Market

Dogwifhat (WIF) Leads Meme Coin Rally Amid Negative Sentiment

Dogwifhat (WIF) emerged as the top meme coin in the last 24 hours following its 12.34% price increase. The increase means that the token, which had endured a long downturn period, has now jumped by 40.17% within the seven days.

However, the colossal jump is not in tune with the perception market participants are showing to WIF. Could this imply a profound change in direction?

The Meme Coin Fever Is Not At Its Peak

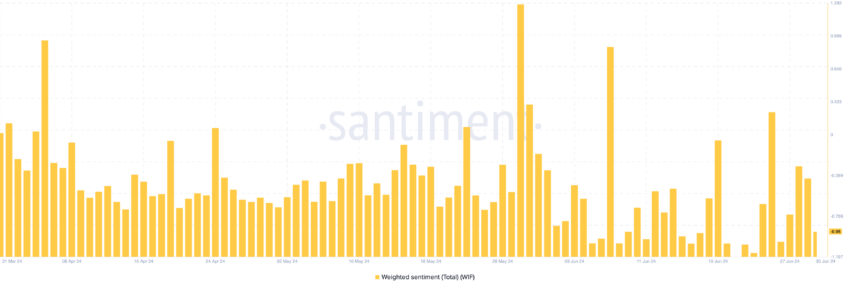

According to Santiment, WIF’s Weighted Sentiment languishes at -0.95. Weighted Sentiment considers the number of mentions of an asset while tracking those expressed in a positive or negative manner.

If the reading is negative, it means that there are more pessimistic comments online. On the other hand, a positive reading implies that the broader market is optimistic about the price potential. For WIF, it is the former.

However, the bearish sentiment combined with the price increase means that the meme coin is nowhere near its top.

Read More: 5 Best Dogwifhat (WIF) Wallets to Consider In 2024

Assuming sentiment is extremely positive with the price jump, WIF may be nearing a significant correction period. But as it stands, the upswing can continue.

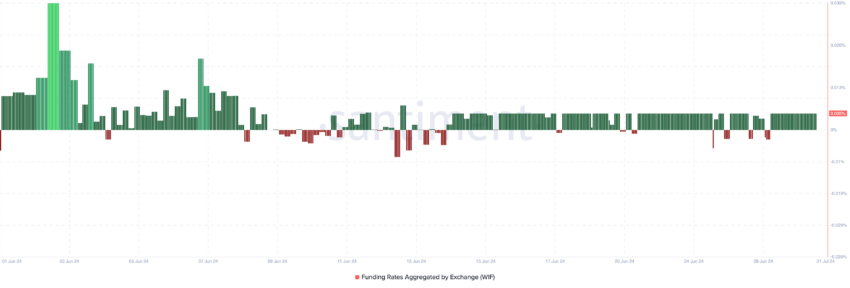

Undeterred by the broader sentiment, traders are positioning for a further hike. The Funding Rate, which represents the difference between a cryptocurrency’s perpetual and spot prices, reveals this.

As of this writing, Dogwifhat’s Funding Rate stands at 0.005%. Funding Rate helps to maintain market equilibrium. This is to ensure that contracts in the market don’t expire. If it is positive, longs (buyers) pay shorts (sellers).

But when it is negative, shorts pay longs a fee to keep their positions open. On June 28, the ratio was negative, indicating that the average trader’s expectation was bearish. Therefore, the positive reading as of this writing means that there is a rising demand for long positions.

WIF Price Prediction: Can Holders Get More Gains?

On the daily chart, BeInCrypto observed that the sellers’ exhaustion on June 23 was crucial to WIF’s bounce. During that period, the price traded at $1.56. Later on, bulls spotted the fatigue, helping the memecoin to form an almost-perfect daily green candle.

Currently, the $1.56 region is the support. Furthermore, WIF is looking to break through the $2.30 resistance. If successful, the price of the token may key into $2.64. Once this happens, a rally toward $3.21 will be possible.

Meanwhile, the Relative Strength Index (RSI) is 51.45, meaning the meme coin’s momentum maintains its bullish position. Likewise, the Moving Average Convergence Divergence (MACD) heads in a similar direction.

Using the difference between the 12 and 26 EMAs, the MACD shows if a trend is bullish or bearish. Since the reading is positive, it means that WIF’s trend is bullish. If sustained, this may confirm the continuation of WIF’s upward run.

However, WIF might not hit the aforementioned prices if Bitcoin (BTC) does not maintain its recent uptrend. This is largely due to the meme coin’s strong correlation with BTC. Should this happen, WIF’s price may drop to $1.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price, Traders Retreat Despite The US ETF Buzz

XRP has faced a challenging decline over the last 48 hours, falling below the $2.00 support level.

This drop came at an inopportune time, especially considering the excitement surrounding Teucrium’s launch of the leveraged US XRP ETF. The news had initially sparked optimism, but the recent decline has overshadowed it.

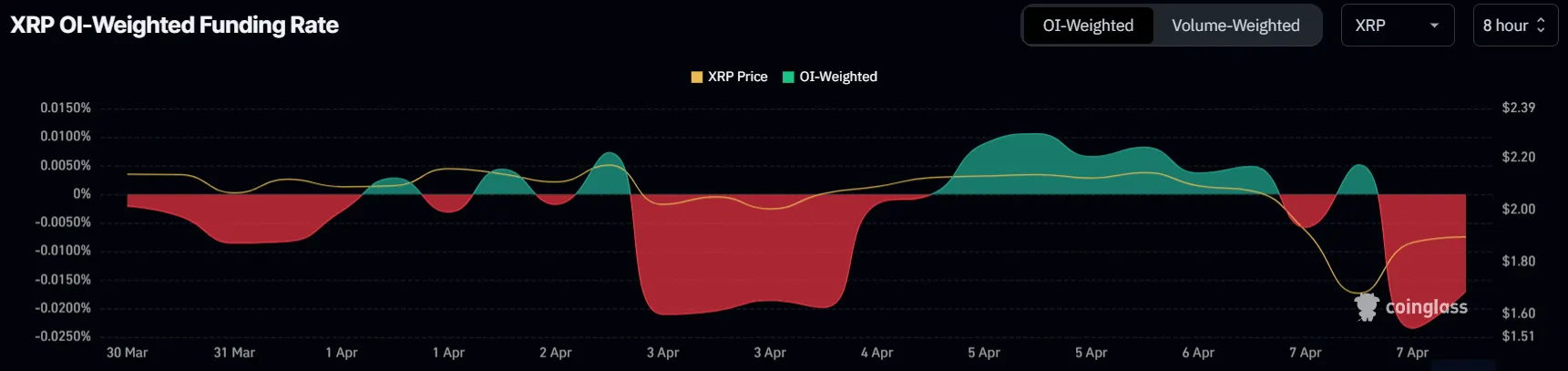

XRP Traders Change Their Stance

In the past 24 hours, the funding rate for XRP switched from positive to negative, indicating a shift in market sentiment. Traders have begun shorting the altcoin, likely in response to the recent price decline. This shift suggests that many traders are preparing for further drops in price, hoping to capitalize on any potential bearish momentum.

The negative funding rate further highlights the growing skepticism among traders about XRP’s short-term price performance. While the ETF launch initially created a buzz, the recent price action has shifted traders’ focus to the downside.

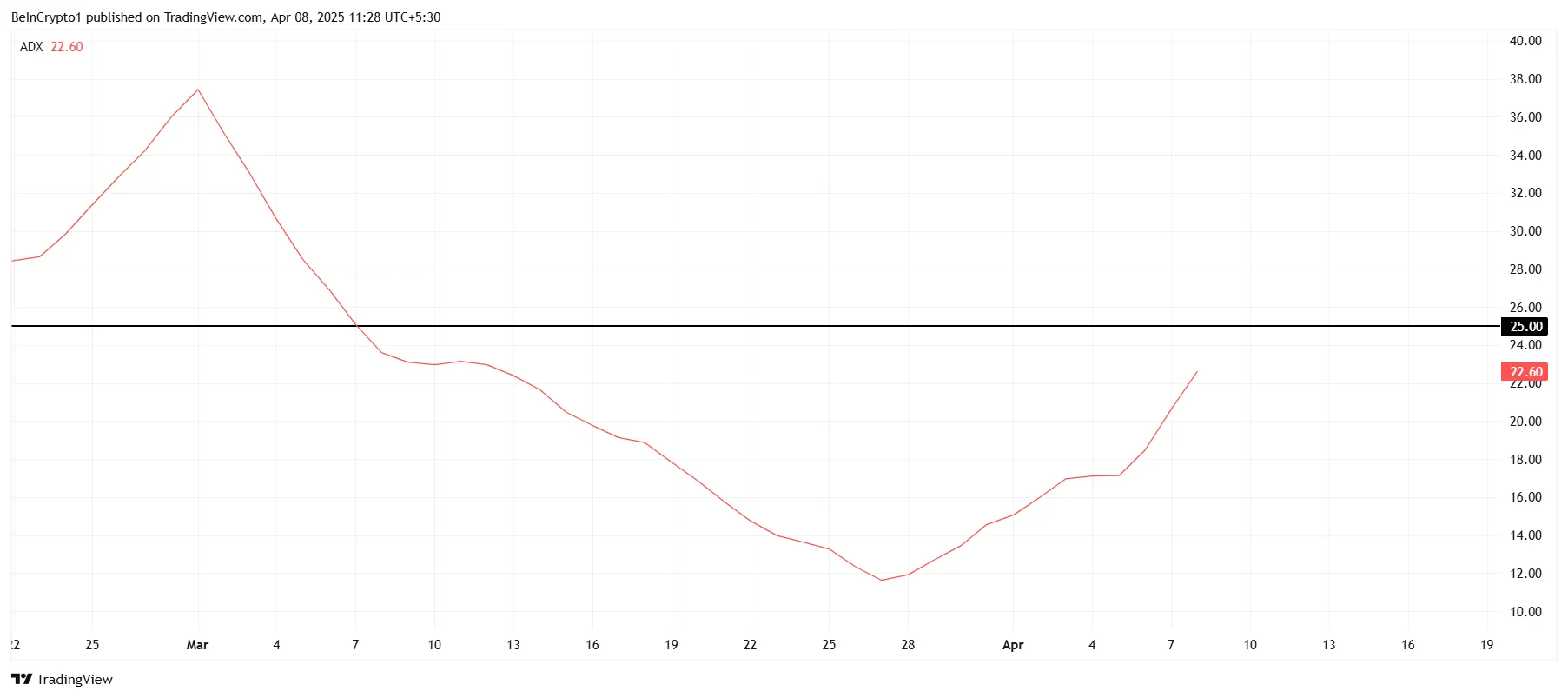

The overall macro momentum for XRP is currently weak, as indicated by technical indicators like the ADX. With the ADX reading of 22, just below the threshold of 25, it signals that the current downtrend may be gaining strength. If the ADX crosses the 25 threshold, it would confirm the strengthening downtrend, potentially leading to further declines in XRP’s price.

Given the current technical setup, XRP may struggle to reverse the trend unless key levels of support are reclaimed. The downtrend could persist as traders and investors react to broader market conditions, particularly as XRP faces negative sentiment and increasing selling pressure.

XRP Price Decline Continues

XRP’s price has dropped nearly 12% in the last 48 hours, trading at $1.88 at the time of writing. The bearish trend has already overshadowed any optimism surrounding the launch of the US XRP ETF by Teucrium. If this sentiment continues, XRP could face further downside pressure.

As the altcoin remains trapped under a declining trend line since early March, a further decline to $1.70 seems likely. This would extend the losses experienced over the past few days and put additional strain on the price of XRP.

However, if XRP manages to reclaim $2.02 as support, it could signal a reversal of the bearish trend. A successful bounce from this level could push XRP beyond $2.14, invalidating the current bearish outlook and allowing the altcoin to break free from its downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Buys Hidden Road for $1.25 Billion to Boost XRP Ledger

Ripple has signed a $1.25 billion agreement to acquire Hidden Road, a global prime brokerage platform. The deal marks one of the largest mergers in the crypto space and signals Ripple’s expansion into institutional finance infrastructure.

With this move, Ripple becomes the first cryptocurrency company to own a multi-asset prime broker operating at a global scale.

Understanding Ripple’s $1.25 Billion Acquisitions

Hidden Road serves over 300 institutional clients and clears around $3 trillion in trades each year across markets, including foreign exchange, digital assets, derivatives, and fixed income.

The acquisition aims to address a key gap in the crypto sector: reliable infrastructure for institutional investors.

By integrating Hidden Road’s services, Ripple plans to offer financial institutions a complete suite of trading and clearing tools that meet traditional finance standards.

Ripple’s large balance sheet will give Hidden Road the capital to grow its services and scale operations globally. The company is expected to become one of the largest non-bank prime brokers as it expands access to both digital and traditional markets.

The deal also strengthens Ripple’s RLUSD stablecoin. Hidden Road will adopt RLUSD as collateral across its brokerage products. This will make RLUSD the first stablecoin to support cross-margining between crypto and traditional asset classes.

As part of the integration, Hidden Road will shift its post-trade processes to the XRP Ledger. This move will cut operating costs and highlight the blockchain’s ability to support institutional-grade decentralized finance.

Ripple also plans to extend digital asset custody services to Hidden Road clients, reinforcing its push into enterprise payments and asset management.

What Does It Mean for XRP Ledger?

In recent months, the XRP community has raised concerns about the network’s underutilization despite its high market capitalization.

As of March, XRP Ledger recorded just $44,000 in daily decentralized exchange (DEX) trading volume—an extremely low figure compared to other major blockchains. The network also lags behind in node distribution, validator count, and smart contract engagement.

So, Ripple’s acquisition of Hidden Road directly addresses the XRP Ledger’s ongoing utility concerns.

As Hidden Road shifts post-trade operations to XRPL and uses Ripple USD (RLUSD) as collateral, this will increase on-chain activity, boost DEX trading volume, and improve total value locked (TVL).

The migration also encourages institutional participants to interact with the ledger, potentially driving up validator participation and smart contract usage.

This real-world integration might strengthen XRPL’s practical utility and drive more engagement on the network.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump-Backed WLFI Proposes Airdrop Test for USD1 Stablecoin

World Liberty Financial (WLFI), backed by the Trump family, announced a new governance proposal to test its airdrop system by distributing its USD1 stablecoin to WLFI token holders.

The move comes shortly after the decentralized finance (DeFi) project launched the stablecoin in late March.

World Liberty Financial Eyes USD1 Stablecoin Airdrop

WLFI’s initiative serves three primary goals. First, it seeks to validate the project’s technical infrastructure. Secondly, it serves as a reward mechanism for early supporters, and lastly, it aims to increase USD1’s visibility ahead of a broader rollout.

“Testing the airdrop mechanism in a live setting is a necessary step to ensure smart contract functionality and readiness. This distribution also serves as a meaningful way to thank our earliest supporters and introduce them to USD1,” the proposal read.

The airdrop will distribute a fixed amount of USD1—a stablecoin pegged to the US dollar and backed by assets like US Treasuries—to all eligible WLFI holders on the Ethereum (ETH) mainnet.

The exact amount per wallet will be determined based on the total number of eligible wallets and WLFI’s budget. In addition, the company reserves the right to modify or terminate the test at its discretion.

Interestingly, comments in the proposal reflect strong community support. The general consensus is likely in favor of a USD1 stablecoin airdrop.

“I believe it is a very valid proposal, which serves both to keep the community engaged and to test the network for implementation. Therefore, I believe it is a positive measure for both holders and the institution. Let’s go ahead, let’s design in order to build,” a user wrote.

The next step would include finalizing the details of the airdrop. Afterward, the proposal will proceed to a governance vote. The voting options will include “Yes” to approve the airdrop, “No” to reject it, and “Abstain” for those who wish not to vote. This process ensures transparency and community involvement in the decision-making process.

Meanwhile, the proposal emerges amid intensified scrutiny of the Trump family’s role in the cryptocurrency venture.

On April 2, Senator Elizabeth Warren and Representative Maxine Waters sent a letter to SEC acting chair Mark Uyeda. The lawmakers requested that the SEC preserve all records and communications related to World Liberty Financial.

They also requested access to information to clarify how the Trump family’s financial stake in WLFI might be influencing SEC operations. Additionally, they expressed concerns that this potential conflict of interest could undermine the SEC’s mission to protect investors and ensure fair, orderly markets.

“The Trump family’s financial stake in World Liberty Financial represents an unprecedented conflict of interest with the potential to influence the Trump Administration’s oversight—or lack thereof—of the cryptocurrency industry, creating an obvious incentive for the Trump Administration to direct federal agencies, including the SEC, to take positions favorable to cryptocurrency interests that directly benefit the President’s family,” the letter read.

Earlier, Senator Warren and five other democrats had sent a letter to the Federal Reserve and the OCC, raising similar concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoPakistan’s Crypto Council Appoints Binance Founder Changpeng Zhao As Strategic Advisor

-

Market23 hours ago

Market23 hours agoXRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

-

Market22 hours ago

Market22 hours agoIs $0.415 the Key to Further Gains?

-

Market24 hours ago

Market24 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Altcoin24 hours ago

Altcoin24 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

-

Market19 hours ago

Market19 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Price Looks Set To Crash To $1,000-$1,500, But Can It Fill The CME Gaps Upwards To $3,933

-

Altcoin22 hours ago

Altcoin22 hours agoPeter Schiff Predicts Ethereum Price To Drop Below $1,000, Compares It To Bitcoin And Gold