Market

Crypto Market Fear Grows as Trump Announces New Tariffs

Trump announces new tariffs against Canada, striking a tough posture against its northern neighbor’s defiant attitude. Trump reiterated his call that the US annex Canada outright, thereby ending its independence.

Like previous announcements, this threat could be explosive for the crypto markets, but the tariffs may be priced in or not take effect. The more pertinent question is whether the US is about to enter a recession.

Trump Gets Tough on Canada Tariffs

President Trump’s planned tariffs have been wreaking havoc on the crypto market, and it looks like they aren’t done yet. At the beginning of February, Canada and Mexico managed to postpone them, significantly helping the crypto market. However, Trump is following through and is placing a new tariff on Canada:

“Based on Ontario, Canada, placing a 25% Tariff on ‘Electricity’ coming into the United States, I have instructed my Secretary of Commerce to add an ADDITIONAL 25% Tariff, to 50%, on all Steel and Aluminum coming into the US from Canada. This will go into effect tomorrow morning, March 12,” Trump claimed on social media.

Trump slightly edited the announcement after first posting it, clarifying that tariffs on Canada have a clear deadline. Trump also pointed to several other priorities in US-Canada relations: dairy sales, automobile manufacturing, military spending, and more. He finished with another call that the US should annex Canada outright.

This last demand, a complete end to Canada’s national autonomy, has been a particular sticking point in the tariff saga. After the US passed tariffs against China, the nation retaliated with a few tariffs of its own.

Canada also retaliated, and this tough posture created a fresh wave of support for its ruling party.

This popularity surge is especially important. It prompted harsher rhetoric on Canada’s part, and Trump has responded in kind. With his new offensive, the situation is escalating. It seems difficult to identify a clear off-ramp for both parties.

What does all of this mean for the crypto market? These tariffs have spelled a consistent bearish outcome for the industry, with markets declining alongside fresh announcements.

