Market

Binance and the SEC File for Pause in Lawsuit

The SEC and Binance filed a joint motion to pause their lawsuit for 60 days. They requested a prior pause 60 days ago and have “been in productive discussions” since then.

Both parties have asked for more time to finalize an agreement and consider all the relevant policy implications. In the main, however, it’s a substantially similar agreement to the one between the SEC and Ripple yesterday.

Binance and SEC Discussing a Settlement

The SEC has been dropping a lot of its most prominent enforcement actions lately, such as its lawsuit against Ripple. Still, despite this progress, a few outstanding cases remain.

The SEC has been ending lawsuits against prominent exchanges like Coinbase and Kraken, and now it’s preparing to drop one against Binance:

“Pursuant to the Court’s February 13, 2025 Minute Order, Plaintiff Securities and Exchange Commission and Defendants Binance Holdings Limited… and Changpeng Zhao submit this joint status report and jointly move to continue to stay this case for a period of 60 additional days,” a motion filed today read.

Binance is the world’s largest crypto exchange, and it has been engaged in this fight since 2023. The SEC sued Binance in June of that year, alleging that it committed a few serious crimes.

In addition to violating securities laws, the Commission also claims that Binance deliberately lied to regulators. This caused serious problems for its business, prompting a lengthy battle.

The SEC, however, is under new management now. Paul Atkins is the Commission’s new Chair, and he’s prioritized friendly crypto regulation.

Before his confirmation, the SEC, under Acting Chair Mark Uyeda, filed a joint request with Binance to pause the lawsuit 60 days ago, and they’re asking for another extension.

Today’s filing is slightly shorter than the previous one, but it suggests that real progress has been made. It claims that Binance and the SEC “have been in productive discussions” concerning the Crypto Task Force and broader policy implications of a settlement. However, they still need more time to fully consider a resolution.

This agreement is similar to the one filed yesterday. Specifically, the Commission also requested a 60-day pause in a cross-appeal from Ripple, attempting to tie up loose ends without wasting the court’s resources.

There are a few subtle differences, but Binance’s filing with the SEC attempts to meet the same basic goals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Users Targeted by New Phishing SMS Scam

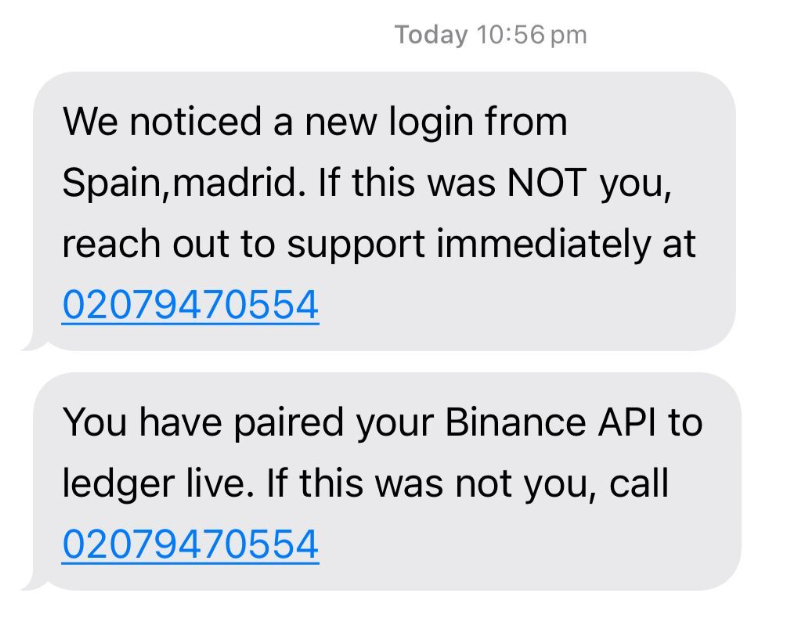

Dozens of Binance users report receiving an alarming wave of phishing text messages that appear genuine. These messages even match the phone number and SMS inbox they regularly see for official Binance updates.

Almost all phishing texts reviewed by BeInCrypto have the same wording and format. This leads us to believe that a particular threat actor or criminal group is targeting Binance users with a sophisticated phishing campaign.

Targeted Phishing Campaign Against Binance Users

The messages often warn of users’ unauthorized account activities—such as a newly added two-factor authentication device.

Most commonly, the phishing messages follow up with a text about an unexpected Binance API pairing with Ledger Live. The recipients are then urged to call a provided phone number.

Some targeted users claim these texts show up in the same thread as their legitimate Binance notifications. This creates confusion and prompts them to engage. Investigations by BeInCrypto reveal a surge in consumer complaints on X (formerly Twitter).

Many users say they were caught off guard because the scam messages originated from the same sender ID used by Binance for authentic notifications.

