Market

Argot Sparks Outcry as Ethereum Foundation Ignores Vyper

The Ethereum Foundation launched the Argot Collective — a long-term, non-profit organization for Ethereum software development.

However, the initiative has sparked controversy, especially among proponents of the Vyper programming language.

Curve Finance Founder Michael Egorov Slams Ethereum Foundation

The Argot Collective shared the announcement, revealing a structure to support Ethereum-related projects for up to a decade, with the backing of long-term grants. Based on the blog, Argot’s mission is to foster a non-hierarchical, democratically governed environment that promotes software development for the Ethereum ecosystem free from commercial pressures.

Argot will focus on several projects, including Solidity, Fe, and other Ethereum tools. It will provide ongoing support for these languages to enhance Ethereum’s developer environment. The Argot Collective is designed to “eliminate rent extraction or exploitative profit-seeking.” It will also serve as a counterbalance to finance-driven entities within the Ethereum community.

Read more: A Deeper Look into the Ethereum Network.

Notably, Fe is a safety-focused Ethereum smart contract language that uses Vyper as a foundation. Vyper is also a contract-oriented programming language that targets the Ethereum Virtual Machine (EVM). The absence of funding for Vyper raises red flags for developers who rely on it.

The Foundation’s critics argue that Vyper’s lack of funding could undermine security and usability for projects that depend on it, making it more difficult to maintain and develop. Nevertheless, the Ethereum Foundation seems to overlook this.

“A group which was deciding to fund projects within Ethereum Foundation (now independent). With a focus on languages (c), they did not fund Vyper (used by Curve Finance, Lido Finance, and yearn Finance). However, they funded Fe (used by exactly no one). Coincidentally and unrelated, members of the group = team members of the funded projects,” Curve founder Michael Egorov remarked.

Egorov’s comments hint at a deeper skepticism, suggesting that personal or professional affiliations within the Foundation may have unduly influenced the decision. The idea is that Vyper’s integral role in decentralized finance (DeFi) warrants support similar to what Argot is now providing for other EVM-compatible languages.

“I find it a bit sad but also a bit cypherpunk that Vyper is always left out of these organizations/collectives. Kind of a ‘you don’t own me’ underdog positioning or incredibly talented people,” another X user commented.

Nevertheless, the launch of Argot reflects a broader organizational shift within the Ethereum Foundation. It has moved toward empowering independent bodies to steer various facets of its development.

Argot Collective Commits to Financial Transparency

In the statement, Argot explained that it is committed to “financial and organizational transparency,” intending to release detailed documentation on budgets, governance, and plans. Argot also promised that the organization would maintain financial autonomy through grants and staking income. This is as opposed to traditional financing models, rejecting equity sales, token offerings, or closed-source projects.

Some community members have also speculated that the preference for niche languages within Argot might reflect a quiet push toward technical decentralization. Reportedly, the Ethereum Foundation is looking to ensure diverse tool support across the EVM.

“This is something I’ve said for years, Solidity (and related projects) finally spinning out from the EF [Ethereum Foundation] into their own independently organized and financed foundation. This is incredibly bullish for Ethereum,” an X user said.

Yet, for Ethereum’s DeFi heavyweights, these assurances may fall short. The funding disparity appears to undercut projects essential to Ethereum’s financial ecosystem, with experimental languages seemingly taking priority over ones that are already integral to DeFi’s infrastructure.

The general sentiment in the replies to Egorov’s comment is that funding should follow impact. Critics see Vyper as vital to Ethereum’s security and usability. They argue that excluding it from funding signals a potentially harmful bias in the Foundation’s approach to resource allocation.

The fallout from this controversy has opened a broader debate around Ethereum’s funding priorities. The potential influence of personal affiliations on decision-making within the ecosystem is also a concern based on feedback.

Read more: How To Fund Innovation: A Guide to Web3 Grants

As the Argot Collective prepares for its official launch in early 2025, the Ethereum Foundation may find itself increasingly pressured to address these concerns. For now, the community awaits further clarifications, hoping that the Foundation’s actions will ultimately reflect the decentralized, democratic ethos it aims to embody.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Investors Shift to Crypto, Gold, and Equities Amid Tariff Volatility

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how investors in emerging markets are doubling down on digital assets and tokenized alternatives as the US dollar falters and inflation risks rise.

Investors Turn To Crypto, Gold Amid Imminent Challenging Economy for the US

Escalated trade war chaos and abounding recession concerns, these narratives have put the status of the US as a haven in question while exacerbating volatility in financial markets.

Now, headlines in Washington are focused on escalating trade tensions, making US crypto news a key market driver. According to Raafi Housain, CEO of digital asset platform Fasset, trading volume has surged internationally for particular assets.

“While US tariff headlines have dominated the macro conversation, in emerging markets we’re seeing a more nuanced response. In countries like Indonesia and Pakistan, trading activity on Fasset has more than doubled this week — partly as users return from Eid, but also due to growing demand for assets that feel resilient amid uncertainty,” Housain told BeInCrypto.

This suggests that perceptive investors are rethinking their strategies and repurposing their portfolios. Specifically, they are looking to new avenues, such as emerging markets, where access to traditional assets has historically been limited.

“Crypto is leading that surge, but we’re also seeing increased appetite for tokenized gold and, interestingly, US equities,” he added.

This portfolio diversification effort is unsurprising, considering US President Donald Trump’s tariff agenda is triggering global market volatility.

Already, macroeconomic signals are darkening despite the Federal Reserve’s (Fed) current inflation figures not fully reflecting the impact of ongoing tariffs.

Economists are sounding the alarm, with Moody’s Analytics chief economist Mark Zandi warning of inflationary pressures by summer.

“…inflation statistics will look pretty ugly by mid-summer if the current trade policies remain in place,” Zandi stated.

Zandi did not rule out the possibility of a recession, with his sentiment coming despite President Donald Trump’s 90-day pause on all reciprocal tariffs, but for China.

This warning aligns with China’s assertion that retaliatory tariffs on US goods lack competitiveness under current tariffs. Recognizing that tariffs are effectively a tax on imports paid by US businesses, Zandi added that these costs are usually passed on to consumers.

Meanwhile, as the investment scope shifts for well-informed investors, Housain notes adaptation, not panic.

“It’s clear that investors in high-growth markets aren’t retreating; they’re recalibrating — seeking diversification and more control in an unpredictable environment,” Housain explained.

Elsewhere, the dollar index (DXY) is dipping against a progressively rising cost of goods. Against this backdrop, crypto, tokenized commodities, and digital access to US equities are the hedges of choice for now.

Chart of the Day

Data on TradingView shows the DXY is down by nearly 10% year-to-date (YTD), from the January 13 intra-day high of $109.87 to $99.04 as of this writing.

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | Market open |

| Strategy (MSTR) | $284.26 (+5.98%) |

| Coinbase Global (COIN): | $171.09 (+1.22%) |

| Galaxy Digital Holdings (GLXY) | $14.29 (+3.97%) |

| MARA Holdings (MARA) | $11.94 (+7.10%) |

| Riot Platforms (RIOT) | $6.85 (+4.41%) |

| Core Scientific (CORZ) | $6.75 (1.91%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How You Can Find Altcoin Winners Early

The crypto market’s “altcoin season” isn’t what it used to be. In past cycles, Bitcoin rallies gave way to altcoin booms, lifting almost every token. Now, new market trends suggest those days of indiscriminate gains are fading.

Analysts predict a more selective altcoin cycle – “the era of everything pumping is over.” In an interview with BeInCrypto, Hitesh Malviya, the founder of the crypto analytical tool DYOR, said that retail investors looking for the next big winner must adapt to these evolving trends.

How to Find Winning Altcoins Amidst Choppy Markets

Traditionally, altcoin season meant Bitcoin’s dominance fell, and most altcoins surged. That broad rally may be ending.

“If the idea of a full-blown alt season comes from past cycles, then that’s something I really don’t expect. What we have seen so far in altcoins was simply the blooming and bursting of a bubble that happened over two bull cycles and two bear cycles,” Malviya told BeInCrypto.

Market experts foresee a more nuanced phase where only the strongest projects thrive. In short, instead of a rising tide lifting all boats, the next altcoin season may favor quality (projects with real usage and revenue) over quantity.

Investors should focus on fundamentals like usage, revenue, and community growth—the market now rewards substance over hype. Indeed, interest in speculative sectors such as meme coins has drastically declined since late January 2025.

“The adoption curve will take a new shape upwards, while the speculative curve will lose its charm, introducing lower volatility in the market, providing more stable returns, and making the market less correlated to stocks. This will create a new asset class in crypto, which should have two major types of asset offerings—tokenized equities with strong cash flow (e.g., AAVE) and store-of-value assets (BTC, ETH),” Malviya continued.

A key reason for the evolution of the altcoin season is that liquidity now rotates between different narratives.

Liquidity flows toward compelling stories. There have been mini-cycles where certain themes catch fire – meme coins, AI tokens, DeFi projects, metaverse gaming, etc. Money chases one hot narrative, then moves to the next.

Savvy investors watch social media, developer activity, and news to catch emerging narratives early and get in before the crowd.

“Liquidity will always flow into different narratives at different times, as there are multiple categories within crypto—just like in stocks, where some categories always outperform others. The same market dynamics will be seen in crypto as well,” Malviya stated.

How to Find Potential Altcoin Season Winner? Identifying Strength in Downtrends

Malviya believes that investors should watch for altcoins showing relative strength during downturns. If an altcoin can hold its value or even rise while Bitcoin slides, that resilience signals strong demand (likely early accumulation).

“At DYOR, we offer a metric called Optimised Relative Strength, which helps track some of the best coins and narratives that have shown the highest strength in the past 7, 30 and 90 days. Coins that have outperformed against the broader market in the past 30 days have a great chance of rallying when the market finds a bottom and starts a fresh leg up,” Malviya explained.

Moreover, Malviya also discussed other fundamental metrics to track. These include:

- DEX Volume: Rising trading volumes on decentralized exchanges can push the native token’s prices higher.

- Total Value Locked (TVL): Growth in deposits and total value locked implies user trust – bullish for the lending protocol’s token.

- Derivatives Volume: Increasing on-chain trading activity means more traders and fees supporting its token.

- Oracle Total Value Secured (TVS): Climbing total value secured by an oracle (e.g., Chainlink) shows a greater reliance on it, boosting token demand.

- DePIN Revenue: Actual revenue from a DePIN project (real-world service) signals a sustainable model, not just hype.

Furthermore, Malviya also emphasized the tokenomics of a crypto project. He believes that even a great project can falter if its tokenomics are flawed.

Tokenomics – a token’s supply and incentive design can make or break an altcoin. Good tokenomics (fair distribution, strong utility) create lasting demand, whereas poor tokenomics (excessive inflation or constant insider unlocks) often doom a project.

“Ideally, the community and ecosystem fund should get at least 60% of the supply to generate actual demand for the product by incentivizing developers and users through planned token emissions at different stages. Tokens are actually created to drive real user demand for the product. They can be considered as bribes to get user attention, but since these bribes are also tradable in the market, they can create a ripple effect that could potentially lead to the product’s failure. This happens because retail sentiment often mixes both the product and the token, where, in most cases, the token price eventually determines how much adoption the product gets,” Malviya elaborated.

Lastly, he shares tools that can help users potentially find the next winner for the altcoin season.

- DYOR – Users can use DYOR to find relative strength data on more than 200+ coins, detailed demand-side tokenomics data on 70+ coins, and fundamental data on 65+ coins, along with detailed research reports on top projects.

- DeFiLlama – It tracks multi-chain DeFi data like TVL and volumes.

- Dune Analytics – It is a community-driven platform offering custom on-chain data dashboards.

“The community should learn to use DeFiLlama and DUNE dashboards to uncover some interesting alphas. Most on-chain data is tracked on both of these platforms—all you need to do is find the right dashboard, take notes of the different growth metrics you notice, and build your thesis around a coin using that data to reach better due diligence,” Malviya concluded.

Those armed with solid research stand the best chance of catching the next altcoin season winner.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

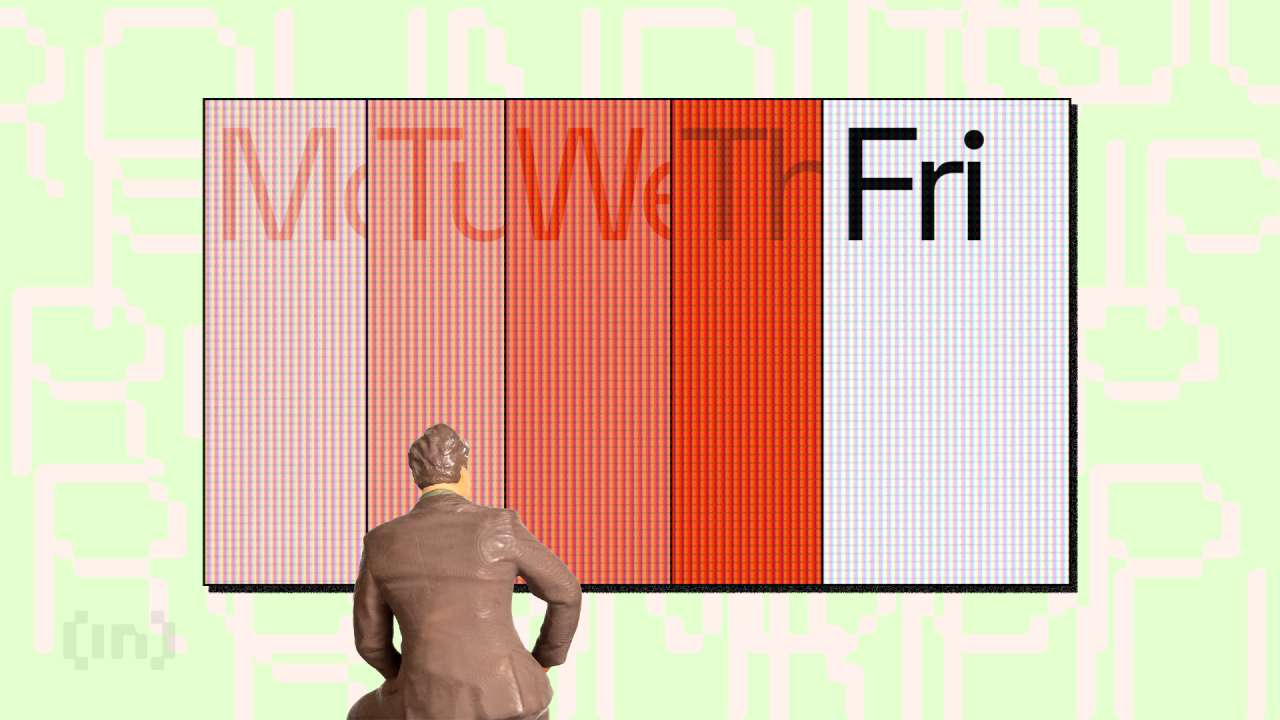

Binance, Trade Wars, Ripple and SEC

Crypto market volatility was high this week as regulatory developments, macro tensions, and the Binance exchange’s decisions shook markets.

A brewing trade war, whispers of stealth quantitative easing, and a historic legal truce between Ripple and the SEC are reshaping narratives. The following is a roundup of what happened this week in crypto.

Binance Earmarks 14 Altcoins For Delisting

Binance, the largest crypto exchange by trading volume metrics, announced a decision to delist 14 tokens, including BADGER, BAL, and CREAM.

The decision led to double-digit losses for the affected tokens almost immediately, highlighting the effect of such announcements on investor sentiment.

Binance initiated the delisting process through its vote-to-delist mechanism, where the community participated in deciding the fate of certain tokens. Reportedly, out of 103,942 votes from 24,141 participants, 93,680 were deemed valid.

The exchange cited factors such as development activity, trading volume, and liquidity in its evaluation before earmarking the cited altcoins.

“Following the Vote to Delist results and completion of the standard delisting due diligence process, Binance will delist BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT on 2025-04-16,” read the announcement.

Trading for these tokens will cease on April 16, with withdrawal limitations set for June 9. Post this date, any unsold tokens will be converted to stablecoins.

Arthur Hayes: Inevitable Return to Fed Stimulus

This week in crypto, Arthur Hayes returned with a bold thesis. According to the BitMEX co-founder, the unfolding US-China trade war and the inevitable return of Fed stimulus could catapult Bitcoin to $1 million.

Hayes tied Trump’s proposed 125% tariffs on Chinese goods to a broader breakdown in global trade. He also referenced a scenario where the USD/CNY hits 10.00, calling it the “super bazooka” that could propel Bitcoin higher.

According to Hayes, such protectionism will trigger supply chain disruption, inflationary spikes, and, ultimately, a resumption of quantitative easing (QE) as central banks try to stabilize faltering economies.

He sees this monetary pivot as the spark for Bitcoin’s next supercycle.

In a more immediate scenario, the BitMEX executive also argued that if the Fed pivots to QE soon, Bitcoin could hit $250,000 even before a global financial reckoning sets in.

Hayes’s outlook sounds overly ambitious. However, with US liquidity injections already under scrutiny, analysts are increasingly aligning with the idea that macro tailwinds could push Bitcoin far beyond the current $81,000 range.

Is the Fed Already Doing Stealth QE?

BeInCrypto reported this hypothesis this week in crypto. Some analysts are raising red flags about stealth quantitative easing, suggesting the Fed is quietly injecting liquidity into the financial system without formally announcing a new QE program.

“This isn’t hopium. This is actual liquidity being unchained. While people are screaming about tariffs, inflation, and ghost-of-SVB trauma… the biggest stealth easing since 2020 has been underway,” wrote Oz, founder of The Markets Unplugged.

Liquidity metrics such as the Reverse Repo Facility (RRP) hint at significant capital flows, even as the Fed maintains a public anti-inflation stance.

Critics argue that these backdoor injections are fueling asset prices, including crypto, without the transparency or accountability of past QE rounds.

For crypto, stealth QE may be one of the key reasons Bitcoin remains resilient despite calls for significant breakdowns below $70,000.

If confirmed, these quiet interventions could be laying the groundwork for a larger, formal liquidity wave. Such an action would align with Arthur Hayes’s prediction of a new Bitcoin super cycle.

Meanwhile, amid cooling inflation and US growth forecasts softening, the possibility of a formal return to QE in 2025 is gaining traction among economists.

Analysts highlighted that if the Fed pivots to liquidity expansion, Bitcoin and major altcoins could enter a multi-year bull cycle akin to the 2020–2021 rally.

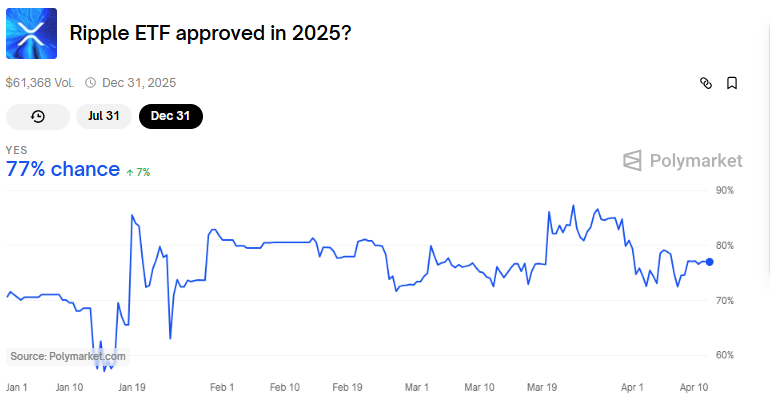

Ripple and SEC File Joint Motion

Another top headline this week in crypto, Ripple and the US SEC (Securities and Exchange Commission) filed a joint motion to settle the remaining remedies phase of their years-long legal battle.

The move signals both parties are ready to wrap up a case that has cast a regulatory shadow over the crypto market since 2020.

“The parties have filed a joint motion to hold the appeal in abeyance based on the parties’ agreement to settle. The settlement is awaiting Commission approval. No brief will be filed on April 16th,” wrote XRP advocate James Filan.

The motion follows Judge Analisa Torres’s 2023 ruling that XRP is not a security when sold to retail investors. This decision marked a partial but critical win for Ripple.

What remains now is a resolution over institutional sales, penalties, and injunctions. According to legal experts, the fact that both Ripple and the SEC are willing to settle suggests neither side wants to prolong the case amid broader legal and political uncertainty.

The resolution will likely influence how the SEC proceeds with other enforcement actions against major crypto firms. For Ripple, regulatory clarity could open the door to US re-listings and deeper integration with traditional finance (TradFi).

Specifically, it could increase the odds for an XRP ETF (exchange-traded fund) in the US, which now stands at 77%, data on Polymarket shows.

Trump Pauses Tariffs—Except on China

This week in crypto, the crypto market surged over 5% in total capitalization after Donald Trump announced he would pause tariffs on most US trading partners. BeInCrypto reported that China was the only exception.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump shared on Truth Social.

The move reignited risk-on sentiment in markets, particularly crypto, which remains highly sensitive to macro policy shifts.

Analysts interpreted the announcement as a double-edged message. On the one hand, the global economy might get a reprieve from broad-based trade pressure.

On the other hand, China remains a geopolitical target, which could further fragment global trade systems and increase reliance on decentralized assets. In a retaliatory move, China raised tariffs on the US to 125%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin24 hours ago

Bitcoin24 hours agoFlorida Bitcoin Reserve Bill Passes House With Zero Votes Against

-

Altcoin23 hours ago

Altcoin23 hours agoDogecoin (DOGE) Reclaims Previous Breakdown, Will This Mark The Bottom?

-

Market22 hours ago

Market22 hours ago3 Bullish Altcoins Surging After Trump’s Tariff Pause

-

Market20 hours ago

Market20 hours agoADA Price Surge Signals a Potential Breakout

-

Market23 hours ago

Market23 hours agoFuser on How Crypto Regulation in Europe is Finally Catching Up

-

Bitcoin23 hours ago

Bitcoin23 hours agoThis is Why Hoskinson Thinks Bitcoin Will Hit $250,000 in 2025

-

Altcoin12 hours ago

Altcoin12 hours agoXRP Price Risks 40% Drop to $1.20 If It Doesn’t Regain This Level

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin Holders are More Profitable Than Ethereum Since 2023