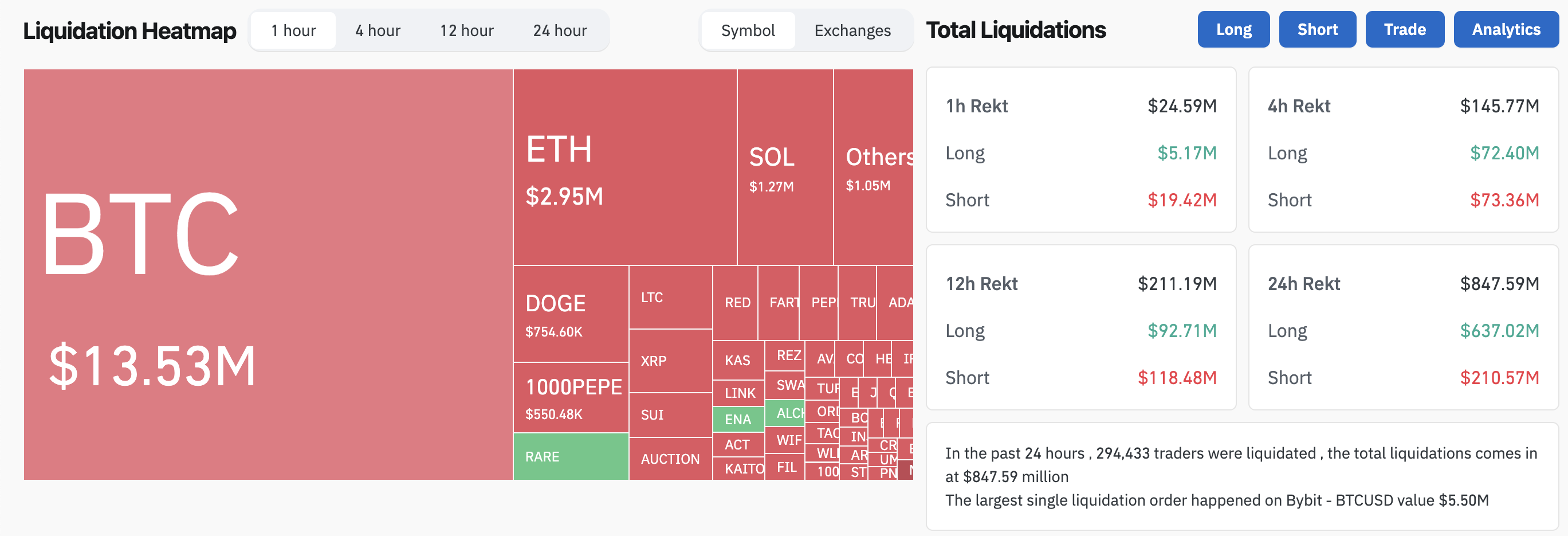

Additionally, crypto liquidations are already high, and Bitcoin’s price is not doing well. New tariffs against Canada could have a severe impact.

However, the market was already falling before Trump announced the new tariffs against Canada. The broader macroeconomic outlook is looking pretty bearish, and these tariffs may not change much on their own.

The crypto community will need to closely follow this situation when/if the tariffs go live tomorrow, and their effects will be more legible then.

Ultimately, “if” is the operant word there. Since Trump already balked from implementing tariffs against Canada and Mexico before, he may blink again.

However, that situation is creating a lot of market uncertainty, which could be much more dangerous than any tariff. If the market loses its confidence, that will definitely affect the crypto market.

The most important question is whether a full-blown recession will happen soon. These tariffs against Canada may or may not actually occur, and if they do, Trump may roll them back within 24 hours.

At this chaotic moment, it’s difficult to say whether any single policy could change everything.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana ETF Delay Fuels Bearish Sentiment, $16M Pulled from SOL

On Tuesday, the US Securities and Exchange Commission (SEC) postponed its decision on multiple altcoin exchange-traded funds (ETFs), including Solana’s.

This development has further dampened investor sentiment toward SOL, which has continued to witness significant spot market outflows.

Solana Investors Exit Amid SEC Delay—$16 Million Pulled Under 24 Hours

In a series of filings made on March 11, the SEC announced its plans to postpone its decision on multiple ETFs tied to major assets, one of which is SOL. According to the regulator, it has “designated a longer period” to review the proposed rule changes that would enable the ETFs to become operational.

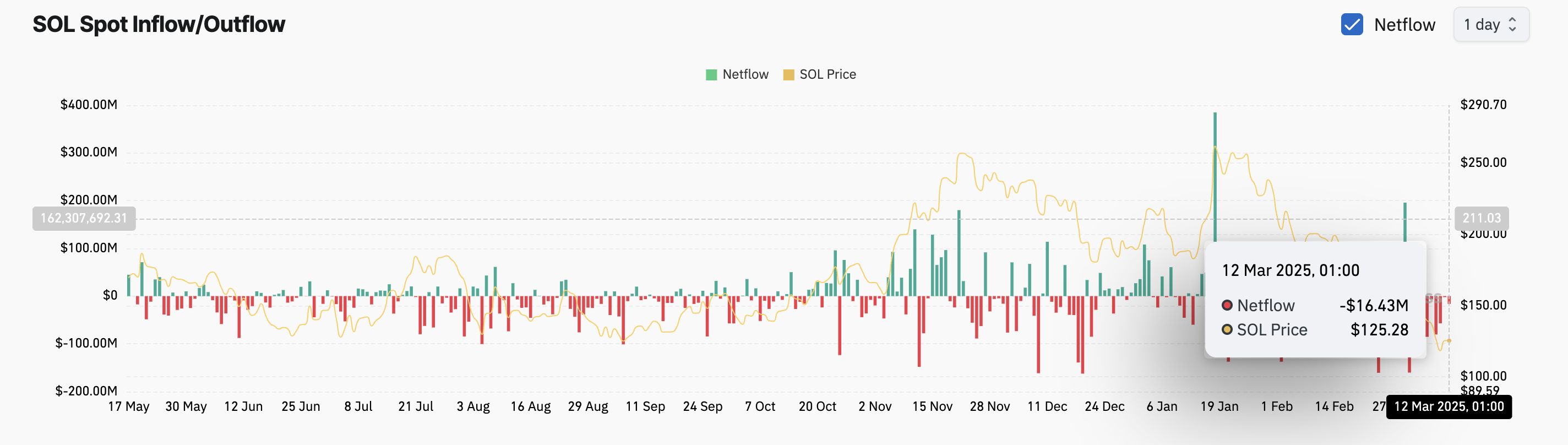

This has exacerbated the bearish sentiment toward SOL, which is reflected in the capital outflows from its spot markets over the past 24 hours. As of this writing, $16.43 million has been removed from the market, marking the seventh day of consecutive outflows, which have now exceeded $250 million.

When an asset experiences spot outflows like this, its investors are selling their holdings. This trend reflects a lack of confidence in SOL’s short-term price recovery, with traders choosing to cash in their accrued gains to prevent further losses on investments.

