Market

io.net CEO Leaves, Helium Mobile Grows, and More

Decentralized Physical Infrastructure Networks (DePin) are transforming the tech landscape by enabling decentralized projects in real-world infrastructure.

Here’s what happened recently in the DePin sector: io.net’s CEO stepped down just before their token launch, Helium Mobile reached over 92,000 subscribers, and the number of active decentralized physical infrastructure projects grew to more than 1,200.

CEO of io.net Steps Down

Solana-based decentralized infrastructure provider io.net, which allows users to monetize their GPU power, has recently replaced its CEO just two days before the launch of its native token on Binance Launchpad. The token launch, scheduled for Tuesday, June 11, is part of io.net’s ambitious plans to become the world’s largest AI computing network. Co-founder Ahmad Shadid stepped down immediately, and fellow co-founder and former COO Tory Green stepped in as his successor.

In an effort to address speculation about his departure, Shadid has provided an explanation for his decision. He stresses that the firm remains committed to growth and success, and his departure aligns with this vision.

“While there have been allegations regarding my past, I want to emphasize that I am stepping down as CEO to allow io.net to move forward without distraction and to focus on its growth and success,” Shadid said.

Read more: 5 DePin Coins to Add to Your Portfolio in June 2024

Io.net aggregates GPU resources to create a network offering machine learning startups affordable computing power, significantly reducing costs compared to traditional cloud services. However, io.net has faced heavy criticism.

Observers argue that io.net misled the community about its GPU capabilities and question why it sets prices instead of allowing compute owners to do so. Furthermore, a GPU metadata attack on April 28 caused active GPU connections to plummet from 600,000 to 10,000, exacerbating concerns about the network’s reliability and transparency.

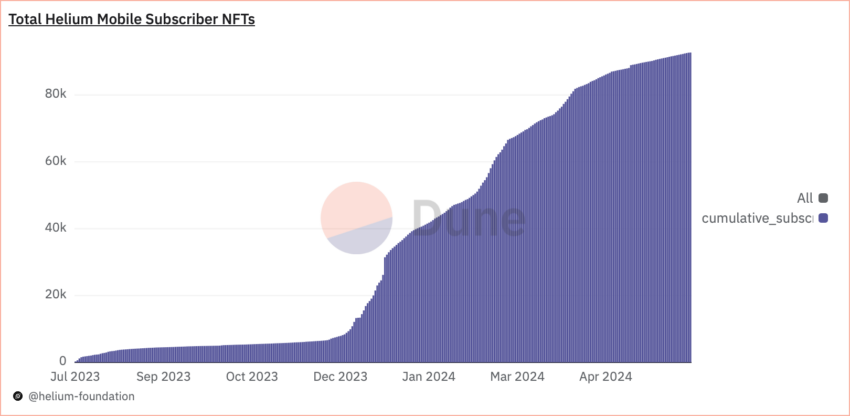

Helium Mobile Crosses 92,000 Subscribers

Helium Mobile now has more than 92,000 subscribers, showing the rising interest in decentralized wireless networks. Helium’s model uses blockchain technology to reward users for setting up and maintaining wireless coverage, which has attracted a large community and expanded its network.

Every time a new subscriber signs up, an NFT is minted, adding to the decentralized network’s appeal. Users can also earn MOBILE tokens by doing tasks like “Discovery Mapping,” where they share their location to help improve coverage. These tokens can pay for their phone plans or be traded for other cryptocurrencies.

Read more: Top 8 Helium (HNT) Wallets to Consider in 2024

Helium Mobile offers a $20 per month plan for unlimited talk, text, and data. It uses both the Helium network and T-Mobile’s infrastructure to provide coverage. This combination, along with strong community support and smart strategies, shows how successful decentralized models are becoming in telecommunications.

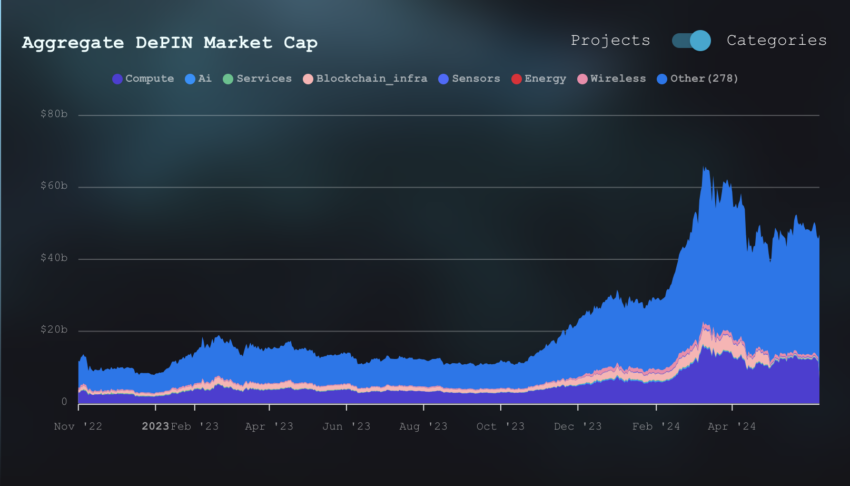

The Number of Active DePin Projects Surpassed 1,200

The DePin ecosystem is flourishing, with 1,215 active projects currently underway, a total market cap of $47 billion, and an annual revenue run rate of $15 million, according to the DePin Ninja dashboard.

Projects range from decentralized wireless networks to community-driven energy grids, showcasing the diverse applications of DePin technologies. The top five by market cap include Fetch.ai ($4.3 billion), Render ($3.56 billion), Filecoin ($3.3 billion), The Graph ($2.5 billion), and Arweave ($2.5 billion).

Read more: Top 9 Web3 Projects That Are Revolutionizing the Industry

These developments point to a promising future for DePin, with rising user engagement and a growing number of active projects paving the way for decentralized solutions across various infrastructure sectors. Although DePin is still in its early stages and has several flaws, it enables the exchange of tokens between synthetic and real-world assets. This complements traditional infrastructure by providing last-mile coverage in areas where conventional models are not economically feasible.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Bulls Lead 17% Recovery, Targeting $138

Solana plunged to a 12-month low of $95.23 on April 7, marking a sharp decline amid broader market turbulence.

However, as the market embarked on a recovery this week, SOL has witnessed a rebound, with its price climbing as demand surges.

SOL Rebounds 17%, Eyes Further Gains

Since SOL began its current rally, its value has soared by 17%. At press time, the altcoin trades at $124.58, resting atop an ascending trend line.

This pattern emerges when the price of an asset consistently makes higher lows over a period of time. It represents an uptrend, indicating that SOL demand is gradually increasing, driving its prices higher. It suggests that the coin buyers are willing to pay more, and it serves as a support level during price corrections.

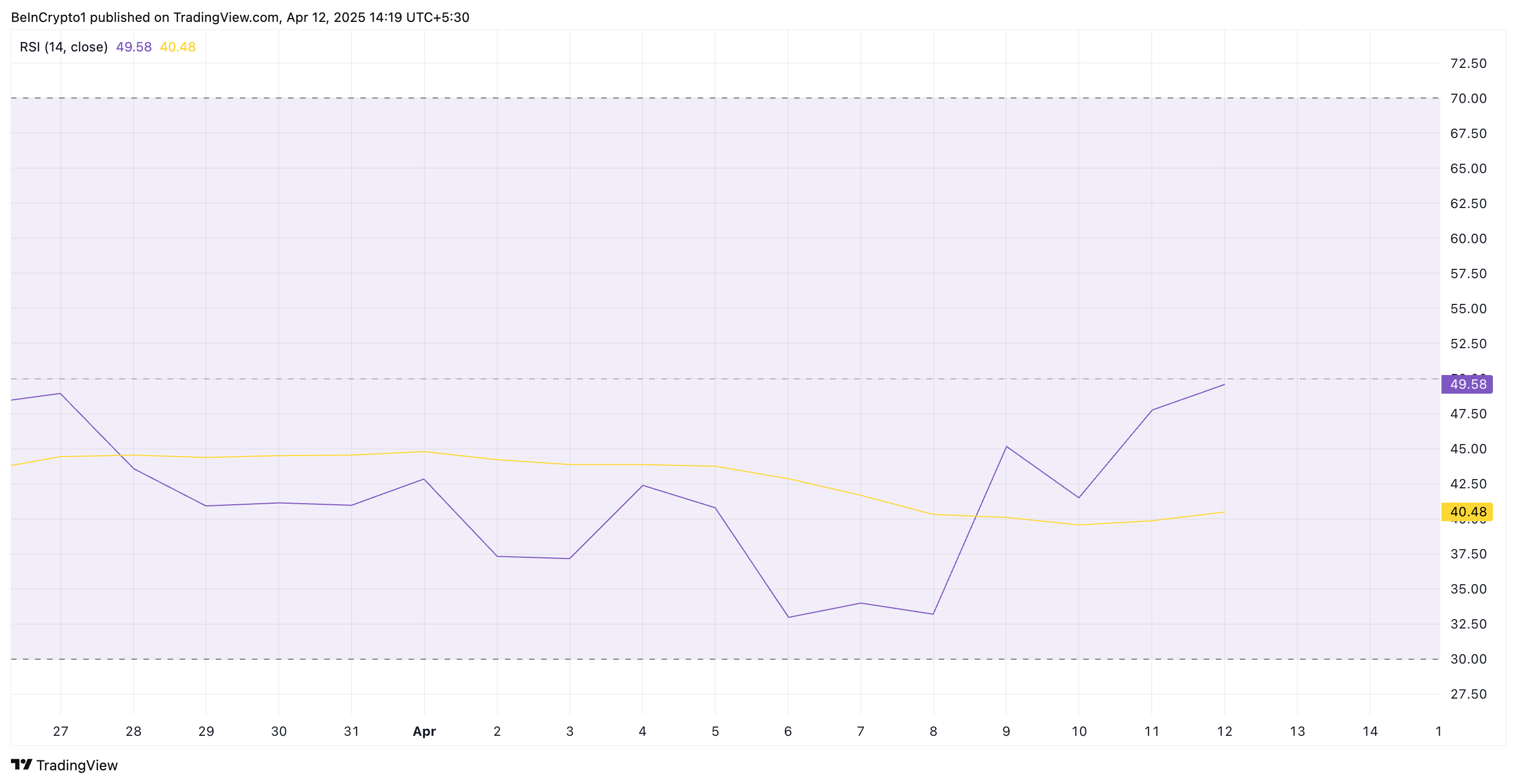

SOL’s recovery is further supported by its rising Relative Strength Index (RSI), indicating increasing buying interest. This momentum indicator is at 49.58 at press time, poised to break above the 50-neutral line.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 49.50 and climbing, SOL’s RSI signals a steady shift in momentum from bearish to bullish. A rise above 50 would confirm increasing buying pressure and a potential for a sustained upward price movement.

Solana Bulls Eye $138

SOL’s ascending trend line forms a solid support floor below its price at $120.74. If demand soars and the bullish presence with the SOL spot markets strengthens, the coin could continue its rally and climb to $138.41.

However, if profit-taking commences, the support at $120.74 would be breached, and the SOL’s price could revisit $95.23.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple May Settle SEC’s $50 Million Fine Using XRP

Ripple’s long-running legal clash with the US Securities and Exchange Commission (SEC) appears to be nearing its final chapter.

However, a surprising detail has emerged from the ongoing settlement talks, which could see Ripple pay its reduced $50 million penalty using its native token, XRP.

Ripple Could Use XRP Token to Pay SEC Fine

On April 11, Ripple CEO Brad Garlinghouse appeared on FOX Business. At the interview, he revealed that the idea of paying the penalty in XRP was floated during settlement discussions.

“The SEC is going to end up with $50 million and the US government gets $50 million and we talked about making that available in XRP,” Garlinghouse stated.

The ongoing negotiations follow Ripple’s and the SEC’s decision to drop their appeals, bringing the multi-year legal battle closer to closure.

“We’re moving past the SEC’s war on crypto and entering the next phase of the market – true institutional flows integrating with decentralized finance,” Garlinghouse added in a post on X.

Judge Analisa Torres originally set the fine at $125 million in 2024, linking it to Ripple’s unregistered XRP sales to institutional investors. Ripple complied by placing the funds in an interest-bearing account, but the appeals process delayed any further action.

With those appeals now abandoned, Ripple is expected to pay a reduced fine of $50 million.

A recent joint court filing confirms that both sides have reached a preliminary agreement. They are now seeking final approval from the SEC’s commissioners.

Once internal reviews are complete, the parties plan to request a formal ruling from the district court.

“There is good cause for the parties’ joint request that this Court put these appeals in abeyance. The parties have reached an agreement-in-principle, subject to Commission approval, to resolve the underlying case, the Commission’s appeal, and Ripple’s cross-appeal. The parties require additional time to obtain Commission approval for this agreement-in-principle, and if approved by the Commission, to seek an indicative ruling from the district court,” the filing stated.

If the commission votes in favor, this case could conclude one of the most closely watched regulatory battles in crypto history. More importantly, the use of XRP for the settlement could mark a significant shift in the SEC’s approach to digital assets.

This turnaround would represent a major regulatory shift and could trigger further bullish momentum for the token.

Since Donald Trump’s election victory in November 2024, investor confidence in XRP has grown sharply, pushing the token’s value up by more than 300%.

At the same time, institutional interest continues to rise, as seen in the wave of spot exchange-traded fund applications tied to the token

Market analysts have linked this performance to the friendlier political climate. They also point to the potential reclassification of XRP as a commodity as a key factor driving the asset’s rise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

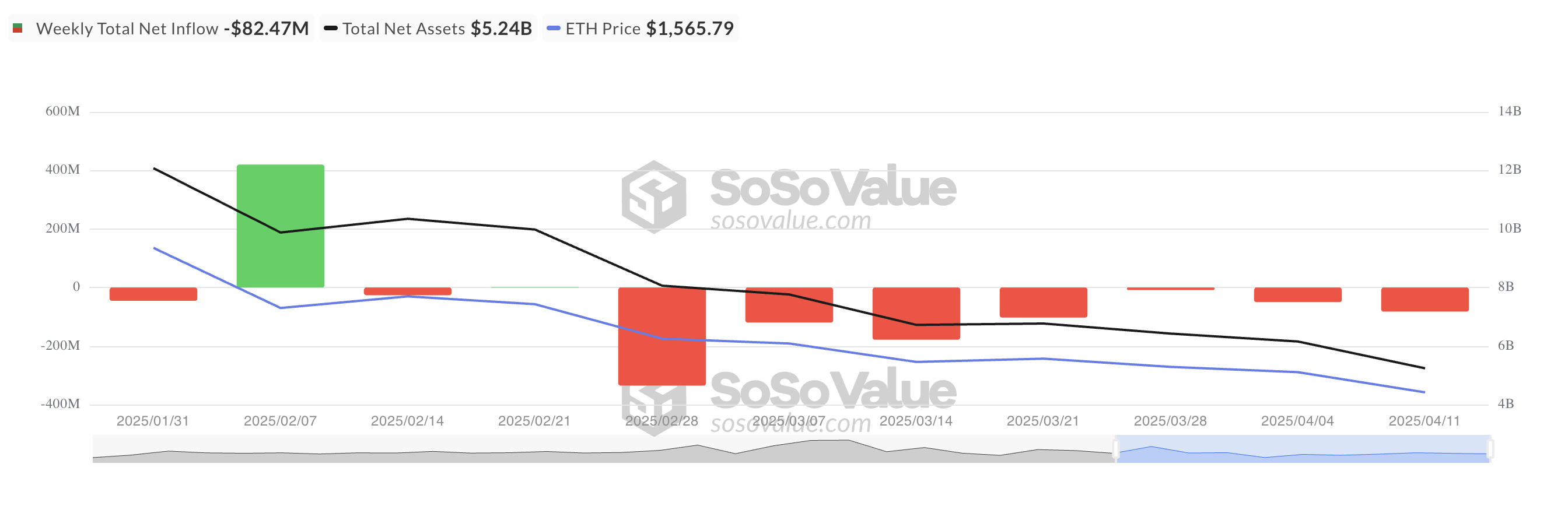

Ethereum ETFs See Seventh Consecutive Week of Net Outflows

Ethereum ETFs have closed yet another week in the red, recording net outflows amid continued investor hesitation.

Notably, there has been no single week of net inflows since the end of February, highlighting waning institutional interest in ETH-related products.

Ethereum ETFs Face Steady Outflows

Ethereum-backed ETFs have recorded their seventh consecutive week of net outflows, highlighting sustained institutional hesitance toward the asset.

This week alone, net outflows from spot ETH ETFs totaled $82.47 million, marking a 39% surge from the $49 million recorded in outflows the previous week.

With the steady decline in institutional presence in the ETH market, the selling pressure on the coin has soared.

Over the past week, ETH’s price has declined by 11%. The steady outflows from the funds backed by the coin suggest that the downward momentum may persist, increasing the likelihood of a price drop below the $1,500 mark.

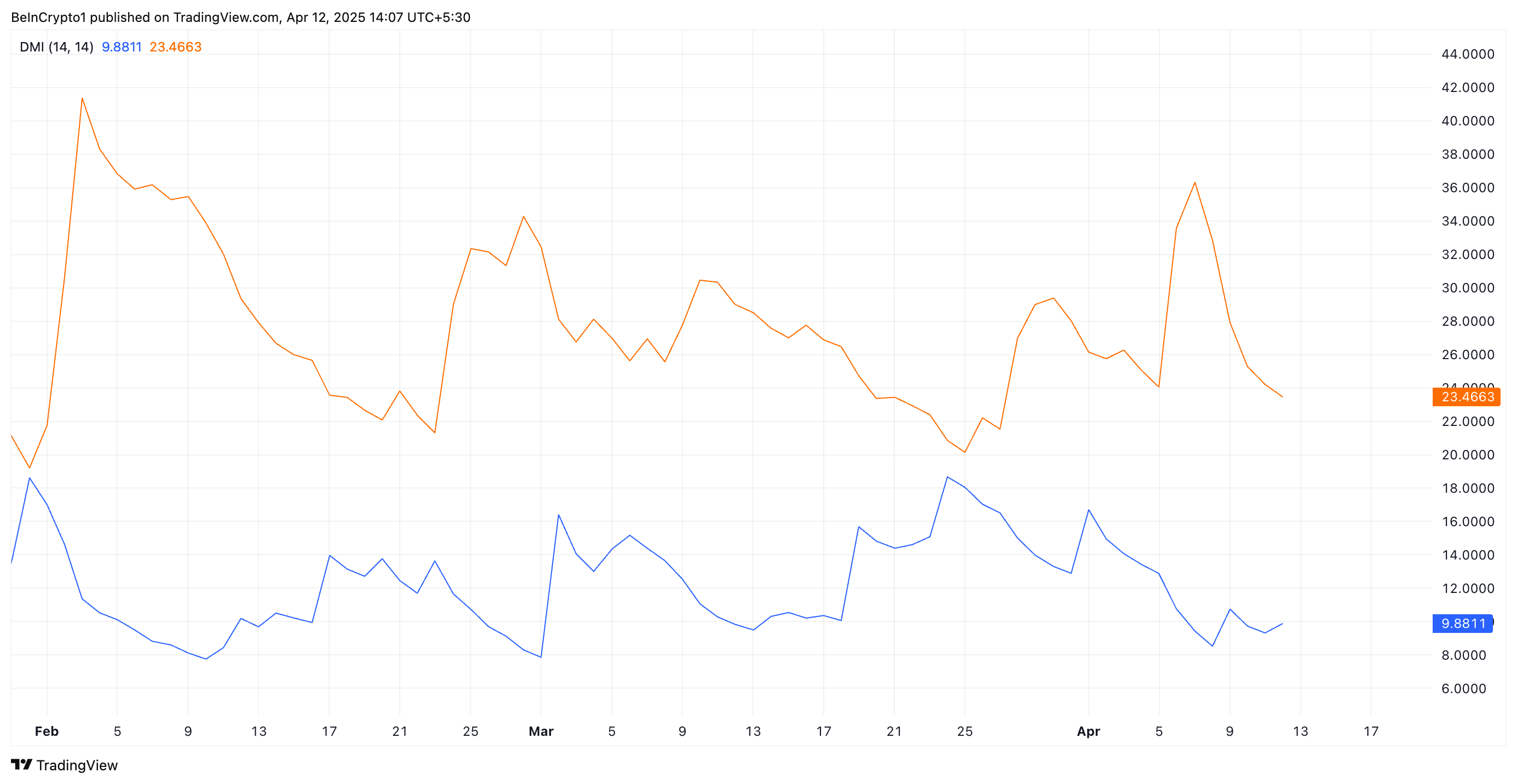

On the price chart, technical indicators remain bearish, confirming the mounting pressure from the selling side of the market. For example, at press time, readings from ETH’s Directional Movement Index (DMI) show its positive directional index (+DI) resting below the negative directional index (-DI).

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which represents downward price movement.

As with ETH, when the +DI rests below the -DI, the market is in a bearish trend, with downward price movement dominating the market sentiment.

Ethereum’s Price Could Drop Below $1,500

The lack of institutional capital could delay any significant rebound in ETH price, further dampening short-term prospects for recovery. If demand leans further, ETH could break out of its narrow range and follow a downward trend.

The altcoin could fall below $1,500 in this scenario to reach $1,395.

However, if ETH witnesses a positive shift in sentiment and demand spikes, its price could climb to $2,114.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours ago3 Altcoins to Watch for Binance Listing This April

-

Market21 hours ago

Market21 hours agoThis is Why The Federal Reserve Might Not Cutting Interest Rates

-

Market22 hours ago

Market22 hours agoLawmakers Propose the PROOF Act to Avoid Another FTX Incident

-

Altcoin22 hours ago

Altcoin22 hours agoSolana Price Eyes Breakout to $200, SOL ETF Approval Timeline

-

Market20 hours ago

Market20 hours agoXRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

-

Market19 hours ago

Market19 hours agoCrypto Whales Are Buying These Altcoins Post Tariffs Pause

-

Market18 hours ago

Market18 hours agoBinance and the SEC File for Pause in Lawsuit

-

Altcoin7 hours ago

Altcoin7 hours agoBinance Issues Important Update On 10 Crypto, Here’s All