Market

Crypto’s $3.67 Billion Boost: Funding Trends For 2024

In a resounding testament to the growing confidence in crypto ventures, funding in the crypto space has surged to an impressive $3.67 billion across 604 funding rounds in 2024.

This figure sets a brisk pace, poised to surpass the $9.3 billion raised in the previous year, according to data from industry analytics firm RootData.

Early Stage Investment Remains Crypto VC Focus in 2024

Crypto venture capital funding has maintained momentum, crossing the $1 billion mark for the second consecutive month. April witnessed a substantial influx of $1.02 billion, distributed across 161 investment rounds. This is slightly lower than March’s $1.09 billion across 186 rounds, as reported by RootData.

However, alternative data from DefiLlama presents a nuanced perspective. It indicates a slightly lower figure of $935 million in April 2024, just shy of the billion-dollar milestone.

Read more: How To Fund Innovation: A Guide to Web3 Grants

Examining the distribution of fundraising sizes, a notable 40.53% of funding falls within the $1 to $3 million range, underscoring the continued interest in early-stage projects. Conversely, only 2.16% of funding rounds boast sizes exceeding $50 million, signaling a concentration of larger investments in select endeavors.

Seed fundraising dominates the crypto funding ecosystem. It comprises over 51% of total fundraising rounds, highlighting the pivotal role of early-stage capital in nurturing innovation within the crypto sphere.

“This year is proving to be a founders’ market with over $2.49 billion invested in 600+ deals. However, the vast majority of deals are being done at the earliest stages, where valuations have come back (relatively speaking) from the bare bottom of Q1 2023. Late stage valuations still remain stagnant with some of the largest “winners” of 2021 remaining “at cost” or in need of a bridge round,” a crypto venture capitalist said on X (Twitter).

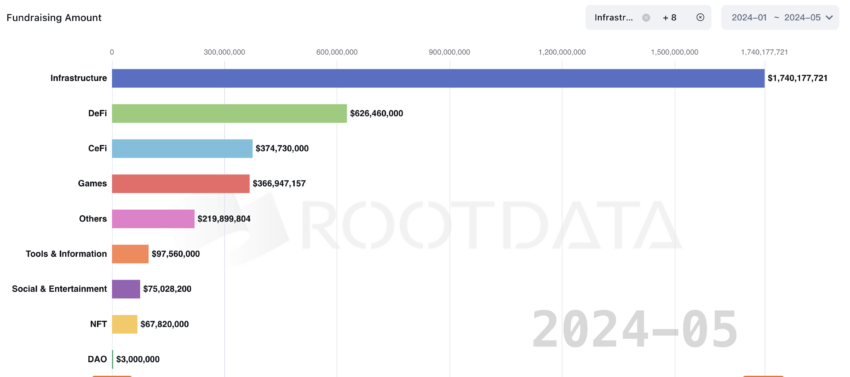

Delving into sector-specific allocations, blockchain infrastructure firms emerge as frontrunners, securing a substantial $1.74 billion in venture capital funding. However, decentralized autonomous organizations (DAOs) present a contrasting narrative, receiving a modest $3 million in funding thus far in 2024.

Key players continue to make significant strides in reshaping the industry’s funding environment. Noteworthy investments include BlackRock’s leadership in a $47 million round for Securitize, emphasizing the growing importance of tokenization in real-world asset management.

Read more: Crypto Hedge Funds: What Are They and How Do They Work?

Pantera Capital’s ambitious plans, aimed at garnering over $1 billion, reflect ongoing optimism in the crypto sector. Not to mention, Pantera Capital has already invested an undisclosed amount in The Open Network (TON) blockchain.

Moreover, Paradigm is also negotiating to raise between $750 million and $850 million for a new fund.

Venture capital powerhouse Andreessen Horowitz’s monumental $7.2 billion fundraising further highlights the sector’s broader appeal. While the latest fund is not crypto-specific, it targets sectors such as Artificial Intelligence, Apps, Games, Infrastructure, and Growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Hovers Over $80,000 as Whale Activity Drops

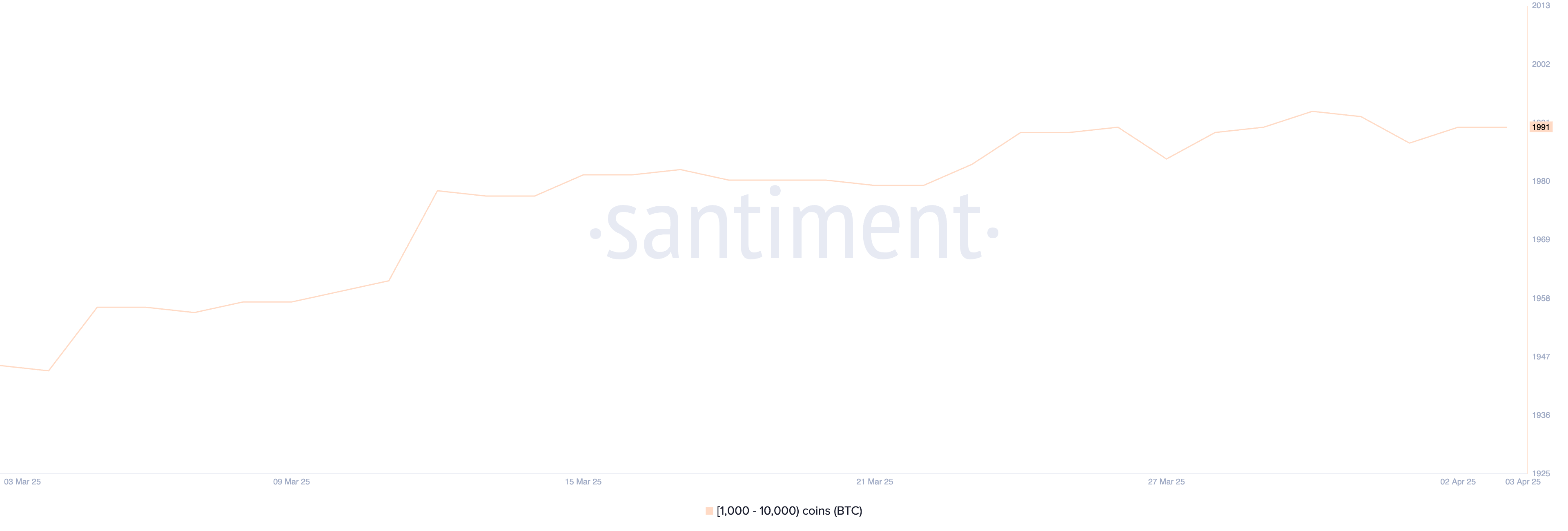

Bitcoin (BTC) continues to hover in a state of uncertainty as both whale activity and technical indicators point to a market lacking strong conviction. Large holders have remained inactive for over a week, with the number of whale wallets holding between 1,000 and 10,000 BTC steady at 1,991 since March 24.

Meanwhile, technical charts like the Ichimoku Cloud and EMA lines offer a mixed outlook, reflecting hesitation in both bullish and bearish directions. As BTC trades near key support and resistance levels, the coming days could determine whether April brings a breakout or deeper correction.

Bitcoin Whales Aren’t Accumulating

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—currently stands at 1,991, a figure that has remained remarkably steady since March 24.

This level of consistency in large holder activity suggests that major players are neither aggressively accumulating nor offloading their positions.

Given the size of these holdings, even minor shifts in whale behavior can significantly impact the market. This stability is particularly noteworthy given recent volatility across the broader crypto market.

Tracking Bitcoin whales is crucial because these large holders often have the power to influence price action through their buying or selling decisions.

When whales accumulate BTC, it can signal confidence in future price appreciation, while large-scale selling can indicate upcoming downward pressure. The fact that the number of whales has remained stable for the last 11 days may suggest a period of consolidation, where big investors are waiting for a clearer macro or market signal before making their next move.

This could imply that major players see the current BTC price as fair value, potentially leading to a tightening of price action in the short term before a breakout in either direction.

