Market

Bittensor’s Subnet Ecosystem Grows Despite Market Uncertainty

Despite tariff fears having an outsized impact on AI tokens, Bittensor’s subnet ecosystem is posting impressive returns. In two months, its subnet tokens’ market cap grew from $4 million to over $200 million.

The total number of subnets has tripled in the last year, and community enthusiasm could fuel further growth. Each one can improve Bittensor’s machine-learning capabilities, potentially creating further gains.

Bittensor Network Grows Thanks to Subnets

Bittensor, a decentralized AI learning network, has been going through a few changes lately. It became the biggest AI cryptoasset last December and rallied again after a Coinbase listing.

Although its token price has since had a period of decline, there are a few key signals of long-term potential. Essentially, the key factor for Bittensor is growth in its subnets.

“Venture capitalists chasing gas hashrate stars is old news. Bittensor subnets are open source projects with Bitcoin-like currencies bolted on top. ~50 days in, < 100 subnets are worth $6 billion+ with billions in emission pouring in over coming months. The bar is LOW. There should be thousands of subnets today!” Joseph Jacks claimed.

Subnets are how Bittensor keeps its machine-learning capabilities decentralized. Each subnet is a specialized partition of the network that focuses on a specific area of expertise, and they’re growing.

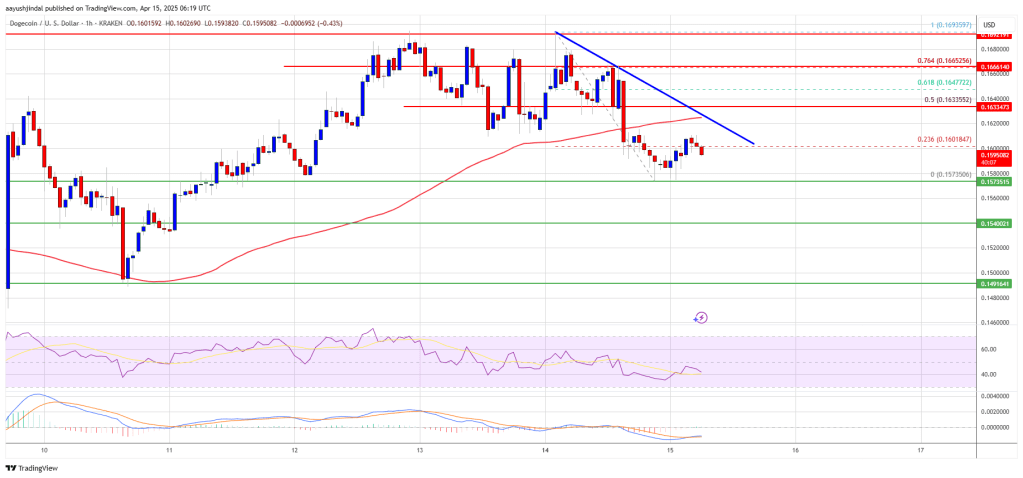

In the last year, the number of total active subnets on the network has nearly tripled:

Some of the leading subnet tokens in Bittensor’s ecosystem have market caps well in excess of $10 million. Indeed, despite a slight hiccup yesterday, the total market cap of all subnet tokens has been growing dramatically.

This figure rose from around $4 million in February to over $200 million today, an impressive rate of growth.

This growth is impressive enough in a vacuum, and even more so in today’s unstable crypto market. However, Bittensor’s subnet performance is particularly noteworthy for another reason.

According to a recent report, tariff instability is heavily impacting AI tokens, with only meme coins suffering worse damage. In other words, Bittensor should be feeling pressure.

Despite these broader concerns, Bittensor’s ecosystem is actually expanding. This high performance has led some advocates to declare that Bittensor might be “the next generational opportunity.”

If the subnet ecosystem is growing under these circumstances, it’ll provide higher utility for Bittensor’s machine learning and a possible source of market stability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Dogecoin (DOGE) Derailed? Meme Coin Faces New Hurdles to Fresh Surge

