Market

CME Rumored to Reject Solana Futures Launch

Recent rumors suggest that the Chicago Mercantile Exchange (CME) will not launch a Solana (SOL) futures product, causing a stir in the financial markets.

CME has neither confirmed nor denied these speculations, leaving the market in a state of uncertainty.

Unverified Claims: CME May Not Launch Solana Futures

After the Securities and Exchange Commission (SEC) approved spot Ethereum ETFs, experts began to actively speculate about the next ETF candidate. While many believe Solana could be the perfect fit, others note that filing for a spot ETF for the altcoin might be challenging because CME has not yet listed SOL futures.

Meanwhile, rumors suggest that the CME may refuse to introduce SOL futures. According to a recent DB News X post, sources close to the exchange indicate no immediate plans for this.

However, CME has made no official statements, leaving market participants guessing. The crypto community reacted skeptically to this post, citing the lack of a verified source of information and questioning the relevance of the rumors.

“PERSON CLOSE TO CME HAS PLANS TO BUY SOL CHEAPER. Source: I made it up,” one X user commented.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

Nevertheless, the importance of launching SOL futures cannot be underestimated. ETF analyst Nate Geraci argues that its ETF potential hinges on establishing a Solana futures market on the CME. Without this, regulatory clarity remains elusive.

James Seyffart, an ETF analyst at Bloomberg, shares that view. He noted that Solana ETF would need a futures market regulated by the Commodity Futures Trading Commission (CFTC). Additionally, the SEC currently classifies SOL as a security, complicating its path to ETF approval.

However, there is still hope for a positive outcome. The recent FIT21 bill empowers the CFTC to classify certain altcoins as commodities. If the SEC reclassifies Solana, opportunities for ETF approval may arise. Geoffrey Kendrick, an analyst at Standard Chartered Bank, predicts that ETFs for cryptocurrencies like SOL and XRP might gain approval by 2025.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

The recent rumors that CME won’t launch Solana futures have caused a lot of uncertainty in the market. Due to regulatory hurdles, getting a Solana ETF approved without SOL futures is challenging. Nevertheless, changes in regulations could improve the chances, and the crypto community remains hopeful despite the current problems.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

MENAKI Leads Cat Themed Tokens

Meme coins have garnered investors’ interest today more than any other category of crypto assets. Leading the joke tokens was Maneki, who continued the momentum from the previous week.

BeInCrypto has analyzed two other meme coins for investors to watch and the direction in which they are taking.

Maneki (MANEKI)

- Launch Date – April 2024

- Total Circulating Supply – 8.85 Billion MANEKI

- Maximum Supply – 8.85 Billion MANEKI

- Fully Diluted Valuation (FDV) – $25.32 Million

MANEKI price surged by nearly 28% over the last 24 hours, reaching $0.0028. This significant rise marks a continuation of the altcoin’s rally from the previous week.

The meme coin is expected to maintain its upward trajectory, aiming to breach the $0.0036 barrier in the coming days. A successful breach could attract more investors, sparking inflows and potentially propelling the price even higher. This would enhance the altcoin’s visibility and fuel its growing popularity.

However, if MANEKI fails to hold its support at $0.0022, it could fall to $0.0017. A drop to this level would invalidate the bullish outlook and extend the recent losses, halting its upward momentum.

Keyboard Cat (KEYCAT)

- Launch Date – January 2024

- Total Circulating Supply – 10 Billion KEYCAT

- Maximum Supply – 10 Billion KEYCAT

- Fully Diluted Valuation (FDV) – $35.39 Million

KEYCAT’s price saw a modest 11% increase today, reaching $0.0035, continuing its rally from the previous week, which now totals 64%. Despite not performing as well as MANEKI, this consistent upward trend could attract investors’ attention.

The next resistance level for KEYCAT is at $0.0040, and to breach this level, the altcoin will likely need broader market support. If successful, this could propel the meme coin toward $0.0053, solidify the current bullish outlook, and fuel further price action, drawing in more investors.

However, if KEYCAT fails to break through $0.0040, it may drop to $0.0030, with further declines possible if this support is lost. Such a fall would invalidate the bullish thesis and signal a potential reversal in price.

Popcat (SOL) (POPCAT)

- Launch Date – December 2023

- Total Circulating Supply – 979.97 Million POPCAT

- Maximum Supply – 979.97 Million POPCAT

- Fully Diluted Valuation (FDV) – $262.19 Million

POPCAT saw an impressive 115% rise over the past week, positioning it as one of the best-performing tokens. However, despite this surge, the meme coin faced a slight decline in the last 24 hours. The volatility signals a possible shift, though the outlook remains generally positive.

While the recent decline has almost been recovered, POPCAT’s momentum seems to be waning. Currently holding above the $0.244 support, the coin looks poised to bounce back and potentially rise to $0.342. Continued support from the market could allow for a more sustained recovery in price.

However, if POPCAT fails to maintain support at $0.244, the price could fall to $0.205, significantly invalidating the bullish outlook. A break below this support would suggest further price erosion, reversing the recent gains and potentially setting the coin on a downward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Strategy and Metaplanet Buy Bitcoin Despite Recession Fears

Despite recent chaos and fears of a recession, public companies Strategy and Metaplanet are doubling down on new Bitcoin purchases. Strategy purchased BTC worth $285 million, while Metaplanet spent $26.3 million.

