Market

Crypto Whales Load Up on These 3 Altcoins: August 2024

Despite a relatively choppy market, crypto whales still splashed their cash on some altcoins this week. According to BeInCrypto’s analysis, their choices suggest optimism that the broader market could experience a substantial recovery soon.

Here is a list of the altcoins crypto whales bought in the second week of August 2024.

Litecoin (LTC)

First on the list is Litecoin (LTC), developed as a lighter version of Bitcoin (BTC). According to IntoTheBlock, LTC’s Large Holders Netflow saw a substantial increase over the last seven days.

Large Holders Netflow tracks the activity of addresses holding 1% or more of the total circulating supply. A decrease in this figure indicates that whales are distributing more coins than they are accumulating. Conversely, the recent increase in August 2024 suggests that crypto whales accumulated more LTC than they sold.

Typically, when whales increase their holdings, it positively impacts the price of the underlying asset as it signals confidence in future price growth.

Read more: Top 9 Safest Crypto Exchanges in 2024

That has been the case with Litecoin. Currently trading at $65.50, this price marks an 8.82% increase over the past week. If crypto whales maintain their buying momentum into the coming week, LTC’s price could extend its recent gains.

Polygon (MATIC)

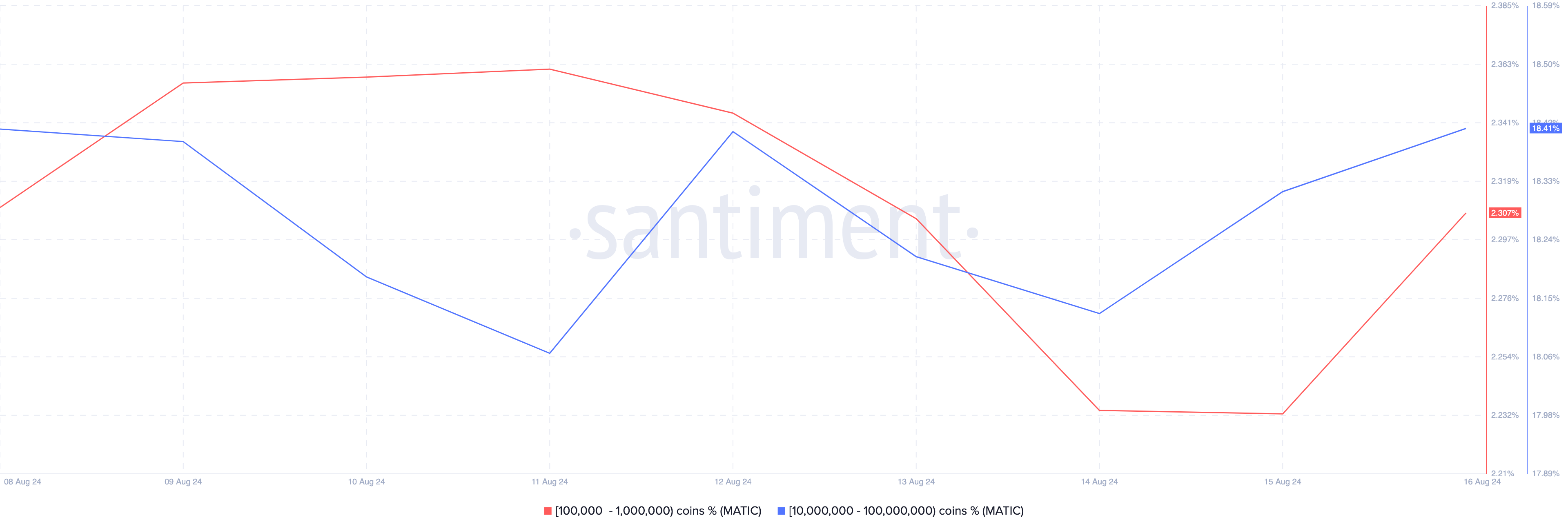

It might be surprising to see Polygon (MATIC) among the altcoins crypto whales buying, given its relatively lackluster performance compared to others in the same category.

