Market

DOGE Price Struggles to Recover as Volume Declines 36%

Dogecoin (DOGE) price has shown little movement in the last 24 hours, down about 3%. Its trading volume has dropped 36% to $1.65 billion despite Neptune Digital Assets buying $370,000 DOGE. The price has been stuck below $0.33 for nearly a week, struggling to gain bullish momentum.

Technical indicators continue to show a bearish setup, with the Ichimoku Cloud and EMA lines reinforcing downside risks. Unless DOGE can break key resistance levels, the trend remains weak, leaving room for further declines.

Ichimoku Cloud Shows a Bearish Outlook for DOGE

Dogecoin Ichimoku Cloud chart presents a bearish outlook, with the price trading below the cloud. The future cloud remains red, signaling continued downward pressure and indicating that resistance levels could remain strong in the near term.

The conversion line (blue) is currently moving sideways near the baseline (red), suggesting a period of consolidation rather than an immediate trend reversal.

However, with the price failing to gain momentum above these lines, bearish sentiment remains dominant, despite Canadian crypto company Neptune Digital Assets announcing that it had purchased $350,000 worth of DOGE in December.

Additionally, the lagging span (green) is positioned below the price action, confirming that DOGE price is still in a downtrend. The cloud ahead is sloping downward, reinforcing the possibility that bearish momentum could persist.

If the baseline flattens while the conversion line moves upward, it could indicate a potential trend shift, but for now, DOGE remains in a weak position with no clear signs of recovery.

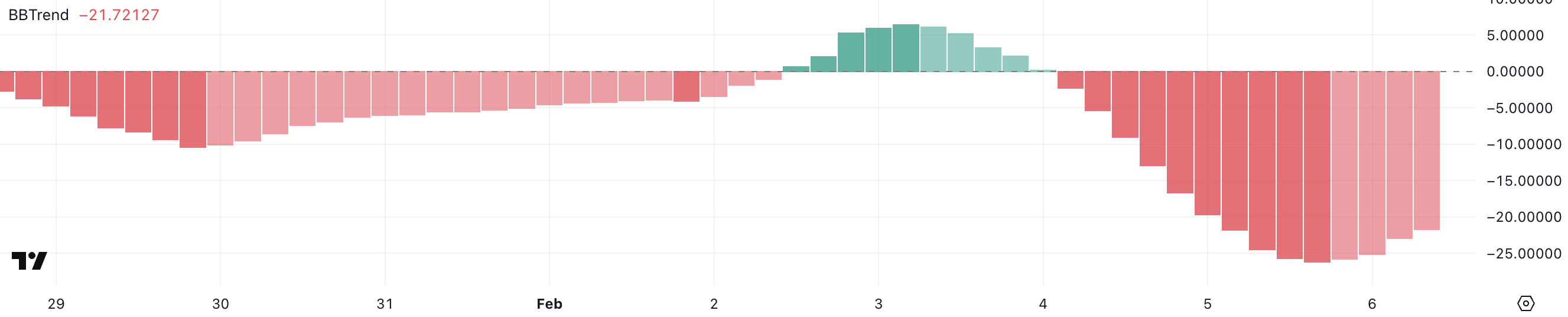

Dogecoin BBTrend Is Still Negative, But Going Up

Dogecoin BBTrend is currently at -21.7, having remained negative for the past two days. It peaked at -26.1 yesterday before beginning to lose strength, signaling that the bearish momentum is still present but slightly weakening.

BBTrend is an indicator that measures trend strength based on Bollinger Bands. Positive values indicate bullish momentum and negative values suggest a bearish trend. The further the value is from zero, the stronger the trend in either direction.

With DOGE’s BBTrend now at -21.7, down from -26.1 yesterday, it suggests that while the downtrend remains intact, selling pressure is starting to ease. A continued move upward in BBTrend could indicate that bearish momentum is fading, potentially leading to consolidation or a relief bounce.

However, as long as the BBTrend remains negative, the overall trend is still bearish, meaning DOGE price could struggle to gain significant upside traction unless a stronger shift in momentum occurs.

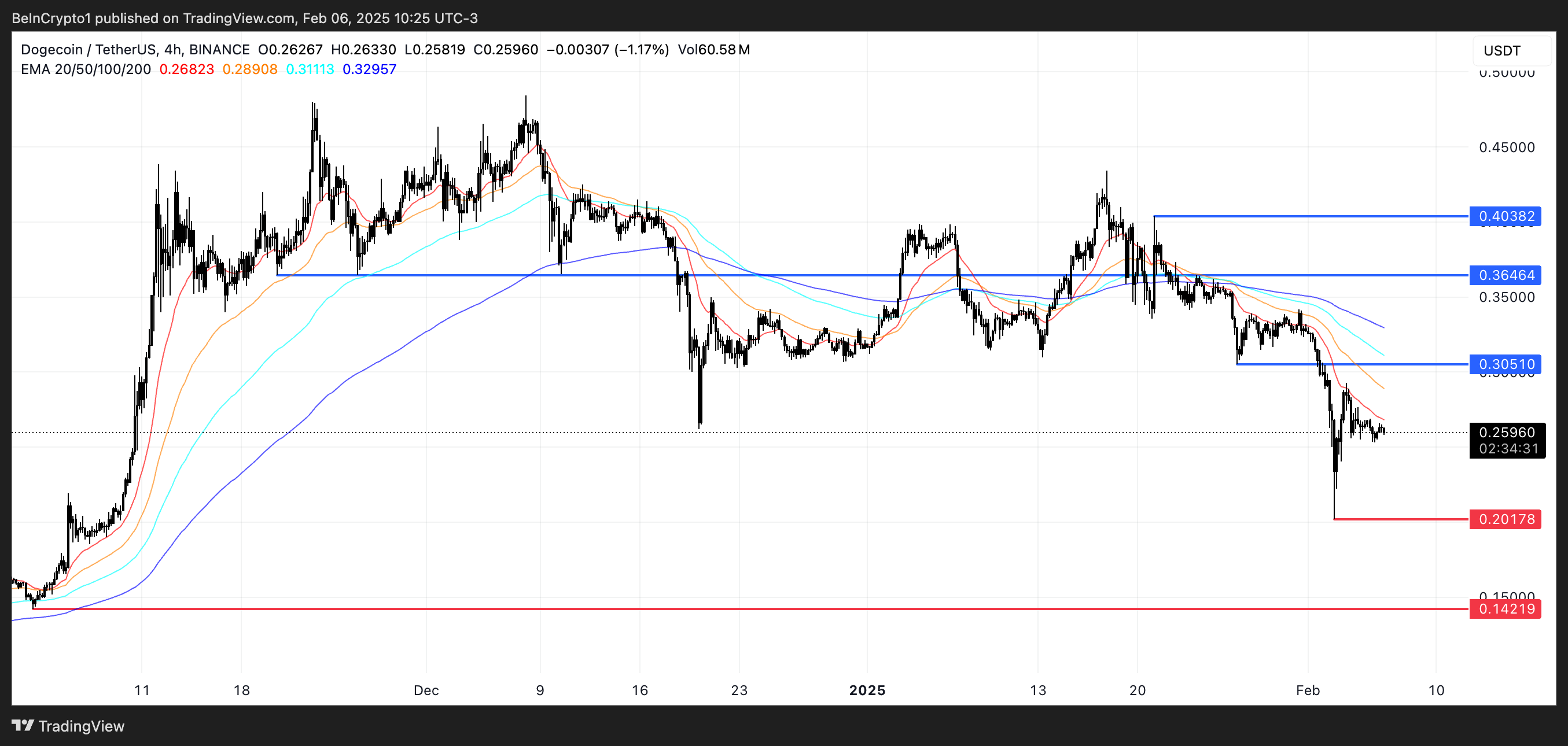

DOGE Price Prediction: Will DOGE Surge and Break the $0.36 Resistance This Time?

Dogecoin EMA lines indicate a bearish outlook, with short-term EMAs positioned below long-term ones. This alignment suggests that the current downtrend remains strong, and if the negative momentum continues, DOGE could test the $0.20 level.

A breakdown below this support could push Dogecoin price further down to $0.14, marking its lowest point since December 10, 2024.

On the other hand, if the trend reverses, DOGE could attempt to reclaim $0.30 as resistance. A successful breakout above this level could lead to a retest of $0.36, a key level that DOGE failed to surpass at the end of January.

