Market

Binance Labs Invests in Kernel to Boost BNB Chain Security

Binance Labs has announced its investment in Kernel, a restaking infrastructure designed to enhance security and utility on the BNB Chain.

Kernel aims to use restaking to transform BNB’s security into programmable trust, supporting a range of crypto services, applications, and middleware.

Kernel Will First Launch On the BNB Chain

The initial rollout will focus on integrating BNB Liquid Staking Tokens (LSTs) and restaked BNB as economic security to drive innovation in DeFi on the BNB Chain.

Also, Kernel plans to expand by incorporating Bitcoin and its derivatives into its restaking framework. Over 20 decentralized applications (dApps), will utilize Kernel’s economic security. This will include AI co-processor Mira and ZK proof aggregation protocol Electron

Meanwhile, collaborations with projects like ListaDAO, Solv, and YieldNest will further enhance the utility of restaked assets. Kernel’s long-term vision includes scaling its infrastructure to additional layer-1 blockchains.

Kernel’s approach integrates native and liquid staking tokens from BNB, BTC, and other yield-bearing assets. This will likely optimize the asset’s utility and improve capital efficiency.

“Kernel exemplifies the type of innovative project that aligns with Binance Labs’ mission to bring more users onto Web3 by supporting meaningful technology and advancing the ecosystem,” Alex Odagiu, Investment Director at Binance Labs said in a press release.

This investment follows Binance Labs’ recent backing of Lombard, a Bitcoin-focused liquid staking platform. Lombard’s LBTC token currently captures 40% of the Bitcoin liquid staking token market and aims to expand its secure multi-chain staking protocol.

Additionally, Binance Labs has ventured into the decentralized science (DeSci) sector. The firm recently invested in BIO Protocol, marking its first entry into this field.

Overall, Binance Labs’ has seemingly adopted a broader strategy to diversify its $10 billion portfolio into innovative and impactful sectors.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Market

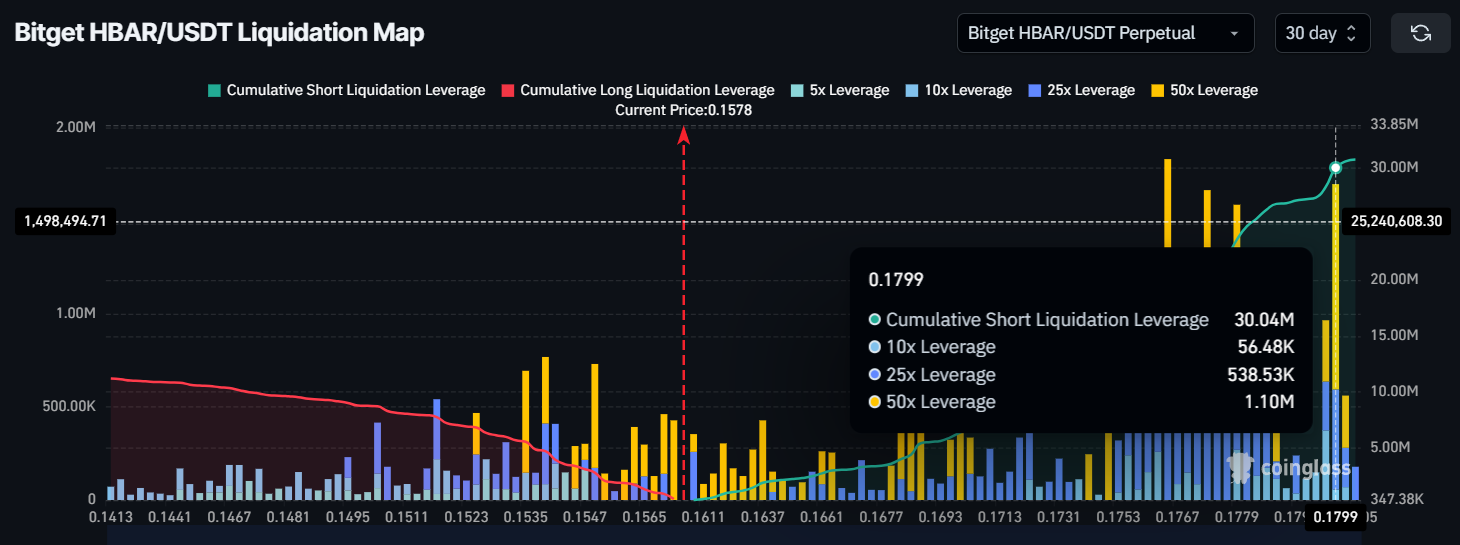

HBAR Could Avoid $30 Million Liquidation Thanks to Death Cross

HBAR has recently experienced a significant price correction, pulling the altcoin to a critical support level. As the market conditions continue to show weakness, the price action has left HBAR vulnerable.

However, this downside movement might be offering short traders a chance to avoid heavy liquidation losses.

Hedera Traders Stand To Lose A Lot

The liquidation map indicates a situation of concern for short traders. Approximately $30 million worth of short contracts are poised for liquidation if the HBAR price rises to $0.18. This could cause massive losses for traders who are betting against the asset. However, the current price range near $0.157 has provided some relief as the market struggles to breach lower support levels.

If HBAR maintains its position above key levels, these traders may be spared the liquidation risk for now. Despite the challenging market conditions, this scenario actually provides a buffer for traders, helping them avoid significant losses.

The overall macro momentum for HBAR shows signs of potential downside pressure as the cryptocurrency approaches a Death Cross. The 200-day exponential moving average (EMA) is just over 3% away from crossing the 50-day EMA.

This technical formation, when confirmed, signals a possible continuation of the bearish trend and could push HBAR further down in the coming days.

The close proximity of these two EMAs has increased the chances of the Death Cross, which could result in further losses for HBAR holders. The market’s lack of substantial improvement and the growing uncertainty surrounding price action contribute to the likelihood of the Death Cross forming.

HBAR Price Holds Above Support

HBAR is currently trading at $0.157, holding just above the critical support level of $0.154. While it has managed to stay above this support for now, it remains vulnerable to falling through it if bearish sentiment intensifies. A break below $0.154 would likely trigger a deeper decline, with the next support level at $0.143.

If HBAR fails to hold the $0.154 support, a further drop could confirm the Death Cross formation. Should this scenario unfold, the price might continue downward toward $0.143, and further declines could follow, pushing HBAR toward $0.12 or lower.

On the other hand, if HBAR can bounce back from $0.154, a recovery rally is possible. Successfully flipping the $0.165 resistance into support could push the price toward $0.177. This movement would bring the liquidation scenario closer to reality, as short traders could face significant losses in a reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SEC Reconsiders Howey Test Use in Crypto Oversight

The US Securities and Exchange Commission (SEC) is preparing to review several internal staff directives that influence how the regulator oversees the crypto industry.

This move aligns with President Donald Trump’s latest Executive Order on deregulation. It also follows guidance from the Department of Government Efficiency (DOGE), currently led by Elon Musk.

SEC to Review Howey Test and Investment Contract Framework Application

On April 5, Acting SEC Chair Mark Uyeda noted that the upcoming reviews could result in changes or full withdrawal of some statements. He emphasized that the agency’s objective is to ensure its guidance remains relevant and consistent with its current priorities.

“The purpose of this review is to identify staff statements that should be modified or rescinded consistent with current agency priorities,” the Commission stated.

One of the main targets of this reassessment is the SEC’s current framework for determining whether a digital asset qualifies as a security. This guideline relies heavily on the decades-old Howey Test.

It also reflects the views of former SEC official Bill Hinman, shared during a 2018 speech. Hinman argued that the degree of decentralization behind a token should matter more than how it was originally sold.

This view has influenced several enforcement decisions, including the legal battle with Ripple over XRP. However, many in the industry argue that the Howey Test is no longer suitable for modern blockchain technologies.

This development may pave the way for a dramatic shift in how crypto assets are evaluated. Crypto analyst Jesus Martinez believes that removing or revising the current framework could be a major turning point for retail investors in the US.

He argues that regulatory constraints have long blocked everyday users from participating in projects like launchpads and node operations. These platforms are often only accessible to those with foreign identification or institutional workarounds.

Martinez says that dismantling such outdated rules could help level the playing field for American investors.

“It’s been hurting retail for the longest time & we need to prioritize American citizens, this is a big step in that direction,” Martinez concluded.

Beyond the Howey-based framework, the SEC is also reviewing several other documents. One of these is a bulletin outlining regulatory concerns around mutual funds investing in Bitcoin futures.

The financial regulator is also reviewing a risk alert from the Division of Examination. This alert warns that digital assets pose unique investor risks, including regulatory uncertainty and cybersecurity threats.

Additionally, the Commission is reassessing whether state-chartered banks and trust companies can act as qualified custodians under the SEC’s Custody Rule.

The crypto community believes the SEC’s broad reassessment points to a shift toward a more modern and flexible regulatory approach. This shift could reshape the crypto landscape for both retail investors and institutional participants

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

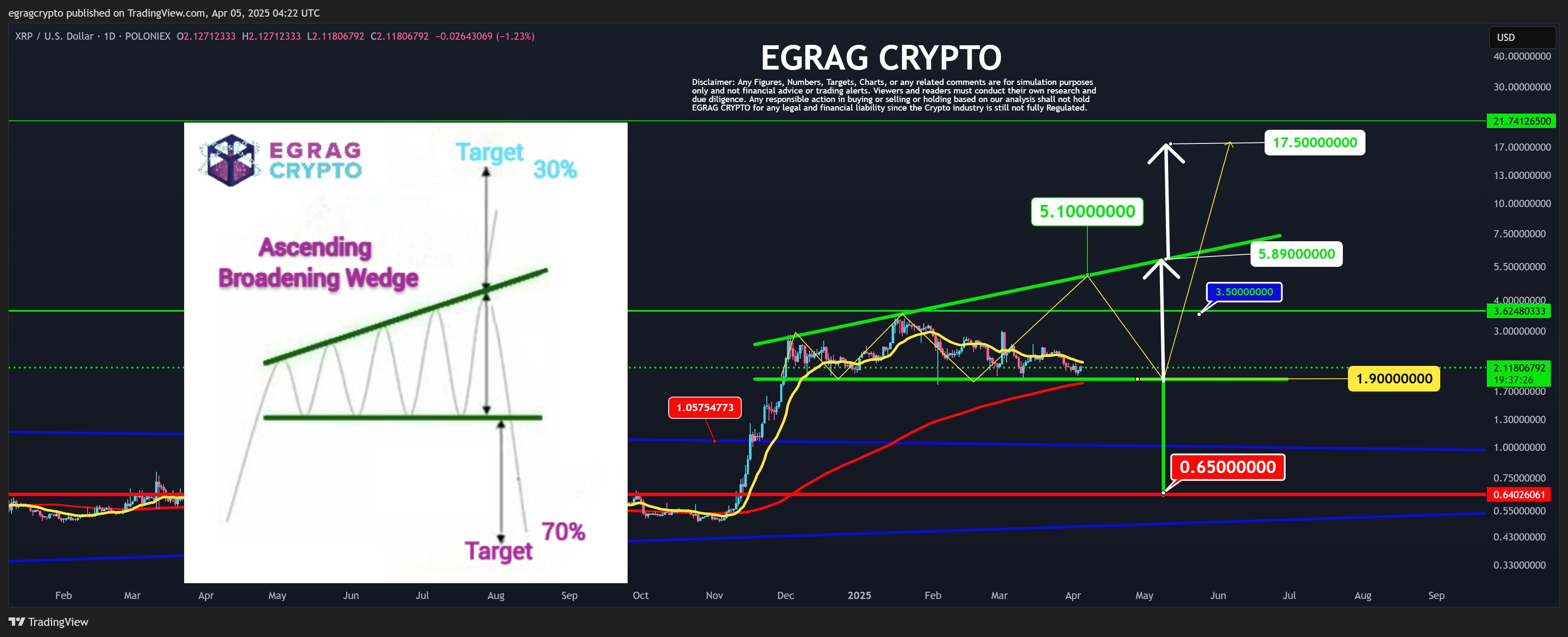

XRP High Stakes Setup: Analyst Warns Of Sharp Move To $17 Or $0.65

Renowned market analyst Egrag Crypto has shared another puzzling XRP price prediction stating the altcoin is at a major technical crossroads. This development follows a resilient price performance in the past week during which XRP gained by 2.07% as the broader crypto market stands bullish despite the announcement of new US trade tariffs.

Ascending Wedge Signals Incoming Volatility — Which Way Will XRP Break?

In an X post on April 5, Egrag Crypto issued a dual price forecast on the XRP market based on the potential implications of a forming Ascending Broadening Wedge pattern. Also known as the megaphone pattern, the chart formation signals increasing volatility and investor indecisions. It looks like a widening triangle with two diverging trendlines, as seen in the chart below.

The Ascending Broadening Wedge presents high unpredictability and offers a 70% chance of a downside breakout and a 30% probability of an upside breakout. However, despite this statistical bias, the analyst postulates the chances of an upside remain valid if certain conditions are met.

According to the analyst, XRP must first close above $3.50 for a bullish scenario to start taking shape. In doing so, the altcoin would surpass the local peak of the current bull cycle and confirm intentions of an upward momentum. Following this move, XRP bulls should then aim for the $5 range—another key resistance level that could determine the asset’s next major move.

Interestingly, Egrag explains that a failure to convincingly close above $5 would only be a critical development that completes the formation of the Ascending Wedge Pattern and increases the likelihood of a breakout. If this rejection occurs, XRP is expected to retest the $1.90 area and make a second push toward the $5, this time breaking through and closing above $6.

Egrag states the breakout above $6 would validate the bullish run and likely spark a surge toward double-digit territory with a potential target at $17.50 based on the Ascending Wedge Pattern. However, should XRP bulls fail to meet these conditions or follow this sequence, the historical 70% chance of a breakdown points to a downside target of around $0.65.

XRP Price Overview

At the time of writing, XRP trades at $2.14 reflecting a price gain of 0.60% in the past day. Meanwhile, the token’s trading volume is down by 62.92% in the past day indicating a fall in market engagement and a declining buying pressure following the recent market gain. In making any significant uptrend, XRP bulls must first reclaim the following resistances at $2.47 and $2.61 while avoiding any slip below the $2 support zone.

-

Market24 hours ago

Market24 hours agoEthereum Transaction Fees Hit Lowest Level Since 2020

-

Market20 hours ago

Market20 hours agoDogecoin Faces $200 Million Liquidation If It Slips To This Price

-

Ethereum19 hours ago

Ethereum19 hours agoCrypto Analyst Who Called Ethereum Price Dump Says ETH Is Now Undervalued, Time To Buy?

-

Market18 hours ago

Market18 hours agoIMX Price Nears All-Time Low After 30 Million Token Sell-Off

-

Market21 hours ago

Market21 hours agoSEC’s Crypto War Fades as Ripple, Coinbase Lawsuits Drop

-

Bitcoin20 hours ago

Bitcoin20 hours agoArthur Hayes Sees Tariff War Pushing Bitcoin Toward $1 Million

-

Altcoin20 hours ago

Altcoin20 hours agoExpert Calls On Pi Network To Burn Tokens To Revive Pi Coin Price

-

Market19 hours ago

Market19 hours agoSEC’s Guidance Raises Questions About Tether’s USDT