Market

Japan Bond Yields Soar to 20-Year High

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how financial markets are performing in what could be the start of a broader global risk-off shift, particularly as monetary tightening returns to center stage in Asia and the West.

Japan’s 30-Year Bond Yield Surges to Multi-Decade Highs

Japan’s 30-year bond yield has surged to the highest level in 20 years, trending as the top US crypto news today. Specifically, it has increased by 12 basis points (bps) to 2.345%, the highest level since 2004. This signals deepening stress in global fixed-income markets.

It is bearish on Bitcoin (BTC) and risk-on assets. Agne Linge, director of growth at decentralized on-chain bank WeFi, agrees that growing bond yields threaten crypto in the short term.

In an email to BeInCrypto, Linge said a major shift might be in the pipeline for risk assets. She cited macroeconomic trends in Japan as they pertain to the current surge in the 30-year bond yield.

“With the bond yield jumping 2.345% to its highest level in 30 years, more risk-averse institutional investors might shun Bitcoin and other speculative assets,” Linge stated.

As Japan’s long-term bond yields surge, pressure is mounting on the Bank of Japan (BoJ) to respond with a possible interest rate hike. Analysts say this could happen as early as the end of April.

If the BoJ tightens policy, it would mark a significant shift for a central bank that has maintained ultra-loose monetary conditions for decades.

“If this forecast plays out as expected, it might lead to dried-up liquidity in the traditional financial market. Since crypto thrives more on excess monetary liquidity, this could also influence the performance of the asset shortly,” she added.

Linge cited the yen carry trade as one of the risk mechanisms. In this strategy, global investors borrow yen at low interest rates to invest in higher-yielding assets abroad. Trade thrives when Japanese rates are low and the international risk appetite is strong.

What Does It Mean for Bitcoin?

As Japanese yields rise and the prospect of a BoJ rate hike grows, the incentive to borrow yen diminishes. This could lead to an unwinding of the carry trade, potentially draining liquidity from global markets.

Such an outcome would amplify downside risk for crypto and other risk assets, which aligns with BeInCrypto’s recent report that Bitcoin’s price is at risk as the reverse yen carry trade unwinds.

“The problem today is that those borrowing costs are starting to get more expensive. Traders who were able to access virtually free capital for years are now finding themselves sitting on costly margin positions that they’re potentially being forced to unwind,” 5x Dow & Founders award winner and portfolio manager Michael A. Gayed said recently.

Meanwhile, the Federal Reserve (Fed) is facing increasing pressure to cut interest rates. Consumer inflation data from the US CPI and PPI (Consumer Price Index and Producer Price Index, respectively) support this push. Lge observes that dovish signals in the US could partially offset this emerging hawkish stance from Japan.

“Since the US is a bigger market, the world may respond more toward the country’s monetary policies than Japan,” Linge added.

The Fed’s move to ease monetary conditions while Japan tightens could create a mixed global liquidity environment. Ts could spur volatility as investors reassess cross-border capital flows.

Nonetheless, the yen carry trade remains especially vulnerable to the BoJ’s decisively hawkish shift. This could trigger a repricing of risk globally, curbing speculative flows and weakening the liquidity backdrop that crypto markets have benefited from in recent years.

Amidst these concerns, however, traders and analysts remain optimistic. Analysts at Deribit recently observed that markets switched from capitulation to aggressive bounce.

“Protective/Bear play BTC 75-78k Puts were dumped, and 85-100k Calls were lifted as BTC surged from 75-85k,” they wrote.

Deribit data corroborates this observation, showing the $100,000 call strike price was the most popular call option as of this writing, recording the highest open interest T s suggests bets that Bitcoin could draw toward this psychological milestone.

Chart of the Day

US Crypto News: Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At Close April 11 | Pre-Market Overview |

| Strategy (MSTR) | $299.98 | $312.00 (+4.00%) |

| Coinbase Global (COIN) | $175.50 | $180.42 (+2.80%) |

| Galaxy Digital Holdings (GLXY) | $15.28 | $15.30 (+0.13) |

| MARA Holdings (MARA) | $12.51 | $13.03 (+4.16) |

| Riot Platforms (RIOT) | $7.06 | $7.06 (+3.97%) |

| Core Scientific (CORZ) | $7.07 | $7.26 (+2.69%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Are TRUMP Meme Coin Investors Selling Before Friday’s Unlock?

The TRUMP meme coin has lost 29% of its value over the past month and is now down more than 90% from its all-time high. The sharp decline has been accompanied by weakening momentum across multiple indicators.

Both suggest that bullish strength has faded and downside risks are growing. Adding to the pressure, a large wallet just withdrew millions in USDC ahead of a $317 million token unlock next week, raising concerns about possible selling activity.

Indicators Suggest Weak Momentum for TRUMP Meme Coin

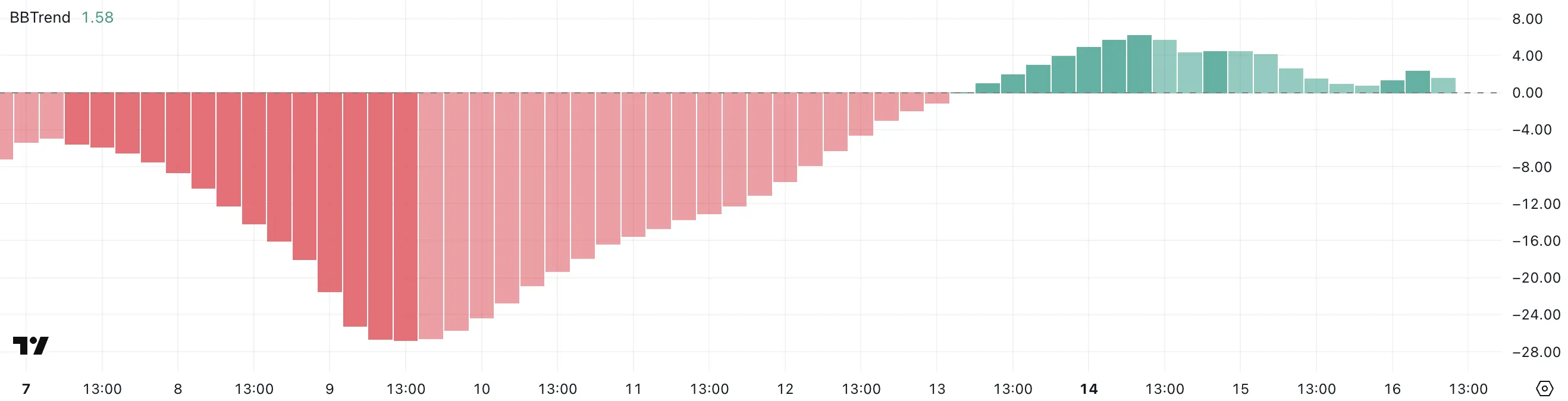

TRUMP’s BBTrend indicator has sharply dropped to 1.58, down from 6.23 just two days ago. This sudden decline suggests that the strength of the previous trend has significantly weakened.

After showing strong momentum earlier in the week, the current BBTrend reading points to a possible shift toward consolidation or even a reversal if buying interest continues to fade.

BBTrend, short for Bollinger Band Trend, is a technical indicator that measures the strength of a price trend based on the width of Bollinger Bands.

Higher values typically indicate a strong directional move, while lower values suggest that the market is entering a less volatile phase.

With TRUMP’s BBTrend now at 1.58—close to the neutral zone—it could signal that the strong bullish phase is cooling off. If the indicator continues to fall and the price loses support, it may point to a period of sideways movement or the beginning of a downtrend.

TRUMP’s Ichimoku Cloud chart shows a clear bearish setup. The price is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline).

This positioning suggests that short-term momentum remains weak, and buyers have yet to regain control.

The fact that price candles are still beneath the cloud reinforces the ongoing bearish sentiment, as the cloud often acts as resistance when prices are below it.

Looking ahead, the cloud (Kumo) is transitioning from red to green but remains flat and narrow, signaling limited upside strength. The green Senkou Span A is only slightly above the red Senkou Span B, meaning the future trend outlook is still uncertain and lacks conviction.

For any bullish reversal to gain traction, TRUMP meme coin would need to break above the cloud with strong volume. Until that happens, the chart points to continued caution, with the potential for more sideways or downward price action.

Whale Withdrawal Raises Concerns Ahead of $317 Million TRUMP Unlock

A wallet linked to Donald Trump’s memecoin withdrew $4.6 million in USDC from the Solana DEX Meteora on Tuesday.

These funds were previously used to provide liquidity for the TRUMP-USDC trading pair. They helped ensure smoother trading and price stability. This wallet has made a withdrawal for the first time, and the size and timing of the move make it noteworthy.

Even after the withdrawal, the pool still holds around $205 million in USDC and $122 million in TRUMP tokens.

This activity comes just days before a major unlock event set for next Friday. Around $317 million worth of TRUMP meme coin tokens will become available.

Unlocks often worry investors as they increase token supply. If a large portion is sold, it can push prices down. The $4.6 million withdrawal has raised speculation about insider moves. Some believe funds are being repositioned ahead of the unlock.

While it’s not clear if a selloff is coming, the timing suggests caution. In the days ahead, on-chain activity should be closely watched.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Crypto Security Flaw Could Expose Seed Phrases

Crypto users often focus on user interfaces and pay less attention to the complex internal protocols. Security experts recently raised concerns about a critical vulnerability in Crypto-MCP (Model-Context-Protocol), a protocol for connecting and interacting with blockchains.

This flaw could allow hackers to steal digital assets. They could redirect transactions or expose the seed phrase — the key to accessing a crypto wallet.

How Dangerous is the Crypto-MCP Vulnerability?

Crypto-MCP is a protocol designed to support blockchain tasks. These tasks include querying balances, sending tokens, deploying smart contracts, and interacting with decentralized finance (DeFi) protocols.

Protocols like Base MCP from Base, Solana MCP from Solana, and Thirdweb MCP offer powerful features. These include real-time blockchain data access, automated transaction execution, and multi-chain support. However, the protocol’s complexity and openness also introduce security risks if not properly managed.

Developer Luca Beurer-Kellner first raised the issue in early April. He warned that an MCP-based attack could leak WhatsApp messages via the protocol and bypass WhatsApp’s security.

Following that, Superoo7—head of Data and AI at Chromia—investigated and reported a potential vulnerability in Base-MCP. This issue affects Cursor and Claude, two popular AI platforms. The flaw allows hackers to use “prompt injection” techniques to change the recipient address in crypto transactions.

For example, if a user tries to send 0.001 ETH to a specific address, a hacker can insert malicious code to redirect the funds to their wallet. What’s worse, the user may not notice anything wrong. The interface will still show the original intended transaction details.

“This risk comes from using a ‘poisoned’ MCP. Hackers could trick Base-MCP into sending your crypto to them instead of where you intended. If this happens, you might not notice,” Superoo7 said.

Developer Aaronjmars pointed out an even more serious issue. Wallet seed phrases are often stored unencrypted in the MCP configuration files. If hackers gain access to these files, they can easily steal the seed phrase and fully control the user’s wallet and digital assets.

“MCP is an awesome architecture for interoperability & local-first interactions. But holy shit, current security is not tailored for Web3 needs. We need better proxy architecture for wallets,” Aaronjmars emphasized.

So far, no confirmed cases of this vulnerability being exploited to steal crypto assets exist. However, the potential threat is serious.

According to Superoo7, users should protect themselves by using MCP only from trusted sources, keeping wallet balances minimal, limiting MCP access permissions, and using the MCP-Scan tool to check for security risks.

Hackers can steal seed phrases in many ways. A report from Security Intelligence at the end of last year revealed that an Android malware called SpyAgent targets seed phrases by stealing screenshots.

Kaspersky also discovered SparkCat malware that extracts seed phrases from images using OCR. Meanwhile, Microsoft warned about StilachiRAT, malware that targets 20 crypto wallet browser extensions on Google Chrome, including MetaMask and Trust Wallet.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Mantra’s OM Token Surges 25% After Token Burn Announcement

After suffering a historic price collapse, Mantra’s OM is making a remarkable comeback. The altcoin plunged over 90% on April 13, falling from $6.30 to under $0.50 in hours.

However, it has bounced back with a 25% gain over the past 24 hours. OM is currently the market’s top gainer and is poised to extend its gains in the short term.

OM Leads Market Gains With a 25% Jump

The sudden resurgence in investor interest in OM comes after an April 15 X post from Mantra CEO John Patrick Mullin, announcing plans to burn the team’s token allocation.

While plans for the token burn are still being finalized, Mullin’s announcement has calmed market fears and revived bullish sentiment among some traders. This renewed confidence has prompted increased OM accumulation, driving the token’s price up by over 25% in the past 24 hours.

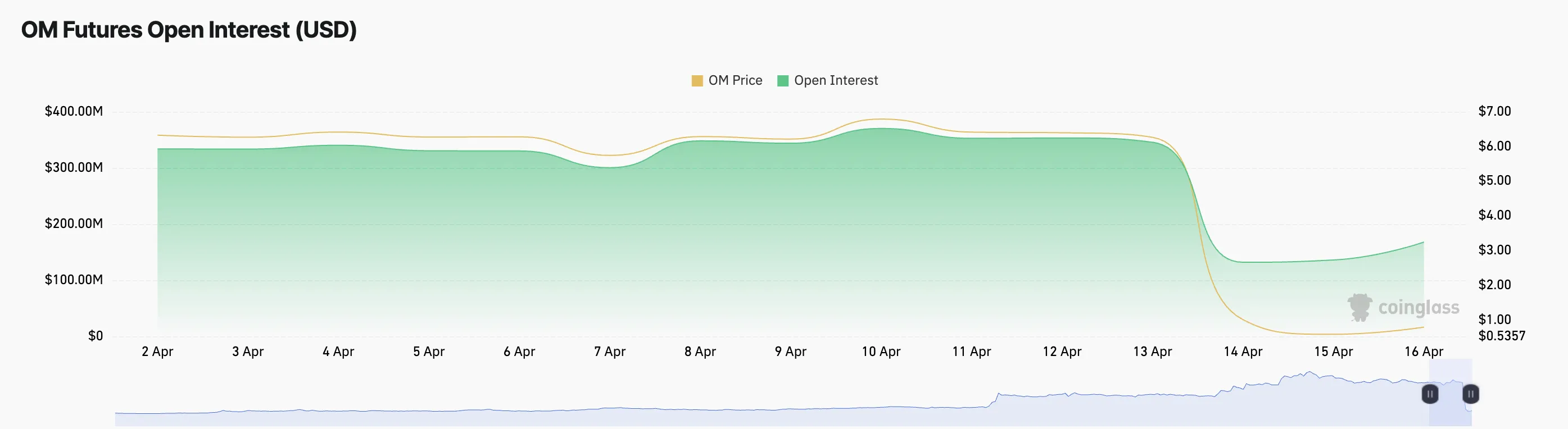

Key on-chain and market metrics support the rebound narrative. For example, the token’s open interest has risen sharply by 9%, indicating a surge in fresh capital entering OM positions in the past 24 hours.

As of this writing, this stands at $156.74 million. When an asset’s open interest climbs alongside its price like this, it signals that new money is entering the market and that traders are opening fresh positions in the direction of the uptrend.

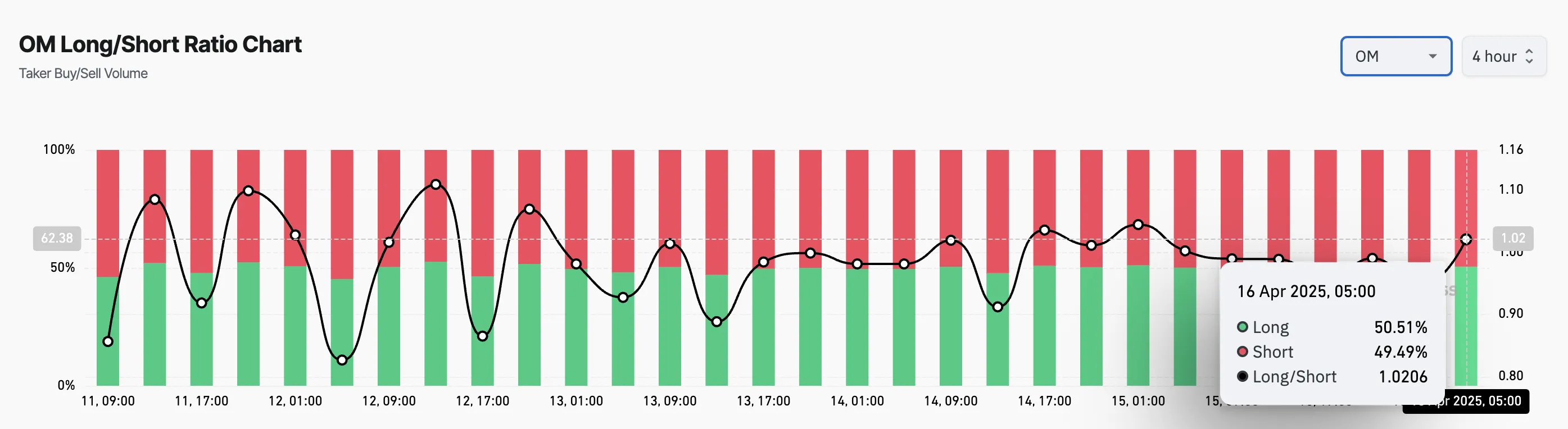

Moreover, OM’s long/short ratio confirms this. As of this writing, it is currently at 1.02, highlighting the preference for long positions among futures traders.

An asset’s long/short ratio measures the proportion of its long positions to short ones in the market.

A ratio above one like this means there are more positions betting on a sustained OM price rally than those opened in favor of a decline.

Next Stop $2.64 or Back to January’s $0.09 Lows?

At press time, OM trades at $0.78, climbing 29% from April 13’s low of $0.50. With the gradual uptick in its buying pressure, the altcoin could maintain its current rally to trade at $2.64.

However, if the bears regain market control and increase the downward pressure on OM, it could extend its decline and fall to $0.09, a low it last reached in January 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Market20 hours ago

Market20 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Altcoin24 hours ago

Altcoin24 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market22 hours ago

Market22 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin22 hours ago

Altcoin22 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Market14 hours ago

Market14 hours agoHedera Under Pressure as Volume Drops, Death Cross Nears

-

Market24 hours ago

Market24 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months

-

Market15 hours ago

Market15 hours agoSolana (SOL) Jumps 20% as DEX Volume and Fees Soar