Market

BlackRock’s IBIT Launch in Chile, and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about BlackRock’s IBIT launch in Chile, Nubank’s partnership with Lightspark, Bolivia’s cryptocurrency ban revoke, and more.

BlackRock Launches IBIT on Santiago Stock Exchange in Chile

BlackRock has introduced its iShares Bitcoin Trust (IBIT) to the Santiago Stock Exchange in Chile, managed by BCI Corredores de Bolsa. This launch allows Chilean investors to participate in Bitcoin investments at an institutional level.

Chile now follows Brazil in the region, where BlackRock launched the same ETF earlier in March. According to GTD, 74% of Chileans recognize Bitcoin as the leading cryptocurrency in the market. The ETF, which began trading on June 27, benefits from BlackRock’s technological expertise and its management of approximately 1,300 other ETFs.

This launch fills us with pride, as it is in line with the long history of innovation driven by BlackRock in the financial markets. Now, investors in Chile will have an accessible and efficient digital asset to include in their portfolios, backed by the extensive experience in risk management that our iShares ETFs have,” said Silvia Fernández, the Country Head of BlackRock Chile.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

IBIT has established itself as the world’s largest Bitcoin ETF, with over $20 billion in assets since it began trading in January 2024. It was also the fastest ETF to reach $10 billion in assets in history.

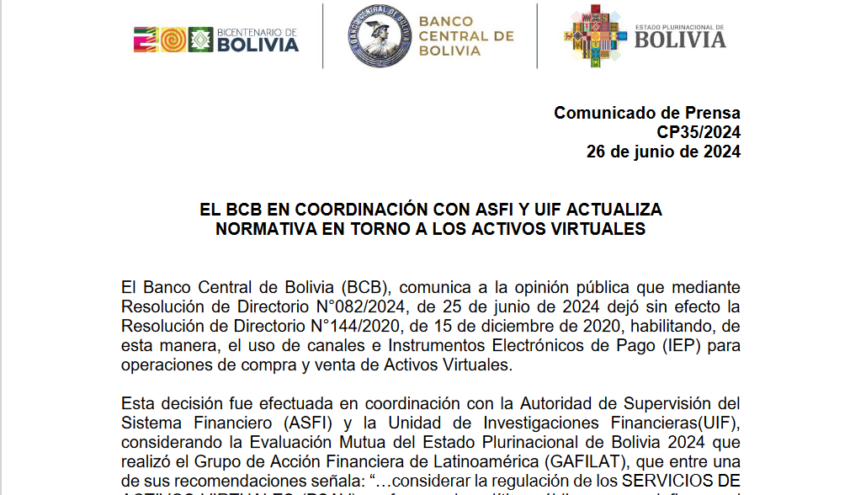

Bolivia Authorizes Cryptocurrency Use, Revoking Historic Ban

Bolivia has officially lifted its ban on cryptocurrencies, authorizing their use through Electronic Payment Instruments (IEP). Edwin Rojas, the president of the Central Bank of Bolivia, announced this decision, marking a massive shift in the country’s approach to digital commerce.

The reversal of the 2020 Resolution 144, which previously restricted cryptocurrency transactions, involved the Financial Investigations Unit and the Financial System Authority. Despite this change, the Boliviano remains the only legal tender.

The Central Bank stresses that all risks associated with virtual assets are the user’s responsibility. It highlights that these assets are not considered legal money and are not obligatory for payments. The Central Bank is committed to adapting existing regulations and launching educational campaigns.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

This initiative aligns with recommendations from the Latin American Financial Action Task Force. They suggested regulating virtual asset services to meet new financial realities and the expanding use of blockchain technologies.

The recent move modernizes Bolivia’s financial system and opens doors to new digital commerce opportunities and financial inclusion, provided that public education manages the transition responsibly.

Santander Brazil Expands Crypto Trading to Retail Customers via Toro Platform

Santander, the multinational banking giant, has recently announced that it will start offering cryptocurrency trading services in Brazil. Starting this week, Santander’s Brazilian investment platform, Toro, will offer its retail customers access to Bitcoin and Ethereum.

Previously, these cryptoassets were available only to the bank’s private clients through ETFs. This move follows similar offerings by other Brazilian banks such as Itaú, Nubank, Inter, and BTG Pactual.

