Market

Ethereum Outperforms Bitcoin: Jumps Amid Market Divergence

Ethereum price started a fresh increase from the $3,350 support zone. ETH is outperforming Bitcoin and might rise further toward the $3,650 resistance.

- Ethereum is gaining pace from the key $3,365 support zone.

- The price is trading above $3,450 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance near $3,460 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair formed a double-bottom pattern and gained pace above the $3,500 resistance.

Ethereum Price Holds Key Support

Ethereum price remained well-bid above the $3,350 support zone. ETH formed a base and started a fresh increase after it formed a double-bottom pattern near $3,350, as discussed yesterday.

It outperformed Bitcoin and broke the $3,450 resistance. There was a clear move above the 50% Fib retracement level of the downward move from the $3,650 swing high to the $3,350 low. Besides, there was a break above a key bearish trend line with resistance near $3,460 on the hourly chart of ETH/USD.

Ethereum is now trading above $3,450 and the 100-hourly Simple Moving Average. It is also showing positive signs for more gains above the $3,535 level. On the upside, the price might face resistance near the $3,580 level or the 76.4% Fib retracement level of the downward move from the $3,650 swing high to the $3,350 low.

The first major resistance is near the $3,650 level. An upside break above the $3,650 resistance might send the price higher. The next key resistance sits at $3,720, above which the price might gain traction and rise toward the $3,750 level.

A clear move above the $3,750 level might send Ether toward the $3,880 resistance. Any more gains could send Ether toward the $4,000 resistance zone in the coming days.

Another Decline In ETH?

If Ethereum fails to clear the $3,580 resistance, it could start another decline. Initial support on the downside is near $3,500. The first major support is $3,450.

A clear move below the $3,450 support might push the price toward $3,350. Any more losses might send the price toward the $3,220 level in the near term.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,450

Major Resistance Level – $3,580

Market

MANTRA Launches $108 Million RWA Fund As OM Price Surges

MANTRA is planning to launch a $108,888,888 Ecosystem Fund to drive RWA innovation over the next four years and help accelerate projects in MANTRA’s blockchain ecosystem.

MANTRA’s native token OM has shown significant resilience in the current market downturn. OM is currently the only altcoin among the top 30 tokens to have posted positive gains over the past 24 hours.

MANTRA’s RWA Ecosystem Fund

MANTRA, a Layer-1 blockchain for asset tokenization, is heavily invested in the RWA market. Since its mainnet launch in 2024, it has carried out major partnerships and planned to tokenize huge volumes of assets.

Today, it announced the launch of a $108,888,888 Ecosystem Fund to propel RWA innovation in its blockchain ecosystem.

“In an era where blockchain technology is revolutionizing finance, the MEF will serve as a catalyst for groundbreaking projects that drive real-world adoption through a focus upon the tokenization of real world assets. We are opening doors for visionary founders and teams to join us in building and creating a thriving ecosystem,” claimed John Patrick Mullin, founder and CEO.

Mullin delivered these comments in an exclusive press release shared with BeInCrypto. MANTRA plans to deploy this fund over the next four years, working with “a strong network of partners and investors” to maximize RWA growth.

The firm also claimed that its new license approvals in Dubai will allow it to facilitate advanced financial services.

MANTRA successfully obtained a Virtual Asset Service Provider (VASP) license, which will allow it to act as a crypto exchange and offer broker-dealer, management, and Investment Services. With these tools, the network can direct RWA investment.

Since the RWA Fund announcement, the OM token has actually performed quite well today. Given the wide-scale liquidations across the crypto market due to Trump’s tariff threats, OM has gained over 2% in the past 24 hours.

In fact, MANTRA’s native token is the only cryptocurrency among the top 30 to have any positive gains. It’s also among the top 5 highest gainers in the market today.

Overall, investors seem extremely confident in MATRA’s growth and the network’s continuous development. The project’s latest investment fund reflects its commitment to influencing positive developments in the RWA ecosystem.

Meanwhile, the find will likely encourage more RWA projects to launch or shift to the network, increasing MANTRA’s utility. According to DefiLlama, the network only has $4.2 million in total value locked (TVL).

With this fund, the project’s main goal will be to improve participation and long-term engagement on the blockchain.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AAVE Buybacks & Key Events This Week

Several major developments across various ecosystems are expected this week, suggesting imminent volatility for tokens within the respective niches. From Aave buybacks to Trump’s reciprocal tariffs, some very interesting updates are in the pipeline.

Traders and investors can front-run the following developments and position their portfolios strategically ahead of the following events.

AAVE Buybacks

AAVE, the native token of the Aave lending protocol, will see buybacks commence on Wednesday, April 9. This follows approval from the Aave DAO.

This move involves allocating $4 million in aEthUSDT to repurchase AAVE tokens from the open market. The goal is to reduce circulating supply and potentially boost token value.

“Buybacks will reduce AAVE’s circulating supply, making tokens scarcer and more valuable. Activating fee mechanism will create a new revenue stream for protocol; increasing demand,” noted Langerius, founder of Hunters of Web3.

The repurchased tokens will be moved to the Ecosystem Reserve, signaling a long-term strategy to enhance scarcity and reward holders. This could see the AAVE token price surge, especially if demand remains steady or increases.

The buybacks follow a tokenomics update that activates a fee switch, introducing a new revenue stream for the protocol.

“New Aavenomics update. This is Fee Switch on steroids,” wrote Stani Kulechov, CEO and founder of Aave.

This dual approach, which reduces supply and generates revenue, could make AAVE a more attractive investment.

BeInCrypto data shows the AAVE token was trading for $123.62 as of this writing, down by over 16% in the last 24 hours.

Trump’s Reciprocal Tariffs

Another crypto headline to watch this week concerns President Trump’s reciprocal tariffs, which are expected to take effect on April 9. The president will introduce a tiered levy system (10%, 15%, 20%) targeting countries like China, Vietnam, and the EU. The UK faces the lowest band.

While these tariffs bolster US economic independence, they could ripple through crypto markets. In the recent past, tariffs spooked investors, driving sell-offs in risk assets, evidenced by Bitcoin’s volatility after past tariff announcements.

Traders should brace for short-term dips, particularly in Bitcoin and altcoins tied to global trade dynamics. However, Trump’s pro-crypto stance, including his strategic Bitcoin reserve, might mitigate some losses, as could a decision to delay the tariffs.

“As soon as he delays or cancels the “reciprocal” tariffs the market will bounce 10%+ immediately. That is want everyone is waiting and hoping for,” one user highlighted.

Such an outcome, however, is contingent on investors viewing digital assets as a hedge against tariff-induced inflation or currency devaluation.

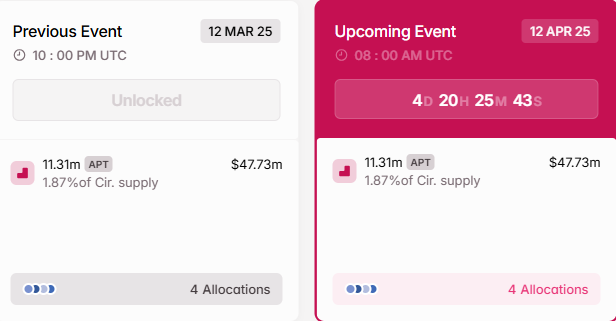

$47 Million Aptos Unlocks

On April 12, the Aptos network will unlock 11.31 million APT tokens worth approximately $47.73 million and comprising 1.87% of the circulating supply. The tokens will be allocated to the community, core contributors, the foundation, and investors.

Token unlocks often lead to selling pressure as early investors or team members liquidate holdings. As such, the Saturday event could drive APT’s price down.

“Aptos is struggling with a strong downtrend and upcoming token unlocks, which could further dilute its value,” one user noted.

Neutron’s Mercury Upgrade

Neutron’s Mercury upgrade, its most significant to date, launches on April 9. The event promises enhanced functionality for this Cosmos-based blockchain. Such upgrades improve scalability, security, or interoperability—key for Neutron’s DeFi and cross-chain ambitions.

“Neutron’s upcoming Mercury upgrade will 11x network throughput,” the network shared.

It follows proposal #993, supported by Stakecito, and aims to transition Neutron from Cosmos Hub’s Interchain Security to full sovereignty via the Mercury upgrade. The move would enhance Neutron’s role as a smart contract platform while maintaining ties with Cosmos Hub.

A successful rollout could bolster Neutron’s position in the Cosmos ecosystem, attracting more projects and capital.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is $0.415 the Key to Further Gains?

Layer-1 (L1) coin KAVA has emerged as the day’s top performer with a modest 0.10% gain over the past 24 hours. The coin remains range-bound despite this lead, signaling a relative balance between buying and selling pressure.

Still, the sentiment around KAVA is quietly bullish. With technical and on-chain indicators pointing to a surging positive bias, the altcoin might be poised for a breakout above its narrow range.

Buyers Dominate as KAVA Teases Break Above Resistance

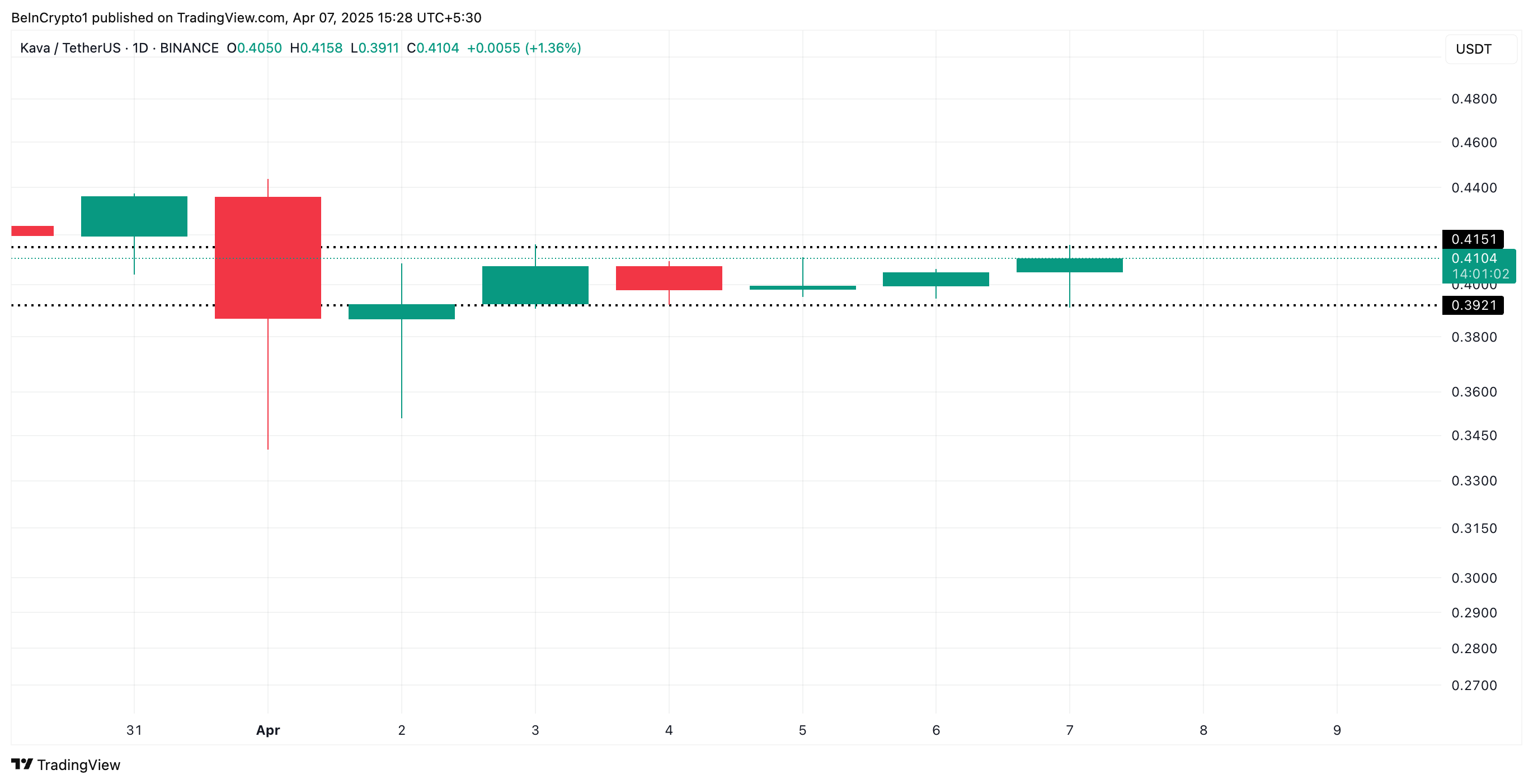

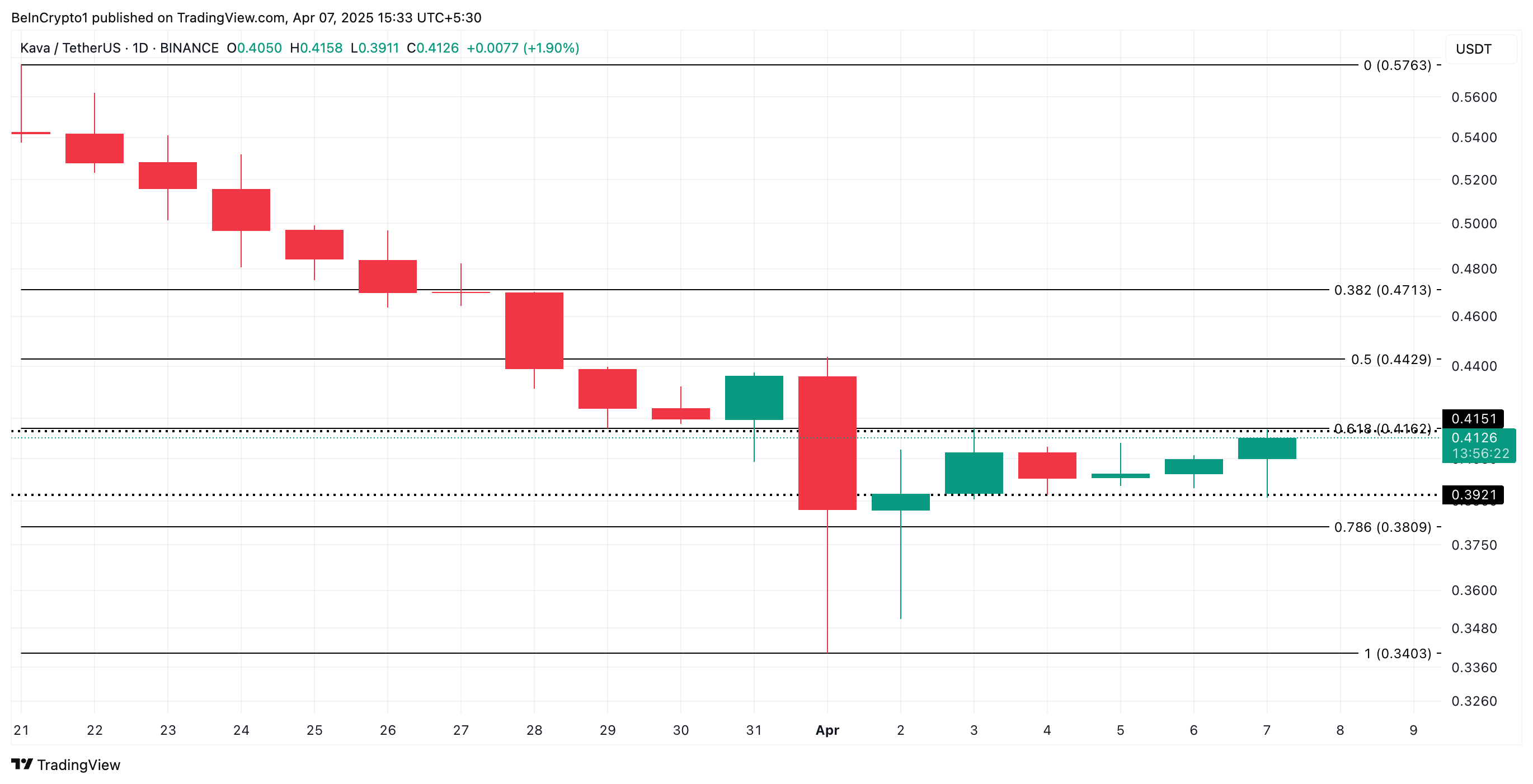

Since the beginning of April, KAVA’s price has oscillated within a range. The 98th largest crypto by market capitalization has faced resistance at $0.415 and has found support at $0.392.

With the gradual resurgence in bullish bias toward the altcoin, KAVA could see a break above the $0.415 resistance level in the near term.

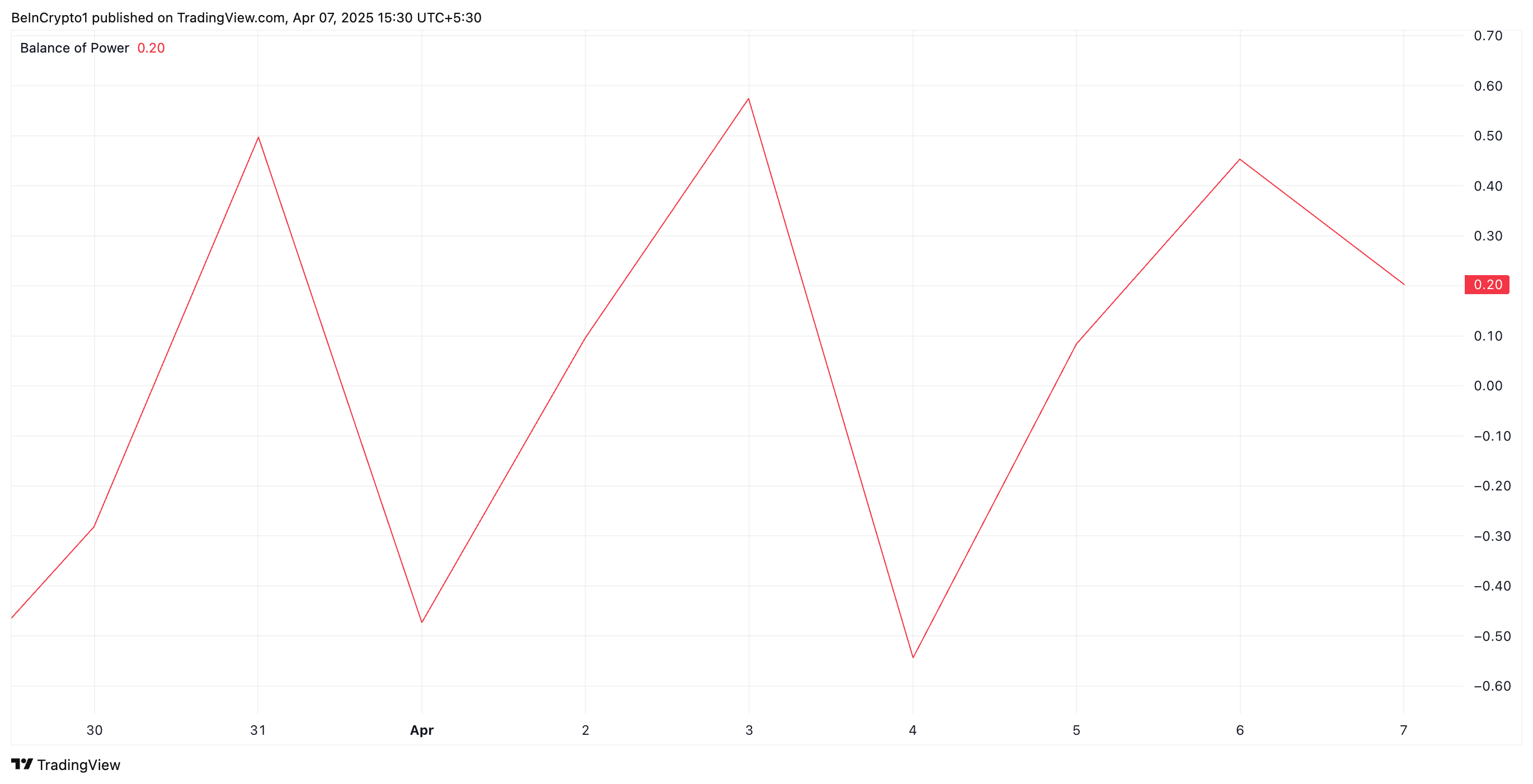

Its positive Balance of Power (BoP) on the daily chart confirms this outlook. At press time, this momentum indicator is at 0.20.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is negative, sellers are dominating the market over buyers.

Converesly, a positive BoP like this suggests that buying activity outweighs selling pressure. This reflects KAVA’s growing demand and potential for its price to appreciate further.

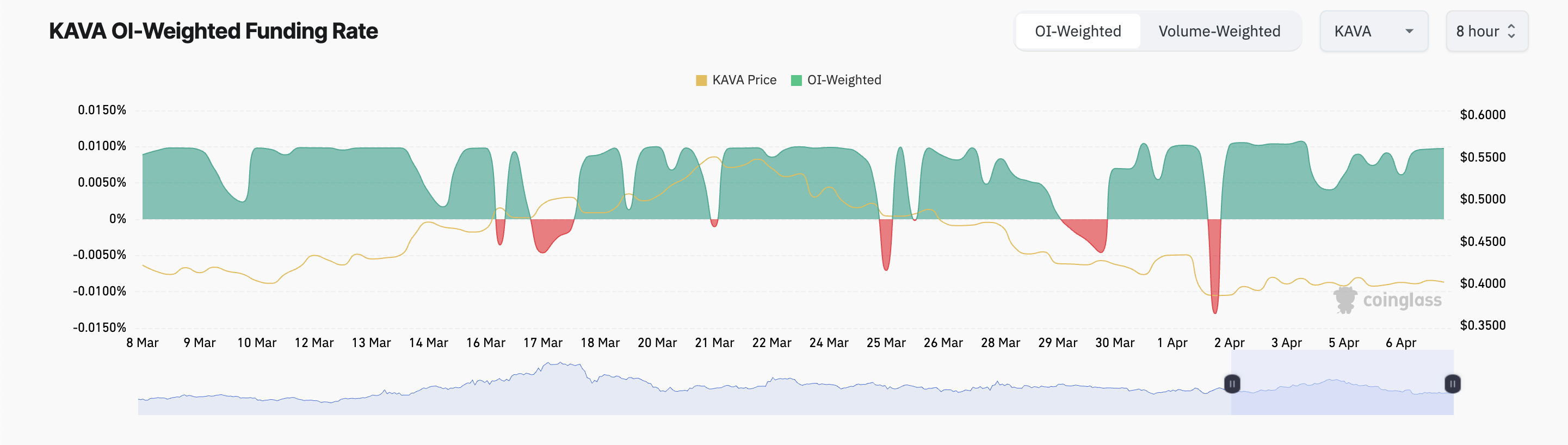

Moreover, the coin’s positive funding rate highlights the bullish sentiment among KAVA’s futures traders. As of this writing, the metric stands at 0.0097%.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep prices aligned with the spot market. KAVA’s positive funding rate means long positions are paying short. This trend indicates that more KAVA traders are betting on its price to increase.

KAVA Approaches Breakout—Can It Flip $0.41 Into Support?

KAVA’s strengthening buying pressure could trigger a break above the resistance at $0.415. If this price level is successfully flipped into a support floor, KAVA’s uptrend will gain momentum and could reach $0.44.

Conversely, if profit-taking spikes, the coin could slip below support at $0.392. In this scenario, KAVA’s price could fall further to $0.38.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market10 hours ago

Market10 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market24 hours ago

Market24 hours agoAvalanche Price Holds Under $20, Low Selling Can’t Lift Price

-

Market23 hours ago

Market23 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Market14 hours ago

Market14 hours agoSolana (SOL) Freefall—Can It Hold Above The $100 Danger Zone?

-

Bitcoin11 hours ago

Bitcoin11 hours ago$1 Billion in Liquidations Over the Weekend

-

Market11 hours ago

Market11 hours agoSolana (SOL) Price Falls Below $100, Crashes To 14-Month Low