Market

Bitcoin Pharaoh Remains Jailed and More

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories about Brazil’s Bitcoin Pharaoh, Botev Plovdiv FC’s move to El Salvador to issue tokenized shares, and more.

El Salvador and Russia Strengthen Economic Cooperation: Bitcoin Could Be on the Agenda

El Salvador and Russia unveiled plans for closer economic collaboration at the St. Petersburg International Economic Forum. Salvadoran Vice President Felix Ulloa proposed enhancing trade relations and establishing mutual embassies, potentially reshaping both nations’ economies.

Russia, facing sanctions from the US and the EU since its 2022 invasion of Ukraine, seeks new trade allies. Under President Nayib Bukele, El Salvador has cooled relations with the US while strengthening ties with China.

Geopolitically, an alliance with Russia could enhance El Salvador’s global standing, reducing its dependence on the United States and solidifying relations with emerging powers like China and Russia. Economically, El Salvador aims to balance its trade deficit with Russia, highlighted by Ulloa’s mention of a $16 million import from Russia in 2021 with no corresponding exports.

Read more: Top 3 Methods for Cross-Border Money Transfer Using Crypto

Technologically, El Salvador aspires to become a hub of innovation. Collaborations with Russian tech firms could support this ambition. Notably, Bitcoin’s role is crucial in this potential partnership. As the first country to adopt Bitcoin as legal tender, El Salvador’s digital asset laws and possibly creating a Bitcoin bank could facilitate trade with Russia, bypassing traditional fiat currencies controlled by central banks.

This economic cooperation could redefine El Salvador’s position on the global stage, offering new opportunities in trade, technology, and digital finance.

Brazilian ‘Pharaoh of Bitcoins’ to Remain in Prison After Supreme Court Ruling

The Federal Supreme Court (STF) upheld the imprisonment of Glaidson Acácio dos Santos, known as the “Pharaoh of Bitcoins,” on June 11. Santos, accused of running a cryptocurrency scam through Gas Consultoria, was arrested in 2021 during the Federal Police’s Operation Kryptos.

Santos’ defense requested habeas corpus, seeking to convert his imprisonment to house arrest due to alleged psychiatric issues and questioning the Federal Court’s jurisdiction. However, Justice Gilmar Mendes rejected the request. He acknowledged that pyramid schemes typically fall under state jurisdiction but noted that federal courts can intervene when cases involve crimes connected to the National Financial System.

Santos faces multiple charges, including financial pyramiding, fraudulent management, irregular securities issuance, unauthorized operations, and criminal organization. His scheme promised victims monthly returns of 10% on crypto-asset investments.

This decision follows the recent arrest of Cláudio Barbosa, another “Pharaoh of Bitcoins,” for running a pyramid scheme through Trust Investing. On the run since 2022, Barbosa allegedly caused a loss of R$4.1 billion to investors from over 80 countries.

Read more: 15 Most Common Crypto Scams To Look Out For

Bulgarian Soccer Club Botev Plovdiv to Issue Tokenized Shares in El Salvador

Bulgarian soccer club Botev Plovdiv FC has announced plans to transfer its cryptocurrency operations to El Salvador through Bitfinex Securities. The club adopted Bitcoin as a payment method in October 2023. It moved its operations to benefit from El Salvador’s tax incentives and favorable business environment, aiming to access new capital markets.

George Manolov, the club’s Bitcoin strategy leader, revealed that Botev Plovdiv established a financial entity in El Salvador to issue tokenized shares. This initiative allows investors to become co-owners of the club.

Read more: What is Tokenization on Blockchain?

“We want Bitcoin to be the main long-term financial strategy for our business. I am here because we want to do a token issuance from El Salvador to accumulate BTC, but also to allow our fans to be part of the process to become a recognized European club. We are working with Bitfinex Securities to democratize the shares, and the investment ticket will be very low. Anyone can become a co-owner,” Manolov explained.

Manolov discussed this new business model at a Bulgarian presentation and will share it at the BTC Prague forum. He explained that tokenization would enable efficient storage, transfer, and management of assets on Bitfinex Securities via the Liquid Network, a Bitcoin sidechain.

