Market

Binance Reportedly Seeks Reentry Into American Market

Binance has drawn renewed attention after reports emerged that its executives met privately with officials from the US Treasury in March.

The meetings, first reported by The Wall Street Journal, allegedly focused on easing regulatory pressure as the exchange seeks a fresh path into the American market.

Zhao Denies Report Linking Him to Investigation Into Justin Sun

This development follows Binance’s $4.3 billion settlement with the US Department of Justice in 2023, which centered on past violations of anti-money laundering laws.

Meanwhile, speculation is mounting that former Binance CEO Changpeng Zhao may be cooperating with US authorities—potentially in investigations related to TRON founder Justin Sun.

While no official confirmation has surfaced, the idea of Zhao assisting in a case against Sun has raised eyebrows. Sun has previously faced scrutiny over alleged securities violations and financial misconduct.

Zhao, however, has dismissed the WSJ article as sensationalist, suggesting it was crafted to generate clicks. He also hinted at fresh lobbying efforts against Binance but did not elaborate.

“Multiple people have told me again WSJ is writing another baseless hit piece about me,” Zhao stated.

In response, Justin Sun released a statement denying any wrongdoing. He emphasized that his communications with US authorities have remained open and cooperative.

“The US Department of Justice has been one of T3FCU’s closest and most trusted partners. Together, we’ve collaborated on numerous cases aimed at protecting users around the world. Whether it’s CZ or our partners at the DOJ, we maintain direct, honest communication at all times. I have full trust in each and every one of them,” Sun stressed.

Sun also underscored his confidence in Zhao’s leadership and the potential for US crypto policy to evolve under a more supportive regulatory environment.

“CZ is both my mentor and a close friend—he has played a crucial role in supporting me during my entrepreneurial journey. To this day, his conduct and principles remain the highest standard I strive to follow as a founder,” Sun stated.

Binance Eyes Stablecoin Partnership With WLFI

In a separate but equally notable move, Binance is reportedly exploring a partnership with World Liberty Financial (WLFI), a decentralized finance project said to have ties to President Donald Trump’s family.

At the center of the talks is the DeFi venture’s recently released stablecoin called USD1, which WLFI aims to list on Binance.

If the deal goes through, it could mark a significant strategic gain for both parties. WLFI would secure a global platform for USD1, while Binance could regain political goodwill as it eyes reentry into the US market.

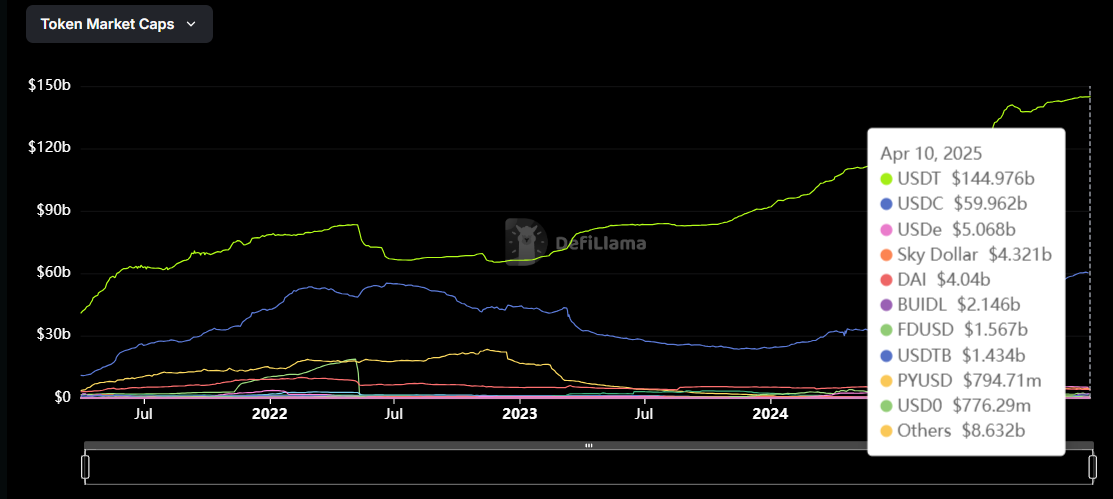

Market analysts say Binance’s infrastructure could fast-track USD1’s adoption, particularly as stablecoin demand grows amid shifting US regulations.

Moreover, the move may also position WLFI to challenge stablecoin leaders like Tether (USDT) and Circle (USDC), potentially reshaping the competitive landscape of dollar-backed digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FLR Token Hits Weekly High, Outperforms Major Coins

Layer-1 (L1) coin FLR has climbed 19% over the past 24 hours to rank as the top gainer in the crypto market today.

This marks another strong day in what has become a week-long rally, pushing FLR’s price to a new weekly high of $0.018, a 57% increase over the past seven days.

Flare Bullish Rally Gains Steam

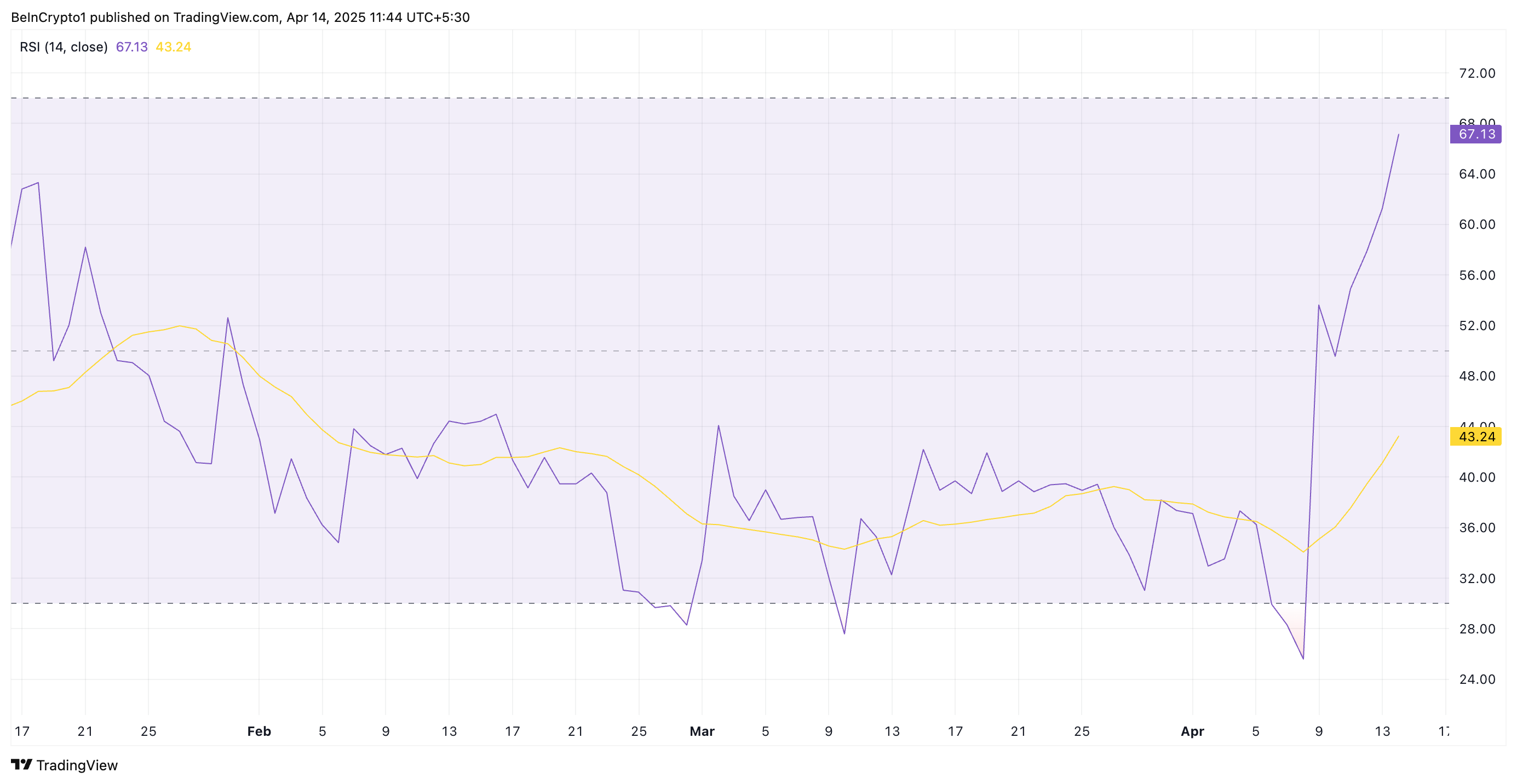

Since April 9, FLR has made new daily highs, indicating strong bullish momentum. The coin’s Relative Strength Index (RSI), which is in an upward trend and at 67.13 at press time, confirms this positive outlook.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 67.13, FLR’s RSI indicates that the buying pressure significantly exceeds selling activity among its spot market participants. It suggests there is still room for further gains before the altcoin becomes overbought and due for a correction.

Moreover, for the first time since January 26, the histogram bars that make up FLR’s Awesome Oscillator (AO) have flipped above the zero line and continue to grow taller. This reflects the strengthening bullish sentiment amongst FLR holders.

The AO indicator measures an asset’s market trends and potential reversals. It comprises a histogram bar chart that visually represents the difference between a short-term and long-term moving average. When the bars are below zero, it suggests that short-term momentum is weaker, indicating bearish pressure.

On the other hand, as with FLR, when the AO bars flip above the zero line and continue trending upward, it signals that bullish momentum is not just present but also growing. This hints at further price gains for FLR if other market conditions align.

Bulls Push Through Resistance, But Profit-Taking Could Halt Gains

FLR’s double-digit rally over the past day has pushed its price above the key resistance formed at $0.016. Should this price point offer a strong support floor for FLR, it could extend its gains and climb to $0.021.

However, a resurgence in profit-taking activity will invalidate this bullish projection. In that case, the altcoin’s price could break below $0.016 and fall toward $0.010.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Outflows Cross $300 Million In April, Why The Price Could Crash Further

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

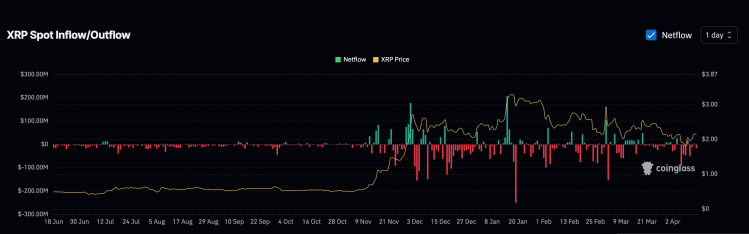

The XRP price saw a rise in value over the weekend as bulls seemed to return to the table. Since the market has been low over the past few months, investors unsurprisingly took this as an opportunity to get out at a somewhat higher price. This has led to more negative networks over the last few days, adding even more red to the month of April that has been dominated by outflows.

XRP’s April Outflows Cross $300 Million

According to data from Coinglass, XRP has been struggling with negative net flows for the better part of April, recording more red days than green. Even the green days have been quite muted and have fallen short of the volumes recorded on the red days. With only 13 days gone out the month so far, there has already been more than $300 million in outflows recorded for the month already.

Related Reading

So far, only four out of the 13 days have ended with positive net flows, coming out to $56.08 million in inflows for the month. In contrast, the other nine days have been dominated by outflows, coming out to $311 million by Sunday.

This consistent outflow suggests that sellers are still dominating the market, which explains why the XRP price has continued to remain low throughout this time. Additionally, if this negative net flow trend continues, then the XRP price could suffer further crashes from here.

However, in comparison to the last three months, the month of April seems to be recording a slow down when it comes to outflows. For example, months of January and March recorded $150 million outflow days, whereas the highest so far in April has been $90 million, which occurred on April 6.

One More Dip Coming?

While there has been a return of positive sentiment among XRP investors, bearish expectations still abound, although mainly for the short-term. Crypto analyst Egrag Crypto, a known XRP bull, has pointed out that the altcoin is likely to see another dip in price before a recovery. Nevertheless, the expectations for the long-term are still extremely bullish.

Related Reading

The crypto analyst highlights the possibility for the XRP price to dip to $1.4, but explains that he continues to hold his position. As for how high the price could go, the analyst maintain three major price targets: $7.50, $13, and $27.

“For me, I follow the charts with a clear understanding that certain events will unfold, but I stay updated on the news to see what narratives are created to influence market movements,” Egrag Crypto explained.

Featured image from Dall.E, chart from TradingView.com

Market

User Data from Major Crypto Exchanges Leaked to Dark Web

April continues to witness a surge in user data from major crypto companies, including Ledger, Gemini, and Robinhood, being sold on the dark web.

The leaked information includes full names, addresses, cities, states, ZIP codes, phone numbers, email addresses, countries, and more. The breach has sparked serious concerns about cybersecurity in the crypto sector, which is already grappling with rising online threats.

How Are User Details Ending Up on the Dark Web?

The Dark Web Informer account on X (formerly Twitter) recently shared a troubling update. An account claimed to be selling data from well-known crypto platforms, including Ledger, Gemini, and Robinhood.

Dark Web Informer posted screenshots showing that the seller has access to detailed user information—from phone numbers to home addresses. Most of the affected users are based in the United States, which matches the primary user base of Gemini and Robinhood.

So far, none of the mentioned platforms have issued official statements about the reported leaks.

This isn’t the first time such an incident has occurred. In 2021, Robinhood suffered a breach in which hackers stole more than 5 million email addresses and 2 million customer names. The attack exploited a customer support employee through social engineering.

A more recent report by BeInCrypto revealed that a similar data breach also affected over 100,000 users. The compromised data contains similar personal information, mostly belonging to US-based users. A smaller portion includes users from Singapore and the UK.

Experts at Dark Web Informer believe these leaks likely did not stem from system breaches within the exchanges. Instead, they point to phishing attacks as the probable cause. Phishing scams trick individuals into sharing sensitive data by impersonating trusted entities, suggesting the exchanges themselves may not have been directly compromised.

However, the scale of the leaks—impacting hundreds of thousands—highlights that many users still fall prey to such tactics. The growing use of AI may worsen the problem. AI-driven fraud, deepfake scams, synthetic identities, and automated phishing attacks are becoming more sophisticated and harder to detect.

“Stay vigilant—your data might already be exposed,” Dark Web Informer warned.

Meanwhile, BeInCrypto’s investigation noted a rise in user complaints on X regarding phishing messages. Many users reported that scam messages, disguised as coming from Binance’s official sender ID used for authentication alerts, deceived them. Somehow, attackers managed to obtain users’ phone numbers.

In response, Binance’s Chief Security Officer told BeInCrypto that the company has expanded its anti-phishing code feature. The update now includes SMS verification in an effort to combat the issue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin13 hours ago

Altcoin13 hours agoMantra Team Responds As The OM Token Price Crashes Over 80% In 24 Hours

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Reclaims Key Support At $1,574, Here’s The Next Price Target

-

Market23 hours ago

Market23 hours agoDOGE Spot Outflows Exceed $120 Million in April

-

Market21 hours ago

Market21 hours agoFARTCOIN Is Overbought After 250% Rally – Is the Bull Run Over?

-

Market17 hours ago

Market17 hours ago3 Token Unlocks for This Week: TRUMP, STRK, ZKJ

-

Market22 hours ago

Market22 hours agoBinance Users Targeted by New Phishing SMS Scam

-

Market20 hours ago

Market20 hours agoEthereum’s Buterin Criticizes Pump.Fun for Bad Social Philosophy

-

Bitcoin19 hours ago

Bitcoin19 hours agoNew Bill Pushes Bitcoin Miners to Invest in Clean Energy