Market

Dogecoin and D.O.G.E – Elon Musk’s Billionaire Crypto Experiment

Originally launched as a parody of crypto speculation, Dogecoin has since become the kind of speculative asset it was meant to mock — largely due to Elon Musk’s influence. His social media activity and public endorsements have played a central and ongoing role in shaping DOGE’s trajectory.

BeInCrypto spoke with Erwin Voloder, Head of Policy of the European Blockchain Association, to discuss how Musk blurred the lines between parody and promotion, leading people to assign real-world value to a meme and generating ethical concerns along the way.

The Genesis of Dogecoin

Toward the end of 2013, software engineers Billy Markus and Jackson Palmer joined forces to create Dogecoin, the first meme coin in crypto history. Its primary purpose was to serve as a lighthearted parody of the chaotic crypto hype.

Born from the “Doge” internet meme, which prominently featured a Shiba Inu, the meme coin was intended as a humorous jab at the often illogical nature of crypto speculation.

Despite its satirical origins, Dogecoin quickly gained a dedicated online following—so much so that even Tesla CEO Elon Musk became drawn to it.

Today, he’s considered a key figure in the community, and Dogecoin, contrary to its initial philosophy, has become a speculative asset.

“Musk’s involvement transformed Dogecoin from a satirical internet token into a speculative asset class by bestowing it with perceived legitimacy and entertainment value. His tweets and appearances turned Dogecoin into a cultural product rather than a financial one—a kind of performance art with real economic consequences. The irony is that a coin created to mock irrational investing became the poster child of irrational investing,” Voloder told BeInCrypto.

In addition to symbolic endorsements, Musk has exerted concrete influence. A prime example is Tesla’s early 2022 decision to accept Dogecoin for select merchandise, significantly strengthening its position and indicating its practical potential.

Musk also didn’t hesitate to use social media to convey his love for Dogecoin.

How Did Musk’s Tweets Impact Dogecoin’s Market?

Throughout the years, Elon Musk, a prolific Twitter user even before he bought the platform, has shared numerous posts referencing Dogecoin. Each of these tweets has substantially impacted the meme coin’s visibility and price performance.

When Musk referred to Dogecoin in an April 2019 tweet as his favorite cryptocurrency, the market went berserk. In two days, the coin’s price went from $0.002 on April 1 to as high as $0.004.

Two years later, Musk’s X posts declaring “Dogecoin is the people’s crypto” triggered an overnight trading volume surge of over 50%.

Soon enough, retail investors started to follow Musk’s endorsements mindlessly. But it wasn’t all butterflies and roses. Musks’s unpredictable pronouncements also came with extreme volatility.

“Musk blurred the line between parody and promotion, which led people to assign real-world value to a meme. Without him, it may have remained a niche internet joke but with him, it became a symbol of speculative absurdity,” Voloder said.

When Musk called Dogecoin ‘a hustle’ on Saturday Night Live in May 2021, the coin lost more than a third of its price in a few hours.

“Dogecoin has no clear roadmap, no underlying yield or utility, and limited development activity, meaning its valuation is especially sentiment-driven. In such an environment, a single individual’s actions can drive or destroy market perception, particularly when that individual is one of the world’s most followed and wealthiest people,” he added.

Then, in January 2025, President Trump appointed Musk as the head of a newly created agency tasked with cutting federal spending.

Musk called it the Department of Government Efficiency, or D.O.G.E. for short. The name was intentional, and the internet broke accordingly.

D.O.G.E. and the Price Plunge: What’s the Correlation?

President Trump launched the D.O.G.E. department by executive order on his first day on the job. After D.O.G.E. launched its official government website, Dogecoin’s price surged by 13% in 15 minutes, breaking its previous short-term downtrend.

