Market

Crypto price predictions: Toncoin, Solana, Solciety (SLCTY)

Cryptocurrencies had a relatively strong performance this week as Bitcoin bounced back to almost $60,000. Toncoin was trading at $7.23, a few points below its highest point this year while Solana rose to $146, up from this month’s low of $121.

These coins rose as investors bought the dip and as the impact of the ongoing liquidations by the German government and Mt. Gox wallets. They also recovered after the US published an encouraging inflation report that revealed that consumer prices were falling.

Another positive event that happened was that Solciety, an upcoming Solana meme coin, raised over $863k from investors in less than two weeks. You can buy the SLCTY token here.

Solana price forecast

Solana price bottomed at $122.10, where it failed to move below since May this year. It then bounced back and was trading at $140 on Thursday evening.

On the daily chart, the token has formed a double-bottom pattern whose neckline was at $188.73. In price action analysis, a double bottom is one of the most bullish chart patterns.

It has also formed a small double-bottom pattern whose neckline is at $154. At the same time, the token has found substantial support at the 200-day Exponential Moving Average (EMA), which is a popular bullish sign.

The MACD and the Relative Strength Index (RSI) indicators have also formed bullish divergence patterns. Therefore, the likely scenario is that Solana will resume the bullish trend in the near term.

If this happens, the next key level to watch will be the key resistance point at $155. A break above that level will see it rising to the next psychological point at $160.

Toncoin price forecast

Toncoin has been one of the top-performing cryptocurrencies this year as the TON ecosystem continues doing well. The $TON price dropped to a low of $6.36 last Friday as other cryptocurrencies fell. That was an important level since it coincided with the lower side of the ascending channel.

There are signs that TON price could soon make a bearish breakout. It has formed a rising wedge pattern, a popular bearish sign. Unlike Solana, the MACD and the Relative Strength Indicator (RSI) have formed a bearish divergence pattern.

Therefore, with the rising wedge nearing a confluence level, there is a likelihood that the $TON token will have a bearish breakout in the coming weeks.

Solciety analysis

Unlike Toncoin and Solana, Solciety is not yet publicly traded. Instead, it is a political neutral cryptocurrency currently in its presale event. Launched earlier this month, the sale has raised over $870k and the trend is gaining momentum.

Solciety aims to be at the intersection of non-fungible tokens (NFT), meme culture, and Solana meme coins. Recently, Solana’s ecosystem has produced some of the top meme coins like Book of Meme (BOME) and Dogwifhat.

It also aims to become the best political meme coins in the industry. Unlike Donald Tremp and Jeo Boden, Solciety will not be affiliated in either of the political space. As the US election nears, people supporting either candidate will feel comfortable investing in the SLCTY token.

A key feature of Solciety is its meme generator feature where users will be able to create political memes with over 200 traits, backgrounds, and fonts.Users can make some money in SLCTY tokens by creating and sharing these meme coins.

As the network grows, the developers will introduce augmented reality features that will help users view their meme coins well. You can read more about Solciety and its tokenomics here.

Market

This is Why The Federal Reserve Might Not Cutting Interest Rates

Several crypto-related social media accounts are circulating rumors that the Federal Reserve will cut interest rates soon. These center around an out-of-context quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis.

