Market

Ethereum Price Teases a Breakout—Can This Spark a Momentum Shift

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,880 zone. ETH is now consolidating and facing hurdles near the $2,020 resistance.

- Ethereum started a recovery wave above the $1,920 level.

- The price is trading below $1,950 and the 100-hourly Simple Moving Average.

- There is a short-term rising channel forming with support at $1,980 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $2,020 and $2,040 resistance levels to start a decent increase.

Ethereum Price Faces Resistance

Ethereum price formed a base above the $1,820 level and started a recovery wave, like Bitcoin. ETH was able to clear the $1,880 and $1,920 resistance levels.

The bulls pushed the price above the $1,950 level. There was a move above the 50% Fib retracement level of the downward wave from the $2,068 swing high to the $1,936 low. However, the bears seem to be active near the $2,020 resistance zone.

Ethereum price is now trading below $1,950 and the 100-hourly Simple Moving Average. There is also a short-term rising channel forming with support at $1,980 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $2,020 level. The next key resistance is near the $2,040 level or the 76.4% Fib retracement level of the downward wave from the $2,068 swing high to the $1,936 low.

The first major resistance is near the $2,040 level. A clear move above the $2,040 resistance might send the price toward the $2,120 resistance. An upside break above the $2,120 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,150 resistance zone or even $2,250 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $2,040 resistance, it could start another decline. Initial support on the downside is near the $1,980 level. The first major support sits near the $1,950 zone.

A clear move below the $1,950 support might push the price toward the $1,880 support. Any more losses might send the price toward the $1,850 support level in the near term. The next key support sits at $1,800.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,880

Major Resistance Level – $2,040

Market

Ethereum Drops As Two Whales Face $235 Million Liquidation Risk

Ethereum (ETH) is under pressure once again, dropping around 3% in the last 24 hours and falling below the $1,800 level. This decline is putting several large leveraged positions at risk, including two massive whale vaults on Maker that collectively hold over $235 million worth of ETH.

With on-chain indicators flashing warning signs and technical levels being tested, the stakes are rising for both bulls and bears. As ETH hovers near critical support, the coming days could prove pivotal for its short-term price trajectory.

Ethereum Whales Could Get Liquidated

Ethereum has dropped around 3% in the past 24 hours, slipping below the $1,900 mark once again. This decline is putting pressure on large leveraged positions within the DeFi ecosystem.

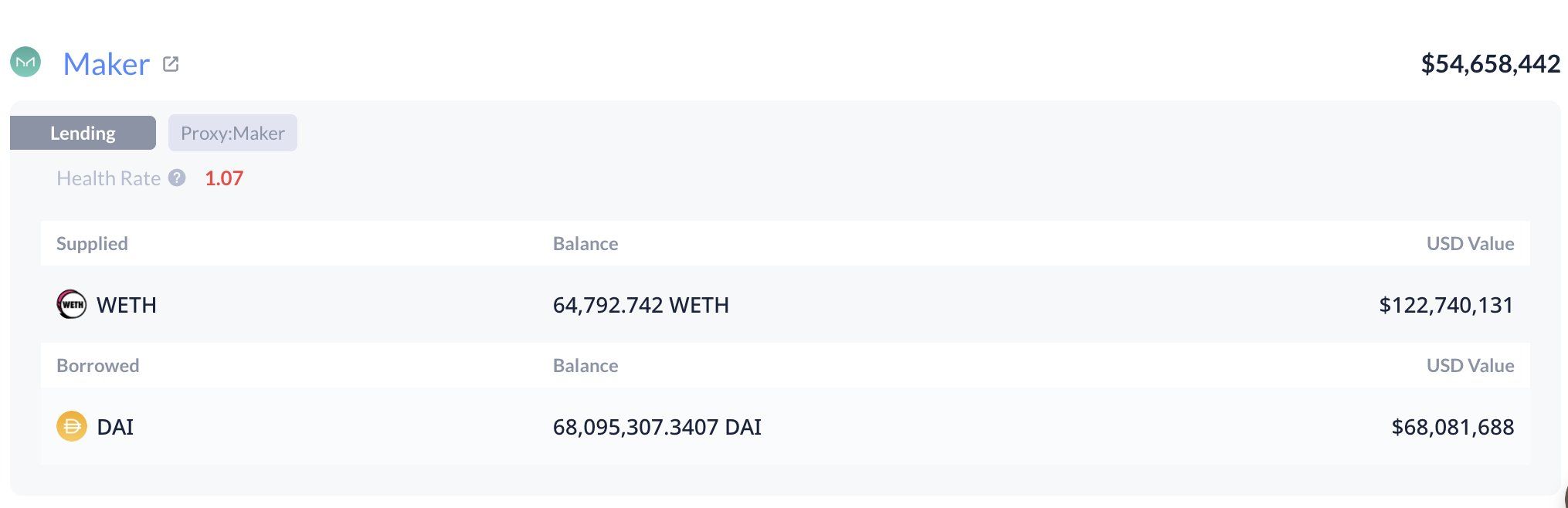

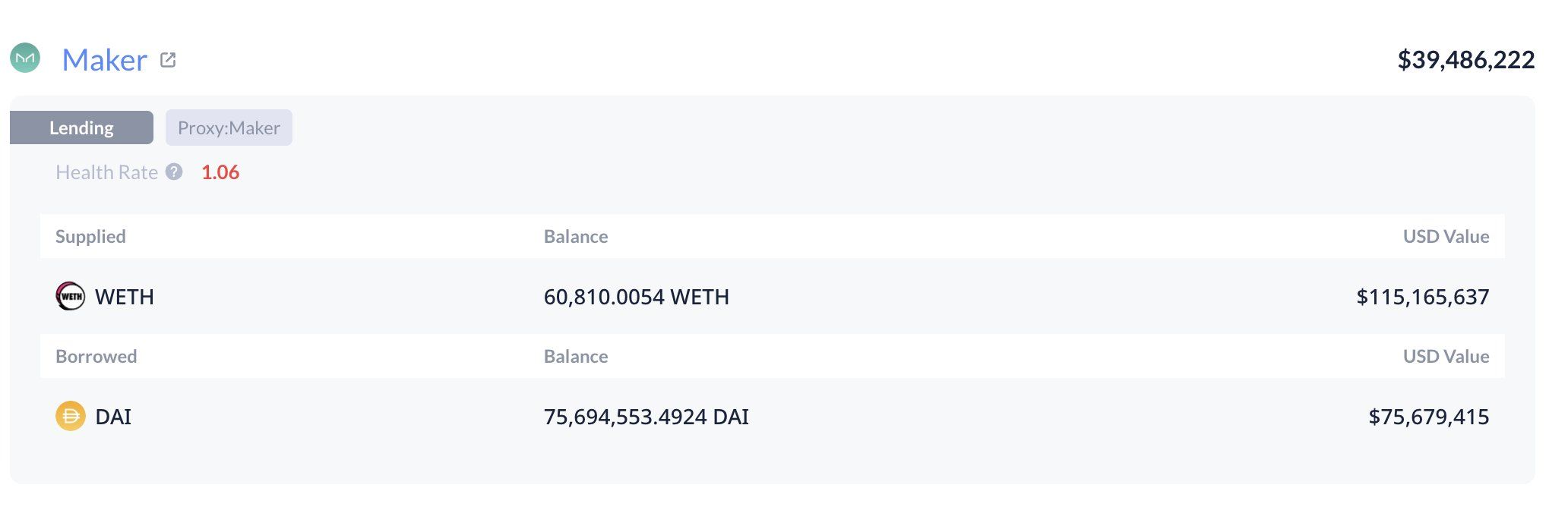

According to on-chain data from Lookonchain, two major whale vaults on Maker—one of the leading decentralized lending protocols—are now approaching critical levels.

Together, these vaults hold 125,603 ETH, valued at approximately $235 million. With ETH’s price nearing their liquidation thresholds, both vaults are at risk of being forcibly closed if the downward trend continues.

In Maker’s system, users can deposit ETH into vaults as collateral to borrow the DAI stablecoin. To avoid liquidation, the collateral must stay above a certain health ratio—essentially a safety buffer.

When that buffer gets too low, the protocol automatically sells off the collateral to cover the debt. In this case, the health ratio of the whale positions has fallen to just 1.07, dangerously close to the minimum threshold.

One vault faces liquidation at an ETH price of $1,805, and the other at $1,787. If ETH continues to dip, these vaults could trigger significant sell pressure, potentially accelerating the downward move.

Indicators Suggest The Downtrend Could Continue

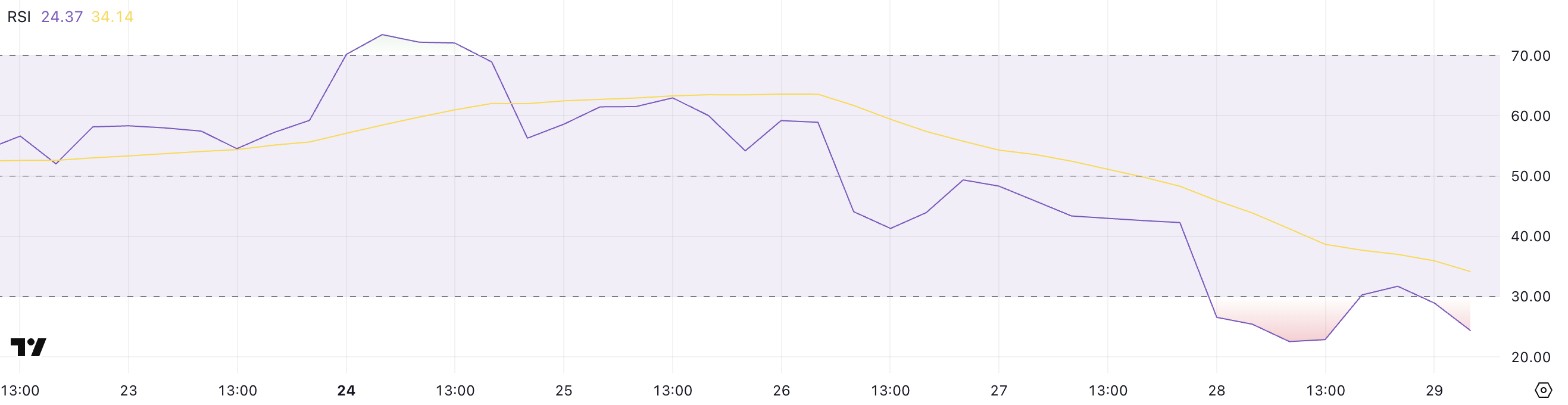

Ethereum’s recent price drop has pushed its Relative Strength Index (RSI) back into oversold territory, currently sitting at 24.37. Just three days ago, the RSI was at 58.92, indicating how quickly sentiment has shifted.

The RSI is a momentum indicator that measures the speed and change of price movements, with readings below 30 typically signaling that an asset is oversold.

While this suggests that Ethereum may be due for a short-term bounce or relief rally, historical data shows that RSI can remain oversold for extended periods—or even drop further—if bearish momentum stays strong.

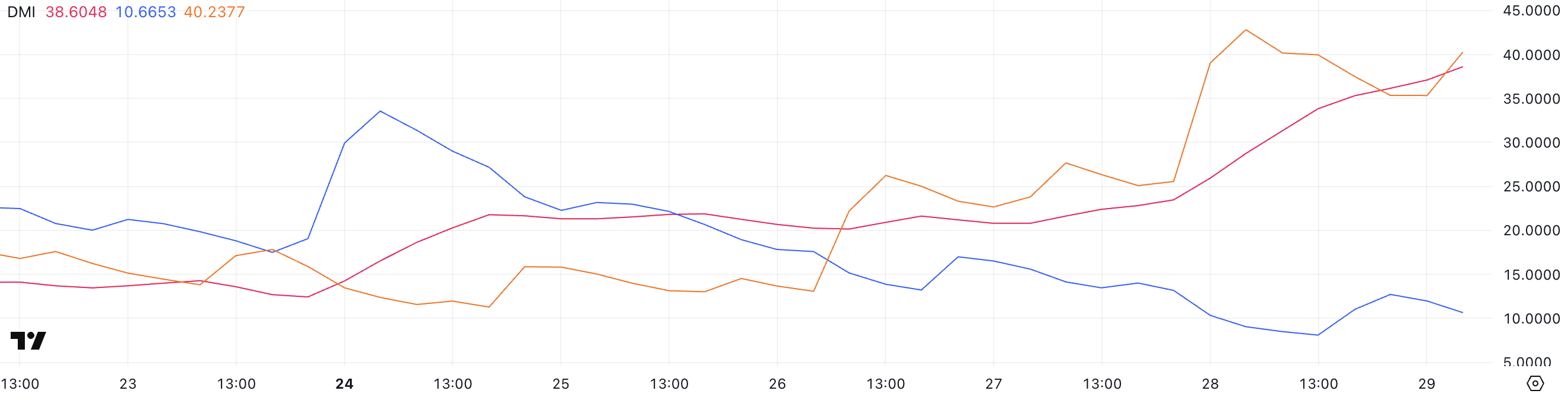

Ethereum’s Directional Movement Index (DMI), which signals a strong downtrend, adds to the bearish outlook. The Average Directional Index (ADX), which measures the strength of a trend, surged to 38.6 from 23.47 just a day ago, indicating growing momentum behind the current move.

Meanwhile, the +DI (positive directional indicator) has fallen to 10.6, while the -DI (negative directional indicator) has spiked to 40.23, showing that sellers are firmly in control.

This combination—rising ADX, high -DI, and falling +DI—typically suggests an intensifying bearish trend, meaning Ethereum’s price could remain under pressure in the near term despite already being technically oversold.

Will Ethereum Fall Below $1,800 Soon?

If Ethereum’s downtrend continues, the next key level to watch is the support at $1,823. A break below this level could quickly push the price down toward $1,759—a move that would trigger the liquidation of two major whale vaults on Maker, which are already hovering near their thresholds.

These potential liquidations could amplify sell pressure, making it even harder for Ethereum price to stabilize in the short term. Given the current bearish momentum and weak technical indicators, this scenario remains a real risk if bulls fail to step in.

However, if sentiment shifts and the trend reverses, Ethereum could regain ground and test the resistance level at $1,938.

Breaking above that could open the path toward $2,104, a level that has previously acted as both resistance and support. Should buying momentum strengthen further, ETH might continue climbing toward $2,320 and potentially even $2,546.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dark Web Criminals Are Selling Binance and Gemini User Data

More than 100,000 users of popular crypto exchanges Binance and Gemini may be at risk after a trove of sensitive information appeared for sale on the dark web.

The leaked data reportedly includes full names, email addresses, phone numbers, and location details—raising alarms over growing cyber threats in the crypto sector.

Dark Web Actors Are Targeting Crypto Users

On March 27, a dark web user operating under the alias AKM69 listed a large database allegedly tied to Gemini, one of the largest crypto trading platforms in the US.

According to Dark Web Informer, the dataset mainly includes information about users from the United States, with a few entries from Singapore and the United Kingdom. The attacker claims the data could be used for marketing, fraud, or crypto recovery scams.

“The database for sale reportedly includes 100,000 records, each containing full names, emails, phone numbers, and location data of individuals from the United States and a few entries from Singapore and the UK,” the report stated.

It is unclear whether the leak resulted from a direct breach of Gemini’s systems or from other vulnerabilities, such as compromised user accounts or phishing campaigns.

Meanwhile, this incident followed another alarming listing on March 26.

According to the report, a separate dark web actor, kiki88888, allegedly offered a trove of Binance user data for sale. The database is said to hold over 132,000 entries, including the exchange users’ login information.

The Dark Web Informer suggests phishing attacks likely caused the breach rather than a compromise of the exchange’s systems.

“Some of you really need to stop clicking random stuff,” the Informer stated.

Binance and Gemini have yet to publicly comment on these incidents. However, phishing remains one of the most effective methods cybercriminals use to exploit crypto holders.

Scammers often impersonate official accounts or place misleading ads that redirect users to fake websites. Coinbase users are also being extensively targeted through phishing campaigns.

As BeInCrypto reported earlier, in March, Coinbase users lost over $46 million to social engineering scams.

Blockchain security firm Scam Sniffer revealed that phishing-related losses exceeded $15 million in the first two months of the year. This figure highlights the growing scale of the threat.

Given the rising threats, crypto users should stay vigilant and avoid unfamiliar links. They should also protect their accounts with two-factor authentication and hardware wallets whenever possible.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

South Carolina Could Spend 10% of Funds on Bitcoin Reserve

Representative Jordan Pace introduced legislation to create a Bitcoin Reserve for South Carolina, joining a nationwide effort. Currently, nearly half of all US states have an active bill to create a similar Reserve.

However, the talking point that this bill “allows 10% of state funds” in Bitcoin investments is taking off like wildfire. It may scare off fiscal conservatives, which contributed to recent failures.

South Carolina Joins the Bitcoin Reserve Race

Since President Trump announced his intention to create a US Bitcoin Reserve, many state governments have attempted to create smaller models.

In the last month, these efforts have been intensifying, with more and more states joining the effort. Today, South Carolina filed its own Bitcoin Reserve bill, allowing the state to make substantial purchases:

“The State Treasurer may invest in digital assets including, but not limited to, Bitcoin with money that is unexpended, unencumbered, or uncommitted. The amount of money that the State Treasurer may invest in digital assets from a fund specified in this section may not exceed ten precent of the total funds under management,” it reads.

State Representative Jordan Pace proposed South Carolina’s Bitcoin Reserve legislation. He claimed that this bill “gives the Treasurer new tools to protect taxpayer dollars from inflation,” one of crypto’s most well-known use cases. Pace is currently the bill’s only sponsor, and it’s unclear what chances it has of passing.

Still, there may be challenges ahead. Similar proposals in other Republican-led states—like Montana and Wyoming—have already failed. This was largely due to concerns over using public funds to buy cryptocurrency.

Even though Trump backs the idea on a national level, not all GOP lawmakers are convinced at the state level.

That said, there are some signs of progress elsewhere. For example, Texas has advanced its Bitcoin Reserve bill, achieving bipartisan support. A key reason for its success is that the bill doesn’t require the state to make crypto purchases; it simply allows them at the Treasurer’s discretion.

Likewise, South Carolina’s bill wouldn’t force the state to invest 10% of its funds into Bitcoin. It just opens the door for that possibility, giving the state financial flexibility rather than a mandate.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation21 hours ago

Regulation21 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Price Set To Reach $1 As Once In A Year Buy Opportunity Returns

-

Regulation24 hours ago

Regulation24 hours agoAVAX Price Eyes Rally To $44 As Grayscale Files For Avalanche ETF

-

Market23 hours ago

Market23 hours agoA Threat to Crypto’s Decentralized Future?

-

Altcoin23 hours ago

Altcoin23 hours agoTRUMP Crypto Whale Incurs Massive $15M Loss Amid Price Slump, Here’s How

-

Market22 hours ago

Market22 hours agoPopular Analyst Peter Brandt Identifies XRP Head & Shoulder Pattern, Reveals Path To Take

-

Market21 hours ago

Market21 hours agoWhat to Expect from XRP Price in April 2025

-

Market16 hours ago

Market16 hours agoWhy Did MUBARAK Drop 40% Despite Binance Listing?