Market

Bitcoin’s Future After Trump Tariffs

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding its ground while Wall Street stumbles, why Trump’s tariffs may push the Fed into money-printing mode, and what that could mean for crypto’s next chapter. From Ethereum’s test of resilience to rising odds of a US recession, here’s everything you need to know to stay ahead.

Bitcoin Enters Its Risk-Dynamic Era Amid Tariffs and Turmoil

Bitcoin’s reaction to recent macro shocks—particularly Trump’s sweeping tariffs—has been noticeably calm compared to traditional markets, and that’s turning heads. While Wall Street stumbles harder than expected, crypto has held relatively steady.

Nexo Dispatch Editor Stella Zlatarev told BeInCrypto that this isn’t just resilience—it’s evidence that Bitcoin may be entering a new phase of market maturity.

“A 2–3% drop in crypto is a rounding error compared to past cycles,” she said, emphasizing that this stability amid chaos suggests Bitcoin is no longer just a speculative punt. “Bitcoin’s ability to weather macro turbulence without the wild swings of previous years suggests institutional investors are treating it less as a speculative punt and more as a strategic asset,” Zlatarev said.

Analysts also stressed that Bitcoin’s behavior doesn’t align with traditional asset categories.

“It’s not gold, and it’s not the yen. Instead, Bitcoin is emerging as a risk-dynamic asset – one that doesn’t crumble like high-growth stocks but also doesn’t attract the same flight-to-safety flows as traditional safe havens,” Zlatarev told BeInCrypto.

This concept of a “risk-dynamic” asset positions Bitcoin in a unique role: something that thrives in uncertainty but doesn’t collapse when the market turns.

Zlatarev from Nexo also noted that how Ethereum and other blue-chip altcoins respond next will be key.

“If ETH mirrors BTC’s performance, it strengthens the case that top-tier crypto assets are evolving into a more predictable asset class. If ETH wobbles, it reinforces that, for now, Bitcoin is in a league of its own.”

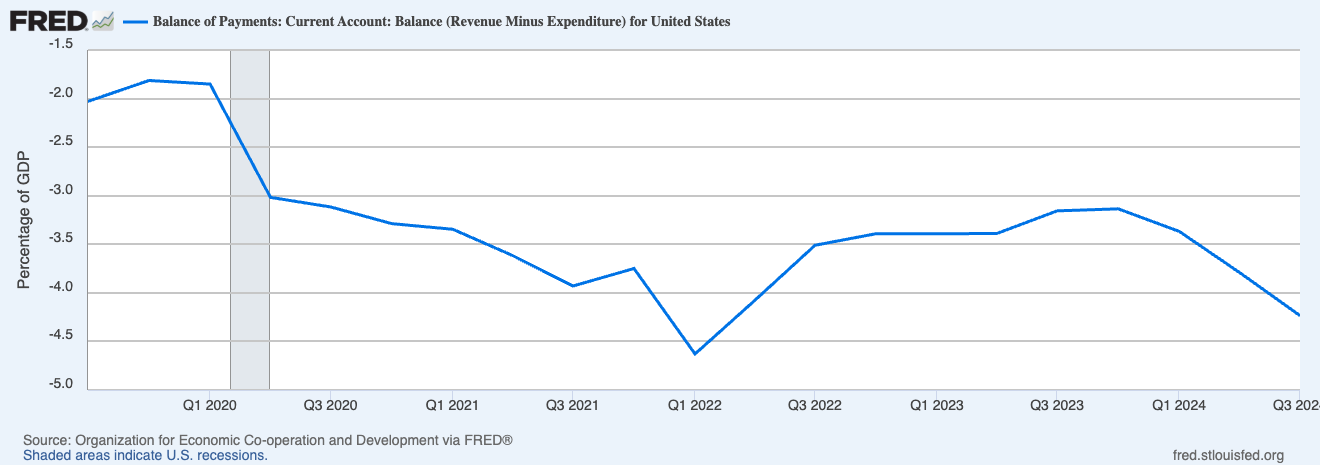

Meanwhile, the macro backdrop is shifting fast. Trump’s new “Liberation Day” tariffs have spooked global trade partners and have also sent ripple effects through prediction markets. Polymarket now gives almost 50% odds of a US recession this year—a major shift following the announcement.

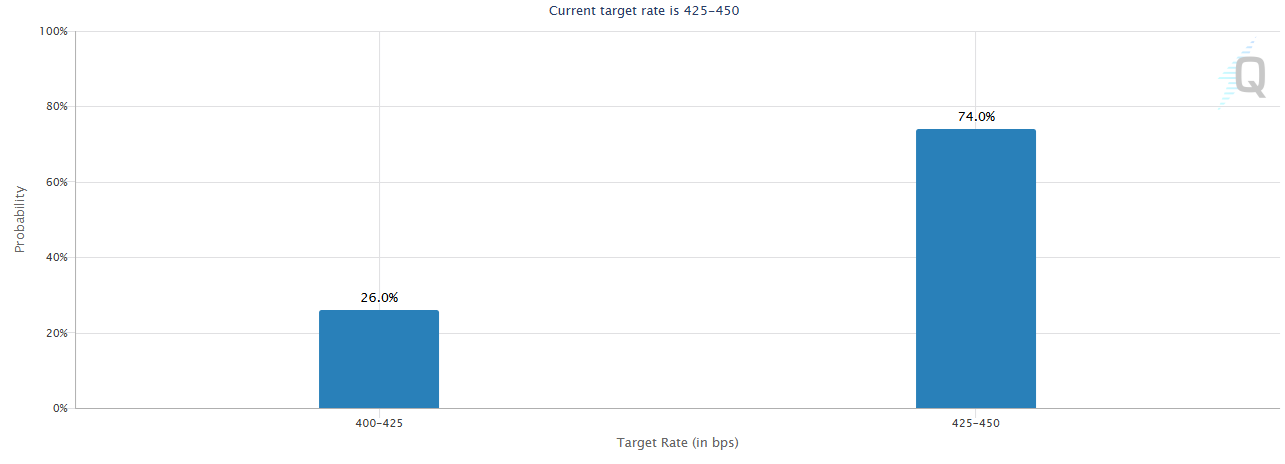

Also, CME FedWatch tool shows interest rate traders have boosted the probability the US Federal Reserve will make four rate cuts this year. Eventually, this could relief the current macroeconomic pressure on Bitcoin.

Former BitMex CEO Arthur Hayes mentioned that Trump’s current tariff strategy could complicate the US bond market. In other words, pressure is building for the Fed to intervene—possibly by turning on the liquidity spigot once again.

All of this puts Bitcoin in a new spotlight. Its steadiness is no longer being dismissed as a coincidence. It may be the first sign that crypto, or at least its most mature players, is stepping out of the shadows of speculation and into the spotlight of strategic finance.

Chart of the Day

By reducing foreign demand for US Treasuries, Trump’s tariffs may force the Fed to inject more liquidity—potentially weakening the dollar and boosting Bitcoin as an alternative store of value.

Byte-Sized Alpha

– Trump’s “Liberation Day” enforces 10%+ tariffs on all imports, hitting China, the EU, and Israel, triggering market drops and recession fears.

– According to Standard Chartered, Bitcoin may hit $500,000 by Trump’s term end, AVAX could 10x by 2029, and Ethereum’s 2025 target drops to $4,000.

– The STABLE Act of 2025 advances with bipartisan support, aiming to tighten stablecoin rules as competition and regulatory pressure intensify.

– Bitcoin ETFs see $221 million in April inflows led by ARKB, but BTC derivatives cool with falling futures interest and bearish options sentiment.

– DXY hits a 2024 low after “Liberation Day” tariffs, fueling short-term Bitcoin surge hopes amid global tensions and policy uncertainty.

– Bitcoin struggles below $85,000 amid weak sentiment, but long-term holders stay firm, keeping capitulation fears at bay.

– Polymarket sees almost 50% chance of US recession as Trump’s tariffs spark market fears and trade tensions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Controversy Follows Babylon’s BABY Token Launch and Airdrop

Babylon launched its BABY token today after a brief delay from Binance. The toke quickly surged 40% to hit $0.15. driven by the listing hype, but airdrop sell-offs and profit-taking saw BABY crash shortly after.

Over the past week, Babylon’s airdrop has been subjected to much controversy. At the time of reporting, the token’s market cap stands just below $185 million.

BABY Airdrop and Token Launch

Token staking is a popular way to gain passive income in the space, and it’s growing noticeably. Last year, Babylon began offering Bitcoin staking and added on-chain yields soon after.

Today, Babylon launched its new BABY token, which began trading on Binance.

“Binance is excited to announce that Babylon (BABY) will be added to Binance Simple Earn, ‘Buy Crypto,’ Binance Convert, Binance Margin, and Binance Futures,” the exchange claimed in its announcement.

Binance, the world’s largest crypto exchange, was a natural candidate for Babylon’s BABY launch. It dominates the vast majority of crypto airdrops, and it offers very popular listings. The firm had to delay the official launch for a few hours, but it went off smoothly.

BABY was also listed by several other exchanges, including MEXC, which conducted an exclusive BTC Fixed Saving Event offering an Annual Percentage Rate (APR) of up to 99% in anticipation of the BABY token listing.

Babylon is a decentralized protocol that enables native, self-custodial Bitcoin staking. It allows holders to stake directly on the Bitcoin network to enhance security without relinquishing control of their assets.

Last week, the project airdropped 600 million tokens ahead of the token launch. The initial airdrop represented 6% of the total supply of BABY tokens, which were distributed to early adopters in several categories.

These include Phase 1 stakers, Pioneer Pass NFT holders, and contributing developers.

However, shortly after this airdrop, over $21 million worth of Bitcoin was unstaked from the Babylon protocol within 24 hours.

Increasing Concerns About Tokenomics

Also, its tokenomics indicate that nearly 66% of the total supply is controlled by insiders or the foundation. The substantial allocation raises concerns about potential centralization and the influence insiders may have on the project’s future.

Yet, there are community members refuting these concerns and backing the project. While insider allocation is high, access to that allocation is gated and structured to avoid market abuse.

Compared to recent examples where insiders had early staking rights and sold off rewards, such as EigenLayer, Babylon has deliberately built protections into its tokenomics to maintain fairness and avoid token dumping dynamics.

VCs, team, and advisors have no token unlocks in Year 1. This prevents early investors from front-running the market and dumping tokens during the protocol’s most fragile growth phase.

Most importantly, locked insider tokens are not allowed to be staked, which is rare.

Overall, the long-term performance of the token will reflect how sustainable this tokenomics is. Babylon’s approach to Bitcoin staking has gained significant attention, but the airdrop and subsequent unstaking activities highlight the dynamic nature of user engagement in response to incentive programs

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple And The SEC File Joint Motion for Final Settlement

The SEC and Ripple filed a joint motion today, asking a US Appeals Court to halt any appeals and cross-appeals between the two parties. This is a prelude to a formal settlement, which both parties are inclined towards.

The filing notes that any further procedural developments may take up to 60 days despite expectations that the outcome is largely predetermined. In the meantime, the XRP market appears to have priced in the likelihood of a resolution.

Ripple and The SEC Move To Settle

The SEC vs Ripple case has been one of crypto’s most important legal battles over the last few years. After months of hints and credible rumors, the Commission finally dropped its lawsuit last month.

Today, both parties are getting close to a final agreement, filing a joint motion regarding one of the case’s remaining loose ends:

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” claimed James Filan, a lawyer and Ripple supporter who is in no way directly affiliated with the firm’s legal efforts.

Specifically, the loose end between Ripple and the SEC regards Ripple’s cross-appeal, which was filed last October. With this new joint motion, the two parties have “reached an agreement-in-principle” to resolve all outstanding business.

This includes the SEC’s initial appeal, the aforementioned cross-appeal, and any other claims involving individual actors.

Technically, both parties publicly announced that they were ready to settle over two weeks ago. It’s unclear why Ripple and the SEC took so long to file this joint motion.

The price of XRP has persistently been less impacted by lawsuit updates since the comission first dropped its case, and this development seems fully priced in.

The joint motion also mentions that further progress may take another 60 days. When they completely finalize a settlement, it could likely have landmark implications for US crypto policy.

However, based on the way that the SEC is improving relations with Ripple, Coinbase, Kraken, etc., a favorable outcome seems extremely likely.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Climbs, But Key Indicators Still Flash Bearish

Ethereum (ETH) dipped over 7% in the last 24 hours despite Trump’s 90-day tariff pause. Key technical indicators suggest that a full trend reversal might be unlikely in the short term.

The BBTrend remains strongly negative, and whale accumulation has stalled, both signaling caution. Combined with a still-bearish EMA structure, Ethereum may need a stronger wave of buying pressure before it can break out of its current downtrend.

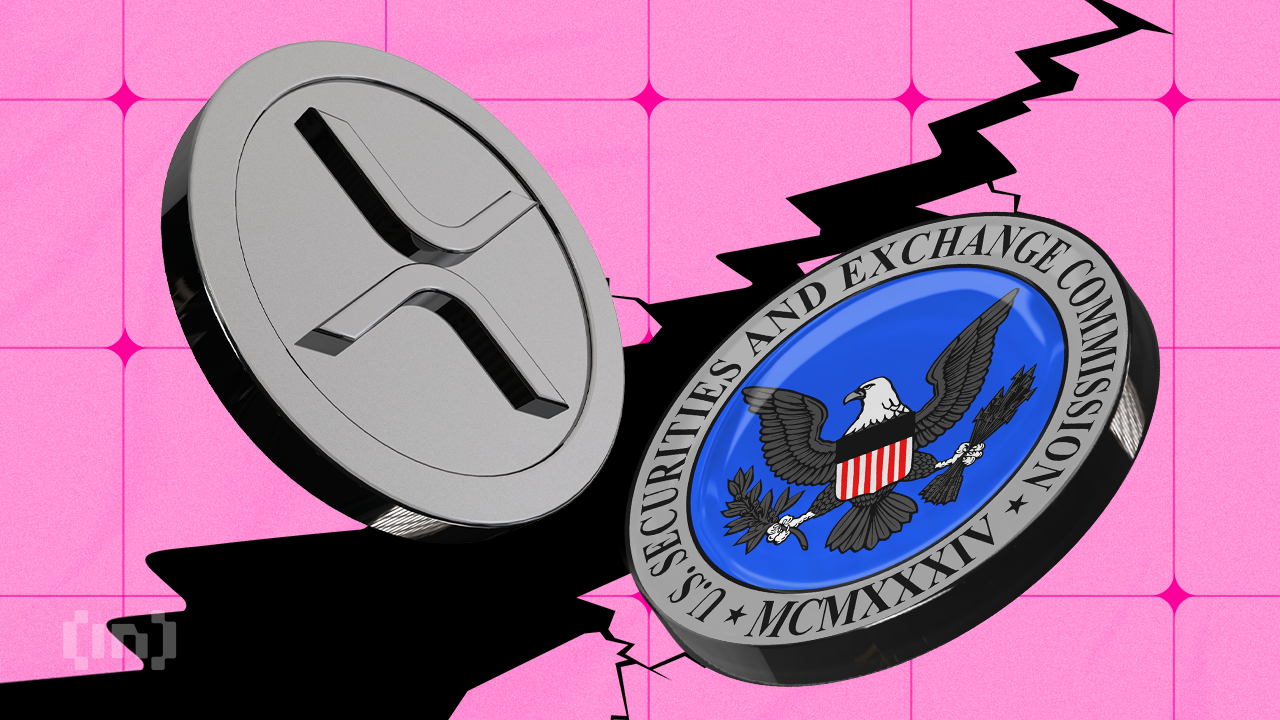

ETH BBTrend Is Strongly Negative But Bigger Than Yesterday

Ethereum’s BBTrend indicator has slightly improved, currently reading -18, up from -21.59 just before Trump’s tariff pause announcement.

This shift suggests that bearish momentum may be starting to fade, although it still signals overall downside pressure. The BBTrend (Band-Based Trend) is a volatility-based indicator that helps gauge the strength and direction of a trend using the relationship between price and Bollinger Bands.

Values above zero indicate bullish momentum, while negative values point to bearish trends—the further from zero, the stronger the directional conviction.

ETH’s BBTrend has remained in negative territory since April 8, reflecting sustained weakness in recent sessions. While the recent uptick could hint at early stabilization, the current value of -18 suggests Ethereum hasn’t yet flipped the broader trend.

For bullish confirmation, ETH would need to push BBTrend back toward neutral or positive territory, ideally supported by volume and strong price action.

Until then, the chart points to a market still in correction mode but with some signs of possible reversal ahead.

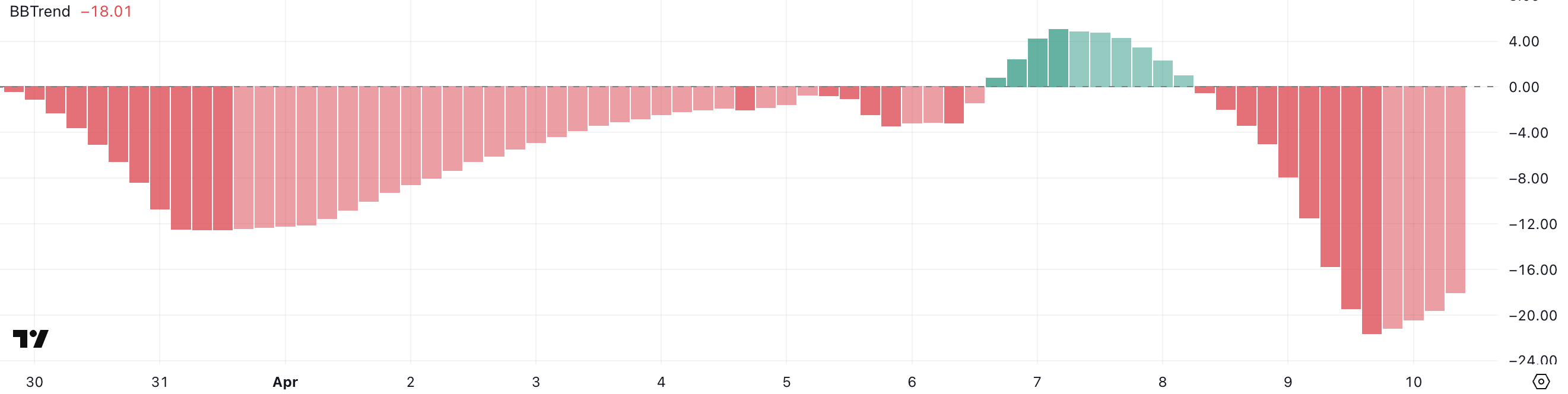

Whales Are Still Not Accumulating

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—rose from 5,340 to 5,382 between April 5 and 6, marking a brief uptick in accumulation.

However, the metric has since stabilized and currently sits at 5,376, showing little change in recent days.

Tracking whale activity is critical because these large holders often have the influence to move markets, either by initiating big buys during dips or selling into strength to take profits.

The recent stabilization in whale numbers suggests a wait-and-see approach from major holders. After a brief accumulation spike, whales appear to be holding their positions rather than aggressively buying or selling.

This could mean that confidence is returning but not yet strong enough to fuel a major breakout.

For Ethereum to see sustained upward momentum, a renewed rise in whale accumulation would be a positive signal, indicating growing conviction from the largest players in the market.

Is The Current Ethereum Surge Just Temporary?

Despite Ethereum’s recent bounce following Trump’s tariff pause, its EMA structure remains bearish, with short-term moving averages still positioned below the longer-term ones.

This lagging alignment typically reflects continued downside pressure, even during relief rallies.

When viewed alongside other indicators—like the still-negative BBTrend and stagnant whale accumulation—it becomes clear that Ethereum needs significantly more buying volume to shift into a confirmed uptrend.

If that bullish pressure does emerge, Ethereum’s price could aim to test resistance at $1,749, and a breakout there could open the path to $1,954 and even $2,104. That could be driven by macro developments, like the SEC’s recent approval of options trading on BlackRock’s Ethereum ETF.

However, if momentum fades, the price risks entering another correction phase.

Key support lies at $1,412, and if that level fails, ETH could slip below $1,400 and potentially revisit sub-$1,300 territory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoMicroStrategy Bitcoin Dump Rumors Circulate After SEC Filing

-

Market20 hours ago

Market20 hours agoBitcoin Rallies After Trump Pauses Tariff—Crypto Markets Cheer the Move

-

Market24 hours ago

Market24 hours agoXRP Primed for a Comeback as Key Technical Signal Hints at Explosive Move

-

Regulation23 hours ago

Regulation23 hours agoUS Senate Confirms Pro-Crypto Paul Atkins As SEC Chair

-

Market23 hours ago

Market23 hours agoPaul Atkins Confirmed as SEC Chair, Crypto Rules to Ease

-

Market22 hours ago

Market22 hours agoSolana (SOL) Drops 4% as Selling Pressure Intensifies

-

Altcoin21 hours ago

Altcoin21 hours agoArgentina Opens LIBRA Investigation, Top Officials May Be Implicated

-

Market18 hours ago

Market18 hours agoTHORWallet CEO Explains Why DeFi is Here to Stay