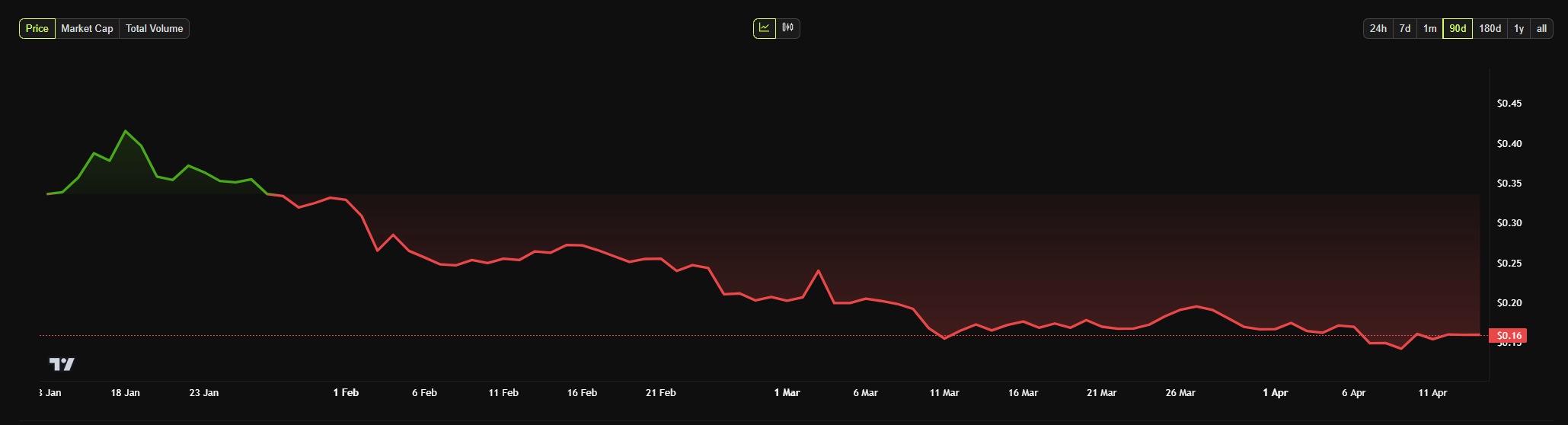

Yet, since the official establishment of the Department of Government Efficiency, DOGE’s price has been freefalling. While valued at $0.36 on January 20, its price has since fallen to $0.15 today.

Findings from a recent Finbold report have also revealed that Musk might now be having the opposite effect on Dogecoin’s value and sentiment.

According to the data, the number of Dogecoin millionaire addresses has plunged by over 41% between January 21 and March 31. In just over two months, the cryptocurrency has decreased by 964 addresses.

Notably, the report indicated a massive proportional decline in the number of the wealthiest Dogecoin addresses. The count of addresses holding $1 million to $9.99 million decreased by 40.21% in Q1 2025.

Even more significantly, the number of addresses holding over $10 million plummeted by 47%, from 400 to 212.

In short, Dogecoin whales are dumping the token.

“Musk’s influence remains a key variable in Dogecoin’s valuation, and the timing of the drop in high-value addresses closely aligns with his D.O.G.E. announcement, suggesting a correlation. However, attributing the entire reversal to Musk overlooks broader macro factors like rising interest rates, tighter crypto regulation, and waning retail enthusiasm post-2021,” Voloder explained.

Despite the difficulty of assessing the precise impact of Elon Musk’s D.O.G.E. leadership on Dogecoin’s performance, his significant influence on the cryptocurrency has become evident.

The ethical considerations accompanying Musk’s influence have also become difficult to ignore.

The Ethical Concerns of a Billionaire’s Influence

According to Voloder, the Dogecoin case illustrates the perils of parasocial investing, a behavior in which people mistakenly assign credibility to famous personalities based on their celebrity status or charisma.

It further shows the damaging effects of uncritical reliance on endorsements, potentially leading to substantial financial losses for retail investors.

The ethics of a billionaire influencing a volatile market like cryptocurrency also present significant complexities.

“On one hand, Musk has the right to express personal views and participate in public discourse, including around assets like Dogecoin. On the other, his outsized influence means that his commentary can trigger real financial harm or euphoria in retail investors who often lack access to sophisticated risk models. Ethically, when you wield that kind of influence, there’s a strong argument for assuming a higher standard of responsibility—especially in a market with minimal guardrails,” Voloder told BeInCrypto.

Given the unregulated nature of the cryptocurrency industry, it’s currently challenging to pinpoint the degree to which Musk’s actions can be held responsible.

Does Musk’s Influence Constitute Market Manipulation?

Although presented as personal opinions, Musk’s tweets demonstrably affect Dogecoin’s price, creating a legal gray area regarding potential market manipulation under US securities and commodities laws.

“Under SEC rules, market manipulation involves intentional conduct designed to deceive or defraud investors by controlling or artificially affecting market prices. While Dogecoin is not officially deemed a security, and thus outside the SEC’s traditional remit, the CFTC could still scrutinize it under its anti-manipulation powers for commodities,” Voloder explained.

The Dogecoin case isn’t the first time a high-profile figure has influenced markets in ways that were manipulative, though not explicitly illegal.

Voloder highlighted two instances at different points in the 20th century: when prominent banker JP Morgan steered markets during the panic of 1907 and investor George Soros broke the Bank of England in 1992.

Though their maneuvers were technically legal, they managed to sway market outcomes. However, this was the 20th century, and their impact was proportionally much smaller.

“The difference today is that social media provides instantaneous reach to millions of investors, amplifying the potential impact. So even if Musk’s tweets are framed as personal musings, their predictable effect on price can be seen as a form of market signaling—intentional or not,” Voloder told BeInCrypto.

In fact, the SEC and legal experts are already debating Elon Musk’s potential influence on Dogecoin’s financial market activities.

A $258 Billion Lawsuit

Elon Musk currently faces a $258 billion class action lawsuit for running a Dogecoin pyramid scheme.

The lawsuit, filed in June 2022, claims that Musk intentionally promoted Dogecoin through his tweets, public appearances, and media interactions, creating hype and driving up demand.

According to the plaintiffs, this artificial inflation of Dogecoin’s price allowed Musk and his companies to profit while leaving other investors with substantial losses when the price inevitably declined.

Due to the SEC’s unclear legal classification of cryptocurrencies like Dogecoin, Voloder anticipates a difficult path for these claims in court. Nevertheless, the lawsuit indicates increased attention to market manipulation by influential figures.

“Still, the lawsuit signals increased legal pressure to define where promotional enthusiasm ends and financial misconduct begins. If regulators or courts decide Musk knowingly manipulated the market or misled investors, he could face civil penalties or be forced into settlements. The SEC’s earlier scrutiny of Musk’s Tesla tweets, resulting in a consent decree, shows that regulators are willing to act when market-moving speech crosses certain lines,” Voloder explained.

Musk’s influence on Dogecoin continues unabated, and the long-term effects on the Dogecoin community remain a subject of debate.

The rapid 40% decrease in Dogecoin whale addresses within two months has raised questions about the meme coin’s future strength and resilience.

However, DOGE’s fundamental strength still remains intact – it’s community.

“While the initial hype has faded, Dogecoin still retains a loyal base of enthusiasts, many of whom appreciate its meme-driven culture, low transaction fees, and iconic branding. But the big speculative crowd that initially drove its [all-time high] has largely left the field in absence of sustained bullish narratives or meaningful tech upgrades,” Voloder concluded.

In the future, traders will be watching to see if Dogecoin’s ‘cult following’ eventually dwindles or if a strong community will sustain the ‘OG meme coin’.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

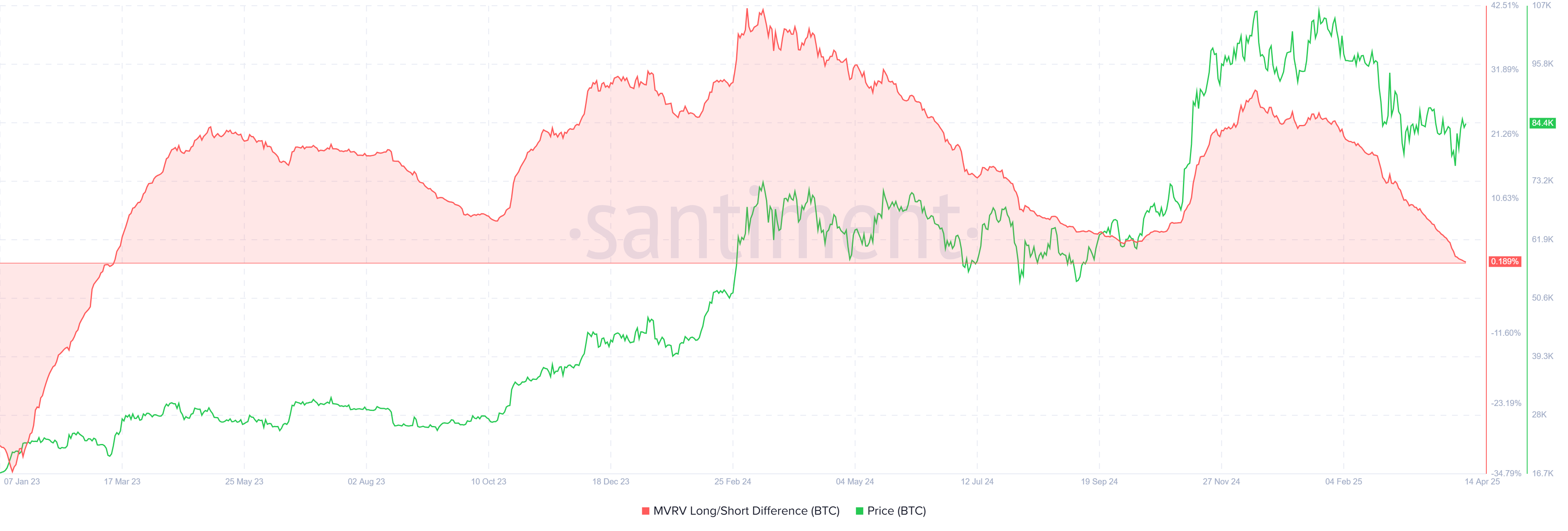

Bitcoin’s price continues to struggle below the psychological $85,000 mark, failing to break past this critical level over the past two months.

Despite some attempts to secure a rise, the leading cryptocurrency has remained stagnant, increasing pressure on long-term holders (LTHs). These investors, once enjoying solid profits, are now seeing a decline in their unrealized gains.

Bitcoin Investors Are Pulling Back

The MVRV Long/Short Difference, a key metric used to gauge market sentiment, reveals a concerning trend for LTHs. The indicator recently hit a two-year low, suggesting that long-term holders’ profits are at their lowest since March 2023. This shift indicates that the market conditions are increasingly unfavorable for LTHs.

As Bitcoin’s price fails to recover, short-term holders (STHs) are beginning to dominate, capitalizing on the price fluctuations. Meanwhile, long-term holders (LTHs), facing diminishing profits, hold off on buying or holding more.