Meanwhile, the criminals behind this campaign appear to be capitalizing on publicly reported leaks of Binance user data on dark web forums.

Last month, an estimated 230,000 combined user records from Binance and Gemini reportedly appeared for sale on the dark web. Security experts suggest these leaks came through phishing attacks rather than direct system breaches.

The suspected group of threat actors is likely using leaked information—names, phone numbers, and emails—to craft targeted messages that give the illusion of legitimacy.

Also, the pattern seen in the phishing attempts typically involves an urgent “not you?” query. It prompts recipients to call an embedded phone line instead of simply clicking a link.

This method bypasses the more common scenario of phishing links in SMS.

Binance is Extending Anti-Phishing Code to SMS

In an exclusive email to BeInCrypto, Binance’s Chief Security Officer, Jimmy Su, responded to these findings. Su confirmed the company’s awareness of the escalating smishing incidents.

“We are aware of smishing scams on the rise where phishing scammers are impersonating us and other legitimate senders via SMS. These scams appear to be more authentic, tricking users into revealing sensitive information, clicking into phishing links, or making a transfer that result in loss of assets.” Binance’s Chief Security Officer told BeInCrypto.

Su further disclosed that Binance has extended its Anti-Phishing Code to SMS. This feature was originally offered for emails.

The code is a user-defined identifier that appears in official Binance messages, making it easier for recipients to recognize genuine notifications and avoid impostors.

“By incorporating a unique Anti-Phishing code into Binance SMS messages, we are making it significantly harder for scammers to deceive our users,” Su said.

The Anti-Phishing Code has been rolled out to all licensed jurisdictions where Binance operates.

Also, according to Binance, both registered and non-registered users have reported receiving suspicious texts.

Therefore, attackers might be leveraging databases that include phone numbers of individuals not actively using Binance.

BeInCrypto advises users to adopt additional measures, such as verifying transactions directly through Binance’s official app or website, using multifactor authentication, and never sharing credentials over the phone.

Reporting suspicious messages to Binance’s support team is strongly advised.

Individuals are encouraged to confirm official communications by checking for the Anti-Phishing Code and to carefully scrutinize any request to call phone numbers provided in unsolicited messages.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

DOGE Spot Outflows Exceed $120 Million in April

Dogecoin holders have been withdrawing their funds from spot markets in April, with the leading meme coin facing mounting selling pressure.

The lack of new capital flowing into DOGE reflects a decline in investor confidence and adds downward pressure on the altcoin.

Sell-Off Worsens for DOGE as Outflows Outpace Inflows

Since the beginning of April, DOGE has seen a consistent stream of net outflows from its spot market, totaling over $120 million. Net inflows during the same period have been negligible, amounting to less than $5 million per Coinglass.

When an asset records spot outflows, more of its coins or tokens are being sold or withdrawn from the spot market than are being bought or deposited.

This indicates that DOGE investors are losing confidence and opting to liquidate their holdings due to increasingly bearish market conditions.

The persistent outflows from the meme coin over the past two weeks reflect the lack of new demand for the altcoin. If this trend continues, DOGE’s price could remain range-bound or face another decline cycle.

On the technical front, DOGE’s Relative Strength Index (RSI) has continued to trend downward on the daily chart, further confirming the bearish outlook.

At press time, this key momentum indicator, which measures an asset’s oversold and overbought market conditions, is below the 50-neutral line at 47.61.

When an asset’s RSI falls below the center line, bearish momentum strengthens. This suggests that DOGE selling pressure is beginning to outweigh buying interest, signaling a potential dip in the asset’s price.

DOGE Risks Retesting Yearly Lows

With the crypto market’s volatility heightened by Donald Trump’s ongoing trade wars and DOGE’s current struggles to attract fresh investment, the meme coin may test new lows in the near term. If selling pressure strengthens, DOGE could revisit its year-to-date low of $0.12.

Conversely, a resurgence in new demand for the meme coin will invalidate this bearish outlook. In that scenario, DOGE’s price could break above $0.17 and climb to $0.20.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PI Coin Recovers 80% From All-time Low — Will It Retake $1?

PI has staged a remarkable comeback after plunging to an all-time low of $0.40 on April 5. Amid a broader market recovery over the past week, the altcoin has seen a resurgence in demand, driving its price up 84% from its recent bottom.

With the bulls attempting to strengthen market control, PI could extend its gains in the short term.

PI Recovers From Crash With Strong Bullish Setup

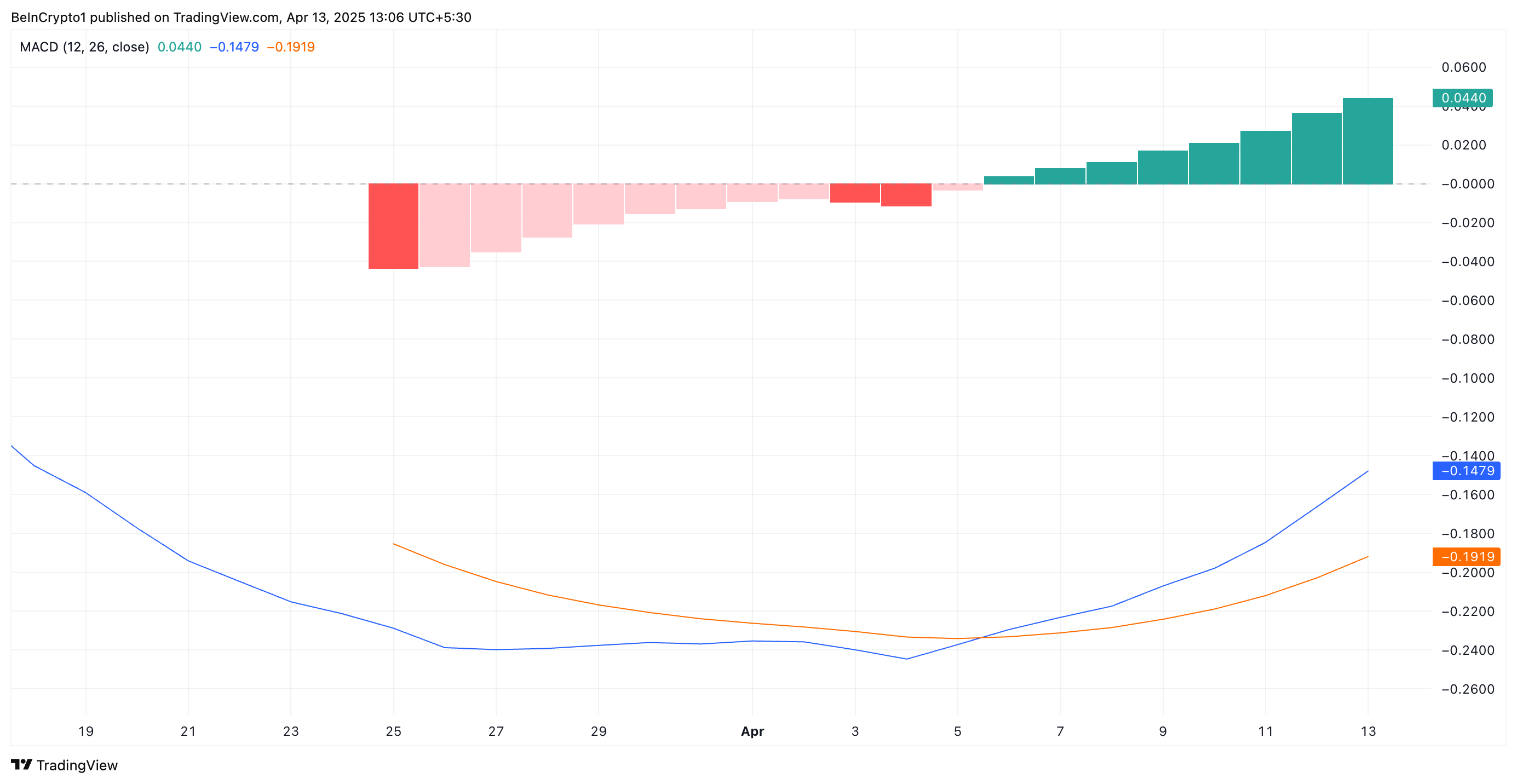

PI’s Moving Average Convergence Divergence (MACD) indicator has flashed a bullish signal. On the daily chart, the MACD line (blue) crossed above the signal line (orange) on April 5, indicating a positive shift in momentum right after it bottomed at $0.40.

Additionally, the histogram bars, which reflect the strength of that momentum, have gradually increased in size over the past few days, highlighting the growing demand for the altcoin.

When an asset’s MACD is set up this way, upward momentum is building, and buyers are gaining control. PI’s MACD crossover is a bullish signal, suggesting the potential for continued price gains as buying pressure increases.

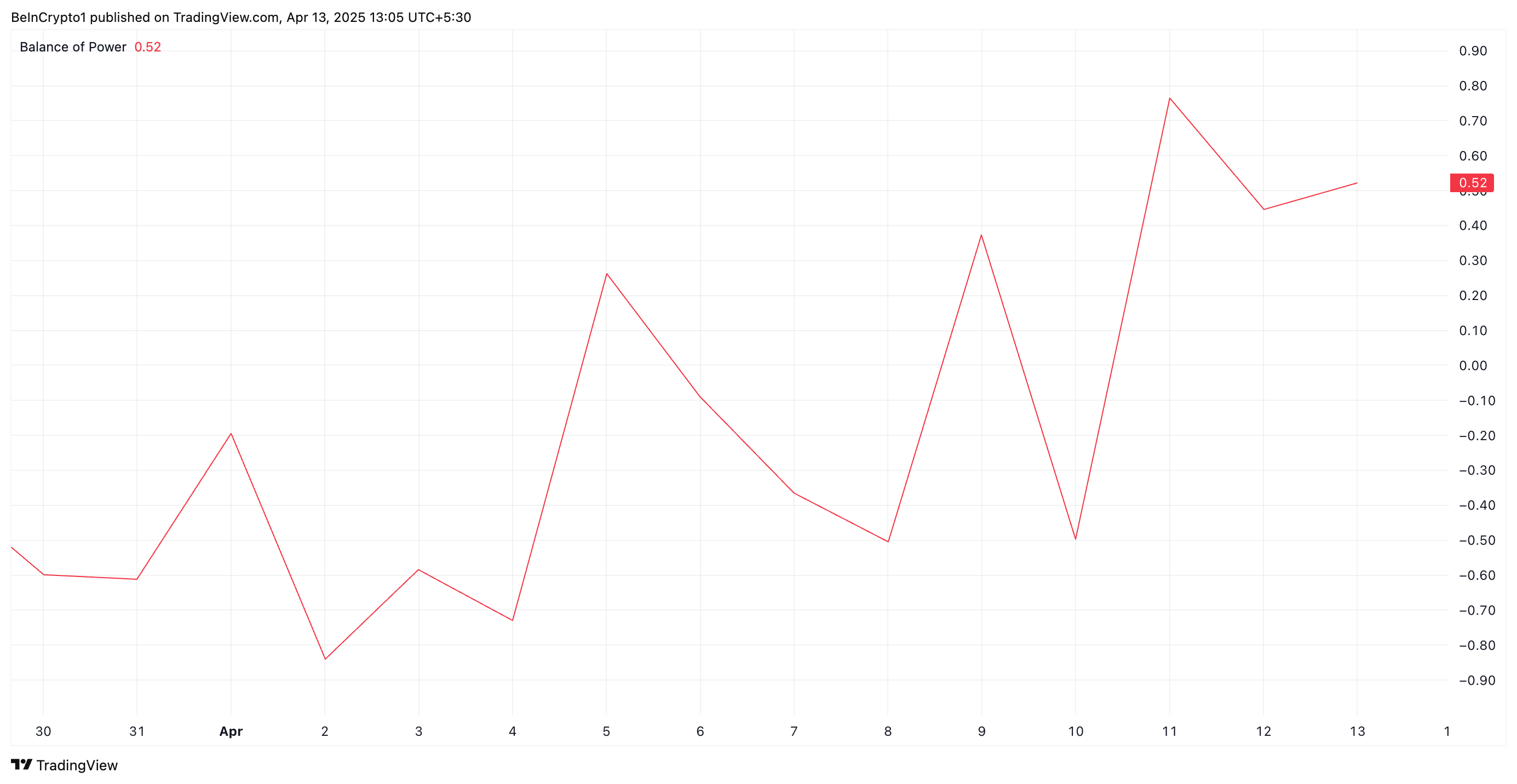

In addition, PI’s positive Balance of Power (BoP) reflects the growing demand for the altcoin. As of this writing, the indicator is at 0.52.

The BoP indicator measures the strength of buyers versus sellers in the market, helping to identify momentum shifts. When its value is positive, buyers are dominating the market over sellers and driving newer price gains.

Is $1 Within Reach?

PI’s ongoing rally has caused its price to trend within an ascending parallel channel. This bullish pattern is formed when an asset’s price consistently moves between two upward-sloping, parallel trendlines.

It signals a sustained uptrend, with PI buyers gradually gaining control while allowing short-term pullbacks. If the rally continues, PI could exchange hands at $0.95.

However, if the altcoin reverses its current trend and sheds recent gains, its value could fall to $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoEthereum ETFs See Seventh Consecutive Week of Net Outflows

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin’s Impact Alarming, Says NY Atty. General—Congress Needs To Act

-

Market22 hours ago

Market22 hours agoRipple May Settle SEC’s $50 Million Fine Using XRP

-

Altcoin21 hours ago

Altcoin21 hours agoBankless Cofounder David Hoffman Reveals Strategy To Improve Ethereum Price Performance

-

Market21 hours ago

Market21 hours agoSolana Bulls Lead 17% Recovery, Targeting $138

-

Market18 hours ago

Market18 hours agoXRP Price To Hit $45? Here’s What Happens If It Mimics 2017 And 2021 Rallies

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum (ETH) Consolidates Within Tight Range As Key Support Level Forms

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Price Volatility Far Lower Than During COVID-19 Crash — What This Means