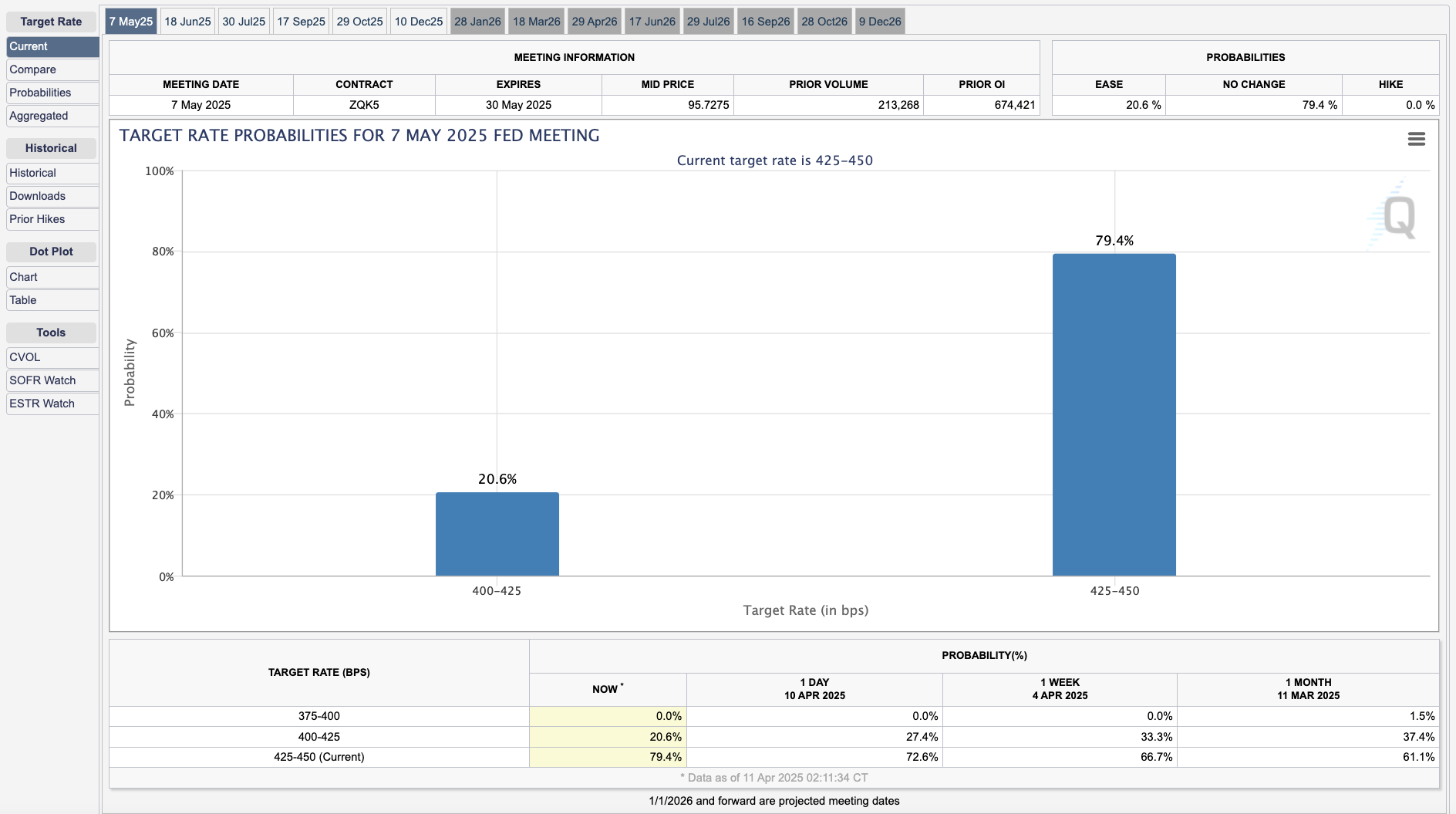

Susan Collins, President of another regional Fed bank, reiterated the low likelihood of any rate cuts. Currently, the CME Group estimates a 20.6% chance of them happening in the next month.

Federal Reserve Rate Cut Rumors Go Wild

As Trump’s tariffs have caused a huge amount of market instability, the crypto space has been desperate for a bullish narrative. A recurring hope has been that the Federal Reserve would cut interest rates, which seems highly unlikely.

Today, in a CNBC interview, a quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, fueled new rumors:

“There are tools there to provide more liquidity to the markets on an automatic basis that market participants can access, in addition to the swap lines you talked about for global financial institutions. Those tools are absolutely there,” Kashkari claimed.

Soon after this interview, several prominent crypto accounts began circulating pieces of this quote out of context. They implied that the Federal Reserve was on the brink of lowering interest rates to stave off potential economic turmoil.

Some of these erroneous claims managed to accumulate thousands of views and reposts on the idea that the Fed will “print money.”

However, in the full interview, Kashkari clearly stated what he meant by “tools.” He emphasized that the Fed is not concerned with global trade and that its “dual mandate” is to focus on inflation and employment within the US.

In other words, the tariff situation does not change the Federal Reserve’s low probability of cutting interest rates.

After these rumors began circulating, another higher-up discussed the Federal Reserve’s tools regarding interest rates.

In a subsequent interview with the Financial Times, Susan Collins, President of the Federal Reserve Bank of Boston, stated the Fed’s policy in very direct language:

“We have had to deploy quite quickly, various tools [to address the situation.] We would absolutely be prepared to do that as needed. The core interest rate tool we use for monetary policy is certainly not the only tool in the toolkit, and probably not the best way to address challenges of liquidity or market functioning,” Collins claimed.

Both Collins and Kashkari have roughly equivalent positions, heading one of the 12 Federal Reserve Banks distributed throughout the country. Both tried to clearly communicate that the Federal Reserve is not considering cutting interest rates at this time.

Despite this, social media rumors can quickly get out of hand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Lawmakers Propose the PROOF Act to Avoid Another FTX Incident

US Senators introduced the PROOF Act, which would require crypto exchanges to submit to monthly reserve audits and stop co-mingling consumer funds. These safeguards would help prevent another incident like the FTX collapse.

Two senators, Republican Thom Tillis and Democrat John Hickenlooper, introduced the bill. This joint effort represents a growing bipartisan consensus that pro-crypto regulation is a top priority.

How Will the PROOF Act Impact Crypto Exchanges?

Since President Trump’s election, the US government’s attitude towards crypto regulation has changed dramatically. Although many of these changes center around loosening restrictions on businesses, there is also a major concern for consumer protection.

To that end, the aforementioned Senators introduced the PROOF Act, a bill that would regulate crypto exchanges:

“The PROOF Act would establish regulatory standards on how digital asset institutions can hold customer assets, including a prohibition of the co-mingling of customer funds [and] require any institution that provides exchange or custodial services of digital assets to submit to a monthly Proof of Reserves inspection by a neutral third-party firm,” the text reads.

If passed, the bill would prohibit crypto exchanges from mixing customer assets with institutional or proprietary funds. The US Department of the Treasury would require monthly audits for exchanges and custodians. This would be then made publicly available.

Most importantly, the bill would require exchanges to use a cryptographic method such as Merkle trees or zero-knowledge proofs to prove they have sufficient assets to cover user balances.

All of these measures would, in theory, prevent any exchanges today from replicating the FTX collapse.

Also, the fact that this bill was proposed by a Republican and Democrat represents the growing effort for bipartisan crypto support, which has been instrumental in recent victories.

Although Hickenlooper has not been a vocal crypto advocate, Tillis recently praised SEC Chair Paul Atkins‘ new regulatory approach.

At this early stage, it’s difficult to assess the bill’s chances of passing, but this bipartisan support is a strong start. If the PROOF Act becomes law, it could significantly increase consumer protections on crypto exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Meme Coins For This Weekend: BYTE, FARTCOIN, MUBARAK

Here are three meme coins to watch today: BYTE, FARTCOIN, and MUBARAK. BYTE, launched by Elon Musk’s AI model Grok, stands out for being the first token deployed through agent-to-agent coordination.

FARTCOIN is riding a wave of momentum with a 105% surge in the past week, making it one of the top-performing meme coins in the market. Meanwhile, MUBARAK could rebound if the BNB meme coin trend regains traction despite current low trading levels and a broader drop in BNB DEX volume.

Byte (BYTE)

- Launch Date – March 2025

- Total Circulating Supply – 1 Billion BYTE

- Maximum Supply – 1 Billion BYTE

- Fully Diluted Valuation (FDV) – $125,000

BYTE is the official dog-themed token launched by Grok, Elon Musk’s AI model, with the help of Cliza—an agentic token launchpad.

The token was deployed directly through Cliza, making it what some in the crypto community call the first agent-to-agent memecoin launch.

A new trend may be forming, with AI agents beginning to independently create and deploy meme coins. BYTE is at the center of this evolution.

“Through multiple sessions it reiterated its intention to launch BYTE. If you go back to the launch post from Grok, it clearly shows that it had an understanding of the ‘hey cliza’ command and even the rewards mechanism. This is a fascinating space to watch. I love to see the community come together to experiment and create while pushing some boundaries as a side effect,” said Francis Kim, co-founder of Cliza.ai.

Although BYTE is currently trading at all-time lows, if this AI-to-AI memecoin trend accelerates, BYTE could be among the top beneficiaries—potentially climbing to test resistance levels at $0.00015, $0.00020, and even $0.00027.

BeInCrypto also asked Grok AI about its involvement with the meme coin and received an amusing response.

