Market

Bullish Whale Behavior Fuels Ethereum (ETH) Price 20% Rally

Ethereum (ETH) price has been on a remarkable rally, gaining 20% over the past week. This rally has been fueled in part by a significant outflow of ETH from exchanges, suggesting growing confidence among holders. Whale accumulation has also picked up, hinting at increasing bullish sentiment.

However, with recent minor corrections, ETH is now at a pivotal point, testing its support and resistance levels to determine its next move.

ETH Net Transfer Volume Reached 128,000 On November 10

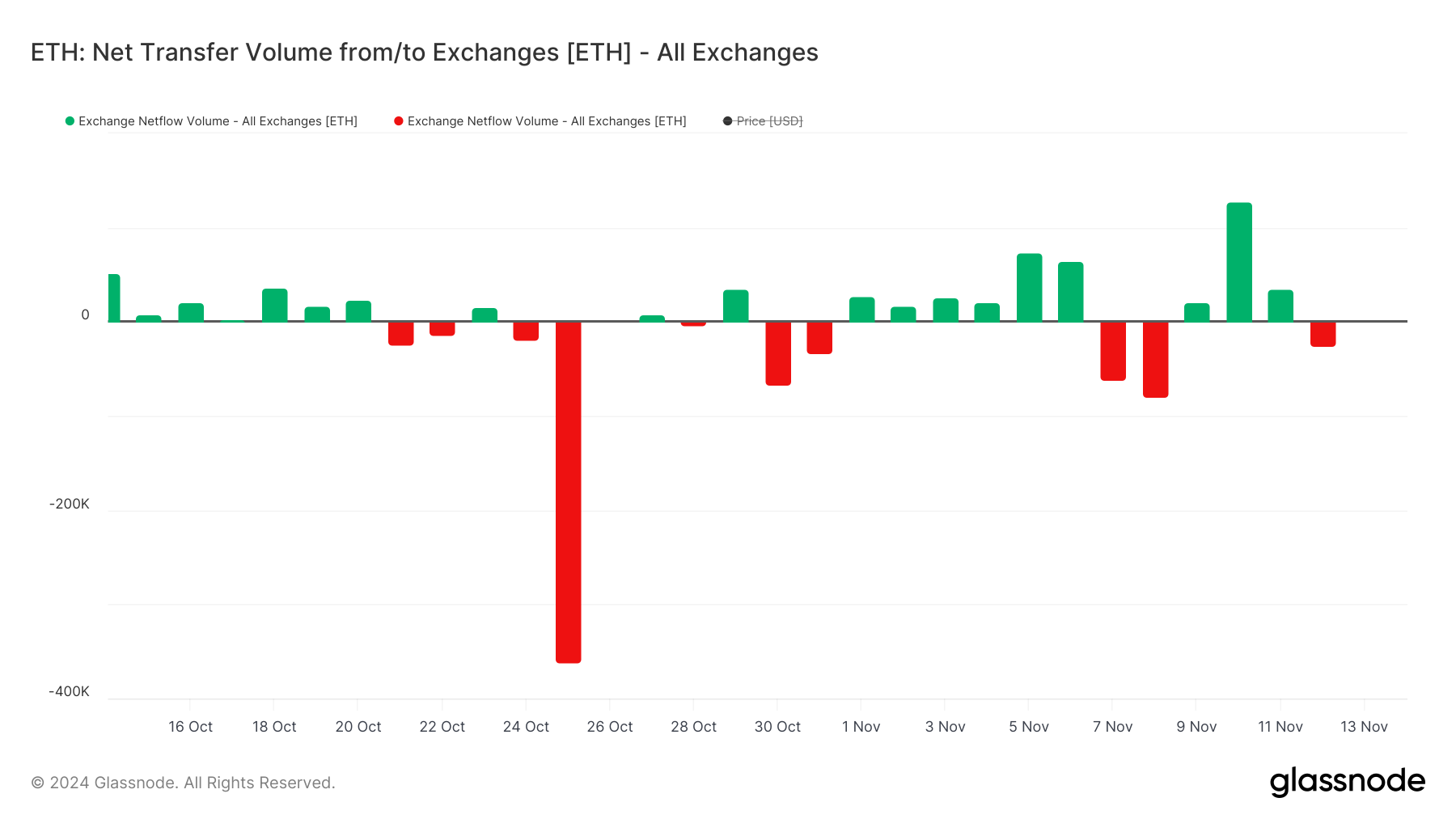

ETH has been on a strong rally, climbing 20.10% in the past 7 days. More than 361,000 ETH left exchanges on October 25 – a substantial outflow that pointed towards growing confidence among holders before the current rally.

Such a large movement typically suggests that investors are moving their assets to personal wallets, hinting that they may be planning to hold rather than sell.

When a lot of coins leave exchanges, it’s generally bullish because it indicates users are less likely to sell. Conversely, when large volumes of coins flow into exchanges, it can be bearish, as holders might be preparing to sell.

Since October 25, the net transfer volume to and from exchanges has been fluctuating between positive and negative, reaching 128,000 on November 10. This indicates uncertainty, as the market is experiencing a mix of buying and selling pressure.

Ethereum Whales Are Accumulating Again

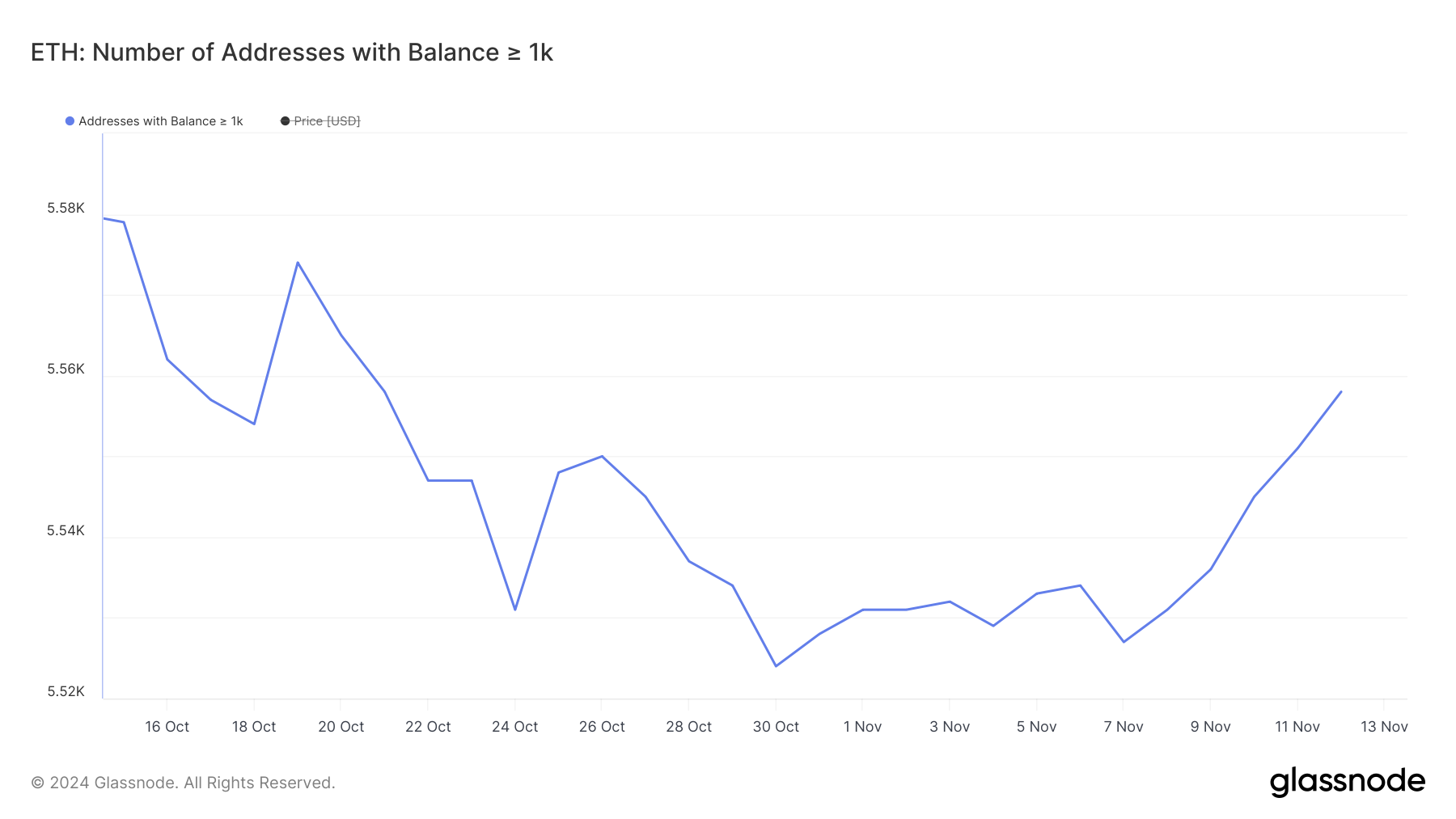

After weeks of decline, the number of whales holding at least 1,000 ETH has finally started to rise again. This trend reversal began on November 7, and the number has been climbing consistently day after day—from 5,527 on November 7 to 5,558 on November 12.

The renewed accumulation among whales suggests a shift in sentiment, with large holders showing increasing confidence in ETH price.

Tracking these whale wallets is crucial because their activity can significantly influence market trends. When whales start accumulating, it often signals a potential price increase, as these holders typically move markets.

Their buying can also reduce the available supply on exchanges, creating more upward pressure on the price of Ethereum.

ETH Price Prediction: Is a Rally To $4,000 Possible?

After a strong rally, ETH price has faced a minor correction over the last few days. The EMA lines remain bullish, with short-term lines still above the long-term ones, indicating an overall upward trend.

However, the price has dropped below the shortest EMA line, which suggests that the current uptrend might be losing some momentum.

ETH’s closest resistance level is now around $3,500. If this resistance is broken, ETH price could potentially surge to $3,700—a possible 17.9% rise and its highest level since June.

On the flip side, if the uptrend reverses, ETH price may retest support at $3,000. If that fails, the next level of support would be around $2,800.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Eyes Resistance Break—Failure Could Spark Fresh Losses

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Teucrium Launches First 2x Long XRP ETF in the US

Teucrium Investment Advisors is set to launch its Teucrium 2x Long Daily XRP ETF (XXRP) after securing NYSE Arca approval. This marks the first exchange-traded fund (ETF) in the United States to offer leveraged exposure to XRP (XRP).

The move comes as the race for a spot XRP ETF intensifies in the US, with Polymarket odds suggesting a high likelihood of approval this year.

What Is Teucrium’s 2x Long XRP ETF and Why It Matters

The XXRP fund aims to deliver two times (2x) the daily price performance of the altcoin. It will begin trading on NYSE Arca on April 8.

According to its prospectus, the fund will not directly invest in XRP. Instead, it will primarily gain exposure through swap agreements with global financial institutions.

There is also a provision for investment in XRP futures contracts, options, XRP-related companies, and spot XRP ETPs as needed. Additionally, the fund may utilize reverse repurchase agreements to enhance its investment capital.

“The fund presents different risks than other types of funds. The fund uses leverage and is riskier than similarly benchmarked funds that do not use leverage. The fund is intended to be used as a short-term trading vehicle,” the prospectus read.

The ETF enables investors to access the XRP market with a lower capital investment compared to buying equivalent derivatives directly. It has a management fee of 1.85% and offers monthly distributions to investors.

The launch of XXRP comes at a pivotal moment for XRP, as Ripple recently settled its legal battle with the SEC. Despite the lack of an approved spot ETF, Teucrium’s leveraged product offers a new avenue for investors seeking amplified exposure to the fourth-largest cryptocurrency by market capitalization. According to BeInCrypto data, XRP’s market cap stands at $111 billion.

Bloomberg’s senior ETF analyst Eric Balchunas commented on the development in the latest X (formerly Twitter post). He highlighted the unusual nature of this launch.

“Very odd (maybe a first) that a new asset’s first ETF is leveraged,” he said.

Balchunas also noted that while a spot XRP ETF has yet to be approved, the odds of such approval remain high. Many in the industry share this sentiment.

Interestingly, in anticipation of the XXRP launch, the likelihood of a spot XRP ETF receiving approval has surged. According to the prediction market platform Polymarket, odds have jumped by 5% since yesterday.

The chances of approval by December 2025 now stand at 75%. However, the outlook for a short-term approval by July 31 remains more cautious, with odds currently sitting at just 33%.

It is worth noting that the SEC faces a critical deadline in October to decide on two XRP-based ETFs. These include the Grayscale and 21Shares XRP ETFs, following their filings in the Federal Register in February.

Additionally, BeInCrypto reported that major asset managers, including BlackRock and Fidelity, could soon file for an XRP ETF, joining WisdomTree, Bitwise, and Canary Capital.

As regulatory clarity around digital currencies continues to evolve, the market will be watching closely to see how this pioneering ETF performs and whether it paves the way for further XRP-based financial products in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Recovery Fades—$2 Remains A Tough Nut to Crack

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Market23 hours ago

Market23 hours agoEthereum Price Tanks Hard—Can It Survive the $1,500 Test?

-

Bitcoin22 hours ago

Bitcoin22 hours agoWill 2025’s Crypto Market Mirror 2020’s Rebound? Analysts Predict

-

Regulation18 hours ago

Regulation18 hours agoPakistan’s Crypto Council Appoints Binance Founder Changpeng Zhao As Strategic Advisor

-

Market21 hours ago

Market21 hours agoBitcoin Price Crashes Hard—Is The Selloff Just Getting Started?

-

Market16 hours ago

Market16 hours agoIs $0.415 the Key to Further Gains?

-

Market18 hours ago

Market18 hours agoBinance Founder CZ Joins Pakistan Crypto Council as Advisor

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Whale Dumps 300M Coins Amid Market Crash, Can DOGE Price Dip Below $0.1?

-

Market22 hours ago

Market22 hours agoWill ADA Drop to $0.44?