Market

Ethereum Price Pulls Back: ETH Gains Under Pressure

Ethereum price started a downside correction from the $3,500 resistance zone. ETH declined below $3,440 and might struggle to stay above $3,380.

- Ethereum is correcting gains from the $3,500 zone.

- The price is trading above $3,400 and the 100-hourly Simple Moving Average.

- There was a break below a connecting bullish trend line with support at $3,420 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to decline further if there is a close below the $3,350 support.

Ethereum Price Retreats From $3,500

Ethereum price started a downside correction from the $3,500 resistance zone. ETH declined below the $3,450 and $3,440 support levels to enter a short-term bearish zone, like Bitcoin.

There was a break below a connecting bullish trend line with support at $3,420 on the hourly chart of ETH/USD. The pair even spiked below $3,400 and the 23.6% Fib retracement level of the upward move from the $3,048 swing low to the $3,516 high.

Ethereum is now trading above $3,380 and the 100-hourly Simple Moving Average. If the price stays above the 100-hourly Simple Moving Average, it could attempt a fresh increase. On the upside, the price is facing resistance near the $3,440 level.

The first major resistance is near the $3,450 level. The next major hurdle is near the $3,500 level. A close above the $3,500 level might send Ether toward the $3,550 resistance. The next key resistance is near $3,620. An upside break above the $3,620 resistance might send the price higher toward the $3,750 resistance zone in the coming days.

More Downsides In ETH?

If Ethereum fails to clear the $3,440 resistance, it could continue to move down. Initial support on the downside is near $3,400 and the 100-hourly Simple Moving Average. The first major support sits near the $3,350 zone.

A clear move below the $3,350 support might push the price toward $3,280 and the 50% Fib retracement level of the upward move from the $3,048 swing low to the $3,516 high. Any more losses might send the price toward the $3,200 support level in the near term. The next key support sits at $3,150.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,350

Major Resistance Level – $3,440

Market

WLFI Token Sale Reaches 99.3% Completion

World Liberty Financial (WLF), a decentralized finance (DeFi) project backed by the Trump family, has successfully sold 99.3% of its recently issued 5 billion WLFI tokens.

The tokens went on sale on January 20, following a surge in demand after the initial public sale.

WLFI Token Achieves Major Milestone

According to the data on the project’s official website, World Liberty Financial has now sold a total of 24.97 billion WLFI tokens out of a 25 billion token supply allocated for public sale.

For context, the total supply of WLFI tokens is 100 billion, with an initial allocation of 20 billion tokens designated for the first public sale. This sale commenced on October 15, 2024, with the token priced at $0.015. Furthermore, the project restricted access to individuals who qualified through a whitelist.

The initial target for the WLFI token sale was set at $300 million. Nonetheless, weak demand in the early stages led to a drastic reduction of the presale target to $30 million.

Despite the initial setback, the tides shifted after Official Trump (TRUMP) and Melania Meme (MELANIA) meme coins were launched. This launch sparked renewed interest in World Liberty Financial, leading to a surge in demand for WLFI tokens.

By January 20, World Liberty Financial had completed its initial token sale, selling 20% of its total token supply. However, seeing the surge in demand, the project released an additional 5% of its token supply at a price of $0.05 per token.

“An additional 5% of our token supply is now available to purchase on our website. We appreciate the overwhelming support and look forward to welcoming so many new people to our community!” the project posted on X.

At the time of writing, only 34.6 million tokens of the 5 billion public sale allocation remain available.

The WLFI token’s primary purpose is governance within the World Liberty Financial Protocol. It allows token holders to propose, discuss, and vote on key protocol decisions. This gives token owners an equal voice in shaping the platform’s development, ensuring fair and democratic changes to its ecosystem.

As an added measure, the tokens will remain non-transferable for the first 12 months post-launch. Moreover, any community-approved changes to this restriction will not take effect until the one-year period concludes.

The milestone comes shortly after World Liberty Financial announced a partnership with Sui (SUI). The aim of this collaboration is to explore opportunities in DeFi. It will also integrate Sui’s technology into WLFI’s token reserve, “Macro Strategy,” supporting leading DeFi projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Hits Resistance—Will The Recovery Stall Here?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave from the $1,750 zone. ETH is now consolidating and facing hurdles near the $1,920 resistance.

- Ethereum started a recovery wave above the $1,850 level.

- The price is trading below $1,950 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,920 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,920 and $1,950 resistance levels to start a decent increase.

Ethereum Price Faces Hurdles

Ethereum price formed a base above the $1,750 level and started a recovery wave, like Bitcoin. ETH was able to clear the $1,800 and $1,820 resistance levels.

The bulls pushed the price above the $1,880 level. There was a move above the 23.6% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low. However, the bears seem to be active near the $1,920 resistance zone.

Ethereum price is now trading below $1,950 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,920 level.

There is also a short-term bearish trend line forming with resistance at $1,920 on the hourly chart of ETH/USD. The next key resistance is near the $1,950 level or the 50% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low.

The first major resistance is near the $2,000 level. A clear move above the $2,000 resistance might send the price toward the $2,060 resistance. An upside break above the $2,060 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,120 resistance zone or even $2,250 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,850 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,920

Market

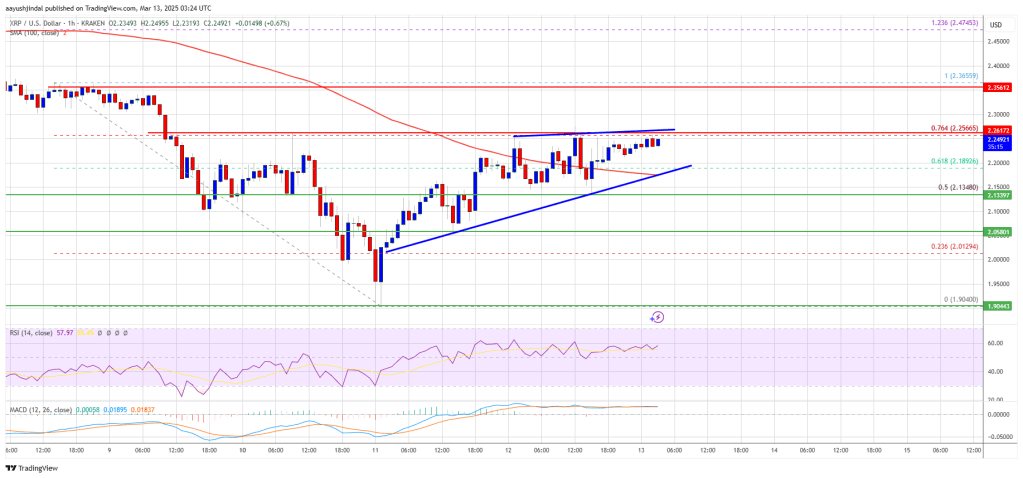

XRP Bulls Ready to Charge—Upside Break May Spark Rally

XRP price started a fresh recovery wave above the $2.00 zone. The price is now showing positive signs and might clear the $2.250 resistance zone.

- XRP price started a fresh recovery wave above the $2.120 resistance zone.

- The price is now trading above $2.150 and the 100-hourly Simple Moving Average.

- There is a short-term bullish trend line forming with support at $2.188 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might continue to move up if it clears the $2.250 resistance zone.

XRP Price Eyes Upside Break

XRP price remained supported and started a recovery wave from the $1.90 zone, like Bitcoin and Ethereum. The price was able to clear the $2.00 and $2.050 resistance levels.

There was a move above the $2.120 resistance. The price surpassed the 50% Fib retracement level of the downward wave from the $2.365 swing high to the $1.90 low. However, the bears are now active near the $2.250 resistance zone.

The price is now trading above $2.150 and the 100-hourly Simple Moving Average. There is also a short-term bullish trend line forming with support at $2.188 on the hourly chart of the XRP/USD pair.

On the upside, the price might face resistance near the $2.250 level. It is near the 76.4% Fib retracement level of the downward wave from the $2.365 swing high to the $1.90 low. The first major resistance is near the $2.3650 level.

The next resistance is $2.450. A clear move above the $2.450 resistance might send the price toward the $2.50 resistance. Any more gains might send the price toward the $2.550 resistance or even $2.650 in the near term. The next major hurdle for the bulls might be $2.80.

Another Decline?

If XRP fails to clear the $2.250 resistance zone, it could start another decline. Initial support on the downside is near the $2.1880 level and the trend line. The next major support is near the $2.120 level.

If there is a downside break and a close below the $2.120 level, the price might continue to decline toward the $2.050 support. The next major support sits near the $2.00 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.180 and $2.120.

Major Resistance Levels – $2.250 and $2.350.

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Reveals Major Backing For These 5 Crypto, Prices To Rally?

-

Bitcoin23 hours ago

Bitcoin23 hours agoSuspicious High-Leverage Trades on Hyperliquid Raise Red Flags

-

Bitcoin22 hours ago

Bitcoin22 hours agoRole of Finality Bridge in Bitcoin’s Future

-

Altcoin20 hours ago

Altcoin20 hours agoHere Are The Possible Outcomes of the Ripple vs SEC Case

-

Market19 hours ago

Market19 hours agoBinance Receives a Record $2 Billion Investment from Abu Dhabi

-

Altcoin23 hours ago

Altcoin23 hours agoCan Dogecoin Price Still Hit $5 Despite US SEC’s DOGE ETF Delay?

-

Market22 hours ago

Market22 hours agoAmericans Miss Out on Billions from Crypto Airdrops, Study Finds

-

Market21 hours ago

Market21 hours agoWill Bittensor (TAO) Rally? Key Indicators Predict Price Rebound