However, on-chain data from Santiment confirms that whales have indeed been accumulating MATIC. The balance of addresses holding 100,000 to 1 million tokens has increased, as has the balance of the 10 million to 100 million cohort, who also added to their holdings.

It seems crypto whales are buying into MATIC ahead of the upcoming migration from MATIC to POL, which is scheduled for September 4. This anticipated transition could be driving interest in the token.

The long-awaited upgrade will see POL replace MATIC and become the native gas on the aggregated Polygon network. Despite the large accumulation, the MATIC price failed to notice a significant increase, decreasing by 4.72% this week.

Avalanche (AVAX)

Last on the list is AVAX, the native token of the Avalanche smart contract blockchain. Similar to Litecoin, AVAX’s Large Holders Netflow saw a significant 36% increase, indicating that whales have accumulated a substantial amount of the token.

At press time, AVAX’s price has dropped by 3.18% in the last 24 hours. This decline could be tied to the upcoming token unlock scheduled for August 19. Token unlocks typically increase the circulating supply, which can lead to selling pressure and a temporary dip in price.

Read more: Which Are the Best Altcoins To Invest in August 2024?

However, if whales continue to accumulate the token after the unlock event, AVAX’s price could stabilize and potentially see a rebound.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Climbs, But Key Indicators Still Flash Bearish

Ethereum (ETH) dipped over 7% in the last 24 hours despite Trump’s 90-day tariff pause. Key technical indicators suggest that a full trend reversal might be unlikely in the short term.

The BBTrend remains strongly negative, and whale accumulation has stalled, both signaling caution. Combined with a still-bearish EMA structure, Ethereum may need a stronger wave of buying pressure before it can break out of its current downtrend.

ETH BBTrend Is Strongly Negative But Bigger Than Yesterday

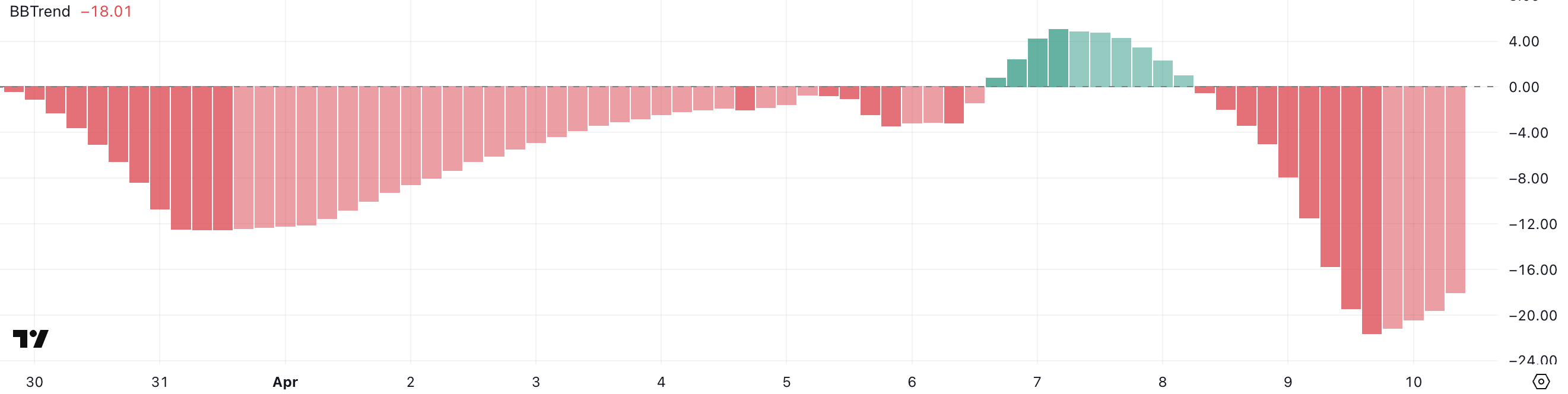

Ethereum’s BBTrend indicator has slightly improved, currently reading -18, up from -21.59 just before Trump’s tariff pause announcement.

