Market

Binance’s CZ Sparks TST Meme Coin Frenzy, Traders Reap Huge

Binance founder and former CEO Changpeng Zhao (CZ) inadvertently triggered a trading frenzy around a test token, TST. Interestingly, One lucky trader turned $35,000 into nearly $700,000, representing gains of almost 1,900%.

The news centers around Four.meme, which advertises as the first meme coin fair launch platform on Binance Smart Chain (BSC).

Binance’s CZ Claims Accidental Exposure

The incident stemmed from an educational video made by the BNB team demonstrating how to launch a meme token on the Four.meme platform. However, it resulted in an unexpected surge in the test token TST’s market capitalization.

Changpeng Zhao took to social media platform X (Twitter) to clarify how TST gained traction. He cited a now-deleted video tutorial posted on the Four.meme platform.

“In this video, we launched a token named TST as the example….,” CZ explained, citing a BNB Chain team member.

Following an accidental reveal by the BNB team, members of the Chinese crypto community identified the token and began actively trading and promoting it. CZ emphasized that neither he nor Binance exchange holds any of the tokens.

“This is NOT an endorsement from me for the token…no one on the team (or Binance) holds any of that token. This is NOT an official token by the BNB Chain team or anyone. It is a test token used just for that video tutorial,” he articulated.

Reportedly, a team member also deleted the private key for the tutorial wallet. However, this did little to stop speculators from jumping in, sending TST’s market cap to nearly $500,000 within hours.

Crypto analyst Ai shed light on an intriguing transaction. A trader, identified by the wallet address 0xeBB…74711c, purchased $35,000 worth of TST just minutes before CZ’s tweet. As the hype built up, the trader’s holdings skyrocketed to a floating profit of $657,000—a staggering 1,885% return. Ai speculated whether this was pure luck or if the trader had inside knowledge about the video leak.

“Lucky/smart money 0xeBB…74711c happened to open a position of 35,000 USD in tokens five minutes before CZ tweeted TST, andnow has a floating profit of 657,000 USD, with a return rate of 1885%! After CZ tweeted, he quickly added 2 BNB. He currently holds 28.82 million TST, making him the top 1 address. I am also impressed by his luck,” Ai remarked.

Adding to the speculation, crypto user 0xSun suggested that the address could be linked to a Binance Chain team member. This speculation fueled suspicions of potential insider trading.

Elliot’s Crypto, another industry veteran, pointed out that BNB community members saw an opportunity, piling in on the trade and fueling a meme-driven price surge.

“Let’s send it for the culture of BNB memes… I mean there could be huge opportunity on these levels. I had just a small bag at dip and still holding…it’s shared by BNB chain first on the video but community found the cat,” the user noted.

Meanwhile, CZ insists that the TST token was purely for demonstration purposes. Nevertheless, the incident reflects his and other industry leaders’ immense influence. Even an unintentional mention can send markets into a frenzy, reinforcing how unpredictable and volatile crypto markets remain.

Data on Gecko Terminal shows that TST remains well above its debut price with a market cap of $15.1 million at press time, but the price action shows continued profit booking.

Rise of Token Launchpads and Regulatory Scrutiny

Notably, Four.meme is a BNB chain-based platform that allows users to easily create and launch meme coins. It comes amid a growing trend of token launchpads, which enable users to easily create and launch new cryptocurrencies.

The launchpad joins an already competitive space. Players such as Solana’s Pump.fun, Tron’s SunPump and PancakeSwap’s SpringBoard are already in the market, lowering the barriers for token creation and fostering an explosion of meme coins.

However, the increasing popularity of these platforms has drawn regulatory scrutiny. The UK’s Financial Conduct Authority (FCA) recently warned against Pump.fun. BeInCrypto reported that the regulator cautioned that it may be operating in violation of financial laws.

Additionally, Pump.fun has faced backlash for enabling harmful live streams. Here, bad actors exploited the platform to mislead and manipulate retail investors.

As token launchpads continue to grow, regulatory oversight is expected to increase. Authorities seek to prevent manipulation and protect investors from bad actors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Price Rise To $1 is Now In The Hands Of Bitcoin

Pi Network’s price has shown signs of recovery in recent days, reaching a two-week high after a notable uptrend.

However, despite this progress, the cryptocurrency’s growth appears heavily dependent on external factors, particularly Bitcoin’s price movements. As a result, its future direction remains closely tied to the crypto king’s performance.

Pi Network Could Keep The Uptrend Going

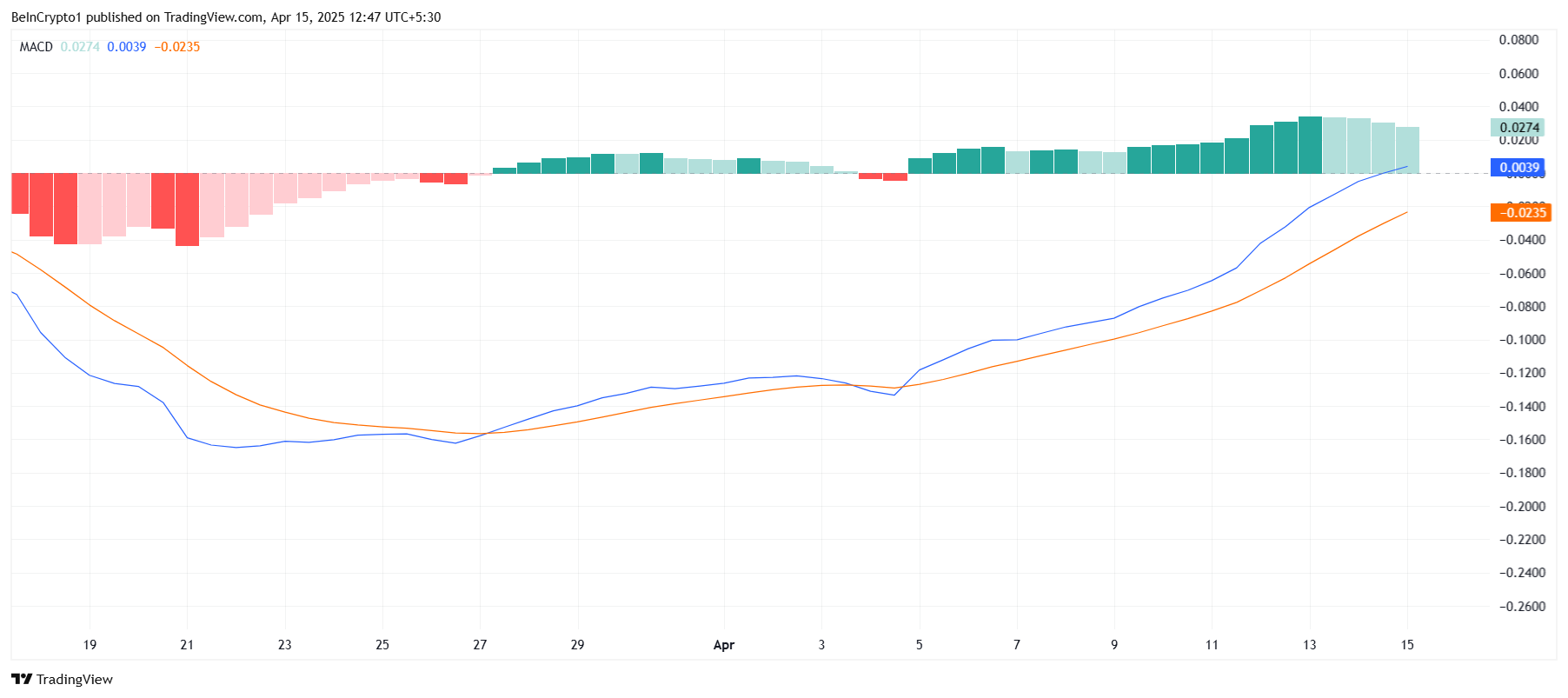

The Moving Average Convergence Divergence (MACD) indicator suggests that while Pi Network’s bullish momentum is beginning to fade, it has not yet reversed course. The indicator remains in positive territory, signaling that there is still potential for continued upward movement. The MACD is far from a bearish crossover, which could suggest that Pi still has room to rise in the short term.

Despite a slight weakening in bullish momentum, the overall outlook for Pi Network remains positive. The current trend still shows that there is enough strength for the altcoin to maintain its uptrend and push higher, particularly if market conditions support its growth.

Pi Network has shown a strong correlation with Bitcoin, standing at 0.84. This suggests that Pi closely follows the movements of Bitcoin, with its price trajectory highly influenced by the performance of the crypto market leader. As Bitcoin holds steady above $85,000, it could act as a strong catalyst for Pi’s price growth.

Given Bitcoin’s ongoing strength, Pi Network has the potential to experience a similar upward movement, especially if BTC continues to see positive price action. Pi’s dependence on Bitcoin’s market performance is evident, and any sustained rise in Bitcoin could trigger a corresponding rise in Pi Network’s value.

PI Price is Aiming At $1

Pi Network is currently trading at $0.74, up by 26% over the past five days. To maintain this positive momentum, Pi must hold above the $0.70 support level. A bounce off this level would allow the altcoin to continue its rise and potentially test the next resistance level at $0.87.

If Pi successfully breaches $0.87, it could open the door for further gains, with a potential move toward $1.00. The market sentiment and Bitcoin’s continued strength could fuel this upward momentum, bringing Pi closer to its key target. A break above this resistance would signify the start of a more substantial rally.

However, should Bitcoin experience a decline, Pi Network may follow suit. A drop through the $0.70 support level could lead Pi to test the $0.60 mark, and a further fall through this point would likely bring the price down to $0.51. This would invalidate the bullish outlook and signal a potential reversal in Pi’s price trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Consolidation Hints at Strength—Is a Move Higher Coming?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a fresh increase above the $1,620 zone. ETH is now consolidating gains and might aim for more gains above $1,680.

- Ethereum started a decent increase above the $1,600 and $1,620 levels.

- The price is trading above $1,625 and the 100-hourly Simple Moving Average.

- There is a new connecting bullish trend line forming with support at $1,625 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,680 resistance zone.

Ethereum Price Eyes More Gains

Ethereum price formed a base above $1,520 and started a fresh increase, like Bitcoin. ETH gained pace for a move above the $1,580 and $1,600 resistance levels.

The bulls even pumped the price above the $1,650 zone. A high was formed at $1,690 and the price recently started a downside correction. There was a move below the $1,640 support zone. The price dipped below the 50% Fib retracement level of the upward move from the $1,562 swing low to the $1,690 high.

However, the bulls were active near the $1,620 zone. Ethereum price is now trading above $1,625 and the 100-hourly Simple Moving Average. There is also a new connecting bullish trend line forming with support at $1,625 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,660 level. The next key resistance is near the $1,680 level. The first major resistance is near the $1,690 level. A clear move above the $1,690 resistance might send the price toward the $1,750 resistance.

An upside break above the $1,750 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,800 resistance zone or even $1,880 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,660 resistance, it could start a downside correction. Initial support on the downside is near the $1,620 level. The first major support sits near the $1,610 zone and the 61.8% Fib retracement level of the upward move from the $1,562 swing low to the $1,690 high.

A clear move below the $1,610 support might push the price toward the $1,575 support. Any more losses might send the price toward the $1,550 support level in the near term. The next key support sits at $1,500.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,610

Major Resistance Level – $1,660

Market

Can Pi Network Avoid a Similar Fate?

Following Mantra’s catastrophic OM token crash, analysts urge the Pi Core Team (PCT) to adopt greater transparency and caution.

These remarks follow Pi Network’s recent transition to the full Open Mainnet phase.

Pi Network Advised to Prioritize Transparency Post-Mainnet

The warning comes after OM’s price plummeted more than 90% in under an hour, wiping out over $5.5 billion in market capitalization.

Following this crash, there is widespread fear across the crypto industry of similar events occurring in projects undergoing key phases of development and token unlocking. Among such projects is Pi Network, which recently transitioned to Open Mainnet.

Dr Altcoin, a crypto analyst and advocate for decentralized ethics, relates the OM incident to the Pi Network and calls for stricter regulation.

“The OM incident is a wake-up call for the entire crypto industry, proof that stricter regulations are urgently needed. It also serves as a huge lesson for the Pi Core Team as we transition from the Open Network to the Open Mainnet,” he tweeted.

Some users defended Pi Network’s fundamentals, highlighting its utility-focused roadmap and avoidance of speculative hype. However, Dr Altcoin doubled down on concerns over a lack of transparency.

“One thing is clear about the PCT, they are not transparent,” he added.

Still, the broader Pi community remains optimistic. The account Pi Open Mainnet, presented as a pioneer, posted a rebuttal citing reasons Pi may avoid OM’s fate. It highlighted Pi’s slow token release strategy and absence of large early-sell events as elements central to that confidence.

“Massive community (35M+ pioneers), steady unlocks, growing utility (.pi domains, dapps), and a clean track record,” they wrote.

Indeed, Pi’s ecosystem is expanding. The integration with Chainlink, new fiat on-ramps, and Pi Ads are creating what the team calls a “virtuous cycle” of adoption and utility, according to Pi Open Mainnet 2025, a senior pioneer’s account.

“These advancements form a virtuous cycle for Pi Network. Easier fiat ramps bring in more users (Pi’s community is already ~60M strong), Pi Ads drive more apps & utility, and Chainlink integration adds trust and interoperability. More users →more utility,” it stated.

With a community reportedly approaching 60 million, many believe the project has a strong user-driven foundation, unlike OM’s more centralized dynamics.

Is This Enough to Prevent OM-Like Fate?

However, not everyone is convinced this will be enough. Mahidhar Crypto, a Pi Coin validator, urged users to withdraw Pi coins from centralized exchanges (CEXs) to prevent price manipulation.

“We have seen what happened to OM—how market makers dumped on users…When you deposit your Pi Coins on CEX, the Market makers will use bots to create artificial buy/sell walls to manipulate prices or Liquidity,” they warned.

This aligns with recent concerns about collusion between market makers and CEXs. Mahidhar also called for the Pi Core Team to scrutinize KYB-verified businesses and avoid listing Pi derivatives on CEXs, citing the risks of leveraged trading on still-maturing assets.

Further fanning skepticism is on-chain behavior tied to OM. Trading Digits, a technical analysis firm, pointed out that the “Pi Cycle Top” indicator, a pattern often signaling market tops, had triggered twice for OM since 2024, the most recent being just two months before its collapse.

“Coincidence or bound to happen?” the firm posed.

Will Pi follow a disciplined, utility-first path, or could it fall into the same traps that triggered OM’s downfall?

BeInCrypto data shows Pi Network’s PI coin was trading for $0.74% as of this writing, down by 1.36% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts Dogecoin Price Rally To $0.29 If This Level Holds

-

Market20 hours ago

Market20 hours agoMENAKI Leads Cat Themed Tokens

-

Market19 hours ago

Market19 hours agoTether Deploys Hashrate in OCEAN Bitcoin Mining Pool

-

Market18 hours ago

Market18 hours ago3 Altcoins to Watch in the Third Week of April 2025

-

Market14 hours ago

Market14 hours agoBinance Futures Causes a Brief Crash For Story (IP) and ACT

-

Market23 hours ago

Market23 hours agoSolana Futures Traders Eye $147 as SOL Recovers

-

Market16 hours ago

Market16 hours agoCardano (ADA) Eyes Rally as Golden Cross Signals Momentum

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Price Threatened With Sharp Drop To $1,400, Here’s Why