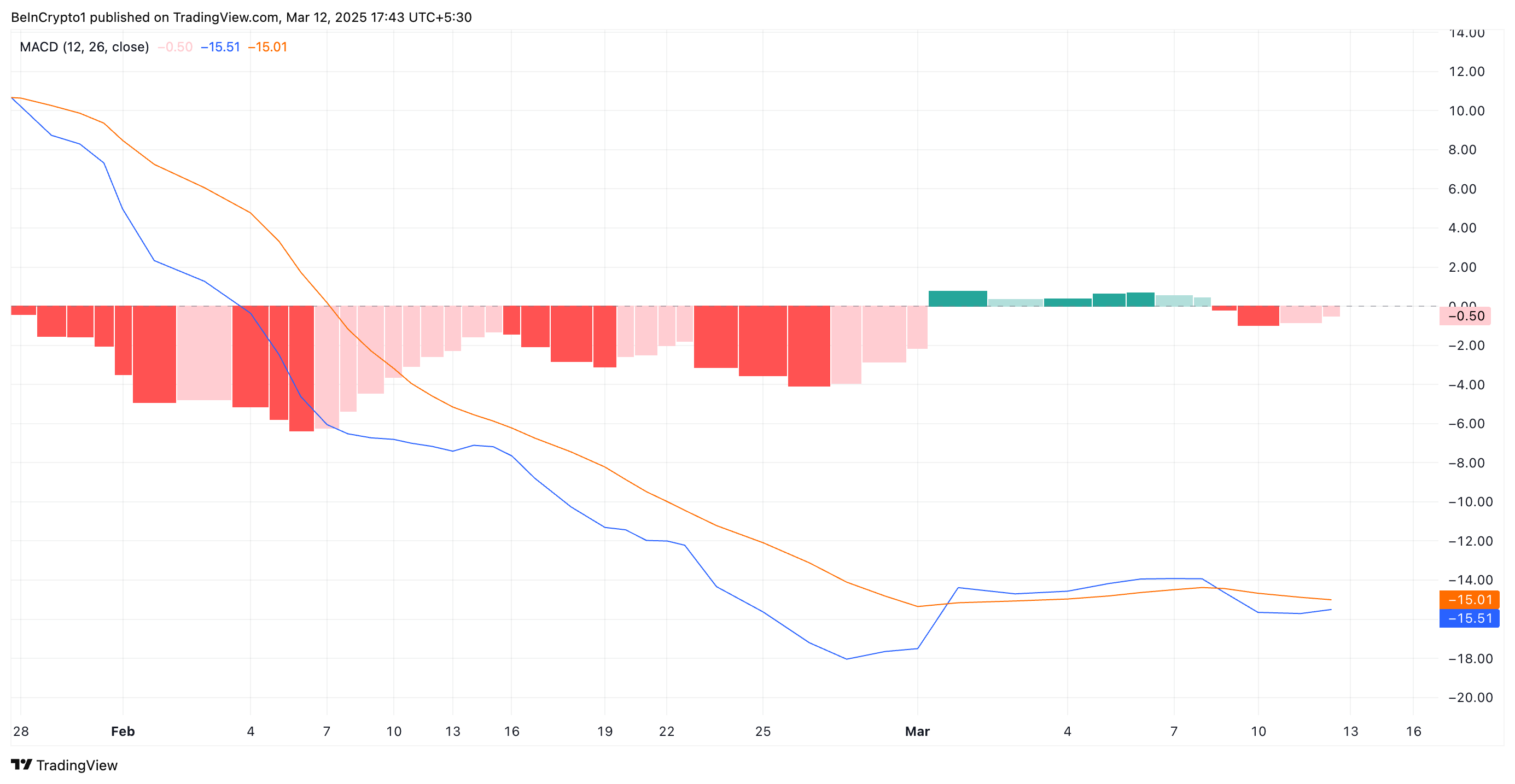

Furthermore, SOL’s Moving Average Convergence Divergence (MACD) indicator, observed on a daily chart, supports this bearish outlook. As of this writing, the coin’s MACD line (blue) is below its signal line (orange).

An asset’s MACD measures its price trends and momentum shifts and identifies potential buy or sell signals based on the crossing of the MACD line, signal line, and changes in the histogram.

When the MACD line rests under the signal line, the market is in a bearish trend. This indicates that SOL selloffs exceed buying activity among market participants, hinting at a further value drop.

Solana at Crossroads: Will SOL Hold $126 or Fall to $110?

SOL trades at $126.82 at press time. With waning buying pressure, it risks falling to $110, a low that it last reached in August 2024.

However, a strong resurgence in buying activity would prevent this. For this to happen, SOL has to establish a strong support flow at $135.22. If successful, it could propel its price to trade at $138.84 and above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Bitcoin Reserve Bills Fail: VeChain Executive Weighs In

In an interview with BeInCrypto, Johnny Garcia, Managing Director of Institutional Growth and Capital Markets at VeChain Foundation, addressed the rejection of Bitcoin (BTC) reserve bills. He emphasized that the core issue goes beyond legislative resistance—highlighting the need for greater education for both the public and policymakers.

His remarks come as five states have already dismissed the legislation. As of now, only 18 states are still considering the possibility of integrating digital assets like Bitcoin into their financial systems.

VeChain’s Executive Weighs In on Bitcoin Reserve Bill Rejections

Garcia pointed out that establishing federal or state Bitcoin reserves could drive innovation by modernizing investment frameworks and enhancing operational capabilities.

“This would bring all the benefits we in crypto are quite familiar with: transparency, immediate settlement, managing counterparty risks—to name a few,” Garcia told BeInCrypto.

Yet, he acknowledged that skepticism persists. Garcia noted that many are still unconvinced about a Bitcoin reserve’s utility and economic sense. The debate becomes even more complex when considering funding sources.

“Not every citizen in a given state will agree with their taxes financing crypto purchases—something they could just do themselves,” he commented.

Thus, Garcia emphasized that states would need to focus on educating their citizens about the purpose and objectives of including Bitcoin in their reserve portfolios. He stressed that while regulatory frameworks are crucial, success hinges on demonstrating real-world value beyond speculation.

“The blockchain/DeFi industry needs to step up and show that it can deliver proven solutions that go beyond speculative investment and offer real-world value,” Garcia remarked

He added that to truly change the minds of political and governmental stakeholders, especially those who are instinctively skeptical of crypto, the solutions must extend beyond financial considerations. The exec emphasized that blockchain technology needs to demonstrate its ability to address a broader range of problems.

Garcia highlighted VeChain as a prime example of how blockchain can tackle both new and ongoing issues. He drew attention to VeChain’s use of blockchain to verify sustainability efforts. Garcia noted that such applications make it harder for lawmakers to ignore the technology’s real-world value beyond finance.

Cryptocurrency Reserve Bill Rejections Don’t Represent a Unified View on Crypto

Meanwhile, Garcia cautioned against viewing the rejections at the state level as blanket opposition to cryptocurrency.

“I wouldn’t say this necessarily reflects deeply ingrained opposition to the concept of crypto in the form of reserves, stockpile, or just another alternative investment option,” he shared with BeInCrypto.

According to Bitcoin Laws, a total of 33 Bitcoin reserve bills were introduced in 23 states. However, Montana, Wyoming, North Dakota, Mississippi, and Pennsylvania have rejected the legislation that would have allowed state investments in digital assets, including Bitcoin.

Currently, there are 27 active bills in 18 states. Importantly, Utah, which was once at the forefront of the Bitcoin reserve race, recently dropped out on a technicality. The Utah bill is still progressing but without the ‘Bitcoin Reserve’ provisions, which have been removed.

Garcia offered a more nuanced view of the legislative resistance. According to him, although several states have voted against reserve bills, the opposition often comes by small margins.

He encouraged assessing the specific reasons behind the rejections rather than generalizing. Gracia also welcomed that states are taking the time to consider the issue carefully.

As states navigate their own approaches to cryptocurrency, momentum is growing at the national level. Senator Lummis has reintroduced the BITCOIN Act. This came shortly after former President Trump signed an executive order to create a strategic Bitcoin reserve funded with seized Bitcoins.

Originally introduced in July 2024, Lummis’ BITCOIN Act failed to pass out of Committee in the Senate.

“I am proud to reintroduce landmark legislation that will codify President Trump’s bold vision to establish the United States Strategic Bitcoin Reserve and strengthening our nation’s economic foundation for generations to come,” Lummis wrote on X.

The bill aims to create a US Strategic Bitcoin Reserve, backed by up to 1 million BTC acquired over five years. Moreover, the holdings would be maintained for at least 20 years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Below $2,000 Triggers Bullish Signal After 2 Years

Ethereum (ETH) has seen a significant decline in price, falling from $2,800 to around $1,900 in recent weeks. This drop has triggered a major bearish signal, the first of its kind in two years.

However, the current price action may also suggest that recovery could be on the horizon.

Ethereum Has A Shot At Recovery

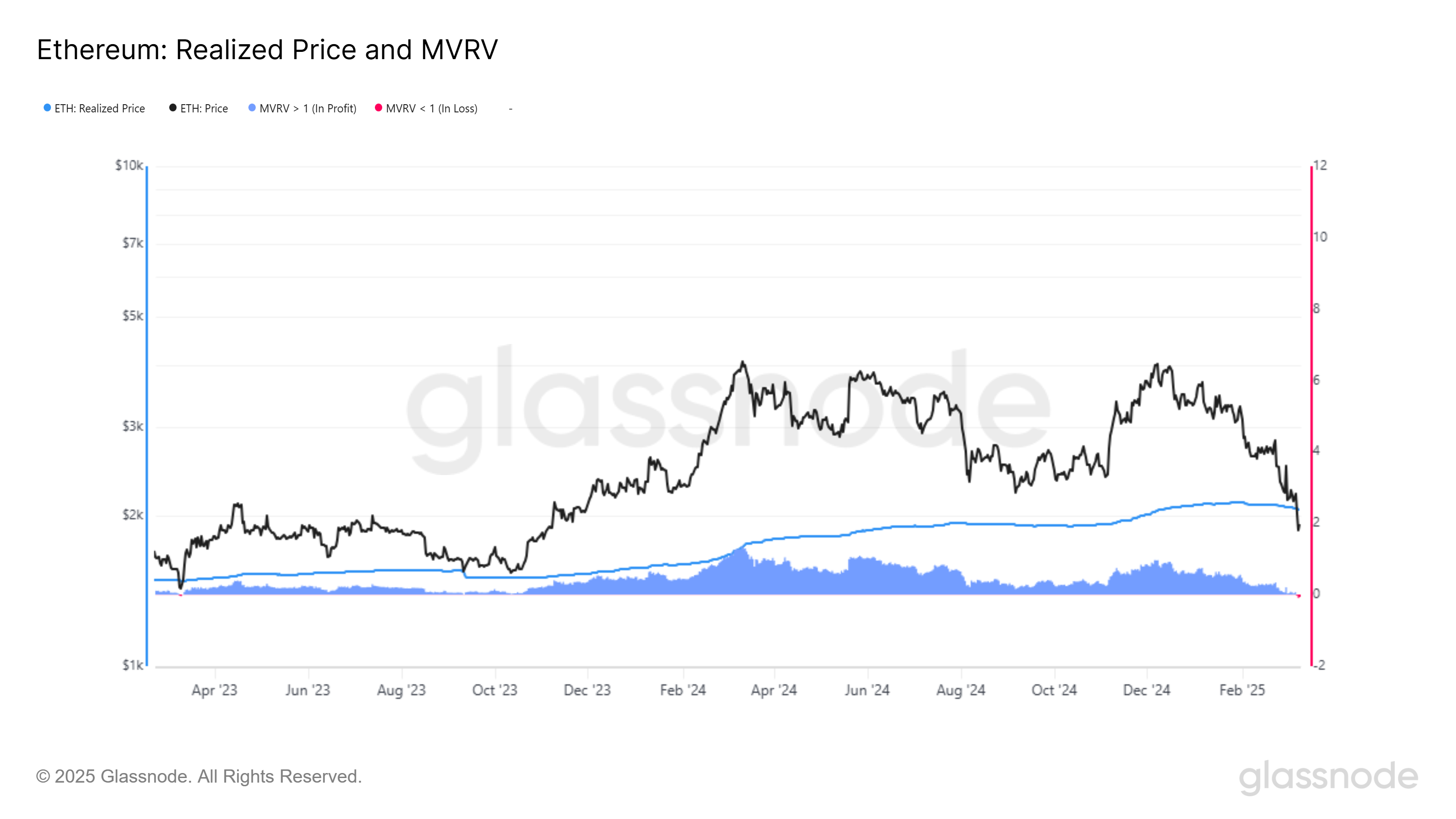

Ethereum’s price recently fell below the Realized Price for the first time in two years, a development that has sparked concern among some investors. This drop has caused the Market Value to Realized Value (MVRV) ratio to decline, indicating that investors are facing approximately 7% losses.

While this may appear bearish at first glance, it actually presents a potential bullish signal. The previous time Ethereum faced this situation, the altcoin rebounded strongly, and the MVRV ratio improved as the price recovered. This pattern has given some market participants hope that the current situation may lead to a similar recovery.

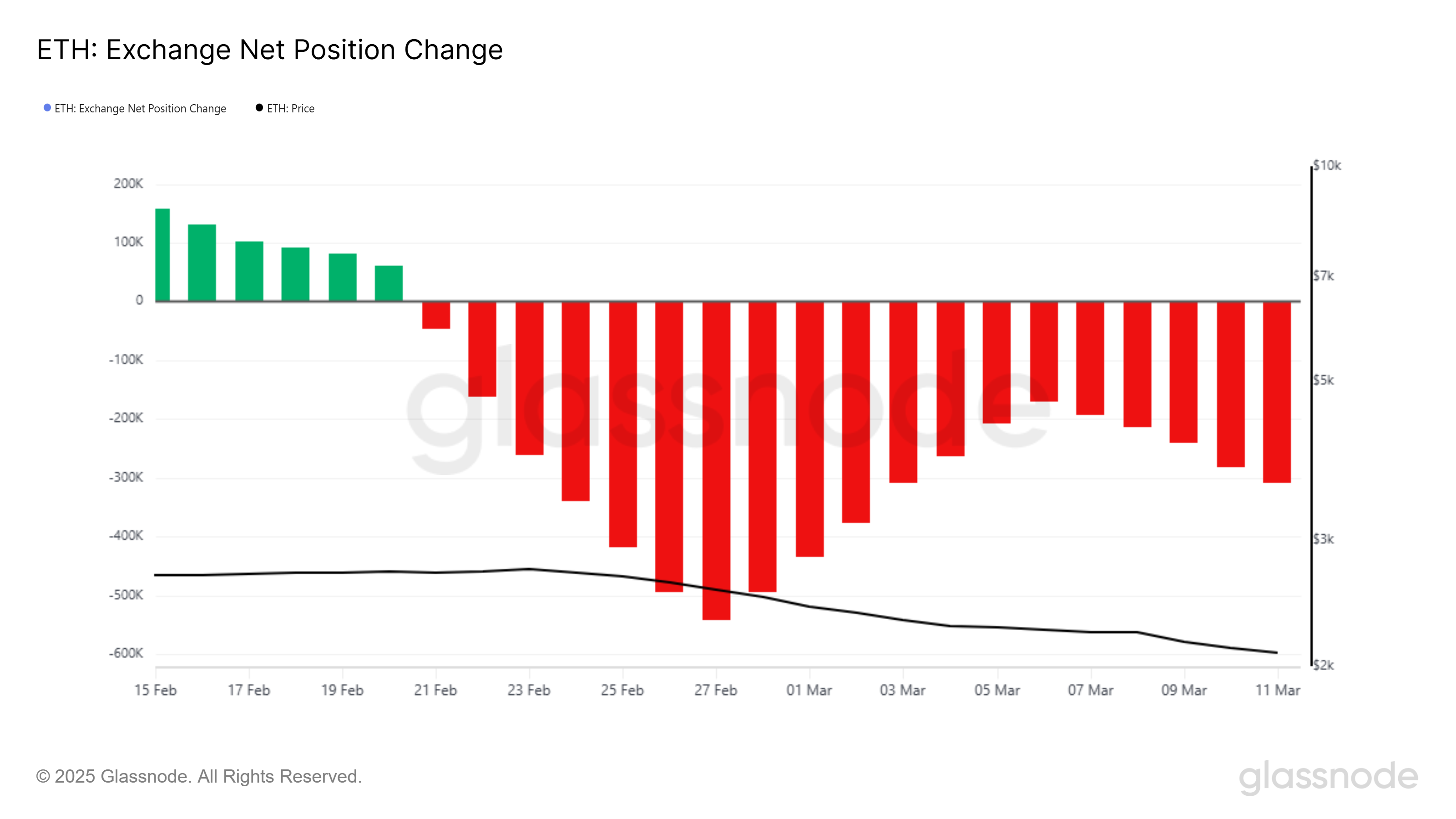

On the macro level, Ethereum’s overall momentum is showing signs of improvement despite the recent downturn. The Exchange Net Position Change, which tracks the flow of ETH into and out of exchanges, has been declining.

This indicates that investors are accumulating Ethereum rather than selling it, which is a positive sign. Investors see the current low prices as an opportunity to buy, anticipating a future price increase.

This shift in investor behavior is reflected in the purchase of 138,000 ETH worth approximately $262 million this week. The inflow of capital into Ethereum supports the idea that many investors are positioning themselves for a rebound.

ETH Price Eyes A Rally

Ethereum is currently trading at $1,897, down 32% over the last two weeks. The altcoin is holding above the support level of $1,862, which could act as a foundation for a potential bounceback. If Ethereum maintains this level, it may find its way to higher prices in the coming weeks.

For Ethereum to confirm a recovery, it must breach and flip $2,141 into support. This level is critical for ETH to move toward $2,344 and secure a more sustained upward movement. The factors discussed, including the RSI recovery and investor accumulation, are likely to contribute to Ethereum’s ability to reach this target.

However, if broader market conditions worsen, Ethereum could fall below the $1,862 support, pushing the price to $1,745 or even $1,625. A drop to these levels would invalidate the bullish outlook and suggest further downside potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoPerpetuals, Made In USA, and Memes

-

Altcoin23 hours ago

Altcoin23 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market22 hours ago

Market22 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market21 hours ago

Market21 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Market24 hours ago

Market24 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Ethereum15 hours ago

Ethereum15 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?