This shift suggests that bearish momentum may be starting to fade, although it still signals overall downside pressure. The BBTrend (Band-Based Trend) is a volatility-based indicator that helps gauge the strength and direction of a trend using the relationship between price and Bollinger Bands.

Values above zero indicate bullish momentum, while negative values point to bearish trends—the further from zero, the stronger the directional conviction.

ETH’s BBTrend has remained in negative territory since April 8, reflecting sustained weakness in recent sessions. While the recent uptick could hint at early stabilization, the current value of -18 suggests Ethereum hasn’t yet flipped the broader trend.

For bullish confirmation, ETH would need to push BBTrend back toward neutral or positive territory, ideally supported by volume and strong price action.

Until then, the chart points to a market still in correction mode but with some signs of possible reversal ahead.

Whales Are Still Not Accumulating

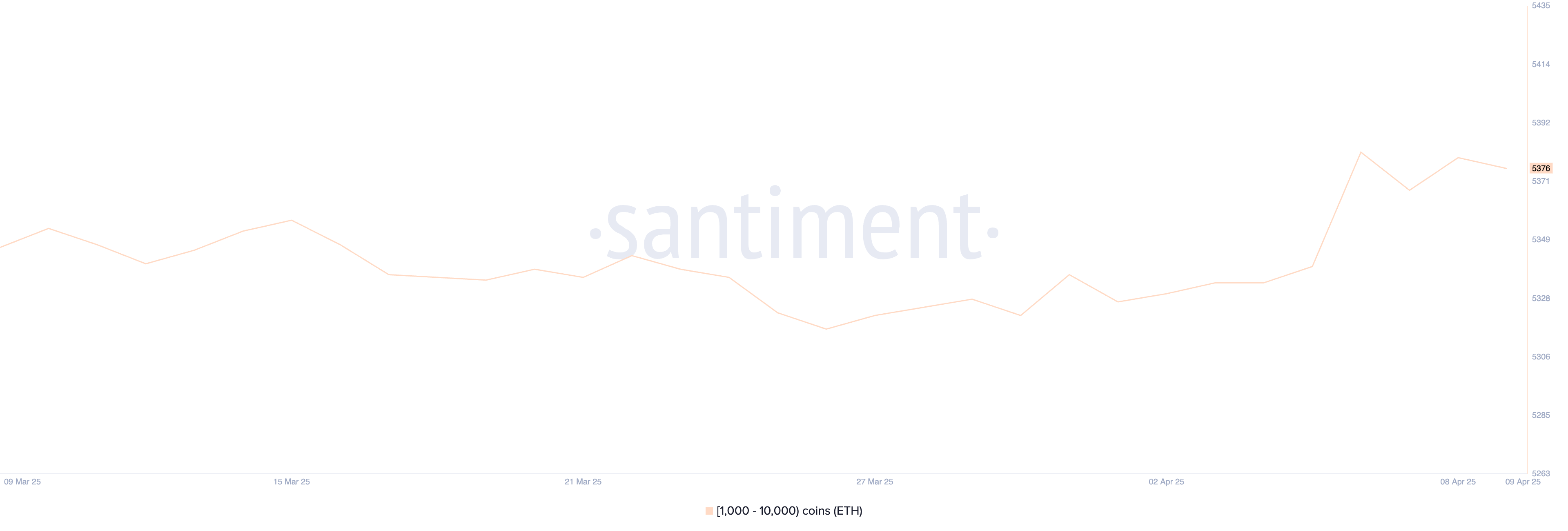

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—rose from 5,340 to 5,382 between April 5 and 6, marking a brief uptick in accumulation.

However, the metric has since stabilized and currently sits at 5,376, showing little change in recent days.

Tracking whale activity is critical because these large holders often have the influence to move markets, either by initiating big buys during dips or selling into strength to take profits.

The recent stabilization in whale numbers suggests a wait-and-see approach from major holders. After a brief accumulation spike, whales appear to be holding their positions rather than aggressively buying or selling.

This could mean that confidence is returning but not yet strong enough to fuel a major breakout.

For Ethereum to see sustained upward momentum, a renewed rise in whale accumulation would be a positive signal, indicating growing conviction from the largest players in the market.

Is The Current Ethereum Surge Just Temporary?

Despite Ethereum’s recent bounce following Trump’s tariff pause, its EMA structure remains bearish, with short-term moving averages still positioned below the longer-term ones.

This lagging alignment typically reflects continued downside pressure, even during relief rallies.

When viewed alongside other indicators—like the still-negative BBTrend and stagnant whale accumulation—it becomes clear that Ethereum needs significantly more buying volume to shift into a confirmed uptrend.

If that bullish pressure does emerge, Ethereum’s price could aim to test resistance at $1,749, and a breakout there could open the path to $1,954 and even $2,104. That could be driven by macro developments, like the SEC’s recent approval of options trading on BlackRock’s Ethereum ETF.

However, if momentum fades, the price risks entering another correction phase.

Key support lies at $1,412, and if that level fails, ETH could slip below $1,400 and potentially revisit sub-$1,300 territory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Price Surge Signals a Potential Breakout

The value of Cardano’s ADA has soared nearly 10% in the past 24 hours, joining the broader crypto market in a strong recovery rally.

The coin’s technical indicators point to renewed bullish momentum, suggesting that ADA may be gearing up for further gains in the near term.

Cardano Gathers Steam with an 8% Gain

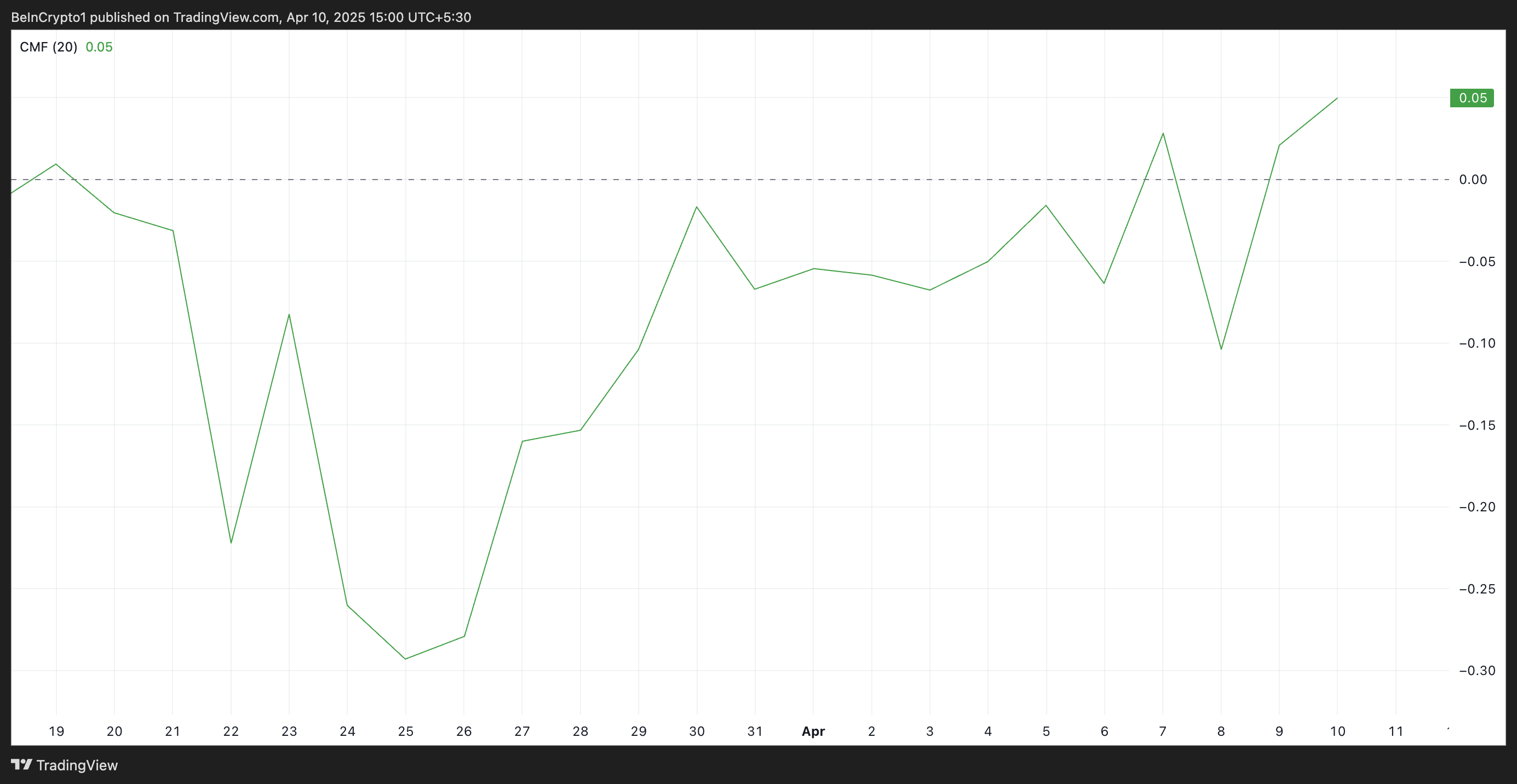

ADA is up 8% over the past day, with its recent price action hinting at growing investor confidence. A key factor supporting this upward trajectory is the rise in its Chaikin Money Flow (CMF), signaling increased capital inflow and accumulation.

At press time, this indicator, which measures the flow of money into and out of an asset, rests above the zero line at 0.05 and is in an uptrend.

An asset’s positive CMF reading indicates that buying pressure is stronger than selling pressure, suggesting accumulation. This signals growing bullish sentiment in the ADA spot markets as more investors buy the altcoin.

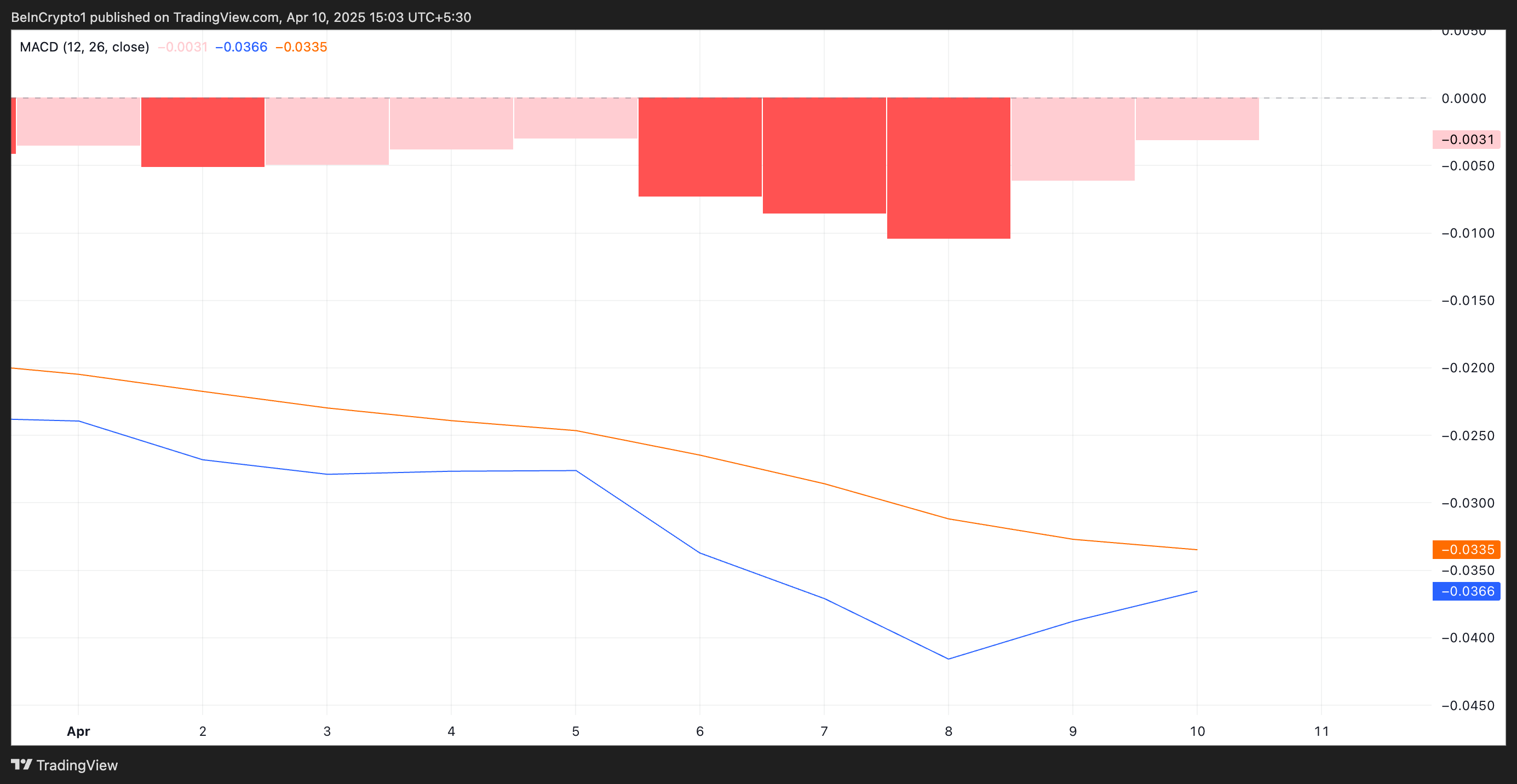

Additionally, ADA’s Moving Average Convergence Divergence (MACD) is approaching a potential golden cross—a historically bullish indicator that occurs when the MACD line (blue) crosses above the signal line.

The MACD indicator measures asset price trends and identifies reversal points. When a potential golden cross emerges, it hints at an upcoming bullish crossover, often seen as an early indicator of upward momentum.

This suggests that ADA’s short-term price strength is increasing, which, if confirmed, could lead to a sustained price rally.

Cardano Bulls Eye $0.76 as Buying Pressure Mounts

A combined reading of these bullish signals reflects strong buying pressure behind ADA, with traders potentially anticipating a breakout. If momentum continues to build, ADA could soon challenge and surpass the resistance level at $0.64.

A break above this barrier may open the door for an extended rally, especially if broader market sentiment remains supportive. In that case, the coin’s price could reach $0.76.

On the other hand, if ADA loses its bullish momentum, it could drop to $0.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

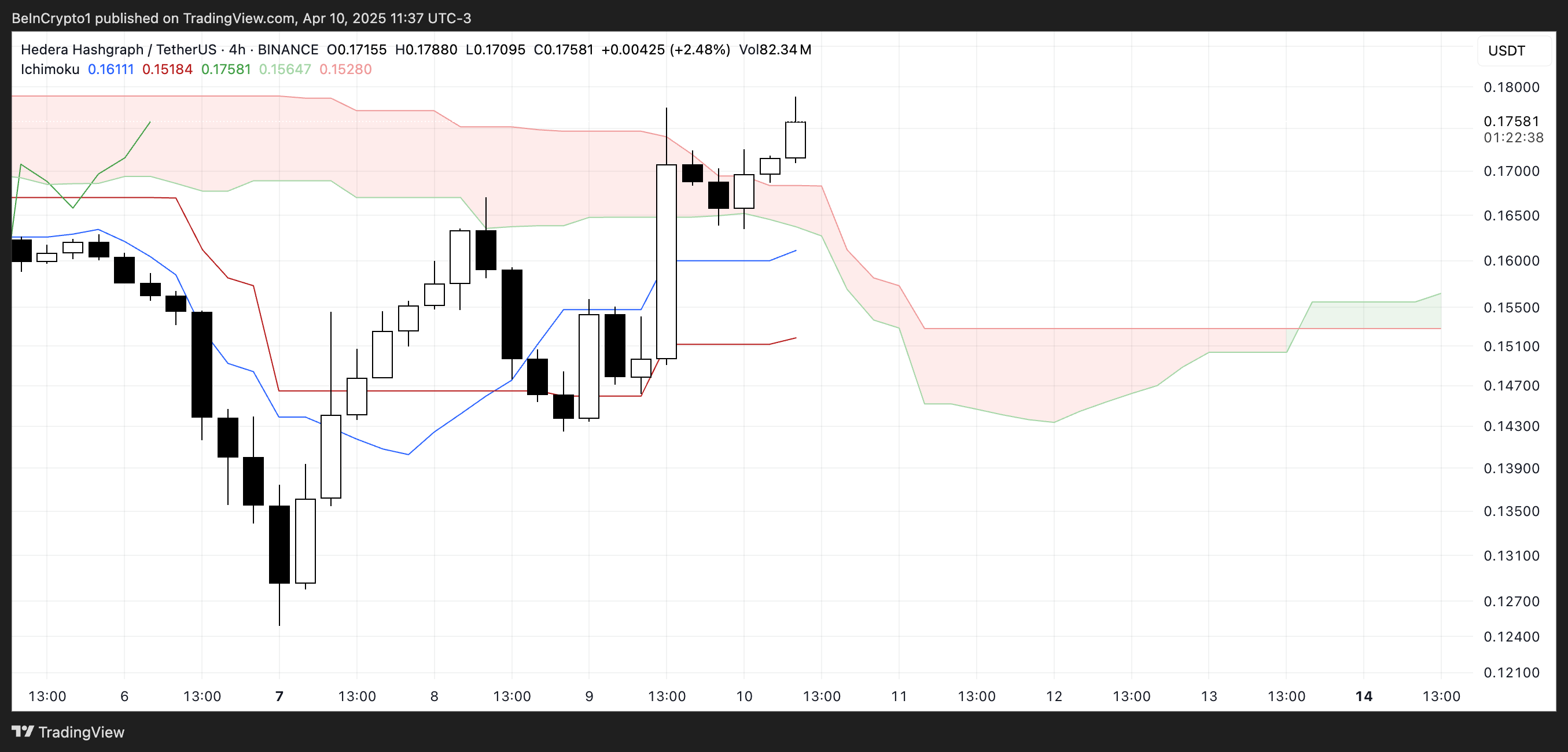

Hedera (HBAR) Jumps 14%—More Gains Ahead?

Hedera (HBAR) has recovered over 5% in the past week. Despite some corrections today, multiple technical indicators flash bullish signals, suggesting a potential shift in momentum.

The DMI shows buyers firmly in control, the Ichimoku Cloud has flipped bullish, and a golden cross appears close to forming on the EMA lines. With key resistance levels approaching, HBAR could be gearing up for an extended move—if the current momentum holds.

HBAR DMI Shows Buyers Are In Full Control

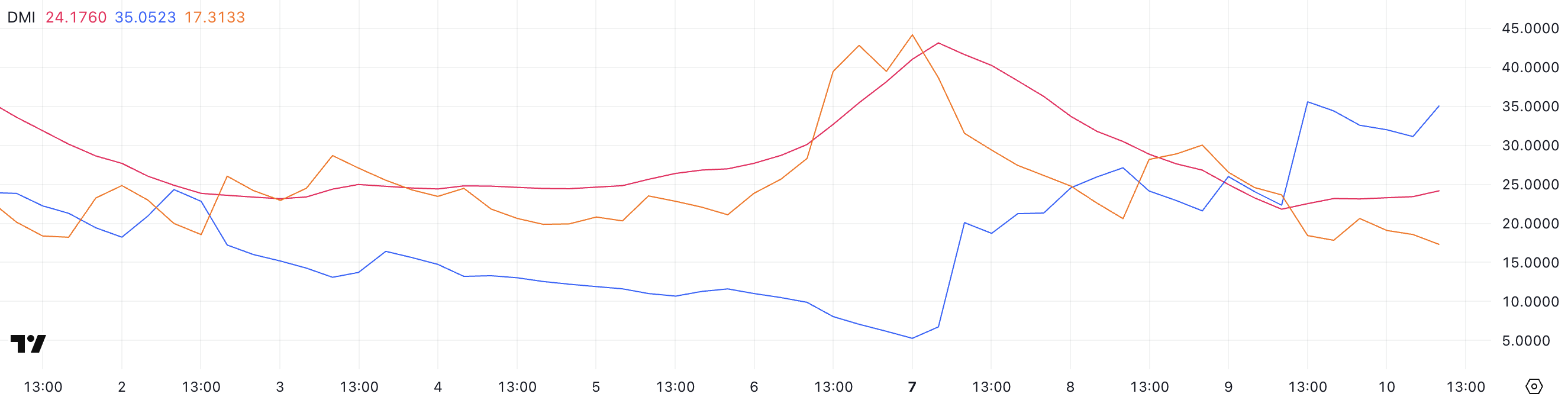

Hedera’s DMI chart is showing signs of strengthening trend momentum, with the ADX (Average Directional Index) rising to 24.17 from 21.82 just a day ago.

The ADX measures the strength of a trend regardless of its direction. Readings above 25 typically indicate a strong trend, while values between 20 and 25 suggest a trend may be developing.

With the ADX nearing that threshold, Hedera could be preparing for a more decisive move if momentum continues building.

Looking at the directional indicators, the +DI has surged to 35.05 from 22.33, while the -DI has dropped to 17.31 from 23.65. This widening gap between the bullish and bearish pressure signals a strong shift in favor of buyers.

If this setup holds, it could indicate a developing uptrend for HBAR, especially if the ADX continues to climb above 25.

The combination of rising bullish momentum and weakening selling pressure is a positive technical signal, suggesting that Hedera may be gearing up for further upside in the short term.

Hedera Ichimoku Cloud Shows A Bullish Setup

Hedera’s Ichimoku Cloud chart is flashing a bullish signal. After a strong move upward, price action broke above the red cloud (Kumo).

This breakout places the candles above both the Tenkan-sen (blue line) and the Kijun-sen (red line), which is generally seen as a sign of bullish momentum and short-term trend strength.

The cloud ahead has also started to thin, suggesting that resistance may be weakening. If momentum holds, further upside is more achievable.

The Chikou Span (lagging green line) is now positioned above the price candles and the cloud, reinforcing the bullish bias. However, with the cloud still showing a mostly flat and narrow structure, the current trend doesn’t yet show strong continuation signals.

If the price remains above the cloud and the Tenkan-sen continues to lead above the Kijun-sen, Hedera could sustain this upward trajectory.

But traders should watch closely for any signs of a reversal back into or below the cloud, which would weaken the bullish setup.

Hedera Could Surge Soon If The Golden Cross Emerges

Hedera’s EMA lines are tightening, signaling a potential breakout. A golden cross—where short-term EMAs move above long-term ones—appears to be forming, which would typically indicate a bullish trend reversal.

If confirmed, this setup could push Hedera price toward resistance levels at $0.18 and $0.20, and if the momentum holds, even higher targets like $0.21 and $0.258 may come into play.

However, this bullish scenario hinges on a successful break above the immediate resistance. If HBAR fails to clear the $0.18 level, it could trigger a pullback toward the support at $0.168.

Losing that support would likely expose Hedera to further downside. The next key levels are $0.153 and possibly below $0.13 if selling pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin22 hours ago

Bitcoin22 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market21 hours ago

Market21 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Market23 hours ago

Market23 hours agoFBI Ran Dark Web Money Laundering to Track Crypto Criminals

-

Market17 hours ago

Market17 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Traders Pulling Back? ETH’s Open Interest On Binance Sees Continued Decline

-

Market22 hours ago

Market22 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Regulation21 hours ago

Regulation21 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market20 hours ago

Market20 hours agoPaul Atkins Confirmed as SEC Chair, Crypto Rules to Ease