Market

Analyst Predicts XRP To Surge To $9-$10 – Here’s Why

XRP emerged as a major headliner in the past week as the US Securities and Exchange Commission (SEC) officially dropped its four-year case with Ripple. Notably, this development resulted in a significant demand for XRP as the altcoin surged over 13% to briefly trade at $2.60 on March 20. However, XRP has since retraced over the last 24 hours and is now valued at around $2.39. Albeit, the altcoin still remains set for major bullish gains based on recent analysis by market expert Egrag Crypto.

XRP Strong Monthly Close Indicates Major Upside Potential

In an X post on March 21, Egrag Crypto shares an interesting bullish prediction on the XRP based on price action in recent months and the Fibonacci retracement levels.

The analyst notes that XRP has consistently closed above Fib. 1.0 level over the past three months forming full body candles. This development demonstrates XRP’s resilience amidst an uncertain crypto market reinforcing the potential of bullish momentum. This is because full-body candles provide stronger confirmation of price movements compared to wick formations.

With the altcoin maintaining such strong technical strength, Egrag predicts XRP could soon start gaining with its first price target at Fib 1.236. However, there is no serious resistance at this level suggesting a continuous surge to Fib Circle 5 and Fib 1.414 i.e. a price range of $5-$6.

Based on the Fibonacci levels, XRP could then see major price extensions to Fib 1.618 hinting at a potential price target of $9-$10. However, it is worth noting that the timing of these events is quite consequential for XRP and the general crypto market.

According to Egrag Crypto, if the projected price gains occur between now and May, a price correction is likely to follow hinting at a continuation of the bull run and higher price targets for XRP. However, if the anticipated price movements happen in the summer of 2025 or in Q4 2025, it could suggest a market top, marking the end of the current market cycle.

XRP Market Overview

According to Coincodex, market sentiment is currently neutral as the crypto market struggles to establish a clear trajectory. However, there are some significant potential positives for the fourth-largest cryptocurrency on the horizon.

Aside from recent legal developments, Ripple CEO Brad Garlinghouse has expressed much optimism on an XRP Spot ETF suggesting a possible approval before 2025 runs out. In addition, Garlinghouse expects US President Donald Trump to include XRP in the digital asset stockpile.

At the time of writing, XRP trades at $2.38 reflecting a 1.43% price loss in the past day. Meanwhile, the asset’s daily trading volume is down by 31.64% indicating a decline in market interest despite a recent price surge.

Market

Bitcoin Price Next Move Hinges on Support—Break or Bounce?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a steady increase above the $86,500 zone. BTC is now correcting gains and might find bids near the $87,000.

- Bitcoin started a decent recovery wave above the $87,000 zone.

- The price is trading above $86,800 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $87,400 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $88,000 and $88,800 levels.

Bitcoin Price Starts Consolidation

Bitcoin price remained stable above the $84,200 level. BTC formed a base and recently started a recovery wave above the $86,500 resistance level.

The bulls pushed the price above the $88,000 resistance level. However, the bears were active near the $88,800 resistance zone. The recent swing high was formed at $88,500 and the price corrected some gains. There was a move below the $88,000 level.

The price dipped and tested the 50% Fib retracement level of the upward move from the $86,306 swing low to the $88,500 high. Bitcoin price is now trading above $86,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $87,400 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $88,000 level. The first key resistance is near the $88,500 level. The next key resistance could be $88,800.

A close above the $88,800 resistance might send the price further higher. In the stated case, the price could rise and test the $89,500 resistance level. Any more gains might send the price toward the $90,000 level or even $90,500.

More Losses In BTC?

If Bitcoin fails to rise above the $88,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $87,400 level and the trend line. The first major support is near the $87,150 level or the 61.8% Fib retracement level of the upward move from the $86,306 swing low to the $88,500 high.

The next support is now near the $86,500 zone. Any more losses might send the price toward the $85,000 support in the near term. The main support sits at $84,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $87,400, followed by $87,150.

Major Resistance Levels – $88,000 and $88,800.

Market

PI Coin Decline Continues as Market Participation Dwindles

PI has continued its downtrend, slipping 5% in the last 24 hours despite the general market rally recorded over the past day.

The altcoin’s downturn signals weakening buying pressure as traders appear to shift their focus away from PI.

Pi Struggles as Market Participation Declines

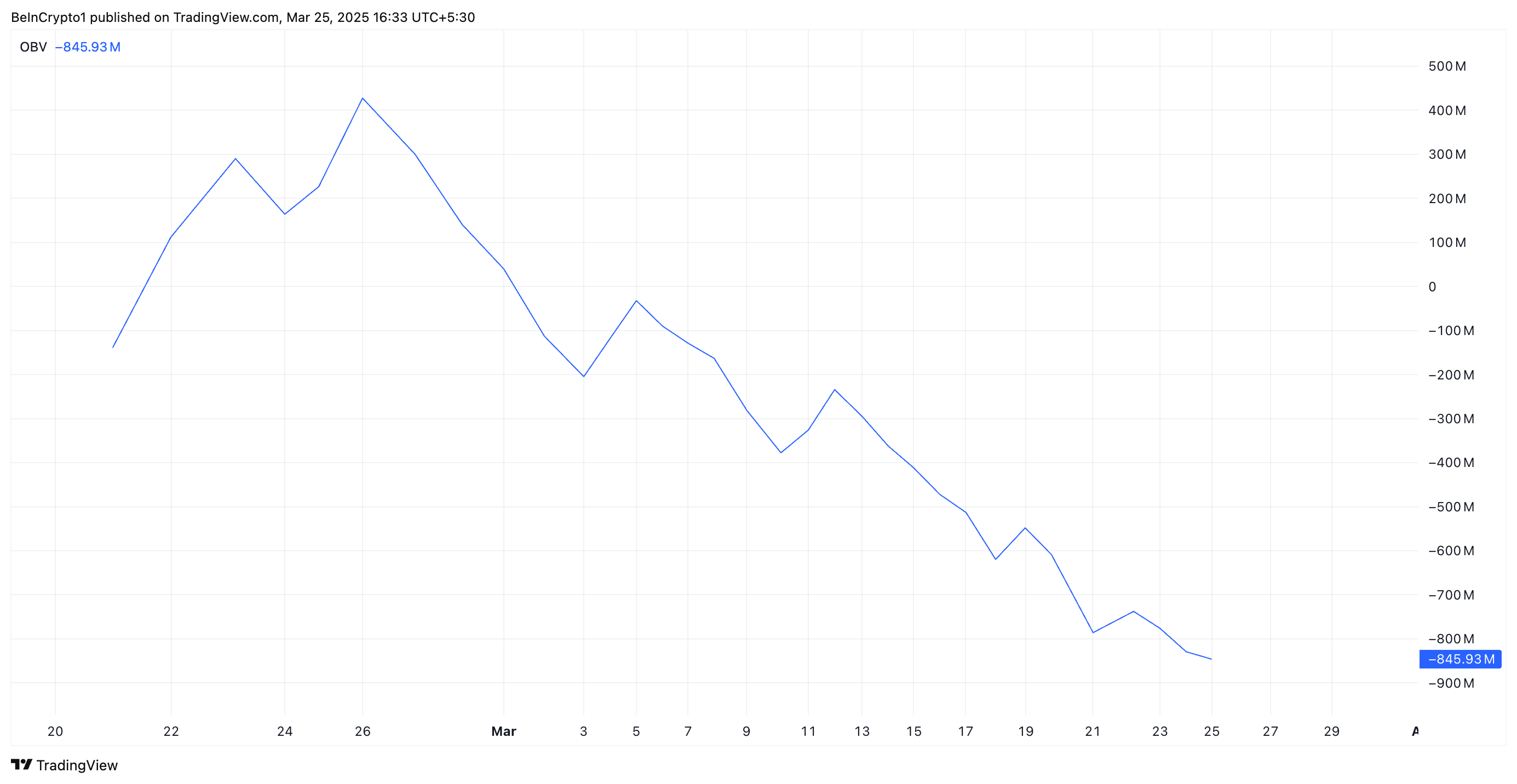

Key technical indicators reinforce the bearish outlook for Pi. Its On-Balance-Volume (OBV), which tracks buying and selling pressure, has been steadily falling, indicating a decline in market participation and liquidity.

As of this writing, PI’s OBV sits at an all-time low of -845.93 million, falling by over 2000% since the beginning of March.

When an asset’s OBV plunges like this, it indicates a decline in buying activity and increasing selloffs. This suggests that more PI traders are offloading the asset than accumulating it, increasing the downward pressure on its price.

Further, PI has remained in a descending parallel channel, a pattern that reflects its downward trend. According to readings from the PI/USD one-day chart, PI has traded within this bearish pattern since reaching an all-time high of $3 on February 26.

A descending parallel channel is formed when an asset’s price moves between two downward-sloping parallel trendlines. This structure indicates a consistent pattern of lower highs and lower lows, suggesting a sustained bearish trend. Here, token sellers maintain control and prevent significant upward momentum.

The pattern hints that PI’s price may continue to decline until it breaks above the channel or finds strong support.

Pi Risks Further Decline as Bears Attempt to Drag Price Below $0.62

PI’s strengthening selling pressure puts it at risk of breaking below the descending parallel channel. If this happens, the token’s downtrend gains momentum, pushing its price to $0.62.

