Market

BitFuFu’s Net Income Soars 13X in Q1 2024: Here’s Why

BitFuFu, a leading digital asset mining service provider, announced a substantial increase in its net income for the first quarter of 2024. The company’s net income soared to $35.3 million, up from just $2.7 million in the same period last year, marking a significant 13-fold increase.

BitFuFu is not the only crypto miner to record stellar performance in the first quarter of 2024. Various other crypto-mining companies also achieved remarkable growth in the same period.

BitFuFu Stock Underperforms Despite Positive Q1 Reports

BitFuFu credits this growth to its strategic cloud-mining solutions and robust Bitcoin self-mining operations. Total revenue for the quarter reached $144.4 million, a 149% increase from the previous year’s $58.0 million.

Moreover, cloud-mining revenue, which surged to $81.5 million, up 181% from the prior year, was a considerable part of this growth.

The company’s Bitcoin self-mining operation revenues reached $60.1 million, up 117% from last year. This was facilitated by optimized mining operations and favorable market conditions, although a higher mining difficulty slightly impacted overall Bitcoin output.

Read more: BitFuFu Review 2024: A Guide to The Cloud Mining Platform

Leo Lu, CEO and Chairman of BitFuFu commented on the results, emphasizing the benefits of their business model.

“Our cloud-mining solutions allow us to reduce revenue volatility created by sharp swings in digital asset prices and significantly strengthen cash flow by pre-selling hashrate at a fixed price that can be invested in expanding our business,” Lu said.

Regarding operational costs, the cost of revenue climbed to $122.7 million, representing a 120.7% increase. This rise was primarily due to expanded operations in cloud-mining and self-mining.

The company’s EBITDA also showed positive trends, with adjusted figures reflecting a 430.9% increase to $49.9 million. This includes an $11.8 million unrealized gain on Bitcoin, attributed to the early adoption of new accounting rules for digital assets.

Despite these strong financial outcomes, BitFuFu’s stock experienced a decline of over 6% on May 20, 2024, with a significant year-to-date drop of over 60%.

BitFuFu’s Q1 2024 report aligns with the broader industry trend. Notably, other crypto miners like Core Scientific have also reported strong performances.

Core Scientific rebounded from bankruptcy, reporting a net income of $210.7 million in the first quarter of 2024. Its recovery was largely due to a strategic overhaul of operations and financial management, which included significant gains from extinguishing pre-emergence obligations.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

Marathon Digital also showcased impressive results in the same period, with revenues soaring by 223% year-over-year to $165.2 million. Its net income increased by 184% to $337.2 million, bolstered by efficient operational advancements and increased Bitcoin mined.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XCN Price’s Month-Long Bearishness Meets Whale Conviction

