Market

Can Stacks (STX) Make It to $2?

Stacks’ (STX) price has surged 40% since hitting an eight-month low of $1.10 on August 5, amid a broader market downturn.

With an 8% gain in the past 24 hours, the altcoin appears poised to attempt a rally toward $2.

Stacks Goes Green as Interest Surges

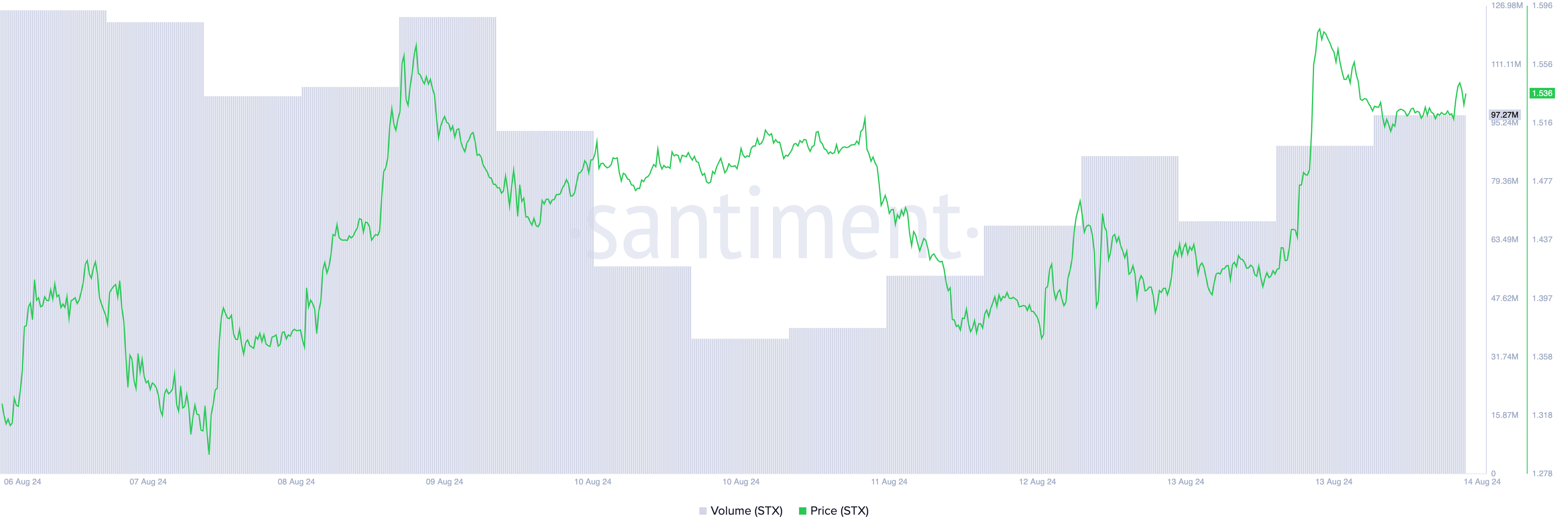

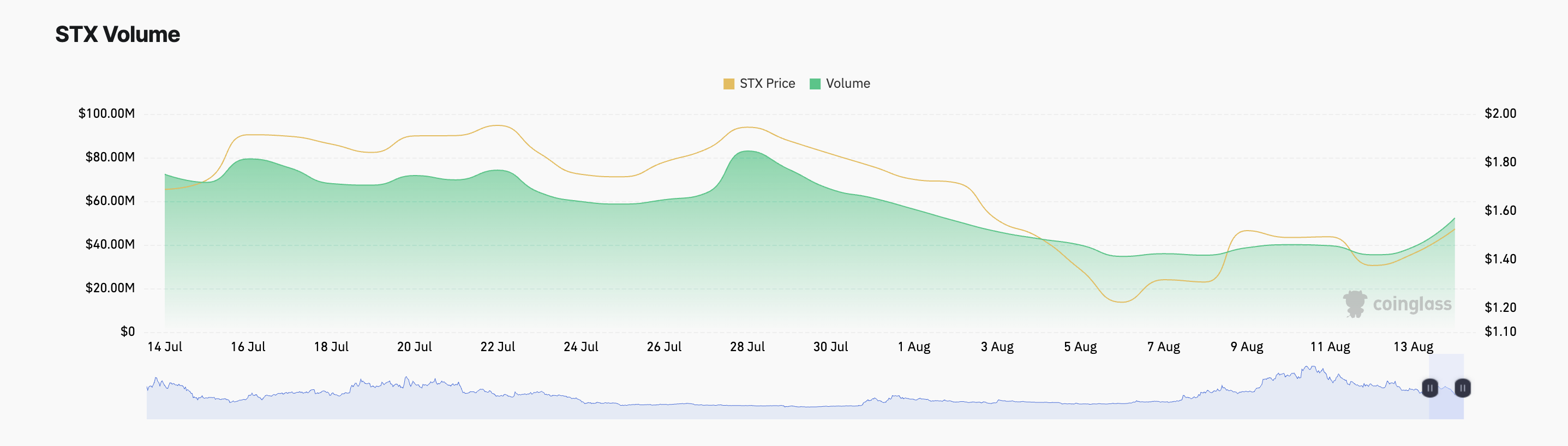

Currently, STX is trading at $1.54, fueled by an 8% price surge in the last 24 hours. This rally is supported by a 31% increase in trading volume, which has reached $97 million during the same period.