Toro founder and CEO João Resende explains that negotiations begin with offering the two largest digital currencies to selected clients with an appropriate risk profile for the product.

“The product will be aimed at clients with an aggressive risk profile. Gradually, the new service will be rolled out to the broker’s entire base of more than one million active clients.” Resende says Toro is considering offering other digital currencies in addition to tokenized assets. “It’s a first step we are taking,” he noted.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

According to a report by Valor Econômico, the success of this initiative in Brazil might lead to its expansion across other Santander branches worldwide. Santander, also participating in the CBDC project known as Drex, recently conducted the first transaction using Anonymous Zether. The solution, developed by Consensys, allows users to conceal transaction amounts and the parties’ identities using cryptographic proofs.

Costa Rican Authorities Unveil Bitcoin Money Laundering Scheme

Costa Rican authorities have dismantled a sophisticated money laundering scheme involving cryptocurrencies, including Bitcoin. After a two-and-a-half-year investigation, police arrested 36 individuals on Tuesday. Among them were judges, lawyers, and two Spanish nationals identified as the ringleaders.

Randall Zúñiga, director of the Judicial Investigation Agency (OIJ), explained that the gang stole properties from Costa Rican residents. They then legitimized these assets through cryptocurrency purchases. In one instance, the organization moved $13 million in Bitcoin in a single day, highlighting the scale of its operations.

“There is a whole team dedicated to cryptocurrencies. In one day, they made a $13 million transaction in bitcoins. We have identified 25 properties, but over 100 have been stolen. Conversations suggest they have taken over 300 properties, with one valued at $30 million. This constitutes a multi-million dollar fraud,” Zúñiga stated.

Read more: Top 9 Safest Crypto Exchanges in 2024

The operation involved around 500 OIJ agents and conducted 47 raids nationwide. Lawyers, notaries, public officials, and five traffic officers were arrested. They face charges of registration fraud, ideological falsehood, and money laundering.

This case in Costa Rica mirrors a similar incident in Venezuela. The Scientific, Criminal, and Criminalistic Investigations Corps (CICPC) captured a criminal operating an illicit cryptocurrency exchange in Chacao, Miranda.

The detainee, Gabriel Bello, enticed victims with offers of currency exchange and cryptocurrencies at affordable prices. He then failed to deliver the promised returns. Bello, who was wanted for continuous swindling and other crimes, is now in the custody of the Public Prosecutor’s Office.

Colombia’s Usiacurí Municipality Adopts Bitcoin

The small Colombian town of Usiacurí, home to over 10,000 residents, has embraced cryptocurrencies like Bitcoin, USDT, and Tron for tourist transactions. This initiative mirrors El Salvador’s 2021 adoption of Bitcoin and aligns with Colombia’s high rate of Bitcoin utilization. President Gustavo Petro has even explored cryptocurrencies as potential solutions for governmental issues.

This adoption is part of the “Distrito Crypto” project, a collaboration between Usiacurí’s municipality, Universidad de la Costa (CUC), Certika, and Corporación CienTech, exclusive to Usiacurí in the Atlántico department. The program aims to facilitate cryptocurrency transactions for foreign tourists across local hotels, shops, and restaurants.

“The participation of the Universidad de la Costa was fundamental throughout the process, since through its teachers and researchers have been strengthening the research line of blockchain and its applications, as is this tool that allowed us to turn Usiacurí into the first municipality with Cryptocurrency District, generating more sales in its tourism and hotel sector,” explained CienTech.

Read more: Who Owns the Most Bitcoin in 2024?

Further enhancing Colombia’s appeal to crypto investors, the recent introduction of Worldcoin’s World ID verifications in Bogotá and Medellín positions the nation as a hub for digital identity solutions. This system serves as a “digital passport of humanity,” designed to verify unique individual identities securely, meeting growing demands for digital services verification.

Nubank Partners with Lightspark to Integrate Lightning Network in Brazil

Nubank has partnered with Lightspark to deploy the Bitcoin Lightning Network on its Brazilian platform. This alliance will explore potential synergies and development opportunities, with more specific details to be announced later.

Lightspark will provide Nubank with an enterprise-grade gateway to the Lightning Network, facilitating reliable, near real-time transactions for Bitcoin and fiat currencies at reduced costs.

“The partnership with Lightspark, which has developed an excellent technical solution for Bitcoin’s Lightning network, is another step in Nubank’s mission to provide the best solutions for our customers and strengthen our long-term relationship with them. The future integration of Lightning underscores Nubank’s ongoing mission to deliver more efficient services faster and at lower costs through blockchain technology,” stated Thomaz Fortes, CEO of Nubank Crypto.

Read more: The Best Bitcoin Lightning Network Wallets In 2024

The collaboration will allow Nubank’s teams to enhance the end-to-end customer experience by focusing on product innovation without the burden of managing a large-scale Lightning deployment. This integration represents a significant advancement in the adoption and efficiency of digital financial transactions, promising a faster, more affordable, and secure service for Nubank’s customers. It’s a significant milestone for the Lightning Network, expected to greatly increase its overall network utilization.

Argentina and Venezuela Face Hyper AI Platform Controversy

The Hyper AI platform, renowned for integrating advanced technologies like AI and blockchain into a metaverse, has recently suspended user withdrawals, alleging a system update. This action has alarmed its investors in Venezuela and caused uncertainty in Argentina. The platform is now accused of operating like a Ponzi scheme, leading many users to organize a protest to file formal complaints with the public prosecutor’s office in Venezuela.

Social media and cryptocurrency forums are buzzing with reactions as users in Venezuela express their frustration over the lack of transparency, accusing Hyper AI of employing common Ponzi scheme tactics. Approximately 20,000 users in Los Teques, El Jarillo, and La Colonia Tovar are reportedly affected. On Wednesday, June 26, a group will officially approach the Superior Prosecutor’s Office of Miranda to denounce the platform.

“I entered in the month of February, I started with the minimum investment of 50 dollars. For a while I recovered something, but for example my son borrowed money, he entered with $5,000 and of course he lost all of that. I know many people who sold houses, cars, who were excited because this platform was supposed to last until next year”, Carlos Chavez told the local Venezuelan media Diario Avance.

Read more: 15 Most Common Crypto Scams To Look Out For

The controversy is not confined to Venezuela; it has also touched Argentina. Users have voiced their dissatisfaction and are seeking answers to the ongoing crisis.

“My experience was awful, I entered through my nephew who was also scammed. I invested almost 900 dollars and I could not withdraw anything and it was horrible to know that they played with us like that”, Gabriela Romando told Argentinean media El Diario del Sur.

The situation that all Hyper AI users are going through has exacerbated the distrust in investments related to emerging technologies in the region. This saga is reminiscent of other recent financial collapses of digital platforms such as FTX, BTR, Solesbot, and CowCoin.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. From BlackRock’s Bitcoin ETF launch in Chile to Brazilian Nubank’s partnership with Lightspark, Latin America is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

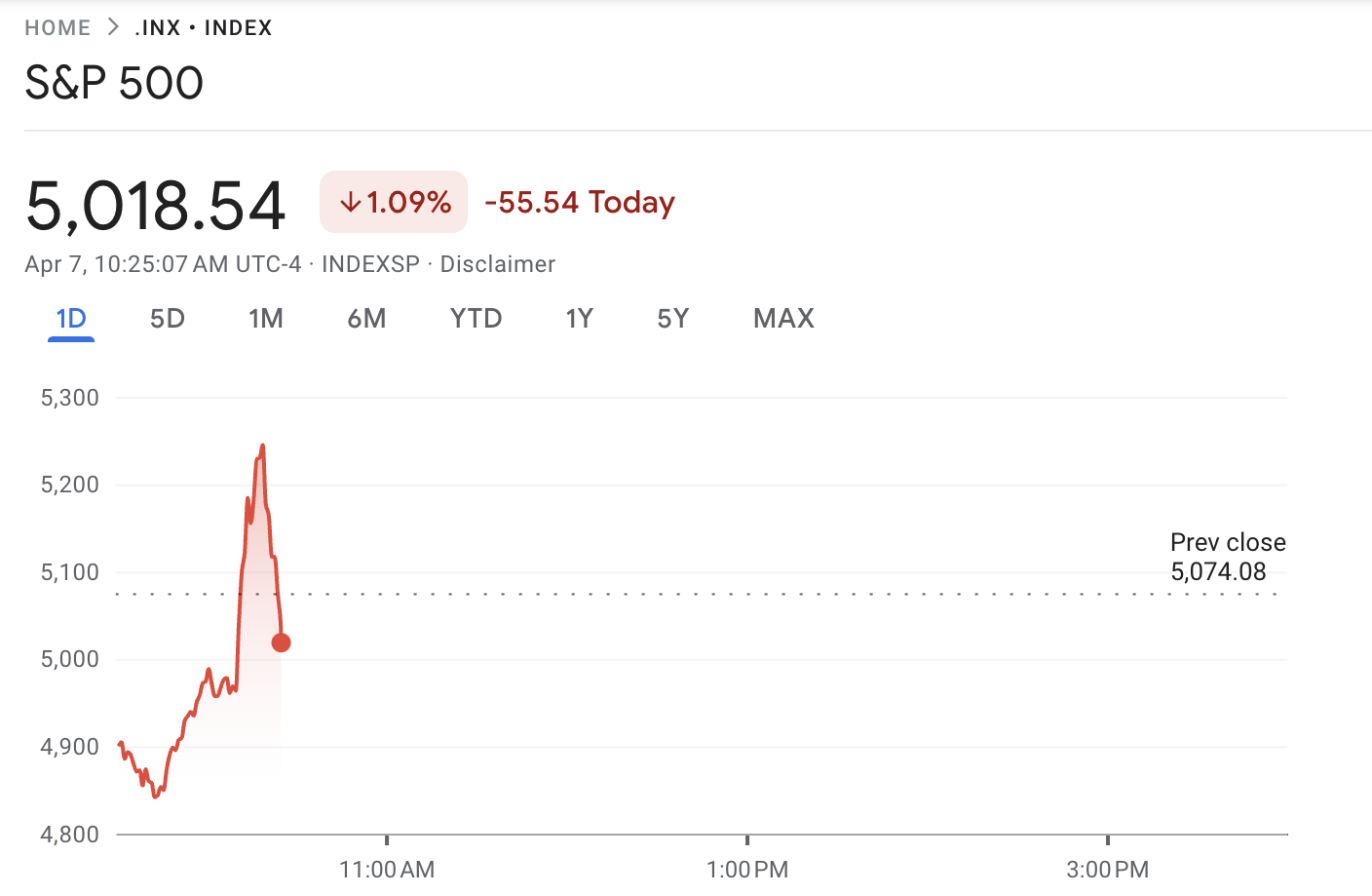

The brief rumor of a 90-day pause from Trump’s tariffs caused the markets to rally significantly. However, the White House squashed these rumors, fueling further crashes.

This highlights a genuine desperation in the markets as traders try to regain some bullish momentum and prevent a recession.

Trump Tariff Fakeout

The threat of Trump’s tariffs is closer than ever, and it’s causing a “Black Monday” event in the crypto markets. Bitcoin dipped below $80,000, and over $1 billion was liquidated from crypto.

However, one of the President’s advisors, Kevin Hassett, suggested this morning that he might be having second thoughts:

“Would Trump consider a 90-day pause in tariffs?’ ‘I think the president is gonna decide what the president is gonna decide … even if you think there will be some negative effect from the trade side, that’s still a small share of GDP,’” Hassett said in an interview.

This news quickly began recirculating, claiming that Trump was seriously considering a 90-day pause in tariffs. This created a huge rally in traditional markets, with the S&P 500 shooting up 6% in seconds. This rally turned on a dime to a certain extent, falling again quickly.

Following the rumor, XRP rallied nearly 10% to hit $2, while Bitcoin rebounded back to $80,000. Both assets have declined again due to the lack of credibility of the news. Overall, the volatility has been extremely chaotic in the crypto market today.

In his interview, Hassett did not make any firm commitments that Trump is considering pausing tariffs. His response focused mostly on ongoing negotiations and assertions that the tariffs would have a limited impact.

Shortly afterward, the White House officially denied any knowledge of a 90-day pause. They are still set to begin in two days.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Founder CZ Joins Pakistan Crypto Council as Advisor

Changpeng ‘CZ’ Zhao, the founder of Binance, has reportedly taken on a new role as Strategic Advisor to the Pakistan Crypto Council.

Pakistan’s local media suggests that the appointment was confirmed during a meeting held in Islamabad with top government officials.

CZ Joins Pakistan Crypto Council

The Finance Minister, Senator Muhammad Aurangzeb, reportedly led the session. Other attendees included the heads of Pakistan’s key financial and regulatory bodies—the Securities and Exchange Commission and the State Bank—and senior officials from the law and IT ministries.

According to the reports, Zhao also met separately with Pakistan’s Prime Minister and Deputy Prime Minister to discuss digital asset policy and blockchain adoption.

His involvement with Pakistan follows a recent agreement with the Kyrgyz Republic. There, he is advising on Web3 infrastructure and blockchain education.

Kyrgyzstan has also launched the A7A5 stablecoin, pegged to the Russian ruble. Both Kyrgyzstan and Pakistan are looking to develop their financial ecosystem around crypto to attract industry interest in the regions.

Meanwhile, CZ continues to engage with multiple governments on crypto regulation. He has been focused on building secure frameworks and enabling digital finance ecosystems.

BeInCrypto has contacted Binance about the reports and whether the company is involved in the initiative.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low

The value of the leading altcoin, Ethereum, has plunged to its lowest point since March 2023, signaling a steep decline in market confidence. This has happened amid the broader market’s downturn, which was exacerbated by Donald Trump’s Liberation Day.

Compounding the bearish sentiment, the ETH/BTC ratio has now dropped to a five-year low, indicating that Bitcoin is gaining relative strength against Ethereum.

ETH/BTC Ratio Hits 5-Year Low as Traders Flee

ETH’s price decline has pushed the ETH/BTC ratio to a five-year low of 0.019. This ratio measures ETH’s relative value compared to BTC. When it rises, it indicates that ETH is outperforming BTC, either because the altcoin’s price is growing faster or the king coin’s price is falling.

Conversely, a decline like this suggests that the leading coin, BTC, is gaining strength relative to the top altcoin, ETH. It suggests that traders are moving capital into BTC, seeing it as a safer or more profitable investment at the moment despite its own price troubles.

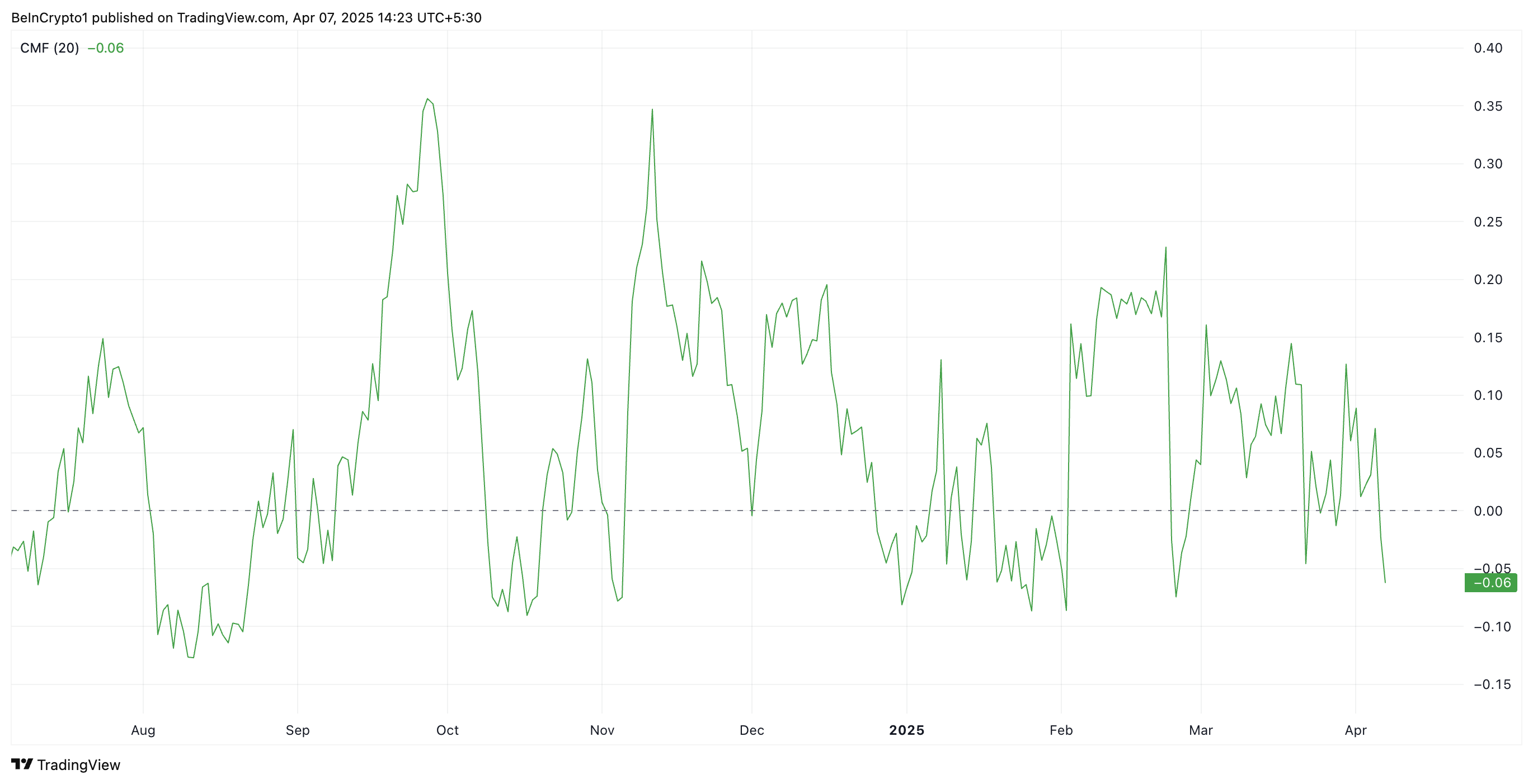

Further, on the daily chart, ETH’s negative Chaikin Money Flow (CMF) confirms the coin’s plummeting demand. At press time, it is at -0.07.

The CMF indicator measures the volume-weighted accumulation and distribution of an asset over a set period, helping gauge buying and selling pressure. When its value falls below zero like this, it indicates that selling pressure is dominating.

ETH’s CMF readings suggest that more traders are distributing (selling) the coin than accumulating it. This reflects weakening demand and is a bearish signal for the asset’s price momentum.

ETH Flashes Oversold Signal: Is a Bounce Back on the Horizon?

ETH’s Relative Strength Index (RSI), observed on a one-day chart, shows that the altcoin is currently oversold. At press time, the momentum indicator is in a downtrend at 25.62.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 25.62, ETH’s RSI signals that the coin is deeply oversold. This presents a buying opportunity, as such lows are usually followed by a price rebound.

If this happens, ETH’s price could regain and climb back above $1,589. If this support level strengthens, it could propel ETH’s value to $1,904.

However, this rebound is not guaranteed. If ETH bears maintain dominance and selloffs continue, the coin could extend its decline and fall toward $1,197.

The post Ethereum (ETH) Tanks to March 2023 Levels as ETH/BTC Ratio Plummets to 5-Year Low appeared first on BeInCrypto.

-

Bitcoin23 hours ago

Bitcoin23 hours agoUS Macro Setup To Favour New Bitcoin ATH In The Long Run

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Reveals Decentralized Strategy To Stabilize Pi Network Price

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Lags Behind Bitcoin In Q1 Performance Amid Market Downturn – Details

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for This Week: AXS, JTO, XAV

-

Ethereum18 hours ago

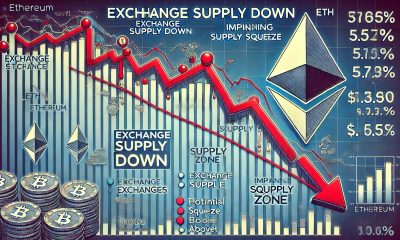

Ethereum18 hours agoEthereum Supply On Exchanges Plummets – Is A Supply Squeeze Coming?

-

Market19 hours ago

Market19 hours agoBitcoin Price Drops Below $80,000 Amid Heavy Weekend Selloff

-

Market24 hours ago

Market24 hours agoKey Solana Holders’ 6-Month High Accumulation Signal Price Rise

-

Bitcoin7 hours ago

Bitcoin7 hours ago$1 Billion in Liquidations Over the Weekend