If bullish momentum strengthens further, DOGE price could climb as high as $0.40, representing a potential 54% upside. However, until the EMAs shift to a more bullish formation, the overall trend remains bearish.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s Tariffs Spark Search for Jerome Powell’s Successor

The Trump administration is gearing up for significant economic shifts, with its proposed tariffs said to be setting the stage for a potential overhaul of the Federal Reserve’s (Fed) leadership.

Like Gary Gensler’s ouster at the SEC (Securities and Exchange Commission), reports indicate that Fed chair Jerome Powell may face a similar fate with discussions starting long before his term ends.

Jerome Powell’s Exit Planned As Trump Tariffs Spell Economic Hardship

Treasury Secretary Scott Bessent announced the Trump administration’s plans to interview candidates to replace Fed Chair Jerome Powell.

Notably, Powell’s term as Fed chair ends in May 2026, over a year out. With almost 13 months left, experts suggest the administration’s move may be a strategic response to the economic turbulence expected from Trump’s aggressive tariff policies in 2025.

The sentiment is that the Trump administration may pave the way for a new Fed Chair to steer the economy through 2026 with interest rate cuts and stimulus measures.

“The interest rates affect credit cards, they’ll affect auto loans, the bottom 50% of Americans over the past two years have gotten crushed by these high interest rates. We’re set on bringing interest rates down,” Bessent claimed in a televised interview.

Trump’s tariff proposals, including a 125% tax on Chinese imports, are projected to impact the US economy substantially. According to a Tax Foundation study published on April 11, 2025, these tariffs could reduce US GDP by 1.3% in the long run.

The study also estimates tariffs will amount to an average tax increase of $1,300 per US household in 2025. This adds pressure on consumers already grappling with inflationary concerns.

Combined with foreign retaliation affecting $330 billion of US exports, the overall GDP reduction could reach 1.0%. This highlights the economic challenges the administration anticipates in the coming year.

Trump Administration Prepares For 2026 Economic Recovery

This report comes a month after Bessent presented Fed Chair Jerome Powell as a significant obstacle. He alluded that Powell impeded the Trump administration’s determination to lower interest rates.

Indeed, the Federal Open Market Committee (FOMC), led by Powell, has rejected interest rate cuts. They maintain this stance until they are comfortable with inflation cooling.

The Fed also made significant downward revisions to its 2025 economic projections. They painted a picture of weaker growth and persistent inflation.

According to economists, the Trump Administration is bracing for “economic weakness” in 2025 due to the tariffs. However, it sees 2026 as a year of recovery through monetary policy adjustments.

“This sets up perfectly for 2026 to be the year of interest rate cuts and economic stimulus, with the newly appointed Fed Chair,” The Kobeissi Letter said.

Therefore, the timing of Powell’s replacement aligns with these economic projections. A new Fed Chair, potentially more aligned with Trump’s economic agenda, could facilitate interest rate cuts and stimulus to counteract the tariff-induced slowdown.

Jerome Powell has served as Fed Chair since 2018. He has maneuvered a complex economic environment, which included high inflation and the post-pandemic recovery.

His second term, confirmed in May 2022, has been characterized by efforts to balance the Fed’s dual mandate of stable prices and full employment. However, this has been met with criticism, including from President Trump, for not being accommodative enough.

“The Fed would be much better off cutting rates as US tariffs start to transition (ease) their way into the economy. Do the right thing,” Trump shared on Truth Social.

The early search for his successor indicates the administration’s desire for a Fed Chair who might be more amenable to its policy goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CoinGecko Conduct Survey on AI and Proof of Personhood

CoinGecko conducted a recent survey on AI user opinions, particularly centered around Proof of Personhood (PoP). The overwhelming majority of users want to distinguish humans from AI and are open to adopting PoP.

Proof of Personhood (PoP) is a mechanism designed to verify that a user is a unique human being—not a bot, not an AI, and not a duplicate identity. Many users feel it’s increasingly critical as generative AI and autonomous agents proliferate across digital platforms.

Is Personhood the Next Big Trend in AI?

AI projects have seen declining popularity over the past months, largely due to macroeconomic factors and other narratives dominating the Web3 space. Yet, AI agent development remains strong.