BTC Ichimoku Cloud Shows A Mixed Picture

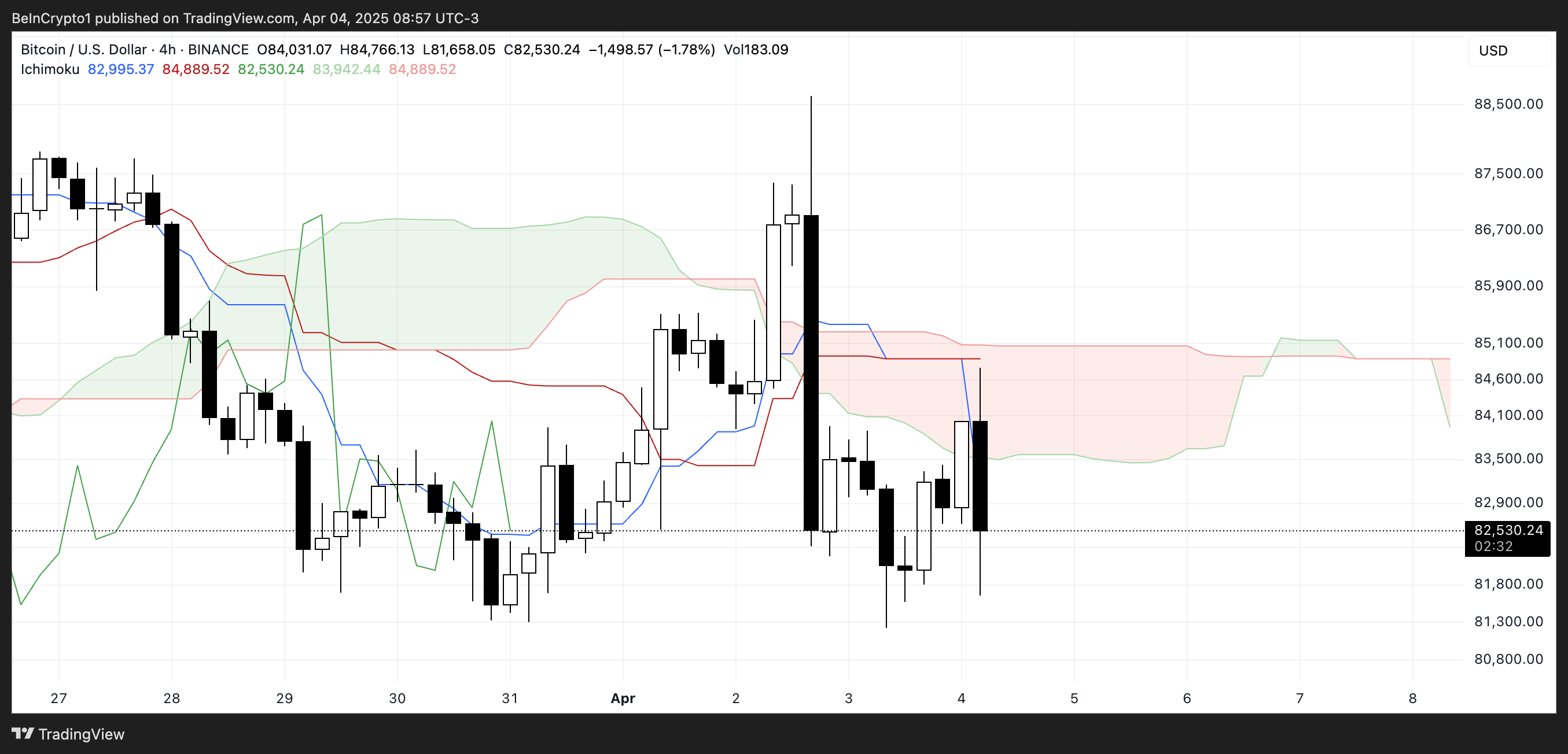

The current Ichimoku Cloud setup for Bitcoin shows a mixed but slightly cautious sentiment.

The price recently dipped below the red baseline (Kijun-sen), and despite a brief push into the cloud, it was rejected and fell back below it—indicating that bullish momentum lacked follow-through.

The blue conversion line (Tenkan-sen) is now trending downward and has crossed below the baseline, which often reflects short-term bearish momentum. Meanwhile, the Leading Span A (green cloud boundary) is starting to flatten, while Leading Span B (red boundary) remains relatively horizontal, forming a thin and neutral cloud ahead.

This type of thin, flat cloud suggests indecision in the market and a lack of strong trending momentum. The price hovering just below the cloud further reinforces the idea that BTC is in a consolidation phase rather than a clear trend.

If the price can break back above the cloud and maintain that level, it could signal renewed bullish strength.

However, continued rejection at the cloud and pressure from the falling Tenkan-sen could keep BTC in a corrective or sideways structure. For now, the Ichimoku setup reflects uncertainty, with no dominant trend confirmed in either direction.

Will Bitcoin Rise Back To $88,000 In April?

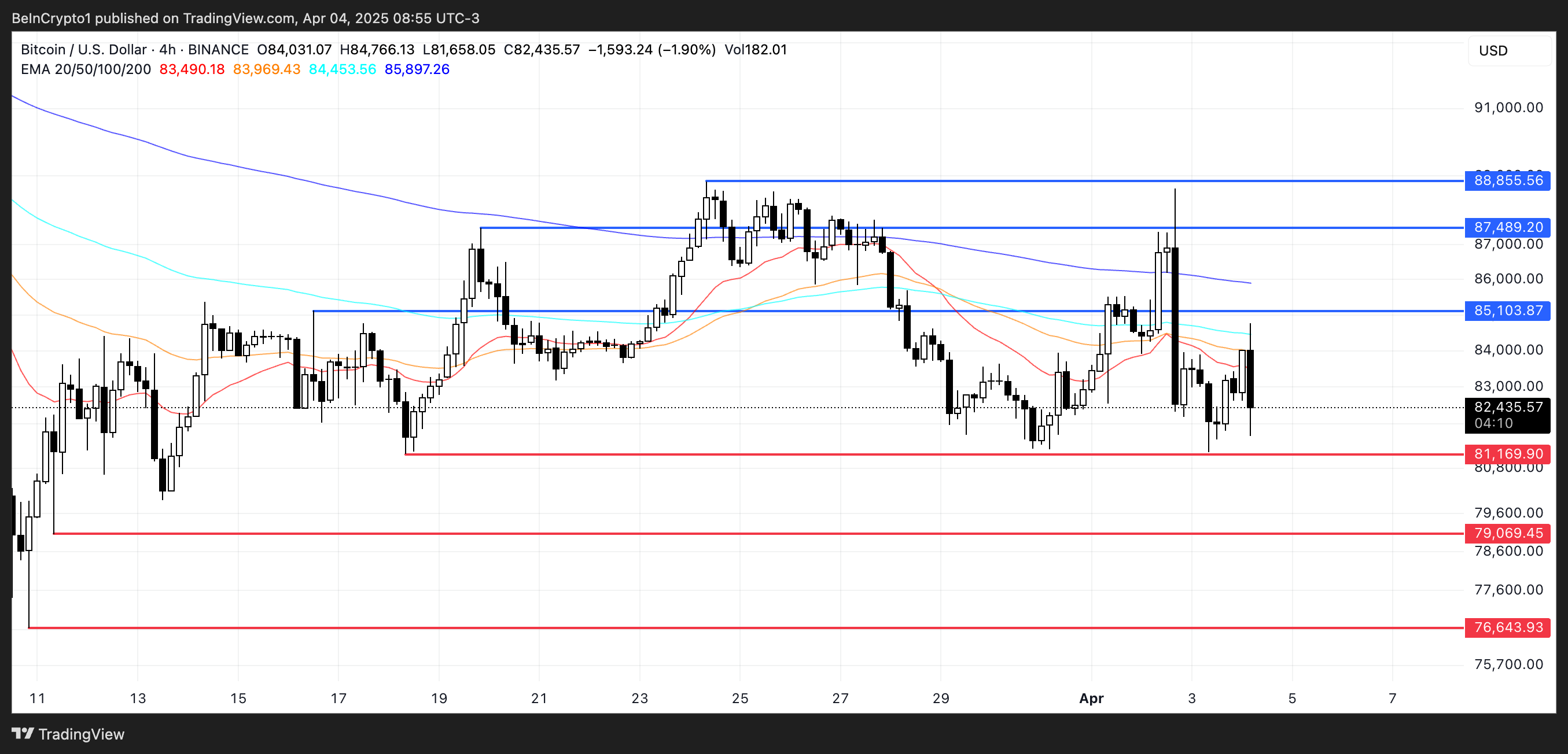

Bitcoin’s EMA structure still leans bearish overall, with longer-term EMAs positioned above the shorter-term ones. However, the recent upward movement in the short-term EMAs suggests that a rebound could be forming.

If this short-term strength develops into a sustained move, Bitcoin could first test the resistance at $85,103. A successful break above this level may signal a shift in momentum, opening the door to higher targets at $87,489. Recently, Standard Chartered predicted that BTC is likely to break $88,500 this weekend.

If bullish pressure remains strong beyond that point, Bitcoin price could push even further to challenge $88,855, a level that would mark a more convincing recovery from the recent pullback.

“(…) After Wednesday’s volatility, BTC has rebounded more than 4% and remains firmly above $79,000, with a key support level forming at $80,000 and slightly higher daily exchange volumes, which is a positive sign. On top of this, Bitcoin ETF flows suggest sentiment remains strong, with $220 million inflows on “Tariff Day”, April 2.,” Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau, told BeInCrypto.

However, if Bitcoin fails to build enough momentum for this rebound, downside risks remain. The first key level to watch is the support at $81,169.

As the trade war between China and the US escalates, a drop below this level could see BTC falling under the psychological $80,000 mark, with the next target around $79,069. If this zone is also lost, the bearish trend could intensify, sending BTC further down toward $76,643.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is Korea Propping Up The XRP Price? Pundit Explains What’s Happening

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A crypto analyst has shared insights into the recent strength in the XRP price, suggesting that South Korea may be the reason behind it. The analyst noted that the altcoin has been seeing high trading volume on South Korean exchanges, and this localized demand may be holding up its price while other altcoins struggle to gain traction.

How South Korea Is Bolstering The Price

According to XForceGlobal South Korea is currently one of the major drivers of the XRP price action. In a recent post on X (formerly Twitter), the analyst disclosed that the engagement and adoption from the crypto users in South Korea was a major contributor to XRP’s bullish performance.

Related Reading

Currently, South Korea is one of the most active crypto markets in the world, leading in global trading volume across multiple assets. However, among the numerous cryptocurrencies in the market, XRP stands out the most within the country. The analyst has revealed that even during low trading days, XRP frequently outpaces Bitcoin, underscoring its high demand and adoption in South Korea.

XForceGlobal has suggested that South Korea’s notable interest in XRP likely stems from its status as one of the most isolated countries in terms of crypto regulations. The analyst revealed that millions of citizens currently own the altcoin, making up about 20% of the cryptocurrency’s market cap valuation.

Moreover, due to a lack of large-scale cross-border payment solutions, most South Koreans opt to use cryptocurrencies like XRP to facilitate transactions. This, in turn, fuels adoption and strengthens the cryptocurrency’s utility, which positively influences its price action.

Compared to South Korea, the regulatory uncertainties and legal challenges in the United States (US) have slowed down XRP’s growth. XForceGlobal has stated that the active participation of retail institutions, strong community support, and early adoption in South Korea have helped prop up prices despite the difficulties it faced over the past years.

What The Future Holds For XRP In South Korea

While discussing the impact of South Korea’s support for XRP on its price action, XForceGlobal offered insights into the cryptocurrency’s future in the country. The analyst revealed that the market is at a pivotal moment where XRP has evolved from a speculative asset to a symbol of Korea’s dominance in the crypto market.

Related Reading

Currently, Upbit, the largest crypto exchange in South Korea, holds the most significant market share of XRP in terms of total supply. The exchange reportedly has about 6 billion XRP, accounting for roughly 5% of the entire supply.

XForceGlobal has revealed that the continued demand from retail investors combined with Upbit’s massive XRP reserve will make South Korea a key driver to the cryptocurrency’s global future price action.

Moving forward, the analyst has discussed XRP’s price movements on the Korean won chart, suggesting that its current action may be foreshadowing upcoming events. He pointed out that the altcoin has already formed a lower low on the chart, possibly hinting at a more controlled pullback rather than an impulsive decline — an outlook he described as “arguably bearish”.

The crypto analyst also noted that XRP may be forming a potential bottom on the Korean won chart, indicating a possible impulse to the upside and a bullish continuation.

Featured image from Adobe Stock, chart from Tradingview.com

Market

Crypto Whales Are Selling These Altcoins Post Trump Tariffs

Crypto whales have begun to quietly shift their altcoin positions following Trump’s Liberation Day tariffs. Uniswap (UNI), Chainlink (LINK), and Ondo Finance (ONDO) have all seen declines in the number of wallets holding between 10,000 and 100,000 tokens.

While the sell-off hasn’t been dramatic, the timing and consistency across multiple tokens suggest growing caution or short-term repositioning. As these altcoins face key support and resistance levels, whale behavior could continue to shape their price trajectories in the coming days.

Uniswap (UNI)

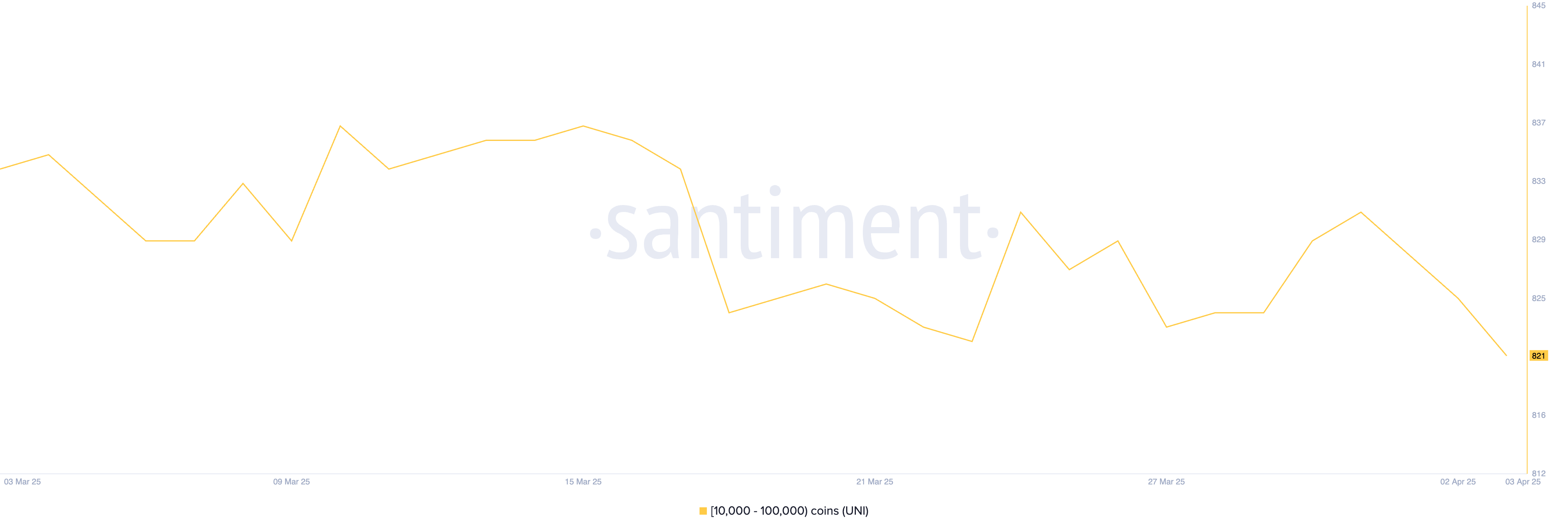

The number of Uniswap (UNI) addresses holding between 10,000 and 100,000 tokens has been steadily declining, a trend that began before Trump’s so-called Liberation Day and has continued in its aftermath.

Between April 2 and April 3 alone, this group of crypto whales dropped from 825 to 821, signaling a slight but notable reduction in confidence or positioning from a segment often seen as strategically reactive.

While this decline may seem modest, it reflects a broader sentiment of caution among larger UNI holders, which often precedes or reinforces price weaknesses.

Currently, UNI price remains in a clear downtrend, with growing risks of a drop toward the $5.50 level or even below it if bearish momentum continues. However, if the trend begins to reverse, the token could first test resistance at $5.97.

A successful breakout from there could push Uniswap higher toward $6.23, a level that would suggest a stronger recovery is underway.

For now, though, the decrease in whale-sized wallets and prevailing bearish momentum place the asset in a vulnerable technical position.

Chainlink (LINK)

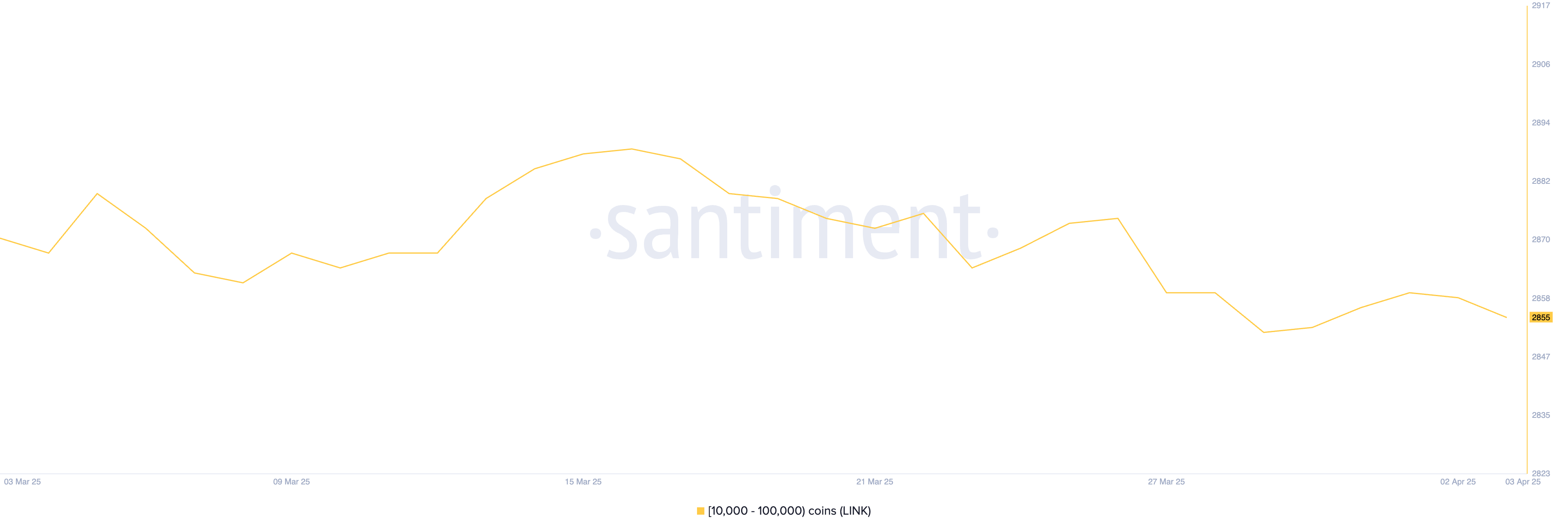

While the number of Chainlink (LINK) whale addresses—those holding between 10,000 and 100,000 LINK—only slightly declined after Trump’s Liberation Day, falling from 2,859 to 2,855, the context leading up to that matters more.

From March 29 to April 1, this group was actively accumulating, with the number of crypto whales rising from 2,852 to 2,860. This short burst of accumulation suggested growing confidence in LINK’s upside potential heading into the month.

The recent dip may simply reflect mild profit-taking or caution during the current correction rather than a broader shift in sentiment.

Technically, LINK is at a critical point. If the ongoing correction deepens, the token could fall below $12 for the first time since November 2024, with $11.85 as the key support to watch.

However, if the trend shifts and buyers regain control, LINK could first test resistance at $13. A break above that level would likely open the door for a move toward $13.45.

Ondo Finance (ONDO)

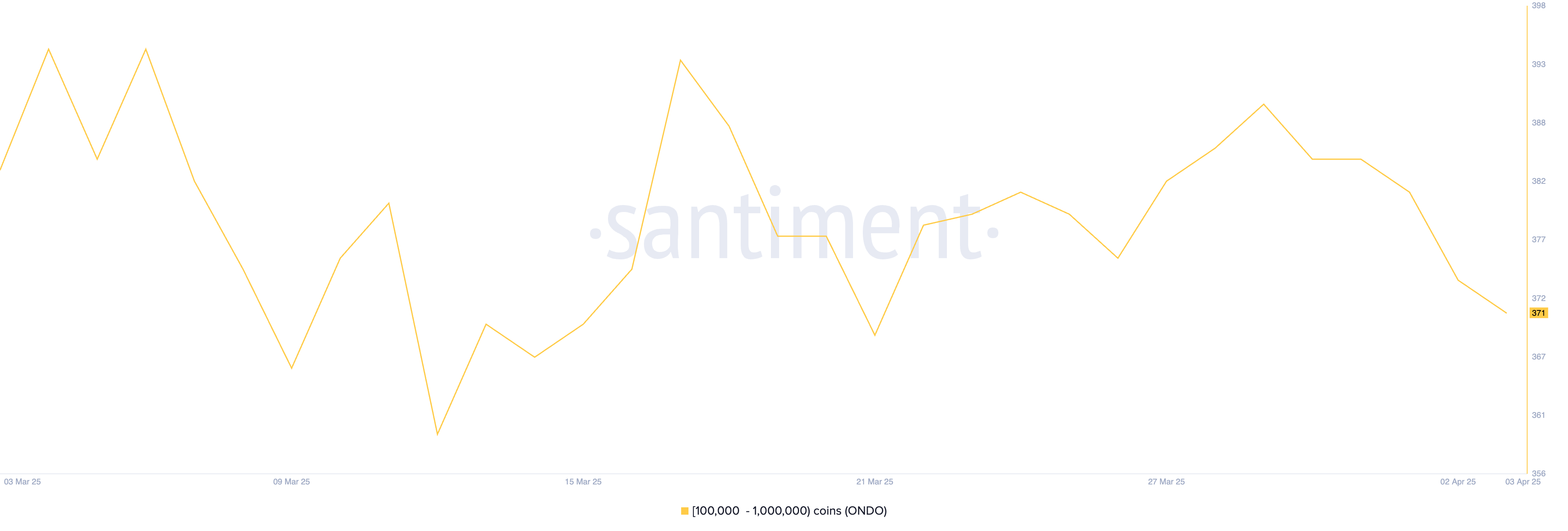

ONDO is showing a trend similar to Chainlink, with whale accumulation taking place between March 26 and March 29 as the number of addresses holding between 10,000 and 100,000 ONDO grew from 376 to 390.

This wave of accumulation pointed to growing interest and confidence from larger holders. However, after peaking, the number of whales started to drop, falling from 374 to 371 following Trump’s Liberation Day.

This decline, while subtle, may indicate a pause in optimism or a cautious shift in positioning among key players.

From a price perspective, ONDO now sits at an important moment. If it can regain the bullish momentum seen last month, it could push through the resistance at $0.82, with the potential to climb further toward $0.90 or even $0.95 if strength persists.

However, if momentum continues to fade, downside risks increase, with support levels around $0.76 and $0.73 likely to be tested.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoStandard Chartered Calls for Bitcoin Push Above $88,500

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin Drops as China Escalates Trade War With 34% Tariff on US

-

Market21 hours ago

Market21 hours agoBitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

-

Market18 hours ago

Market18 hours agoWill the SEC Approve Grayscale’s Solana ETF?

-

Bitcoin20 hours ago

Bitcoin20 hours agoWhy Bitcoin Is Gaining Appeal Amid Falling US Treasury Yields

-

Altcoin13 hours ago

Altcoin13 hours agoAnalyst Predicts XRP Price To Reach Double Digits By July 21 Cycle Peak

-

Market19 hours ago

Market19 hours agoXRP Price Vulnerable To Falling Below $2 After 18% Decline

-

Market17 hours ago

Market17 hours agoPENDLE Token Outperforms BTC and ETH with a 10% Rally