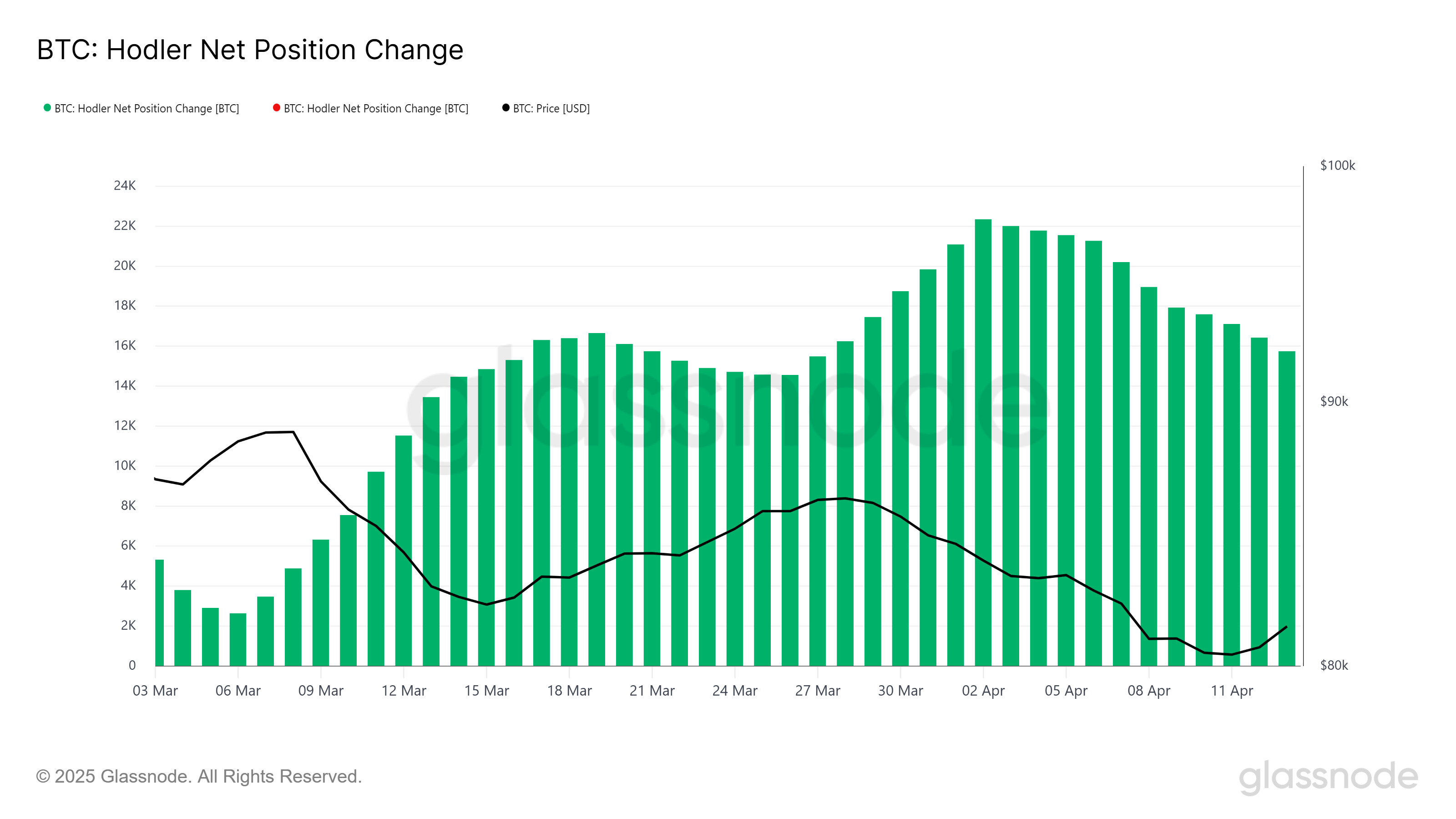

The overall momentum of Bitcoin, measured by technical indicators, also reflects bearish signals. The HODLer net position change further backs this narrative, as it shows that LTHs have sold a significant portion of their holdings over the last two weeks. In total, these sales amounted to more than 6,596 BTC, which is worth over $550 million.

Although this figure may not be enormous, the psychological shift from confidence to caution among LTHs is a larger concern. This lack of conviction could delay Bitcoin’s recovery and contribute to further price stagnation. In turn, this could further limit market activity and exacerbate the ongoing downturn.

BTC Price Is Facing A Decline

Bitcoin’s price is trading at $84,421, hovering just above the crucial support level of $82,619. The price remains trapped under the key $85,000 resistance level, which could cause further pressure if it fails to break above. If Bitcoin loses support at $82,619, a decline to the next major psychological support of $80,000 is possible.

If the bearish trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support would mark a more significant downturn, confirming the continued market weakness and deepening the bearish outlook for Bitcoin.

However, if Bitcoin manages to breach and hold $85,000 as support, it could ignite a recovery, pushing the price back up toward $86,848. A sustained rise above $85,000 would invalidate the current bearish trend and pave the way for a potential surge toward $89,800, reestablishing confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Turns Green, Sparks Hopes of a Fresh Upside Push

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Ethereum Price Steadies After Increase—Now Eyes More Gains Ahead

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

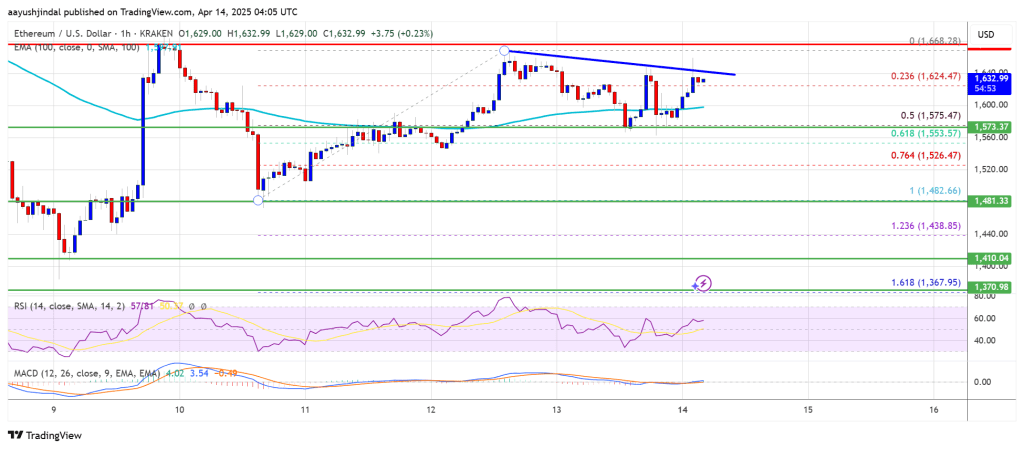

Ethereum price started a fresh increase above the $1,580 zone. ETH is now consolidating gains and might aim for more gains above $1,665.

- Ethereum started a decent increase above the $1,580 and $1,620 levels.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There is a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,665 resistance zone.

Ethereum Price Gains Pace

Ethereum price formed a base above $1,500 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,550 and $1,580 resistance levels.

The bulls even pumped the price above the $1,620 zone. A high was formed at $1,668 and the price recently started a downside correction. There was a move below the $1,650 support zone. The price dipped below the 23.6% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

Ethereum price is now trading below $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,640 level. There is also a new connecting bearish trend line forming with resistance at $1,640 on the hourly chart of ETH/USD.

The next key resistance is near the $1,665 level. The first major resistance is near the $1,680 level. A clear move above the $1,680 resistance might send the price toward the $1,720 resistance. An upside break above the $1,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,640 resistance, it could start a downside correction. Initial support on the downside is near the $1,600 level. The first major support sits near the $1,575 zone and the 50% Fib retracement level of the upward move from the $1,482 swing low to the $1,668 high.

A clear move below the $1,575 support might push the price toward the $1,550 support. Any more losses might send the price toward the $1,520 support level in the near term. The next key support sits at $1,480.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,575

Major Resistance Level – $1,665

-

Altcoin8 hours ago

Altcoin8 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market18 hours ago

Market18 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market16 hours ago

Market16 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Market13 hours ago

Market13 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market12 hours ago

Market12 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Bitcoin20 hours ago

Bitcoin20 hours agoCryptoQuant CEO Says Bitcoin Bull Cycle Is Over, Here’s Why

-

Market6 hours ago

Market6 hours agoMANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations