Market

Kraken Challenges SEC Over ADA, ALGO, and Other Cryptos

Centralized crypto exchange Kraken retaliated against the US Securities and Exchange Commission (SEC) by challenging its securities label on digital assets.

The regulator claimed Kraken violated federal securities laws when it offered certain digital assets, which qualify as unregistered securities.

Kraken Despites SEC Allegations Against Digital Assets

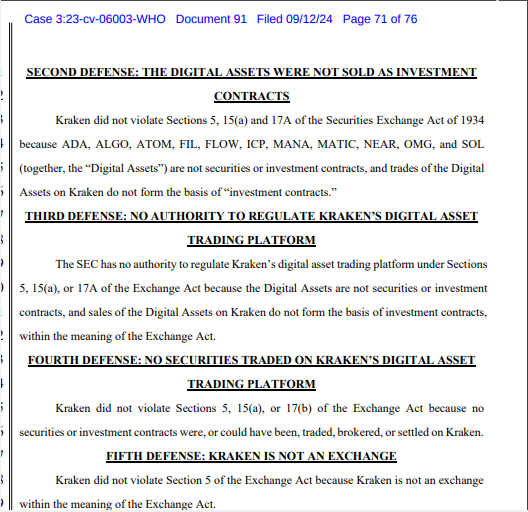

Kraken said ADA, ALGO, SOL, and other assets do not meet the legal definition of securities under US law. The exchange also slammed the SEC for the lack of clarity, calling it out for regulatory overreach.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

In its defense, Kraken cites the Howey ruling, a milestone Supreme Court case that serves as a reference point to determine what constitutes an investment contract. With this reference, the exchange challenges that the SEC failed to demonstrate that the named tokens meet the criteria outlined in the Howey framework and, thereby, do not fall under the SEC’s jurisdiction.

“The SEC has no authority to regulate Kraken’s digital asset trading platform […] because the Digital Assets are not securities or investment contracts,” the filing read.

Kraken is, therefore, pushing for a jury trial, saying the SEC is blocking its efforts to register or cooperate. It argues that the regulator consistently “stonewalls” it using inconsistent rulings and guidance.

Some community members have criticized the Howey test, arguing that it’s too broad and doesn’t account for the complexities of modern investment structures or technologies. As a result, the test may not always accurately classify certain types of transactions in today’s increasingly complex financial landscape.

“The problem is really that the Howey test is far too generic. The truth is that many cryptocurrencies do not pass that specific test. But that doesn’t take in the nuance of what securities were meant to be,” one X user commented.

This isn’t the first time the SEC has faced criticism for labeling digital assets as securities. In June 2023, the regulator alleged that several crypto assets traded on Binance, Coinbase, and Robinhood qualified as securities, a claim that was quickly challenged by crypto executives.

Read More: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Recently, the SEC revised its position by amending its complaint related to “Third Party Crypto Asset Securities.” The regulator clarified that the term refers to contracts tied to the sale of crypto assets, not the assets themselves. This update came from the wording used in Footnote 6 of its amended complaint against Binance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Faces Resistance; Price To $1 Not Happening Soon

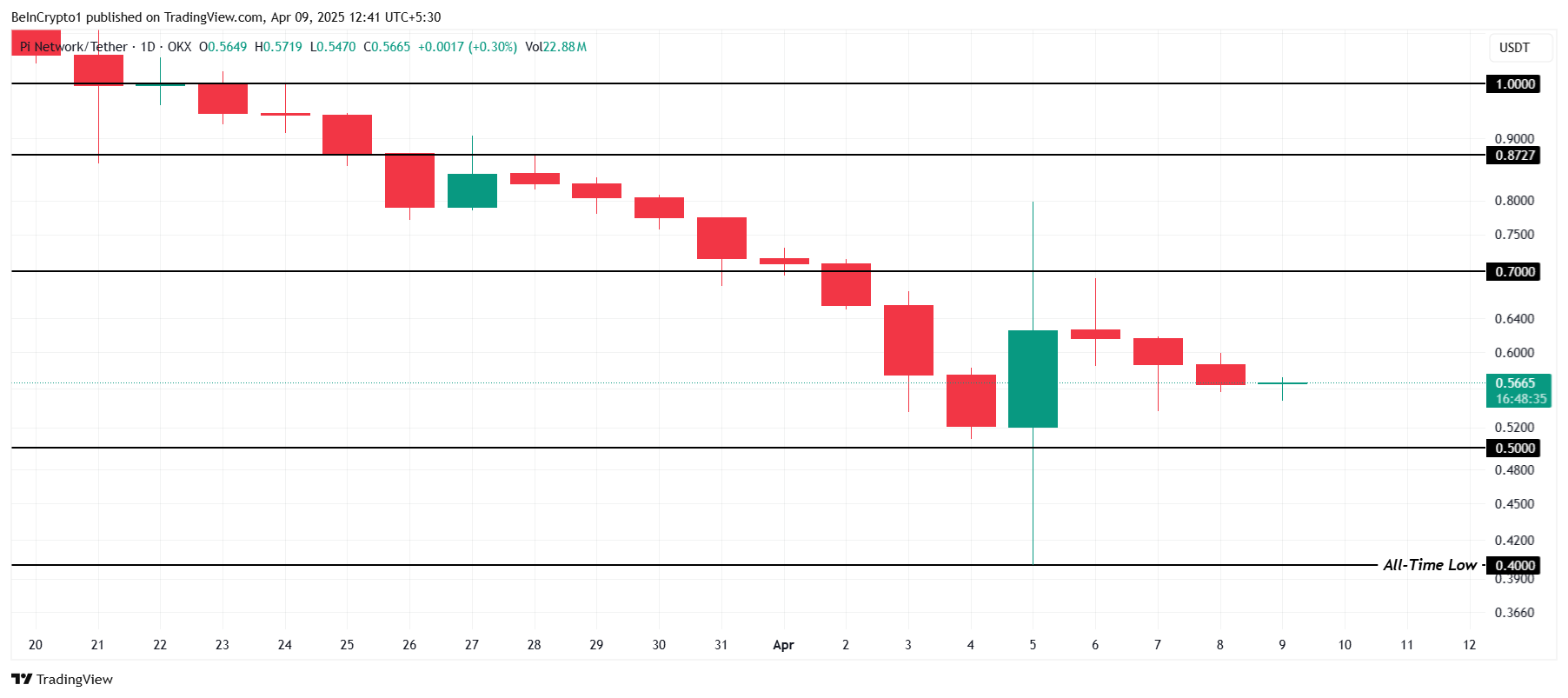

Pi Network (PI) has recently experienced a significant downtrend, leading to the formation of a new all-time low (ATL). Despite a slight bounce from these levels, the cryptocurrency has been unable to shift its overall bearish trend.

Investors have noted this price action, but they remain skeptical about Pi’s potential for recovery.

Pi Network Gets No Support

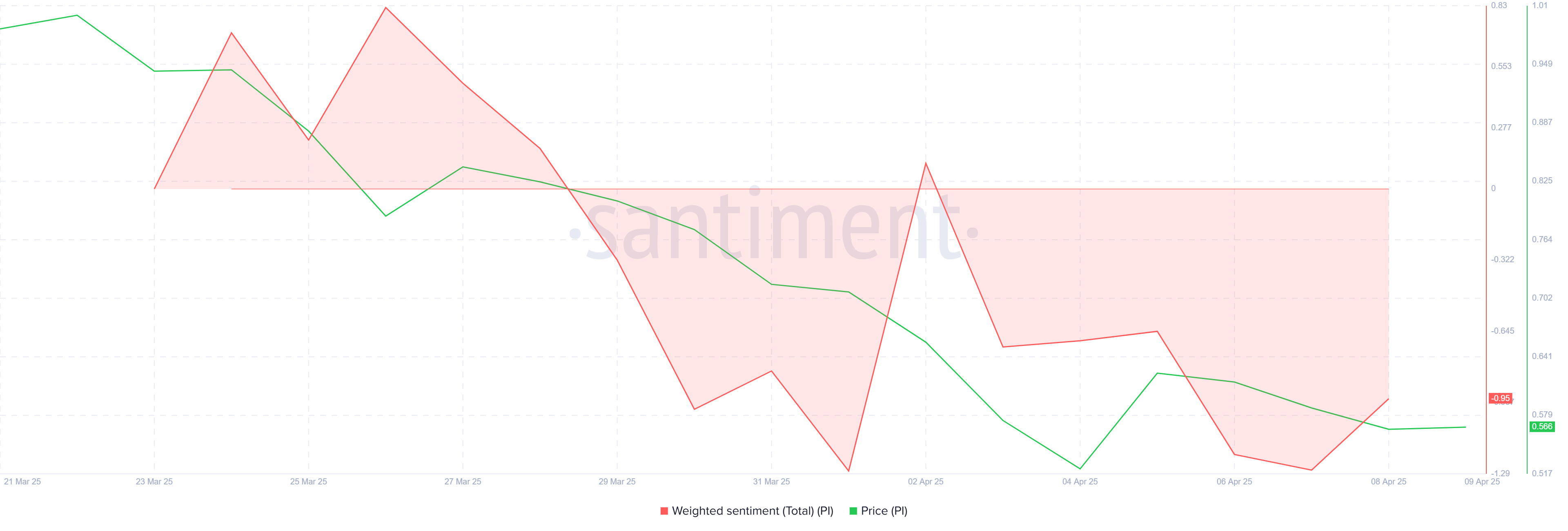

Currently, the investor sentiment surrounding Pi Network is overwhelmingly bearish. The recent price action, coupled with the broader market’s worsening conditions, has convinced many that Pi Network is unlikely to see a major price rise soon. This perception has led to a decline in investor confidence, further contributing to the overall negative sentiment.

The price decline has created a situation where many investors are uncertain about Pi’s future prospects. Given the lack of any substantial market catalysts or news that could drive the price upward, most of the market participants are likely staying on the sidelines.

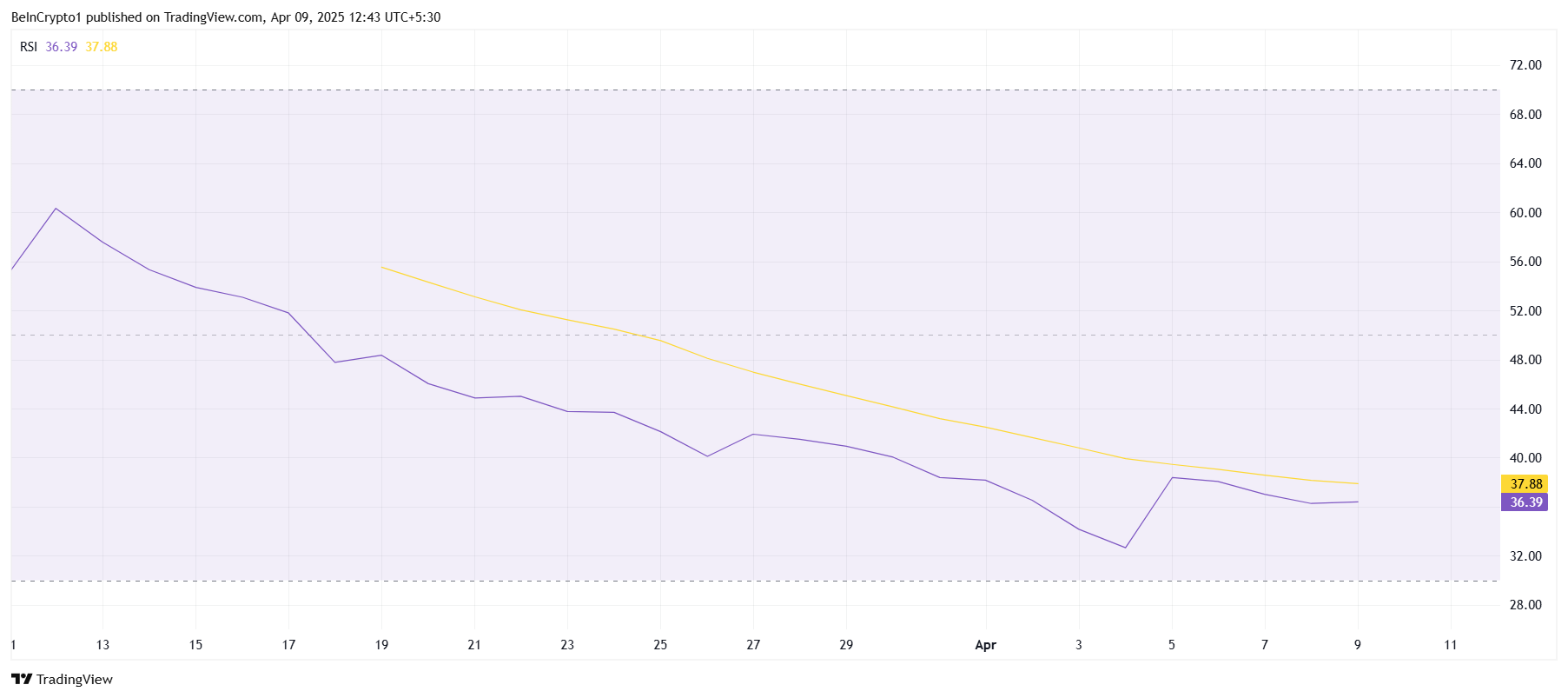

The overall macro momentum of Pi Network continues to face challenges. The Relative Strength Index (RSI) has remained in the bearish zone for over three weeks. Currently, the RSI is far from the neutral 50.0 level, suggesting that the market for Pi is still under pressure and there is no immediate sign of a reversal.

This prolonged bearish reading on the RSI indicates that Pi Network is struggling to gain momentum, with few signs of significant improvement. Without an influx of positive market sentiment or new developments, it seems unlikely that Pi will see a sustained rally anytime soon.

Can Pi Price Go Lower?

Pi Network’s price is currently trading at $0.56, just above the critical support of $0.50. This price is still under the $0.70 resistance level, which Pi has struggled to breach for an extended period. Recently, Pi Network formed a new all-time low (ATL) of $0.40, further solidifying its struggle to maintain a bullish momentum.

Given the current market conditions, it seems likely that Pi will continue consolidating in its current range, potentially heading back toward the $0.50 support. A failure to hold this level could result in further declines, with the price possibly forming a new ATL.

However, if market conditions improve unexpectedly, Pi Network could find the support needed to push past the $0.70 resistance. A breakout above this level would need to be followed by a move toward $0.87 to break the downtrend and potentially invalidate the current bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Ripple’s $1.25 Billion Deal Could Surge XRP Demand

Ripple’s acquisition of Hidden Road could lead to a surge in demand for (XRP) XRP and Ripple USD (RLUSD) stablecoin, according to industry experts.

On April 8, Ripple acquired the global prime brokerage platform Hidden Road for $1.25 billion. This has positioned it for significant growth in the financial services sector.

How Will Ripple’s Hidden Road Acquisition Impact XRP Demand?

In a detailed thread on X (formerly Twitter), Jake Claver, Managing Director of Digital Ascension Group, highlighted the scale of Hidden Road’s operations. He noted that the firm processes over $10 billion in daily transactions, more than many blockchains handle in a month.

With this acquisition, he emphasized that transactions will now be processed on the XRP Ledger (XRPL). This development raises intriguing possibilities, particularly as prominent financial institutions are set to harness XRPL for its original design — a decentralized, efficient system built for seamless financial transactions.

“What happens when just a fraction of that $10 billion daily volume starts settling through XRP? Demand skyrockets. These aren’t retail traders—these are hedge funds and market makers who need XRP to power their operations. And they’ll be buying lots of it,” he wrote.

Claver also explained that Hidden Road’s integration of RLUSD makes it the first stablecoin to enable cross-margining between digital and traditional markets. According to him, this acquisition addresses issues of risk and inefficiency by using XRP for fast settlement and RLUSD for stable collateral.

“Ripple’s acquisition of Hidden Road is a fundamental shift in XRP and RLUSD’s position in global finance. Increased utility, institutional demand, and improved liquidity create the perfect storm for long-term value growth,” he noted.

Dom Kwok, co-founder of EasyA, corroborated this sentiment. He stressed that the move boosts the adoption of XRP Ledger and the RLUSD stablecoin.

“I’ve tracked tons of deals in the crypto space but Ripple’s acquisition of hidden road is without a doubt one of the most important deals for crypto,” Kwok claimed.

In a statement shared with BeInCrypto, Nic Puckrin, the founder of The Coin Bureau, emphasized that this acquisition might fuel more demand for the XRP tokens.

“It’s also notable that this acquisition is in part financed by XRP, along with cash and stock, while Hidden Road will migrate its post-trade activity to the XRP Ledger (XRPL) – Ripple’s native blockchain. This has the potential to drive demand for XRPL and is potentially good news for XRP’s price trajectory, which has struggled with performance despite the recent SEC win as tariff news decimated the altcoin market,” Puckrin told BeInCrypto.

Despite the optimism, XRP continues to struggle amid a broader market crash. Over the past day, the altcoin has dropped 2.9%. At the time of writing, it was trading at $1.8.

Nonetheless, an analyst urged the community to remain optimistic. He elaborated that Ripple is quietly building the “Internet of Value” with its strategic acquisitions and partnerships.

“XRP’s price isn’t reflecting the bullish news right now, and that’s not a glitch. It’s a reminder. A reminder that price isn’t the mission. Understanding the tech is,” the post read.

He emphasized that Ripple’s every move is part of a larger, interconnected strategy. This even includes the launch of RLUSD. This initiative is positioned as more than just a trend.

It’s part of a broader effort to rebuild the global financial infrastructure from the ground up, offering a stable, secure, and innovative alternative to traditional monetary systems.

“Yet the price remains quiet. Because until they flip the switch. Until the new system is fully in place. We’re just being handed breadcrumbs, enough for those with eyes to see,” he added.

The analyst stresses viewing any potential XRP price drops as an opportunity rather than a reason to panic sell. He encouraged investors to focus on long-term goals, such as building the future of finance, rather than chasing short-term gains.

He asserts that those who stack, learn, and hold the line position themselves ahead of the curve and become part of a historic shift in the financial landscape.

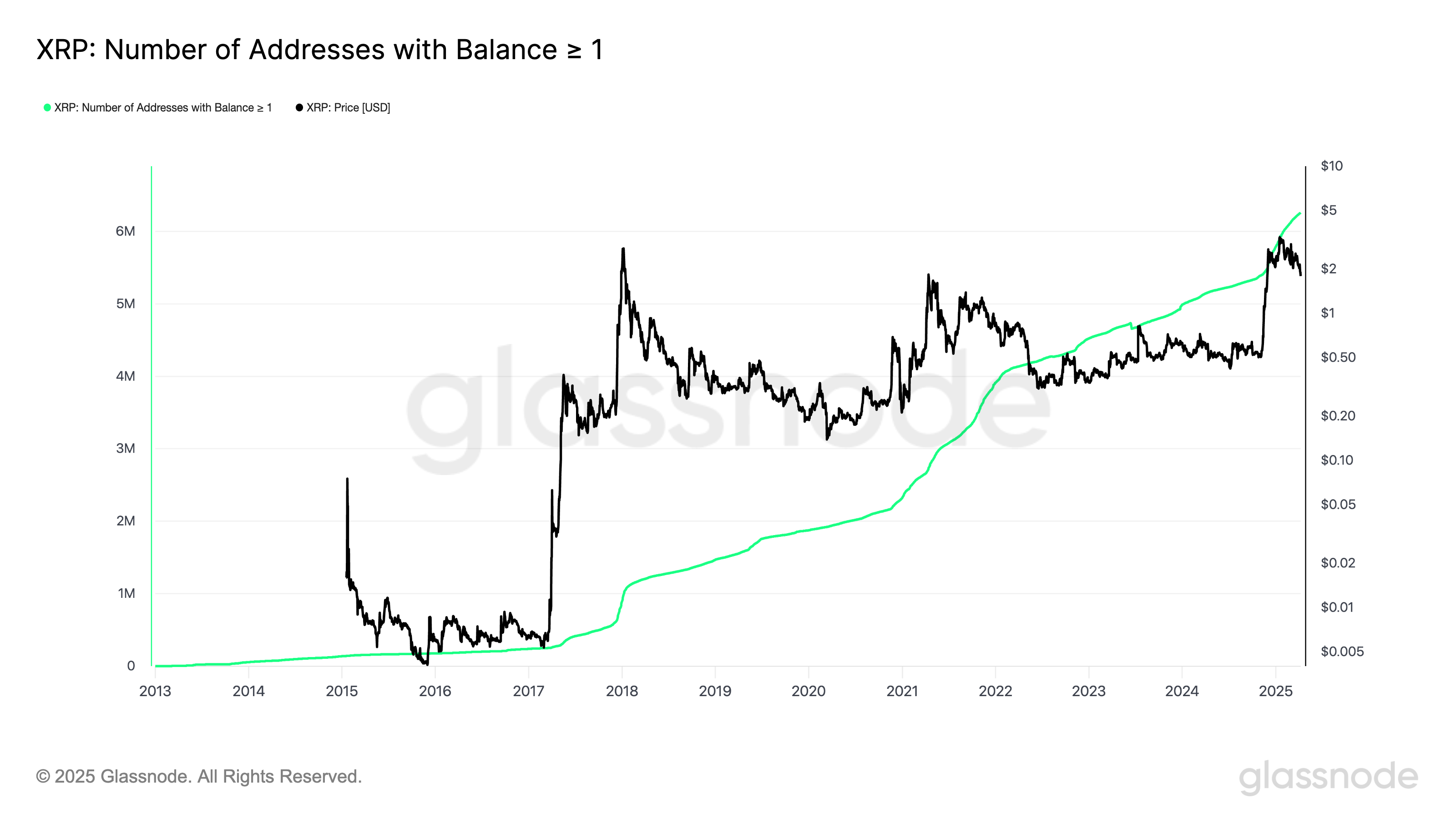

Interestingly, it seems that many share the same belief. Despite the recent volatility, small investor interest in XRP is on the rise. According to recent data from Glassnode, addresses holding 1 XRP or more have reached an all-time high of 6.2 million.

