Market

Major Token Unlocks of Next Week: AVAX and More

Token unlock involves releasing tokens that were previously blocked under fundraising terms. Projects carefully schedule these releases to avoid market pressure and prevent a drop in token prices.

However, factors like lack of liquidity or early investor profit-taking can significantly impact an asset’s dynamics. Here are four major token unlocks to watch next week.

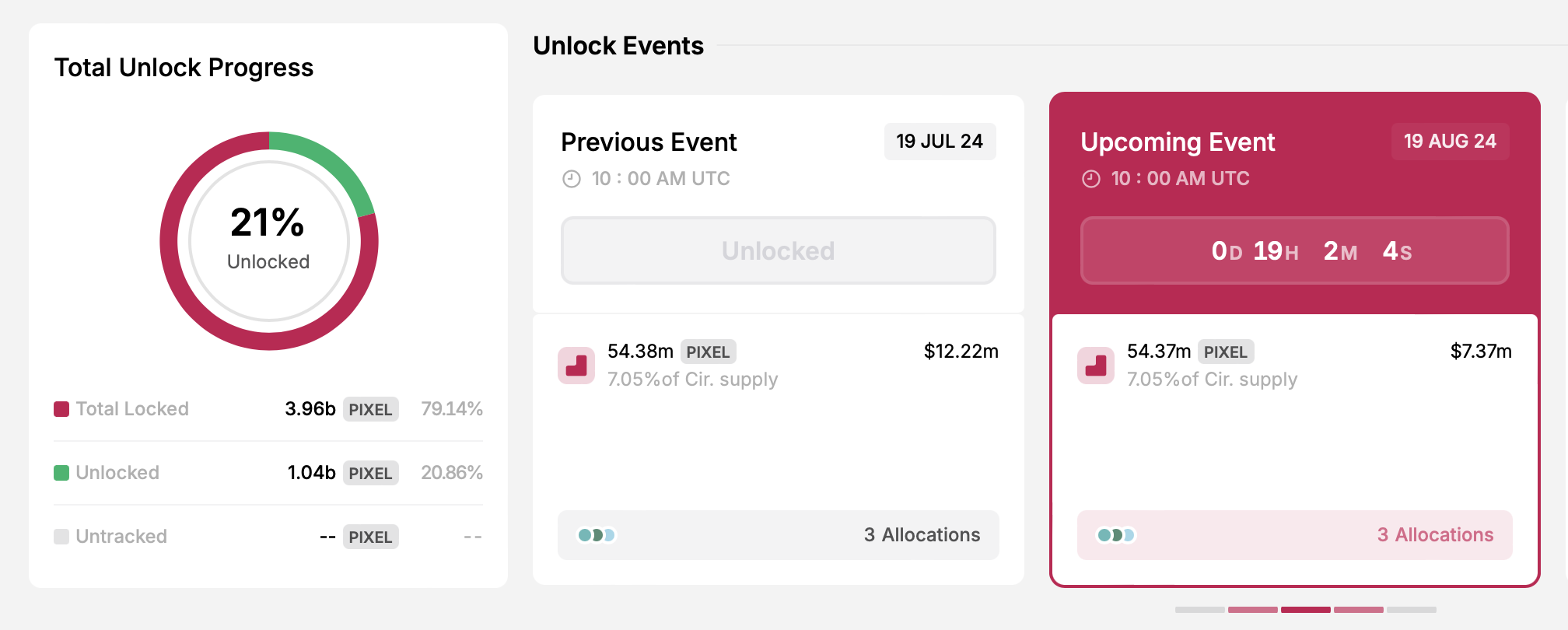

Pixels (PIXEL)

- Unlock date: August 19

- Number of tokens unlocked: 54.37 million PIXEL

- Current circulating supply: 771.04 million PIXEL

Pixels is a multiplayer game on the Ronin blockchain, utilizing the PIXEL token as its in-game currency and for community governance. Holders of PIXEL can mint NFTs, purchase items and VIP passes, join guilds, and vote on project developments.

On August 19, 54 million PIXEL tokens will be released into circulation and distributed among advisors, the project’s treasury, and ecosystem rewards.