Metaplanet’s activity is particularly noteworthy because Japan’s 30-year treasury yields are soaring. For public companies in Japan, conventional economic practice is to pull back from the dollar, but committing to Bitcoin is a bold strategy.

Strategy (formerly MicroStrategy) is one of the world’s largest Bitcoin holders, and it’s been going through a chaotic period. In recent weeks, it has alternated between massive BTC purchases and abrupt acquisition pauses, prompting a great deal of speculation.

Today, however, its Chair, Michael Saylor, announced a major new Bitcoin buy at $285 million:

“Strategy has acquired 3,459 BTC for ~$285.8 million at ~$82,618 per bitcoin and has achieved BTC Yield of 11.4% YTD 2025. As of 4/13/2025, Strategy holds 531,644 BTC acquired for ~$35.92 billion at ~$67,556 per bitcoin,” Saylor claimed via social media.

A lot of this chaos is due to fears of a US recession, which has made the price of Bitcoin swing wildly. When Bitcoin was down, it prompted speculation that MicroStrategy may have to dump its assets.

However, since BTC has started to recover, Michael Saylor’s firm is back on the market.

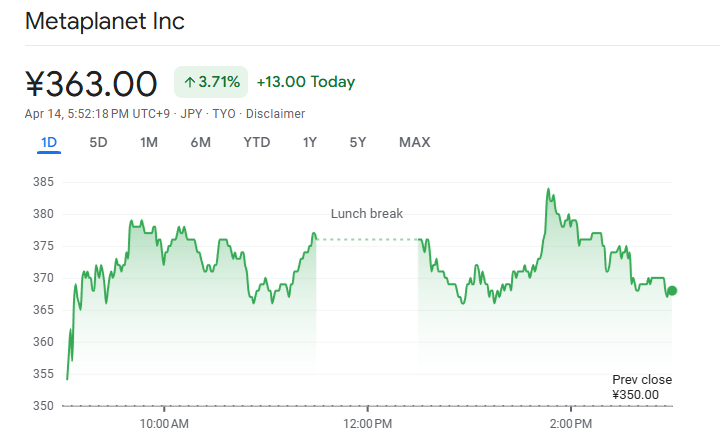

Critically, Strategy isn’t alone in its Bitcoin acquisitions. Metaplanet is a Japanese firm with substantial BTC holdings and ambitions to acquire even more.

Two days before Strategy made its own major purchase, Metaplanet CEO Simon Gerovich announced a similar investment:

“Metaplanet has acquired 319 BTC for ~$26.3 million at ~$82,549 per bitcoin and has achieved BTC Yield of 108.3% YTD 2025. As of 4/14/2025, we hold 4525 BTC acquired for ~$386.3 million at ~$85,366 per bitcoin,” Gerovich claimed.

Metaplanet’s commitment here is particularly noteworthy because it contradicts near-term macroeconomic headwinds. The global market is filled with risk-averse behavior right now, and Japan’s 30-year bond yields surged to the highest level in over two decades.

Despite this clear signal, the Japanese Metaplanet is continuing to make major Bitcoin investments. The latest purchases also had a positive impact on the company’s stock market. It’s currently up by 3% today, after suffering notable losses the past month.

In short, major corporate Bitcoin holders like Strategy and Metaplanet aren’t interested in tapering off yet. Despite the recent chaos, there is serious confidence that BTC will either gain in price or represent a stable store of value.

Either way, when public firms like this publicly take a bullish stance, it can shore up confidence across the entire market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Delays Decision on Grayscale Ethereum ETF Staking

The SEC has delayed its decision on whether to allow staking for Grayscale’s proposed Ethereum spot ETFs.

The ETFs in question—Grayscale Ethereum Trust and Grayscale Ethereum Mini Trust ETF—were filed by NYSE Arca on February 14, 2025. The filing included a rule change request to enable staking as part of their investment strategy.

SEC Pushes Back Grayscale Ethereum ETF Staking Deadline July

The SEC deadline for deciding on the original proposal was set to conclude on April 17. Under the Securities Exchange Act of 1934, the SEC is authorized to extend this review period for up to 90 days.

The agency has now exercised that option. This now allows the SEC to decide on this filing by July 2025.

Staking would allow the ETFs to earn rewards by participating in Ethereum’s proof-of-stake consensus mechanism, a feature not yet approved for any US spot crypto ETF.

Grayscale has proposed that staking be conducted exclusively by the sponsor without commingling funds. Also, Coinbase Custody would continue safeguarding the ETH assets.

The SEC’s delay is part of a broader pattern of cautious regulatory scrutiny over crypto ETF innovations, including similar filings from other asset managers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin STH MVRV Climbs To 0.90, Is A Price Rebound On?

-

Altcoin21 hours ago

Altcoin21 hours agoEthereum Price Eyes Rally To $4,800 After Breaking Key Resistance

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Market24 hours ago

Market24 hours agoHackers are Targeting Atomic and Exodus Wallets

-

Market16 hours ago

Market16 hours agoMANTRA’s OM Token Crashes 90% Amid Insider Dump Allegations

-

Market5 hours ago

Market5 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin5 hours ago

Altcoin5 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?