Market

Io.net Explores DePin Growth Amid Token Struggles

Io.net, a decentralized physical infrastructure network (DePin) project for computing networks, has forged a strategic partnership with OpSec, a privacy-centric cloud solution.

This collaboration aims to integrate io.net’s decentralized GPU resources with OpSec’s cloud infrastructure, enhancing cloud operations for developers and enterprises.

IO Tokens Struggle Despite New Partnerships

Under this alliance, both companies will develop a proof-of-concept showcasing the efficient deployment of OpSec’s nodes across io.net’s expansive network. Consequently, the DePin companies expect that the initiative will improve the scalability and accessibility of cloud resources markedly.

These improvements will support a vast array of machine-learning models and cloud-based applications. The partnership begins with the immediate development of the integration proof-of-concept, followed by extensive scalability tests to ensure a frictionless developer experience.

“This partnership with OpSec is a significant milestone in our mission to democratize access to GPU compute capacity. By integrating our decentralized resources with OpSec’s advanced privacy-focused cloud infrastructure, we are paving the way for a more scalable, efficient, and secure cloud computing environment,” Tausif Ahmed, VP of Business Development at io.net, said.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

Moreover, io.net has expanded its partnership network by collaborating with AIRian, a sport-AI community and healthcare provider. Through this partnership, AIRian plans to deploy and expand GPU compute resources to support an active user community.

These resources will be essential for collecting and processing extensive data on daily activities such as walking, running, and healthcare. These will help develop sophisticated sports AI models focused on behavior and statistics. Furthermore, AIRian will delve into GPS-based applications, including competitions and Web3 games.

Despite these promising developments, the IO token, io.net’s native currency, has faced significant market volatility. After reaching an all-time high of $6.5 on June 13, the token has since declined by over 30%.

The token, which was listed on Binance on June 11, plays a crucial role within the io.net ecosystem, facilitating services, transactions, and fees and incentivizing contributors for their GPU power.

The company also witnessed a leadership change as co-founder Ahmad Shadid stepped down from his role as CEO, with co-founder and former COO Tory Green taking over.

Read more: Top 7 Machine Learning Applications in 2024

Previously, observers have expressed concerns about io.net’s transparency and reliability, especially after a GPU metadata attack that caused active GPU connections to plummet from 600,000 to 10,000. These incidents have intensified scrutiny of how the network manages its GPU capabilities and pricing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance, Trade Wars, Ripple and SEC

Crypto market volatility was high this week as regulatory developments, macro tensions, and the Binance exchange’s decisions shook markets.

A brewing trade war, whispers of stealth quantitative easing, and a historic legal truce between Ripple and the SEC are reshaping narratives. The following is a roundup of what happened this week in crypto.

Binance Earmarks 14 Altcoins For Delisting

Binance, the largest crypto exchange by trading volume metrics, announced a decision to delist 14 tokens, including BADGER, BAL, and CREAM.

The decision led to double-digit losses for the affected tokens almost immediately, highlighting the effect of such announcements on investor sentiment.

Binance initiated the delisting process through its vote-to-delist mechanism, where the community participated in deciding the fate of certain tokens. Reportedly, out of 103,942 votes from 24,141 participants, 93,680 were deemed valid.

The exchange cited factors such as development activity, trading volume, and liquidity in its evaluation before earmarking the cited altcoins.

“Following the Vote to Delist results and completion of the standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT on 2025-04-16,” read the announcement.

Trading for these tokens will cease on April 16, with withdrawal limitations set for June 9. Post this date, any unsold tokens will be converted to stablecoins.

Arthur Hayes: Inevitable Return to Fed Stimulus

This week in crypto, Arthur Hayes returned with a bold thesis. According to the BitMEX co-founder, the unfolding US-China trade war and the inevitable return of Fed stimulus could catapult Bitcoin to $1 million.

Hayes tied Trump’s proposed 125% tariffs on Chinese goods to a broader breakdown in global trade. He also referenced a scenario where the USD/CNY hits 10.00, calling it the “super bazooka” that could propel Bitcoin higher.

According to Hayes, such protectionism will trigger supply chain disruption, inflationary spikes, and, ultimately, a resumption of quantitative easing (QE) as central banks try to stabilize faltering economies.

He sees this monetary pivot as the spark for Bitcoin’s next supercycle.

In a more immediate scenario, the BitMEX executive also argued that if the Fed pivots to QE soon, Bitcoin could hit $250,000 even before a global financial reckoning sets in.

Hayes’s outlook sounds overly ambitious. However, with US liquidity injections already under scrutiny, analysts are increasingly aligning with the idea that macro tailwinds could push Bitcoin far beyond the current $81,000 range.

Is the Fed Already Doing Stealth QE?

BeInCrypto reported this hypothesis this week in crypto. Some analysts are raising red flags about stealth quantitative easing, suggesting the Fed is quietly injecting liquidity into the financial system without formally announcing a new QE program.

“This isn’t hopium. This is actual liquidity being unchained. While people are screaming about tariffs, inflation, and ghost-of-SVB trauma… the biggest stealth easing since 2020 has been underway,” wrote Oz, founder of The Markets Unplugged.

Liquidity metrics such as the Reverse Repo Facility (RRP) hint at significant capital flows, even as the Fed maintains a public anti-inflation stance.

Critics argue that these backdoor injections are fueling asset prices, including crypto, without the transparency or accountability of past QE rounds.

For crypto, stealth QE may be one of the key reasons Bitcoin remains resilient despite calls for significant breakdowns below $70,000.

If confirmed, these quiet interventions could be laying the groundwork for a larger, formal liquidity wave. Such an action would align with Arthur Hayes’s prediction of a new Bitcoin super cycle.

Meanwhile, amid cooling inflation and US growth forecasts softening, the possibility of a formal return to QE in 2025 is gaining traction among economists.

Analysts highlighted that if the Fed pivots to liquidity expansion, Bitcoin and major altcoins could enter a multi-year bull cycle akin to the 2020–2021 rally.

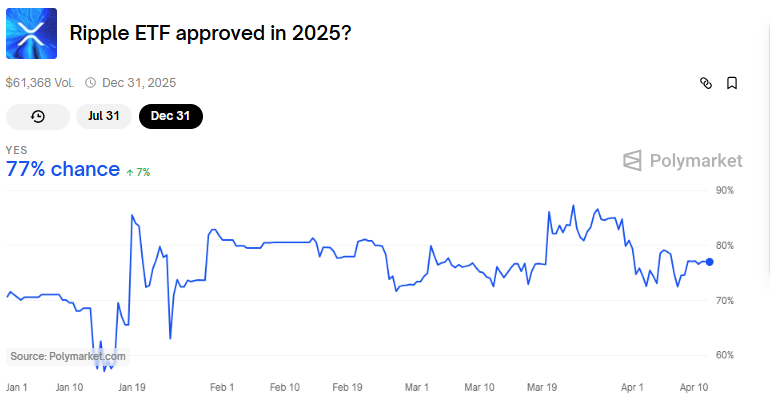

Ripple and SEC File Joint Motion

Another top headline this week in crypto, Ripple and the US SEC (Securities and Exchange Commission) filed a joint motion to settle the remaining remedies phase of their years-long legal battle.

The move signals both parties are ready to wrap up a case that has cast a regulatory shadow over the crypto market since 2020.

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” wrote XRP advocate James Filan.

The motion follows Judge Analisa Torres’s 2023 ruling that XRP is not a security when sold to retail investors. This decision marked a partial but critical win for Ripple.

What remains now is a resolution over institutional sales, penalties, and injunctions. According to legal experts, the fact that both Ripple and the SEC are willing to settle suggests neither side wants to prolong the case amid broader legal and political uncertainty.

The resolution will likely influence how the SEC proceeds with other enforcement actions against major crypto firms. For Ripple, regulatory clarity could open the door to US re-listings and deeper integration with traditional finance (TradFi).

Specifically, it could increase the odds for an XRP ETF (exchange-traded fund) in the US, which now stands at 77%, data on Polymarket shows.

Trump Pauses Tariffs—Except on China

This week in crypto, the crypto market surged over 5% in total capitalization after Donald Trump announced he would pause tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump shared on Truth Social.

The move reignited risk-on sentiment in markets, particularly crypto, which remains highly sensitive to macro policy shifts.