This surge in participation from retail investors suggests growing confidence in XRP’s long-term potential, even as broader market struggles persist.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Bitget’s BGB Burns and Utility Match Binance’s BNB Boom?

Bitget is ramping up its deflationary strategy for the BGB token by initiating large-scale token burns.

In today’s fiercely competitive centralized exchange market, could token burning become a key tool to enhance the intrinsic value of exchange-native tokens?

Bitget’s Token Burn Strategy

According to Bitget’s latest announcement, the exchange burned 30 million BGB tokens in Q1 2025. The BGB circulating supply decreased from 1.2 billion to approximately 1.17 billion tokens, a 2.5% drop.

On December 30, 2024, Bitget completed a massive burn of 800 million BGB, representing 40% of the token’s original total supply. This move reduced the BGB supply from 2 billion to 1.2 billion tokens.

Looking ahead, Bitget has outlined a long-term tokenomics roadmap beginning in 2025. The exchange will allocate 20% of profits from both the Bitget Exchange and Bitget Wallet to buy back and burn BGB every quarter—a strategic shift aimed at boosting the long-term value of BGB.

One of the most successful examples of token burns is Binance. According to BNB Burn Info, Binance has burned over 59 million BNB to date. This deflationary model has helped BNB surge from under $1 in 2017 to over $600 in 2024.

The ongoing reduction in BNB’s supply, paired with the strong ecosystem of Binance Smart Chain (BSC), has positioned BNB as one of the world’s most valuable exchange tokens. Bitget appears to be following in these footsteps—but the key question remains: Can BGB replicate BNB’s success story?

Is Burning BGB Enough to Boost Price Like BNB?

According to CoinGecko, BGB reached its all-time high (ATH) of $8.45 earlier in 2025. The burn of 800 million tokens at the end of 2024 created immediate scarcity, helping drive this price surge.

However, this figure still pales in comparison to BNB’s performance. To sustain and increase value, Bitget must go beyond reducing supply and significantly expand BGB’s real-world utility.

Starting in January 2025, BGB has become the primary token for multi-chain gas payments via Bitget Wallet’s GetGas feature. This allows users to pay gas fees on major blockchains like Ethereum, Solana, and BNB Chain using BGB, USDT, or USDC—eliminating the need for chain-specific gas tokens.

Additionally, Bitget integrates BGB into real-world payment scenarios through PayFi and the Bitget Card. The PayFi initiative aims to make BGB a practical payment method for daily expenses like dining, travel, and shopping.

This effort expands BGB’s utility beyond the blockchain and positions it as a bridge between decentralized finance (DeFi) and everyday life—echoing Binance’s ambitions for BNB.

While Bitget is on the right track, achieving BNB-level growth still poses significant challenges. First, Bitget’s ecosystem is smaller and less developed than Binance’s. Second, the actual adoption rate of new features like multi-chain gas payments and PayFi will directly influence BGB’s real-world demand.

Finally, while Binance has spent years building brand trust and a loyal user base, Bitget is still establishing its position in the market. To sustain long-term growth, Bitget must balance reducing supply and boosting demand through practical, real-world applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Whale Activity Peaks Amid Market Uncertainty

-

Market19 hours ago

Market19 hours agoIs Ethereum Falling to $1,000 This April?

-

Market24 hours ago

Market24 hours agoXRP Price, Traders Retreat Despite The US ETF Buzz

-

Market22 hours ago

Market22 hours agoRipple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

-

Altcoin21 hours ago

Altcoin21 hours agoDeveloper Advocates For Pi Network Community To Launch Liquidity Pool To Stablilize Pi Coin Price

-

Market17 hours ago

Market17 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Market16 hours ago

Market16 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Altcoin15 hours ago

Altcoin15 hours agoWhy Is XRP Price Falling After ETF Hype?