However, if the bulls regain dominance and buying activity spikes, PI could reverse its current trend and rally toward $1.13.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Loses Steam After SEC Win, Enters Consolidation Mode

XRP is up more than 8% over the past seven days, but it hasn’t been able to maintain the strong momentum sparked by the SEC dropping its lawsuit against Ripple.

After the initial surge, XRP has entered a phase of consolidation, with price action stuck between key support and resistance levels. Technical indicators now reflect a market on pause, with momentum fading and direction unclear.

XRP RSI Is Currently Neutral

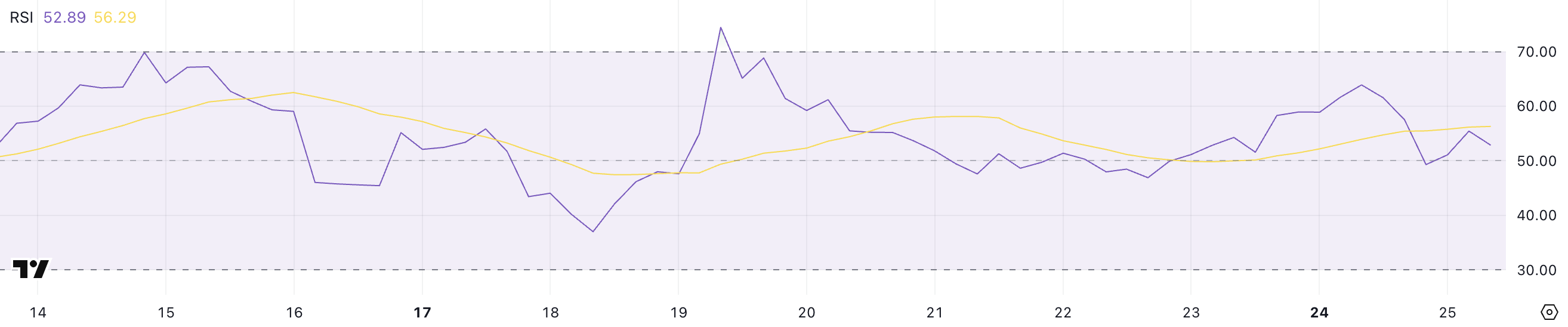

XRP’s Relative Strength Index (RSI) is currently at 52.89, a notable drop from 63.90 just one day ago. This sharp decline signals a weakening in recent bullish momentum, as buyers appear to be losing control over the short term.

RSI has now slipped closer to neutral territory, suggesting that market participants are increasingly uncertain about the next move.

Importantly, XRP hasn’t reached RSI levels above 70—commonly associated with overbought and strongly bullish conditions—since March 19, over a week ago, indicating a lack of strong buying pressure during this period.

RSI, or Relative Strength Index, is a widely used momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100.

An RSI reading above 70 typically signals that an asset is overbought and could be due for a pullback, while a reading below 30 suggests it may be oversold and primed for a bounce. Values between 50 and 70 generally reflect bullish momentum, whereas readings between 30 and 50 lean bearish.

With XRP now sitting at 52.89, it remains above the midpoint but is edging closer to neutral, suggesting the recent bullish phase may be cooling off unless renewed buying activity steps in.

Ichimoku Cloud Shows An Indecisive Market

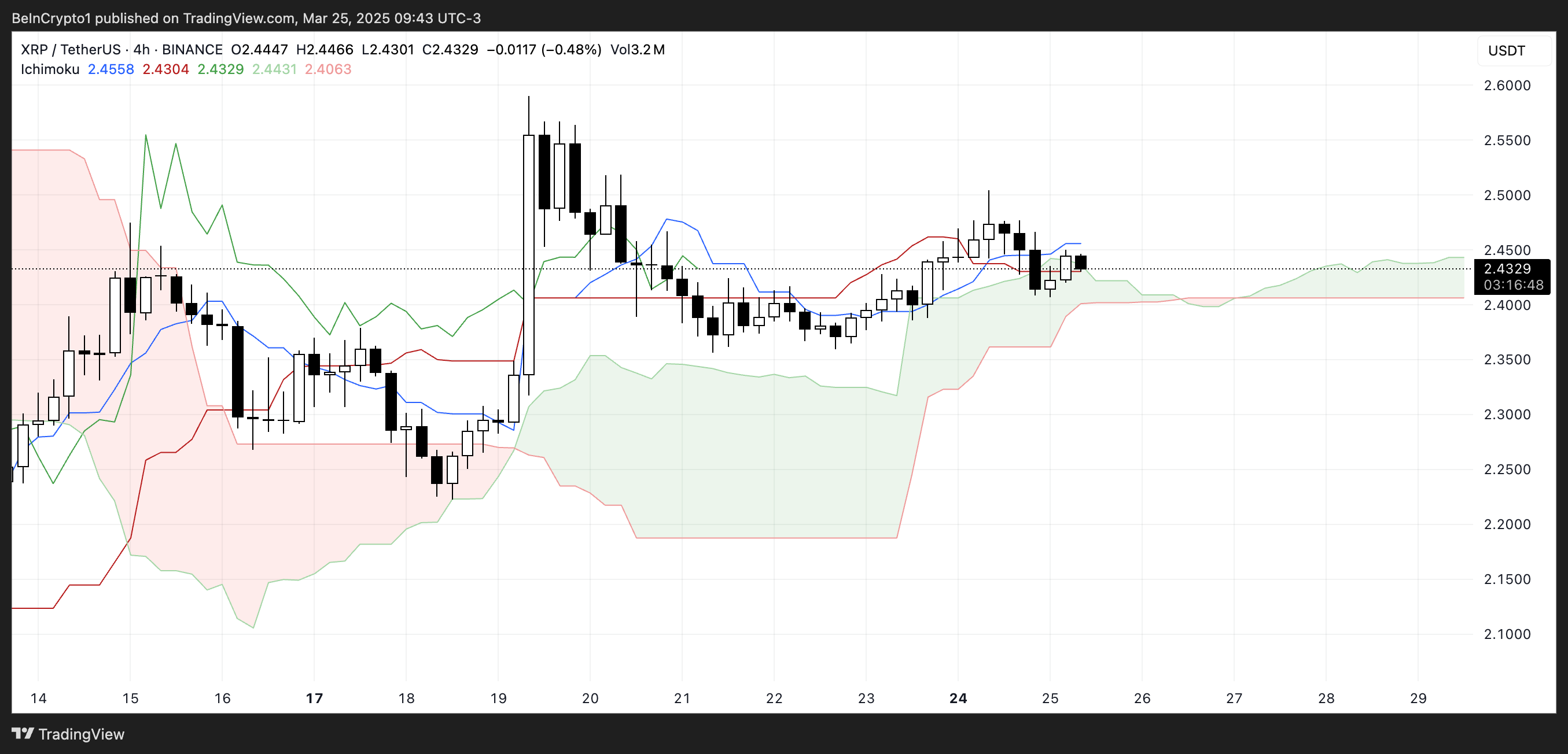

XRP’s Ichimoku Cloud chart shows a market in consolidation, with price action hovering just above the cloud but lacking strong momentum.

The Tenkan-sen and Kijun-sen lines are relatively flat and close together, indicating a pause in trend strength and a balance between buyers and sellers.

The lack of a clear Tenkan/Kijun crossover also supports the idea that the market is in a neutral phase rather than trending decisively in either direction.

The cloud ahead is thin and slightly bullish. This suggests that while there is some support beneath the price, it’s not particularly strong.

A thin cloud typically signals potential vulnerability, as it may not hold up well against increased selling pressure. Meanwhile, the Chikou Span (lagging line) is interacting closely with past price action, another sign that momentum is weakening.

Overall, the Ichimoku setup reflects uncertainty, with XRP needing a decisive push in either direction to escape this range-bound structure.

Will XRP Breach $2.50 Resistance?

XRP experienced a strong surge following the news that the SEC had dropped its case against it. However, that initial momentum has since cooled.

The price is now caught between a resistance zone at $2.47 and support at $2.35. That highlights a phase of consolidation and indecision.

If the current support level is retested and fails to hold, XRP could see increased selling pressure. That would open the door for a move down to $2.22. If bearish momentum intensifies, a deeper drop toward $1.90 is possible.

On the flip side, if buyers can regain control and push XRP price above the $2.47 resistance.

The next targets in that scenario would be $2.59 and $2.749, both of which align with previous areas of rejection.

If the uptrend gathers strength, XRP could climb as high as $2.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoEthereum Price Back Above $2,000—Breakout or Just a Temporary Bounce?

-

Market21 hours ago

Market21 hours agoSolana (SOL) Gains Capped—Breaking $150 Won’t Be Easy

-

Altcoin21 hours ago

Altcoin21 hours agoCronos Is Scam Allegations Appear After Trump CryptoCom Deal, Will CRO Price Crash?

-

Bitcoin21 hours ago

Bitcoin21 hours agoMt. Gox’s $1 Billion Bitcoin Transfer: Is Liquidation Coming?

-

Market19 hours ago

Market19 hours agoXRP Price Consolidates—Breakout Incoming or More Choppy Moves?

-

Altcoin19 hours ago

Altcoin19 hours agoEthereum Price To Hit $5K Before SOL Rally To $300, Arthur Hayes Says

-

Altcoin12 hours ago

Altcoin12 hours agoCBOE Files 19b-4 For Fidelity’s Solana ETF With US SEC

-

Market18 hours ago

Market18 hours agoBlackRock Expands Bitcoin ETPs to Europe After US ETF Success