Market

Ethereum Price Below $2,000 Triggers Bullish Signal After 2 Years

Ethereum (ETH) has seen a significant decline in price, falling from $2,800 to around $1,900 in recent weeks. This drop has triggered a major bearish signal, the first of its kind in two years.

However, the current price action may also suggest that recovery could be on the horizon.

Ethereum Has A Shot At Recovery

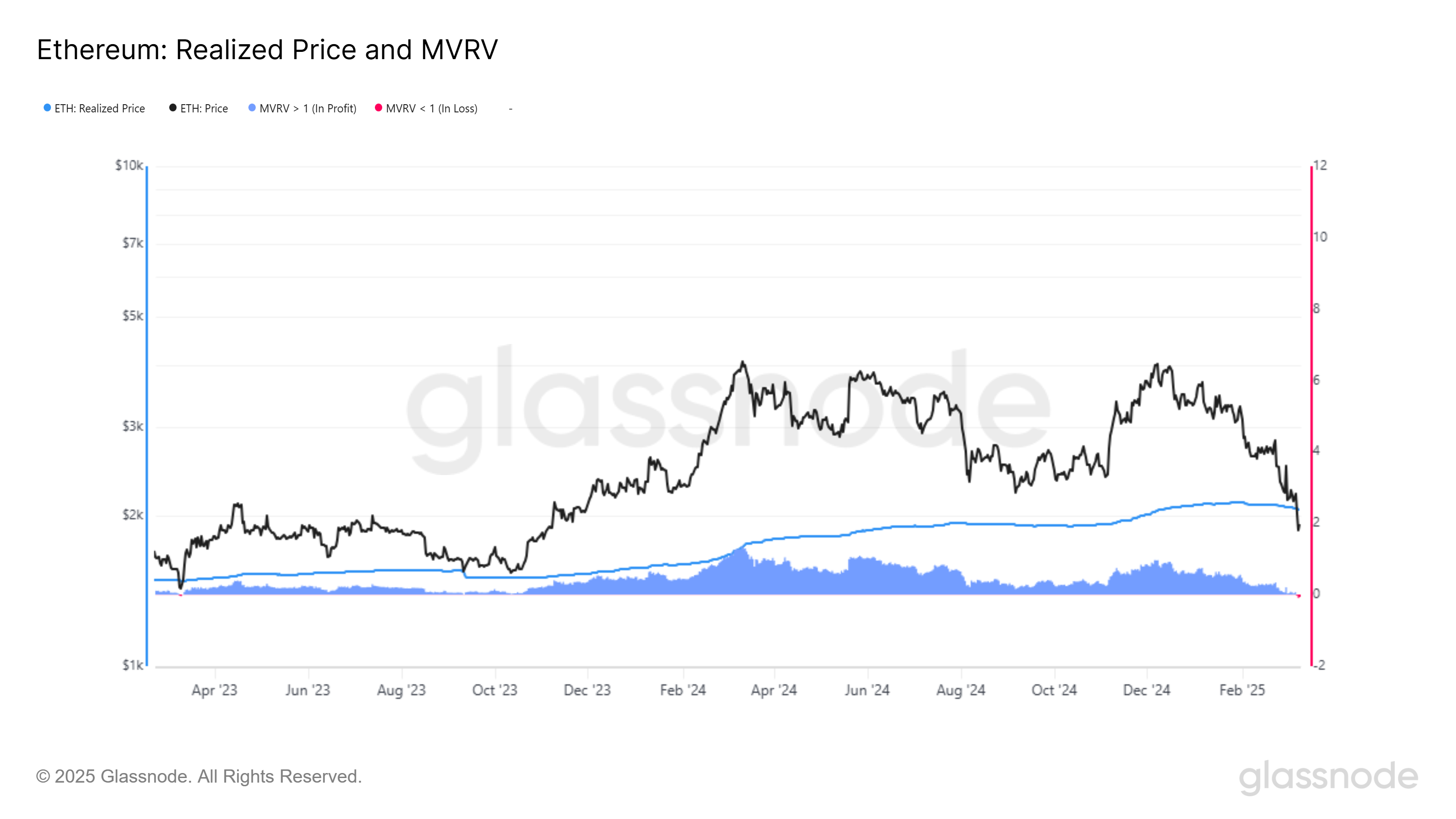

Ethereum’s price recently fell below the Realized Price for the first time in two years, a development that has sparked concern among some investors. This drop has caused the Market Value to Realized Value (MVRV) ratio to decline, indicating that investors are facing approximately 7% losses.