Brazil’s Largest Private Bank Expands Access to Bitcoin and Ethereum

Itaú Unibanco, Brazil’s largest private bank, has expanded its cryptocurrency offerings, allowing customers to trade Bitcoin and Ethereum through its digital platform, Íon. With assets exceeding R$2.7 trillion, the bank aims to make access to these top cryptocurrencies more straightforward and secure.

The initiative began gradually at the end of 2023, receiving positive client feedback. In internal surveys, over 90% of users rated their experience as good or great. With a minimum contribution of R$10, all active users on the Íon platform can now trade cryptocurrencies.

“We are very happy with the cryptoassets journey we are building with our customers. Opening trading to all Íon users reflects not only the evolution of our product but also of the entire market,” said Guto Antunes, head of Itaú Digital Assets. He stressed Itaú’s commitment to offering intuitive and secure crypto trading.

Itaú also aims to educate clients about the crypto market, ensuring they make informed investment decisions. This move aligns Itaú with other Brazilian institutions like BTG Pactual and Nubank, which already offer cryptocurrency exposure to their clients.

Read more: Crypto vs. Banking: Which Is a Smarter Choice?

El Salvador Overcame IMF Observations and Reaffirms Bitcoin Agenda

El Salvador’s Vice President Félix Ullóa has reaffirmed the country’s commitment to Bitcoin, aiming for economic liberation from central banks. Since enacting the Law of Digital Assets last year, the nation has embraced various tokens and cryptocurrencies.

Ullóa highlighted El Salvador’s pioneering role in admitting Bitcoin in exchange-traded funds (ETFs) ahead of the US He expressed confidence that Bitcoin could reach $100,000 by the end of 2024.

Despite initial criticism from the International Monetary Fund (IMF) and rating agencies, El Salvador has diversified its financing sources beyond traditional multilateral organizations. This strategy has bolstered the country’s credibility and attracted digital economy companies through a supportive regulatory framework.

Read more: Who Owns the Most Bitcoin in 2024?

El Salvador recently marked three years since adopting Bitcoin as a legal tender. The country has been purchasing one Bitcoin daily, accumulating up to 30 BTC monthly. These investments have yielded over $67 million in unrealized profits.

Notable investors like Cathie Wood, CEO of ARK Invest, believe President Bukele’s Bitcoin strategy could significantly boost the nation’s GDP over the next five years. Ullóa acknowledged that the IMF continues to monitor the Bitcoin Law, highlighting ongoing discussions about the associated risks and benefits.

As the Latin American crypto scene grows, these stories highlight the region’s increasing influence in the global market. From El Salvador’s Bitcoin plans to Brazilian banks’ crypto trading launch, LATAM is positioning itself as a key player in the tech world. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Are Buying These Altcoins Post Tariffs Pause

Crypto whales are making bold moves following Donald Trump’s 90-day tariff pause, with Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) drawing significant accumulation.

ETH whales pushed holdings to their highest level since September 2023, while OM holders are quietly increasing exposure amid the growing real-world asset narrative. XCN, meanwhile, saw a sharp spike in whale activity alongside a 50% price surge in just 24 hours.

Ethereum (ETH)

The broader crypto market rallied after Donald Trump announced a 90-day pause on tariffs—excluding China—boosting investor sentiment across risk assets.

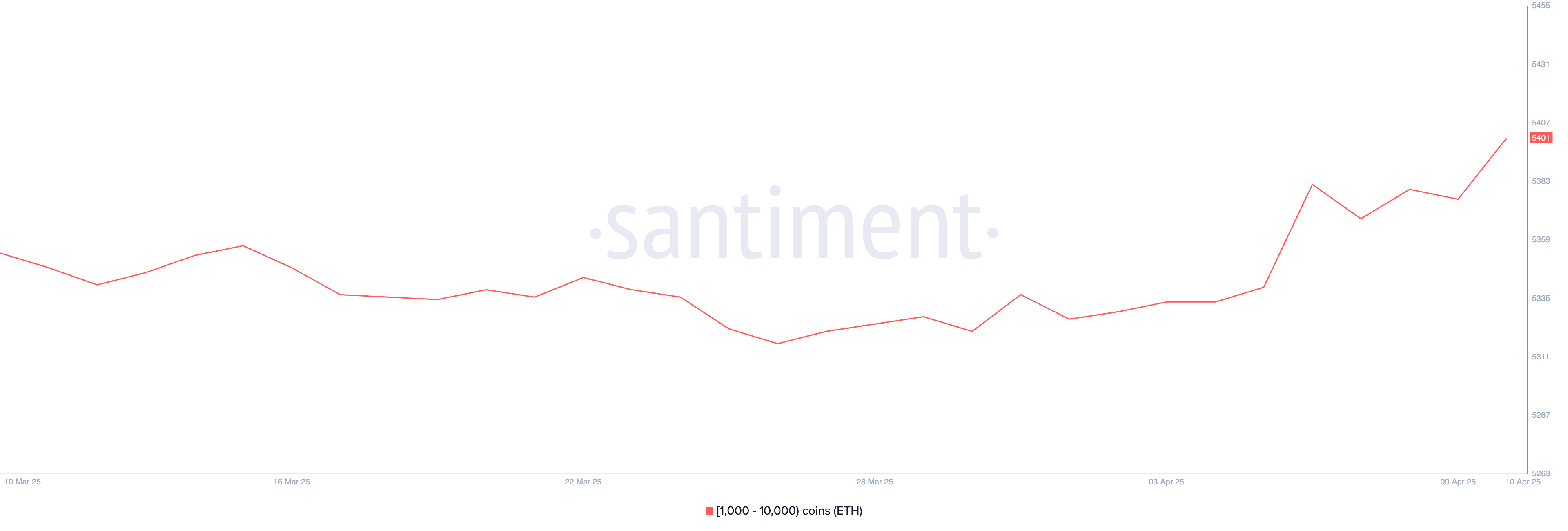

Ethereum followed suit, with on-chain data showing a rise in crypto whales activity; the number of addresses holding between 1,000 and 10,000 ETH climbed from 5,376 to 5,417 between April 9 and 10, reaching its highest level since September 2023.

If Ethereum can maintain this renewed momentum, it may test key resistance levels at $1,749 and potentially rally further toward $1,954 and $2,104. However, macroeconomic uncertainty still looms.

A sentiment reversal could see Ethereum price retesting the $1,412 support zone. If that level fails, a deeper decline toward $1,200—or even $1,000—is possible.

Some analysts have gone as far as comparing Ethereum’s decline to Nokia’s historical collapse, warning of long-term structural weakness.

Mantra (OM)

Real-world assets (RWAs) on the blockchain have hit a new all-time high, surpassing $20 billion in total value, reinforcing their growing importance as a crypto narrative and sector.

Binance Research also highlighted that RWA tokens have shown more resilience than Bitcoin during tariff-related volatility, further boosting confidence in the sector.

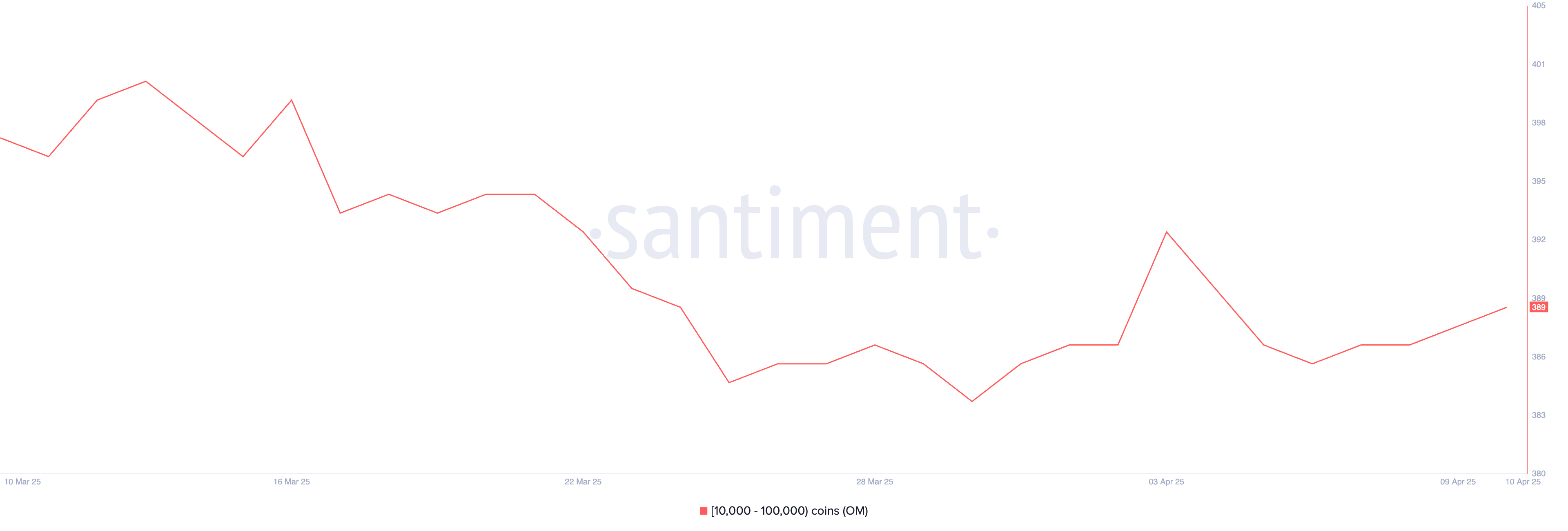

With the RWA narrative gaining traction, OM could see significant upside. Between April 6 and April 10, the number of OM whale addresses holding between 10,000 and 100,000 tokens rose from 386 to 389, signaling quiet accumulation.

If OM breaks past the resistance levels at $6.51 and $6.85, it could climb above $7. However, if the momentum fades, a correction could push the token down to $6.11, with further downside risk toward $5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has surged over 50% in the past 24 hours, breaking above the $0.02 mark as whale accumulation intensifies.

Between April 7 and April 10, the number of addresses holding between 1 million and 10 million XCN rose from 503 to 532, signaling renewed interest from large holders.

If this strong bullish momentum continues, XCN could rally toward resistance levels at $0.026, $0.033, and even $0.040. However, given the rapid price increase in a short timeframe, a correction may follow.

In that case, XCN could retest support at $0.020, with potential downside extending to $0.014 if selling pressure accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Flashes Symmetrical Triangle From 2017, A Repeat Could Send It as Flying To $30

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price may be gearing up for a historic breakout as a long-term Symmetric Triangle pattern from 2017 resurfaces on the charts. If history repeats and a similar explosive move follows, a crypto analyst predicts XRP could skyrocket to an eye-popping $30.

XRP Price Triangle Pattern Signals Breakout Above $30

A new technical analysis by Egrag Crypto, a crypto analyst on X (formerly Twitter), has stirred excitement among XRP supporters, suggesting that the digital asset may be on the brink of a historic price surge and that XRP could jump from its current market value of $2 to reach $30 soon.

Related Reading

While this figure may seem rather ambitious, Egrag Crypto has identified a massive Symmetrical Triangle formation on XRP’s monthly chart. Interestingly, the analyst has revealed that this pattern is strikingly similar to one that preceded XRP’s legendary 2,600% rally in the 2017 bull market.

In the 2017-2018 bull market, XRP had surged to an all-time high of $3.84 in just months. Now, after years of tightening price action within a giant Symmetrical Triangle, the altcoin appears to be breaking out once again, and this time, the analyst predicts that the upside could be even more explosive.

According to Egrag Crypto’s chart, if the asset mirrors its previous 2,600% triangle breakout, it could soar from the breakout zone around $1.20 to as high as $32.36. Notably, XRP’s Symmetrical Triangle formation is a classic consolidation pattern that usually results in a bullish surge in the direction of the prevailing trend.

Currently, XRP’s all-time high is $3.84. A potential surge to $32.36 would represent a whopping 741.6% increase, propelling its price to a level far exceeding its historical peak.

Bullish Pennants Strengthen Symmetrical Triangle Forecast

Egrag Crypto’s bullish forecast for XRP is supported by a textbook diagram comparing bullish pennants and symmetrical triangles, both of which point to double target zones once a breakout occurs. The pattern suggests that once the altcoin escapes its multi-year consolidation, the analyst’s projected rally may play out in three stages: an initial pump, followed by a retracement, and a second explosive move.

Related Reading

The XRP price chart shows a lower target, around $3.52, which aligns with the 1.0 Fibonacci retracement level. This indicates that the token could see a temporary rebound to 3.52, followed by a short-term pullback to the triangle breakout point at $1.20, before ultimately bouncing toward the projected $32.36 target.

Notably, this movement aligns with XRP’s current market structure, where it has maintained long-term support and is now showing signs of upward momentum. While historical price patterns offer insights into potential moves, the predicted rise to $32.36 is uncertain, given the magnitude of such a rise.

Featured image from Adobe Stock, chart from Tradingview.com

Market

This is Why The Federal Reserve Might Not Cutting Interest Rates

Several crypto-related social media accounts are circulating rumors that the Federal Reserve will cut interest rates soon. These center around an out-of-context quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis.

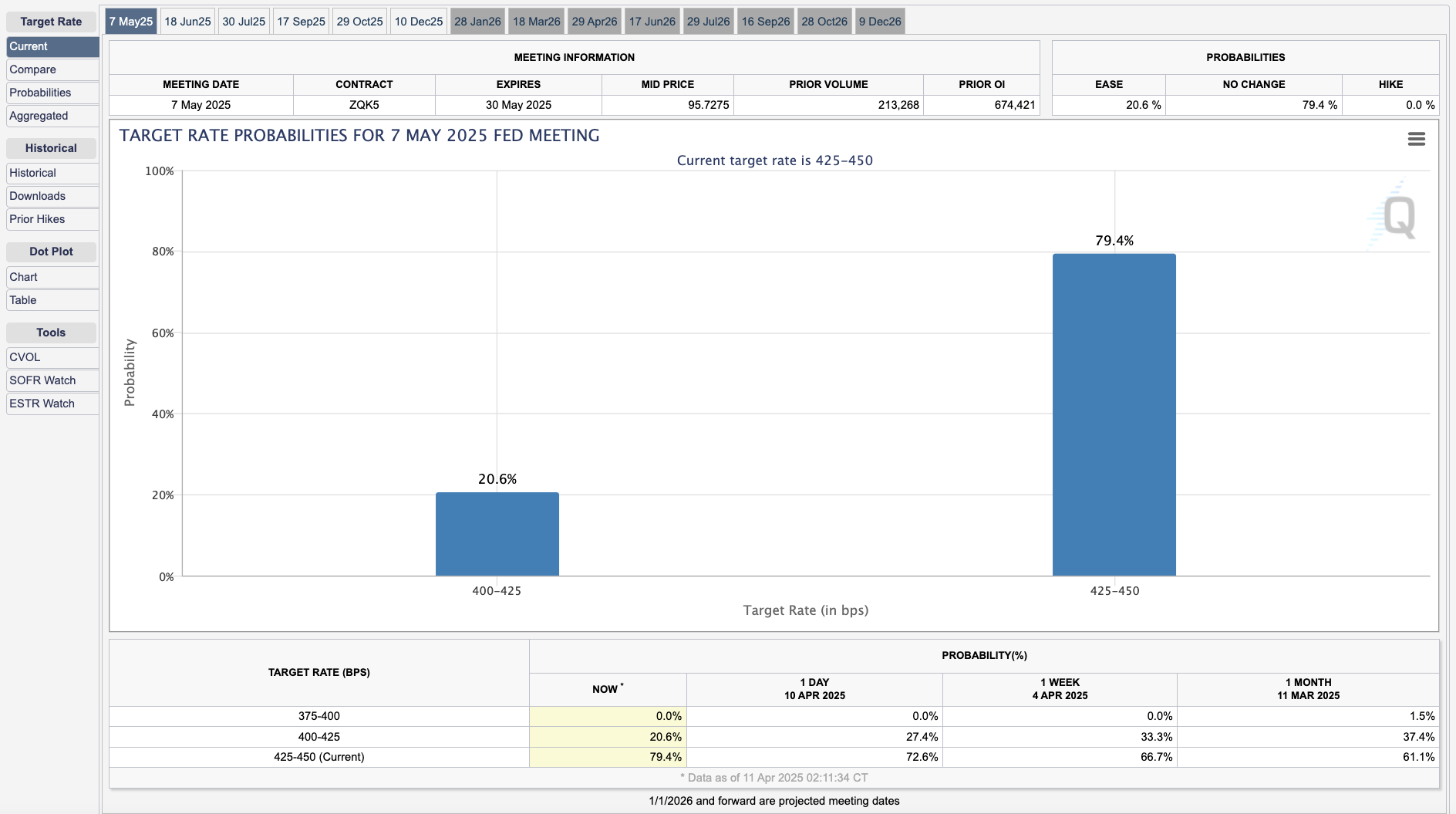

Susan Collins, President of another regional Fed bank, reiterated the low likelihood of any rate cuts. Currently, the CME Group estimates a 20.6% chance of them happening in the next month.

Federal Reserve Rate Cut Rumors Go Wild

As Trump’s tariffs have caused a huge amount of market instability, the crypto space has been desperate for a bullish narrative. A recurring hope has been that the Federal Reserve would cut interest rates, which seems highly unlikely.

Today, in a CNBC interview, a quote from Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, fueled new rumors:

“There are tools there to provide more liquidity to the markets on an automatic basis that market participants can access, in addition to the swap lines you talked about for global financial institutions. Those tools are absolutely there,” Kashkari claimed.

Soon after this interview, several prominent crypto accounts began circulating pieces of this quote out of context. They implied that the Federal Reserve was on the brink of lowering interest rates to stave off potential economic turmoil.

Some of these erroneous claims managed to accumulate thousands of views and reposts on the idea that the Fed will “print money.”

However, in the full interview, Kashkari clearly stated what he meant by “tools.” He emphasized that the Fed is not concerned with global trade and that its “dual mandate” is to focus on inflation and employment within the US.

In other words, the tariff situation does not change the Federal Reserve’s low probability of cutting interest rates.

After these rumors began circulating, another higher-up discussed the Federal Reserve’s tools regarding interest rates.

In a subsequent interview with the Financial Times, Susan Collins, President of the Federal Reserve Bank of Boston, stated the Fed’s policy in very direct language:

“We have had to deploy quite quickly, various tools [to address the situation.] We would absolutely be prepared to do that as needed. The core interest rate tool we use for monetary policy is certainly not the only tool in the toolkit, and probably not the best way to address challenges of liquidity or market functioning,” Collins claimed.

Both Collins and Kashkari have roughly equivalent positions, heading one of the 12 Federal Reserve Banks distributed throughout the country. Both tried to clearly communicate that the Federal Reserve is not considering cutting interest rates at this time.

Despite this, social media rumors can quickly get out of hand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Market18 hours ago

Market18 hours agoPresident Trump Signs First-Ever Crypto Bill into Law

-

Market19 hours ago

Market19 hours agoEthereum Price Cools Off—Can Bulls Stay in Control or Is Momentum Fading?

-

Market17 hours ago

Market17 hours agoXRP Price Ready to Run? Bulls Eyes Fresh Gains Amid Bullish Setup

-

Altcoin17 hours ago

Altcoin17 hours agoBNB Chain Completes Lorentz Testnet Hardforks; Here’s The Timeline For Mainnet

-

Market23 hours ago

Market23 hours agoHow SEC Chair Paul Atkins Will Reset US Crypto Policy

-

Market14 hours ago

Market14 hours agoHow Vitalik Buterin Plans to Enhance Ethereum’s Privacy

-

Altcoin14 hours ago

Altcoin14 hours agoWhy Pi Network Price Should Hit $10, Or Its Over for Pi Coin