Market

Ethereum Up 6%, But Bearish Pressure is Still Strong

Ethereum (ETH) has gained nearly 6% in the last 24 hours, bringing its price back above $2,200 after briefly dropping near $2,000. This recovery comes as investors anticipate potential market-moving developments from the upcoming White House Crypto Summit.

Key indicators such as the RSI and DMI suggest that Ethereum is at a pivotal point, with bearish momentum weakening but not entirely gone. If bullish pressure continues to build, ETH could break above key resistance levels, potentially aiming for $3,000 in the coming weeks.

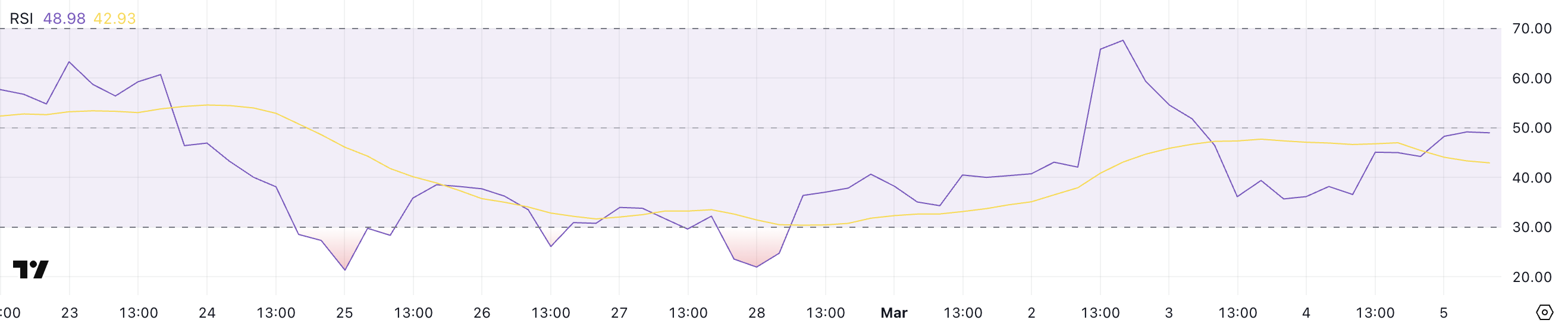

Ethereum RSI Is Neutral, But Up From Yesterday

Ethereum’s Relative Strength Index (RSI) is currently at 48.9, reflecting a neutral stance after significant fluctuations in recent days.

Two days ago, RSI reached 67.6, approaching overbought territory, before dropping to 36.1 yesterday, signaling a brief period of stronger selling pressure.

The current RSI level near 50 indicates that Ethereum is neither strongly overbought nor oversold, positioning it at a key inflection point where the next move could define short-term direction.

RSI, or the Relative Strength Index, is a momentum indicator that measures the speed and magnitude of price changes to determine whether an asset is overbought or oversold.

Typically, RSI values above 70 indicate overbought conditions, suggesting a potential pullback, while values below 30 signal oversold conditions, often leading to a bounce. With ETH RSI now at 48.9, it suggests a more balanced market, where neither buyers nor sellers have a clear upper hand.

If RSI starts climbing again, it could indicate renewed bullish momentum, pushing Ethereum toward higher levels. However, if it declines further, it may signal increasing bearish pressure, leading to a potential retest of lower support zones.

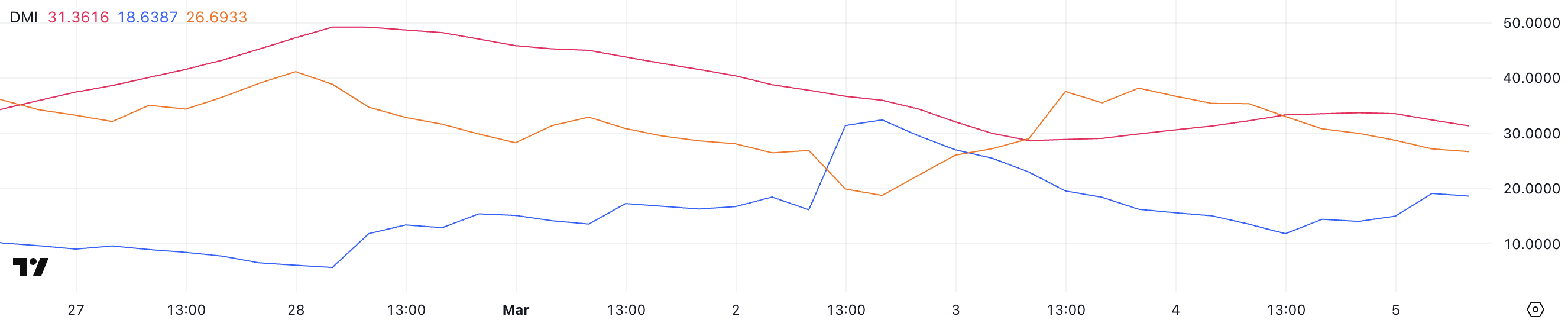

Ethereum DMI Shows Sellers Are Still In Control, But The Gap Is Narrowing

Ethereum’s Directional Movement Index (DMI) shows that the ADX is currently at 31.3, maintaining a level around 30 for the last two days. An ADX above 25 typically indicates a strong trend, and with the indicator holding steady above this threshold, it confirms that Ethereum is in a well-defined trend.

At the same time, the +DI has risen to 18.6 from 11.8 yesterday, while the -DI has dropped from 33 to 26.6. This shift suggests that bearish momentum is weakening while bullish pressure is slowly increasing.

However, since the -DI remains above the +DI, Ethereum is still in a downtrend, though signs of potential stabilization or trend reversal are emerging.

ADX, or the Average Directional Index, measures the strength of a trend without indicating its direction. Readings above 25 signal a strong trend, while values below 20 indicate weak or indecisive market conditions.

With ETH’s ADX at 31.3, the current downtrend remains strong, but the narrowing gap between +DI and -DI suggests that selling pressure is losing intensity. If +DI continues rising and overtakes -DI, Ethereum could begin shifting toward a more bullish structure.

However, if DI stays dominant and ADX remains elevated, the downtrend could persist, leading to further declines before any meaningful reversal occurs.

Will Ethereum Break Above $3,000 In March?

Ethereum recently experienced a sharp correction, briefly testing levels around $2,000 before rebounding. If the current downtrend reverses,

ETH could push toward the $2,550 resistance, with a breakout above this level potentially leading to a rally toward $2,855.

A strong uptrend could even propel Ethereum above $3,000 for the first time in over a month, with the possibility of reaching $3,442 if bullish momentum continues.

The strength of this recovery will depend on upcoming events, such as the White House Crypto Summit, with some users concerned about Ethereum’s indirect representation.

However, Ethereum remains at risk of further downside if bearish momentum returns. A renewed sell-off could bring ETH back to the $2,077 support level, and if this zone fails to hold, Ethereum price could drop below $2,000 once again.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Ripple’s $1.25 Billion Deal Could Surge XRP Demand

Ripple’s acquisition of Hidden Road could lead to a surge in demand for (XRP) XRP and Ripple USD (RLUSD) stablecoin, according to industry experts.

On April 8, Ripple acquired the global prime brokerage platform Hidden Road for $1.25 billion. This has positioned it for significant growth in the financial services sector.

How Will Ripple’s Hidden Road Acquisition Impact XRP Demand?

In a detailed thread on X (formerly Twitter), Jake Claver, Managing Director of Digital Ascension Group, highlighted the scale of Hidden Road’s operations. He noted that the firm processes over $10 billion in daily transactions, more than many blockchains handle in a month.

With this acquisition, he emphasized that transactions will now be processed on the XRP Ledger (XRPL). This development raises intriguing possibilities, particularly as prominent financial institutions are set to harness XRPL for its original design — a decentralized, efficient system built for seamless financial transactions.

“What happens when just a fraction of that $10 billion daily volume starts settling through XRP? Demand skyrockets. These aren’t retail traders—these are hedge funds and market makers who need XRP to power their operations. And they’ll be buying lots of it,” he wrote.

Claver also explained that Hidden Road’s integration of RLUSD makes it the first stablecoin to enable cross-margining between digital and traditional markets. According to him, this acquisition addresses issues of risk and inefficiency by using XRP for fast settlement and RLUSD for stable collateral.

“Ripple’s acquisition of Hidden Road is a fundamental shift in XRP and RLUSD’s position in global finance. Increased utility, institutional demand, and improved liquidity create the perfect storm for long-term value growth,” he noted.

Dom Kwok, co-founder of EasyA, corroborated this sentiment. He stressed that the move boosts the adoption of XRP Ledger and the RLUSD stablecoin.

“I’ve tracked tons of deals in the crypto space but Ripple’s acquisition of hidden road is without a doubt one of the most important deals for crypto,” Kwok claimed.

In a statement shared with BeInCrypto, Nic Puckrin, the founder of The Coin Bureau, emphasized that this acquisition might fuel more demand for the XRP tokens.

“It’s also notable that this acquisition is in part financed by XRP, along with cash and stock, while Hidden Road will migrate its post-trade activity to the XRP Ledger (XRPL) – Ripple’s native blockchain. This has the potential to drive demand for XRPL and is potentially good news for XRP’s price trajectory, which has struggled with performance despite the recent SEC win as tariff news decimated the altcoin market,” Puckrin told BeInCrypto.

Despite the optimism, XRP continues to struggle amid a broader market crash. Over the past day, the altcoin has dropped 2.9%. At the time of writing, it was trading at $1.8.

Nonetheless, an analyst urged the community to remain optimistic. He elaborated that Ripple is quietly building the “Internet of Value” with its strategic acquisitions and partnerships.

“XRP’s price isn’t reflecting the bullish news right now, and that’s not a glitch. It’s a reminder. A reminder that price isn’t the mission. Understanding the tech is,” the post read.

He emphasized that Ripple’s every move is part of a larger, interconnected strategy. This even includes the launch of RLUSD. This initiative is positioned as more than just a trend.

It’s part of a broader effort to rebuild the global financial infrastructure from the ground up, offering a stable, secure, and innovative alternative to traditional monetary systems.

“Yet the price remains quiet. Because until they flip the switch. Until the new system is fully in place. We’re just being handed breadcrumbs, enough for those with eyes to see,” he added.

The analyst stresses viewing any potential XRP price drops as an opportunity rather than a reason to panic sell. He encouraged investors to focus on long-term goals, such as building the future of finance, rather than chasing short-term gains.

He asserts that those who stack, learn, and hold the line position themselves ahead of the curve and become part of a historic shift in the financial landscape.

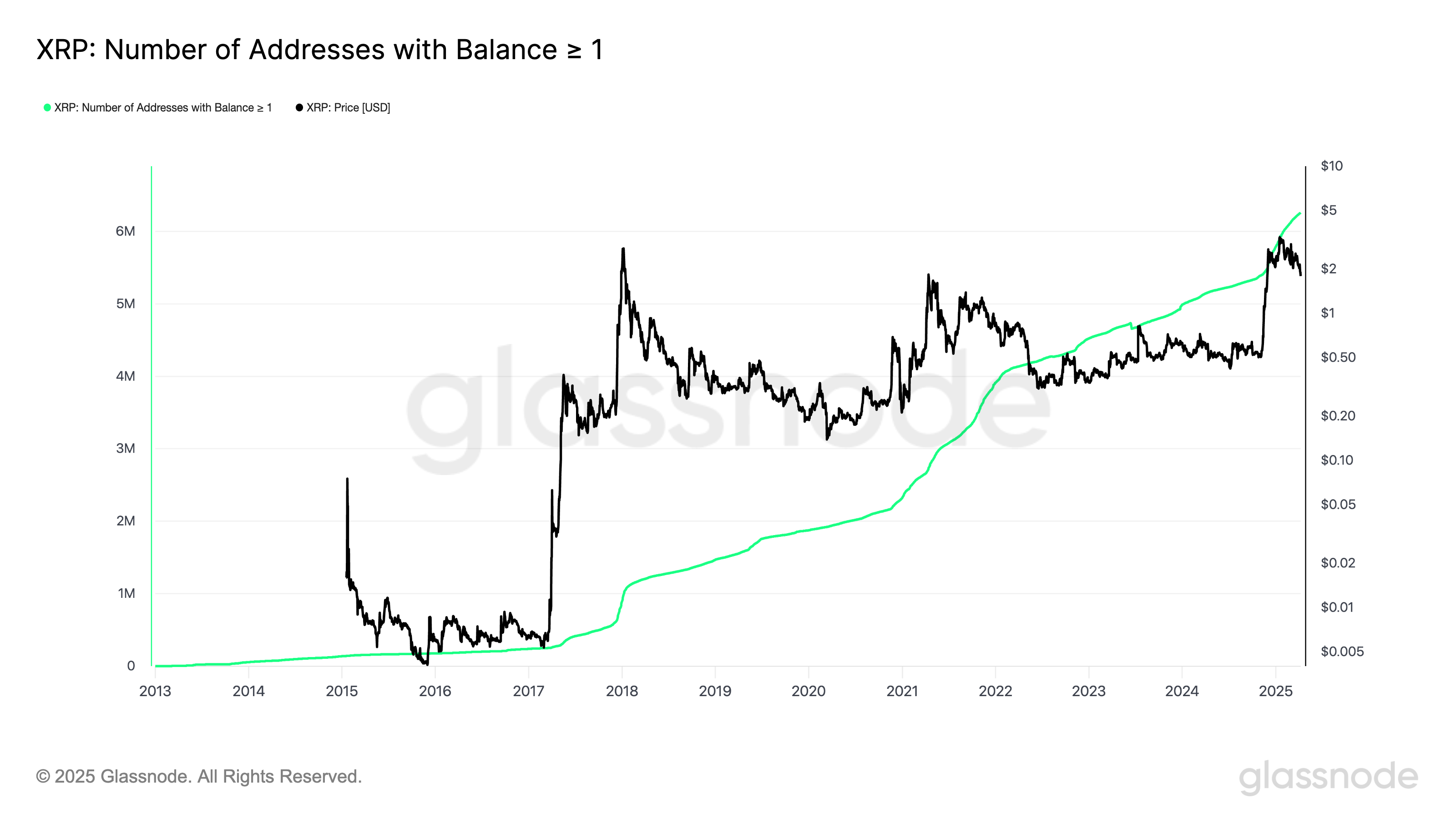

Interestingly, it seems that many share the same belief. Despite the recent volatility, small investor interest in XRP is on the rise. According to recent data from Glassnode, addresses holding 1 XRP or more have reached an all-time high of 6.2 million.

This surge in participation from retail investors suggests growing confidence in XRP’s long-term potential, even as broader market struggles persist.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Bitget’s BGB Burns and Utility Match Binance’s BNB Boom?

Bitget is ramping up its deflationary strategy for the BGB token by initiating large-scale token burns.

In today’s fiercely competitive centralized exchange market, could token burning become a key tool to enhance the intrinsic value of exchange-native tokens?

Bitget’s Token Burn Strategy

According to Bitget’s latest announcement, the exchange burned 30 million BGB tokens in Q1 2025. The BGB circulating supply decreased from 1.2 billion to approximately 1.17 billion tokens, a 2.5% drop.

On December 30, 2024, Bitget completed a massive burn of 800 million BGB, representing 40% of the token’s original total supply. This move reduced the BGB supply from 2 billion to 1.2 billion tokens.

Looking ahead, Bitget has outlined a long-term tokenomics roadmap beginning in 2025. The exchange will allocate 20% of profits from both the Bitget Exchange and Bitget Wallet to buy back and burn BGB every quarter—a strategic shift aimed at boosting the long-term value of BGB.

One of the most successful examples of token burns is Binance. According to BNB Burn Info, Binance has burned over 59 million BNB to date. This deflationary model has helped BNB surge from under $1 in 2017 to over $600 in 2024.

The ongoing reduction in BNB’s supply, paired with the strong ecosystem of Binance Smart Chain (BSC), has positioned BNB as one of the world’s most valuable exchange tokens. Bitget appears to be following in these footsteps—but the key question remains: Can BGB replicate BNB’s success story?

Is Burning BGB Enough to Boost Price Like BNB?

According to CoinGecko, BGB reached its all-time high (ATH) of $8.45 earlier in 2025. The burn of 800 million tokens at the end of 2024 created immediate scarcity, helping drive this price surge.

However, this figure still pales in comparison to BNB’s performance. To sustain and increase value, Bitget must go beyond reducing supply and significantly expand BGB’s real-world utility.

Starting in January 2025, BGB has become the primary token for multi-chain gas payments via Bitget Wallet’s GetGas feature. This allows users to pay gas fees on major blockchains like Ethereum, Solana, and BNB Chain using BGB, USDT, or USDC—eliminating the need for chain-specific gas tokens.

Additionally, Bitget integrates BGB into real-world payment scenarios through PayFi and the Bitget Card. The PayFi initiative aims to make BGB a practical payment method for daily expenses like dining, travel, and shopping.

This effort expands BGB’s utility beyond the blockchain and positions it as a bridge between decentralized finance (DeFi) and everyday life—echoing Binance’s ambitions for BNB.

While Bitget is on the right track, achieving BNB-level growth still poses significant challenges. First, Bitget’s ecosystem is smaller and less developed than Binance’s. Second, the actual adoption rate of new features like multi-chain gas payments and PayFi will directly influence BGB’s real-world demand.

Finally, while Binance has spent years building brand trust and a loyal user base, Bitget is still establishing its position in the market. To sustain long-term growth, Bitget must balance reducing supply and boosting demand through practical, real-world applications.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Warning Signs Flash—Fresh Selloff May Be Around the Corner

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Whale Activity Peaks Amid Market Uncertainty

-

Market23 hours ago

Market23 hours agoXRP Price, Traders Retreat Despite The US ETF Buzz

-

Market21 hours ago

Market21 hours agoRipple Announces $1.25B Acquisition Of Hidden Road To Set Major Milestone

-

Altcoin21 hours ago

Altcoin21 hours agoDeveloper Advocates For Pi Network Community To Launch Liquidity Pool To Stablilize Pi Coin Price

-

Market18 hours ago

Market18 hours agoIs Ethereum Falling to $1,000 This April?

-

Market16 hours ago

Market16 hours agoYellow Card Aims to Replace SWIFT with Stablecoins in 5 Years

-

Market15 hours ago

Market15 hours agoUS DOJ Will No Longer Investigate Crypto Exchanges

-

Market22 hours ago

Market22 hours agoXCN Price’s Month-Long Bearishness Meets Whale Conviction