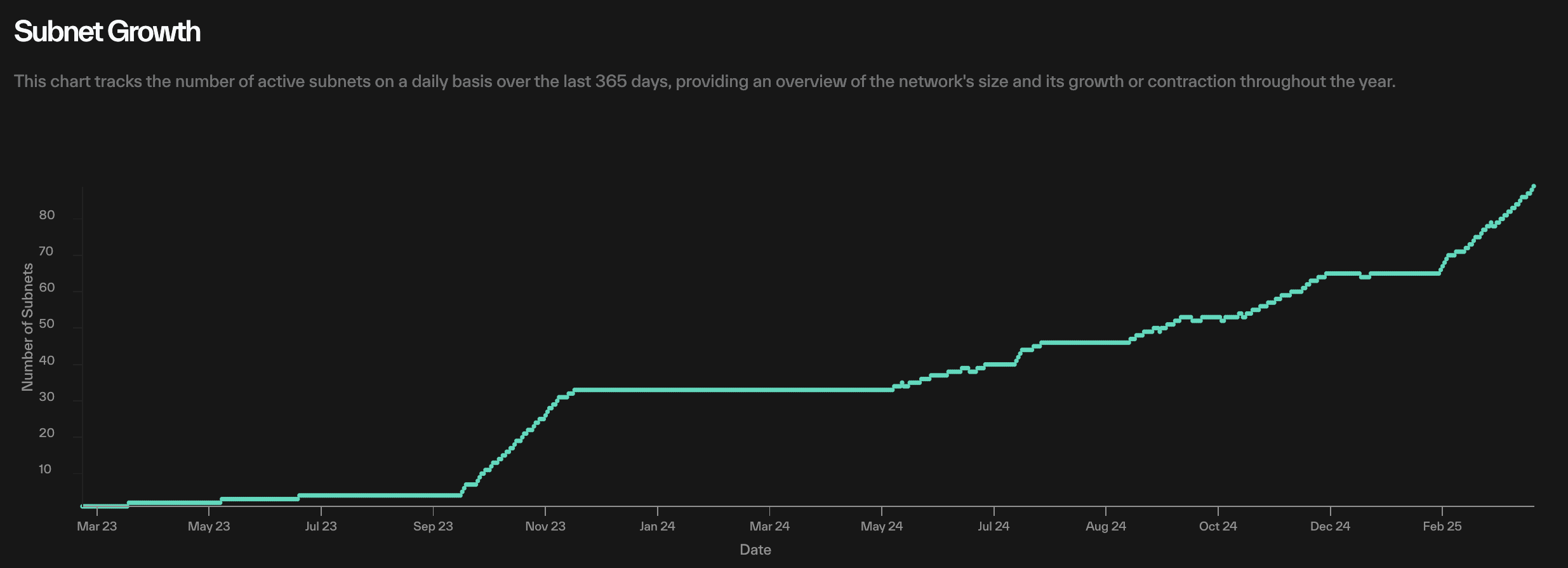

Dogecoin started a fresh decline from the $0.1700 zone against the US Dollar. DOGE is consolidating and might struggle to recover above $0.1650.

- DOGE price started a fresh decline below the $0.1650 and $0.1600 levels.

- The price is trading below the $0.1620 level and the 100-hourly simple moving average.

- There is a connecting bearish trend line forming with resistance at $0.1620 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1575 support zone.

Dogecoin Price Faces Rejection

Dogecoin price started a fresh decline after it failed to clear $0.170, unlike Bitcoin and Ethereum. DOGE dipped below the $0.1650 and $0.1600 support levels.

The bears were able to push the price below the $0.1585 support level. It even traded close to the $0.1575 support. A low was formed at $0.1573 and the price recently corrected some losses. There was a minor move above the 23.6% Fib retracement level of the downward move from the $0.1693 swing high to the $0.1573 low.

Dogecoin price is now trading below the $0.1620 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.1620 level. There is also a connecting bearish trend line forming with resistance at $0.1620 on the hourly chart of the DOGE/USD pair.

The first major resistance for the bulls could be near the $0.1635 level and the 50% Fib retracement level of the downward move from the $0.1693 swing high to the $0.1573 low.

The next major resistance is near the $0.1665 level. A close above the $0.1665 resistance might send the price toward the $0.1700 resistance. Any more gains might send the price toward the $0.1720 level. The next major stop for the bulls might be $0.1800.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.1620 level, it could start another decline. Initial support on the downside is near the $0.1575 level. The next major support is near the $0.1540 level.

The main support sits at $0.1500. If there is a downside break below the $0.1500 support, the price could decline further. In the stated case, the price might decline toward the $0.1420 level or even $0.1350 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now gaining momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1575 and $0.1540.

Major Resistance Levels – $0.1620 and $0.1665.

Market

Cardano Buyers Eye $0.70 as ADA Rallies 10%

Layer-1 (L1) coin Cardano has recorded a 10% gain over the past week, positioning itself for an extended rally.

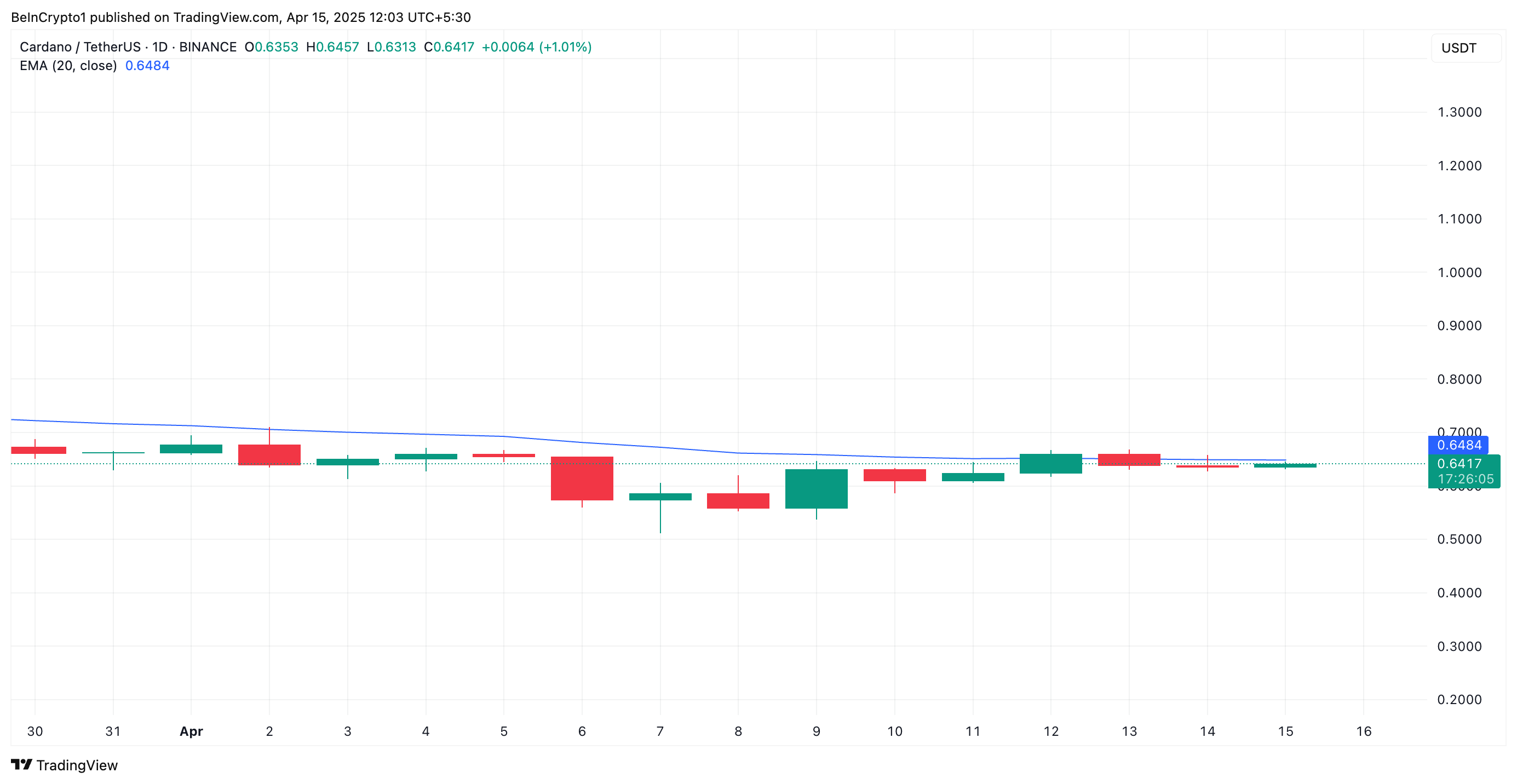

The altcoin is now trading close to its 20-day Exponential Moving Average (EMA), a key technical level that, if breached, could validate the ongoing rally and open the door to fresh highs.

ADA Approaches Key Breakout Zone Amid Surge in Buying Pressure

ADA currently trades near its 20-day EMA and is poised to climb above it. This key moving average measures an asset’s average price over the past 20 trading days, giving more weight to recent prices.

When an asset is about to rally above its 20-day EMA, it signals a shift in short-term momentum from bearish to bullish. This crossover signals that ADA buying pressure is increasing and confirms that the asset has entered an upward trend.

ADA’s successful break above the 20-day EMA would signal renewed momentum and act as a dynamic support level for the coin’s price, giving buyers more control.

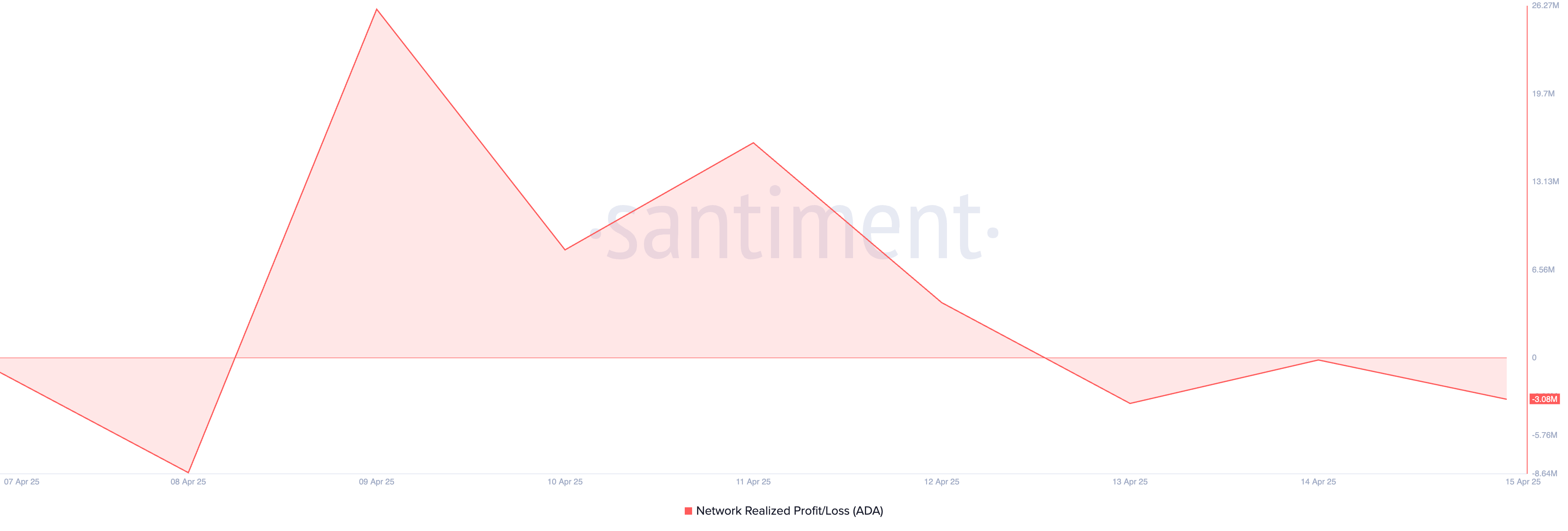

On-chain metrics further support the bullish outlook. According to Santiment, ADA’s Network Realized Profit/Loss (NPL) has turned negative, indicating that most holders are currently at a loss.

Historically, this discourages selling pressure as traders are less willing to part with their assets at a loss. This behavior encourages longer holding periods, which in turn tightens supply and can drive up ADA’s price in the short term.

Cardano Bulls in Control

On the ADA/USD one-day chart, the coin’s positive Chaikin Money Flow (CMF) reinforces this bullish outlook. At press time, this indicator, which measures how money flows into and out of an asset, is at 0.04.

A positive CMF reading like this indicates that buying pressure outweighs selling pressure. It reflects strong capital inflows into ADA, suggesting that its investors are accumulating rather than offloading their positions. ADA could extend its rally and climb to $0.70 if this trend persists.

However, if profit-taking resumes, ADA could reverse its rally and fall to $0.55.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Could Regain Momentum—Is a Bullish Reversal in Sight?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Altcoin22 hours ago

Altcoin22 hours agoXRP Price Climbs Again, Will XRP Still Face a Death Cross?

-

Market23 hours ago

Market23 hours agoFLR Token Hits Weekly High, Outperforms Major Coins

-

Market22 hours ago

Market22 hours agoAuto.fun Launchpad Set to Debut Amid Fierce Market Rivalry

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market17 hours ago

Market17 hours agoMENAKI Leads Cat Themed Tokens

-

Market15 hours ago

Market15 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Market20 hours ago

Market20 hours agoSolana Futures Traders Eye $147 as SOL Recovers

-

Market16 hours ago

Market16 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool