Market

Is Cardano Price Primed For This Rally?

Cardano price has oscillated within a narrow range since the beginning of the month. The altcoin has faced resistance at $0.36 and has found support at the $0.33 price level.

However, things are about to change. With rising demand for ADA, the coin is primed to break through this resistance and extend its uptrend. But how soon could it happen?

Cardano Traders Begin to Fill Their Bags

Cardano is currently trading at $0.35, positioned above its Ichimoku Cloud. The Ichimoku Cloud is a key indicator used to assess market trends, momentum, and support and resistance levels.

When an asset’s price stays above the Ichimoku Cloud, it indicates a bullish trend. In this scenario, the Cloud acts as a dynamic support level, suggesting that buyers are in control.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

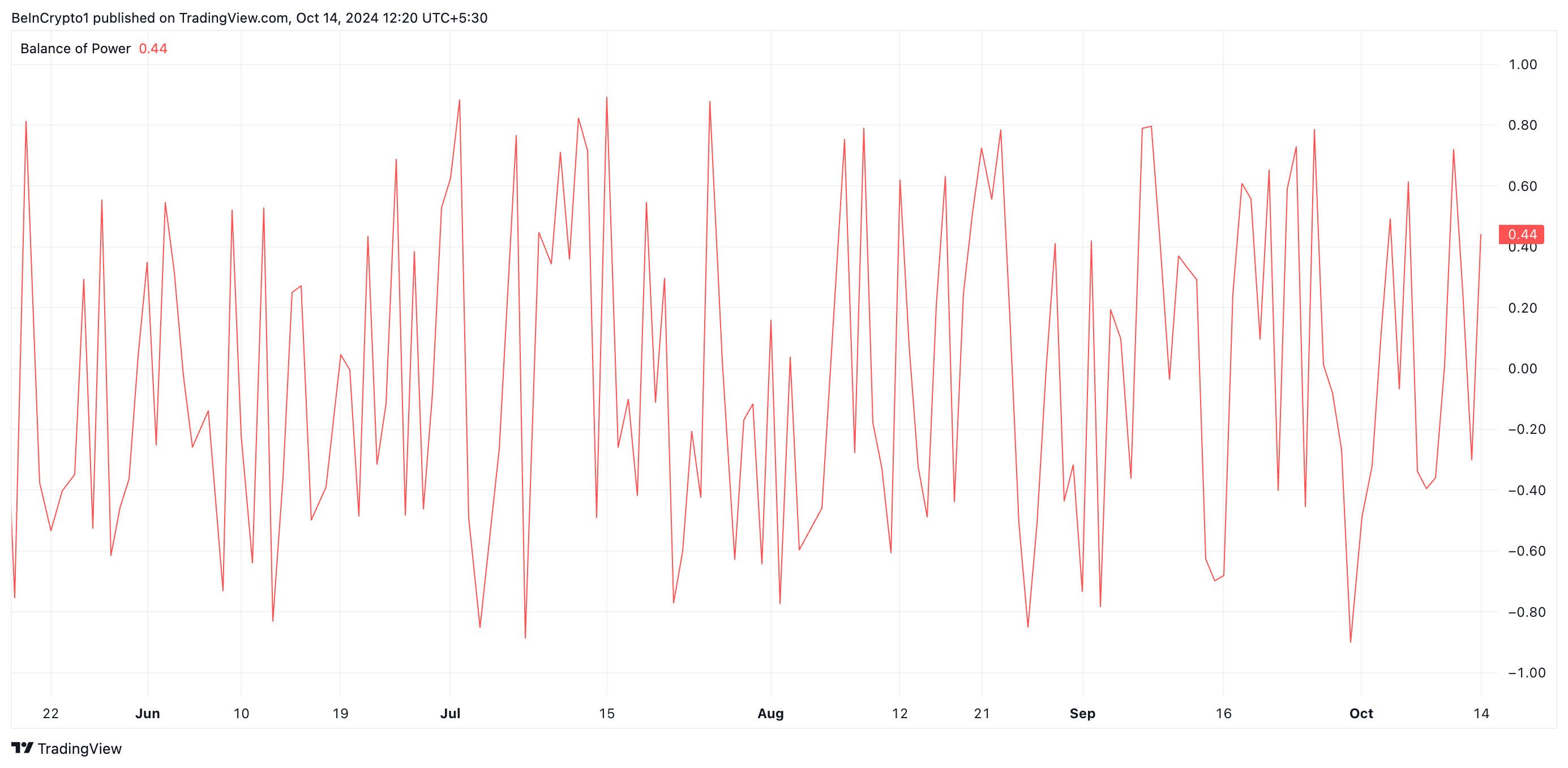

Moreover, Cardano’s Balance of Power (BoP) confirms the uptick in buying activity in the market. This indicator, which measures the strength of buyers versus sellers in the market, is at 0.44 at press time. A positive BoP suggests buyers are in control and attempting to push the asset’s price higher.

Notably, Cardano whales have increased their trading activity, as evidenced by the coin’s surging large holders’ netflow, which has skyrocketed by over 1000% over the past seven days.

Large holders refer to addresses that hold more than 0.1% of an asset’s circulating supply. When their netflow spikes, it signals that whales are accumulating the asset, which is a strong bullish indicator. This can spark increased interest from retail investors, leading to further accumulation and potentially driving the asset’s price higher.

ADA Price Prediction: Coin May Reach Four-Month High

If buying activity gains momentum, Cardano’s price will break above the $0.36 resistance level. A successful breakout of this level could pave the way for a rally toward $0.48, a price last seen in June.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if buying pressure fades and selling activity increases, Cardano’s price may be pulled back to its support at $0.33. Should the bulls fail to defend this level, the price could decline, potentially reaching $0.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

President Trump Signs First-Ever Crypto Bill into Law

President Donald Trump signed the first-ever crypto-specific bill into law on April 10, 2025. The bill sought to repeal the IRS DeFi Broker Rule enacted under the Biden administration.

Previously, the resolution passed the Senate with a 70-28 vote and the House with a 292-132 margin. This reflected a widespread recognition of the need to protect innovation and privacy in the digital asset space.

Trump Signs Historic Crypto Bill, Ending IRS DeFi Broker Rule

The IRS DeFi Broker Rule mandated that decentralized finance (DeFi) platforms report transaction data to the Internal Revenue Service (IRS). It also suggested creating a new classification for brokers, including certain participants or entities involved in the DeFi sector.

Senator Ted Cruz and Representative Mike Carey introduced the Congressional Review Act of Disapproval (CRA), H.J. Res. 25, which ended this rule. In the latest press release, Representative Carey stressed that the bill marked the first cryptocurrency law passed and the first CRA related to taxes to be enacted.

He argued that the rule now repealed, stifled growth and placed unnecessary burdens on the sector.

“The DeFi Broker Rule needlessly hindered American innovation, infringed on the privacy of everyday Americans, and was set to overwhelm the IRS with an overflow of new filings that it doesn’t have the infrastructure to handle during tax season. By repealing this misguided rule, President Trump and Congress have given the IRS an opportunity to return its focus to the duties and obligations it already owes to American taxpayers instead of creating a new series of bureaucratic hurdles,” he stated.

Industry leaders widely celebrated the move. Bo Hines, the Executive Director of the President’s Council of Advisers on Digital Assets, took to X (formerly Twitter) to underline the positive implications of Trump’s decision on the crypto sector.

“Huge Moment! First crypto legislation ever signed into law. Repealing the IRS’s DeFi broker rule protects innovation and privacy—another big step toward ushering in a golden age for digital assets,” Hines posted.

SEC’s Shift in Strategy Paves the Way for Crypto Growth

Meanwhile, this legislative milestone coincides with a series of positive regulatory developments. On the same day, the SEC’s Division of Corporation Finance released new guidance on securities issuance and registration disclosures in the crypto asset market.

“As part of an effort to provide greater clarity on the application of the federal securities laws to crypto assets, the Division of Corporation Finance is providing its views about the application of certain disclosure requirements under the federal securities laws to offerings and registrations of securities in the crypto asset markets,” the statement read.

The guidance addresses disclosure requirements related to price volatility, technological risks, and legal uncertainties. It also stresses transparency to ensure investors are fully informed about these offerings’ risks, characteristics, and details. This move signals a more structured approach to regulating crypto securities, potentially easing compliance for issuers while protecting investors.

In another significant development, the SEC dismissed unregistered securities charges against Nova Labs, the firm behind the Helium Network. This ruling removed the securities classification from Helium Hotspots and Helium’s tokens (HNT, MOBILE, and IOT) distributed through the network.

“With this chapter finally closed, Helium, DePIN, and crypto can now move forward with full confidence, accelerating real-world adoption and innovation in the industry. Together, we’ll fight for a future where everyone and everything can connect freely—without the barriers of inflated costs or gatekeepers standing in the way,” Helium remarked.

The dismissal reflected a shift in the SEC’s enforcement strategy under new leadership following Gary Gensler’s departure in January 2025. Since a new presidential term began, the SEC has dismissed several lawsuits and investigations into many crypto companies.

Notably, the regulator even dropped its long-standing lawsuit against Ripple last month. BeInCrypto reported that both parties reached a preliminary settlement agreement in their legal dispute. They filed a joint motion to suspend the appeal process.

These developments collectively signal a turning point for cryptocurrency regulation in the US, balancing innovation with investor protection as the industry continues to mature.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,550 zone. ETH is now correcting gains from $1,680 and finding bids near the $1,500 level.

- Ethereum started a decent increase above the $1,550 and $1,600 levels.

- The price is trading below $1,580 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,550 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,580 resistance zone.

Ethereum Price Trims Gains

Ethereum price formed a base above $1,400 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,480 and $1,550 resistance levels.

The bulls even pumped the price above the $1,600 zone. A high was formed at $1,687 and the price recently started a downside correction. There was a move below the $1,600 support zone. The price dipped below the 50% Fib retracement level of the upward move from the $1,385 swing low to the $1,687 high.

Ethereum price is now trading below $1,580 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,550 level. There is also a new connecting bearish trend line forming with resistance at $1,550 on the hourly chart of ETH/USD.

The next key resistance is near the $1,580 level. The first major resistance is near the $1,620 level. A clear move above the $1,620 resistance might send the price toward the $1,680 resistance. An upside break above the $1,680 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,580 resistance, it could start a downside correction. Initial support on the downside is near the $1,520 level. The first major support sits near the $1,500 zone and the 61.8% Fib retracement level of the upward move from the $1,385 swing low to the $1,687 high.

A clear move below the $1,500 support might push the price toward the $1,455 support. Any more losses might send the price toward the $1,420 support level in the near term. The next key support sits at $1,380.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,500

Major Resistance Level – $1,580

Market

Bitcoin Holds The Line—But Can It Bounce Back or Break Lower?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $80,000 zone. BTC is now correcting gains and might struggle to stay above the $79,500 support.

- Bitcoin started a fresh increase above the $80,000 zone.

- The price is trading above $79,500 and the 100 hourly Simple moving average.

- There is a new connecting bearish trend line forming with resistance at $80,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $80,500 zone.

Bitcoin Price Dips Again

Bitcoin price started a fresh increase above the $77,500 zone. BTC formed a base and gained pace for a move above the $79,500 and $80,000 resistance levels.

The bulls pumped the price above the $82,500 resistance. A high was formed at $83,548 and the price recently started a downside correction. There was a move below the $81,500 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

Bitcoin price is now trading above $79,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $80,500 level. There is also a new connecting bearish trend line forming with resistance at $80,500 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $81,500 level. The next key resistance could be $82,500. A close above the $82,500 resistance might send the price further higher. In the stated case, the price could rise and test the $83,500 resistance level. Any more gains might send the price toward the $85,000 level.

More Losses In BTC?

If Bitcoin fails to rise above the $80,500 resistance zone, it could continue to move down. Immediate support on the downside is near the $79,500 level. The first major support is near the $79,000 level and the 50% Fib retracement level of the upward move from the $74,572 swing low to the $83,548 high.

The next support is now near the $78,000 zone. Any more losses might send the price toward the $76,500 support in the near term. The main support sits at $75,000.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $79,500, followed by $79,000.

Major Resistance Levels – $80,500 and $81,500.

-

Market22 hours ago

Market22 hours agoIs Trump’s Tariff Delay Masking a Crypto Dead Cat Bounce?

-

Altcoin20 hours ago

Altcoin20 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

-

Blockchain23 hours ago

Blockchain23 hours agoBlockchain in the Ballot Box? NY Assembly Considers Tech to Fight Election Fraud

-

Bitcoin18 hours ago

Bitcoin18 hours agoBullish Signal for Bitcoin in 2025?

-

Market18 hours ago

Market18 hours agoSolana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

-

Market17 hours ago

Market17 hours agoOnyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

-

Altcoin17 hours ago

Altcoin17 hours agoBinance Lists BABY As Bitcoin Protocol Babylon Goes Live