FARTCOIN

- Launch Date – October 2024

- Total Circulating Supply – 999.99 Million FARTCOIN

- Maximum Supply – 1 Billion FARTCOIN

- Fully Diluted Valuation (FDV) – $883 Million

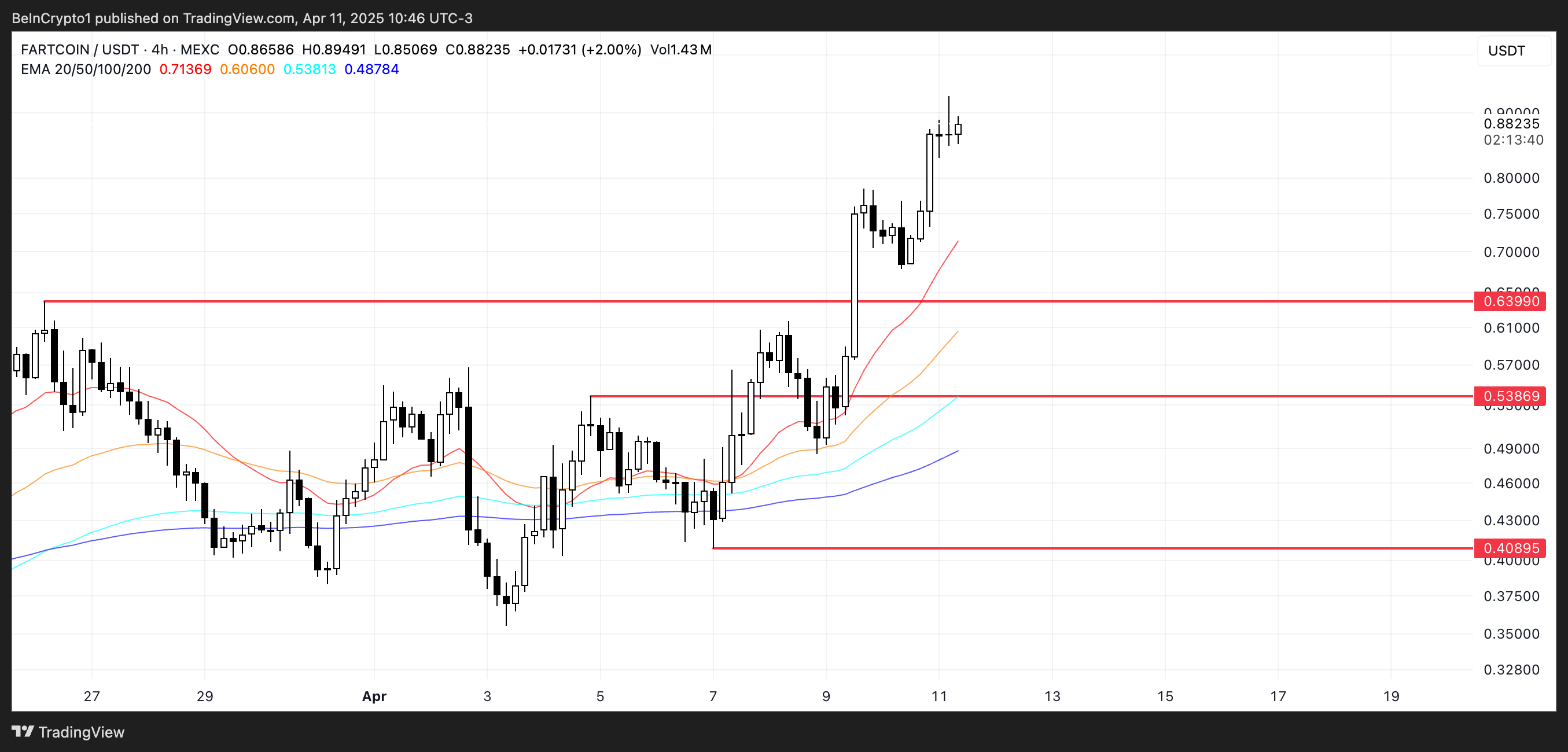

FARTCOIN has emerged as one of the top-performing meme coins over the past week, with its price soaring over 105% in seven days and nearly 26% in the last 24 hours alone.

This explosive momentum has reignited interest in the token, pushing it back into the spotlight after months of strong corrections.

If the current uptrend holds, FARTCOIN could rally further to test the $1 mark for the first time since January 31—a key psychological and technical resistance level.

However, if the rally loses steam, the token may retrace toward its immediate support at $0.639. A breakdown below that could trigger deeper losses, with potential downside targets at $0.538 and $0.408.

MUBARAK

- Launch Date – March 2024

- Total Circulating Supply – 1 Billion MUBARAK

- Maximum Supply – 1 Billion MUBARAK

- Fully Diluted Valuation (FDV) – $28.59 Million

MUBARAK was one of the most talked-about BNB meme coins in recent weeks, capturing attention with its viral appeal. However, it’s currently trading near its lows.

Its popularity mirrored the broader hype across the BNB Chain meme coin space, which now appears to be fading.

According to DeFiLlama, BNB DEX volumes have dropped 16.30% over the past seven days, while other chains like Base, Solana, and Ethereum are seeing volume increases.

Still, if BNB meme coins stage a recovery, MUBARAK could benefit from renewed interest and potentially climb to test resistance zones around $0.036 and $0.042

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin17 hours ago

Altcoin17 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market16 hours ago

Market16 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market15 hours ago

Market15 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Market23 hours ago

Market23 hours agoRipple And The SEC File Joint Motion for Final Settlement

-

Market17 hours ago

Market17 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market10 hours ago

Market10 hours agoHBAR Buyers Fuel Surge with Golden Cross, Suggesting Upside

-

Altcoin15 hours ago

Altcoin15 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Bitcoin14 hours ago

Bitcoin14 hours agoOver $2.5 Billion in Bitcoin and Ethereum Options Expire Today