Market

Can Chainlink Help WLFI Beat Setbacks?

World Liberty Financial (WLFI), a project inspired by Donald Trump’s vision of financial independence, has announced its adoption of Chainlink’s infrastructure.

The partnership with Chainlink aims to establish WLFI as a reliable, secure DeFi platform focused on promoting USD-backed stablecoins and safeguarding the dollar’s role as the global reserve currency. However, amid these ambitious goals, the project faces significant skepticism from crypto investors and a challenging launch marked by technical setbacks.

Chainlink Adoption for Enhanced Security and Interoperability

According to a press release shared with BeInCrypto, World Liberty Financial’s decision to leverage Chainlink technology centers on its use of Chainlink’s Price Feeds for the Ethereum mainnet.

By integrating Chainlink’s secure price feeds, WLFI hopes to enable real-time, dependable financial data across assets like USDC, USDT, ETH, and WBTC. These are crucial to its future launch of an Aave v3-based lending service on its platform.

WLFI’s integration of Chainlink aims to address common DeFi challenges, such as secure cross-chain interoperability and protection from market volatility. This is particularly significant as DeFi has faced frequent scrutiny over transaction security and reliability. Chainlink’s ecosystem, which has processed over $16 trillion in transaction value, is expected to enable WLFI to secure more users and grow its DeFi ecosystem.

“Never before have we been more bullish on crypto or the overall future of DeFi technology,” noted Eric Trump, WLFI’s Web3 Ambassador.

WLFI’s mission represents a vision to democratize financial access and reinforce USD’s supremacy on the global stage, a stance inspired by Trump’s policies. This focus includes promoting privacy-oriented, peer-to-peer (P2P) transactions that WLFI claims align with “American values” of financial independence and freedom.

The platform’s governance is community-driven, with token holders (WLFI) voting on protocol decisions. This would allow World Liberty Financial to take what it calls a “user-driven approach” to shaping the future of its DeFi ecosystem.

Trump’s decentralized finance project also hopes to bridge Web2 and Web3, simplifying DeFi’s notoriously complex user interfaces. This is while it aims to attract a broader, mainstream audience.

The project’s integration of Chainlink for multi-chain connectivity and data infrastructure is a step in that direction. It seeks to streamline asset tokenization and make DeFi accessible to those without a technical background.

Chainlink Partnership May Instill Greater Confidence in World Liberty Financial

While World Liberty Financial’s partnership with Chainlink appears promising on paper, the project has faced investor doubt and early setbacks. During its presale phase, WLFI had to drastically cut its fundraising goals by 90%, sparking questions about the project’s viability. Similarly, many investors remained unimpressed, and concerns have circulated about the project’s capacity to achieve its bold vision.

BeInCrypto also reported how technical difficulties plagued World Liberty Financial’s highly publicized launch. Reports of delayed transactions and connectivity issues dampened investor enthusiasm as potential users faced difficulty accessing the platform. Such issues highlight the inherent risks associated with complex, large-scale DeFi launches, particularly for new projects striving to compete with well-established players.

Despite these challenges, Chainlink Co-Founder Sergey Nazarov expressed optimism. He said Chainlink’s infrastructure could attract a community of users who prioritize security and transparency.

“The Chainlink standard is already widely used across DeFi. It will help WLFI attract users that value the security and reliability that has already helped grow DeFi as an industry,” Nazarov said in a press release shared with BeInCrypto.

This suggests that the partnership may instill greater confidence in WLFI’s platform moving forward. Yet, World Liberty Financial must still prove its value amid a fast-paced DeFi playing field.

The tokenized asset initiative, central to WLFI’s long-term strategy, has yet to demonstrate its unique value proposition compared to established DeFi projects that already leverage Chainlink’s cross-chain infrastructure.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh decline below the $83,500 zone. BTC is consolidating losses and might start another decline below the $80,000 level.

- Bitcoin started a fresh decline below the $82,000 zone.

- The price is trading below $81,200 and the 100 hourly Simple moving average.

- There was a break below a connecting bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $80,500 zone.

Bitcoin Price Dips Below Support

Bitcoin price failed to settle above the $83,500 level and started a fresh decline. BTC traded below the $83,000 ad $82,000 levels to enter a bearish zone.

There was a break below a connecting bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair. The pair even dived below the $80,000 support zone. A low was formed at $77,057 and the price started a recovery wave.

There was a move above the $78,800 level. The price climbed above the 23.6% Fib retracement level of the recent decline from the $83,680 swing high to the $77,057 low. However, the price is struggling to continue higher.

Bitcoin price is now trading below $81,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $80,000 level. The first key resistance is near the $80,500 level or the 50% Fib retracement level of the recent decline from the $83,680 swing high to the $77,057 low.

The next key resistance could be $81,500. A close above the $81,500 resistance might send the price further higher. In the stated case, the price could rise and test the $82,500 resistance level. Any more gains might send the price toward the $83,500 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $80,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $77,500 level. The first major support is near the $77,000 level.

The next support is now near the $76,500 zone. Any more losses might send the price toward the $75,000 support in the near term. The main support sits at $74,200.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $77,500, followed by $77,000.

Major Resistance Levels – $80,000 and $80,500.

Market

Will ADA Drop to $0.44?

Cardano (ADA) has faced a sharp price decline amid heightened volatility and widespread liquidations across the broader crypto market. Over the past 24 hours, ADA has shed more than 10% of its value, marking one of its steepest single-day losses in recent months.

ADA is now trading at $0.52, levels last seen in November 2024. This reinforces the growing bearish sentiment against the altcoin.

Death Cross and Heavy Outflows Weigh on ADA

ADA’s downturn in the past day has pushed its price into precarious territory, with a death cross now appearing on its daily chart. This marks the first time the pattern will appear on ADA charts since May 2024.

The death cross pattern—where the 50-day moving average falls below the 200-day moving average—is viewed as a long-term bearish signal, often preceding extended periods of price weakness.

When a death cross is formed, it indicates a definitive shift in market sentiment from bullish to bearish, leading to increased selling pressure and a possible further decline in price. This suggests ADA could face continued downward pressure in the near term if the bulls remain in the shadows.

