Market

Crypto Investment Outflows Hit $726 Million as US Leads Exodus

Bitcoin (BTC) led last week’s crypto investment outflows, seeing $643 million in negative flows. Ethereum followed with outflows totaling $98 million, while Solana stood out with positive inflows of $6.2 million.

Traders and investors remain uneasy as they brace for key US economic events this week and throughout September, which could significantly impact market sentiment.

Bitcoin At The Forefront of Crypto Investment Outflows

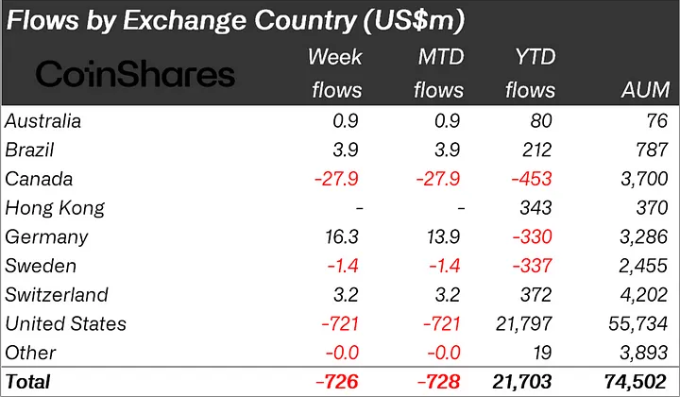

Crypto investment products saw outflows of $726 million last week, levels not seen since March. The US dominated the outflows, contributing $721 million in negative flows, highlighting regional concerns ahead of key economic events.

The latest CoinShares report ascribes the negative flows to interest rate cut uncertainty. This followed last week’s weak jobs report and other US economic data, which left traders and investors cautious about future market conditions.

“This negative sentiment was driven by stronger-than-expected macroeconomic data from the previous week, which increased the likelihood of a 25 bp interest rate cut by the US Federal Reserve. However, daily outflows slowed later in the week as employment data fell short of expectations, leaving market opinions on a potential 50bp rate cut highly divided. The markets are now awaiting Tuesday’s Consumer Price Index (CP|) inflation report, with a 50bp cut more likely if inflation comes in below expectations,” read the report.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Variations in the CME Fed Watchtool reflect this trends. After last Friday’s jobs report, the probability of a 50 basis points (bps) rate cut rose to 55%, compared to 45% for a 25 bps cut.

By Monday, however, the tool indicated a 75% probability of a 25 bps cut, with only a 25% chance of a 50 bps reduction. These shifts highlight ongoing uncertainty, with most expecting a rate cut at the September 17-18 Federal Reserve meeting, though the size remains unclear.

This week’s US economic calendar, particularly the August Consumer Price Index (CPI) report on Wednesday, could intensify the uncertainty. The CPI data from the Bureau of Labor Statistics (BLS) will be pivotal in shaping the Fed’s upcoming rate decision. Some experts argue that rate cuts might negatively impact Bitcoin.

Read more: How to Invest in Ethereum ETFs?

