Market

Ethereum Name Service (ENS) Price Increase Sees Top 100 Entry

On June 25, the Ethereum Name Service (ENS) price fell to $22.95 amid market hesitation. Then something intriguing happened—the price began to climb, eventually rising to $25.13 in the early hours of June 26.

This 8.82% price increase made ENS the highest gainer among the cryptocurrencies in the top 100. Despite the hike, market participants’ behavior displays a more fascinating trend that may affect ENS’ value.

Investors Set To Offload 812,000 Tokens

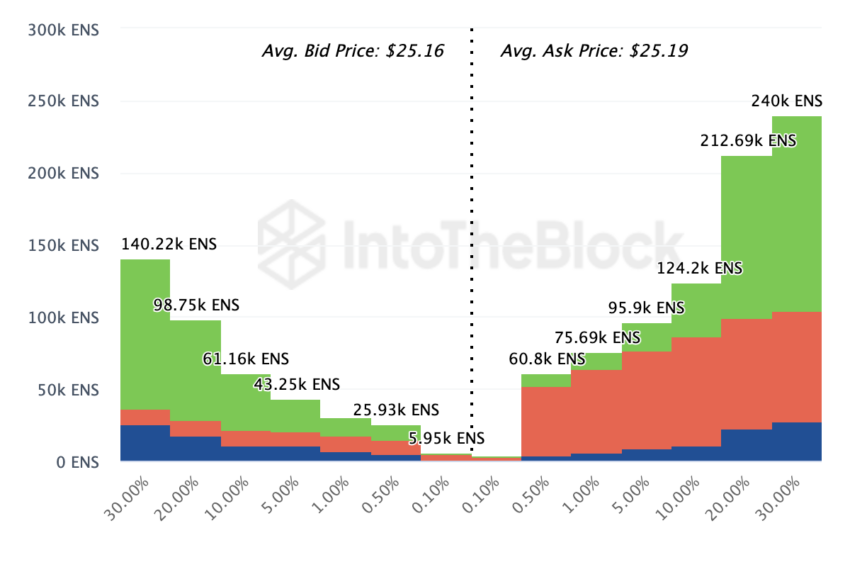

As things stand, ENS investors seem unconvinced that the token’s price will continue to climb. As such, many of them have placed orders to sell. Evidence of this decision is reflected in the Exchange-OnChain Market Depth.

The Exchange-OnChain Market Depth provides real-time trading activity on exchanges. Divided into two, the bid side shows the number of buy orders, while the sell ask region reveals the number of tokens that could put selling pressure on the price.

According to IntoTheBlock, investors look prepared to sell a total of 812,870 tokens at an average price of $25.19. At that price, the value of tokens let go will be $20.32 million.

Read More: Ethereum Name Service (ENS): Everything You Need to Know

However, buy orders fall short, with only 399,800 tokens ready to save the cryptocurrency from another downtrend. Considering the difference in the ask and bid values, the ENS price may not add to its current gains.

Apart from this, the pattern shown by the total amount of holders puts ENS at risk of falling below $24. According to Santiment, the holder count has decreased from 66,300 on April 18 to 65,100 at the time of writing.

Situations like this imply that some holders are not liquidating a part of their holdings. Instead, they are selling all. If this continues, it will signal a lack of confidence in Ethereum Name Service’s future potential and a potential decrease in price.

As shown above, historical analysis traced back to December 2023 supports the thesis. During that period, ENS price was $21.97. Less than a week after the number of hodlers dived, the value declined to $17.89.

ENS Price Prediction: Bulls Are Pulling Out

Regarding the price’s next movement, the 4-hour chart shows that it has been able to exit the correction (marked in the red box) that took place between June 23 and 24. Even though the price continues to increase, it faces resistance at $25.69.

Failure to curb the hurdle at this value may send ENS back to $23.52. If the downward pressure persists, ENS may slide to $21.84, which holds major support.

Given the current conditions, the Average Directional Index (ADX) exhibits weakness for the uptrend. The ADX is a technical indicator used to determine the strength of a trend. Typically, readings at 25 or above imply a strong directional movement.