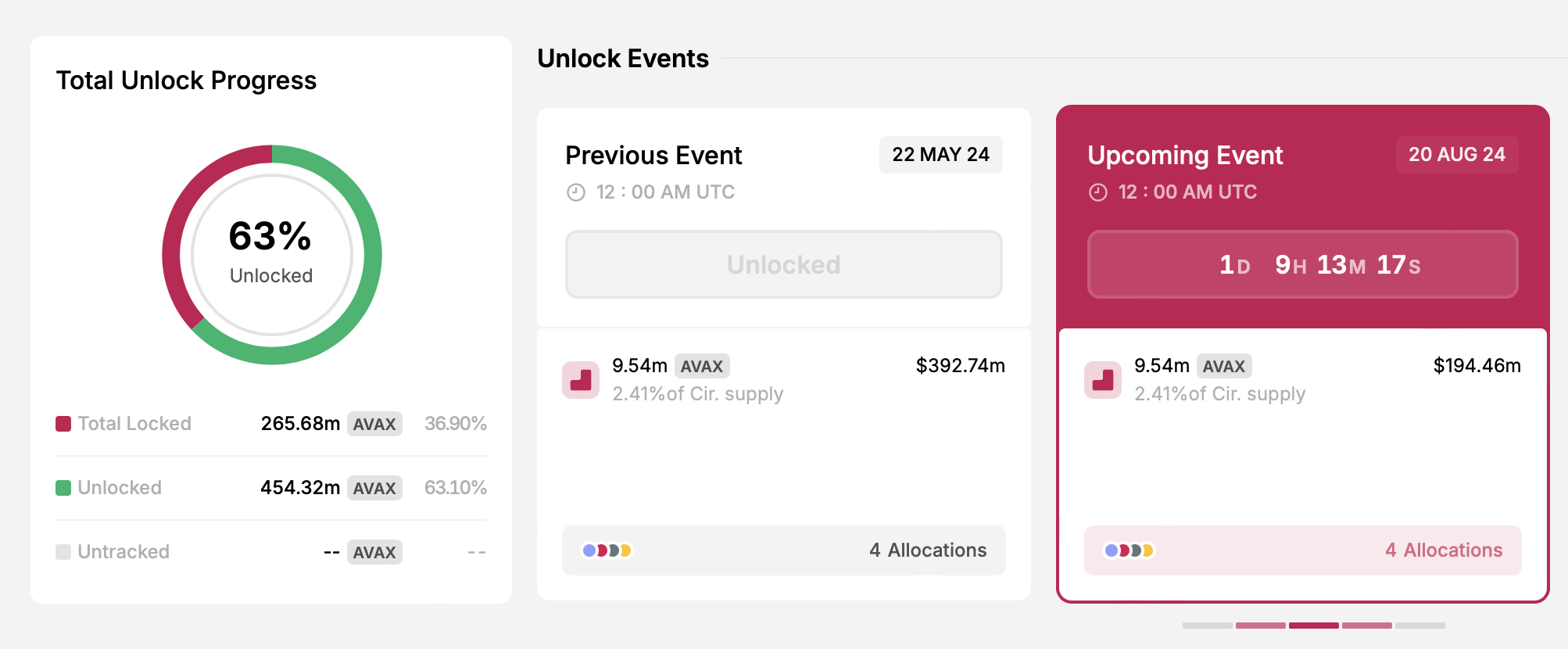

Avalanche (AVAX)

- Unlock date: August 19

- Number of tokens unlocked: 9.54 million AVAX

- Current circulating supply: 395.36 million AVAX

Avalanche is a decentralized blockchain platform that delivers high performance and scalability, enabling developers to create and deploy decentralized applications (dApps) and custom blockchain networks. The native token of the Avalanche network is AVAX, used for paying transaction fees, staking, and participating in the platform’s governance.

Avalanche accounts for nearly all of next week’s token unlocks value. On August 19, the project will unlock 9.54 million AVAX tokens worth nearly $200 million. It is worth noting that this is the latest unlock that could impact the asset’s price.

“Following this event, there will be no additional tokens allocated to the team and strategic partners. Any remaining vesting emissions will be directed towards the Avalanche Foundation, supporting initiatives focused on growth and development,” Avalanche Insider stated.