When a spike in trading volume backs an asset’s price rally, it suggests strong interest and conviction from market participants. This means that buying pressure is high, and the market sentiment is bullish.

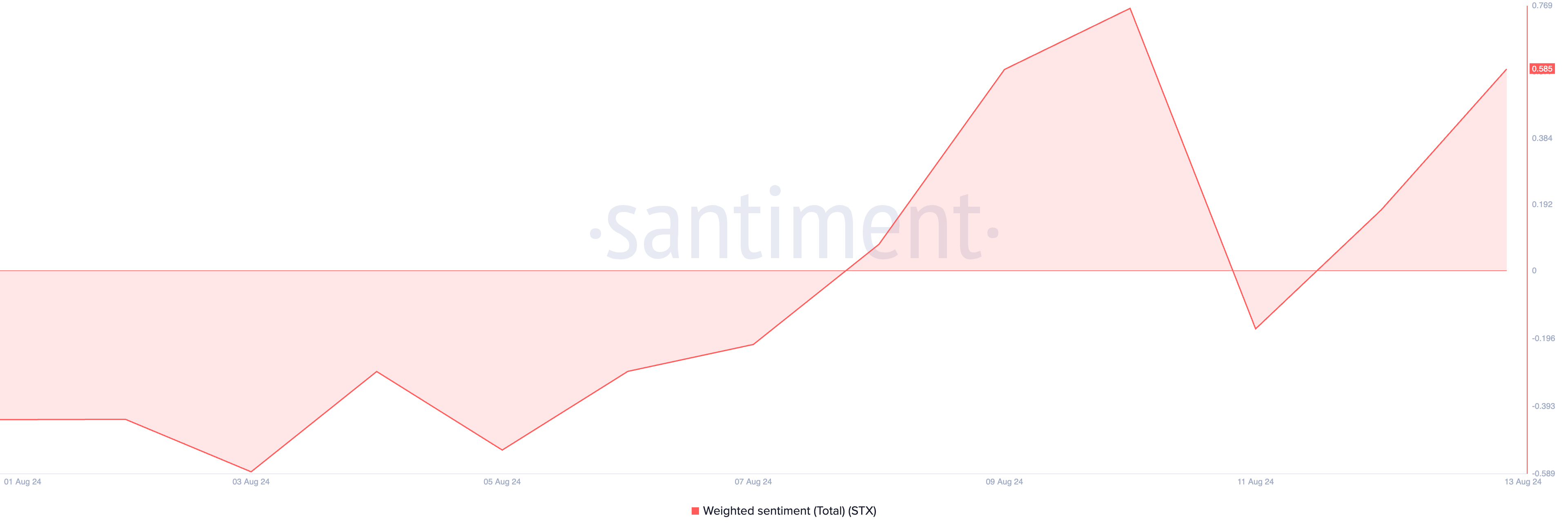

STX’s positive weighted sentiment confirms the bullish bias that the altcoin currently enjoys. This metric tracks the market’s mood regarding an asset. When its value is positive, the majority of social media mentions, news articles, and other online discussions about the asset are bullish. At press time, STX’s weighted sentiment is 0.585.

Further, STX’s price rally has led to a surge in activity in its derivatives market. According to Coinglass, in the past 24 hours, trading volume in the token’s futures and options market has totaled $196.19 million, rising by 60%. Likewise, its open interest has increased by 29% during the same period.

Read more: What Are Decentralized Exchanges and Why Should You Try Them?

An asset’s futures open interest refers to the total number of outstanding futures contracts that have not been settled. When it spikes like this, it means that more traders are entering into new positions.

STX Price Prediction: Buying Pressure Overshadows Selloffs

STX’s price hike has paved the way for its bulls to regain market dominance, as evidenced by its Directional Movement Index (DMI). This indicator, assessed on a 12-hour chart, shows that the token’s positive directional indicator (+DMI) recently crossed above its negative directional indicator (-DMI).

An asset’s DMI measures the strength and direction of a trend. When the +DI is above the -DI, it suggests that the uptrend is strong. It indicates the presence of bullish market conditions, where buying pressure is beginning to dominate, and the asset is likely to continue its uptrend.

Further, the altcoin has formed an ascending channel within which it currently trends. This channel is formed when an asset’s price creates a series of higher and lower highs. It is a bullish signal and a visual representation of an uptrend.

Read more: Top 10 Aspiring Crypto Coins for 2024

If STX remains within this channel, its price could rally past $1.70 and head toward $2.10. However, if the current trend reverses, the altcoin’s price may break below the channel’s support and drop to $1.05.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Expanding Blockspace and Enhancing Privacy

Ethereum Layer-2 (L2) network Base, incubated by Coinbase, has unveiled its product roadmap for the second quarter (Q2) 2025.

It indicates a bold slate of performance upgrades, enhanced privacy features, and broader support for developers.

Base Q2 Roadmap: Speed, Privacy, and Builder Adoption

In a detailed post on X (Twitter), Base’s development team outlined key objectives for the quarter. The roadmap reaffirms Base’s commitment to building in the open. It also lays the groundwork for scaling its role as a core pillar of the on-chain economy.

The plan to achieve 200ms effective block times on the mainnet is among the most eye-catching. The move could dramatically increase throughput and improve user experience.

Additionally, Base aims to scale blockspace from 30 to 50 Mgas/s and reach “Stage 1 decentralization.” Notably, they are key milestones in both performance and network security.

Privacy is also a central focus. Base is working to implement privacy-preserving on-chain account verification. This initiative reflects the growing importance of identity and privacy in a blockchain environment where transparency and pseudonymity often clash.

Beyond scaling and privacy, the roadmap details efforts to enhance its developer toolkit, notably expanding usage of the Base MCP (Modular Crypto Platform) tooling. This includes increasing weekly active apps built on OnchainKit and MiniKit and launching new Base Appchains on the mainnet.

The Base MCP tooling is part of a broader push to enable developers to go from “Idea to App, App to Business,” as described by the team. However, it is worth noting that MCP protocols have come under scrutiny recently due to a critical security flaw, raising concerns about their current implementations.

BeInCrypto recently reported on vulnerabilities that, if left unpatched, could expose user data or funds. This suggests that Base’s teams must prioritize security alongside growth.

“This risk comes from using a ‘poisoned’ MCP. Hackers could trick Base-MCP into sending your crypto to them instead of where you intended. If this happens, you might not notice,” Superoo7, head of Data and AI at Chromia, highlighted.

Base’s community-centric ethos is evident in its continued support for builder programs like Base Batches, Buildathons, and the Builder Rewards initiative. The team emphasized that these initiatives will support developers technically and economically, creating viable paths to earning a living by building on-chain.

Coinbase CEO Brian Armstrong also weighed in, endorsing the roadmap with a simple but affirming statement. This highlights Coinbase’s continued backing of the Layer-2 solution, which has become a standout in the ecosystem.

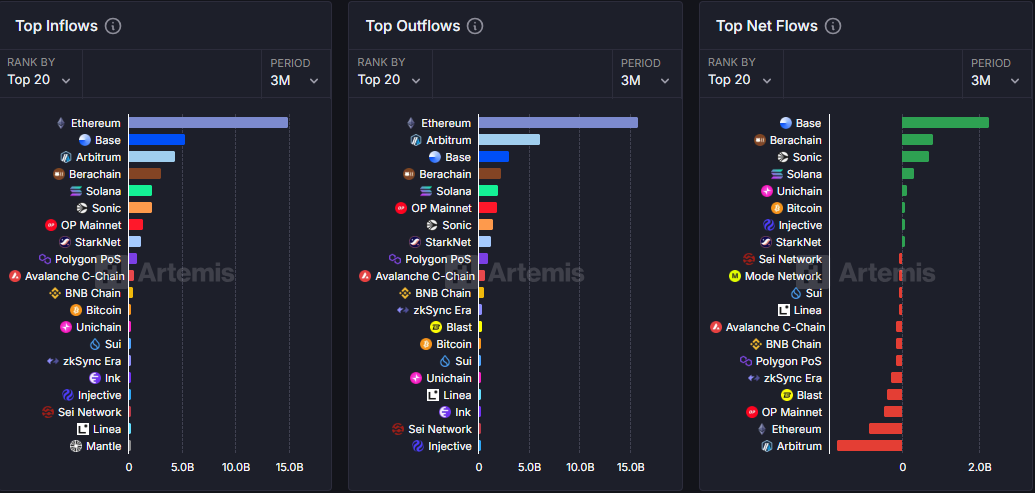

Base Blockchain Leads Net Flows Across DeFi Bridges

Base has emerged as a top performer in 2025, leading the market in net flow over the past three months. On total inflow metrics, data on Artemis Terminal shows it is second, after Ethereum (ETH). This traction reflects growing user confidence and adoption across DeFi, gaming, and NFT verticals.

Still, the network has not been immune to controversy. Only hours ago, Base faced backlash after a meme coin, allegedly promoted by insiders, triggered a trading frenzy and abrupt collapse. As BeInCrypto reported, this raised accusations of a pump-and-dump scheme.

While Base distanced itself from the coin in question, the incident raises concerns about transparency and ethical boundaries on the platform.

“This wasn’t a meme coin. This wasn’t a token launch. Base didn’t drop a coin to pump bags or flip the market. This was a content coin — and that distinction matters,” Base developer Charis posted on X.

As Base moves into Q2, it stands at a crossroads. On the one hand, it is armed with performance upgrades and developer momentum. On the other hand, it faces heightened scrutiny.

If successful, its roadmap could further cement Base’s place as a foundation of the next-generation internet. However, the pressure to balance innovation, security, and trust has never increased.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Range-Bound—But a Move Higher May Be Brewing?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

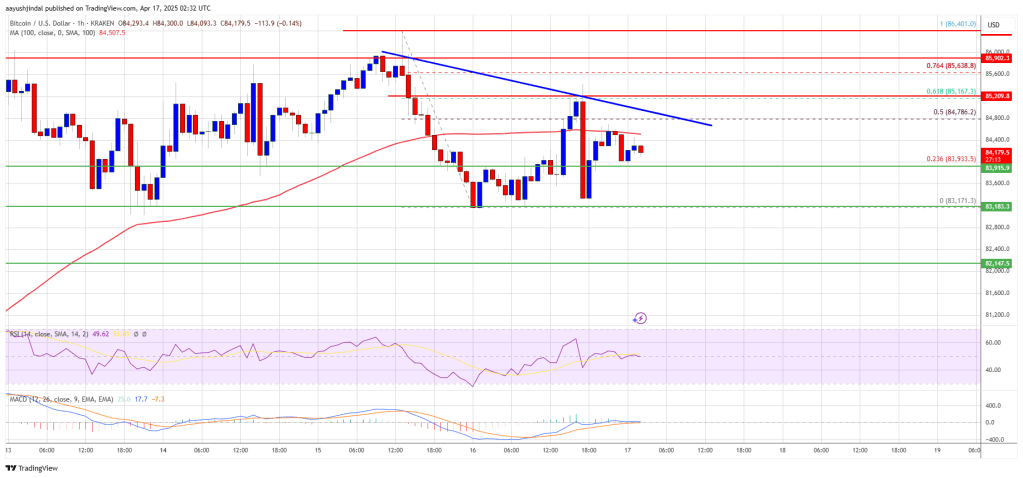

Bitcoin price started a fresh decline below the $85,500 zone. BTC is now consolidating and might attempt to clear the $85,200 resistance zone.

- Bitcoin started a fresh decline below the $85,500 zone.

- The price is trading below $85,000 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,000 zone.

Bitcoin Price Eyes Fresh Increase

Bitcoin price struggled near the $86,500 zone and started a fresh decline. BTC declined below the $85,500 and $85,000 levels to enter a short-term bearish zone.

The price tested the $83,200 support. A low was formed at $83,171 and the price recently corrected some losses. There was a move above the $83,800 level. The price surpassed the 50% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low.

Bitcoin price is now trading below $85,000 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $84,750 level. There is also a connecting bearish trend line forming with resistance at $84,800 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $85,150 level or the 61.8% Fib retracement level of the downward move from the $86,401 swing high to the $83,171 low. The next key resistance could be $85,500.

A close above the $85,500 resistance might send the price further higher. In the stated case, the price could rise and test the $85,800 resistance level. Any more gains might send the price toward the $86,400 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,000 resistance zone, it could start another decline. Immediate support on the downside is near the $83,900 level. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $83,200, followed by $82,200.

Major Resistance Levels – $84,750 and $85,150.

Market

Bitcoin Whales Withdraw $280 Million: Bullish Signal?

Massive Bitcoin withdrawals worth hundreds of millions of USD from major exchanges have sparked significant interest in the crypto community.

However, if Bitcoin fails to break the $86,000 barrier, a price correction remains a real possibility, especially amid wavering investor confidence.

Bitcoin Whales Withdraw Hundreds of Millions in BTC

Data from the X account OnchainDataNerd on April 17, reveals that several large Bitcoin whales executed substantial withdrawals from top exchanges. Galaxy Digital withdrew 554 BTC, valued at approximately $76.74 million, from OKX and Binance.

Abraxas Capital pulled out 1,854 BTC, worth around $157.26 million, from Binance and Kraken.

Two other whales, identified by addresses 1MNqX and 1BERu, withdrew 545.5 BTC ($45.5 million) and 535.2 BTC ($45.44 million) from Coinbase, respectively. In a single day, over $280 million in Bitcoin was removed from exchanges.

Such withdrawals from Bitcoin whales, like those by Galaxy Digital and Abraxas Capital, often signal a strategy to move BTC into cold storage. This is typically viewed as a bullish sign, reducing selling pressure and reflecting expectations of future price increases.

Surge in First-Time Bitcoin Buyers

A report from Glassnode on X highlights a sharp rise in first-time Bitcoin buyers. This influx of new investors could drive short-term price gains. However, long-term holders (LTHs) have paused their accumulation, signaling caution amid heightened market volatility.

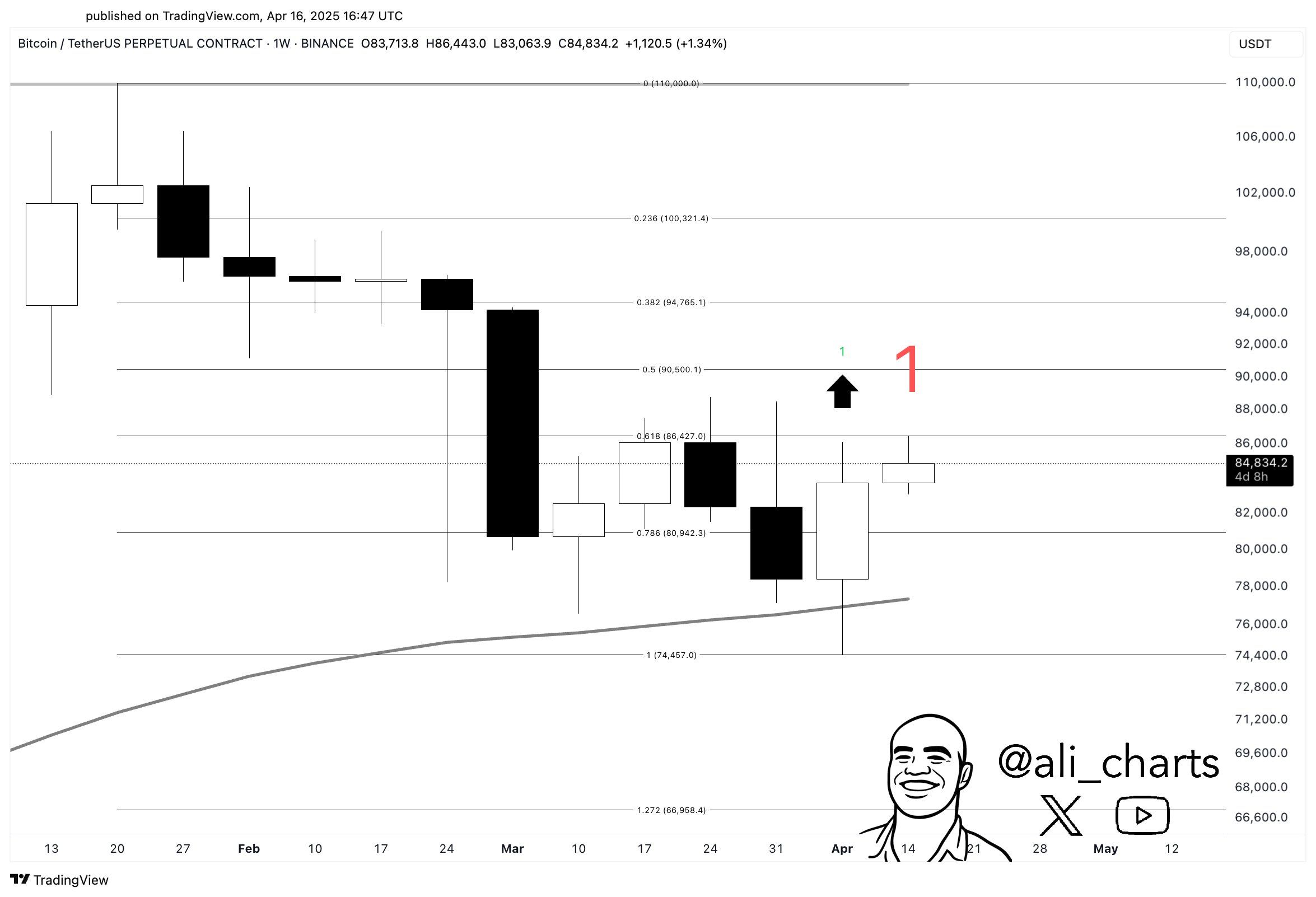

In a post on X, the analyst Ali used the TD Sequential technical indicator to forecast Bitcoin’s price trend. The TD Sequential flashed a buy signal on the Bitcoin weekly chart.

If Bitcoin consistently closes above $86,000, further price increases are likely. Currently, Bitcoin is hovering above $80,000, indicating growth potential. However, surpassing the critical $86,000 resistance level is essential to confirm the bullish trend.

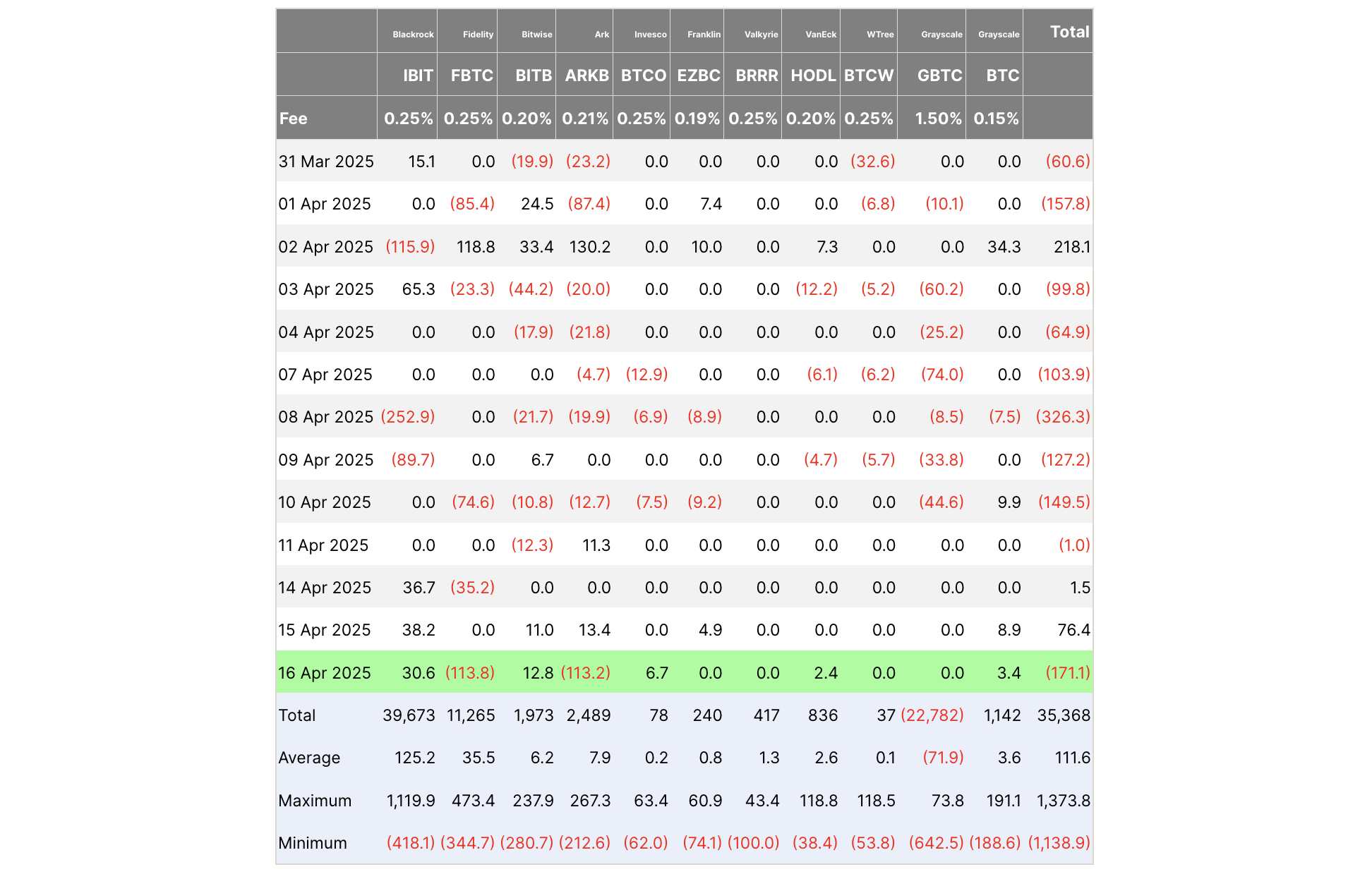

Despite recent whale accumulation, not all signals are positive. Inflows into Bitcoin ETFs have dropped significantly. This decline suggests weakening investor confidence, which could exert downward pressure on prices without fresh catalysts.

Additionally, data from Lookonchain indicates that over $1.26 billion in Bitcoin was unstaked from Babylon. If this capital flows back to exchanges, selling pressure could intensify, making it harder for Bitcoin to breach key resistance levels.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoMantra (OM) Price Pumps As Founder Reveals Massive Token Burn Plan

-

Altcoin18 hours ago

Altcoin18 hours agoDOGE Whale Moves 478M Coins As Analyst Predicts Dogecoin Price Breakout “Within Hours”

-

Market20 hours ago

Market20 hours agoHow It’s Impacting the Network

-

Market24 hours ago

Market24 hours agoMantra’s OM Token Surges 25% After Token Burn Announcement

-

Market16 hours ago

Market16 hours agoBitcoin and Ethereum Now Accepted by Panama City Government

-

Market23 hours ago

Market23 hours agoThis Crypto Security Flaw Could Expose Seed Phrases

-

Market13 hours ago

Market13 hours agoCrypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals Why The Solana Price Can Still Drop To $65