However, as of this writing, the ADX reading was 21.13 while facing downwards. Should the directional strength continue to decrease, ENS price will have no option but to descend.

Read More: Ethereum Name Service (ENS) Price Prediction 2024/2025/2030

Meanwhile, this price prediction will be invalidated if demand for the token rises. One factor that can trigger the demand is the Ethereum Name Service migration announced last month because less expensive transaction costs make it easy for market participants to buy a token. If this pattern plays out, ENS may attempt to retest $28.35.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BTC ETF Outflows Continue Amid Institutional Caution,

Even as crypto markets try to put on a brave face this week, institutional investors clearly are not buying it. Yesterday, Bitcoin spot ETFs recorded another round of outflows, marking the sixth straight day of capital flight from these funds.

Despite the broader market’s attempt at a short-term rebound, the continued withdrawals suggest that institutional sentiment remains cautious. The consistent outflows paint a picture of investors seeking safety or perhaps just sitting on the sidelines while volatility does its thing.

Bitcoin ETFs Continue Losing Streak

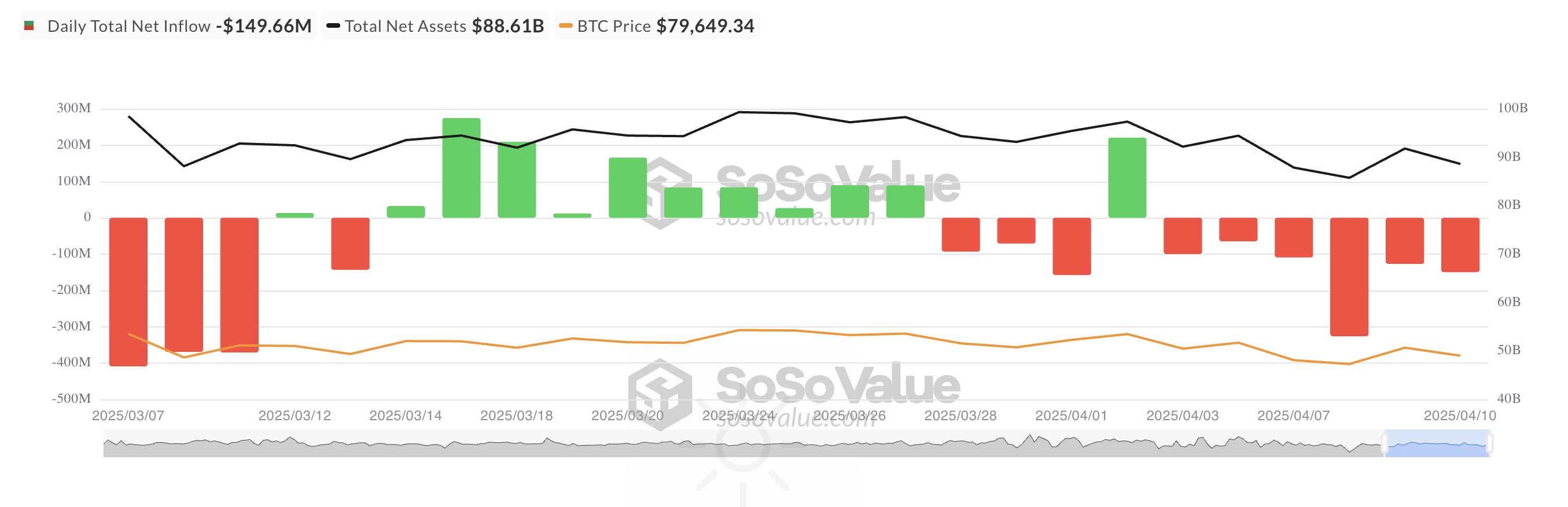

On Thursday, net outflows from BTC ETFs totaled $149.66 million, reflecting a 17% increase from the $127.12 million in outflows seen on Wednesday.

This marked the sixth consecutive day of withdrawals from spot Bitcoin ETF funds, highlighting the growing caution and weakening sentiment among institutional BTC investors.

According to SosoValue, Grayscale Bitcoin Mini Trust ETF $BTC recorded the highest net inflow on that day, totaling $9.87 million, bringing the fund’s historical net inflow to $1.15 billion.

On the other hand, Fidelity’s ETF FBTC witnessed the highest net outflow on Wednesday, totaling $74.67 million. As of this writing, its total historical net inflow is $11.40 billion.

Derivatives Market Remain Optimistic

Meanwhile, BTC futures open interest has taken a modest hit, in line with the broader market dip. At press time, it stands at $51.73 billion, falling by 7% over the past day. This comes amid the decline in broader cryptocurrency market activity over the past 24 hours, during which BTC’s value has dipped by 2%.

A drop in open interest during a price decline suggests that traders are closing out positions rather than opening new ones. This indicates a possible bottoming phase or reduced volatility ahead.

But the story doesn’t end there.

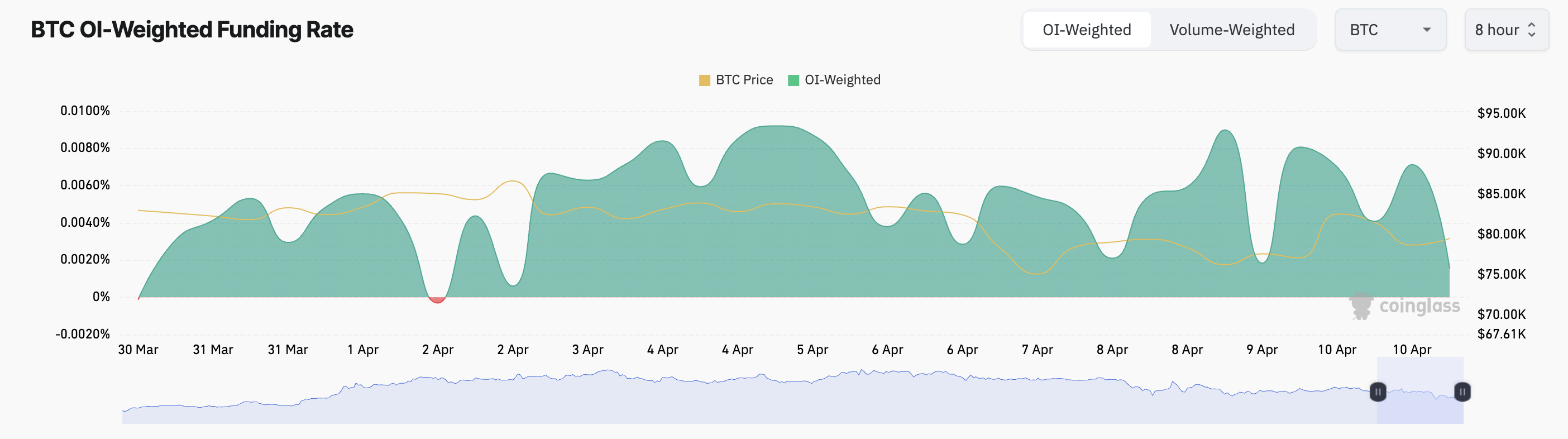

Funding rates remain positive, and call options are in high demand, both considered bullish signals.

At press time, BTC’s funding rate stands at 0.0015%. The funding rate is a recurring payment exchanged between long and short traders in perpetual futures markets to keep contract prices aligned with the spot market. A positive funding rate like this indicates that long traders pay short traders, signaling that bullish sentiment is dominant.

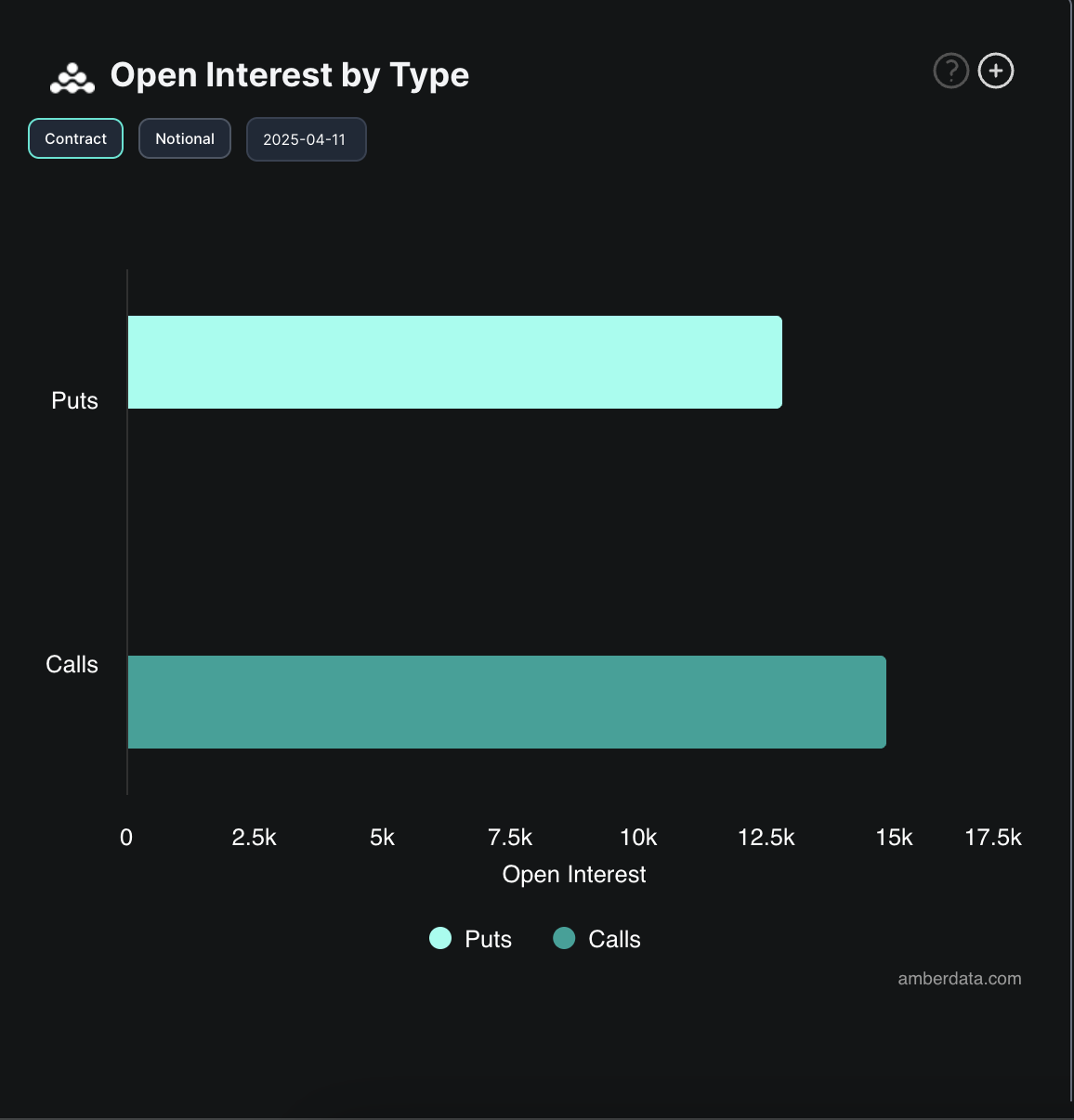

In the options market, there is a high demand for calls over puts, further reflecting a bullish bias toward BTC.

The divergence between ETF flows and derivatives activity recorded this week suggests that while traditional institutions may be scaling back exposure, retail and leveraged traders continue to bet on rebounds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

President Trump Signs First-Ever Crypto Bill into Law

President Donald Trump signed the first-ever crypto-specific bill into law on April 10, 2025. The bill sought to repeal the IRS DeFi Broker Rule enacted under the Biden administration.

Previously, the resolution passed the Senate with a 70-28 vote and the House with a 292-132 margin. This reflected a widespread recognition of the need to protect innovation and privacy in the digital asset space.

Trump Signs Historic Crypto Bill, Ending IRS DeFi Broker Rule

The IRS DeFi Broker Rule mandated that decentralized finance (DeFi) platforms report transaction data to the Internal Revenue Service (IRS). It also suggested creating a new classification for brokers, including certain participants or entities involved in the DeFi sector.

Senator Ted Cruz and Representative Mike Carey introduced the Congressional Review Act of Disapproval (CRA), H.J. Res. 25, which ended this rule. In the latest press release, Representative Carey stressed that the bill marked the first cryptocurrency law passed and the first CRA related to taxes to be enacted.

He argued that the rule now repealed, stifled growth and placed unnecessary burdens on the sector.

“The DeFi Broker Rule needlessly hindered American innovation, infringed on the privacy of everyday Americans, and was set to overwhelm the IRS with an overflow of new filings that it doesn’t have the infrastructure to handle during tax season. By repealing this misguided rule, President Trump and Congress have given the IRS an opportunity to return its focus to the duties and obligations it already owes to American taxpayers instead of creating a new series of bureaucratic hurdles,” he stated.

Industry leaders widely celebrated the move. Bo Hines, the Executive Director of the President’s Council of Advisers on Digital Assets, took to X (formerly Twitter) to underline the positive implications of Trump’s decision on the crypto sector.

“Huge Moment! First crypto legislation ever signed into law. Repealing the IRS’s DeFi broker rule protects innovation and privacy—another big step toward ushering in a golden age for digital assets,” Hines posted.

SEC’s Shift in Strategy Paves the Way for Crypto Growth

Meanwhile, this legislative milestone coincides with a series of positive regulatory developments. On the same day, the SEC’s Division of Corporation Finance released new guidance on securities issuance and registration disclosures in the crypto asset market.

“As part of an effort to provide greater clarity on the application of the federal securities laws to crypto assets, the Division of Corporation Finance is providing its views about the application of certain disclosure requirements under the federal securities laws to offerings and registrations of securities in the crypto asset markets,” the statement read.

The guidance addresses disclosure requirements related to price volatility, technological risks, and legal uncertainties. It also stresses transparency to ensure investors are fully informed about these offerings’ risks, characteristics, and details. This move signals a more structured approach to regulating crypto securities, potentially easing compliance for issuers while protecting investors.

In another significant development, the SEC dismissed unregistered securities charges against Nova Labs, the firm behind the Helium Network. This ruling removed the securities classification from Helium Hotspots and Helium’s tokens (HNT, MOBILE, and IOT) distributed through the network.

“With this chapter finally closed, Helium, DePIN, and crypto can now move forward with full confidence, accelerating real-world adoption and innovation in the industry. Together, we’ll fight for a future where everyone and everything can connect freely—without the barriers of inflated costs or gatekeepers standing in the way,” Helium remarked.

The dismissal reflected a shift in the SEC’s enforcement strategy under new leadership following Gary Gensler’s departure in January 2025. Since a new presidential term began, the SEC has dismissed several lawsuits and investigations into many crypto companies.

Notably, the regulator even dropped its long-standing lawsuit against Ripple last month. BeInCrypto reported that both parties reached a preliminary settlement agreement in their legal dispute. They filed a joint motion to suspend the appeal process.

These developments collectively signal a turning point for cryptocurrency regulation in the US, balancing innovation with investor protection as the industry continues to mature.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoIs Trump’s Tariff Delay Masking a Crypto Dead Cat Bounce?

-

Altcoin21 hours ago

Altcoin21 hours agoWill Q2 2025 Mark the Return of Altcoin Season?

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals How XRP Price Can Hit $22 If BTC Rallies To This Level

-

Bitcoin20 hours ago

Bitcoin20 hours agoBullish Signal for Bitcoin in 2025?

-

Market20 hours ago

Market20 hours agoSolana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

-

Market19 hours ago

Market19 hours agoOnyxcoin Buyers Drive Strong Demand as XCN Surges Past $0.01

-

Market14 hours ago

Market14 hours agoFuser on How Crypto Regulation in Europe is Finally Catching Up

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Lists BABY As Bitcoin Protocol Babylon Goes Live