Read more: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

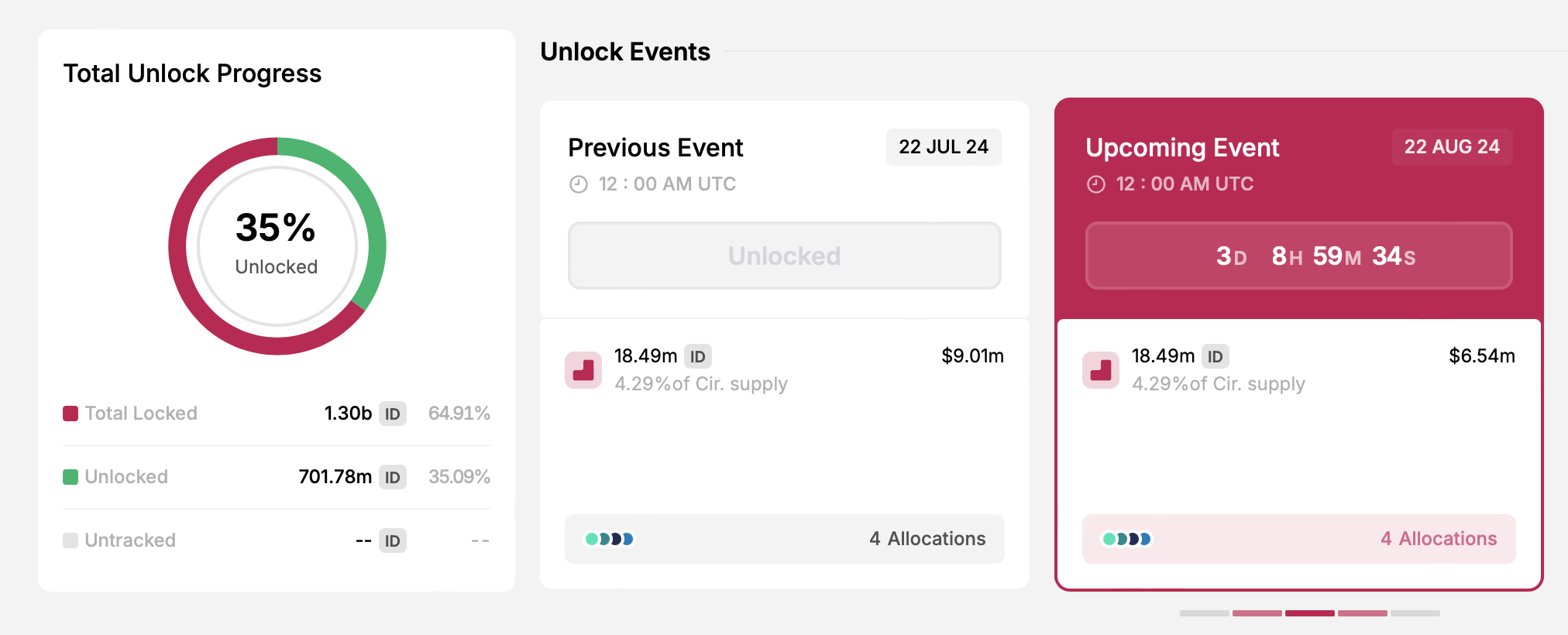

Space ID (ID)

- Unlock date: August 22

- Number of tokens unlocked: 18.49 million ID

- Current circulating supply: 430 million ID

Space ID is a universal decentralized identity protocol that connects people, assets, and dApps across various blockchains. It allows users to use a single domain name to represent their identity across different applications and networks.

On August 22, the project will unlock over 18 million ID tokens and allocate them between the Space ID Foundation, ecosystem fund and community.

Read more: Decentralized Identity and the Future of Web3: What To Know

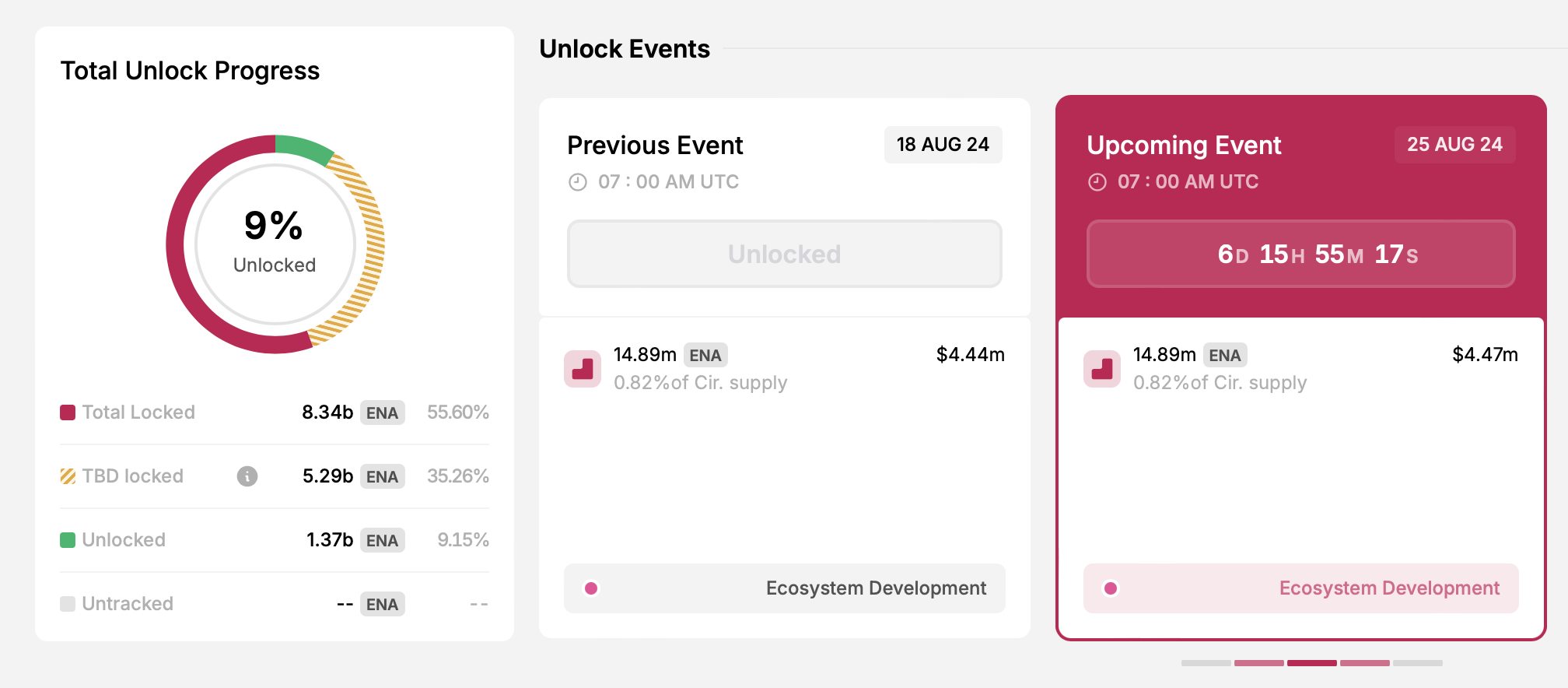

Ethena (ENA)

- Unlock date: August 25

- Number of tokens unlocked: 14.89 million ENA

- Current circulating supply: 1.80 billion ENA

Ethena is a synthetic currency protocol built on Ethereum. It provides a native cryptocurrency solution independent of traditional banking, and also offers global users a dollar-denominated savings instrument called the ‘Internet Bond.’

The ENA token enables holders to vote on governance proposals. On August 25, the project will unlock almost 15 million ENA dedicated to ecosystem development.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

Other next-week cliff unlocks include Galxe (GAL), Acala (ACA), and 1Inch (1INCH), with a total value exceeding $230 million. Although many consider token unlocks bearish, a well-planned schedule can strengthen a project’s long-term viability. Aligned with milestones and development progress, unlocks will motivate team members, boost community engagement, and promote ecosystem growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How You Can Find Altcoin Winners Early

The crypto market’s “altcoin season” isn’t what it used to be. In past cycles, Bitcoin rallies gave way to altcoin booms, lifting almost every token. Now, new market trends suggest those days of indiscriminate gains are fading.

Analysts predict a more selective altcoin cycle – “the era of everything pumping is over.” In an interview with BeInCrypto, Hitesh Malviya, the founder of the crypto analytical tool DYOR, said that retail investors looking for the next big winner must adapt to these evolving trends.

How to Find Winning Altcoins Amidst Choppy Markets

Traditionally, altcoin season meant Bitcoin’s dominance fell, and most altcoins surged. That broad rally may be ending.

“If the idea of a full-blown alt season comes from past cycles, then that’s something I really don’t expect. What we have seen so far in altcoins was simply the blooming and bursting of a bubble that happened over two bull cycles and two bear cycles,” Malviya told BeInCrypto.

Market experts foresee a more nuanced phase where only the strongest projects thrive. In short, instead of a rising tide lifting all boats, the next altcoin season may favor quality (projects with real usage and revenue) over quantity.

Investors should focus on fundamentals like usage, revenue, and community growth—the market now rewards substance over hype. Indeed, interest in speculative sectors such as meme coins has drastically declined since late January 2025.

“The adoption curve will take a new shape upwards, while the speculative curve will lose its charm, introducing lower volatility in the market, providing more stable returns, and making the market less correlated to stocks. This will create a new asset class in crypto, which should have two major types of asset offerings—tokenized equities with strong cash flow (e.g., AAVE) and store-of-value assets (BTC, ETH),” Malviya continued.

A key reason for the evolution of the altcoin season is that liquidity now rotates between different narratives.

Liquidity flows toward compelling stories. There have been mini-cycles where certain themes catch fire – meme coins, AI tokens, DeFi projects, metaverse gaming, etc. Money chases one hot narrative, then moves to the next.

Savvy investors watch social media, developer activity, and news to catch emerging narratives early and get in before the crowd.

“Liquidity will always flow into different narratives at different times, as there are multiple categories within crypto—just like in stocks, where some categories always outperform others. The same market dynamics will be seen in crypto as well,” Malviya stated.

How to Find Potential Altcoin Season Winner? Identifying Strength in Downtrends

Malviya believes that investors should watch for altcoins showing relative strength during downturns. If an altcoin can hold its value or even rise while Bitcoin slides, that resilience signals strong demand (likely early accumulation).

“At DYOR, we offer a metric called Optimised Relative Strength, which helps track some of the best coins and narratives that have shown the highest strength in the past 7, 30 and 90 days. Coins that have outperformed against the broader market in the past 30 days have a great chance of rallying when the market finds a bottom and starts a fresh leg up,” Malviya explained.

Moreover, Malviya also discussed other fundamental metrics to track. These include:

- DEX Volume: Rising trading volumes on decentralized exchanges can push the native token’s prices higher.

- Total Value Locked (TVL): Growth in deposits and total value locked implies user trust – bullish for the lending protocol’s token.

- Derivatives Volume: Increasing on-chain trading activity means more traders and fees supporting its token.

- Oracle Total Value Secured (TVS): Climbing total value secured by an oracle (e.g., Chainlink) shows a greater reliance on it, boosting token demand.

- DePIN Revenue: Actual revenue from a DePIN project (real-world service) signals a sustainable model, not just hype.

Furthermore, Malviya also emphasized the tokenomics of a crypto project. He believes that even a great project can falter if its tokenomics are flawed.

Tokenomics – a token’s supply and incentive design can make or break an altcoin. Good tokenomics (fair distribution, strong utility) create lasting demand, whereas poor tokenomics (excessive inflation or constant insider unlocks) often doom a project.

“Ideally, the community and ecosystem fund should get at least 60% of the supply to generate actual demand for the product by incentivizing developers and users through planned token emissions at different stages. Tokens are actually created to drive real user demand for the product. They can be considered as bribes to get user attention, but since these bribes are also tradable in the market, they can create a ripple effect that could potentially lead to the product’s failure. This happens because retail sentiment often mixes both the product and the token, where, in most cases, the token price eventually determines how much adoption the product gets,” Malviya elaborated.

Lastly, he shares tools that can help users potentially find the next winner for the altcoin season.

- DYOR – Users can use DYOR to find relative strength data on more than 200+ coins, detailed demand-side tokenomics data on 70+ coins, and fundamental data on 65+ coins, along with detailed research reports on top projects.

- DeFiLlama – It tracks multi-chain DeFi data like TVL and volumes.

- Dune Analytics – It is a community-driven platform offering custom on-chain data dashboards.

“The community should learn to use DeFiLlama and DUNE dashboards to uncover some interesting alphas. Most on-chain data is tracked on both of these platforms—all you need to do is find the right dashboard, take notes of the different growth metrics you notice, and build your thesis around a coin using that data to reach better due diligence,” Malviya concluded.

Those armed with solid research stand the best chance of catching the next altcoin season winner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance, Trade Wars, Ripple and SEC

Crypto market volatility was high this week as regulatory developments, macro tensions, and the Binance exchange’s decisions shook markets.

A brewing trade war, whispers of stealth quantitative easing, and a historic legal truce between Ripple and the SEC are reshaping narratives. The following is a roundup of what happened this week in crypto.

Binance Earmarks 14 Altcoins For Delisting

Binance, the largest crypto exchange by trading volume metrics, announced a decision to delist 14 tokens, including BADGER, BAL, and CREAM.

The decision led to double-digit losses for the affected tokens almost immediately, highlighting the effect of such announcements on investor sentiment.

Binance initiated the delisting process through its vote-to-delist mechanism, where the community participated in deciding the fate of certain tokens. Reportedly, out of 103,942 votes from 24,141 participants, 93,680 were deemed valid.

The exchange cited factors such as development activity, trading volume, and liquidity in its evaluation before earmarking the cited altcoins.

“Following the Vote to Delist results and completion of the standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT on 2025-04-16,” read the announcement.

Trading for these tokens will cease on April 16, with withdrawal limitations set for June 9. Post this date, any unsold tokens will be converted to stablecoins.

Arthur Hayes: Inevitable Return to Fed Stimulus

This week in crypto, Arthur Hayes returned with a bold thesis. According to the BitMEX co-founder, the unfolding US-China trade war and the inevitable return of Fed stimulus could catapult Bitcoin to $1 million.

Hayes tied Trump’s proposed 125% tariffs on Chinese goods to a broader breakdown in global trade. He also referenced a scenario where the USD/CNY hits 10.00, calling it the “super bazooka” that could propel Bitcoin higher.

According to Hayes, such protectionism will trigger supply chain disruption, inflationary spikes, and, ultimately, a resumption of quantitative easing (QE) as central banks try to stabilize faltering economies.

He sees this monetary pivot as the spark for Bitcoin’s next supercycle.

In a more immediate scenario, the BitMEX executive also argued that if the Fed pivots to QE soon, Bitcoin could hit $250,000 even before a global financial reckoning sets in.

Hayes’s outlook sounds overly ambitious. However, with US liquidity injections already under scrutiny, analysts are increasingly aligning with the idea that macro tailwinds could push Bitcoin far beyond the current $81,000 range.

Is the Fed Already Doing Stealth QE?

BeInCrypto reported this hypothesis this week in crypto. Some analysts are raising red flags about stealth quantitative easing, suggesting the Fed is quietly injecting liquidity into the financial system without formally announcing a new QE program.

“This isn’t hopium. This is actual liquidity being unchained. While people are screaming about tariffs, inflation, and ghost-of-SVB trauma… the biggest stealth easing since 2020 has been underway,” wrote Oz, founder of The Markets Unplugged.

Liquidity metrics such as the Reverse Repo Facility (RRP) hint at significant capital flows, even as the Fed maintains a public anti-inflation stance.

Critics argue that these backdoor injections are fueling asset prices, including crypto, without the transparency or accountability of past QE rounds.

For crypto, stealth QE may be one of the key reasons Bitcoin remains resilient despite calls for significant breakdowns below $70,000.

If confirmed, these quiet interventions could be laying the groundwork for a larger, formal liquidity wave. Such an action would align with Arthur Hayes’s prediction of a new Bitcoin super cycle.

Meanwhile, amid cooling inflation and US growth forecasts softening, the possibility of a formal return to QE in 2025 is gaining traction among economists.

Analysts highlighted that if the Fed pivots to liquidity expansion, Bitcoin and major altcoins could enter a multi-year bull cycle akin to the 2020–2021 rally.

Ripple and SEC File Joint Motion

Another top headline this week in crypto, Ripple and the US SEC (Securities and Exchange Commission) filed a joint motion to settle the remaining remedies phase of their years-long legal battle.

The move signals both parties are ready to wrap up a case that has cast a regulatory shadow over the crypto market since 2020.

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” wrote XRP advocate James Filan.

The motion follows Judge Analisa Torres’s 2023 ruling that XRP is not a security when sold to retail investors. This decision marked a partial but critical win for Ripple.

What remains now is a resolution over institutional sales, penalties, and injunctions. According to legal experts, the fact that both Ripple and the SEC are willing to settle suggests neither side wants to prolong the case amid broader legal and political uncertainty.

The resolution will likely influence how the SEC proceeds with other enforcement actions against major crypto firms. For Ripple, regulatory clarity could open the door to US re-listings and deeper integration with traditional finance (TradFi).

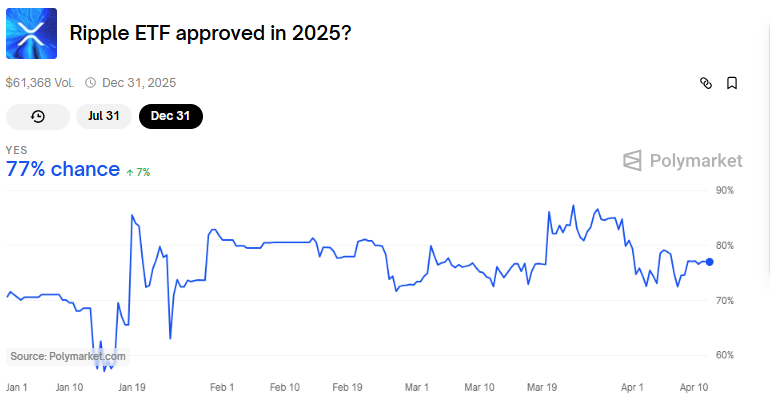

Specifically, it could increase the odds for an XRP ETF (exchange-traded fund) in the US, which now stands at 77%, data on Polymarket shows.

Trump Pauses Tariffs—Except on China

This week in crypto, the crypto market surged over 5% in total capitalization after Donald Trump announced he would pause tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump shared on Truth Social.

The move reignited risk-on sentiment in markets, particularly crypto, which remains highly sensitive to macro policy shifts.

Analysts interpreted the announcement as a double-edged message. On the one hand, the global economy might get a reprieve from broad-based trade pressure.

On the other hand, China remains a geopolitical target, which could further fragment global trade systems and increase reliance on decentralized assets. In a retaliatory move, China raised tariffs on the US to 125%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China Raises Tariffs on US to 125%, Crypto Markets Steady

On April 11, 2025, China’s State Council Tariff Commission issued an official notice announcing an increase in additional tariffs on imported US goods—from 84% to 125%. The new rate takes effect on April 12.

This move directly responds to the United States’ decision, announced on April 10, to impose a “reciprocal” 125% tariff on Chinese exports to the US.

Crypto Market Stays Calm Amid Escalating US-China Trade War

Despite escalating tensions between the world’s two largest economies, the cryptocurrency market has shown remarkable stability. Investors appear unfazed by the intensifying trade conflict.

Crypto market capitalization remains around $2.5 trillion. Bitcoin’s price holds above $81,000 after recovering 10% since April 9, when Trump announced a 90-day tariff pause, excluding tariffs on China.

According to the Chinese statement, the tariff hike follows China’s Customs Law, Tariff Law, and Foreign Trade Law. The government reaffirmed its commitment to international rules. It accused the US of violating global trade norms and called Washington’s policy “unilateral bullying.”

Notably, China warned that it would not respond to further tariff increases from the US, arguing that American goods have already lost their competitiveness in the Chinese market at the current tariff level.

“Given that US exports to China are no longer market-viable under the current tariff rate, China will not respond further if the US continues to raise tariffs on Chinese goods,” the statement said.

The tariff dispute is not new. Since 2018, the US and China have imposed retaliatory tariffs on each other. Key sectors affected include agriculture, tech, and energy.

The latest hike pushes tariffs to a record 125%. Economists warn this could disrupt global supply chains, raise prices, and add pressure to inflation in both nations.

Bitcoin miners also feel the impact as mining machine prices surge.

China’s tariff hike sends a strong message about its tough stance in trade negotiations. While the crypto market remains stable for now, analysts urge investors to monitor upcoming developments—especially any potential response from the US.

If no resolution is reached, the ongoing standoff could trigger a broader economic fallout. The world is now watching to see whether the trade war will de-escalate or further entrench the divide between the two economic superpowers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoCash App’s Block Inc Settles for $40 Million Over AML Failures For Crypto Platform

-

Market24 hours ago

Market24 hours agoSolana Price Attempts Recovery, Nears $120, But Needs A Push

-

Altcoin24 hours ago

Altcoin24 hours agoEthereum’s Controversial Developer Freed Before Full Sentence

-

Bitcoin22 hours ago

Bitcoin22 hours agoFlorida Bitcoin Reserve Bill Passes House With Zero Votes Against

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market19 hours ago

Market19 hours agoADA Price Surge Signals a Potential Breakout

-

Market18 hours ago

Market18 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish

-

Market22 hours ago

Market22 hours agoFuser on How Crypto Regulation in Europe is Finally Catching Up