Market

Bitcoin Price Could Extend Gains: Will Bulls Stay in Control?

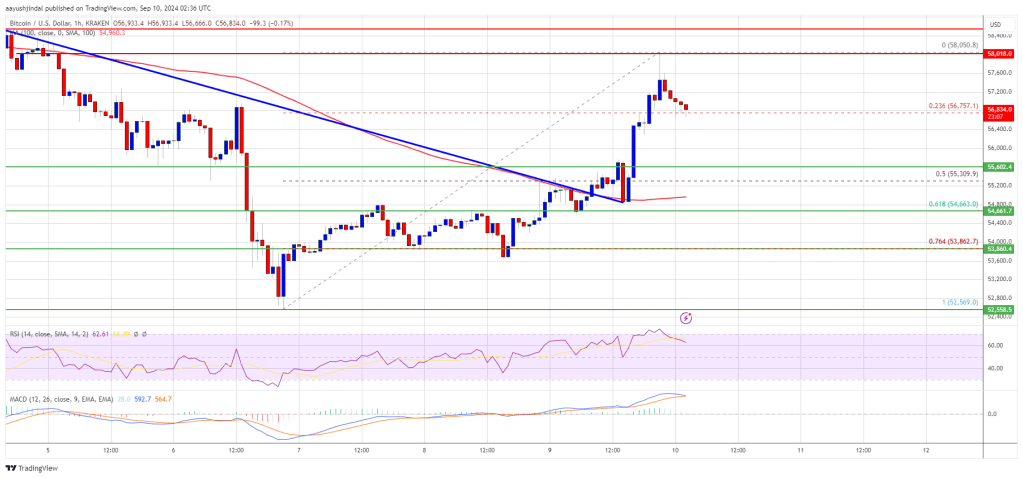

Bitcoin price started a decent increase above the $55,500 resistance. BTC is consolidating and might aim for more gains if it clears the $58,000 resistance.

- Bitcoin is rising from the $52,500 support zone.

- The price is trading above $55,500 and the 100 hourly Simple moving average.

- There was a break above a key bearish trend line with resistance at $55,300 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is facing resistance near the $58,000 and $58,200 resistance levels in the near term.

Bitcoin Price Starts Recovery

Bitcoin price started a decent increase after it broke the $55,500 resistance zone. BTC gained pace and was able to clear the $56,200 resistance. There was a break above a key bearish trend line with resistance at $55,300 on the hourly chart of the BTC/USD pair.

The pair even spiked above the $58,000 resistance zone. A high was formed at $58,050 and the price is now consolidating gains. There was a minor decline below the $57,500 level. The price dipped below the 23.6% Fib retracement level of the upward move from the $52,569 swing low to the $58,050 high.

Bitcoin is now trading above $55,500 and the 100 hourly Simple moving average. On the upside, the price could face resistance near the $57,500 level. The first key resistance is near the $58,000 level.

A clear move above the $58,000 resistance might send the price further higher in the coming sessions. The next key resistance could be $58,500. A close above the $58,500 resistance might spark more upsides. In the stated case, the price could rise and test the $60,000 resistance.

Another Decline In BTC?

If Bitcoin fails to rise above the $58,000 resistance zone, it could start another decline. Immediate support on the downside is near the $56,750 level.

The first major support is $55,500 or the 50% Fib retracement level of the upward move from the $52,569 swing low to the $58,050 high. The next support is now near the $53,500 zone. Any more losses might send the price toward the $52,600 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $56,750, followed by $55,500.

Major Resistance Levels – $57,500, and $58,000.

Market

Bitcoin Price Takes Another Tumble—Is The Floor About to Crack?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh decline below the $78,000 zone. BTC is now consolidating losses and might face resistance near the $77,800 zone.

- Bitcoin started a fresh decline below the $78,000 zone.

- The price is trading below $78,500 and the 100 hourly Simple moving average.

- There is a connecting bearish trend line forming with resistance at $79,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $78,500 zone.

Bitcoin Price Dips Again

Bitcoin price started a fresh decline below the $80,000 and $79,500 levels. BTC traded below the $78,500 and $77,000 levels to enter a bearish zone.

The price even dived below the $75,000 support zone. A low was formed at $74,475 and the price started a recovery wave. There was a move above the $75,500 level. The price climbed above the 23.6% Fib retracement level of the recent decline from the $80,800 swing high to the $74,475 low.

Bitcoin price is now trading below $78,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $77,800 level or the 50% Fib retracement level of the recent decline from the $80,800 swing high to the $74,475 low.

The first key resistance is near the $78,500 level. The next key resistance could be $79,500. There is also a connecting bearish trend line forming with resistance at $79,500 on the hourly chart of the BTC/USD pair.

A close above the $79,500 resistance might send the price further higher. In the stated case, the price could rise and test the $81,500 resistance level. Any more gains might send the price toward the $82,000 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $78,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $75,750 level. The first major support is near the $74,750 level.

The next support is now near the $73,500 zone. Any more losses might send the price toward the $72,000 support in the near term. The main support sits at $70,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $75,750, followed by $74,750.

Major Resistance Levels – $78,500 and $79,500.

Market

Berachain Drops 47% in a Month as Bearish Signals Grow

Berachain (BERA) is under heavy pressure, down 50% over the last seven days as technical indicators continue flashing warning signs. Momentum remains firmly bearish, with the RSI stuck deep in oversold territory and the DMI signaling that sellers are still in control.

The EMA setup also points to continued downside, raising the risk that BERA could break below $3.80 and hit new all-time lows. However, if bulls manage to step in, key resistance levels at $4.44 and $4.78 could come into play, opening the door for a potential recovery.

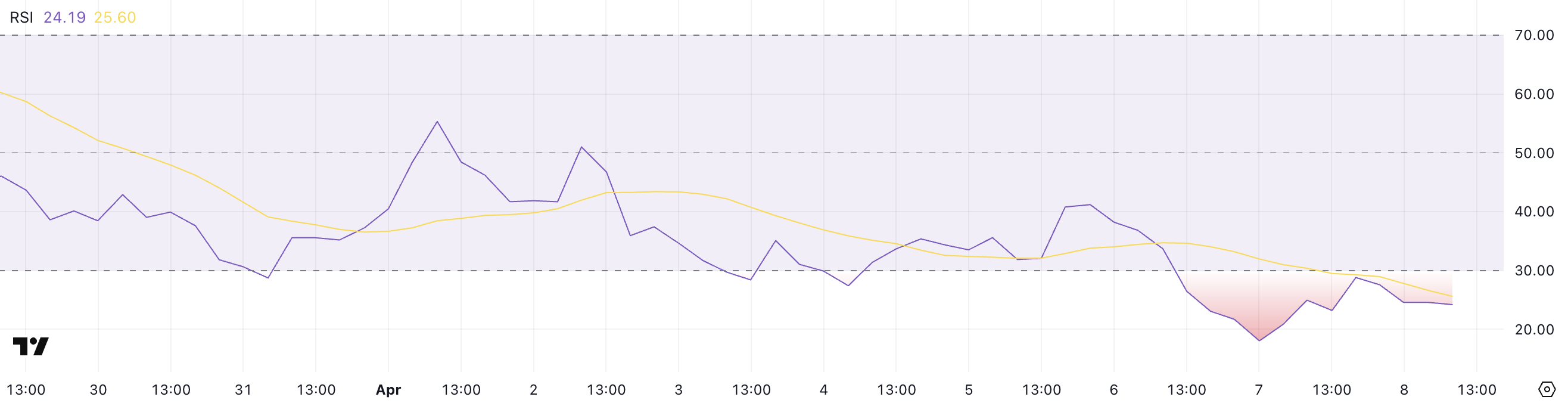

BERA RSI Is Struggling Below 30

Berachain’s RSI (Relative Strength Index) is currently sitting at 24.19, having remained below the oversold threshold of 30 since yesterday.

This persistent weakness in RSI indicates sustained bearish pressure, with the token struggling to regain bullish momentum.

Notably, BERA’s RSI has been below the neutral 50 mark since April 3, suggesting that the broader trend has been skewed to the downside for several days.

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100.

Readings above 70 typically indicate overbought conditions, while values below 30 suggest that an asset may be oversold and potentially primed for a rebound.

With BERA’s RSI deeply oversold at 24.19, a short-term bounce could occur if buyers step in, but unless it can break above the 50 level, the broader downtrend may remain intact.

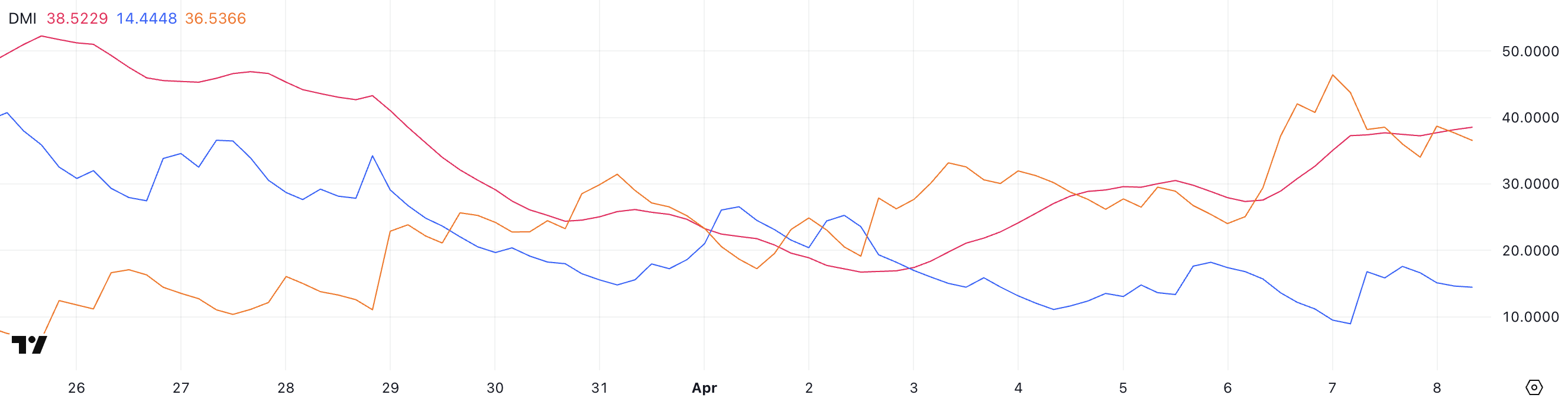

Berachain DMI Shows Sellers Are Still In Control

Berachain’s DMI (Directional Movement Index) chart shows its ADX has climbed to 38.52, up significantly from 27.56 just two days ago. This sharp rise in ADX signals that the strength of the current trend — in this case, a bearish one — is intensifying.

An ADX value above 25 typically indicates a strong trend, and with it now approaching 40, market momentum appears to be gaining traction.

The DMI consists of two directional indicators: +DI, which tracks upward movement, and -DI, which tracks downward movement.

BERA’s +DI has risen from 8.94 to 14.44, showing a modest increase in bullish pressure, though it’s remained stable in the last several hours. Meanwhile, the -DI has dropped from 46.4 to 36.53, suggesting that bearish dominance is softening slightly.

While the narrowing gap between +DI and -DI points to a potential shift, the fact that -DI is still clearly in the lead, and ADX continues rising implies the downtrend remains in control — though bulls may be starting to push back.

Will Berachain Make New All-Time Lows Soon?

Berachain’s price chart currently shows a bearish EMA setup, with short-term moving averages positioned below the long-term ones — a classic signal that downward momentum may persist.

If this correction continues, BERA could fall below the $3.80 mark, setting a new all-time low and further shaking investor confidence in the short term.

However, if the trend reverses and buyers step in with strength, BERA could begin climbing toward key resistance levels. The first major hurdle is at $4.44, and a breakout above that could open the path to $4.78.

Should bullish momentum return in full force, Berachain may even rally to retest the $5.43 level, signaling a potential shift back into an uptrend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

5 RWA Altcoins to Watch In April 2025

Ondo (ONDO), Parcl (PRCL), Mantra (OM), OriginTrail (TRAC), and Clearpool (CPOOL) are five RWA altcoins worth keeping an eye on in April 2025.

ONDO holds a $2.4 billion market cap despite a 7% drop this week, while PRCL has fallen nearly 40% amid broader market weakness. Mantra is down just 1.5% over the same period, showing relative strength, though its actual on-chain impact is still debated. TRAC and CPOOL are both in correction phases, but key support and resistance levels could define their next moves.

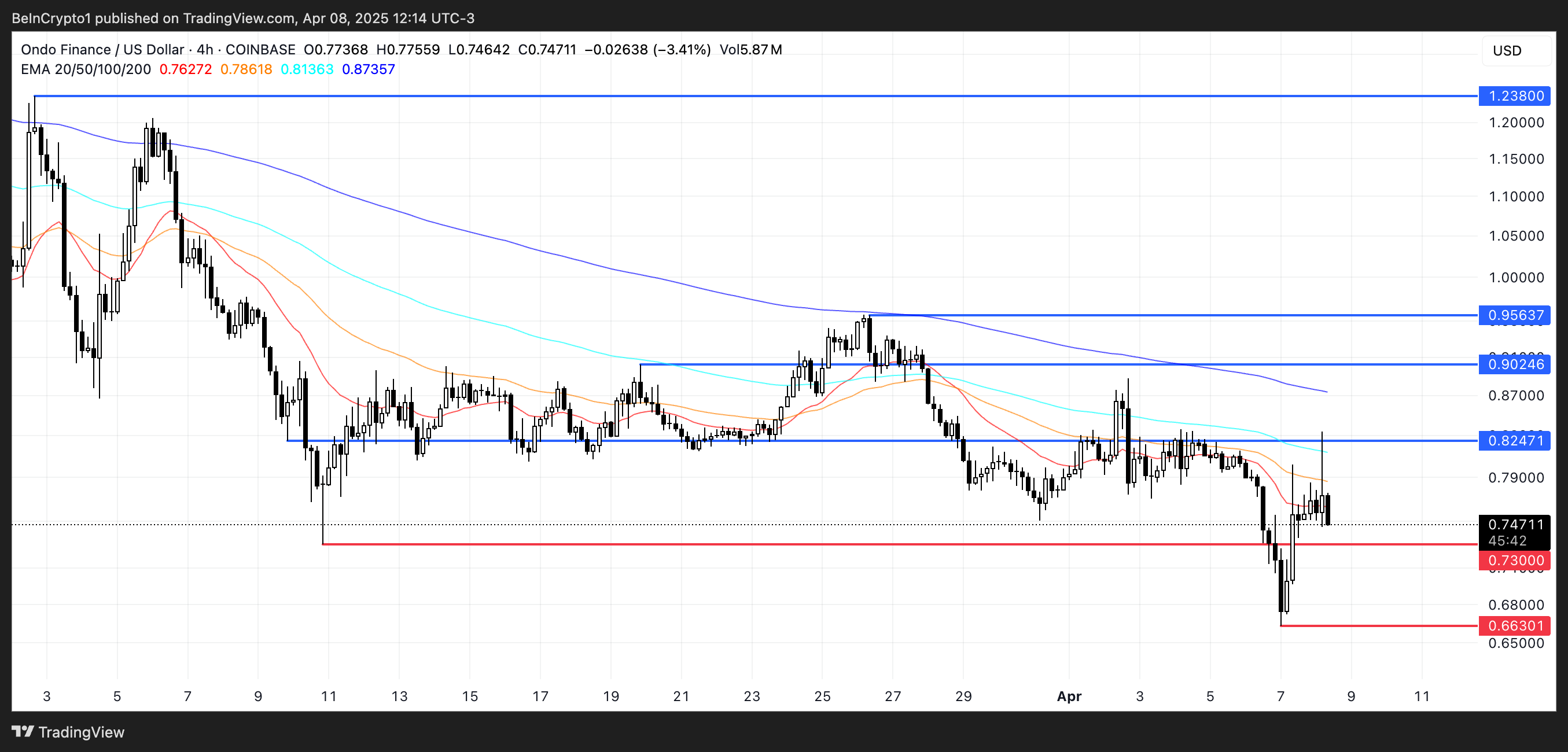

Ondo (ONDO)

Despite a 7% decline over the past seven days, ONDO remains one of the leading RWA altcoins in crypto. It holds a strong position with a market cap near $2.4 billion.

If the downtrend persists, ONDO could first test key support at $0.73. A breakdown below that level may trigger further losses toward $0.66, and if selling pressure accelerates, the token could slide below $0.60 — a level not seen since early 2024.

However, if bulls regain control and reverse the current trend, ONDO could begin climbing toward resistance at $0.82. A successful breakout could lead to a retest of $0.90 and $0.95, and if the momentum holds, the token could even rally up to $1.23 — signaling a strong return of bullish sentiment.

Parcl (PRCL)

Parcl, a decentralized real estate trading platform, current has a market cap nearing $16 billion.

However, the last seven days have been rough for PRCL, with its price plummeting nearly 40% amid a broader altcoin correction and waning market sentiment.

If PRCL can recover from its current downturn, the first key resistance level to watch is $0.073.

A break above that could open the door for a move toward $0.10, potentially signaling a shift in momentum and restoring some confidence among investors looking for a rebound in the RWA space.

On the flip side, if bearish pressure continues, PRCL may slide down to test critical support at $0.050.

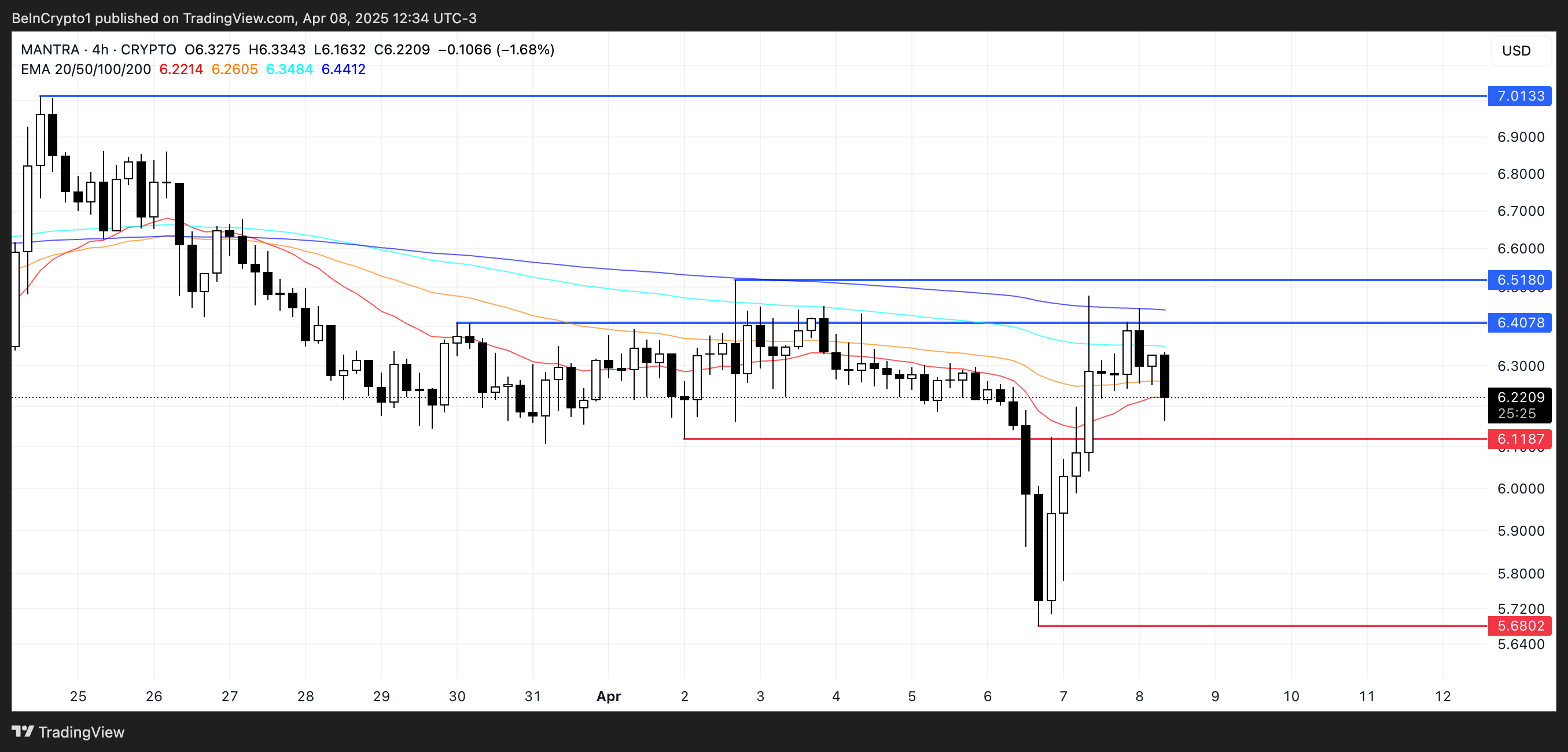

Mantra (OM)

Mantra has emerged as one of the standout RWA altcoins in recent months, with its market cap reaching an impressive $6 billion. Unlike many of its peers, OM has held up relatively well during the latest market correction, dropping just 1.5% over the past seven days — a much smaller decline compared to other RWA altcoins. Recently, Binance Research published that RWA altcoins remain safer than Bitcoin during tariffs.

However, according to Marcos Viriato, CEO of Parfin, it’s too early to declare Mantra as the winner of this cycle:

“It’s still too early to declare a definitive winner. Mantra has executed well and gained momentum, but the RWA space is vast and still maturing. We’re likely to see a multi-platform landscape, with different players excelling in different segments, whether it’s institutional custody, yield generation, or settlement infrastructure. The winners will be those who combine regulatory readiness, composability, and real-world utility and there’s still a lot of room for innovation,” Viriato told BeInCrypto.

OM is still technically in a short-term downtrend. If the correction continues, the token could retest support at $6.11, and a break below that level could push prices down to $5.68. A loss of that support may signal weakening momentum, especially if broader market sentiment remains bearish.

However, if buyers regain control and the trend reverses, Mantra could begin moving higher toward key resistance at $6.40 and $6.51. A successful breakout above these levels could trigger a stronger rally, potentially taking OM back to $7 — a level that would reinforce its bullish long-term outlook.

Kevin Rusher, founder of DeFi RWA lending and borrowing ecosystem RAAC.io, defends that despite price action, Mantra’s value to the whole RWA ecosystem isn’t that big:

“I think it’s definitely too soon to say that Mantra has cornered the RWA market. If you want to talk about price action, you might declare them the winner so far, but the value they have actually brought on-chain is minimal. According to DeFi Llama, Mantra’s current TVL is just $4.3m – this does not even place it within even the top 45 of RWA projects by TVL,” Rusher told BeInCrypto.

OriginTrail (TRAC)

TRAC is the native token of OriginTrail, a decentralized ecosystem focused on building a trusted knowledge infrastructure for artificial intelligence. Its mission is to create a Verifiable Web for decentralized AI.

Despite being down 8.6% over the past seven days, TRAC is showing signs of recovery, bouncing 7.6% in the last 24 hours. If this rebound gains momentum, the token could soon test resistance at $0.37.

A breakout above that level could pave the way for a move toward $0.44, signaling a stronger bullish reversal and renewed interest in the OriginTrail project.

However, traders are closely watching the $0.31 support level, which remains a critical zone for maintaining the current structure. If TRAC drops and fails to hold that support, the price could slip below $0.30, potentially triggering another wave of downside pressure.

Clearpool (CPOOL)

Clearpool is a decentralized capital markets ecosystem that allows institutional borrowers to access unsecured loans directly from the DeFi apps. In a major development, the project recently introduced Ozean — a new blockchain initiative focused on enabling real-world asset (RWA) yield.

CPOOL, Clearpool’s native token, has declined by 7.5% over the past seven days, dropping below the $0.12 mark.

If the current correction continues, the token may test support at $0.106, and a breakdown from that level could push CPOOL below $0.10 — a psychologically significant threshold that may increase bearish sentiment.

However, if the trend reverses and bullish momentum around RWA coins returns, CPOOL could aim for resistance at $0.137. A breakout above that could open the path toward $0.154 and potentially $0.174, depending on the strength of the recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours agoBitcoin Price Recovery In Play—But Major Hurdles Loom Large

-

Altcoin18 hours ago

Altcoin18 hours agoBitcoin +6%, Ethereum +10% Amid Tariff Uncertainty; FARTCOIN Skyrockets +38%, Recovery or Bubble?

-

Market24 hours ago

Market24 hours agoEthereum Price Rebound Stalls—Can It Reclaim the Lost Support?

-

Ethereum18 hours ago

Ethereum18 hours agoHere’s Where Ethereum’s Last Line Of Defense Lies, According To On-Chain Data

-

Market23 hours ago

Market23 hours agoXRP Price Recovery Fades—$2 Remains A Tough Nut to Crack

-

Market21 hours ago

Market21 hours agoCardano (ADA) Eyes Resistance Break—Failure Could Spark Fresh Losses

-

Market20 hours ago

Market20 hours agoSui’s Community Passport & More This Week

-

Bitcoin15 hours ago

Bitcoin15 hours agoBitcoin Whale Activity Peaks Amid Market Uncertainty