Market

Cardano Struggles to Climb—ADA Faces Strong Hurdles Ahead

Cardano price started a fresh decline below the $0.75 zone. ADA is correcting some losses and might face resistance near the $0.750 level.

- ADA price started a recovery wave from the $0.650 zone.

- The price is trading below $0.750 and the 100-hourly simple moving average.

- There is a short-term bearish trend line forming with resistance at $0.720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.750 resistance zone.

Cardano Price Climbs Higher

In the past few days, Cardano saw a bearish wave below the $0.80 level, like Bitcoin and Ethereum. ADA declined below the $0.750 and $0.70 support levels.

Finally, it tested the $0.650 zone. A low was formed at $0.6495 and the price recently started a recovery wave. The price climbed above the $0.680 and $0.70 level. The price tested the 50% Fib retracement level of the downward move from the $0.8169 swing high to the $0.6495 low.

There was a short-term bearish trend line forming with resistance at $0.720 on the hourly chart of the ADA/USD pair. Cardano price is now trading below $0.80 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.750 zone and the 61.8% Fib retracement level of the downward move from the $0.8169 swing high to the $0.6495 low. The first resistance is near $0.7750. The next key resistance might be $0.80.

If there is a close above the $0.80 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.950 region. Any more gains might call for a move toward $1.00 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.750 resistance level, it could start another decline. Immediate support on the downside is near the $0.7150 level.

The next major support is near the $0.6880 level. A downside break below the $0.6880 level could open the doors for a test of $0.650. The next major support is near the $0.6320 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.7150 and $0.6880.

Major Resistance Levels – $0.7500 and $0.7750.

Market

Ondo Finance (ONDO) Bulls Push for a Breakout Above $1

Ondo Finance (ONDO) is up nearly 7% in the last 24 hours, attempting to reclaim a $3 billion market cap after a sharp 38% correction over the past 30 days. The recent price recovery suggests a potential trend shift, but key resistance levels must be broken for confirmation.

Indicators like the DMI and CMF show that selling pressure is fading while buying interest is increasing. If ONDO breaks past $0.90, it could rally toward $1.08 and even $1.20. However, failure to sustain momentum could lead to another drop below $0.70.

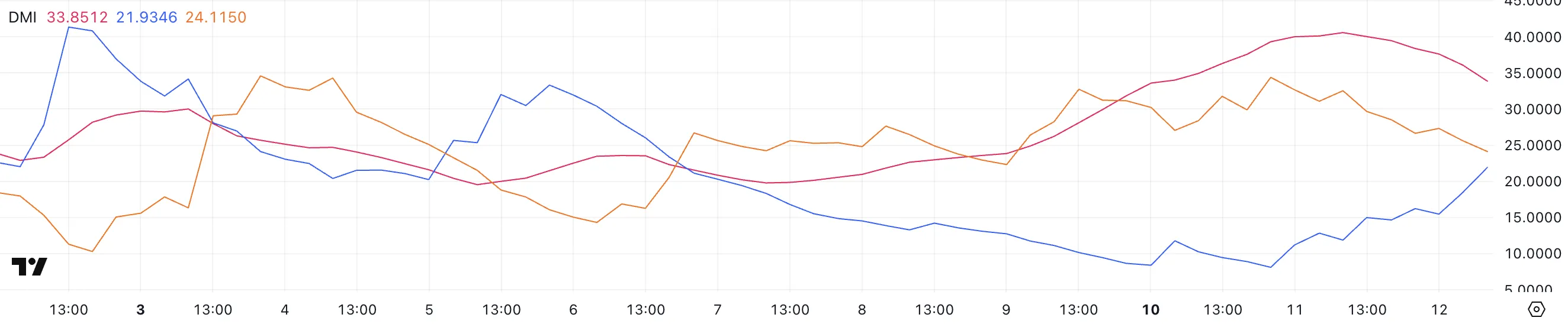

ONDO DMI Shows The Downtred Could Revert Soon

ONDO’s ADX is currently at 33.8, down from 40.5 yesterday. This indicates that while the downtrend remains strong, its intensity is starting to weaken.

The ADX (Average Directional Index) measures trend strength on a scale from 0 to 100, with values above 25 signaling a strong trend and values below 20 suggesting a weak or non-trending market.

Since Ondo Finance ADX is still well above 25, the bearish trend remains dominant, but the decline suggests that momentum could be slowing.

Meanwhile, the +DI has climbed to 21.9 from 11.18, while the -DI has dropped from 34.3 to 24.11, showing that selling pressure is fading while buying pressure is increasing.

However, since -DI remains slightly above +DI, the downtrend is still in place. If +DI continues rising and crosses above -DI, it could confirm a shift in momentum, potentially signaling a trend reversal.

Until then, Ondo Finance remains in a downtrend, but bulls are gaining ground.

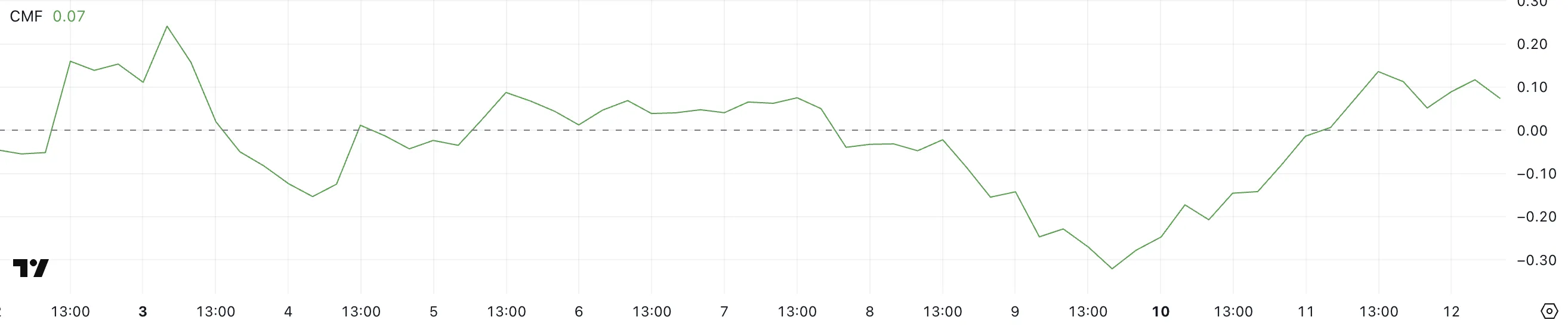

Ondo Finance CMF Surged In The Last Three Days

ONDO’s Chaikin Money Flow (CMF) is currently at 0.07, recovering from a negative low of -0.32 just three days ago.

The CMF measures buying and selling pressure by analyzing both price and volume, with values above 0 indicating accumulation (buying pressure) and values below 0 signaling distribution (selling pressure).

A CMF above 0.05 suggests growing bullish momentum, while prolonged negative readings often align with downtrends.

Ondo Finance CMF turned positive yesterday after spending two consecutive days in negative territory, signaling that buying pressure is increasing.

With CMF now at 0.07, capital inflows are returning, which could support further price recovery. However, since the value is still relatively low, sustained buying volume is needed to confirm a strong uptrend.

If CMF continues rising, it could indicate stronger accumulation, potentially leading to a breakout, establishing ONDO among the top Real-World Assets coins in the market.

Will ONDO Reclaim $1 Soon?

ONDO is currently recovering after dipping below $0.79 for the first time in months, following a broader correction across major RWA coins in the last 30 days.

The recent bounce suggests buyers are stepping in, but the trend remains uncertain, with key resistance levels ahead.

If it breaks above $0.90, it could continue rising toward $0.99, and a further breakout could send it to $1.08 or even $1.20.

However, if the uptrend fails and selling pressure returns, ONDO price could drop to $0.73, with the risk of falling below $0.70 for the first time since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Alameda Unstakes $23 Million in Solana for 38 FTX Addresses

Alameda Research unlocked Solana tokens worth nearly $23 million today. Despite this notable unlock, it barely affected SOL’s underlying price or demand dynamics.

FTX’s reimbursement process has begun, and the firm unlocked SOL worth $1.57 billion. Alameda’s comparatively small unlock exists in the context of bearish market factors that are drastically impacting demand.

How Will Alameda Use Its Unstaked Solana Tokens?

According to on-chain data from Arkham Intelligence, Alameda Research distributed the unstaked SOL to 38 FTX-linked addresses. As a refresher, Alameda was the trading firm linked to the FTX collapse, operated by Caroline Ellison.

“Alameda address just unstaked $23 million SOL to 38 new addresses. An FTX/Alameda staking address received $22.9 million SOL from a staking address unlock and has just distributed these funds to 37 addresses that have previously received SOL from this address. These addresses currently hold $178.82 million SOL,” Arkham claimed via social media.

Since its downfall, Alameda has moved huge amounts of assets on several occasions. For example, Alameda bankruptcy addresses staked $10 million in MATIC tokens in late 2023 and moved Ethereum worth $14.75 million in early 2024.

However, both these incidents caused significant price fluctuations in the relevant assets.

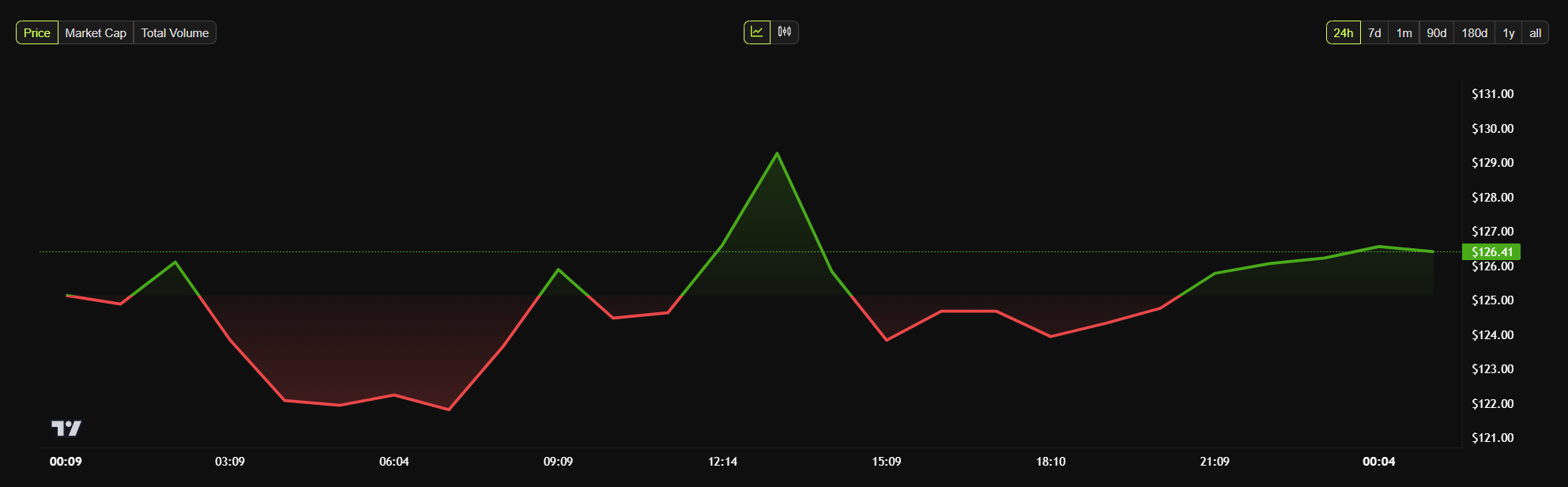

Solana’s price, on the other hand, has barely budged since these Alameda transactions took place. Yesterday, the SEC delayed several Solana ETF applications, and this had a slightly bearish impact on the altcoin’s price.

Even so, ETH jumped 10% when Alameda moved a supply worth $14.75 million. It moved much more SOL today, but this didn’t even cause the day’s largest price move.

Solana declined and spiked in a short time span, but all of this happened before the announcement. Comparatively, the Alameda unlock had practically no effect.

So far, it isn’t clear what exactly Alameda is planning to do with these unlocked Solana tokens. Last month, FTX began the first round of creditor repayments, but this will be a long process. Earlier this month, FTX also unlocked Solana tokens worth $1.57 billion.

In other words, Alameda may be planning to use these tokens as part of the FTX reimbursement process, but that might not change Solana’s demand.

The crypto market is currently in a state of Extreme Fear, and most major assets are seeing big outflows. Alameda’s actions are just one drop in a very large bucket.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 AI Coins Smart Wallets Are Buying: VIRTUAL, GROKCOIN, ARC

AI coins have been struggling in recent weeks, but smart money wallets are quietly accumulating Virtuals Protocol (VIRTUAL), GrokCoin (GROKCOIN), and AI Rig Complex (ARC). Despite sharp corrections, these three projects have seen notable inflows from experienced traders, suggesting potential rebounds.

VIRTUAL is down 53% in the last 30 days, ARC has dropped 68%, and GROKCOIN fell 33% in the past 24 hours. Yet, on-chain data reveals increasing accumulation. If momentum returns, these AI coins could recover key resistance levels, but further downside remains a risk if the sector fails to regain strength.

Virtuals Protocol (VIRTUAL)

VIRTUAL, once the biggest AI coin in the market, has been in a steep correction, with its price dropping over 53% in the last 30 days. The prolonged decline has weakened market sentiment, as AI-related tokens have lost momentum after their previous hype cycle.

However, despite this heavy sell-off, recent on-chain data suggests that smart money wallets are accumulating, which could indicate that some investors believe the bottom may be near.

If buying pressure continues to increase, VIRTUAL could stabilize and attempt a recovery.

In the last seven days, 21 crypto smart money wallets had a net inflow of $213,430 into VIRTUAL, suggesting renewed confidence from experienced traders.

This accumulation could be the first sign of a potential trend shift, but the price still needs to reclaim key resistance levels to confirm a reversal.

If VIRTUAL regains momentum, it could test $0.80 and $0.97, with a breakout above those levels opening the door for a move toward $1.24. However, for a sustained rally, AI coins need to regain market attention, as recent trends have shifted focus away from this sector.

GrokCoin (GROKCOIN)

GrokCoin (GROKCOIN) is a meme coin that gained rapid popularity due to its origins tied to Elon Musk’s AI, Grok.

The token was initially introduced as a joke following a tweet from Musk but quickly caught the attention of the crypto community.

Despite a 33% drop in the last 24 hours, smart money wallets have shown interest, with 54 wallets accumulating a net total of $133,049 in GROKCOIN over the past week.

This suggests that experienced traders may be positioning for a potential rebound. If GROKCOIN can reverse its current downtrend, it could test resistance levels at $0.0026, with a stronger rally potentially pushing it toward $0.0033.

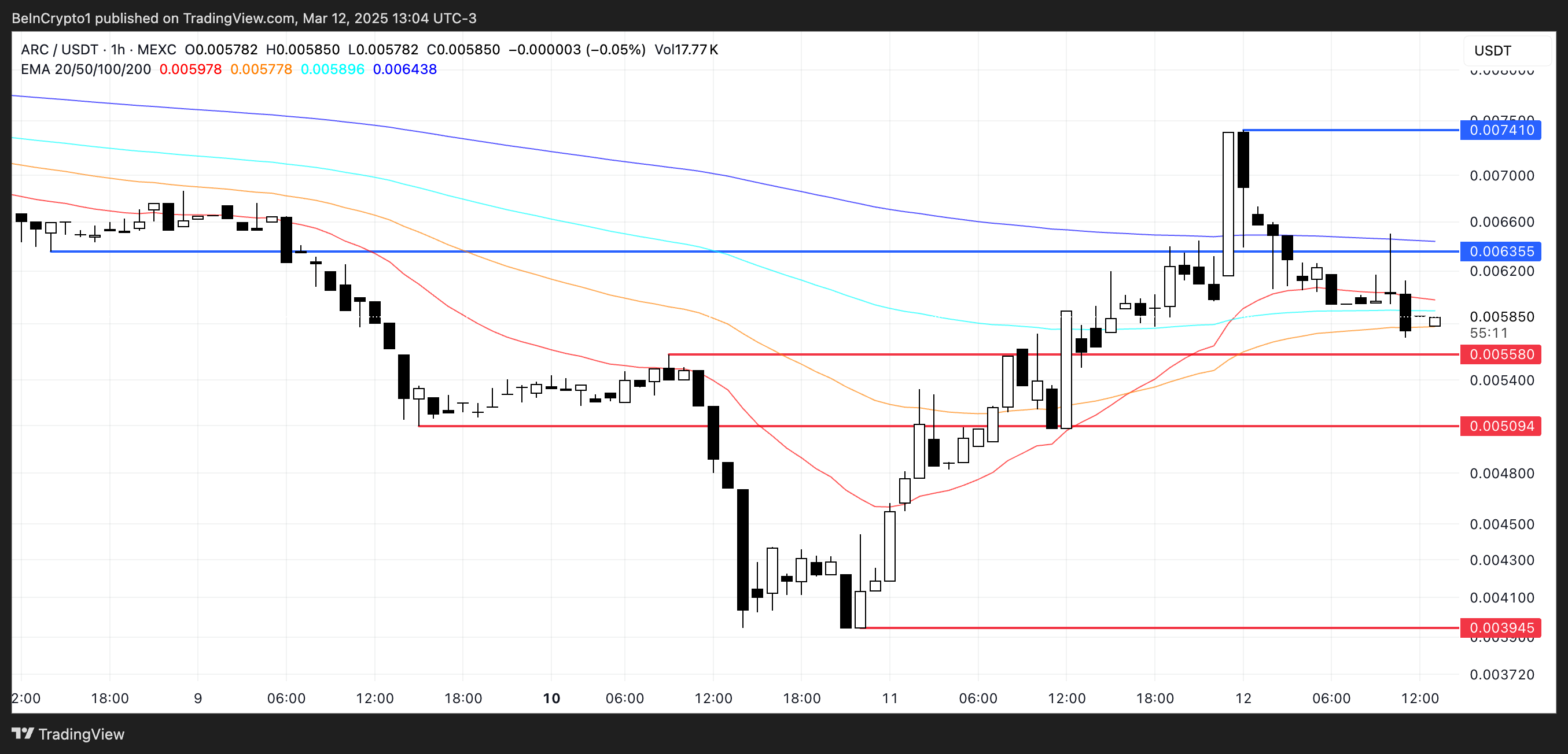

AI Rig Complex (ARC)

ARC has been hit hard by the ongoing correction in AI coins, with its price plunging 68% in the last 30 days. ARC is developing Rig, an open-source framework that enables developers to create portable, modular, and lightweight AI agents.

However, its price action suggests that market sentiment remains weak, with ARC currently trading at its lowest levels ever.

Even with the sharp decline, 14 smart money wallets have accumulated a net total of $47,275 in ARC over the past seven days, signaling potential accumulation.

If ARC can regain momentum, it could test $0.0063 and $0.0074, which would mark a significant recovery from current levels.

However, if the correction continues, support at $0.0055 and $0.0050 will be critical, and a break below them could send ARC as low as $0.0039.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Market22 hours ago

Market22 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Ethereum21 hours ago

Ethereum21 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Bitcoin21 hours ago

Bitcoin21 hours agoCrypto Market Recovers After Liquidations: Here’s Why

-

Market19 hours ago

Market19 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Market24 hours ago

Market24 hours agoSEC Delays XRP and Solana ETF Approvals

-

Market20 hours ago

Market20 hours agoEthereum Price Recovery Capped—Bulls Struggle Near Resistance

-

Altcoin20 hours ago

Altcoin20 hours agoIs Pi Network Heading for Price Pegging? What Happens to Pi Coin Next?