Analysts interpreted the announcement as a double-edged message. On the one hand, the global economy might get a reprieve from broad-based trade pressure.

On the other hand, China remains a geopolitical target, which could further fragment global trade systems and increase reliance on decentralized assets. In a retaliatory move, China raised tariffs on the US to 125%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

China Raises Tariffs on US to 125%, Crypto Markets Steady

On April 11, 2025, China’s State Council Tariff Commission issued an official notice announcing an increase in additional tariffs on imported US goods—from 84% to 125%. The new rate takes effect on April 12.

This move directly responds to the United States’ decision, announced on April 10, to impose a “reciprocal” 125% tariff on Chinese exports to the US.

Crypto Market Stays Calm Amid Escalating US-China Trade War

Despite escalating tensions between the world’s two largest economies, the cryptocurrency market has shown remarkable stability. Investors appear unfazed by the intensifying trade conflict.

Crypto market capitalization remains around $2.5 trillion. Bitcoin’s price holds above $81,000 after recovering 10% since April 9, when Trump announced a 90-day tariff pause, excluding tariffs on China.

According to the Chinese statement, the tariff hike follows China’s Customs Law, Tariff Law, and Foreign Trade Law. The government reaffirmed its commitment to international rules. It accused the US of violating global trade norms and called Washington’s policy “unilateral bullying.”

Notably, China warned that it would not respond to further tariff increases from the US, arguing that American goods have already lost their competitiveness in the Chinese market at the current tariff level.

“Given that US exports to China are no longer market-viable under the current tariff rate, China will not respond further if the US continues to raise tariffs on Chinese goods,” the statement said.

The tariff dispute is not new. Since 2018, the US and China have imposed retaliatory tariffs on each other. Key sectors affected include agriculture, tech, and energy.

The latest hike pushes tariffs to a record 125%. Economists warn this could disrupt global supply chains, raise prices, and add pressure to inflation in both nations.

Bitcoin miners also feel the impact as mining machine prices surge.

China’s tariff hike sends a strong message about its tough stance in trade negotiations. While the crypto market remains stable for now, analysts urge investors to monitor upcoming developments—especially any potential response from the US.

If no resolution is reached, the ongoing standoff could trigger a broader economic fallout. The world is now watching to see whether the trade war will de-escalate or further entrench the divide between the two economic superpowers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

Hedera’s HBAR has bucked the broader market dip to record a slight 1% rally over the past 24 hours. As of this writing, the altcoin trades at $0.17.

This upward movement comes amidst signs of a resurgence in new demand for the altcoin, as highlighted by key technical indicators on the daily chart.

HBAR Bullish Trend Gains Strength

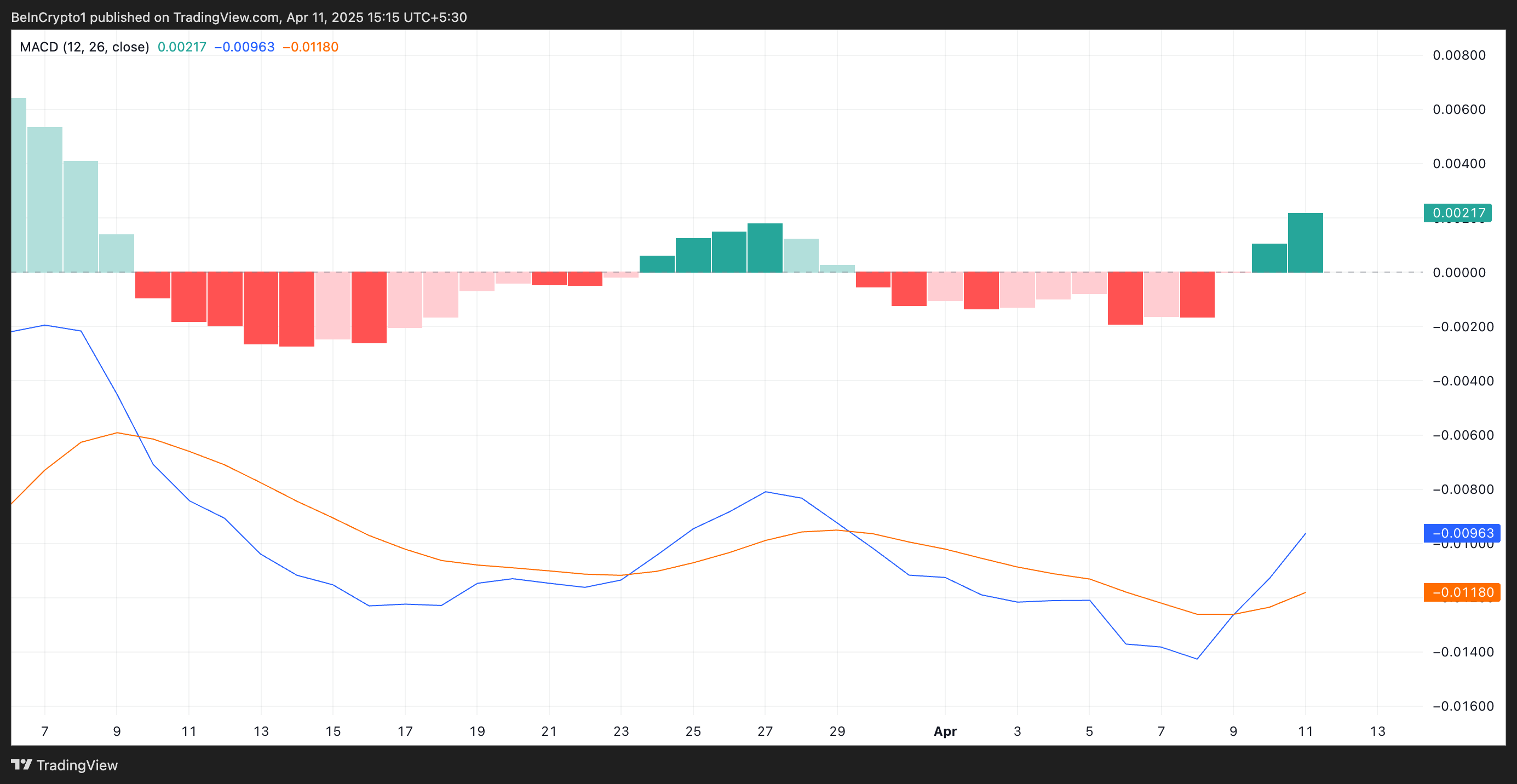

Readings from HBAR’s Moving Average Convergence Divergence (MACD) reveal that on April 9, the token’s MACD line (blue) climbed above its signal line (orange), forming a “golden cross.”

A golden cross occurs when the MACD line crosses above the signal line, signaling a potential bullish trend and increased buying pressure. This confirms that HBAR’s upward momentum is gaining strength, especially as investors commonly view this pattern as a buy signal.

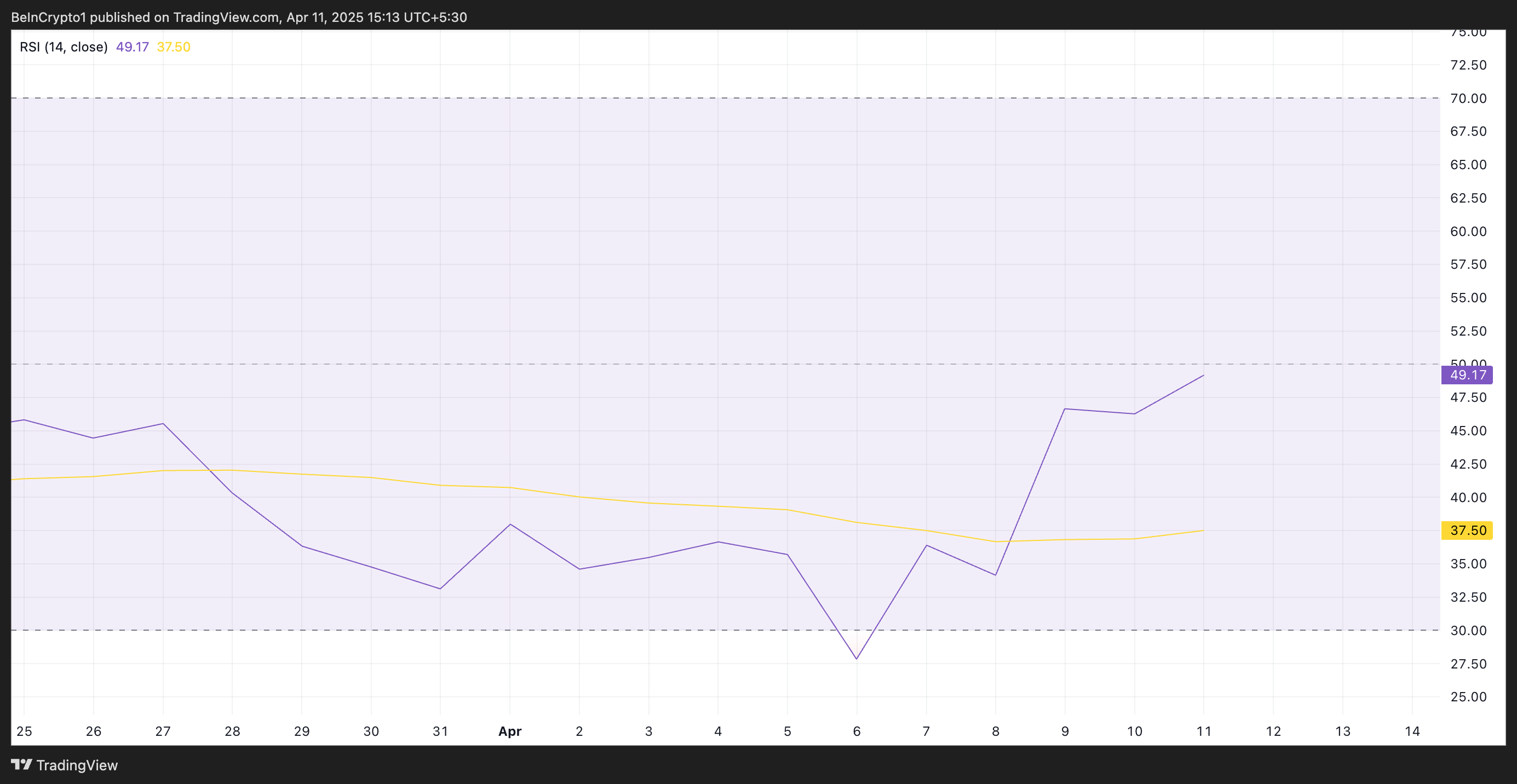

Moreover, as of this writing, HBAR’s Relative Strength Index (RSI) is poised to break above the 50-neutral line, highlighting the spike in fresh demand for the altcoin. It is currently at 49.17 and remains in an uptrend.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.17 and climbing, HBAR’s RSI signals a gradual shift from bearish territory into a more neutral zone. If the altcoin’s RSI continues to rise above 50, it would signal increasing bullish sentiment, driving up HBAR’s value.

HBAR Eyes $0.19 Amid Strong Buying Pressure

HBAR’s surge over the past day has pushed its price above the key resistance formed at $0.16, which has kept the token in a downtrend since March 30.

With growing buying pressure, the token could flip this zone into a support floor. If successful, it could propel HBAR’s price to $0.19.

However, if traders resume profit-taking, HBAR’s current rally would halt, and the token’s price could fall below $0.16 and decline toward $0.12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoCash App’s Block Inc Settles for $40 Million Over AML Failures For Crypto Platform

-

Market23 hours ago

Market23 hours agoSolana Price Attempts Recovery, Nears $120, But Needs A Push

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum’s Controversial Developer Freed Before Full Sentence

-

Bitcoin21 hours ago

Bitcoin21 hours agoFlorida Bitcoin Reserve Bill Passes House With Zero Votes Against

-

Bitcoin18 hours ago

Bitcoin18 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023

-

Market18 hours ago

Market18 hours agoADA Price Surge Signals a Potential Breakout

-

Market17 hours ago

Market17 hours agoEthereum Price Climbs, But Key Indicators Still Flash Bearish

-

Market21 hours ago

Market21 hours agoFuser on How Crypto Regulation in Europe is Finally Catching Up