Market

Community Is 70% of Any Meme Coin’s Success

Meme coins often mirror the emotional extremes of market cycles, whether bullish or bearish. However, according to prominent analyst Murad Mahmudov, the success of these projects hinges significantly on their community support.

Currently, the market capitalization of meme coins shows a modest increase of 0.1%, standing at $41.48 billion. Leading this sector are Dogecoin, Shiba Inu, Pepe, Dogwifhat, Bonk, and Floki, each enjoying a strong and loyal following.

Meme coins, like memes themselves, have unpredictable lifespans and attract speculative investors, often referred to as “Degens.” These investors seek rapid profits, quickly selling off their assets and moving on to the next trend or narrative.

According to Mahmudov, the aesthetics and ticker symbol play crucial roles in a project’s development. He notes that the meme itself only contributes about 30% to a coin’s success. The remaining 70% hinges on the strength of its community. Without an active and engaged following, even the most cleverly designed meme coin is likely to fade into obscurity.

“When you’re buying Memecoins you are, first and foremost, betting on People,” he wrote.

Read more: What Are Meme Coins?

Meme coins have recorded a meteoric rise in the crypto arena, fueled by whimsical branding, viral marketing, and passionate online communities. These factors have captivated retail investors, who are drawn to the blend of humor and speculative opportunity.

Despite their lighthearted image, the success of meme coins hinges on a crucial balance between community engagement and solid project fundamentals. Whether driven by savvy investors or enthusiastic supporters, the community remains the most critical asset for these projects.

“Meme Popularity” doesn’t immediately translate to “Memecoin Market Cap”; otherwise, Wojak, Skibidi, and Hammy would be trading in the Billions already. It’s clearly more complicated than that. Meme Popularity is just one of ~50 factors to consider,” the analyst added.

Indeed, the collective belief of community members, their efforts to promote the coin, and their defense against skeptics create a strong sense of unity and momentum, which are vital for a coin’s success.

Crypto executive Justin Sun highlights the importance of capturing public attention but places even greater value on genuine community engagement. He looks beyond follower counts, focusing on the depth of interaction and support before making investment decisions.

“I will check on the real social engagement. Are those likes real, or it’s just general bullshit? Do they have lots of influence, and the people really believe them? Also, I will see the founders, see their material, and see the memes they made and the videos they made. I will see if this is the right video and the right social engagement,” Sun elaborated during a discussion on the Crypto Banter YouTube channel.

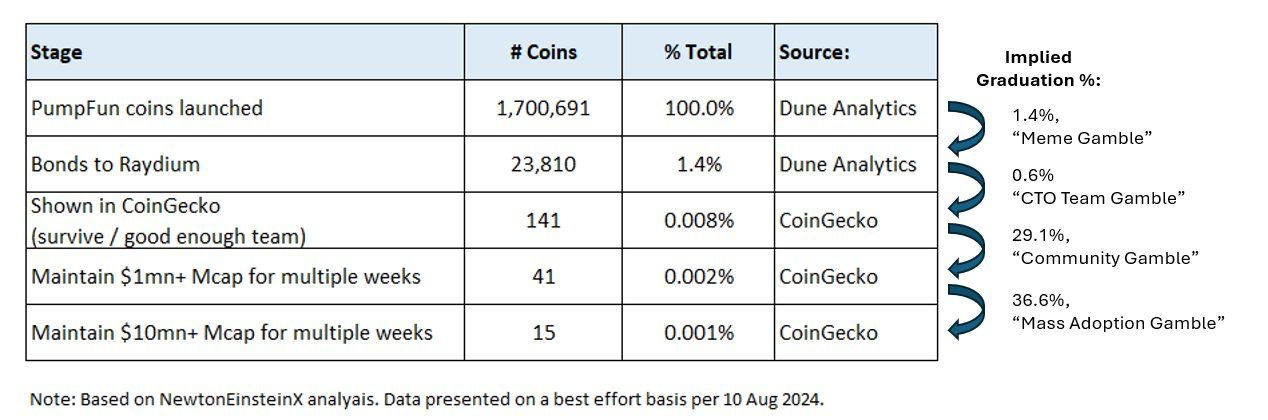

Many projects in this sector fail due to weak or non-existent community support. According to BeInCrypto, a mere 15 out of 1.7 million meme coins succeed, translating to a success rate of just 0.0001%.

As Mahmudov stresses out the importance of community, the crypto market remains divided between Tron’s SunPump and Solana’s Pump.fun. Although SunPump entered the market recently, it quickly outpaced competitors like Moonshot, which rivaled Pump.fun.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, the sector grapples with a persistent issue: rug pulls and scam tokens. These practices, where creators withdraw funds and abandon investors, continue to create unease, further eroding trust in the crypto industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

The brief rumor of a 90-day pause from Trump’s tariffs caused the markets to rally significantly. However, the White House squashed these rumors, fueling further crashes.

This highlights a genuine desperation in the markets as traders try to regain some bullish momentum and prevent a recession.

Trump Tariff Fakeout

The threat of Trump’s tariffs is closer than ever, and it’s causing a “Black Monday” event in the crypto markets. Bitcoin dipped below $80,000, and over $1 billion was liquidated from crypto.

However, one of the President’s advisors, Kevin Hassett, suggested this morning that he might be having second thoughts:

“Would Trump consider a 90-day pause in tariffs?’ ‘I think the president is gonna decide what the president is gonna decide … even if you think there will be some negative effect from the trade side, that’s still a small share of GDP,’” Hassett said in an interview.

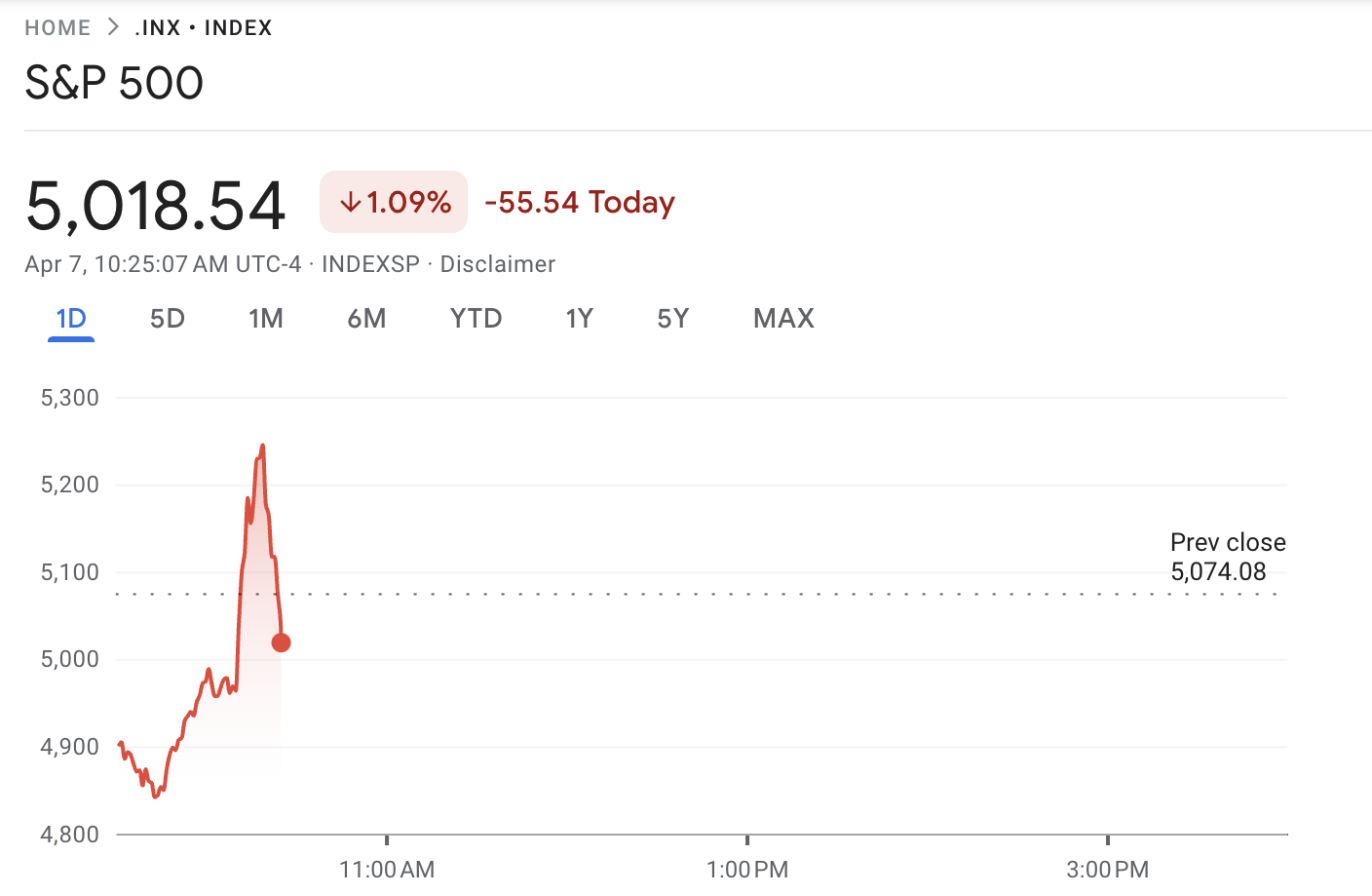

This news quickly began recirculating, claiming that Trump was seriously considering a 90-day pause in tariffs. This created a huge rally in traditional markets, with the S&P 500 shooting up 6% in seconds. This rally turned on a dime to a certain extent, falling again quickly.

Following the rumor, XRP rallied nearly 10% to hit $2, while Bitcoin rebounded back to $80,000. Both assets have declined again due to the lack of credibility of the news. Overall, the volatility has been extremely chaotic in the crypto market today.

In his interview, Hassett did not make any firm commitments that Trump is considering pausing tariffs. His response focused mostly on ongoing negotiations and assertions that the tariffs would have a limited impact.

Shortly afterward, the White House officially denied any knowledge of a 90-day pause. They are still set to begin in two days.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Founder CZ Joins Pakistan Crypto Council as Advisor