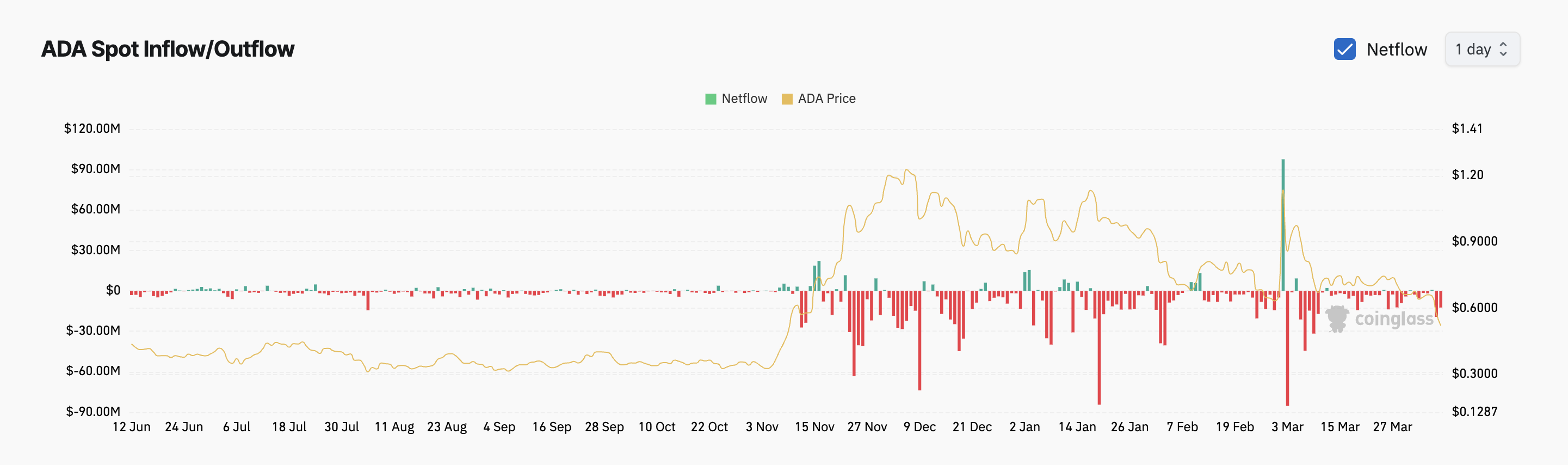

Moreover, the steady outflows from the ADA spot markets add to the downward pressure on its price. According to Coinglass, ADA spot outflows have totaled $12 million so far today.

Over the past month, capital exit from the ADA spot markets has exceeded $150 million.

Spot outflows like this indicate bearish sentiment, as they suggest that investors are pulling their capital in anticipation of further price drops or moving funds into other assets.

This persistent trend signals a loss of confidence among ADA traders as they continuously liquidate their positions. This has worsened the market’s selling pressure and contributed significantly to ADA’s price troubles.

Cardano’s Downward Trend Deepens: Death Cross Threatens More Drop

While broader market instability has impacted many altcoins, ADA’s price drop is notable due to the formation of the Death Cross. The emergence of this technical indicator, combined with a multi-month price low as buying activity falls, suggests ADA could face continued downward pressure in the near term.

In this scenario, its value could dip to $0.44, marking a 14% decline from its current value.

On the other hand, a resurgence in new demand for the altcoin will invalidate this bearish outlook. In that scenario, ADA’s price could regain its losses and attempt to break above resistance at $0.54.

If successful, it could extend its gains to $0.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Tanks Hard—Can It Survive the $1,500 Test?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price failed to recover above $1,820 and dropped below $1,650. ETH is now consolidating losses and might face resistance near the $1,675 zone.

- Ethereum failed to stay above the $1,650 and $1,620 levels.

- The price is trading below $1,650 and the 100-hourly Simple Moving Average.

- There was a break below a connecting bullish trend line with support at $1,775 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair remains at risk of more losses below the $1,550 support zone.

Ethereum Price Dips Further

Ethereum price failed to stay above the $1,800 support zone and extended losses, like Bitcoin. ETH declined heavily below the $1,750 and $1,700 levels.

There was a break below a connecting bullish trend line with support at $1,775 on the hourly chart of ETH/USD. The bears even pushed the price below the $1,600 level. A low was formed at $1,537 and the price recently corrected some losses.

There was a move above the $1,580 level. The price tested the 23.6% Fib retracement level of the downward move from the $1,815 swing high to the $1,537 low. However, the bears are active near the $1,600 zone. The price is now consolidating and facing many hurdles.

Ethereum price is now trading below $1,650 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,600 level.

The next key resistance is near the $1,675 level or the 50% Fib retracement level of the downward move from the $1,815 swing high to the $1,537 low. The first major resistance is near the $1,710 level. A clear move above the $1,710 resistance might send the price toward the $1,820 resistance.

An upside break above the $1,820 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,880 resistance zone or even $1,920 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,600 resistance, it could start another decline. Initial support on the downside is near the $1,550 level. The first major support sits near the $1,535 zone.

A clear move below the $1,535 support might push the price toward the $1,420 support. Any more losses might send the price toward the $1,400 support level in the near term. The next key support sits at $1,350.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,550

Major Resistance Level – $1,600

-

Bitcoin24 hours ago

Bitcoin24 hours agoAltseason Dead On Arrival? Data Shows Bitcoin Outperforming All Categories

-

Market24 hours ago

Market24 hours agoHBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

-

Bitcoin19 hours ago

Bitcoin19 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Altcoin16 hours ago

Altcoin16 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Market23 hours ago

Market23 hours agoConor McGregor’s Crypto Token REAL Tanks After Launch

-

Market19 hours ago

Market19 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market16 hours ago

Market16 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff