Market

Ethereum ETF Launch Incoming: Analysts Predict July 23

The approval of spot Ethereum exchange-traded funds (ETFs,) previously expected by July 18, now faces another delay. New predictions indicate a potential go-ahead on July 23.

This adjustment adds a new chapter to the saga that has seen several approval dates come and go without a final decision.

Why Analysts Predicted July 23 For the Ethereum ETF Launch?

Bloomberg ETF analyst Eric Balchunas shared the latest update.

“[I am] hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wednesday (incl fees) and then request effectiveness on Monday after close for a Tuesday July 23 launch. This is provided no unforeseeable last min issues of course,” Balchunas said.

Read more: Ethereum ETF Explained: What It Is and How It Works

Community reactions have been mixed, with some expressing disappointment over the adjustments in the launch date predictions. A community member humorously questioned the prolonged timeline with a sarcastic, “What year?” comment.

Despite these setbacks, there remains a sense of optimism within the industry. Reports suggest that the US Securities and Exchange Commission (SEC) has preliminarily approved at least three of the eight asset managers hoping to launch their ETFs, contingent on the submission of final offering documents this week. Should conditions be met, all eight could potentially launch simultaneously.

Noteworthy asset managers such as BlackRock, VanEck, and Franklin Templeton are among the eight whose applications are likely to receive the green light by the SEC next Monday. However, an SEC spokesperson said that the agency does not comment on individual filings.

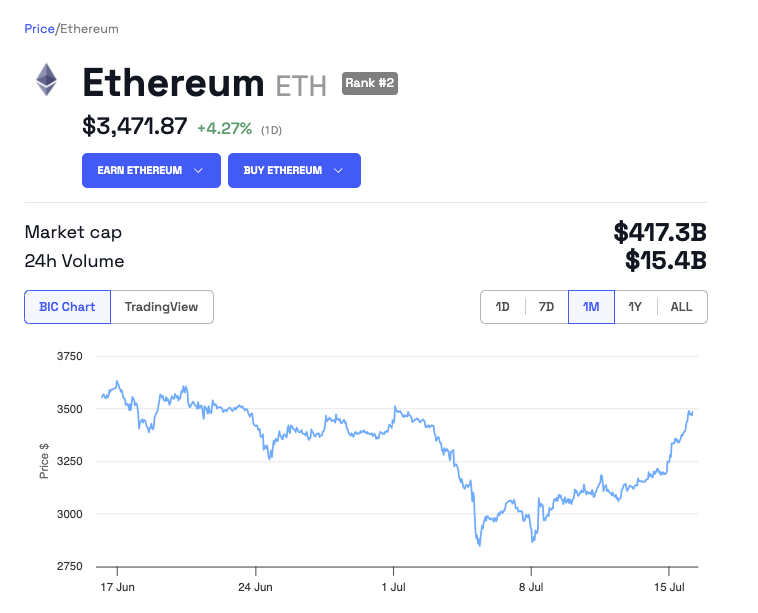

The anticipated approval and launch of these Ethereum-based ETFs mark significant progress for the crypto sector. It pushes digital assets closer to mainstream financial acceptance. Ethereum (ETH), the world’s second-largest crypto by market cap, has seen a price increase of 4.27% in the past 24 hours, now trading around $3,471.

Read more: How to Invest in Ethereum ETFs?

Amid these developments, crypto analyst Andrew Kang weighed in on the market implications.

“ETH heading close to $3600 pre-ETF on this relief rally. Still believe ETHBTC will be down for a while after ETF approval/launch. Bitcoin stronger than anticipated in the face of poor market structure dynamics leads me to believe that there are likely some unannounced major developments being front-run,” Kang wrote on X (Twitter).

These could include potential new market entrants, a change in crypto policy in China, or even other significant national moves towards embracing Bitcoin and other crypto assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.