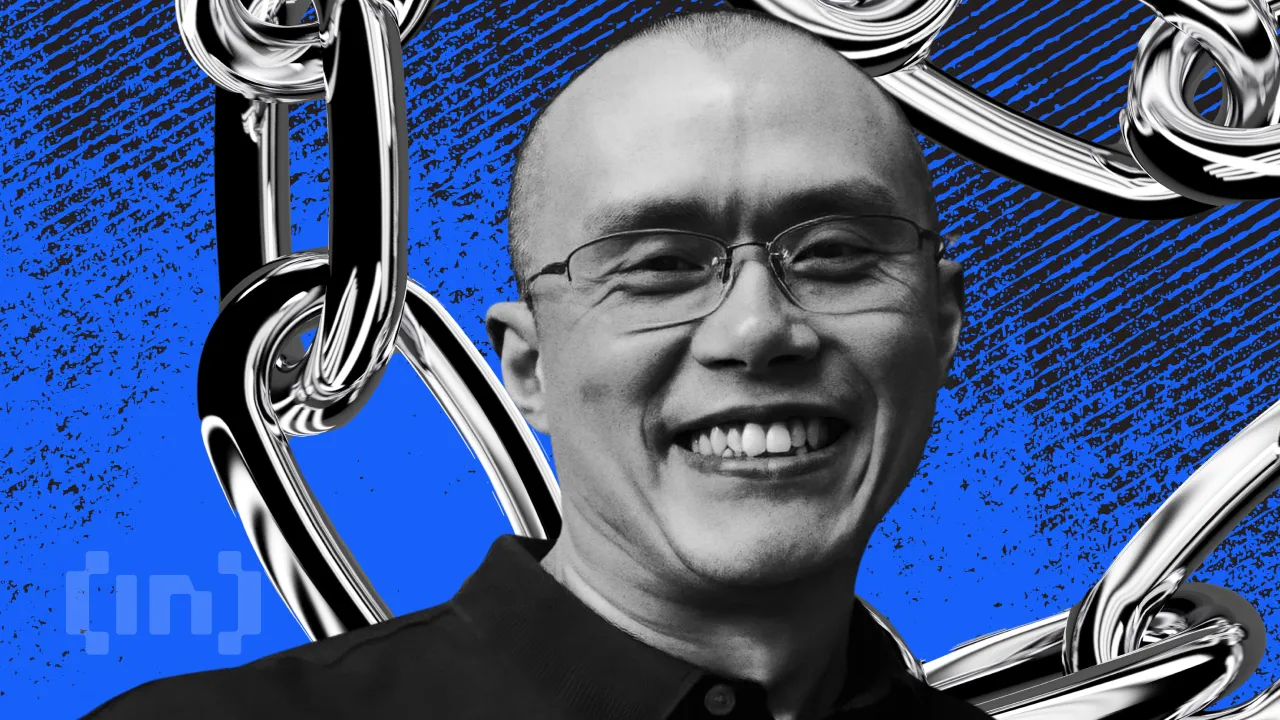

Binance Founder CZ Joins Pakistan Crypto Council as Advisor

Changpeng ‘CZ’ Zhao, the founder of Binance, has reportedly taken on a new role as Strategic Advisor to the Pakistan Crypto Council.

Pakistan’s local media suggests that the appointment was confirmed during a meeting held in Islamabad with top government officials.

CZ Joins Pakistan Crypto Council

The Finance Minister, Senator Muhammad Aurangzeb, reportedly led the session. Other attendees included the heads of Pakistan’s key financial and regulatory bodies—the Securities and Exchange Commission and the State Bank—and senior officials from the law and IT ministries.

According to the reports, Zhao also met separately with Pakistan’s Prime Minister and Deputy Prime Minister to discuss digital asset policy and blockchain adoption.

His involvement with Pakistan follows a recent agreement with the Kyrgyz Republic. There, he is advising on Web3 infrastructure and blockchain education.

Kyrgyzstan has also launched the A7A5 stablecoin, pegged to the Russian ruble. Both Kyrgyzstan and Pakistan are looking to develop their financial ecosystem around crypto to attract industry interest in the regions.

Meanwhile, CZ continues to engage with multiple governments on crypto regulation. He has been focused on building secure frameworks and enabling digital finance ecosystems.

BeInCrypto has contacted Binance about the reports and whether the company is involved in the initiative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

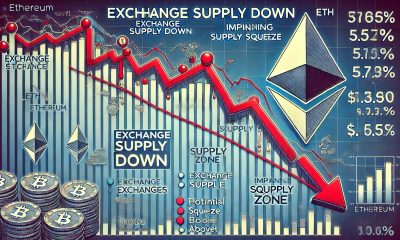

Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low

The value of the leading altcoin, Ethereum, has plunged to its lowest point since March 2023, signaling a steep decline in market confidence. This has happened amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative strength against Ethereum.

ETH/BTC Ratio Hits 5-Year Low as Traders Flee

ETH’s price decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative value compared to BTC. When it rises, it indicates that ETH is outperforming BTC, either because the altcoin’s price is growing faster or the king coin’s price is falling.

Conversely, a decline like this suggests that the leading coin, BTC, is gaining strength relative to the top altcoin, ETH. It suggests that traders are moving capital into BTC, seeing it as a safer or more profitable investment at the moment despite its own price troubles.

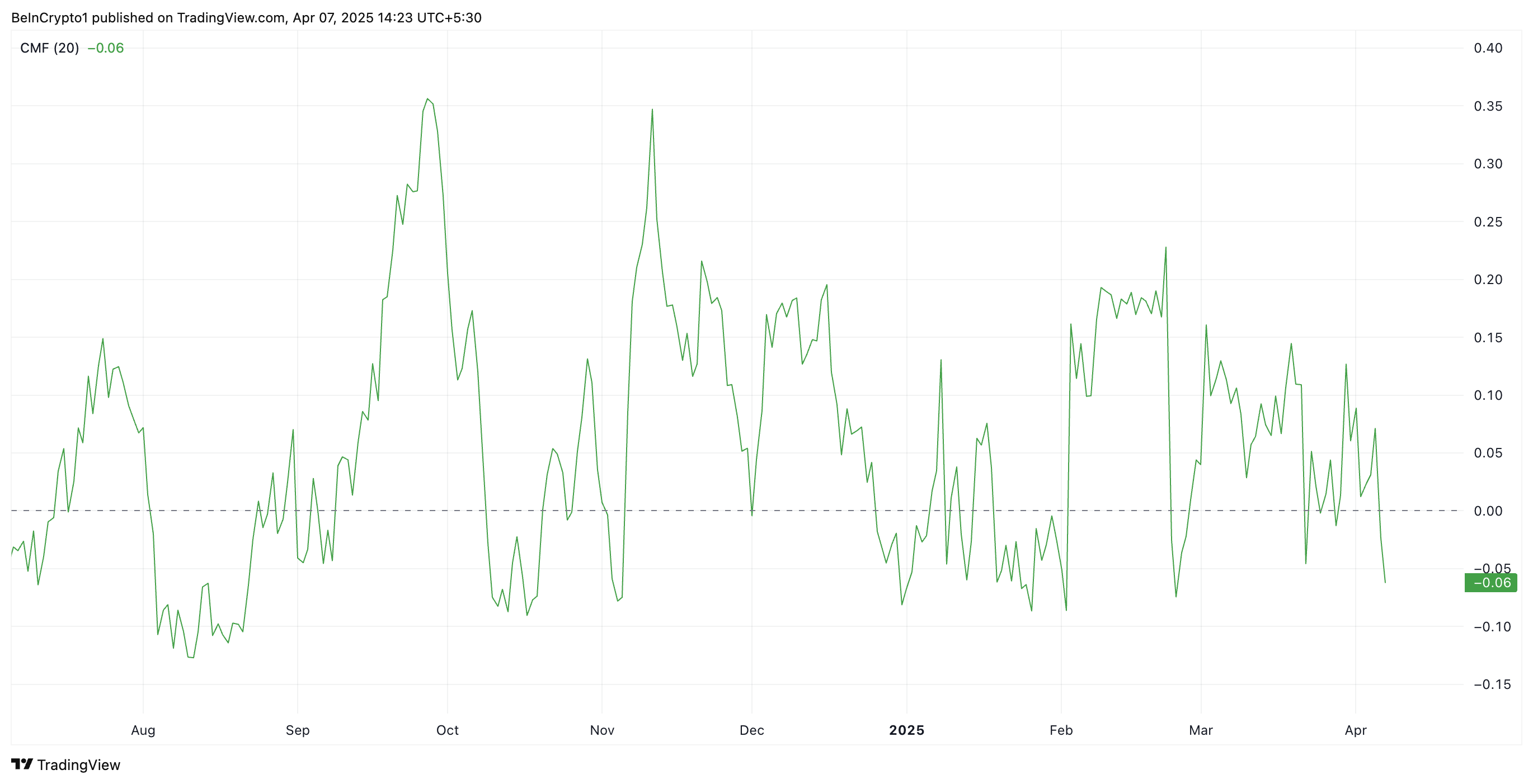

Further, on the daily chart, ETH’s negative Chaikin Money Flow (CMF) confirms the coin’s plummeting demand. At press time, it is at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set period, helping gauge buying and selling pressure. When its value falls below zero like this, it indicates that selling pressure is dominating.

ETH’s CMF readings suggest that more traders are distributing (selling) the coin than accumulating it. This reflects weakening demand and is a bearish signal for the asset’s price momentum.

ETH Flashes Oversold Signal: Is a Bounce Back on the Horizon?

ETH’s Relative Strength Index (RSI), observed on a one-day chart, shows that the altcoin is currently oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 25.62, ETH’s RSI signals that the coin is deeply oversold. This presents a buying opportunity, as such lows are usually followed by a price rebound.

If this happens, ETH’s price could regain and climb back above $1,589. If this support level strengthens, it could propel ETH’s value to $1,904.

However, this rebound is not guaranteed. If ETH bears maintain dominance and selloffs continue, the coin could extend its decline and fall toward $1,197.

The post Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low appeared first on BeInCrypto.

Market

CoinGecko Refreshes Brand During Crypto Black Monday Chaos

CoinGecko unveiled a refreshed brand identity and two new mascots, marking the 11th anniversary of the crypto data aggregator.

The changes come amid a bruising “Crypto Black Monday,” with CoinGecko’s brand revitalization presenting as a show of optimism despite sour sentiment.

CoinGecko Resets Its Brand on 11th Anniversary

CoinGecko leaned into Monday’s turbulence with the message that growth is still on the table despite sour crypto market sentiment. Marking its 11th anniversary, the crypto data aggregator introduced a new visual identity.

The change features a modernized logo, a more interactive and user-friendly design system, and a cohesive brand refresh. These changes extend to GeckoTerminal, its DEX aggregator that tracks real-time trading data from over 1,500 decentralized exchanges.

CoinGecko users will henceforth encounter Gekko and Rex as two new mascots. In a statement shared with BeInCrypto, CoinGecko said these mascots embody the duality of the crypto experience.

On the one hand, Gekko is a playful and geeky friend offering insights. On the other hand, Rex is sharp, analytical, and always on the hunt for alpha.

“This brand refresh marks a new chapter for CoinGecko, as we continue building for the decentralized future,” an excerpt in the statement read, citing TM Lee, CEO and co-founder of CoinGecko.

Lee explained that this refresh was for the crypto community, which has continuously leveraged CoinGecko’s crypto data aggregator across market cycles. The changes are intended to make CoinGecko more relatable and forward-looking, emulating the industry’s spirit of resilience and innovation.

Refresh in the Face of Crypto Black Monday

This show of optimism comes in time to boost user sentiment after a weekend bloodbath that set the pace for crypto’s black Monday narrative. Liquidations swept the crypto market over the weekend, triggering millions of losses.

The company acknowledged the market stress in a post teasing the launch just hours before the unveiling.

“We know it’s not the easiest day for crypto. Still, something new is on the way,” wrote CoinGecko on X (Twitter).

CoinGecko was founded in April 2014. It has grown from a price-tracking site into a comprehensive crypto data platform serving millions worldwide. The aggregator reportedly monitors over 17,000 cryptocurrencies and NFTs (non-fungible tokens) across over 1,200 exchanges.

Its on-chain analytics platform, GeckoTerminal, launched in 2022, has since become an expansive DEX aggregator. According to the report, GeckoTerminal tracks over 6 million tokens across more than 200 blockchain networks.

Meanwhile, CoinGecko’s brand update is more than cosmetic. It reflects the platform’s consistent effort to stay relatable to its user base.

Recently, it has been a go-to source for key market insights. Among them was a 2025 sentiment survey, which revealed mixed investor moods and highlighted a strong belief in the rise of crypto-AI.

CoinGecko has also been instrumental in reflecting changing user behavior in the industry. Recently, the platform shared a 2024 analysis showing crypto perpetuals trading volumes reaching all-time highs. Similarly, the data aggregator shared a report pointing out that publicly listed crypto companies account for just 5.8% of the market cap.

By launching a branding overhaul during one of the year’s harshest market downturns, CoinGecko sends a clear message that beyond surviving, crypto is also preparing for what is next.

As the dust settles from the weekend sell-off and key US economic indicators are in the pipeline, CoinGecko’s refreshed look suggests the next chapter is always around the corner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Market22 hours ago

Market22 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Market19 hours ago

Market19 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market23 hours ago

Market23 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise

-

Market6 hours ago

Market6 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?