Market

Bitcoin’s Price Under $85,000 Brings HODlers Profit To 2-Year Low

Bitcoin’s price continues to struggle below the psychological $85,000 mark, failing to break past this critical level over the past two months.

Despite some attempts to secure a rise, the leading cryptocurrency has remained stagnant, increasing pressure on long-term holders (LTHs). These investors, once enjoying solid profits, are now seeing a decline in their unrealized gains.

Bitcoin Investors Are Pulling Back

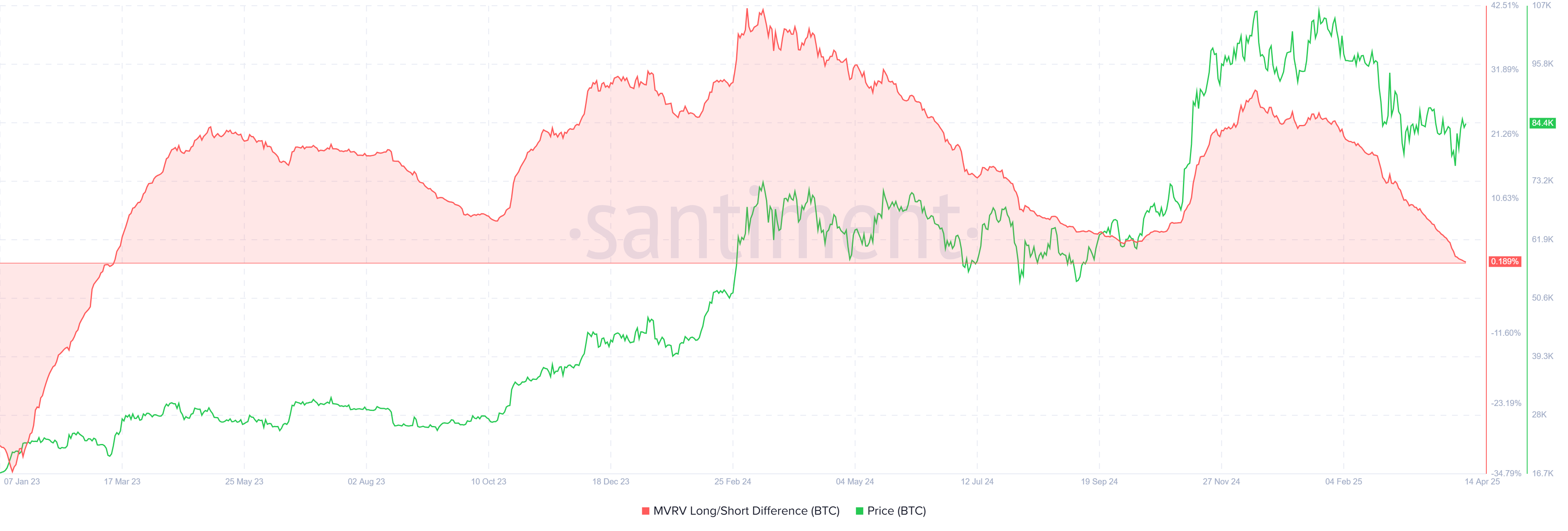

The MVRV Long/Short Difference, a key metric used to gauge market sentiment, reveals a concerning trend for LTHs. The indicator recently hit a two-year low, suggesting that long-term holders’ profits are at their lowest since March 2023. This shift indicates that the market conditions are increasingly unfavorable for LTHs.

As Bitcoin’s price fails to recover, short-term holders (STHs) are beginning to dominate, capitalizing on the price fluctuations. Meanwhile, long-term holders (LTHs), facing diminishing profits, hold off on buying or holding more.

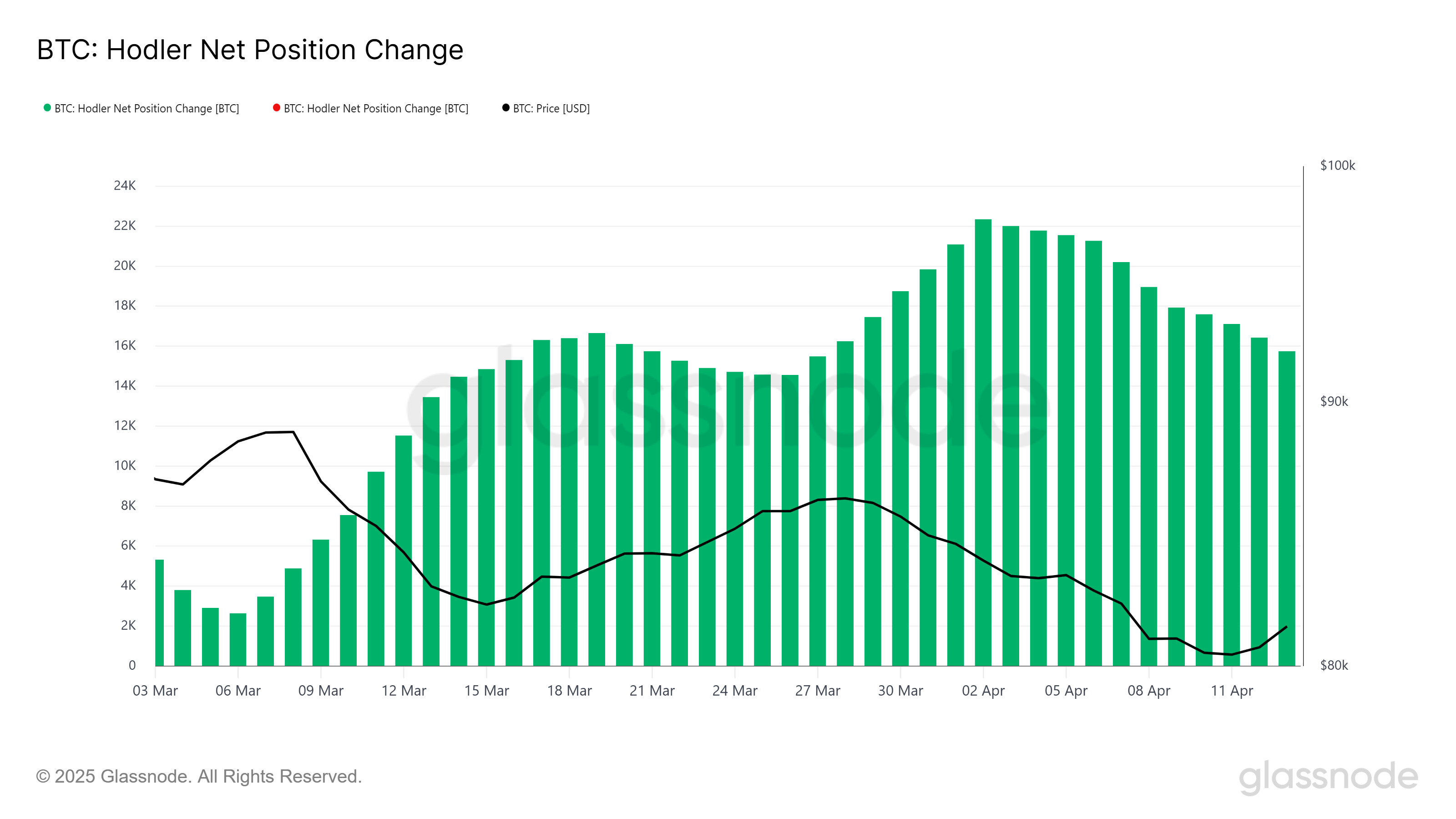

The overall momentum of Bitcoin, measured by technical indicators, also reflects bearish signals. The HODLer net position change further backs this narrative, as it shows that LTHs have sold a significant portion of their holdings over the last two weeks. In total, these sales amounted to more than 6,596 BTC, which is worth over $550 million.

Although this figure may not be enormous, the psychological shift from confidence to caution among LTHs is a larger concern. This lack of conviction could delay Bitcoin’s recovery and contribute to further price stagnation. In turn, this could further limit market activity and exacerbate the ongoing downturn.

BTC Price Is Facing A Decline

Bitcoin’s price is trading at $84,421, hovering just above the crucial support level of $82,619. The price remains trapped under the key $85,000 resistance level, which could cause further pressure if it fails to break above. If Bitcoin loses support at $82,619, a decline to the next major psychological support of $80,000 is possible.

If the bearish trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support would mark a more significant downturn, confirming the continued market weakness and deepening the bearish outlook for Bitcoin.

However, if Bitcoin manages to breach and hold $85,000 as support, it could ignite a recovery, pushing the price back up toward $86,848. A sustained rise above $85,000 would invalidate the current bearish trend and pave the way for a potential surge toward $89,800, reestablishing confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Burn Reduces Circulating Supply by $916 Million

Binance co-founder Changpeng Zhao (CZ) announced a major deflationary milestone, confirming the completion of BNB Chain’s 31st quarterly token burn.

In total, 1.57 million BNB, valued at approximately $916 million, was permanently removed from circulation.

BNB Chain Burns $916 Million Worth of Tokens in 31st Quarterly Event

The BNB burn is part of BNB Smart Chain’s long-running commitment to reduce the token’s total supply and potentially bolster long-term value.

According to an official blog post, this quarter’s burn was completed successfully. The remaining total supply of BNB stands at just over 139 million. Former Binance CEO Changpeng Zhao echoed the update with a simple post on X (Twitter).

“$916,000,000 BNB burned,” CZ wrote.

They sent the tokens to a burn address, 0x000…dEaD, making them unrecoverable and effectively reducing the total supply.

The burn occurred under BNB’s Auto-Burn mechanism and marks one of the largest events in the chain’s history. Established under BEP95, BNB’s Auto-Burn system provides transparency and predictability. It adjusts the burn amount based on BNB’s market price and the number of blocks generated on the BNB Smart Chain (BSC) each quarter.

The goal is gradually reducing the token’s circulating supply to 100 million BNB. Once this happens, regular burns will cease.

Deflationary mechanisms are typically bullish, but the market reaction was tepid. BNB’s price slipped 2.11% over the past 24 hours, trading around $578.04 as of this writing.

Impact of BNB Burn on Market Sentiment

The muted response mirrors the aftermath of the 30th burn, suggesting that even billion-dollar reductions in supply are not enough to overcome broader market sentiment or investor fatigue. Meanwhile, community members expressed mixed feelings about the event.

“It actually pains me sometimes to see BNB burns! I know it’s part of the deflationary process… but it still hurts brother CZ,” crypto advocate Shahzad Quadri commented.

Meanwhile, others questioned the utility of such a large burn. Users asked CZ why the BNB chain did not redirect the funds toward marketing efforts.

“It’s not up to me. It was in the whitepaper. A promise is a promise,” CZ replied.

This statement resonated with community leaders, including a MEXC exchange KOL, who responded in a post.

“Saw people wishing it wasn’t burnt. The only way is burning because if it is not burnt, the team won’t be keeping the promise on the whitepaper,” the KOL highlighted.

Changpeng Zhao added a touch of irony, seeming surprised by the size of the burn. Users asked whether this burn was separate from the ongoing gas fee burn introduced under BEP95.

“I have no idea. There are a few different automated burn mechanisms. I learned about this burn on X,” he chimed.

In addition to the quarterly Auto-Burn, BNB implements a real-time burn model that permanently removes a portion of gas fees from circulation. Since its inception, over 259,000 BNB tokens have been burned through this mechanism.

Furthermore, the BNB Pioneer Burn Program continues to cover user losses from accidental token misplacements. It uses quarterly burns to offset such events.

CZ has a personal investment, with 98.6% of his portfolio in BNB as of February. Still, the commitment to scheduled burns and BNB’s critical role across BNB Smart Chain, opBNB Layer 2, and BNB Greenfield blockchain reaffirms the long-term strategy to drive utility, governance participation, and ecosystem growth.

The BNB community is left watching price action, balancing hope in the deflationary model with the reality of market headwinds.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Gold Price Hits New All-Time High Above $3,300 Amid Tariff Turmoil

Gold prices have surpassed $3,300 per ounce, setting a historic high as global markets face heightened volatility.

This surge reflects investor anxiety over economic uncertainty and highlights the significant impact of controversial tariff policies under President Trump. Consequently, experts have issued conflicting forecasts on how this may influence Bitcoin.

What’s Driving Gold to Keep Breaking Records?

At the time of writing, gold has surged past $3,000, reaching a peak of $3,317. That marks a 25% increase since the beginning of the year.

According to a report in The New York Times, the global trade war is the primary force behind gold’s continued rise. Retaliatory tariffs among major economies are clouding the global economic outlook.

The US imposed new tariffs, quickly triggering countermeasures from China, the European Union, and Canada. In response, the White House escalated the situation further.

“While general uncertainty and deteriorating economic vibes are improving interest in gold, most of gold’s price action is around the uncertainty related to tariffs,” Helima Croft, head of global commodity strategy at RBC Capital Markets, said.

In addition, there are growing concerns that tariffs could directly target imported gold. This fear has led to gold stockpiling within the United States.

Business Standard reported that major banks like JPMorgan Chase and HSBC have been moving large quantities of gold from London to New York. JPMorgan alone plans to transport $4 billion worth of gold this month.

Besides the tariff war, macro analyst Zerohedge pointed to another factor—the Senate Budget Resolution for FY2025. This resolution allows the US to increase its budget deficit by up to $5.8 trillion over the next ten years. Zerohedge suggested that Gold is responding to this news.

The price spike reflects fears of currency devaluation due to ballooning deficits.

Goldman Sachs has also raised its year-end gold forecast to $3,700. The bank cited stronger-than-expected central bank demand and rising recession risks.

What Are Analysts Saying About Bitcoin as Gold Hits a New Peak?

While gold shines, Bitcoin, often called “digital gold,” has drawn mixed opinions.

Anthony Papillano, CEO of Professional Capital Management, told CNBC on April 15 that Bitcoin has dropped around 10% since the start of the year, while gold has gained 20%. However, both assets have risen approximately 35% over the past year.

He also outlined reasons why Bitcoin might soon rally like gold. These include the US government’s strategic Bitcoin reserve plans and the younger generation’s growing view of Bitcoin as part of a long-term investment strategy.

“History tells us Bitcoin’s returns will skyrocket past Gold in the coming months,” Papillano predicted.

Supporting this view, several analysts noted that Bitcoin often follows gold’s upward momentum with a lag of about 100 days, especially during increased global liquidity. Additionally, companies purchased more than 95,400 BTC in the first quarter of 2025, showing strong institutional demand.

However, not everyone agrees. Economist Peter Schiff, a long-time Bitcoin critic, offered a contrasting view. He claimed the best trade right now is to sell all Bitcoin and other cryptocurrencies and invest entirely in gold and silver mining stocks.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh decline from the $1,690 zone. ETH is now consolidating and might decline further below the $1,580 support zone.

- Ethereum started a fresh decline after it failed to clear $1,700 and $1,720.

- The price is trading below $1,620 and the 100-hourly Simple Moving Average.

- There was a break below a new connecting bullish trend line with support at $1,625 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,640 resistance zone.

Ethereum Price Faces Rejection

Ethereum price formed a base above $1,550 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,600 and $1,620 resistance levels.

The bulls even pumped the price above the $1,650 zone. A high was formed at $1,690 and the price recently corrected gains. There was a move below the $1,640 support zone. Besides, there was a break below a new connecting bullish trend line with support at $1,625 on the hourly chart of ETH/USD.

The price tested the 50% Fib retracement level of the upward move from the $1,472 swing low to the $1,690 high. Ethereum price is now trading below $1,625 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,620 level. The next key resistance is near the $1,640 level. The first major resistance is near the $1,650 level. A clear move above the $1,650 resistance might send the price toward the $1,690 resistance.

An upside break above the $1,690 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,750 resistance zone or even $1,800 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,640 resistance, it could start another decline. Initial support on the downside is near the $1,580 level. The first major support sits near the $1,555 zone and the 61.8% Fib retracement level of the upward move from the $1,472 swing low to the $1,690 high.

A clear move below the $1,555 support might push the price toward the $1,525 support. Any more losses might send the price toward the $1,450 support level in the near term. The next key support sits at $1,420.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,580

Major Resistance Level – $1,640

-

Market16 hours ago

Market16 hours agoBitcoin Eyes $90,000, But Key Resistance Levels Loom

-

Market24 hours ago

Market24 hours agoPi Network Price Rise To $1 is Now In The Hands Of Bitcoin

-

Altcoin21 hours ago

Altcoin21 hours agoWhispers Of Insider Selling As Mantra DAO Relocates Nearly $27 Million In OM To Binance

-

Market20 hours ago

Market20 hours agoTrump Family Plans Crypto Game Inspired by Monopoly

-

Market19 hours ago

Market19 hours agoETH Retail Traders Boost Demand Despite Institutional Outflows

-

Altcoin18 hours ago

Altcoin18 hours agoCould Tomorrow’s Canada Solana ETF Launch Push SOL Price to $200?

-

Altcoin24 hours ago

Altcoin24 hours agoHas XRP Price Already Bottomed? Analyst On How Ripple Coin Can Hit $15

-

Market21 hours ago

Market21 hours agoForget XRP At $3, Analyst Reveals How High Price Will Be In A Few Months