Market

Ethereum Transaction Fees Hit Lowest Level Since 2020

Ethereum’s transaction fees have dropped to their lowest point over four years, marking a significant shift in on-chain activity.

The decline comes as the network faces mounting challenges, including falling market performance and weakening fundamentals.

Ethereum Faces Declining Fees and Inflation Concerns

According to IntoTheBlock, Ethereum’s total transaction fees dropped by nearly 60% in Q1 2025, falling to roughly $208 million as of April 4. The firm noted that this was their lowest level since 2020.

“Total ETH fees decreased to their lowest level since 2020 this quarter, primarily driven by the gas limit increase and transactions moving to L2s,” IntoTheBlock stated.

Several factors have contributed to this decline. The biggest driver is the adoption of Layer-2 networks, especially Coinbase’s Base. Ethereum’s Dencun upgrade, which launched in March 2024, made transactions on these scaling layers much cheaper.

As a result, more users are bypassing Ethereum’s mainnet and shifting to faster, cost-effective alternatives. According to L2Beat, Base currently processes over 80 transactions per second, leading all other Layer-2 networks.

Despite the benefits of lower fees, Ethereum’s underlying metrics are showing signs of strain.

Michael Nadeau, founder of The DeFi Report, flagged a steep drop in ETH burn rates. He noted that ETH burned through major platforms like Uniswap, Tether, MetaMask, and 1inch, which collapsed by more than 95% since November 2024.

Nadeau explained that fading retail enthusiasm and the slower-than-expected scaling from L2s are contributing to Ethereum’s reduced deflationary pressure.

“ETH’s annualized inflation is now 0.75%. We should expect it to continue to rise, exceeding BTC inflation. We should also expect Ethereum’s fundamentals to continue to erode over the next year,” he added.

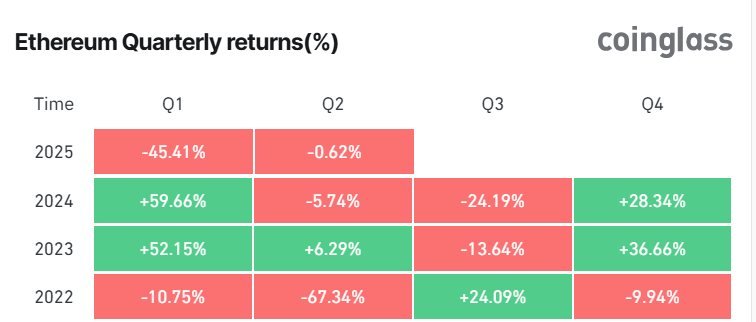

Meanwhile, the network’s financial performance reflects these concerns. ETH’s price fell over 45% in Q1 2025, marking its worst quarterly performance since 2022.

In comparison to Bitcoin, Ethereum has also underperformed, losing 39% of its value against BTC this year. That drop has pushed the ETH/BTC ratio to its lowest point in nearly five years.

Still, long-term investors are not backing down. IntoTheBlock pointed out that Ethereum whales accumulated over 130,000 ETH as the price dipped below $1,800—its lowest since November 2024—signaling strong buy-the-dip sentiment.

Beyond that, industry experts believe the upcoming Pectra upgrade, scheduled for May, could give the asset a fresh start.

According to them, Pectra can help restore confidence and drive renewed growth across the Ethereum ecosystem with its improved wallet functionality and user experience.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Stocks Suffer As Trump Confirms 104% Tariffs on China

The White House confirmed that 104% tariffs against China will go live at midnight tonight, much to the woe of the crypto market. After a brief recovery to $79,000, Bitcoin fell to $76,000 amid $300 million in total crypto liquidations.

There are a few points of optimism, as Bitcoin’s long positions rose to 54%. Tomorrow will be a critical day to follow; it may bring chaos to TradFi, but crypto could potentially weather the storm.

Trump’s Tariffs Massacre Crypto Market

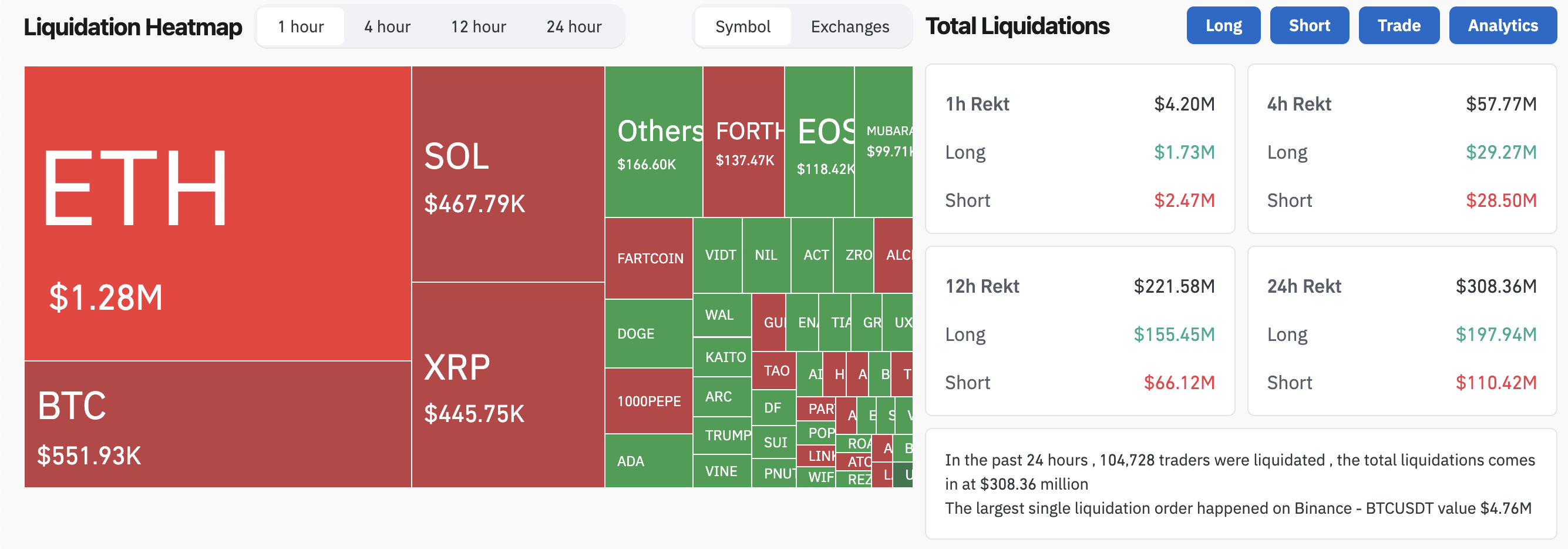

Trump’s tariffs are about to take effect, and the markets are in a profound moment of uncertainty. Yesterday, over $1 billion was liquidated from the crypto market, but optimism about a potential deal buoyed prices today.

The White House subsequently confirmed that 104% tariffs against China would take effect at midnight, prompting crypto to drop again:

China is America’s largest trading partner, and these sweeping tariffs could devastate the markets. Crypto, however, has been especially devastated. Publicly listed crypto companies faced another day of harsh drops after the tariff confirmation, as MicroStrategy’s MSTR slumped over 11%.

Additionally, Coinbase, Robinhood, and publicly traded Bitcoin miners all approached a 5% drop.

Bitcoin might be in a particularly dangerous position. Although a recent report claimed that it has been one of the crypto sector’s most tariff-proof assets, its risk profile might be changing.

It dropped 2.6% today, approaching the $75,000 price mark as more than $300 million was liquidated from crypto. If Bitcoin falls below this point, it could trigger further price routs.

Bitcoin Long-Short Ratio Fuels Optimism

As this morning’s price gains clearly demonstrated, the market still has a lot of remaining optimism. This could help all of crypto withstand tariff threats, including Bitcoin.

Its long positions have surged to 54%, showing that most traders are betting on BTC to rebound back to a higher price point.

Ultimately, tomorrow will be a very critical day for tariffs, crypto, and TradFi markets as a whole. It’s probably too late to hold out hope that Trump will decide not to escalate with China.

However, it remains to be seen whether the crypto market will continue to co-relate with the stock market after the tariffs are live or at-risk assets will reverse course and hedge against potential inflation fears.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Surges 8% as Bulls Push for Breakout

Cardano (ADA) is showing signs of life despite dropping 3% in the past 24 hours as traders weigh the possibility of a broader recovery. Technical indicators like BBTrend and DMI are flashing mixed signals, hinting that momentum may be fading after a brief surge.

ADA’s BBTrend has flipped into negative territory, while its DMI suggests bulls are gaining ground but haven’t fully taken control. With ADA hovering just above key support levels, the next few sessions will be crucial in determining whether this rally has legs or if another correction is around the corner.

ADA BBTrend Is Fading After Reaching Levels Above 5 Yesterday

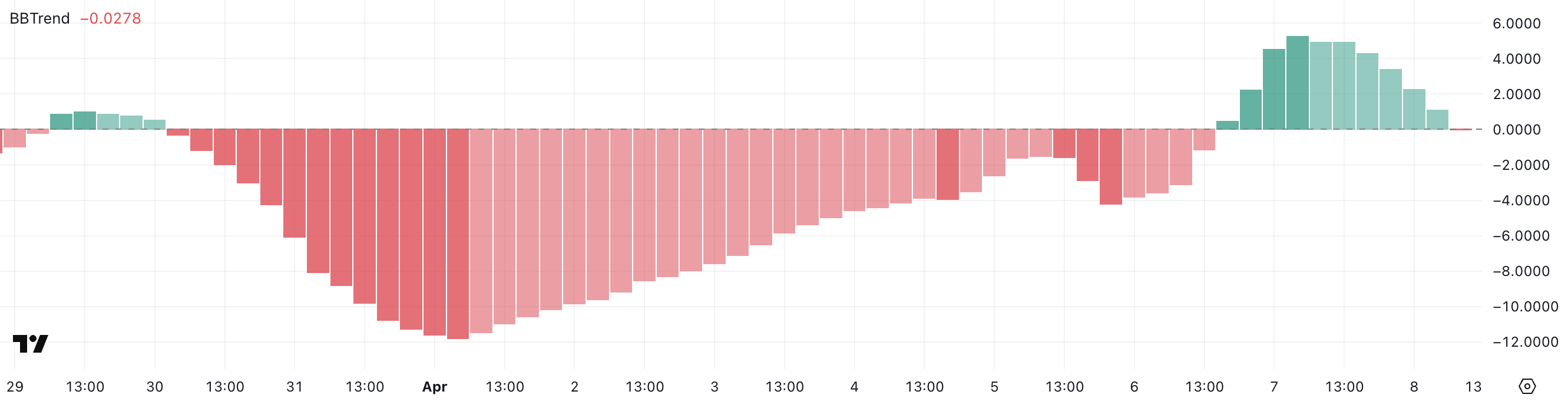

Cardano’s BBTrend indicator has flipped into negative territory, currently sitting at -0.02 after reaching a positive peak of 5.28 just a day earlier.

This sharp reversal highlights a potential shift in market sentiment, suggesting that bullish momentum may be losing strength.

The abrupt drop adds to growing concerns among ADA holders, especially with the broader altcoin market showing signs of weakness.

The BBTrend (Bull and Bear Trend) indicator measures the strength and direction of a price trend. Values above +1 typically indicate a strong bullish trend, while readings below -1 signal a strong bearish trend.

A value near zero, like the current -0.02, suggests indecision or a possible trend reversal.

For Cardano, this neutral-to-negative reading could mean that upward momentum is fading, increasing the risk of further downside if selling pressure builds in the coming sessions.

Cardano DMI Shows Buyers Are Almost Taking Control

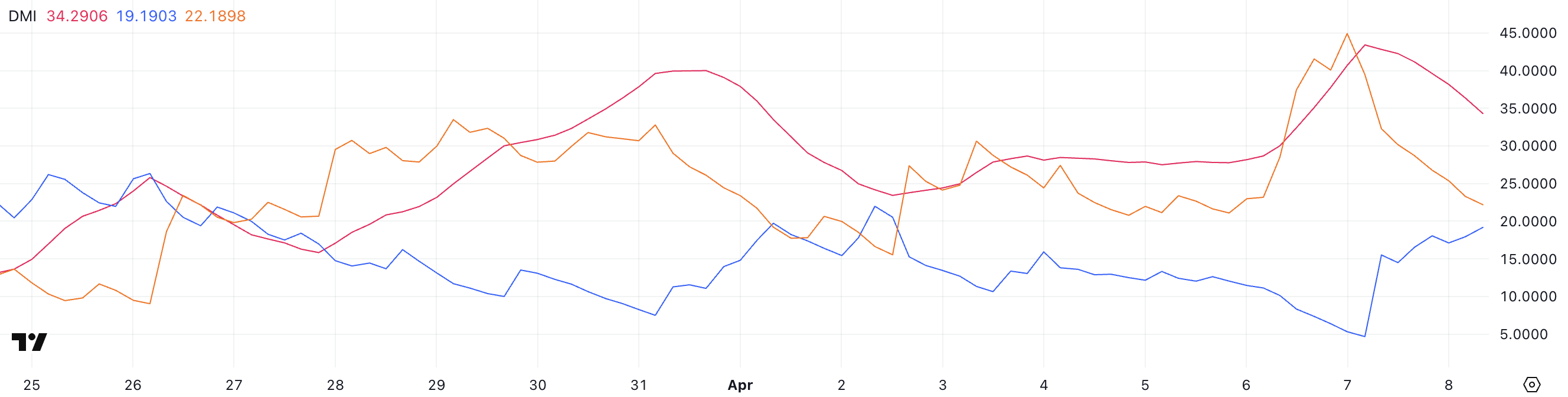

Cardano’s DMI (Directional Movement Index) chart shows that its ADX, which measures trend strength, has dropped to 34.29 from 43.41 yesterday.

While this indicates that the current trend is weakening, the ADX is still well above the key 25 threshold, meaning the market remains in a strong directional move.

The shift suggests that although momentum is cooling, the currently bearish trend hasn’t lost control just yet.

The ADX is part of the DMI system, which includes the +DI (positive directional index) and -DI (negative directional index).

The +DI has climbed from 4.68 to 19.19, showing growing bullish interest, while the -DI has sharply dropped from 44.92 to 22.18. This narrowing gap hints at a potential trend reversal or at least a slowing of bearish momentum.

However, since -DI is still slightly above +DI and ADX remains elevated, ADA is technically still in a downtrend — though bulls may be starting to regain some ground.

Is Cardano Getting Ready For A Recovery?

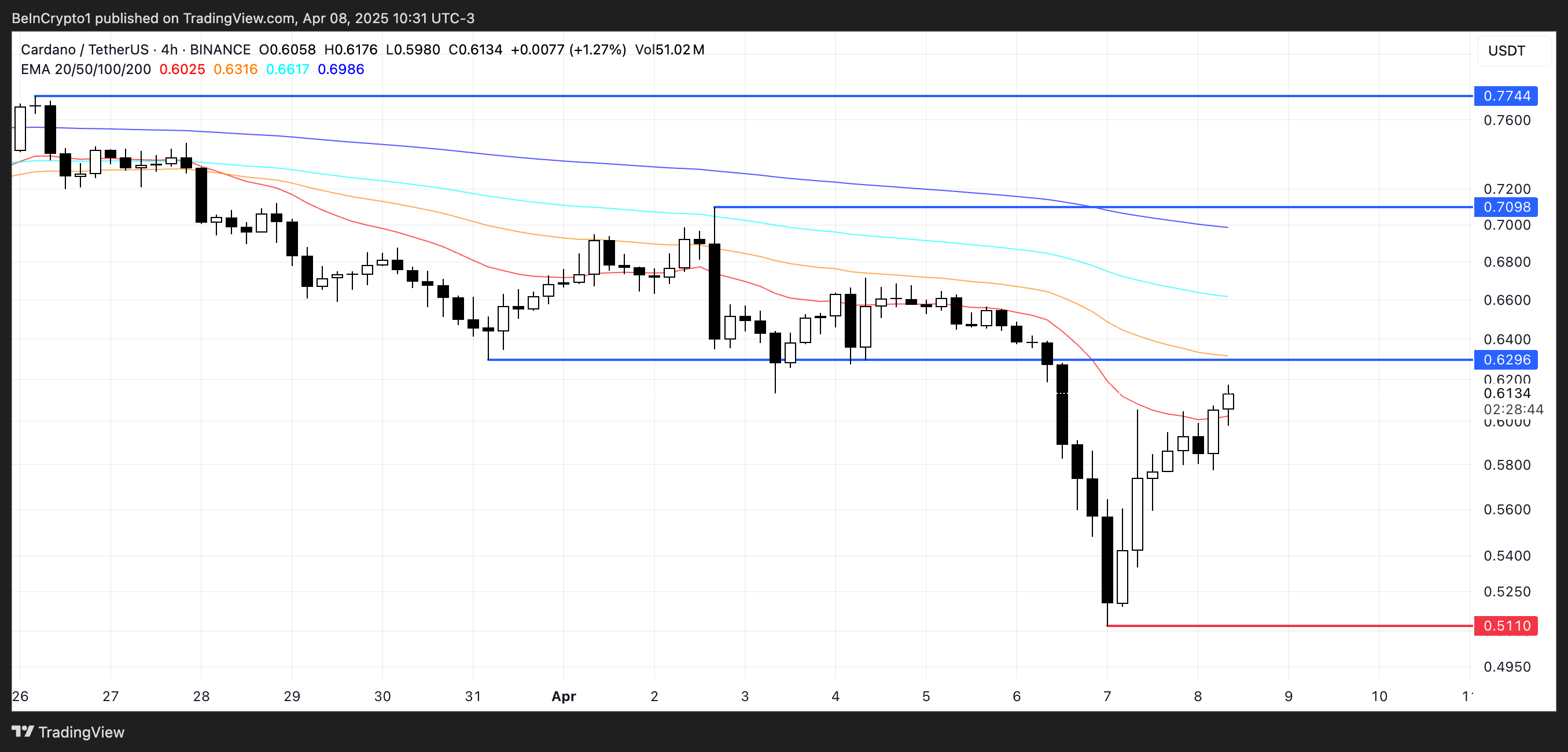

Cardano price is currently attempting a recovery after dipping below the $0.52 mark, a key support level in recent weeks. If buyers manage to confirm their strength and sustain upward momentum, ADA could first test resistance at $0.629.

A successful breakout above that could open the path toward $0.70, and if bullish pressure continues, a further rally to $0.77 may be on the table — levels not seen since early 2024.

However, if ADA fails to hold its current ground and bearish momentum returns, the token risks sliding back below $0.52.

A move toward $0.51 would be the first critical test, and losing that level could push Cardano below the $0.50 threshold for the first time since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

US DOJ Will No Longer Investigate Crypto Exchanges

The US DOJ just published a new directive claiming it will stop investigating and criminally charging crypto exchanges, mixers, and offline wallets.

This has produced a mixed response from the crypto community. Some sectors are jubilant about the potential freedom for business, while others fear the growing problem of fraud and criminal money laundering.

DOJ is Moving On From Crypto

The US financial regulatory apparatus has been much more friendly to crypto since President Trump took office. The SEC is reviewing its guidelines, the FDIC is working to prevent future debanking, and the entire political climate is changing.

Today, the Department of Justice (DOJ) released a statement claiming it will no longer investigate crypto entities.

“The Justice Department will stop participating in regulation by prosecution in this space. Specifically, the Department will no longer target virtual currency exchanges, mixing and tumbling services, and offline wallets for the acts of their end users or unwitting violations of regulations,” the DOJ’s statement claimed.

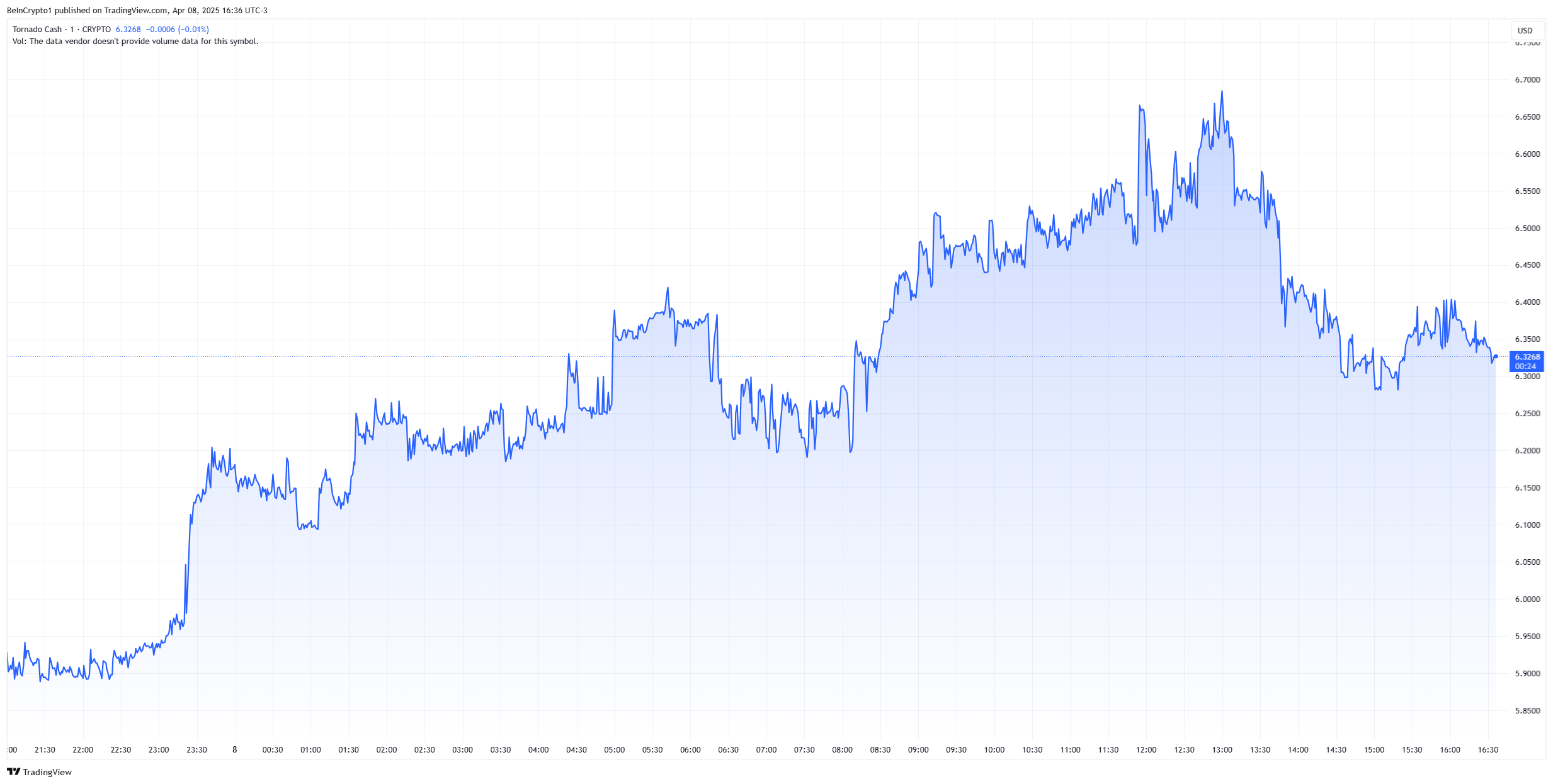

The DOJ’s statement applies to cryptocurrency exchanges, wallets, and crypto mixers like Tornado Cash. It builds on the Department’s previous announcement today, claiming that it disbanded the National Cryptocurrency Enforcement Team.

The department gives itself room to prosecute individual bad actors, but only in specific circumstances.

The US DOJ has been notorious for leading some of the biggest criminal investigations against crypto exchanges, such as Binance and KuCoin. Its critical investigation and charges against Binance led to the record $4.3 billion settlement in 2023.

However, the department is now moving on from crypto. According to today’s announcement, it will even drop any ongoing investigations against such entities immediately.

Also, it will not pursue legal liability for developers whose code is used by others to commit crimes, and it has closed all active investigations.

While it was expected that the department would lower its crypto enforcement under Trump, the complete laissez-faire decision has caught the crypto by surprise. Following the news, Tornado Cash (TORN) surged nearly 10% today.

The Department also asked regulators to review victim compensation laws. Although this is arguably a victory for crypto, it may also enable future finance crimes.

Will Crypto Crime Run Riot?

Crypto sleuth ZachXBT recently claimed that there is an “eye-opening” level of North Korean activity in DeFi. If the department turns a blind eye to major criminal operations on these exchanges and mixers, it may enable serious violations.

After the announcement first broke, crypto Twitter was filled with users declaring that “crime is legal now.”

Additionally, the industry may be pushing its luck with a dramatic move like this. Crypto scams are at an epidemic level right now, and the market is very uncertain.

The DOJ is disabling its ability to target criminals on exchanges and mixers, with little guarantee that it can enforce the law. In other words, it may be removing critical guardrails to prevent future disasters.

“Crypto lobby: ‘Sure, Trump nixed the Crypto Enforcement Team, directed Major Fraud prosecutors to stop prosecuting crypto cases, and is trying to exempt crypto platforms from the Bank Secrecy Act, but they wrote right here that they care about stopping crypto crime! Reject the evidence of your eyes and ears!’” claimed crypto researcher Molly White.

Overall, it’ll be difficult to fully predict the implications of the department’s new policy on exchanges. For now, this directive will give many crypto-related businesses the freedom to conduct operations as they see fit.

Hopefully, business will proceed as usual without any serious controversies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoProgrammer Reveals Reason To Be Bullish On Pi Network Despite Pi Coin Price Crash

-

Altcoin22 hours ago

Altcoin22 hours agoSolana’s Fartcoin Jumps 20% Despite Market Selloff

-

Market19 hours ago

Market19 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Market18 hours ago

Market18 hours agoXRP Price Recovery Fades—$2 Remains A Tough Nut to Crack

-

Market24 hours ago

Market24 hours agoCrypto Pundit Reveals What Will Happen If XRP Price Does Not Break $2.3

-

Market22 hours ago

Market22 hours agoRWA Tokens Outperform Bitcoin During Tariffs

-

Market21 hours ago

Market21 hours agoRWA Tokenization Takes Center Stage in Hong Kong

-

Market14 hours ago

Market14 hours agoBitcoin Price Recovery In Play—But Major Hurdles Loom Large