While this may appear bearish at first glance, it actually presents a potential bullish signal. The previous time Ethereum faced this situation, the altcoin rebounded strongly, and the MVRV ratio improved as the price recovered. This pattern has given some market participants hope that the current situation may lead to a similar recovery.

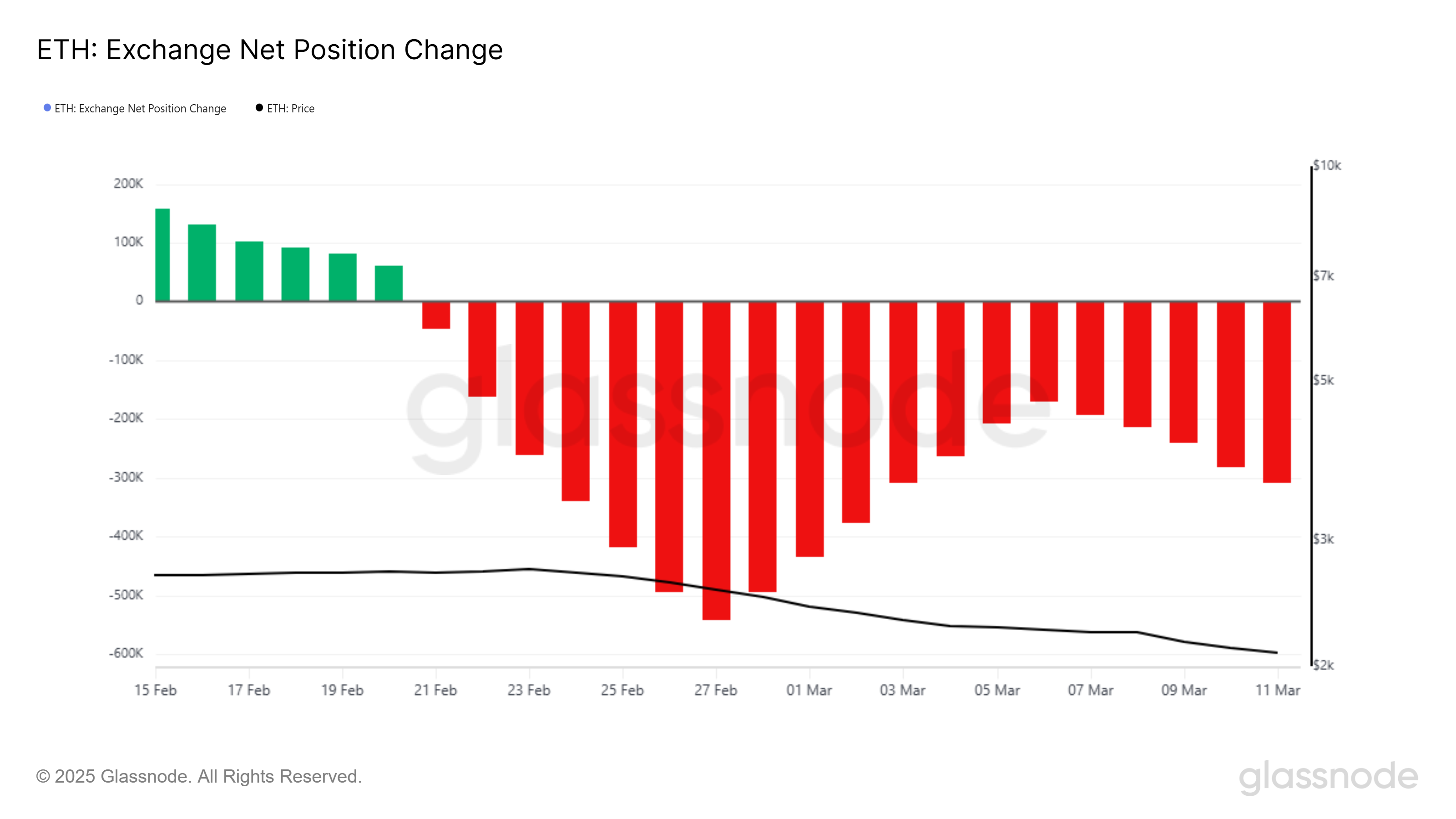

On the macro level, Ethereum’s overall momentum is showing signs of improvement despite the recent downturn. The Exchange Net Position Change, which tracks the flow of ETH into and out of exchanges, has been declining.

This indicates that investors are accumulating Ethereum rather than selling it, which is a positive sign. Investors see the current low prices as an opportunity to buy, anticipating a future price increase.

This shift in investor behavior is reflected in the purchase of 138,000 ETH worth approximately $262 million this week. The inflow of capital into Ethereum supports the idea that many investors are positioning themselves for a rebound.

ETH Price Eyes A Rally

Ethereum is currently trading at $1,897, down 32% over the last two weeks. The altcoin is holding above the support level of $1,862, which could act as a foundation for a potential bounceback. If Ethereum maintains this level, it may find its way to higher prices in the coming weeks.

For Ethereum to confirm a recovery, it must breach and flip $2,141 into support. This level is critical for ETH to move toward $2,344 and secure a more sustained upward movement. The factors discussed, including the RSI recovery and investor accumulation, are likely to contribute to Ethereum’s ability to reach this target.

However, if broader market conditions worsen, Ethereum could fall below the $1,862 support, pushing the price to $1,745 or even $1,625. A drop to these levels would invalidate the bullish outlook and suggest further downside potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

El Salvador’s IMF Deal Could be Affected By Bitcoin Purchases

ARENA, the largest opposition party in El Salvador, criticized Bukele over the IMF deal. In exchange for $1.4 billion in loans, Bukele agreed to stop using public funds to buy Bitcoin, but he insists that he won’t stop.

ARENA warned that this behavior could scuttle the deal and destroy the country’s economic stability. However, due to recent election losses, the party is more or less powerless to change Bukele’s policy directly.

El Salvador Headed for IMF Showdown

Since El Salvador adopted Bitcoin as legal tender, it’s become one of the world’s largest Bitcoin holders. This has given the country many new economic opportunities, creating new crypto-centric industries as its profits swelled. However, not everyone is happy with this, and the ARENA opposition party is concerned about El Salvador’s IMF loans.

“El Salvador’s economy is in a very delicate state, and this warrants a very responsible and orderly fiscal policy. President Bukele has been emphatic in stating that the purchase of Bitcoin will not stop, despite the agreement stipulating a ban on government purchases of cryptocurrency,” its statement read.

Specifically, the IMF spent years opposing El Salvador’s turn towards Bitcoin. President Bukele cast the nation’s growing BTC stockpile as an economic independence issue; before his Presidency, the US dollar was the nation’s sole currency. However, last October, the IMF began softening its maximalist position.

Specifically, the IMF claimed that El Salvador could get massive new loans if it cut back its support for Bitcoin. The state wouldn’t have to sell its stockpile, but it couldn’t buy more with government money, and BTC would no longer be legal tender. El Salvador was receptive to the deal last December and finally amended its Bitcoin Law in January.

There’s just one problem. Despite receiving a $1.4 billion loan from the IMF, El Salvador hasn’t stopped its Bitcoin purchases at all. Crypto enthusiasts couldn’t identify a loophole in the agreement, but Bukele publicly claimed he would not stop. In other words, it seems like he’s openly defying the IMF. El Salvador has bought Bitcoin every single day since.

Clearly, ARENA doesn’t think this is a good idea. Its statement urged Bukele to honor the IMF agreement, saying that this action is necessary to maintain El Salvador’s economic stability. If there’s a secret clause that lets Bukele buy more Bitcoin for a limited window, his country’s largest opposition party doesn’t seem to know anything about it.

However, even if ARENA detests this plan, it’s not in a good position to do anything about it. It won a little over 5.5% of the vote in last year’s election and currently holds two seats out of 60 in the Legislative Assembly.

Bukele’s party, on the other hand, controls 54, and that’s not counting its coalition partners. In other words, it’s powerless to change the actual policy.

Still, this is very worrying. If El Salvador keeps openly buying Bitcoin, the IMF may retaliate. An open conflict between these two parties would have truly unpredictable consequences. For now, it’s impossible to say what the future may hold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Jumps 5% as Bulls Target Breakout Above $3

XRP has risen nearly 5% in the last 24 hours, breaking above $2.30 as bullish momentum continues to build. This recovery comes amid broader market anticipation, even as the SEC delayed its decision on several XRP ETF applications.

Technical indicators show that XRP’s RSI has climbed steadily since March 10, approaching levels that signal strong buying pressure. XRP could soon challenge key resistance levels, potentially eyeing a breakout above $3 for the first time since late January.

XRP RSI Is Growing Steadily Since March 10

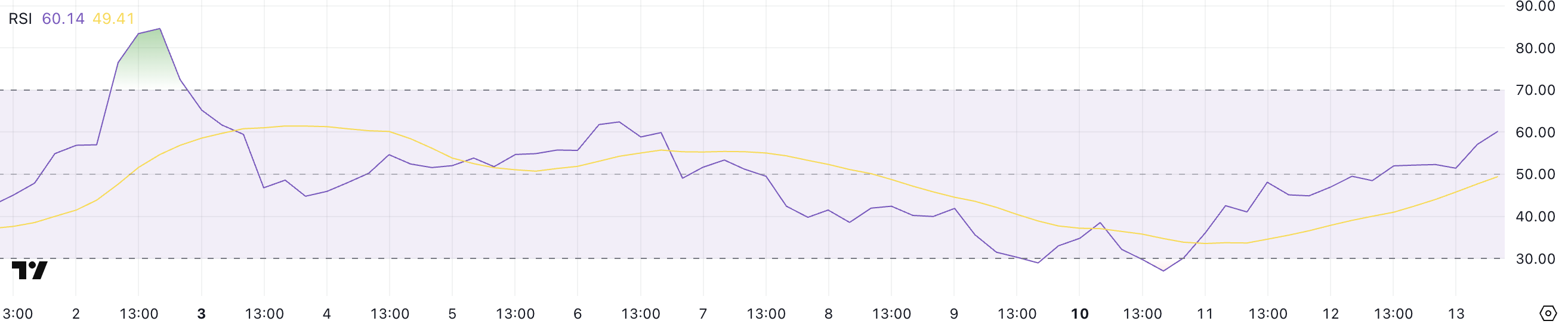

XRP’s Relative Strength Index (RSI) has climbed significantly to 60.14, rising from 27 just three days ago. RSI is a momentum oscillator that measures the speed and magnitude of recent price changes on a scale from 0 to 100.

Typically, an RSI above 70 indicates overbought conditions, suggesting a potential pullback, while an RSI below 30 signals oversold conditions, often preceding a price recovery.

The rapid increase from oversold levels suggests a strong shift in momentum, with buyers stepping in to drive the price higher.

With the altcoin’s RSI now at 60.14, it is approaching bullish territory but remains below the critical 70 threshold. Notably, XRP has not surpassed 70 since March 2, indicating that this level has historically acted as a resistance for momentum.

If RSI continues to rise and breaks past 70, it would suggest extreme bullish strength, potentially leading to further price gains.

However, if it stabilizes or begins to decline from this level, XRP could enter a consolidation phase or face a temporary slowdown before making another move.

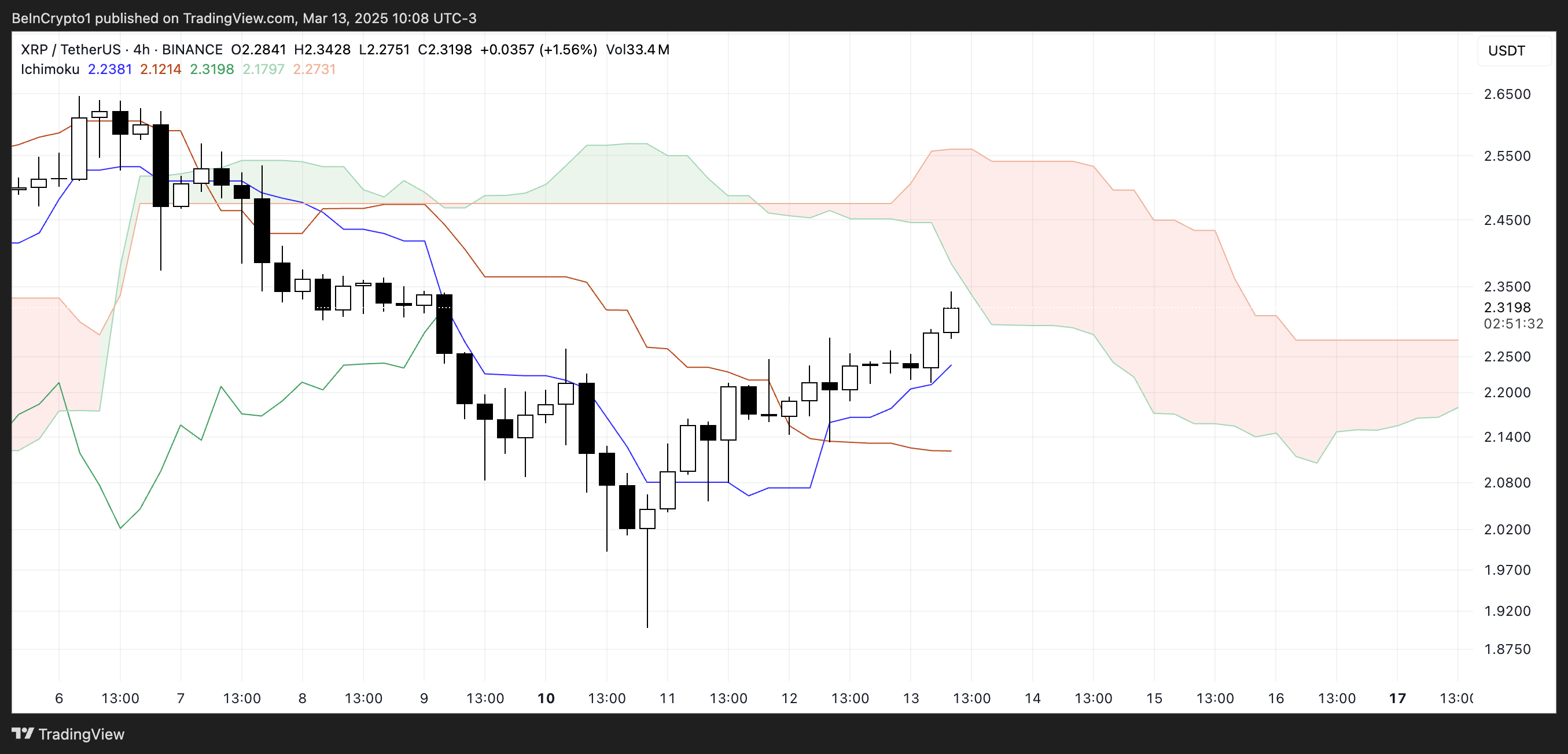

Ichimoku Cloud Shows Momentum Is Shifting

The Ichimoku Cloud chart for XRP shows that price action has recently broken above the blue Tenkan-Sen (conversion line), suggesting short-term bullish momentum.

Additionally, the price is now trading above the red Kijun-Sen (baseline), which further reinforces the bullish shift. However, the cloud (Kumo) ahead remains red, indicating that the longer-term trend is still bearish.

For XRP to sustain its upward movement, it would need to push through the lower boundary of the red cloud and establish support above it.

If it faces resistance at the cloud, it could struggle to maintain its current uptrend and risk a pullback toward the Kijun-Sen for support.

A rejection from the cloud could indicate a continuation of the prior bearish trend, especially if XRP falls back below the Tenkan-Sen.

However, if buyers manage to push it above the red cloud, it would confirm a more significant trend reversal, potentially leading to stronger bullish momentum.

The upcoming candlestick closes will be crucial in determining whether XRP can maintain its recovery or face renewed selling pressure.

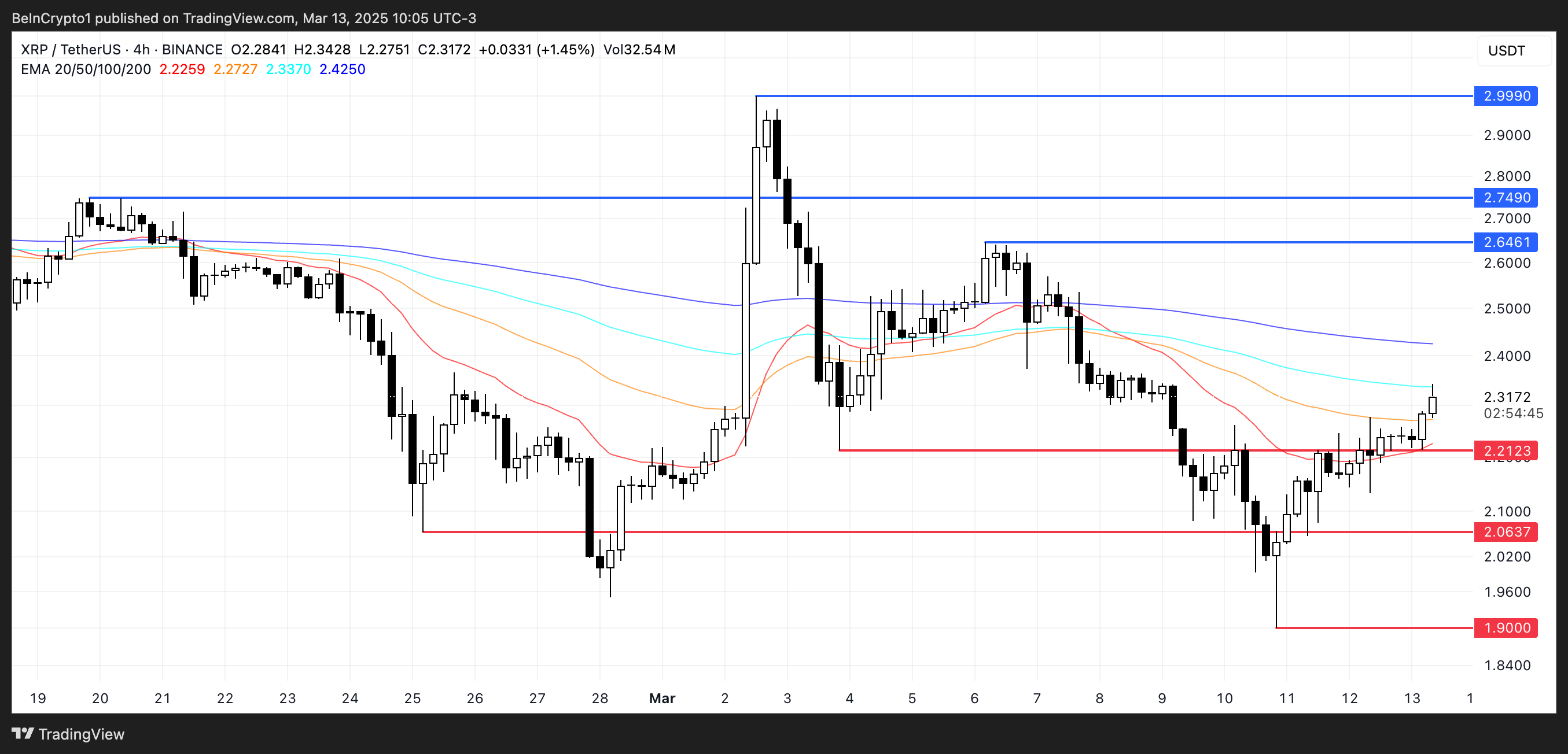

Can XRP Break Above $3 In March?

XRP’s EMA lines are still in a bearish formation, with short-term EMAs positioned below the longer-term ones.

However, the recent upward movement in short-term EMAs suggests growing bullish momentum. If they cross above the long-term EMAs, they will form a golden cross—a signal often associated with trend reversals to the upside.

If this bullish crossover occurs, XRP could gain enough strength to test key resistance levels at $2.64 and $2.74. More news around SEC and the XRP ETF could drive that bullish trend.

Breaking above these levels would reinforce the bullish outlook, potentially driving XRP price toward $2.99 and even above $3 for the first time since late January.

On the downside, if the short-term recovery loses strength and the bearish structure remains intact, it could struggle to sustain its current price levels.

A renewed downtrend would bring the $2.21 support level into play, which has been a critical zone in previous price action. If this level fails to hold, XRP could extend its decline toward $2.06, with the possibility of testing $1.90 in a deeper correction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Staking Surges Despite Market Dip

Ethereum’s price has remained under significant pressure over the past month, yet staking activity has surged.

On-chain data shows a notable increase in the amount of ETH locked in staking contracts, even as the altcoin struggles to regain upward momentum.

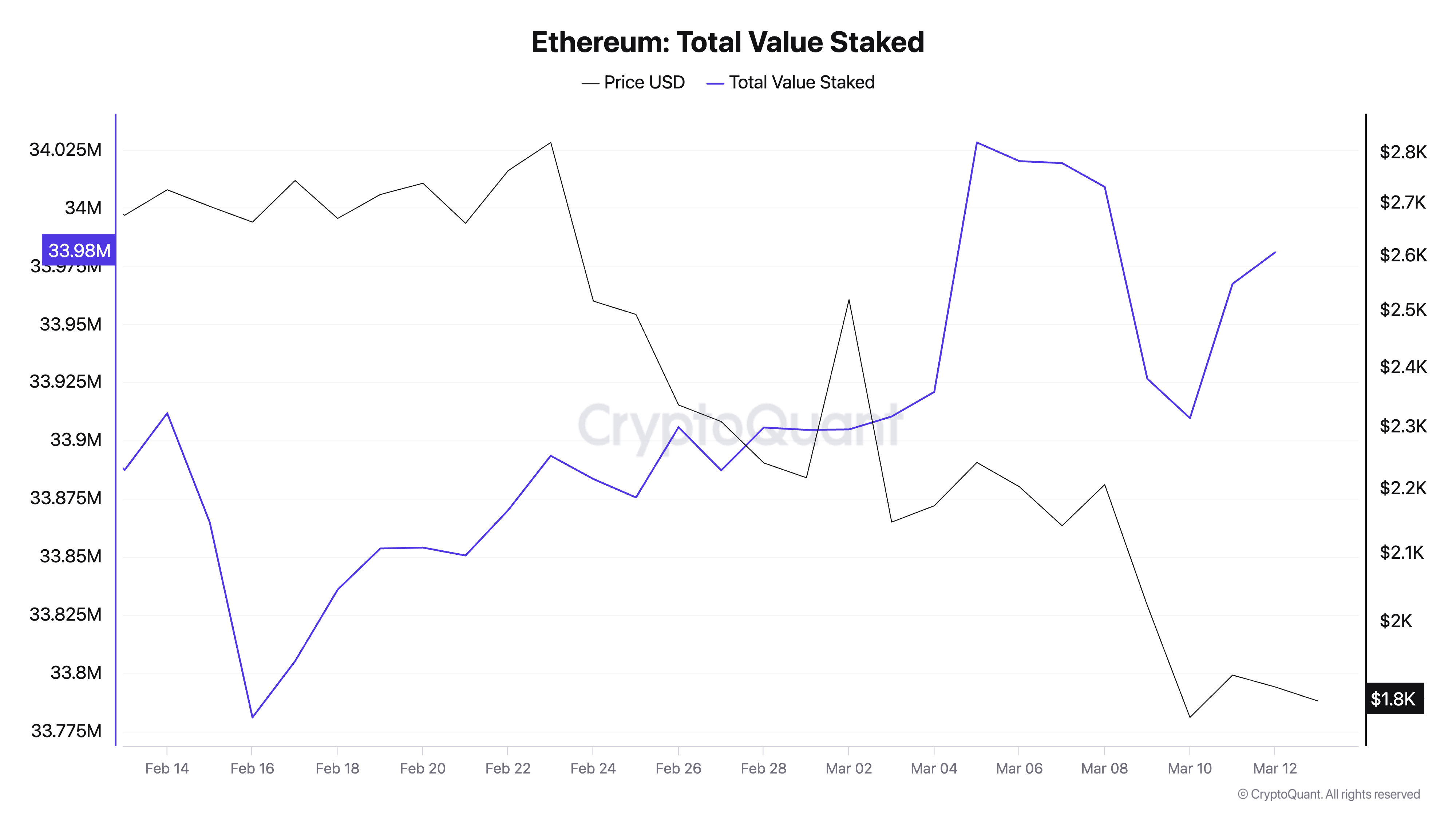

ETH Staking Grows While ETF Outflows Hit $524 Million

Since plummeting to its year-to-date low on February 16, the amount of staked ETH has risen. With 33.98 million ETH currently locked in staking contracts, this figure has gone up by 1% over the past month.

This has happened despite the significant drop in ETH’s value in the past 30 days. Trading at $1,897 at press time, ETH’s price has plummeted by 30% since February 16.

The divergence suggests that many investors continue to see the coin as a long-term asset rather than a short-term trading opportunity. They demonstrate confidence in ETH’s future price performance by locking up their coins instead of selling amid recent headwinds.

Moreover, this increased staked ETH could indicate growing institutional and retail interest in passive yield, even as short-term price action remains unimpressive.

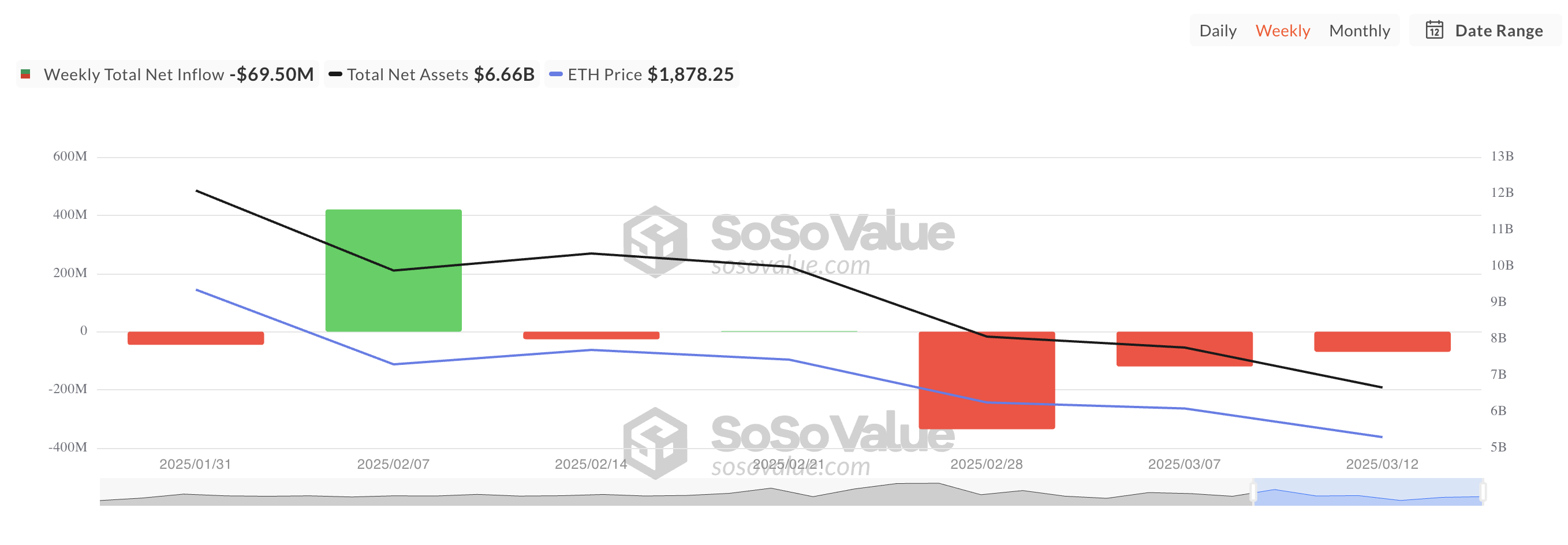

However, this bullish stance contrasts with the recent decline in spot ETH exchange-traded fund (ETF) inflows, raising questions about broader market sentiment. Data from SosoValue shows that these funds have recorded outflows totaling $524.68 million in the past three weeks.

When ETH ETFs see net outflows like this, investors are withdrawing more funds than they are putting in. This indicates a bearish sentiment toward the coin and puts more downward pressure on its price.

Ethereum’s Eyes Deeper Pullback—Or a Bullish Reversal?

ETH trades at $1,897 at press time, breaking below the key support formed at $1,924. The negative readings from its Balance of Power (BoP) reflect the ongoing selling activity among ETH holders.

As of this writing, this indicator, which compares the strength of the bulls against the bears, is below zero at -0.27. When an asset’s BoP is negative, its sellers exert more control over price action, confirming the downward pressure on price.

If this trend persists, ETH could continue its decline to trade at $1,758.

On the other hand, if sentiment flips and becomes fully bullish, it could drive ETH’s price above the $1,924 resistance and toward $2,224.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Poised For A Strong Comeback: Key Oversold Zone Hints At A Potential Breakout

-

Altcoin22 hours ago

Altcoin22 hours agoSolana Price At Risk As Alameda Unstakes $23 Million SOL

-

Market16 hours ago

Market16 hours agoSolana (SOL) Faces Many Challenges—Can Bulls Hold the Line?

-

Altcoin23 hours ago

Altcoin23 hours agoPI Network Price Breaks Key Resistance, Is $20 Imminent?

-

Regulation23 hours ago

Regulation23 hours agoOKX Expands Institutional Offerings In Europe With MiFID II License

-

Bitcoin12 hours ago

Bitcoin12 hours agoUS Strategic Bitcoin Reserve Sparks Crypto Regulation Surge

-

Market11 hours ago

Market11 hours agoPEPE Whales Propel 11% Rally, Fueling Market Optimism

-

Market24 hours ago

Market24 hours agoHedera (HBAR) Price Surge Incoming? Buyers Gain Momentum