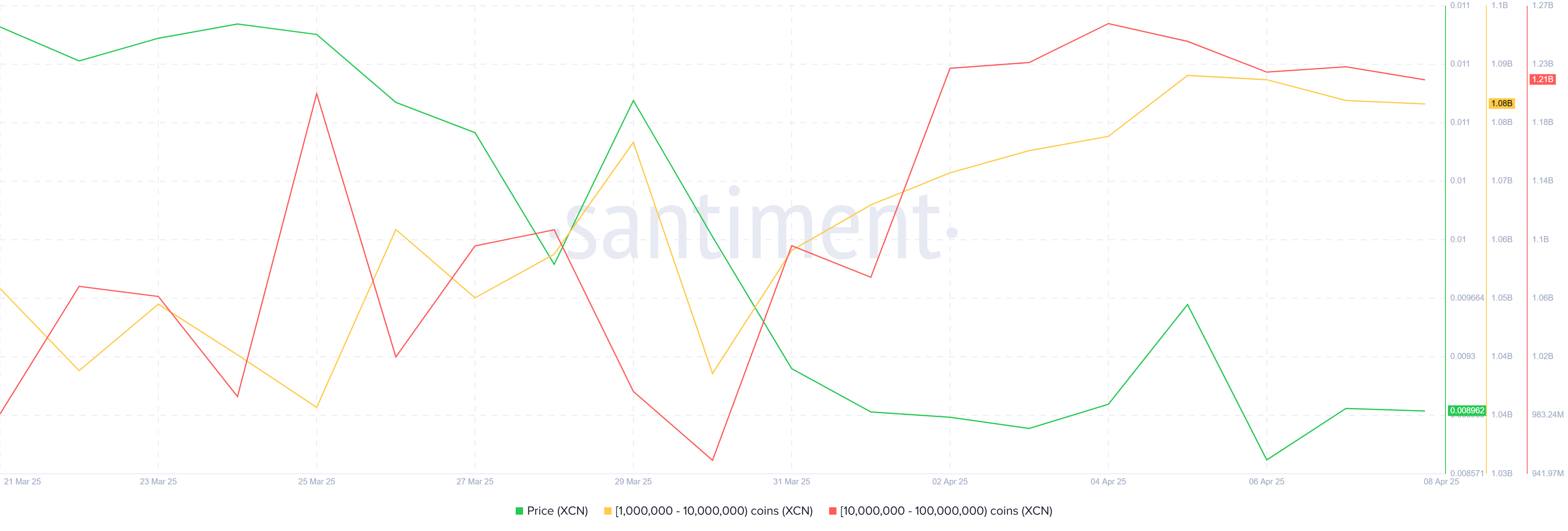

Onyxcoin (XCN) has experienced a month-long consolidation with little upward momentum, leaving the price largely stagnant. The altcoin has struggled to make significant gains, but this has not deterred key investors.

Whale addresses have continued to hold their positions, signaling optimism despite the market’s sluggishness.

Onyxcoin Whales Are Optimistic

Whale addresses, or holders with significant XCN holdings, have shown resilience amid the price decline. Over the past week, even with no growth in the altcoin’s value, these investors have refrained from selling sharply. This ongoing HODLing behavior suggests that they maintain a long-term bullish outlook for Onyxcoin, possibly expecting future gains once market conditions improve.

This conviction among large holders reflects a belief in Onyxcoin’s potential for recovery. Despite a lack of short-term gains, these investors appear focused on holding until the price begins to rise again. Their reluctance to sell even in a stagnant market is a positive indicator of potential upside when the market conditions shift.

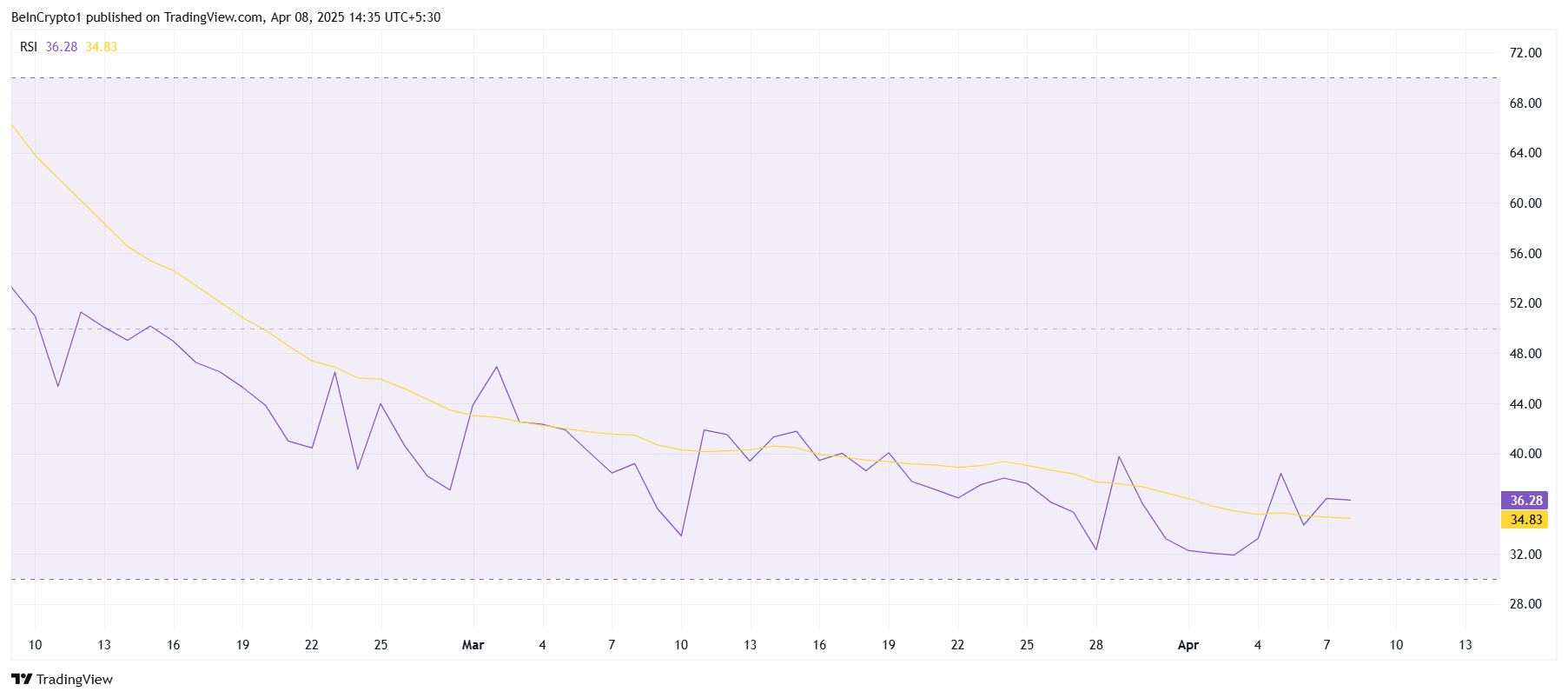

On the broader scale, technical indicators like the RSI have been showing a bearish trend for over a month, remaining stuck below the neutral line. The RSI’s positioning below 50.0 suggests that selling pressure still outweighs buying momentum, keeping the price suppressed. The indicator’s prolonged decline points to a sustained bearish market environment.

While this presents challenges for Onyxcoin in the short term, it also implies that the bearish momentum could eventually reach a saturation point. If the market shifts and buying pressure increases, XCN may experience a recovery rally, provided other macroeconomic factors align.