Changpeng ‘CZ’ Zhao, the founder of Binance, has reportedly taken on a new role as Strategic Advisor to the Pakistan Crypto Council.

Pakistan’s local media suggests that the appointment was confirmed during a meeting held in Islamabad with top government officials.

CZ Joins Pakistan Crypto Council

The Finance Minister, Senator Muhammad Aurangzeb, reportedly led the session. Other attendees included the heads of Pakistan’s key financial and regulatory bodies—the Securities and Exchange Commission and the State Bank—and senior officials from the law and IT ministries.

According to the reports, Zhao also met separately with Pakistan’s Prime Minister and Deputy Prime Minister to discuss digital asset policy and blockchain adoption.

His involvement with Pakistan follows a recent agreement with the Kyrgyz Republic. There, he is advising on Web3 infrastructure and blockchain education.

Kyrgyzstan has also launched the A7A5 stablecoin, pegged to the Russian ruble. Both Kyrgyzstan and Pakistan are looking to develop their financial ecosystem around crypto to attract industry interest in the regions.

Meanwhile, CZ continues to engage with multiple governments on crypto regulation. He has been focused on building secure frameworks and enabling digital finance ecosystems.

BeInCrypto has contacted Binance about the reports and whether the company is involved in the initiative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low

The value of the leading altcoin, Ethereum, has plunged to its lowest point since March 2023, signaling a steep decline in market confidence. This has happened amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative strength against Ethereum.

ETH/BTC Ratio Hits 5-Year Low as Traders Flee

ETH’s price decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative value compared to BTC. When it rises, it indicates that ETH is outperforming BTC, either because the altcoin’s price is growing faster or the king coin’s price is falling.

Conversely, a decline like this suggests that the leading coin, BTC, is gaining strength relative to the top altcoin, ETH. It suggests that traders are moving capital into BTC, seeing it as a safer or more profitable investment at the moment despite its own price troubles.