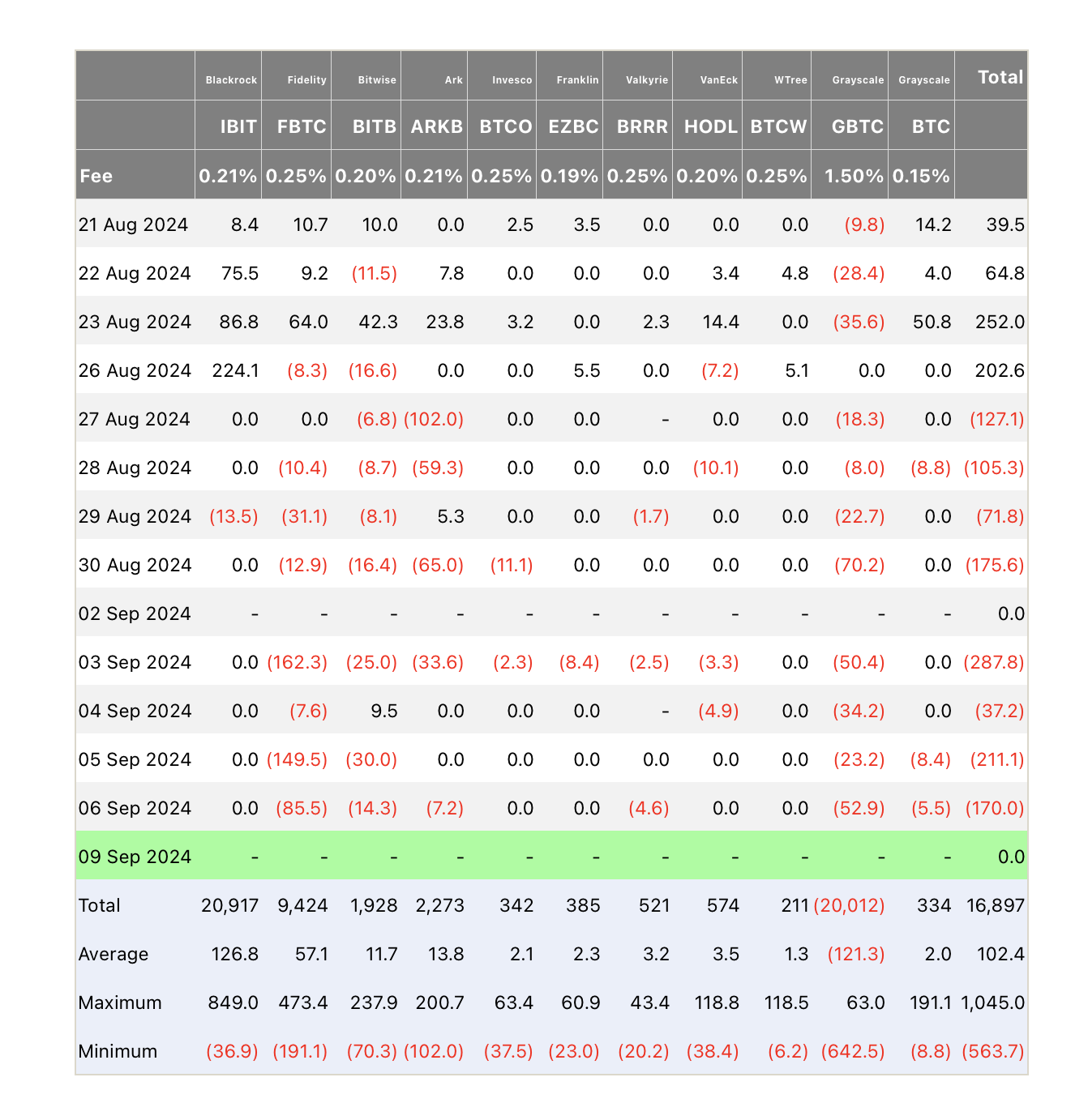

Meanwhile, Bloomberg reported the longest streak of daily net outflows from US Bitcoin ETFs since their listing, with investors withdrawing nearly $1.2 billion over eight consecutive trading days leading up to September 6.

Ethereum has also seen declining institutional interest, mirroring Bitcoin’s struggles. Data from Farside shows almost zero flows for most Ethereum ETFs, while Grayscale reports negative flows, explaining the $98 million outflows for Ethereum last week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Jumps But Smacks Into $120 Resistance Wall—Can It Break Through?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Meme Coin FARTCOIN Hits Two-Month High, Could It Reach $1?

The Solana-based meme coin FARTCOIN has once again claimed its spot as the market’s top gainer, surging to a two-month high of $0.73.

It has seen an impressive 39% price increase over the past 24 hours, reflecting a notable uptick amid an otherwise declining market.

FARTCOIN Defies the Odds, Soars to Two-Month High

FARTCOIN plunged to a year-to-date low of $0.19 on March 10. This presented a buying opportunity for the meme coin holders, who have since increased their buy orders for the token. Trading at a two-month high of $0.72 as of this writing, FARTCOIN’s value has since soared by 279% in the past month.

On the daily chart, FARTCOIN’s triple-digit rally has pushed its price above the Leading Span A (green line) of its Ichimoku Cloud. The strengthening bullish momentum is now driving the altcoin toward the Leading Span B (red line) of this indicator, a breakout of which would further validate FARTCOIN’s current bull run.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels.

When an asset’s price breaks above Leading Span A and is poised to break above Leading Span B, it signals a strengthening bullish trend. This hints at the potential for further upward movement as FARTCOIN moves into a more favorable market position.