AI agents are now highly integrated into crypto Twitter and social media. They are driving conversations, changing narratives, and even creating dialog. So, the concept of personhood has become a critical discussion among the crypto community.

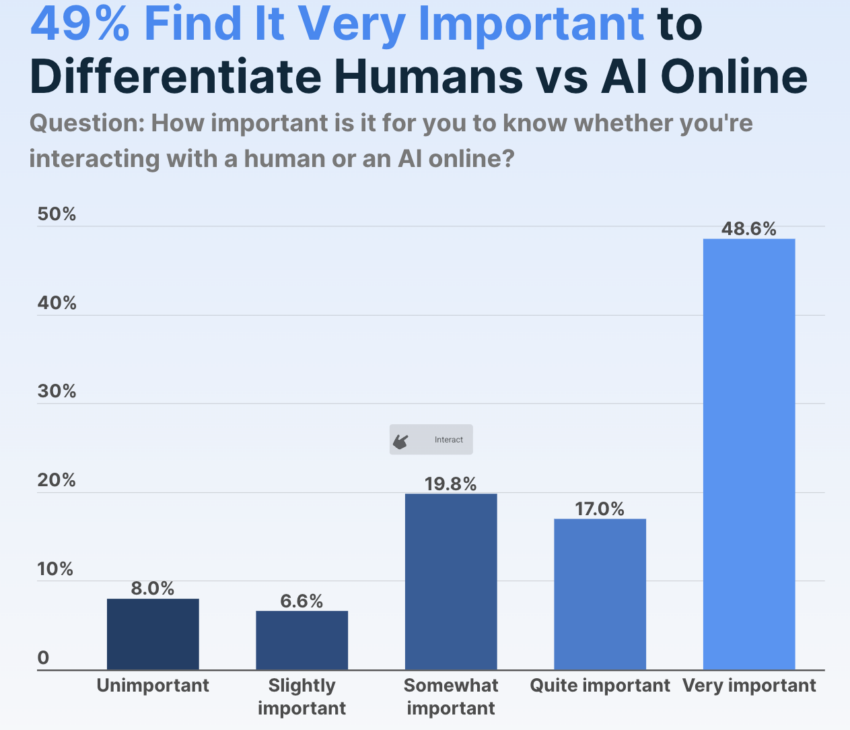

Most recently, CoinGecko conducted a survey on AI-related opinions and identifying personhood.

CoinGecko’s data shows that most AI users firmly believe that it’s important to know if they’re interacting with a human. Nearly half of respondents think this task is “very important,” and 92% think it’s at least somewhat important.

This can help explain why Proof of Personhood (PoP), a concept pioneered by Sam Altman’s Worldcoin, has remained an enduring idea in the AI space.

What’s the problem, then? Although this survey shows that AI users want to identify personhood, that doesn’t mean that everyone is willing to adopt PoP methods as currently devised or understood.

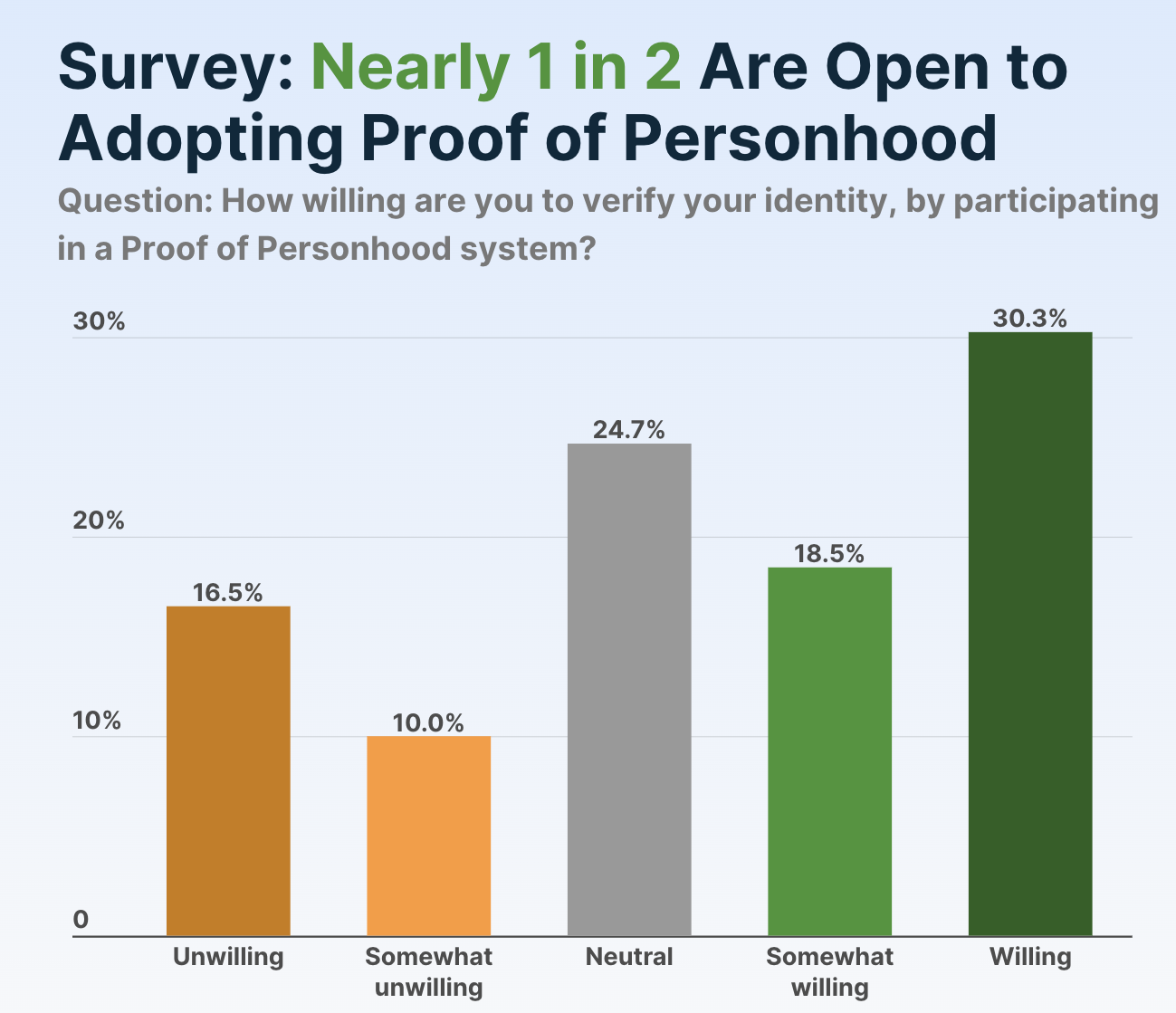

Nearly half of users were willing or somewhat willing to try them, but it was a far smaller margin than the other question.

Furthermore, the survey determined that only 30.3% of respondents believe that it’s very important to distinguish humans from AI and are also willing to adopt Proof of Personhood methods.

On the other hand, 18.3% thought identifying humans was important but were neutral or actively opposed to PoP.

The survey did not apparently describe specific PoP protocols from any one project. PoP generally involves using non-traditional forms of verification, such as biometric data, social media profiles, or other methods that are difficult to fake or replicate, but there isn’t a single industry standard yet.

Considering that another CoinGecko survey identified declining interest in AI investment, this polling discrepancy could present a problem. AI users are mostly unified as to what the issue is, but the proposed solutions are much more controversial.

A heavy-handed approach to the personhood question could turn users away from AI. This is far from ideal in the current market.

Still, it’s important not to overstate the level of controversy. Although less than half of AI users want to adopt Proof of Personhood, the pool of hostile respondents was comparatively small.

There’s a substantial number of ambivalent people, and they may respond well to new protocols, marketing campaigns, or other incentives.

Overall, it’s evident that PoP is becoming a key discussion point in the Web3 community. As autonomous agents gain influence, PoP might serve as a firewall between digital manipulation and genuine participation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

-

Market20 hours ago

Market20 hours agoXRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Breaks Silence Amid Mantra (OM) 90% Price Crash

-

Market19 hours ago

Market19 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Market23 hours ago

Market23 hours agoBitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

-

Bitcoin18 hours ago

Bitcoin18 hours agoCrypto Outflows Hit $795 Million On Trump’s Tariffs & Market Fear

-

Market18 hours ago

Market18 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds