Market

ApeCoin (APE) Price Jumps on Apechain News

The price of ApeCoin (APE) has surged nearly 100% in the last seven days following the announcement of Apechain and APE’s staking program. Despite this rally, whales are not accumulating more APE, indicating a lack of confidence in the sustainability of this price increase.

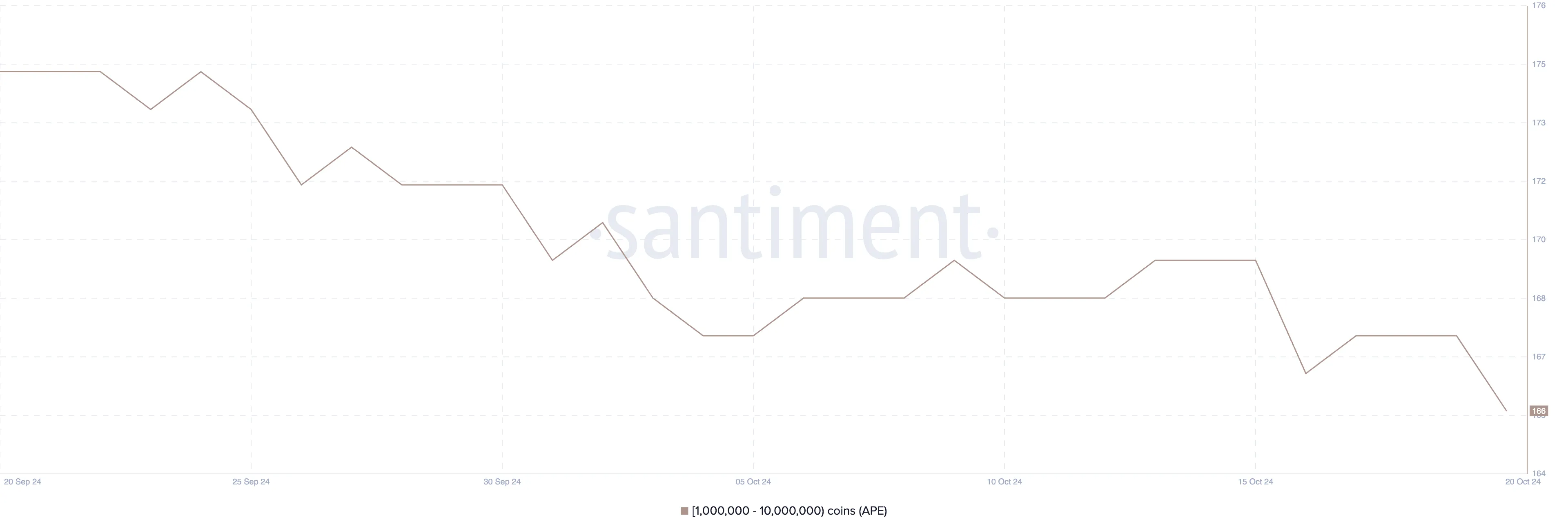

The number of wallets holding between 1 million and 10 million APE has actually decreased, suggesting that the recent momentum might be driven more by hype than strong fundamentals. As APE reaches overbought conditions, the potential for a correction remains a significant risk.

Whales Are Not Accumulating APE

Despite the hype around the launch of Apechain, the number of wallets accumulating large amounts of APE is not increasing. Specifically, the count of holders with between 1 million and 10 million APE has been steadily decreasing, dropping from 175 on September 20 to 166 by October 20.

This trend indicates that big investors, often referred to as “whales,” are not yet confident enough to increase their positions.

Read more: ApeCoin (APE): Everything You Need To Know

This metric is important because whale activity often reflects broader market sentiment. When large holders accumulate, it typically signals strong confidence in the asset’s future growth potential.

Even with the recent price surge in APE, whales appear cautious, suggesting that they may not believe this rally is sustainable. Until these major players start accumulating, a continued price uptrend remains uncertain.

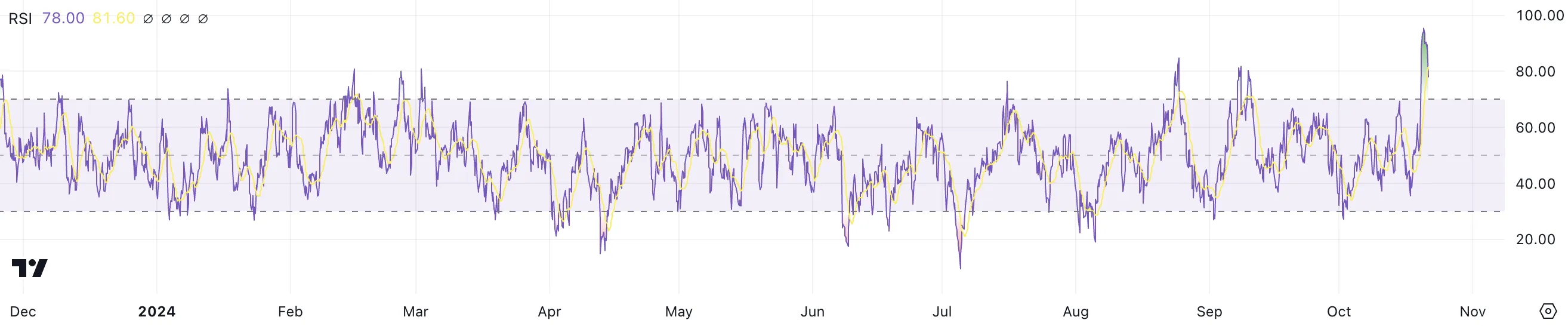

ApeCoin RSI Shows an Overbought State

APE’s Relative Strength Index (RSI) is currently at 78, up significantly from 35 just a few days ago. This sharp increase in RSI reflects the recent surge in buying activity, pushing APE into overbought territory.

When RSI moves into such high levels, it suggests that the asset may be overvalued in the short term. That means it could be due for a pullback.

RSI, or Relative Strength Index, is a momentum indicator used to assess whether an asset is overbought or oversold. It ranges from 0 to 100, with readings above 70 typically indicating overbought conditions and readings below 30 indicating oversold conditions.

APE’s RSI is now well above 70, combined with a lack of whale accumulation and uncertain fundamentals, which points to a possible price correction ahead. The recent rally may not be sustainable if it’s driven solely by hype, making a pullback increasingly likely.

APE Price Prediction: Will It Go Back to April Levels?

APE price is approaching its next significant resistance levels at $1.82 and $2.07, which it has not reached since late March and early April.

If APE manages to break through these resistance points, it could result in a 38% price surge. However, breaking these levels would require strong buying momentum, potentially driven by sustained interest in Apechain.

Read more: ApeCoin (APE) Price Prediction 2024/2025/2030

On the flip side, if the current hype around Apechain fades and buying strength diminishes, APE might face a downturn. The price could test key support levels at $1.10 and $0.94.

If these supports fail, APE could drop as low as $0.54, representing a potential 60% correction from the current price. The market’s reaction to upcoming developments will be crucial in determining if APE can maintain its upward trajectory or face a significant pullback.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Slides Into Bearish Zone Amid Weak Trading Signals

XRP gained only 2% in the past week, signaling weak momentum and fading interest from buyers in the short term.Technical indicators like the RSI, Ichimoku Cloud, and EMA lines are all starting to reflect increased bearish pressure. Here’s a breakdown of what the charts are saying and what could come next for XRP.

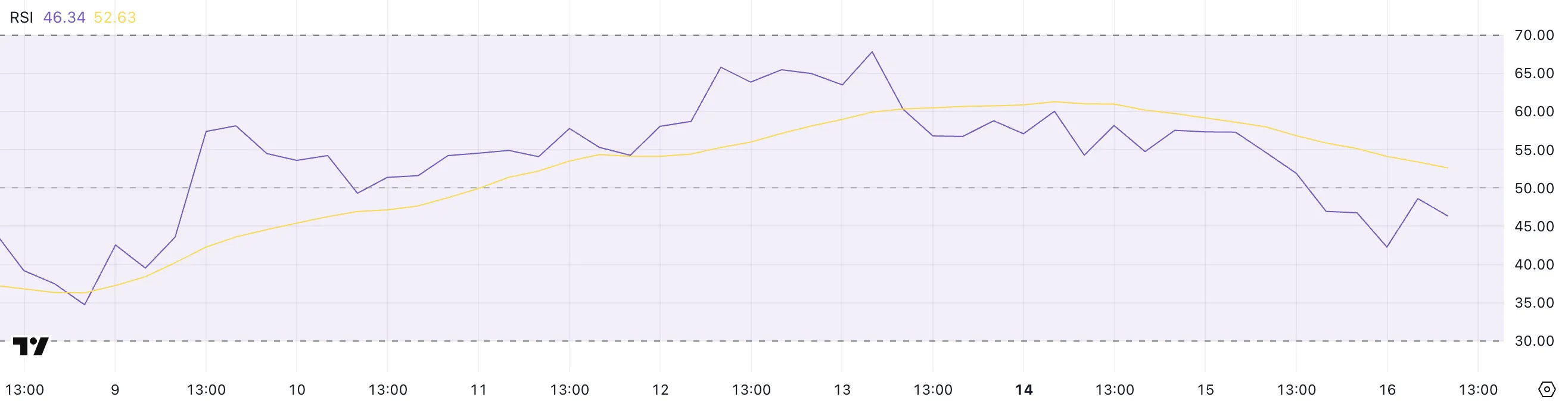

XRP RSI Shows Buyers Are Losing Control

XRP’s Relative Strength Index (RSI) has declined to 46.34, a noticeable drop from 57.30 just one day ago. This sharp move suggests a clear shift in momentum, with buying pressure cooling off significantly in the short term.

When the RSI drops this quickly, it can often indicate that traders are taking profits or beginning to rotate out of a position, especially after a period of modest gains.

While XRP hasn’t entered oversold territory yet, the drop below the 50 mark is typically viewed as a bearish signal, pointing to a potential shift in sentiment from bullish to neutral or bearish.

The RSI, or Relative Strength Index, is a widely used technical indicator that helps traders gauge the strength of a price trend. It ranges from 0 to 100, with readings above 70 considered overbought and readings below 30 considered oversold.

When the RSI is above 50, momentum is typically bullish, while levels below 50 reflect increasing bearishness. With XRP now sitting at 46.34, it suggests the asset is losing upward momentum and may be at risk of further downside unless buying interest returns soon.

If selling pressure continues and RSI trends lower, XRP could test key support levels in the near future.

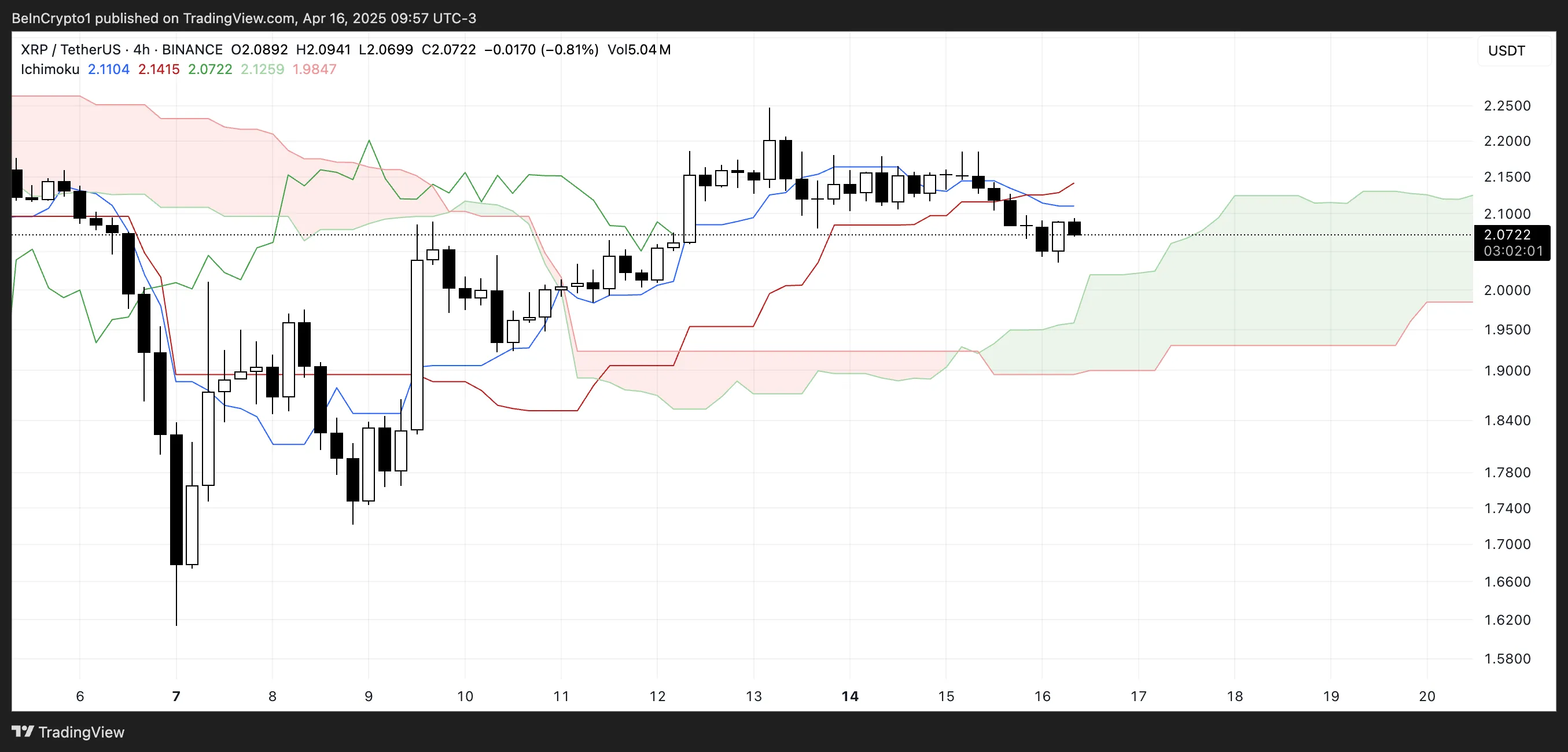

XRP Ichimoku Cloud Shows Momentum Is Shifting

XRP’s Ichimoku Cloud chart currently shows a shift toward short-term bearish momentum.

The price has fallen below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (baseline), which is typically viewed as a bearish signal.

When the price trades beneath these two lines, it often suggests weakening momentum and increasing downside risk unless a quick recovery follows.

Additionally, the price is now entering the green cloud (Kumo), which represents a zone of uncertainty or consolidation. The cloud ahead is relatively flat and wide, indicating potential support but also a lack of strong upward momentum.

The green Senkou Span A (leading span A) remains above the red Senkou Span B (leading span B), signaling that the broader trend is still slightly bullish—but if price action stays inside or breaks below the cloud, that trend may begin to reverse.

Overall, the Ichimoku setup points to caution for bulls unless XRP reclaims the Tenkan and Kijun lines convincingly.

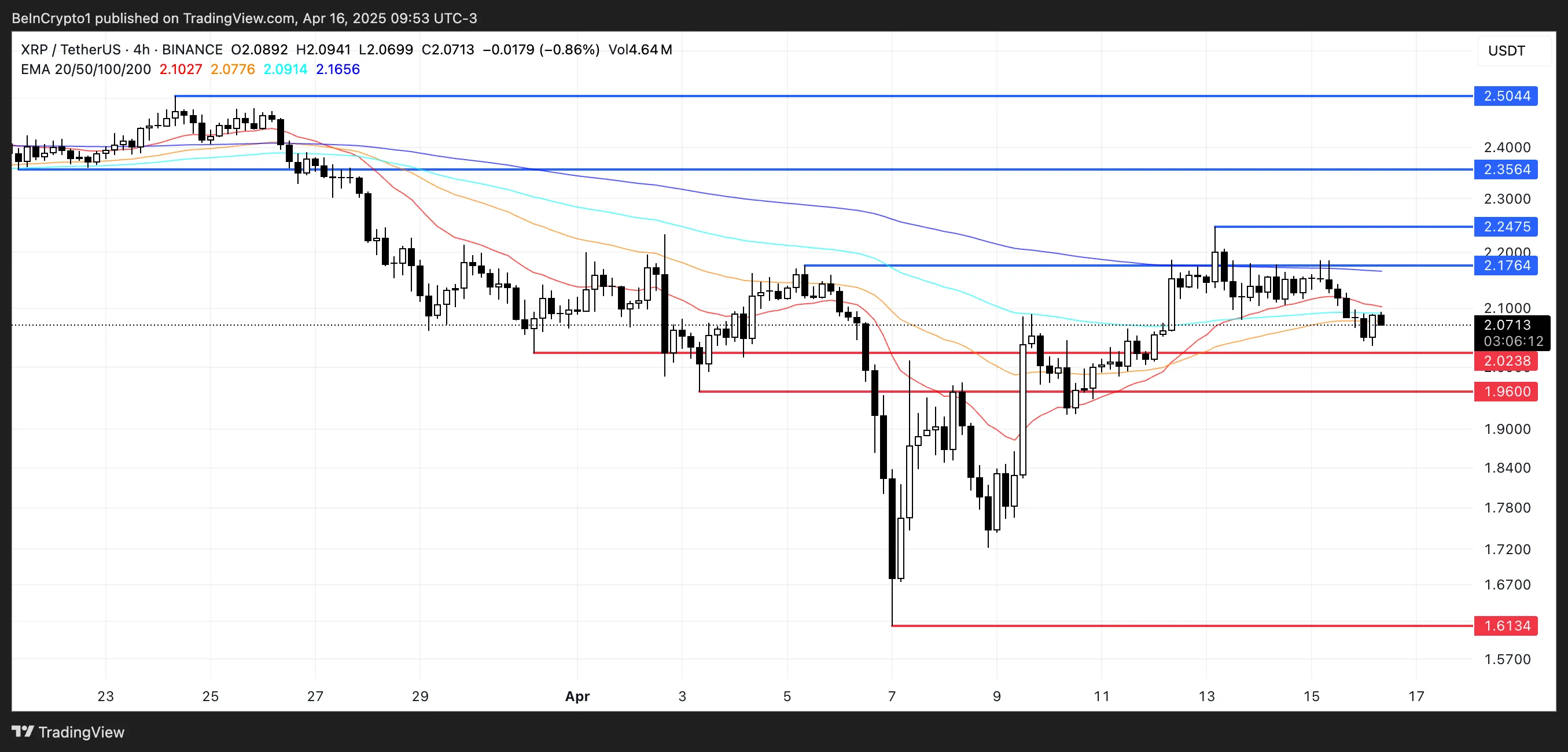

EMA Lines Suggest XRP Could Fall Below $2

XRP’s EMA lines are showing signs of weakness, with XRP price repeatedly failing to break through the resistance near $2.17—even amid speculation about a potential partnership with Swift.

This repeated rejection at the same level indicates strong selling pressure. The EMAs suggest momentum is fading as the shorter-term average is beginning to bend downward.

A potential death cross, where the short-term EMA crosses below the long-term EMA, appears to be forming. If confirmed, it could signal a deeper correction ahead, with XRP possibly retesting support levels at $2.02 and $1.96.

A breakdown below these levels could lead to a drop toward $1.61. However, if bulls manage to reclaim $2.17, the next resistance at $2.24 becomes the key target.

A clean break above that could trigger a stronger rally, potentially pushing XRP to $2.35 or even $2.50 if momentum accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Price To Bounce 796% To New All-Time Highs In 2025? Here’s What The Chart Says

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

PEPE’s price action has been relatively quiet in the past few weeks. The meme coin has been quietly going through a continued wave of selloffs amidst the volatility in the wider crypto market.

However, an interesting technical analysis shows that the chart structure of PEPEUSDT is pointing to a massive move to the upside, one that could send the token soaring by as much as 796% before the end of 2025. As the broader crypto market continues to move sideways, crypto analyst MasterAnanda identified a short-term higher low forming around support levels, which could act as the launchpad for a major PEPE price breakout.

Short-Term Higher Low Points To Strong Accumulation Zone

The bullish outlook on PEPE is based on the repeat of a similar price formation that played out in 2024 before its run to new price highs and eventually its current all-time high of $0.00002803. According to the price chart shared by the analyst on the TradingView platform, PEPE initially traded in a descending channel between May to September 2024 before eventually breaking out of the channel. After breaking out of the channel, PEPE went on a brief uptrend and another downside which led to the creation of a lower low, before eventually going on an extended rally that peaked in December 2024.

Related Reading

Notably, it seems the same structure is showing up again on the PEPE price chart, specifically on the daily candlestick timeframe. In the analysis, MasterAnanda marks April as the period where PEPE bottomed out within a descending channel. Since then, two distinct highs and two clear lows have shaped what appears to be a reversal structure.

Most notably, a new higher low is beginning to form a pattern that, according to previous price action, could precede a bullish wave. The analyst labels this as a important stage, especially for spot traders who are positioning for long-term growth. Although there could be weakness in the short term, which could result in one last shakeout or another downside wick, the analyst noted that this shouldn’t worry spot investors.

It may offer a final opportunity to accumulate before momentum builds toward a new cycle high. On the other hand, leveraged traders are advised to proceed with caution and risk management, given the potential volatility during the build-up to the breakout.

Fibonacci Levels Show 480% To 796% Rally Target

The chart highlights a significant confluence around Fibonacci extension levels, with the 1.618 Fib level suggesting a possible 480% move and the more ambitious 2.618 extension pointing to a 796% upside. Interestingly, MasterAnanda noted that the numbers are huge.

Related Reading

Although these targets are just projections, they align with the previous rally seen in late 2024. If this prediction structure holds, the next rally could push PEPE beyond the 1.618 Fib level at $0.0004264, surpassing all prior highs and printing a new all-time high in 2025.

At the time of writing, PEPE is trading at $0.00000708, down by 4.7% in the past 24 hours.

Featured image from Shutterstock, chart from Tradingview.com

Market

Crypto Market Lost $633 Billion in Q1 2025, CoinGecko Finds

According to CoinGecko’s quarterly report, the overall crypto market cap fell 18.6% in Q1 2025. Trading volume on centralized exchanges also fell 16% compared to the previous quarter.

This report identified a few positive trends, but most of them contained at least one significant downside. Despite the market euphoria in January, recession fears are taking a very serious toll.

Crypto Suffered Heavy Losses in Q1

The latest CoinGecko report shows just how bearish the first quarter of the year has been. Although the crypto market started January with a major bullish cycle, macroeconomic factors have heavily impacted market sentiment for the past two months.

According to this report, crypto’s total market cap fell 18.6% in Q1 2025, a staggering $633.5 billion. Investor activity fell alongside token prices, as daily trading volumes fell 27.3% quarter-on-quarter from the end of 2024. Spot trading volume on centralized exchanges fell 16.3%, which CoinGecko at least partially attributes to the Bybit hack.

The report mostly focused on concrete numbers, but it pointed to a few specific events that impacted crypto. Markets hit a local high around Trump’s inauguration, thanks to market euphoria over possible friendly policies.

His TRUMP meme coin fueled a brief frenzy in Solana meme coin activity, but this quickly slumped. The LIBRA scandal had a further dampening impact.

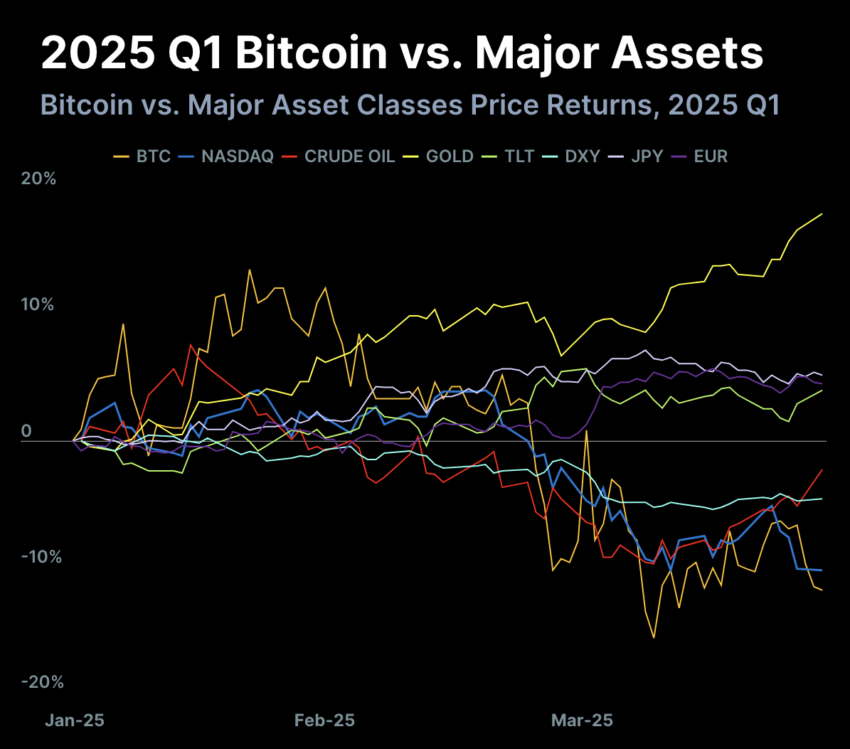

Bitcoin increased its dominance in Q1 2025, accounting for 59.1% of crypto’s total market cap. It hasn’t maintained that share of the market since 2021, symbolizing how much more stable it’s been than altcoins.

Nevertheless, BTC also fell 11.8% and was outperformed by gold and US Treasury bonds.

This data point is especially worrying because Trump’s tariffs have wrought havoc on Treasury yields. Even so, the report clearly shows that the rest of crypto suffered even more. Ethereum’s entire 2024 gains vanished in Q1 2025, and multichain DeFi TVL fell 27.5%. C

ountless other areas saw similar results, but they’re too numerous to easily summarize.

That is to say, almost every quantifiable positive development came with at least one major caveat. Solana dominated the DEX trade, but its TVL declined by over one-fifth.

Bitcoin ETFs saw $1 billion in fresh inflows, but total AUM fell by nearly $9 billion due to price drops. The reports reflect that recession fears are gripping the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price on The Brink? Signs Point to Renewed Decline

-

Market21 hours ago

Market21 hours agoXRP Price Pulls Back: Healthy Correction or Start of a Fresh Downtrend?

-

Altcoin21 hours ago

Altcoin21 hours agoRipple Whale Moves $273M As Analyst Predicts XRP Price Crash To $1.90

-

Market20 hours ago

Market20 hours agoArbitrum RWA Market Soars – But ARB Still Struggles

-

Bitcoin19 hours ago

Bitcoin19 hours agoIs Bitcoin the Solution to Managing US Debt? VanEck Explains

-

Market22 hours ago

Market22 hours agoEthereum Leads Q1 2025 DApp Fees With $1.02 Billion

-

Market19 hours ago

Market19 hours agoCardano (ADA) Pressure Mounts—More Downside on the Horizon?

-

Altcoin19 hours ago

Altcoin19 hours agoExpert Reveals Current Status Of 9 Ripple ETFs