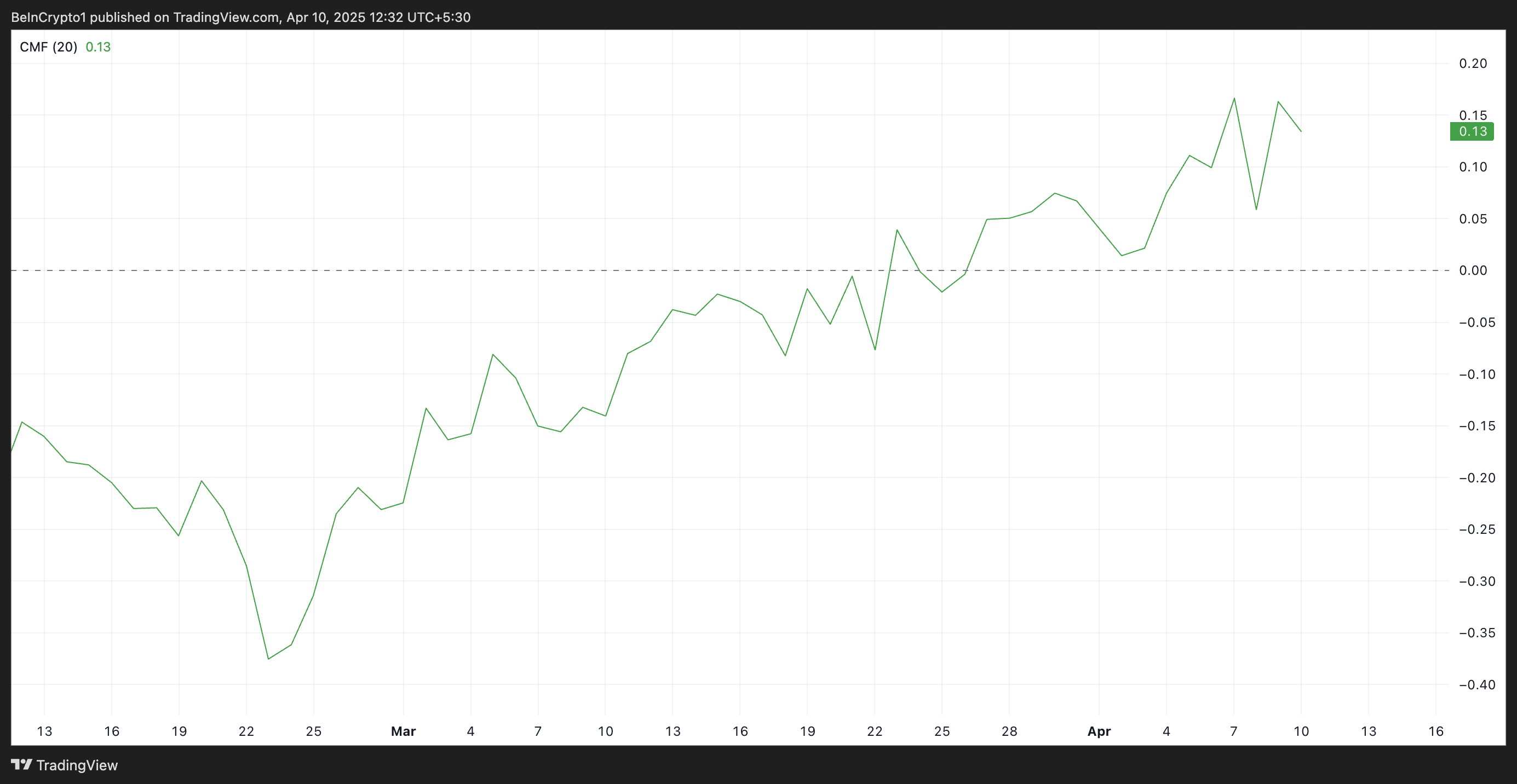

Further, the altcoin’s Chaikin Money Flow (CMF) remains above the zero line, confirming the preference for FARTCOIN accumulation over selloffs. At press time, this momentum indicator, which measures how money flows into and out of an asset, is at 0.13.

A positive CMF reading during a rally like this indicates strong buying pressure and market participation, as the volume of buy orders outweighs sell orders. This suggests that FARTCOIN’s rally is supported by solid demand, reinforcing the sustainability of the upward movement.

FARTCOIN is on Track for $1

Since its rally began on March 10, FARTCOIN has traded within an ascending parallel channel. This bullish pattern confirms the growing demand for the meme coin.

If buying pressure strengthens, FARTCOIN could extend its gains. In that case, its price could break above the Leading Span B, which currently forms a dynamic resistance above its price. A successful break above this level could propel the token toward $1.

However, if profit-taking resumes, this bullish projection will be invalidated. In that scenario, meme coin FARTCOIN’s price could dip to $0.54.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Forms Rounded Bottom Within Descending Channel, Target Set Above $3

Despite breaking above $3 earlier this year, the XRP price has since gone on to disappoint investors with multiple crashes that have rocked the altcoin. This has seen the cryptocurrency lose almost 50% of its acquired value between late 2024 and early 2025. Nevertheless, this has failed to erode bullish sentiment, with predictions for higher prices dominating the community.

Time To Go Long On The XRP Price?

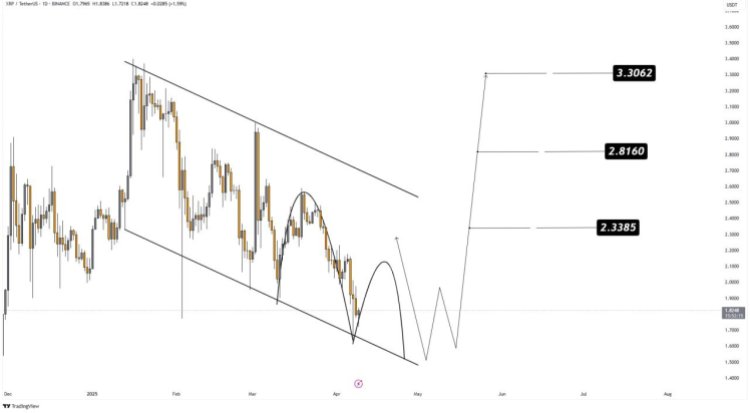

A crypto analyst on X (formerly Twitter) has renewed bullish hope after identifying an important formation on the XRP price chart. The analysis pointed out that the XRP Price is still moving within a descending channel, a formation that usually signals a bearish move.

However, the downtrend has pushed the altcoin’s price to the point where it is now testing the bottom trend line. This bottom trend line has been known to act as strong support previously and is expected to do so this time around.

With the support forming, it is likely that the XRP Price is gearing up for a bounce from this level. Furthermore, the crypto analyst points out that XRP is also forming a rounded bottom inside this descending channel. Such a rounded bottom could signal an end to the downtrend from here.

As the formation grows, the main level of support is now sitting at $1.6. So far, this level has held up quite nicely and bulls have been using it as a bounce-off point for recovery. Given this, the crypto analyst advises that entries for the XRP price are best at around $1.70 to $1.85.

This is not the only good news for the XRP price with support forming. If it holds and the altcoin does indeed bounce from this level toward $2, then the next important levels lie between $2 and $2.2. These serve as the levels for the bulls to beat to confirm a bullish continuation toward a possible all-time high.

If the bulls are successful, then three profit targets are placed by the crypto analyst. These include $2.3385, $2.8160, and $3.3062, pushing it toward January 2025 highs.

The Bearish Case

While the analysis is inherently bullish, there is still the possibility of invalidation that could send the XRP price tumbling further. As the analyst points out, the major support currently lies at $1.6. This means that bulls must hold this level. Otherwise, there is the risk of a much deeper correction as a liquidity sweep could send support further down to $1.3.

Nevertheless, with buy sentiments building once again, it is likely that XRP will follow the bullish scenario in this case.

Chart from TradingView.com

-

Bitcoin12 hours ago

Bitcoin12 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market12 hours ago

Market12 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Altcoin16 hours ago

Altcoin16 hours agoNFT Drama Ends For Shaquille O’Neal With Hefty $11 Million Settlement

-

Market21 hours ago

Market21 hours agoPaul Atkins SEC Confirmation Vote

-

Market8 hours ago

Market8 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market13 hours ago

Market13 hours agoSEC Approves Ethereum ETF Options Trading After Delays

-

Regulation12 hours ago

Regulation12 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Altcoin23 hours ago

Altcoin23 hours agoPepe Coin Whales Offload Over 1 Trillion PEPE