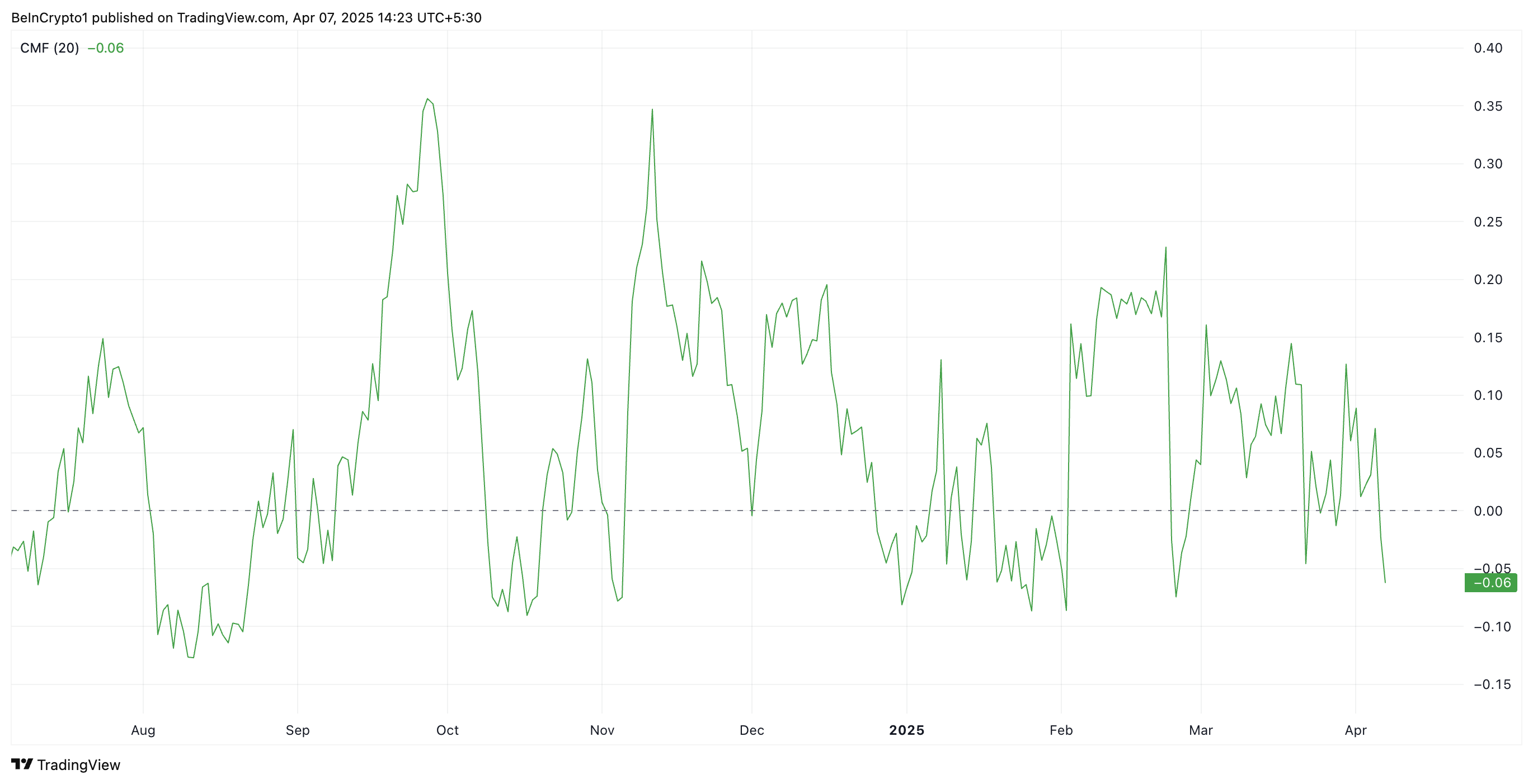

Further, on the daily chart, ETH’s negative Chaikin Money Flow (CMF) confirms the coin’s plummeting demand. At press time, it is at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set period, helping gauge buying and selling pressure. When its value falls below zero like this, it indicates that selling pressure is dominating.

ETH’s CMF readings suggest that more traders are distributing (selling) the coin than accumulating it. This reflects weakening demand and is a bearish signal for the asset’s price momentum.

ETH Flashes Oversold Signal: Is a Bounce Back on the Horizon?

ETH’s Relative Strength Index (RSI), observed on a one-day chart, shows that the altcoin is currently oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 25.62, ETH’s RSI signals that the coin is deeply oversold. This presents a buying opportunity, as such lows are usually followed by a price rebound.

If this happens, ETH’s price could regain and climb back above $1,589. If this support level strengthens, it could propel ETH’s value to $1,904.

However, this rebound is not guaranteed. If ETH bears maintain dominance and selloffs continue, the coin could extend its decline and fall toward $1,197.

The post Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low appeared first on BeInCrypto.

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market6 hours ago

Market6 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Market20 hours ago

Market20 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Market24 hours ago

Market24 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise