Market

Bybit Hack, SEC Lawsuits, and Bitcoin ETFs

This week in crypto, the Lazarus Group stole $1.5 billion from Bybit, yet the exchange has sustained the damage and remained operational. US Bitcoin ETFs saw a record $2.6 billion outflow turning BTC bearish and impacting major crypto stocks. At the same time, meme coin scams on social media are still on the rise.

On the regulatory front, the SEC dropped its lawsuit against Coinbase, prompting one Commissioner to accuse it of open corruption. Meanwhile, the recently launched Pi Network is being accepted by some Florida businesses.

Lazarus Group Pulls Off $1.5 Billion Hack

One week ago, Bybit, a leading crypto exchange, was hacked. With $1.5 billion in damages, it was the most successful crime in crypto history. A few conflicting narratives circulated throughout the community, but famous sleuth ZachXBT cracked the case.

The culprit was none other than the Lazarus Group, a North Korean hacker collective.

“At 19:09 UTC today, ZachXBT submitted definitive proof that this attack on Bybit was performed by the Lazarus Group. His submission included a detailed analysis of test transactions and connected wallets used ahead of the exploit, as well as multiple forensics graphs and timing analyses. The submission has been shared with the Bybit team,” Arkham claimed.

The Lazarus Group conducted a sophisticated security breach that sought to exploit Bybit’s wallet signing process. Safe Wallet confirmed that the hackers were able to breach its infrastructure but claimed its smart contracts remain secure.

Several community figures criticized its statement as too vague. Bybit, for its part, has rebuilt its reserves through several methods. The industry and crypto community have applauded the exchange’s excellent crisis management.

SEC Drops Coinbase Lawsuit, Dissension in the Ranks

After hinting that it would do so for weeks, the SEC finally dropped its lawsuit against Coinbase this week. Brian Armstrong, the crypto exchange’s founder and CEO, pre-emptively announced that he and the SEC struck a deal, but it took a few days for everything to finalize.

“Great news! After years of litigation, millions of your taxpayer dollars spent, and irreparable harm done to the country, we reached an agreement with SEC staff to dismiss their litigation against Coinbase. Once approved by the Commission (which we’re told to expect next week) this would be a full dismissal, with $0 in fines paid and zero changes to our business,” he said.

The Commission has been dropping several lawsuits and enforcement probes into the crypto industry this week. However, the SEC’s lawsuit against Ripple is still active, and there’s no clear hint of when it will end.

Additionally, these actions have attracted criticism from within the Commission.

Earlier today, Commissioner Caroline Crenshaw publicly lambasted the SEC’s shift towards the crypto industry. She accused its leadership of willfully ignoring 80 years of precedent to deliberately favor a political faction.

Moreover, she did not offer to resign and will remain an active Commissioner for over three months. This is a shocking upset to the SEC’s normal operations.

Bitcoin Drops 17%, Damaging ETFs and Corporate Holders

Strategy (formerly MicroStrategy), one of the world’s largest Bitcoin holders, recently spent nearly $2 billion on the asset. However, this did not help the company’s stock price, following sharp drops in BTC itself.

This fueled concerns that Strategy may have to liquidate some of its crypto holdings, as it might be overleveraged into the asset.

“Forced liquidation of MSTR is not necessarily impossible. But, it is highly unlikely. It would need a “mayday” situation to occur,” one commentator claimed.

Since those rumors started two days ago, things have gotten worse. Several key metrics are showing a decline in Bitcoin, and it’s proved contagious. Bitcoin ETFs had $2.6 billion in outflows this week, and corporate Bitcoin holders like Strategy and Tesla are all dropping.

Liquidations are up, and the Federal Reserve is predicting economic downturns; it looks like a bear market.

Pi Network Gets Institutional Adoption in Florida

Pi Network, one of the highly-anticipated crypto projects, made new headway in institutional acceptance this week. According to several social media posts, a Florida real estate company is now accepting Pi tokens. Cube Motor, a car dealership in the state, also set up similar infrastructure.

“American film producer and actor James J Zito is currently the director of Zito Realty, a real estate company in Florida, USA, which accepts real estate transactions with Pi coins,” the post read.

Pi Network is generating huge amounts of hype, with Binance’s community overwhelmingly voting to list the token. However, not everyone in the crypto sphere is thrilled with the project.

Before the hack, Bybit CEO Ben Zhou called the project a scam and a pyramid scheme. Its price is showing a few signs of market fatigue, but nothing definitive has happened yet.

Meme Coin Scams Are On the Rise

Kanye West, a famous American rapper, may or may not be wrapped up in a social media scam. Earlier this month, he denied involvement with any extant Kanye meme coin but allegedly planned to launch his own.

However, some crypto sleuths are speculating that he sold his X account to Barkmeta for $17 million, enabling a major fake token scam.

“Kanye West sold his X account for $17 million. The most anticipated meme coin launch is Barkmeta’s rug pull. The chance of YE’s sold account is above 95%. I do not recommend you to buy Kanye’s meme coin in any case,” a sleuth named Blade claimed.

A scam-centric paranoia is circulating through the crypto space, and the Bybit hack is only helping matters. Pump.fun’s social media account was hacked to promote a scam this week.

After the initial posts were deleted, the hackers were able to advertise another scam on the same page minutes later. Fears are building that this chaos is damaging the industry’s reputation.

In short, a lot has happened in crypto this week. Major crimes and bearish market conditions go alongside political developments and institutional adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Firms Donated $85 million in Trump’s Inauguration

According to a new report, 15 firms and individuals from the crypto industry donated more than $100,000 to President Trump’s Inauguration, totaling over $85 million.

Almost all of these companies apparently received direct or indirect benefits from Trump’s administration. This includes dropped legal proceedings, lucrative business partnerships, participation in Trump’s Crypto Summit, and more.

Crypto Industry Went All-In on Trump’s Inauguration

Since promising to bring friendlier regulations on the campaign trail, Donald Trump attracted a reputation as the Crypto President.

Trump’s Inauguration festivities included a “Crypto Ball,” and several prominent firms made donations for these events. Today, a report has compiled all crypto-related contributions of over $100,000, revealing some interesting facts.

Since taking office, President Trump and his family have been allegedly involved in prominent crypto controversies, and these donations may be linked to several of them.

For example, eight of the donors, Coinbase, Crypto.com, Uniswap, Yuga Labs, Kraken, Ripple, Robinhood, and Consensys, had SEC investigations or lawsuits against them closed since Trump’s term began.

The commission might have dropped its probe against these companies anyway due to its changing stance on crypto enforcement. However, being in the President’s good books likely helped the process.

Further Alleged Benefits for Donors

In other words, nearly half the firms that made donations to Trump’s Inauguration have seen their legal problems cleared up quickly. This isn’t the only regulation-related benefit they allegedly received.

Circle, for example, recently made an IPO after openly stating that Trump’s Presidency made it possible. Galaxy Digital received SEC approval for a major reorganization, a key step for a NASDAQ listing.

Other donors, such as Crypto.com and ONDO, got more direct financial partnerships with businesses associated with the Trump family.

Previously, Ripple’s CEO, Brad Garlinghouse, anticipated a crypto bull market under Trump. Also, XRP, Solana, and Cardano were all unexpectedly included in the US Crypto Reserve announcement.

All three of these companies made major donations to Trump’s Inauguration.

It seems that most of the firms involved got at least some sort of noticeable benefit from these donations. Donors like Multicoin and Paradigm received invitations to Trump’s Crypto Summit, while much more prominent groups like the Ethereum Foundation got snubbed.

Meanwhile, various industry KOLs and community members have already alleged major corruption in Trump’s crypto connections.

While some allegations might lack substantial proof, the crypto space has changed dramatically under the new administration, for both good and bad.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Surpasses Ethereum In This Major Metric After Outperforming For 6 Months

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a surprising move within the crypto market, XRP has surpassed Ethereum (ETH) in a key valuation metric: Fully Diluted Market Capitalization (FDMC). While Ethereum has been in a downtrend this bull cycle, XRP’s performance over the last six months has been nothing short of impressive, leading to it quietly overtaking the world’s second-largest cryptocurrency by market capitalization.

XRP Flips Ethereum In FDMC

Edward Farina, a crypto analyst and outspoken XRP supporter, took to X (formerly Twitter) on April 18 to announce that XRP has officially overtaken Ethereum in terms of Fully Diluted Market Capitalization. The FDMC represents the total potential value of a cryptocurrency if all of its tokens were in circulation.

Related Reading

This metric is usually calculated by multiplying a cryptocurrency’s current price by its maximum token supply. This contrasts with the more commonly referenced market capitalization metric, which only factors in circulating supply.

At the time of his post, Farina reported that XRP’s FDMC had reached $208.4 billion, surpassing Ethereum’s $192.5 billion by approximately $15.9 billion. This marks over six consecutive months of XRP outperforming Ethereum in terms of projected value, signaling a potential shift in altcoin dominance between the two leading cryptocurrencies.

Despite XRP’s FDMC milestone, it’s worth noting that Ethereum’s current market capitalization remains significantly higher. As of writing, ETH’s market cap is estimated at $199.14 billion, compared to XRP’s $124.3 billion, reflecting a difference of around $74.84 billion.

The key reason for this discrepancy between XRP’s market capitalization and FDMC lies in its unique token structure. A significant portion of XRP’s supply is held in escrow, meaning those tokens are not yet available in the open market. While they do not count toward the circulating supply, they are included in its Fully Diluted Market Capitalization.

The implication behind this distinction remains clear: if all of XRP’s tokens in escrow were unlocked and circulated today, its market value could exceed that of Ethereum. As the altcoin steadily gains momentum in valuation metrics and investor interest, it could pose a significant challenge to Ethereum’s position as the number one altcoin and second-largest cryptocurrency.

Bollinger Bands Signal Major Move In The Altcoin Price

The XRP price could be gearing up for a significant move upward as technical chart indicators point toward rising volatility. A recent analysis of the 4-hour chart by crypto analyst Ali Martínez shows Bollinger Bands tightening — a classic signal that often precedes a breakout.

Related Reading

Currently trading near the midline of the bands after a bounce from the lower support zone, XRP is now consolidating within a narrow range. The “squeeze” pattern reflects reduced volatility. While the target of the proposed price move remains uncertain, Martinez is confident that its next breakout is just around the corner.

Featured image from Unsplash, chart from Tradingview.com

Market

Cardano (ADA) Jumps 4% as Bullish Signals Emerge

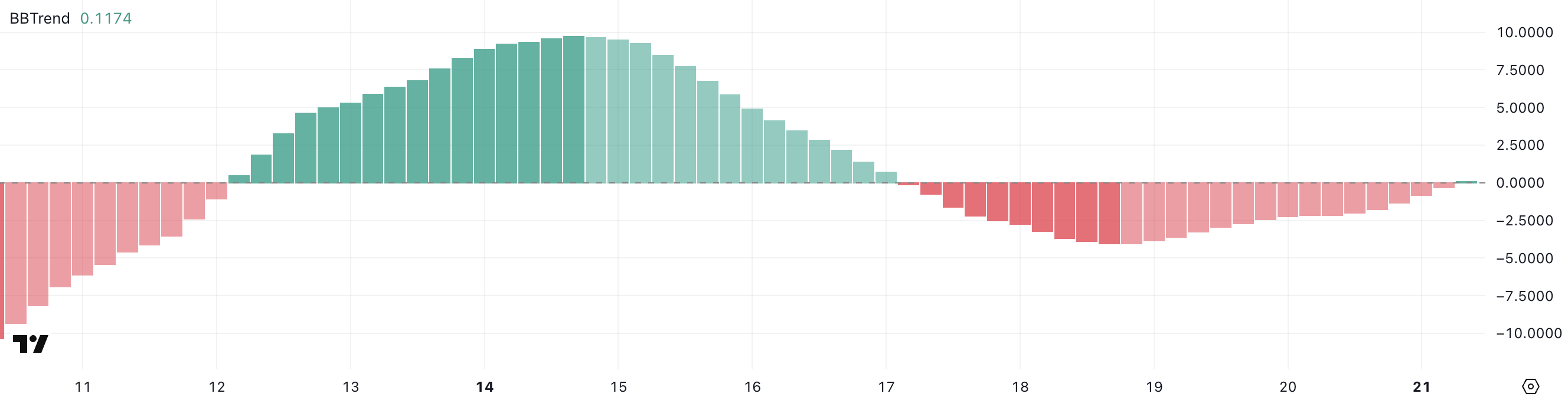

Cardano (ADA) is up 4% on Monday, trying to hit $0.65, showing signs of renewed bullish momentum. Technical indicators are beginning to align in favor of buyers, with the BBTrend turning positive for the first time in days and the DMI signaling strengthening upward pressure.

ADA is also nearing a potential golden cross formation on its EMA lines, which could further support a breakout if resistance levels are cleared. With momentum building and key levels in sight, Cardano is entering a critical zone that could define its short-term direction.

Cardano Shows Early Signs of Recovery as BBTrend Turns Positive

Cardano BBTrend has just flipped back into positive territory at 0.11, following four straight days in the negative zone. This shift, though subtle, may be the first sign of momentum stabilizing after recent weakness.

BBTrend, or Bollinger Band Trend, is a technical indicator that gauges the strength and direction of a trend based on how wide or narrow the Bollinger Bands are.

When the bands begin to expand and BBTrend moves into positive values, it often suggests growing volatility in favor of an emerging bullish trend. On the other hand, prolonged negative readings typically signal fading momentum and a lack of directional strength.

While a BBTrend of 0.11 is still low and not yet signaling a strong uptrend, the fact that it turned positive marks a potential inflection point.

It suggests that selling pressure may be fading and the price could be entering a recovery phase if buying activity increases. This early uptick in BBTrend often precedes a broader move.

Traders will likely be watching closely to see if this positive shift is sustained in the coming sessions, as continued gains in BBTrend could indicate the beginning of a more defined upward move for ADA.

Cardano Buyers Regain Control as Uptrend Shows Early Strength

Cardano Directional Movement Index (DMI) is showing a notable shift in momentum, with its Average Directional Index (ADX) climbing to 17.79, up from 13.77 yesterday.

The ADX measures the strength of a trend, regardless of its direction, on a scale from 0 to 100. Values below 20 suggest a weak or non-existent trend, while readings above 25 typically confirm that a trend is gaining strength.

ADA’s ADX is still below the 20 threshold but rising steadily—indicating that momentum is building and a stronger directional move could soon take shape.

Looking deeper, the +DI (positive directional indicator) has jumped to 26.38 from 16.30 just a day ago, signaling increased buying pressure. Although it has slightly pulled back from an earlier peak at 29.57, it remains firmly above the -DI (negative directional indicator), which has dropped significantly from 22.72 to 13.73.

This widening gap between the +DI and -DI suggests a clear shift in favor of bulls, with buyers regaining control after a brief period of selling pressure.

If the ADX continues to rise alongside a dominant +DI, it could confirm a strengthening uptrend for Cardano.

Cardano Nears Golden Cross as Bulls Eye Breakout—but Key Support Still in Play

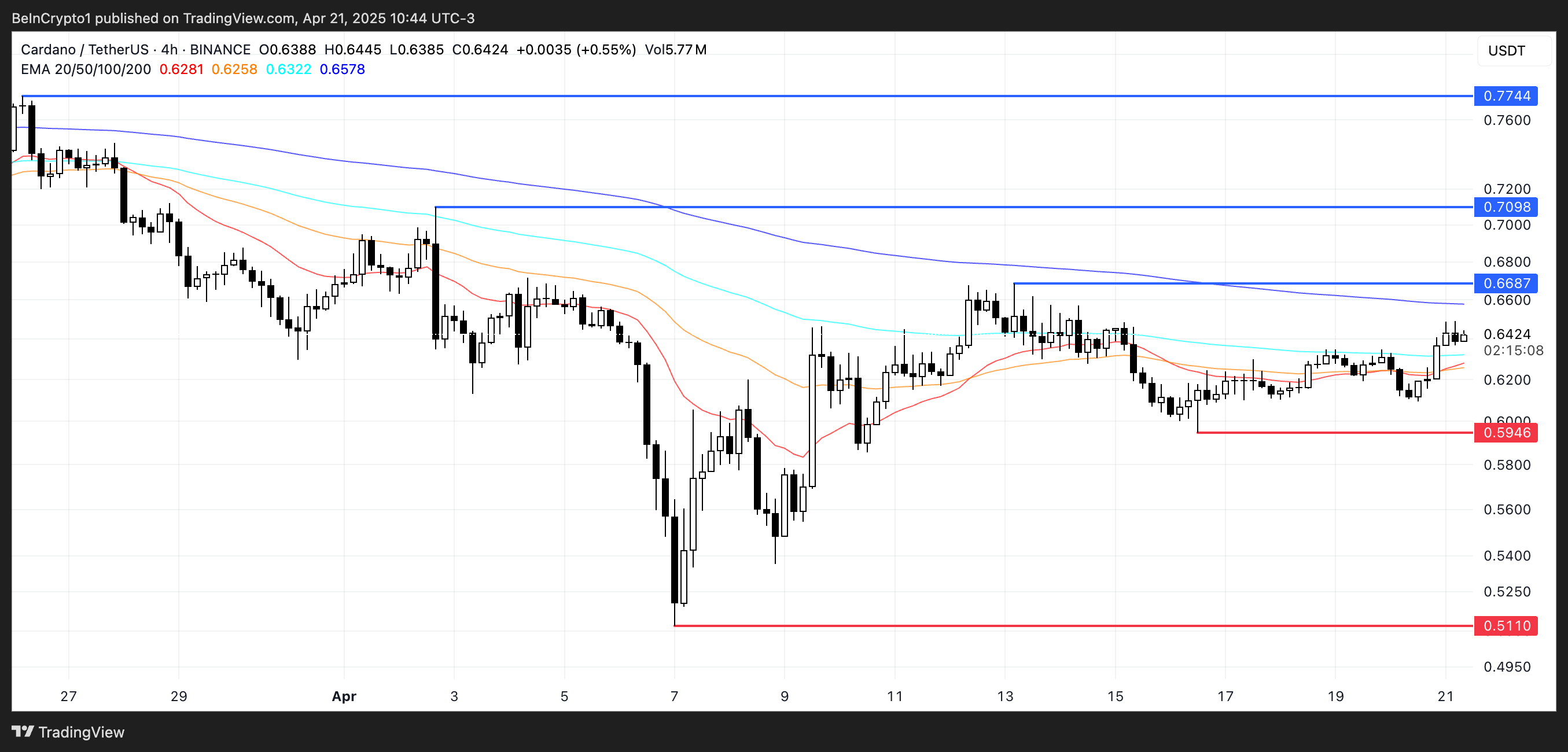

Cardano price is approaching a potentially bullish technical development, as its EMA lines suggest a golden cross may form in the coming sessions.

A golden cross occurs when the short-term moving average crosses above the long-term moving average, often signaling the start of a stronger uptrend.

If this crossover is confirmed and ADA manages to break above the resistance at $0.668, the next upside targets sit at $0.709 and $0.77—levels not seen since late March.

However, if ADA fails to maintain its upward trajectory and the momentum fades, downside risks remain in play.

A drop back toward the $0.594 support would be the first sign of weakness, and a breakdown below that level could expose the asset to deeper losses, with $0.511 as the next key support zone.

Price action around the $0.668 resistance will likely be the deciding factor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin19 hours ago

Bitcoin19 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Market22 hours ago

Market22 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Says Solana Price To $2,000 Is Within Reach, Here’s How

-

Market20 hours ago

Market20 hours agoSolana Rallies Past Bitcoin—Momentum Tilts In Favor of SOL

-

Altcoin17 hours ago

Altcoin17 hours agoExpert Reveals Why BlackRock Hasn’t Pushed for an XRP ETF

-

Market19 hours ago

Market19 hours agoVitalik Buterin Proposes to Replace EVM with RISC-V

-

Market15 hours ago

Market15 hours agoSolana Staking Cap Surpasses Ethereum, But Is This Sustainable?

-

Market14 hours ago

Market14 hours agoOptimism, Aztec, and Huma Finance