Market

Can Polkadot (DOT) Price Make It to $9 by the End of May?

Polkadot’s (DOT) price is on track to continue its ongoing recovery after noting corrections over the past two months.

This is supported by the investors who have been exhibiting bullishness towards the asset.

Polkadot Traders Pour Money

Polkadot’s price at the time of writing is observing the impact of DOT holders changing their behavior. The evidence of the same can be seen in the Open Interest in the Futures market.

Open interest (OI) refers to the total number of active derivative contracts, such as futures or options, that have not yet been settled. In the case of DOT, this OI has risen by more than $63 million, bringing the total to $284 million from $221 million in merely three days.

While a rise in OI does not necessarily mean that the move is bullish, the positive funding rate suggests that long contracts dominate over short contracts.

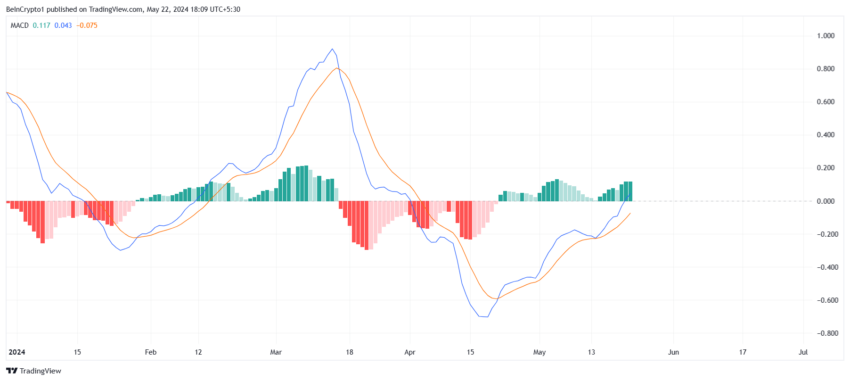

Additionally, the Moving Average Convergence Divergence (MACD) is also observing a surge in bullishness. MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price, helping to identify potential buy and sell signals.

Read More: What Is Polkadot (DOT)?

The indicator has avoided a bearish crossover twice this month now, and the green bars on the histogram confirm that bullishness has taken precedence. This could be reflected in Polkadot’s price as well, assisting a rise.

DOT Price Prediction: Another Rise After a Monthly High

Polkadot’s price trading at $7.50 is close to breaching the resistance at $8.0. Flipping this resistance into support can push the price further up, as it previously served as support before a past uptick.

This could result in an uptrend towards $9.0, marking a 22% rally for the cryptocurrency.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

However, if the breach fails, Polkadot’s price could fall back to $6.8, where it might face consolidation. A drop below this would send DOT to $6.3, marking a 14% drawdown, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.