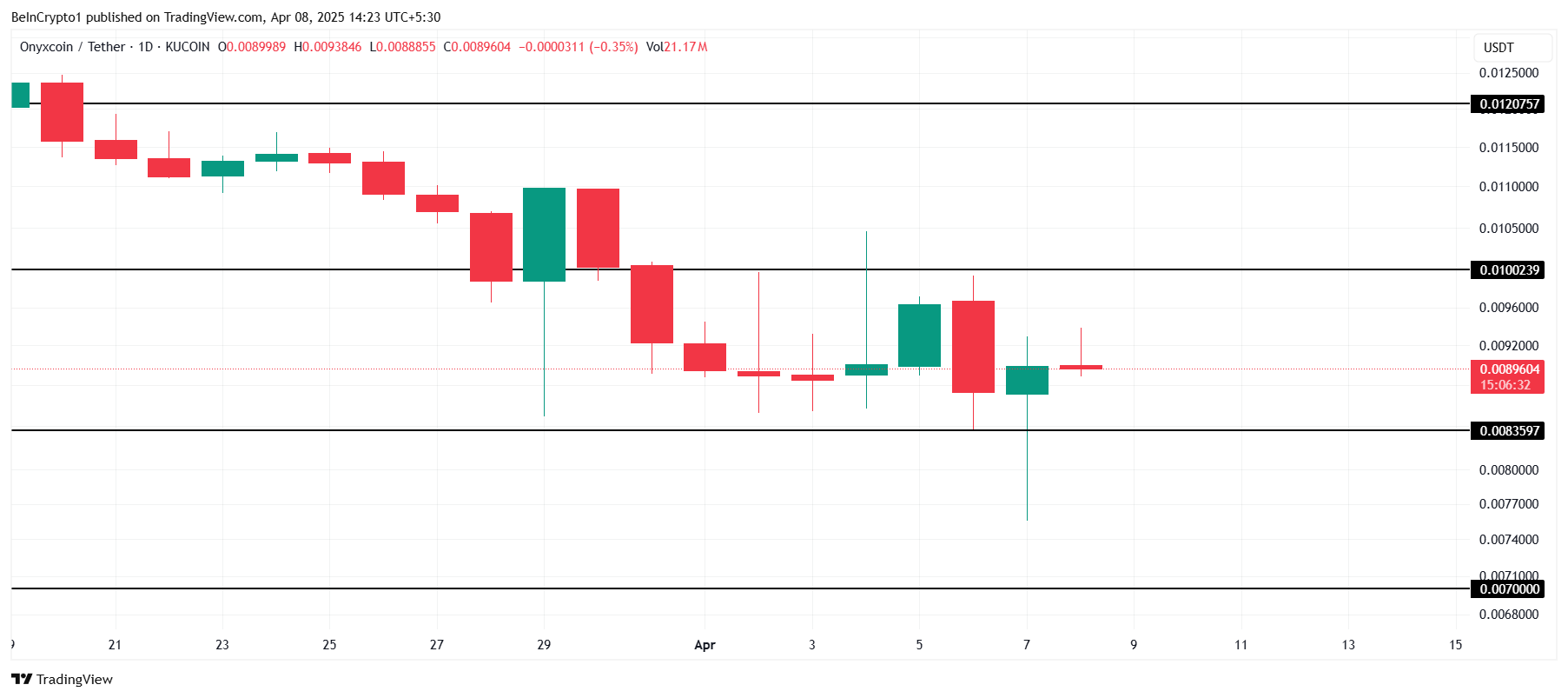

XCN Price Is Looking To Rise

XCN is currently trading at $0.0089, staying within a narrow range between $0.0100 and $0.0083 for the past week. This consolidation is likely to continue unless market conditions improve. The altcoin’s price action has been largely dictated by the lack of positive market momentum, limiting any immediate breakthroughs.

If the broader crypto market sees improvement, XCN could break through the $0.0100 resistance and begin moving toward the $0.0120 level. This would mark a recovery of a portion of the recent losses, potentially restoring investor confidence and signaling a shift toward a more bullish trend.

However, if XCN fails to hold above $0.0083, the altcoin could face a further decline, potentially reaching $0.0070. This would invalidate the bullish outlook and deepen the losses, reinforcing the need for caution among investors awaiting market stabilization.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price, Traders Retreat Despite The US ETF Buzz

XRP has faced a challenging decline over the last 48 hours, falling below the $2.00 support level.

This drop came at an inopportune time, especially considering the excitement surrounding Teucrium’s launch of the leveraged US XRP ETF. The news had initially sparked optimism, but the recent decline has overshadowed it.

XRP Traders Change Their Stance

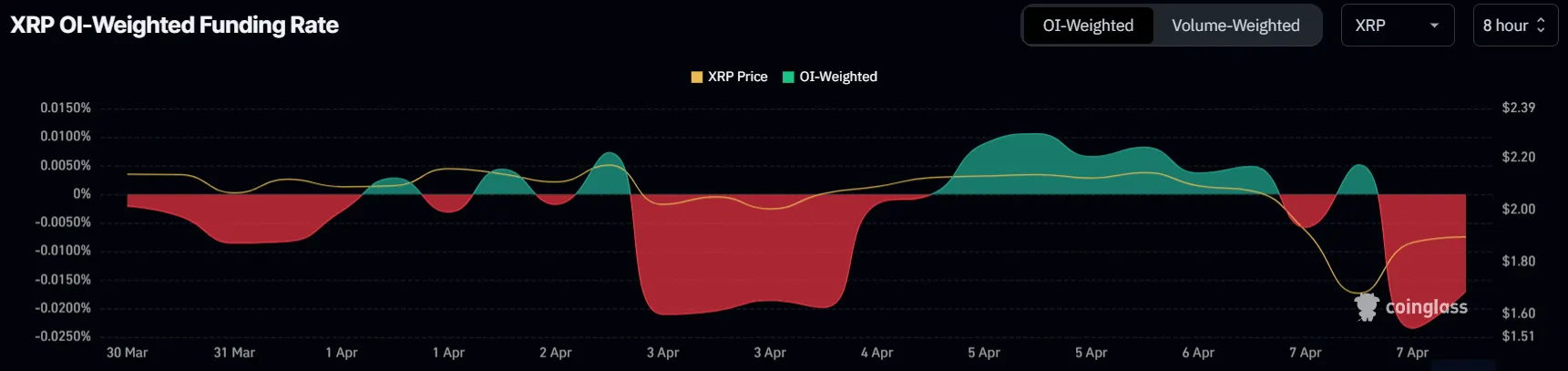

In the past 24 hours, the funding rate for XRP switched from positive to negative, indicating a shift in market sentiment. Traders have begun shorting the altcoin, likely in response to the recent price decline. This shift suggests that many traders are preparing for further drops in price, hoping to capitalize on any potential bearish momentum.

The negative funding rate further highlights the growing skepticism among traders about XRP’s short-term price performance. While the ETF launch initially created a buzz, the recent price action has shifted traders’ focus to the downside.

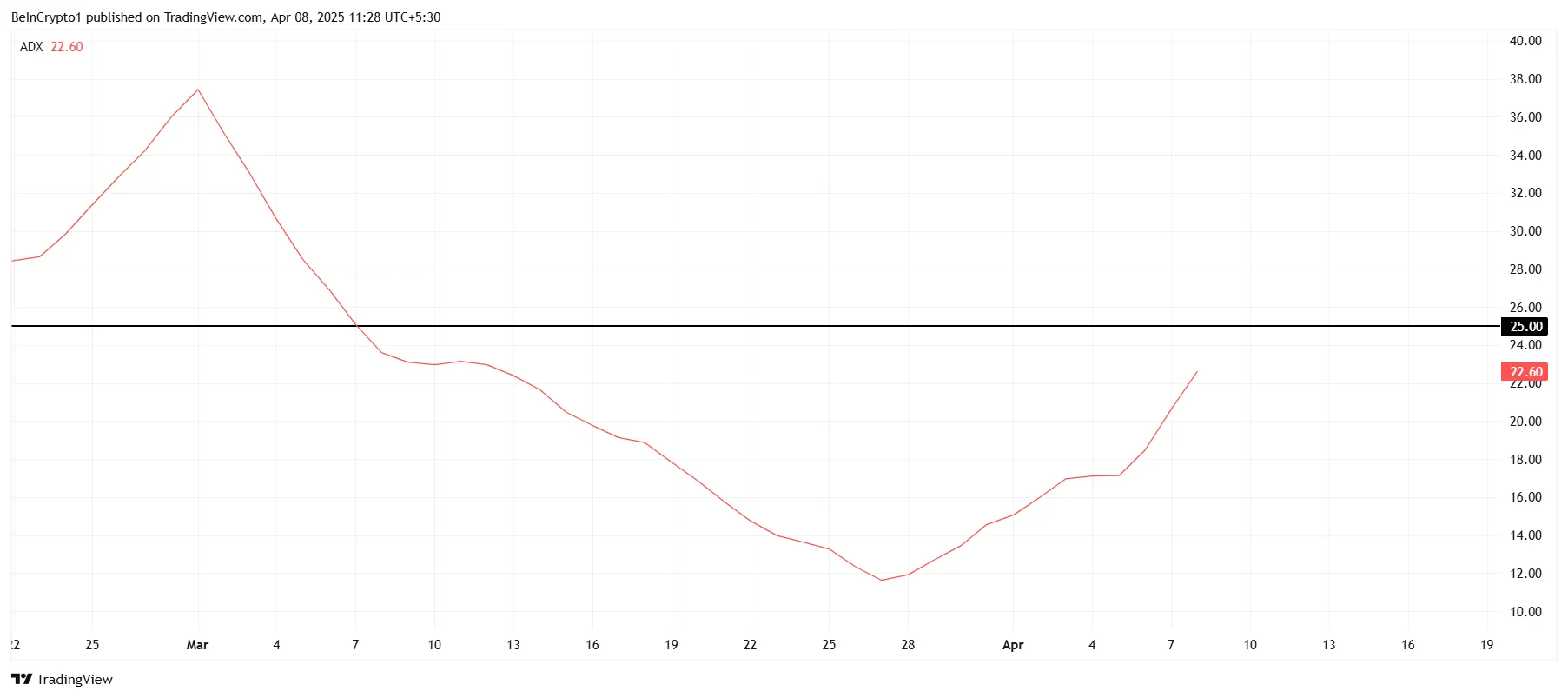

The overall macro momentum for XRP is currently weak, as indicated by technical indicators like the ADX. With the ADX reading of 22, just below the threshold of 25, it signals that the current downtrend may be gaining strength. If the ADX crosses the 25 threshold, it would confirm the strengthening downtrend, potentially leading to further declines in XRP’s price.

Given the current technical setup, XRP may struggle to reverse the trend unless key levels of support are reclaimed. The downtrend could persist as traders and investors react to broader market conditions, particularly as XRP faces negative sentiment and increasing selling pressure.

XRP Price Decline Continues

XRP’s price has dropped nearly 12% in the last 48 hours, trading at $1.88 at the time of writing. The bearish trend has already overshadowed any optimism surrounding the launch of the US XRP ETF by Teucrium. If this sentiment continues, XRP could face further downside pressure.

As the altcoin remains trapped under a declining trend line since early March, a further decline to $1.70 seems likely. This would extend the losses experienced over the past few days and put additional strain on the price of XRP.

However, if XRP manages to reclaim $2.02 as support, it could signal a reversal of the bearish trend. A successful bounce from this level could push XRP beyond $2.14, invalidating the current bearish outlook and allowing the altcoin to break free from its downtrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple Buys Hidden Road for $1.25 Billion to Boost XRP Ledger

Ripple has signed a $1.25 billion agreement to acquire Hidden Road, a global prime brokerage platform. The deal marks one of the largest mergers in the crypto space and signals Ripple’s expansion into institutional finance infrastructure.

With this move, Ripple becomes the first cryptocurrency company to own a multi-asset prime broker operating at a global scale.

Understanding Ripple’s $1.25 Billion Acquisitions

Hidden Road serves over 300 institutional clients and clears around $3 trillion in trades each year across markets, including foreign exchange, digital assets, derivatives, and fixed income.

The acquisition aims to address a key gap in the crypto sector: reliable infrastructure for institutional investors.

By integrating Hidden Road’s services, Ripple plans to offer financial institutions a complete suite of trading and clearing tools that meet traditional finance standards.

Ripple’s large balance sheet will give Hidden Road the capital to grow its services and scale operations globally. The company is expected to become one of the largest non-bank prime brokers as it expands access to both digital and traditional markets.

The deal also strengthens Ripple’s RLUSD stablecoin. Hidden Road will adopt RLUSD as collateral across its brokerage products. This will make RLUSD the first stablecoin to support cross-margining between crypto and traditional asset classes.

As part of the integration, Hidden Road will shift its post-trade processes to the XRP Ledger. This move will cut operating costs and highlight the blockchain’s ability to support institutional-grade decentralized finance.

Ripple also plans to extend digital asset custody services to Hidden Road clients, reinforcing its push into enterprise payments and asset management.

What Does It Mean for XRP Ledger?

In recent months, the XRP community has raised concerns about the network’s underutilization despite its high market capitalization.

As of March, XRP Ledger recorded just $44,000 in daily decentralized exchange (DEX) trading volume—an extremely low figure compared to other major blockchains. The network also lags behind in node distribution, validator count, and smart contract engagement.

So, Ripple’s acquisition of Hidden Road directly addresses the XRP Ledger’s ongoing utility concerns.

As Hidden Road shifts post-trade operations to XRPL and uses Ripple USD (RLUSD) as collateral, this will increase on-chain activity, boost DEX trading volume, and improve total value locked (TVL).

The migration also encourages institutional participants to interact with the ledger, potentially driving up validator participation and smart contract usage.

This real-world integration might strengthen XRPL’s practical utility and drive more engagement on the network.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoXRP and Bitcoin Briefly Rallies After Rumors of 90-Day Tariff Pause

-

Market23 hours ago

Market23 hours agoIs $0.415 the Key to Further Gains?

-

Market19 hours ago

Market19 hours agoCrypto Whales Are Buying These Altcoins Post Market Crash

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Price Looks Set To Crash To $1,000-$1,500, But Can It Fill The CME Gaps Upwards To $3,933

-

Altcoin22 hours ago

Altcoin22 hours agoPeter Schiff Predicts Ethereum Price To Drop Below $1,000, Compares It To Bitcoin And Gold

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Capitulation May Be Nearing End – Will A Fed Pivot Spark A Recovery?

-

Market20 hours ago

Market20 hours agoMANTRA Launches $108 Million RWA Fund As OM Price Surges

-

Bitcoin24 hours ago

Bitcoin24 hours agoUS Trade Tariffs Trigger $240 Million Crypto Outflows Last Week