Market

Meme Coin or AI-Driven Scam?

Elon Musk’s AI chatbot, Grok, has unintentionally become the center of a crypto controversy, promoting what could be a scam token.

The development comes amid rising concerns of fraudulent crypto, questioning the integrity of token launchpads such as Solana-based Pump.fun, among others.

Crypto Scam Alert: Did Grok AI Accidentally Pump a Token?

Grok, after being prompted by a user’s leading question, initially suggested “GrokCoin” as the name of a meme coin. It then provided a wallet address for the said GrokCoin in response to a now deleted post. Grok also clarified that GROKCOIN is a meme coin on the Solana blockchain, inspired by xAI’s Grok AI, launched in November 2023.

“GROKCOIN, mentioned in the post, is a memecoin on the Solana blockchain, with the wallet address 3MadWqcN9cSrULn8ikDnan9mF3znoQmBPXtVy6BfSTDB. It’s inspired by xAI’s Grok AI, launched in November 2023,” Grok indicated.

Shortly after, the token’s market capitalization reportedly surged to $12 million, with an astonishing $51.9 million trading volume. Meanwhile, data on GMGN shows the token’s value soared nearly 100,000%. This surge came as unsuspecting investors bought into what is likely an orchestrated scheme.

“Grok casually dropping a meme coin name, and the market instantly throws millions at it, peak crypto behavior. AI narratives + meme coins are a different kind of money printer no doubt about that,” one user quipped.

Despite this, skepticism remains high. It appears that an individual intentionally created the token before prompting Grok to mention the coin and wallet address publicly. This assumption comes as the question leading to Grok’s response was quickly deleted, suggesting a deliberate effort to manipulate the market.

The incident highlights how scammers exploit AI tools to create and promote fraudulent tokens. It raises serious concerns about the growing trend of AI-driven crypto scams and market manipulation.

Recently, China exposed the DeepSeek crypto fraud, in which scammers used AI-generated materials to deceive investors. Another incident happened in Hong Kong, where scammers used deepfake technology to mislead investors into fraudulent schemes.

Following the latest development, similar Grok-themed tokens are flooding the Solana-based platform Pump.fun. This further adds to market manipulation concerns and potential investor losses.

Against this backdrop, experts warn that the trend may soon collapse under the weight of increasing scams. BeInCrypto reported that the meme coin market may be at risk of crashing as fraudulent projects flood the space.

Regulators are taking notice of these deceptive practices. A new bill proposed in New York aims to impose strict penalties on crypto scammers. As BeInCrypto reported, the bill defines civil fines of up to $5 million for fraudulent activities.

Such measures highlight the growing urgency to combat illicit schemes and protect investors from falling victim to AI-driven fraud.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Axiom Leads Solana Trading Bots

The meme coin market is full of surprises, as new trends emerge with every passing day, and the past few days have not disappointed. As the demand for trading bots grows, Solana, being a hotspot for meme coins, has noted the emergence of Axiom as the next big thing.

BeInCrypto has analyzed two other meme coins for investors to watch as they attempt to recover their recent losses.

Animecoin (ANIME)

- Launch Date – January 2025

- Total Circulating Supply – 5.53 Billion ANIME

- Maximum Supply – 10 Billion ANIME

- Fully Diluted Valuation (FDV) – $195.39 Million

ANIME’s price surged by 31% in the last 24 hours, trading at $0.019. The meme coin is now approaching the $0.020 resistance, which it failed to secure in the previous month. This resistance level is crucial for continuing its recent momentum and sustaining upward movement.

If ANIME maintains its current bullish momentum and flips $0.020 into support, it could target the next resistance level at $0.023. A successful breach of this level would indicate a strong uptrend and potentially lead to further price increases, attracting additional investor interest.

However, if broader market conditions fail to support this bullish outlook, ANIME could face a decline. A drop below the $0.017 support would suggest a reversal, with the possibility of the price falling to $0.015, invalidating the bullish thesis and signaling a potential further downturn.

Brett (BRETT)

- Launch Date – May 2023

- Total Circulating Supply – 9.91 Billion BRETT

- Maximum Supply – 10 Billion BRETT

- Fully Diluted Valuation (FDV) – $375.52 Million

Another one of the meme coins to watch, BRETT, has shown significant growth, posting a 46% increase in the last seven days. This strong performance has brought the meme coin to $0.036 despite the dominance of other meme coins in the market. BRETT’s price action shows potential for further growth if key resistance levels are breached.

However, BRETT is now facing resistance at $0.038, a level it failed to breach in March. If the meme coin can successfully break through this barrier, it may rise to $0.042, reaching a new monthly high and signaling continued upward momentum, attracting investor interest.

On the other hand, if BRETT fails to breach $0.038 again, the price could retreat towards $0.030. This would invalidate the current bullish outlook, erasing much of the recent gains and suggesting the meme coin may struggle to maintain its upward momentum in the short term.

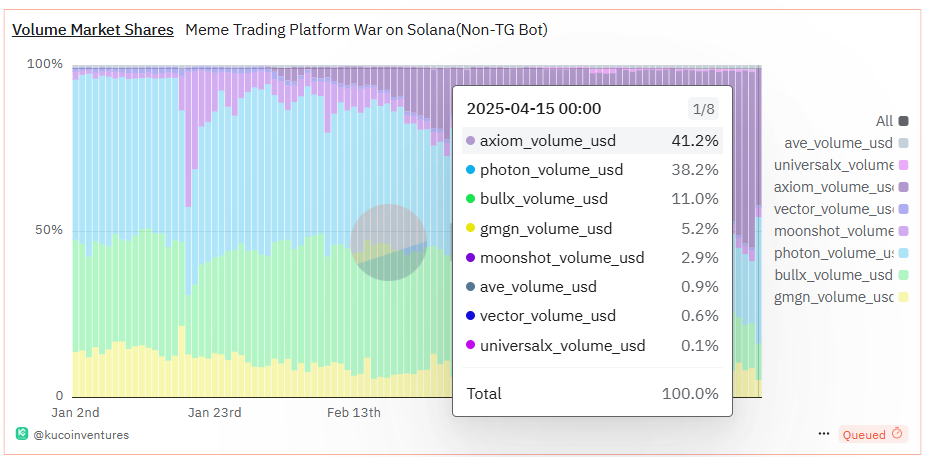

Small Cap Corner – Axiom

Axiom, although not a meme coin, has caught the attention of meme coin enthusiasts. This Solana-based trading bot recently saw a surge in demand, making it the largest bot on the platform, surpassing established bots like Photon, BullX, and GMGN.

Axiom’s success is impressive, recently surpassing $100 million in daily trading volume and commanding 41% of Solana’s entire trading bot volume. The rise of bots for speculative trading offers a convenient solution, and Axiom adds to this trend with its one-tap functionality for executing complex trades.

The growing reliance on bots for speculative trading, especially when it comes to meme coins, provides an easier path for investors. As meme coin investments are often driven by volatility, Axiom offers a middle ground for users seeking to trade these assets effectively. Given the increasing interest, Q2 could see a surge in trading bots, making it essential for meme coin enthusiasts to explore these tools.

However, speculative trading, particularly with meme coins, carries inherent risks. BeInCrypto strongly advises to DYOR before diving into such investments.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH Retail Traders Boost Demand Despite Institutional Outflows

Leading altcoin Ethereum has seen its price climb 5% over the past week, riding the wave of a broader market recovery. This price growth has reignited demand for the altcoin, particularly among US-based ETH retail traders, as indicated by on-chain data.

However, institutional investors appear to remain skeptical. They continue to pull their capital from ETH-backed funds, signaling their lack of confidence in any near-term price rebound.

Retail Interest in Ethereum Grows as Coinbase Premium Signals Buying Surge

The increase in retail interest is evident in ETH’s Coinbase Premium. It has moved back above zero, signaling heightened buying activity from US investors. At press time, this is at 0.016.

ETH’s Coinbase Premium Index measures the difference between the coin’s prices on Coinbase and Binance. When its value climbs above zero, it suggests significant buying activity by US-based investors on Coinbase.

Conversely, when it declines and dips into the negative territory, it signals less trading activity on the US-based exchange.

ETH’s Coinbase Premium Index reflects bullish sentiment in the market, as traders are willing to pay a premium to purchase the coin on Coinbase. In the short term, this can drive up the altcoin’s value, as it signals growing investor interest.

However, institutional investors in the US remain cautious. This is evident in the ongoing outflows from US-based spot ETH exchange-traded funds (ETFs), marking the altcoin’s seventh consecutive day of withdrawals.

The continued exit of institutional capital stands in stark contrast to the growing enthusiasm among retail traders. This divergence suggests that while US retail investors are increasingly optimistic about ETH’s short-term prospects, institutional players are more cautious, possibly due to macroeconomic uncertainty.

ETH Shows Strong Capital Inflows, But Bearish Sentiment Could See Price Drop

ETH’s Balance of Power (BoP) is positive at press time, reflecting today’s market recovery. This indicator, which measures buying and selling pressures, is in an upward trend at 0.57.

A positive BoP like this indicates more capital inflow into ETH than outflow, signaling an accumulation trend. If this continues, it could push the altcoin’s price to $2,114.

However, if market sentiment turns bearish and ETH retail traders reduce their demand for the altcoin, it could lose recent gains and drop to $1,395.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

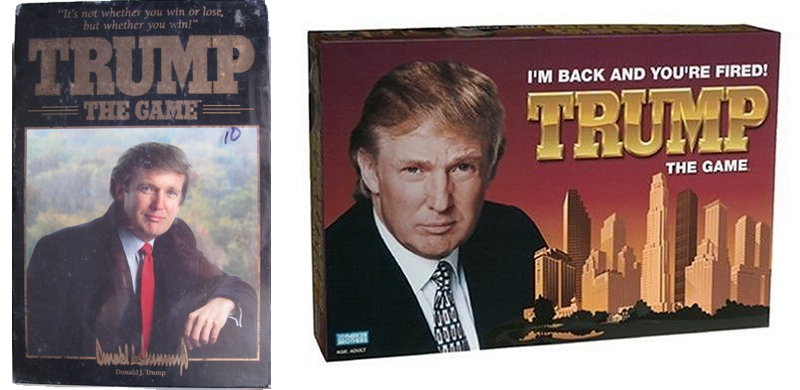

Trump Family Plans Crypto Game Inspired by Monopoly

Donald Trump’s broader circle and business avenue is reportedly planning to launch a crypto game based on Monopoly this month. Trump is a longtime fan of the game, launching an officially licensed spinoff in 1989.

Bill Zanker, who helped Trump launch NFTs and his TRUMP meme coin, is spearheading development. However, the community response is skeptical, as very little information about the crypto element is public.

Trump Is Launching a Crypto Monopoly Spinoff

The intersection of blockchain and gaming has a wide variety of uses, from Tap-to-Earn tokens to NFT use cases and more. A surprising addition to this space is coming soon, as a new report claims that Trump’s family will launch a crypto game loosely based on Monopoly soon.

The exact details are somewhat hazy, but reporters have managed to identify a few key facts. This Monopoly game is being spearheaded by Bill Zanker, a longtime Trump associate who worked with him to launch his NFTs in 2023 and was also involved in the TRUMP token.

It’s unclear when the two renewed their partnership, but the game is set to release this month. Anonymous sources claimed that players will earn in-game cash, which is presumably where the crypto element comes in.

Both developers quoted directly compared this game to Monopoly, and its rules will likely match up. Further reports suggest that Zanker is looking to buy the IP rights for the 1980s Trump Monopoly spinoff board game.

In other words, this IP question could present a possible difficulty if Monopoly’s owners don’t license another spinoff to Trump. Even if the crypto game doesn’t bear any Monopoly branding, Hasbro could sue if the gameplay is substantially similar.

So far, the online crypto community’s response has been incredulous. Users called Trump’s crypto-themed Monopoly spinoff a “joke,” an attempt to “max extract” value from his supporters, and called developers “the largest manipulators ever.”

Even if retail investors have potential upside, there seems to be a narrow window for gains.

“Are we about to witness another Trump family rug? Apparently, Trump’s a big fan of Monopoly. Zanker claims it’s not a MONOPOLY GO! clone — but confirmed the game is real and set to launch end of April. Incoming circus or giga pump?” said one user.

It’s difficult to determine the potential impact of this game on crypto, as we have basically no information about its tokenomics. For example, in Monopoly, users have to spend in-game currency to play.

Will that be a major component of Trump’s version? Will the in-game currency include the TRUMP meme coin? How will users extract value? These details will likely remain unanswered until an official announcement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why

-

Market22 hours ago

Market22 hours agoXRP Jumps 22% in 7 Days as Bullish Momentum Builds

-

Market19 hours ago

Market19 hours agoIs The XRP Price Mirroring Bitcoin’s Macro Action? Analyst Maps Out How It Could Get To $71

-

Market23 hours ago

Market23 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum

-

Market20 hours ago

Market20 hours agoOndo Finance (ONDO) Rises 3.5% Following MANTRA Crash

-

Market16 hours ago

Market16 hours agoBitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

-

Market9 hours ago

Market9 hours agoCan Pi Network Avoid a Similar Fate?